Hip Replacement Devices Market Summary

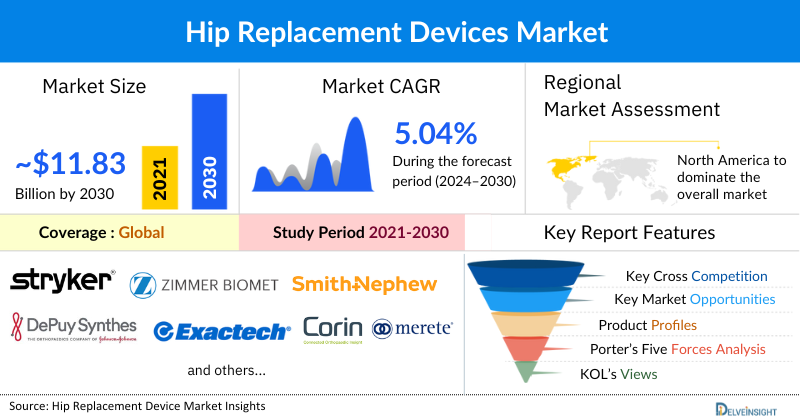

- The Global Hip Replacement Devices Market Size is expected to increase from ~USD 8.82 billion in 2024 to ~USD 11.83 billion by 2032, reflecting strong and sustained growth.

- The Global Hip Replacement Devices Market is growing at a CAGR of 5.04% during the forecast period from 2025 to 2032.

Hip Replacement Devices Market Trends & Insights

- According to DelveInsight, the Hip Reconstruction Devices Market is expected to expand at a healthy growth rate during the forecast period (2025-2032), owing to the launch of new therapies.

- The leading Hip Reconstruction Devices Companies such as Zimmer Biomet, Stryker Corporation, Smith & Nephew, Exactech Inc, Johnson & Johnson Services Inc, Corin, Microport Scientific Corporation, Conformis, B. Braun Melsungen AG, Medacta International, DJO LLC, United Orthopedic Corporation, Meril Life Sciences Pvt. Ltd, Advin Health Care, Auxein Medical, MatOrtho Limited, Surgival, Amplitude, DEDIENNE SANTÉ, Merete GmbH, and others.

Hip Replacement Devices Market Size and Forecasts

- 2024 Market Size: USD 8.82 Billion

- 2032 Projected Market Size: USD 11.83 Billion

- Growth Rate (2025-2032): 5.04% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Request for Unlocking the Sample Page of the "Hip Reconstruction Market"

Factors Contributing to the Growth of Hip Replacement Devices

-

Rising Prevalence of Osteoarthritis and Hip Joint Degeneration

The increasing global incidence of osteoarthritis, particularly among aging populations, is a major driver for hip replacement procedures. Degenerative joint disease leads to pain, loss of mobility, and reduced quality of life, necessitating surgical intervention with hip replacement devices.

-

Aging Global Population

As life expectancy rises, a larger segment of the population is entering age groups where hip-related disorders are most common. This demographic shift increases demand for hip replacement surgeries and related orthopedic devices.

-

Technological Advancements in Implant Design

Continuous innovation in materials (such as highly cross-linked polyethylene, ceramic components), modular implants, and advanced bearing surfaces has improved implant longevity, biocompatibility, and performance—boosting clinician confidence and patient outcomes.

-

Growing Preference for Minimally Invasive Surgical Techniques

Minimally invasive approaches for hip replacement are associated with reduced pain, shorter hospital stays, and faster recovery. Increased adoption of these techniques has broadened the patient pool opting for surgery, further driving market growth.

-

Expansion of Healthcare Infrastructure and Access to Elective Surgeries

Improved healthcare infrastructure, especially in emerging economies, alongside better health insurance coverage and reimbursement policies, has increased access to joint replacement surgeries, fueling market demand.

-

Rising Incidence of Hip Fractures

Hip fractures, particularly among elderly individuals due to osteoporosis and falls, are a significant contributor to the need for hip replacement devices. The growing burden of hip fractures worldwide supports long-term market expansion.

