Osteoporosis Market Summary

- The Osteoporosis Market is anticipated to experience growth during the forecast period (2025–2034). This growth can be attributed to several factors, including the rise in the number of prevalent cases, increasing research and development efforts for new therapies targeting Osteoporosis, potential approvals and launches of treatments under development, and the rising demand for effective solutions to manage the condition.

- On the other hand, the major challenges that limit the Osteoporosis Market Growth include fewer products in different developmental stages, leading to higher utilization of the already present biosimilars and generics with proven potential in the Osteoporosis treatment market.

- Key Osteoporosis Companies driving the future of Osteoprosis market include Entera Bio, Rani Therapeutics, and Celltrion, Shanghai JMT-Bio Inc., Transcenta Holding, Celltrion, Sandoz, Enzene Biosciences, Fresenius Kabi, Gedeon Richter, Samsung Bioepis, Alvotech, MAbxience, Shanghai Henlius Biotech, and others which are developing their assets. With the expected approval of all these therapies currently under development, the overall therapeutic market of Osteoporosis is likely to rise at a significant CAGR during the forecast period (2025–2034).

Download the Sample PDF to Get More Insight @ Osteoporosis Drugs Market

Factors affecting the Osteoporosis Market Growth

Rising Prevalence of Osteoporosis and Aging Population

The global burden of osteoporosis is increasing rapidly due to the growing elderly population, especially among postmenopausal women. As life expectancy rises, the prevalence of age-related bone loss and fragility fractures continues to drive the demand for osteoporosis diagnosis and treatment.

Advancements in Diagnostic Technologies

The adoption of dual-energy X-ray absorptiometry (DEXA) scans, quantitative computed tomography (QCT), and biochemical bone markers has significantly improved early detection and monitoring. Enhanced diagnostic accuracy leads to higher diagnosis rates, expanding the potential patient pool.

Introduction of Novel and Targeted Therapies

The emergence of biologics (e.g., denosumab, romosozumab) and next-generation antiresorptive and anabolic agents has transformed osteoporosis treatment paradigms. These therapies offer improved efficacy and safety profiles compared to conventional bisphosphonates, boosting market adoption.

Growing Awareness and Screening Programs

Public health initiatives and awareness campaigns emphasizing bone health, fracture prevention, and early diagnosis are increasing treatment rates. Healthcare organizations and patient advocacy groups are actively promoting screening for postmenopausal and elderly populations.

Increased Fracture Burden and Healthcare Costs

The rising incidence of osteoporotic fractures, particularly hip and vertebral fractures, imposes a significant socioeconomic burden. This has prompted governments and healthcare systems to prioritize early intervention and preventive treatment strategies.

Supportive Reimbursement Policies and Regulatory Approvals

Favorable reimbursement frameworks and the growing number of regulatory approvals for innovative osteoporosis drugs in major markets such as the U.S., EU, and Japan are strengthening industry growth.

DelveInsight’s report titled “Osteoporosis Market Insights, Epidemiology, and Market Forecast – 2034” comprehensively analyzes historical and projected epidemiological data concerning Osteoporosis. This analysis includes a breakdown of the Prevalent Cases of Osteoporosis, Diagnosed Prevalent Cases of Osteoporosis segmented by Gender and Age, and the number of Treatable Cases of Osteoporosis. The Osteoporosis market report offers an in-depth understanding of the various aspects related to the patient population, including diagnosis, prescription patterns, physician perspectives, market access, treatment, and future market developments for the seven major markets, including the United States, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan from 2020 to 2034.

The report examines the current treatment practices and algorithms for Osteoporosis to assess the market’s potential and uncover potential business opportunities. The report also addresses the unmet medical needs in the field, aiming to identify areas where there is room for improvement and opportunities for innovation.

Osteoporosis Overview and Treatment Outlook

Osteoporosis is a systemic skeletal disease characterized by low bone mass and microarchitectural deterioration of bone tissue, consequent increase in bone fragility and susceptibility to fracture. This well-established definition, developed by the international consensus in 1993, captures two important characteristics of the disease: Its adverse effects on bone mass and microstructure and the clinical outcome of fracture. The causes of Osteoporosis include hyperparathyroidism, hyperglycemia, medications, smoking, alcohol use, oxidative stress, inflammation, calcium deficiency, menopause, etc.

The most common symptom of Osteoporosis is a vertebral compression fracture or hip fracture. The compression fractures in the spine, caused by weakened vertebrae, can lead to pain in the mid-back area. Key risk factors for Osteoporosis are genetic, lack of exercise, and lack of calcium and vitamin D.

Osteoporosis Diagnosis

In terms of diagnosis, The National Osteoporosis Foundation, the American Medical Association, and other major medical organizations recommend a dual-energy x-ray absorptiometry scan (DXA, formerly known as DEXA) that can be used to detect the occurrence of Osteoporosis accurately.