-

Increased Focus on Outpatient and Ambulatory Surgical Centers

The shift toward outpatient procedures and ambulatory surgical centers, driven by cost-effectiveness and patient preference, has further facilitated the uptake of hip replacement surgeries and associated devices.

-

Strong R&D Pipeline and New Product Introductions

Ongoing research and development activities by leading orthopedic device manufacturers continue to introduce advanced hip implant systems, patient-specific solutions, and digital surgical planning tools, driving competitive market growth.

-

Enhanced Patient Awareness and Demand for Quality of Life Improvements

With better information access and awareness about treatment options, patients increasingly seek surgical solutions that provide pain relief and restore mobility, thereby contributing to higher adoption of hip replacement devices.

Hip Reconstruction Devices Market by Product Type (Total Hip Replacement System, Partial Hip Replacement System, Hip Revision System, and Hip Resurfacing System), Fixation (Cemented and Non-Cemented), End-User (Hospitals, Orthopedic Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to the increasing cases of bone related disorders and rising product developmental activities across the globe.

The Hip Reconstruction Devices Market was valued at USD 8.82 billion in 2024, growing at a CAGR of 5.04% during the forecast period from 2025 to 2032 to reach USD 11.83 billion by 2032. The Hip Reconstruction Devices Market is growing significantly due to the rising global incidence of osteoarthritis and osteoporosis, increasing numbers of hip fractures, coupled with advancements in joint-replacement technology and innovative product developments by leading Hip Reconstruction Devices Companies, is expected to escalate the demand for Hip Reconstruction Devices during the forecast period from 2025 to 2032.

Scope of the Hip Reconstruction Devices Market Report | |

|

Study Period |

2022 to 2032 |

|

Forecast Period |

2025-2032 |

|

Geographies Covered |

Global |

|

Hip Replacement Devices CAGR | 5.06% |

|

Hip Replacement Devices Market Size | |

|

Hip Replacement Devices Companies |

|

What are the latest Hip Replacement Devices Market Dynamics and Trends?

According to the World Health Organization (2023), 344 million individuals are affected by osteoarthritis globally on average. Amongst this population, 73% of people living with osteoarthritis are older than 55 years, and 60% are female. Moreover, as per the same source, 13 million people are living with Rheumatoid Arthritis globally. Hip reconstruction and replacement devices are essential in alleviating pain and restoring mobility for individuals with advanced joint degeneration. Employed in surgical interventions, these devices help improve the quality of life and functionality, making them crucial in managing the increasing demand for effective solutions in arthritic conditions.

According to the International Osteoporosis Foundation 2021 data, more than about 50% of all osteoporotic hip fractures will occur in Asia by the year 2050. Moreover, as per data from the National Institute of Health (2023), it projected that the global incidence of hip fracture will rise from 7 to 21 million by 2050. The anticipated surge in hip fractures globally highlights a growing need for hip reconstruction and replacement devices. These devices play a vital role in managing the increasing number of hip injuries, offering effective solutions for restoring mobility and function, and addressing the rising demand driven by the higher incidence of fractures.

Increased product developmental activities by market key Hip Reconstruction Devices Companies are also slated to witness the market growth of hip replacement devices. For example in February 2024, Stryker Corporation announced it to showcase new joint-replacement technology and updates to its Mako surgical robotic platform. The company also aimed to reduce intra-operative fluoroscopy in certain hip-replacement procedures.

Additionally, in August 2023, Smith and Nephew, the global medical technology company, announced the launch of its OR3O Dual Mobility System for primary and revision hip arthroplasty in India. Compared to traditional solutions, the dual mobility implants featured a small diameter femoral head that locked into a larger polyethylene insert, enhancing stability, reducing the risk of dislocation, and providing an improved range of motion.