The treatment of Osteoporosis involves treating and preventing fractures and using medicines to strengthen the weak bones. According to the International Osteoporosis Foundation, for patients at high risk, drug treatments are needed to effectively reduce the risk of broken bones due to Osteoporosis. Treatments have been shown to reduce the risk of hip fracture by up to 40%, vertebral fractures by 30–70%, and some medications reduce the risk for non-vertebral fractures by 15–20%.

The treatment landscape of Osteoporosis comprises mostly pharmacological therapies, which is further characterized as anti-resorptive agents (i.e., bisphosphonates, estrogen agonist/antagonists (EAAs), estrogens, calcitonin, and denosumab), anabolic agents (i.e., teriparatide and abaloparatide), and mixed agents (i.e., Romosozumab). Apart from the mentioned pharmacotherapies, there are several other anti-resorptive treatment options to treat Osteoporosis, such as estrogen replacement and selective estrogen receptor modulators, which further comprise raloxifene, lasofoxifene, and bazedoxifene. In addition, a few dietary supplements, such as calcium and vitamin D, also provide benefits to patients with Osteoporosis.

In April 2019, EVENITY (romososzumab), co-developed by Amgen and UCB, was approved by the US FDA for the treatment of Osteoporosis in postmenopausal women at high risk for fracture. On the other hand, in June 2010, the US FDA approved Amgen’s PROLIA (denosumab) for the first time for the treatment of Osteoporosis in postmenopausal women at high risk of fracture, followed by its approval as a treatment to increase bone mass in men, in September 2012. Another drug intervention by Pfizer, i.e., DUAVEE (Conjugated estrogens/bazedoxifene), is the first FDA-approved medication that combines conjugated estrogens with an estrogen agonist/antagonist, bazedoxifene. Moreover, in April 2017, TYMLOS (abaloparatide) manufactured by Radius Health was approved by the US FDA for the treatment of postmenopausal women with Osteoporosis at high risk for fracture.

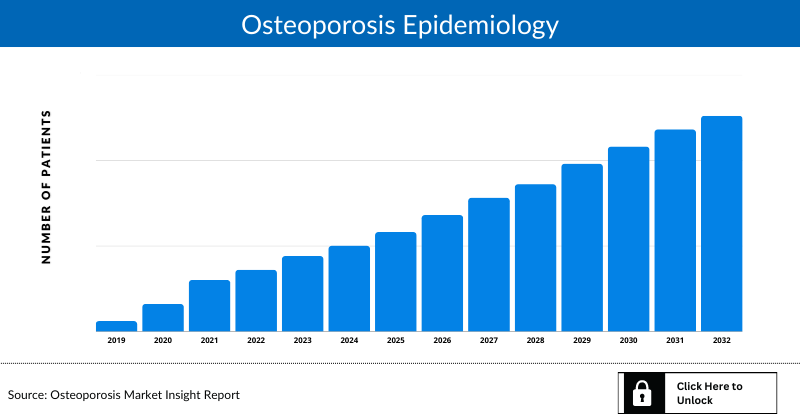

Osteoporosis Epidemiology

The Osteoporosis epidemiology section provides insights into the historical and current Osteoporosis patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted trends by exploring numerous studies and key opinion leaders’ views. This part of the report also provides the diagnosed patient pool, its trends, and assumptions undertaken.

Examining the views of key opinion leaders from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report.

Key Findings from the Osteoporosis Epidemiology Insights and Forecast

- According to the data provided by the Centers for Disease Control and Prevention (CDC), in the US, in 2017–2018, the age-adjusted prevalence of Osteoporosis at either the femur neck or lumbar spine or both among adults aged 50 and over was 12.6% and was higher among women (19.6%) compared with men (4.4%).

- According to the CDC, in the US, the prevalence of low bone mass, a precursor of Osteoporosis, at either the femur neck or lumbar spine or both among adults aged 50 and over was 43.1% and was higher among women (51.5%) compared with men (33.5%). Osteoporosis prevalence increased from 2007–2008 to 2017–2018 among women but not men.

- According to the International Osteoporosis Foundation, in the UK, the prevalence of Osteoporosis in the total population amounted to 5.2%, on par with the EU27+2 average (5.6%). In the UK, 21.9% of women and 6.7% of men aged 50 years or more were estimated to have Osteoporosis. Hip fracture is the most serious consequence of Osteoporosis in terms of morbidity, mortality, and health care expenditure.

- According to a study conducted by Yoshimura et al. (2022), in Japan, the prevalence of lumbar spine (L2–L4) osteoporosis at the baseline survey was 13.6% (men, 3.4%; women, 19.2%) and at the fourth survey was 9.7% (men, 1.4%; women, 13.9%), which decreased significantly (p < 0.01), while that of the femoral neck was not significantly different between the baseline and fourth surveys.