Therefore, the factors stated above collectively will drive the overall Hip Reconstruction Devices Market during the forecast period from 2024 to 2030. However, nerve and blood vessel injury, bleeding, and stiffness associated with implants, nerve damage can cause numbness, weakness & pain, among others may limit their end-user base, thus acting as key constraints limiting the growth of the Hip Reconstruction Devices.

Hip Replacement Devices Market Segment Analysis

Hip Reconstruction Devices Market by Product Type (Total Hip Replacement System, Partial Hip Replacement System, Hip Revision System, and Hip Resurfacing System), Fixation (Cemented and Non-Cemented), End-User (Hospitals, Orthopedic Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World). In the product type segment of Hip Reconstruction Devices, the total hip replacement system category is expected to have a significant revenue share in the year 2023. The rapid growth of this product category can be attributed to the features of the total hip replacement system category.

These are designed to address severe hip joint damage. The total Hip Reconstruction Devices include a femoral component and an acetabular component. The femoral component consists of a metal stem that is inserted into the thigh bone, a metal or ceramic ball that replaces the damaged hip socket, and a neck that connects the ball to the stem. The acetabular component is a cup-shaped device that fits into the pelvic bone socket, often lined with a durable material such as polyethylene, ceramic, or metal to reduce friction.

Total Hip Reconstruction Devices Systems are engineered to replicate the natural movement of the hip joint, providing stability and flexibility. The materials used are selected for their durability and biocompatibility, ensuring that the implant integrates well with the surrounding bone and minimizes the risk of rejection or complications.

Increased positive product activities by the Hip Reconstruction Devices Companies are likely to drive the market for this category.

For example, in August 2022, Exactech, a developer and producer of innovative implants, instrumentation, and smart technologies for joint replacement surgery, announced the successful completion of the first surgeries using the Spartan™ Stem and Logical™ Cup System for total hip replacement.

Therefore, owing to the above-mentioned factors, the demand for the total hip replacement system category upsurges, thereby the category is expected to witness considerable growth, eventually contributing to the overall growth of the Hip Reconstruction Devices Market during the forecast period from 2025 to 2032

Hip Replacement Devices Market Size is anticipated to be dominated by North America

Among all the regions, North America is expected to dominate the Hip Reconstruction Devices Market in the year 2023 and is expected to do the same during the forecast period from 2024 to 2030. This is due to the high incidence of hip fractures and avascular necrosis. Escalating healthcare costs, advancements in product development, and the introduction of innovative technologies by key market players in the region is expected to drive the market for Hip Reconstruction Devices during the forecast period from 2024 to 2030.

According to data from the American Academy of Orthopaedic Surgeons (2024), annually, over 300,000 individuals in the U.S. experience a hip fracture, with the majority occurring in those aged 65 and older due to falls in the home or community. Moreover, the National Institute of Health (2023) estimated that a patient incurs costs of USD 40,000 in the first year after a hip fracture, with the annual expense for hip fracture care in the U.S. exceeding USD 17 billion. Hip reconstruction and replacement devices play a crucial role in managing hip fractures, especially among older adults. They are used to restore mobility and function, significantly impacting recovery and reducing long-term healthcare costs.

As per data from the National Institute of Health (2023), it stated that in the United States, avascular necrosis of the femoral head is estimated to affect between 20,000 and 30,000 new patients each year. This condition contributes to the overall number of total hip arthroplasties performed annually, which totals approximately 250,000 procedures.

Rising product developmental activities by regulatory bodies in the region will further boost the market for Hip Reconstruction Devices. For example in March 2024, Ortho Development Corporation, a designer and manufacturer of orthopedic implants and instruments for hip and knee joint replacement surgery, announced the receipt of U.S. Food and Drug Administration (FDA) 510(k) clearance for the Trivicta™ Hip System. The clearance was granted for the triple-taper femoral stem, which was designed to provide an optimal fit within the canal for a wide range of patient anatomies.

In addition to this, in March 2022, Stryker announced the launch of the Insignia hip stem for total hip and hemiarthroplasty procedures. The Insignia stem was designed to be compatible with Stryker’s Mako SmartRobotics platform, which utilizes Total Hip 4.1 software. This integration allowed surgeons to use data from a 3D, CT-based plan to capture each patient’s unique anatomy.

Additionally, the presence of key Hip Reconstruction Devices Companies such as Zimmer, Stryker, Johnson and Johnson Services, Inc., Exactech, Inc, among others in the region is also a driving factor for the Hip Reconstruction Devices market as they hold significant revenue shares. Therefore, the interplay of all the aforementioned factors above would provide a conducive growth environment for the North America region in the Hip Reconstruction Devices market.

Who are the major players in Hip Replacement Devices?

The following are the leading companies in Hip Replacement Devices. These companies collectively hold the largest Hip Replacement Devices market share and dictate industry trends.

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- Exactech Inc.

- Johnson & Johnson Services Inc.

- Corin

- Microport Scientific Corporation

- Conformis

- B. Braun Melsungen AG

- Medacta International

- DJO LLC

- United Orthopedic Corporation

- Meril Life Sciences Pvt. Ltd

- Advin Health Care

- Auxein Medical

- MatOrtho Limited

- Surgival

- Amplitude

- DEDIENNE SANTÉ

- Merete GmbH

Recent Developmental Activities in the Hip Replacement Devices Market

- In February 2025, Hydrix Limited announced that Gyder Surgical, part of its Ventures portfolio, received FDA 510(k) clearance for the GYDER Hip System, advancing its U.S. commercialization. This milestone highlights Hydrix’s medical product development expertise and strengthens Gyder’s market position, boosting Hydrix Ventures' investment value to $2.65 million.

- In February 2025, Gyder Surgical announced that the FDA granted 510(k) clearance for the GYDER® Hip System, the world’s first non-invasive, pin-less, and image-less solution for precise acetabular cup positioning during Anterior Hip Arthroplasty.

- On November 16, 2024, Corin received FDA 510(k) clearance for its Icona femoral stem, designed for direct anterior total hip arthroplasty, with specific considerations for use in the ASC setting, as announced in a press release.

- On November 5, 2024, Corin, a global leader in orthopedic innovation, announced 510(k) clearance for its Icona™ femoral stem. This new collared, metaphyseal-filling, triple-taper stem was developed using data from the CorinRegistry™ and adds to Corin’s portfolio of clinically proven implants for total hip arthroplasty (THA).

- In July 2024, Smith & Nephew announced that it received 510(k) clearance from the United States Food and Drug Administration for its new CATALYSTEM Primary Hip System. The system was designed to meet the evolving needs of primary hip surgery, including the growing adoption of anterior approach procedures and the expanding role of Ambulatory Surgery Centers (ASCs).

- In February 2021, MicroPort Orthopedics launched HA Coated Collared Hip Stem and Cemented Collared Hip Stem, Expanding its Hip Stem Portfolio. The introduction of these new stems marks a significant enhancement in their offerings, providing advanced options for hip replacement surgeries.

Key Takeaways from the Hip Replacement Devices Market Report Study

- Hip Reconstruction Devices Market Size analysis for current market size (2023), and market forecast for 6 years (2025 to 2032)

- Top key product/services developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key Hip Reconstruction Devices Companies Dominating the Market

- Various opportunities are available for the other competitors in the Hip Reconstruction Devices market space

- What are the top-performing segments in 2024? How will these segments perform in 2032?

- Which are the top-performing regions and countries in the current Hip Reconstruction Devices market scenario?

- Which are the regions and countries where Hip Reconstruction Devices Companies should have concentrated on opportunities for Market Growth in the coming future?

Target Audience who can be benefited from Hip Replacement Devices Market Report Study

- Hip Reconstruction Devices product providers

- Research organizations and consulting Hip Reconstruction Devices Companies

- Hip Reconstruction Devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in Hip Reconstruction Devices

- Various end-users who want to know more about the market and the latest developments in the Hip Reconstruction Devices market

Stay updated with us for Recent Articles @ New DelveInsight Blogs