Get detailed insights into the historical as well as forecasted epidemiology trends in the 7MM, at: Osteoporosis Prevalence

Osteoporosis Market Outlook

Treatment recommendations are often based on estimating the patient’s risk of breaking a bone in the next 10 years using information such as the bone density test. If the risk is not high, treatment might not include medication and might focus instead on modifying risk factors for bone loss and falls. For both men and women at increased risk of broken bones, the most widely prescribed osteoporosis medications are bisphosphonates like Alendronate (Binosto, Fosamax) and Risedronate (Actonel, Atelvia).

The US FDA has approved multiple drugs for treating Osteoporosis, including RECLAST (Zoledronic acid), EVENITY (romososzumab), and PROLIA (denosumab). Romosozumab is a humanized monoclonal antibody (IgG2). In October 2019, the US FDA approved Bonsity for treating Osteoporosis in certain patients at high risk for fracture, a biosimilar of Forteo.

In case treatment methods, such as medication, exercise, and diet, do not help the effects of Osteoporosis after 3 months of treatment, surgery is the only option. There are two minimally invasive surgical procedures for osteoporotic fractures of the spine, which include kyphoplasty and vertebroplasty. These surgeries are used to mend recent fractures. Additionally, OSSURE LOEP (AgNovos) is a minimally-invasive new procedure to replace the bone lost due to Osteoporosis, increasing bone density and strength.

According to DelveInsight, the Osteoporosis market in the 7MM is expected to change significantly during the forecast period owing to its changing epidemiology and the anticipated treatments.

Osteoporosis Drug Analysis

Marketed Osteoporosis Drugs

EVENITY (romososzumab): Amgen and UCB

In April 2019, EVENITY (romososzumab), co-developed by Amgen and UCB, was approved by the US FDA for the treatment of Osteoporosis in postmenopausal women at high risk for fracture. Romosozumab is a humanized monoclonal antibody (IgG2), which is the first and only bone builder with a unique dual effect that increases bone formation as well as, to a lesser extent, reduces bone resorption (or bone loss) to reduce the risk of fracture rapidly. In December 2019, the European Commission approved Evenity for the treatment of severe Osteoporosis in postmenopausal women at high risk of fracture.

Note: Detailed marketed therapies assessment will be provided in the final report.

Emerging Osteoporosis Drugs

Research and development efforts by researchers and pharmaceutical companies aim to explore novel treatment options for Osteoporosis. These potential treatments are designed to target the symptoms and underlying mechanisms of the condition, offering hope for improved management and relief for individuals affected by Osteoporosis.

The Osteoporosis market dynamics are expected to change, primarily due to increased healthcare spending worldwide. Osteoporosis Companies such as EnteraBio, Rani Therapeutics, Haoma Medica, Amgen, Celltrion, and others are actively involved in developing Osteoporosis treatments.

EB613 (PTH 1-34): EnteraBio

EB613 (PTH 1-34) is the first oral, once-daily mini-tablet presentation of hPTH (1-34) (teriparatide). EB613 has a well-established mechanism of action, PK, and safety profile and met primary (PD/biomarker) and secondary endpoints (BMD) in a placebo-controlled, dose-ranging Phase II study in 161 postmenopausal women with low bone mass and Osteoporosis. In October 2022, the company reached agreement on an with the FDA that a single Phase III placebo-controlled study could support a New Drug Application (NDA) submission of EB613 under the regulatory pathway. The FDA also agreed that Total Hip Bone Mineral Density (BMD) could serve as the primary endpoint for the registrational study of EB613 in postmenopausal osteoporosis patients.

RT-102: Rani Therapeutics

RT-102 is the original RaniPill capsule containing the parathyroid hormone analog PTH (1-34) for the treatment of Osteoporosis. Rani Therapeutics has completed a pre-investigational new drug (IND) meeting with the US FDA with respect to RT-102, the RaniPill GO containing a proprietary formulation of human parathyroid hormone (1-34) analog (PTH) for the potential treatment of Osteoporosis, and provided a corporate update. In December 2022, Rani announced topline results from Part 2 (repeat-dose portion) of the Phase I study of RT-102. RT-102 is being developed for the treatment of Osteoporosis. The study achieved all of its endpoints, with repeat doses of RT-102 being generally well tolerated and delivering the drug with high reliability to participants via the RaniPill GO. The company anticipates initiating a Phase II study of RT-102, expected in the second half of 2023.

Note: Detailed emerging therapies assessment will be provided in the final report.

Osteoporosis Competitive Analysis

Osteoporosis Companies

- Merck & Co. Inc.

- Amgen Inc.

- Radius Health Inc.

- Teva Pharmaceutical Industries Ltd

- GlaxoSmithKline PLC

- Pfizer Inc.

- Eli Lily and Company

- F. Hoffmann La Roche

- Novartis International AG

- Actavis PLC,

- Shanghai JMT-Bio Inc.

- Transcenta Holding

- Celltrion

- Sandoz

- Enzene Bioscience

- Fresenius Kabi

- Gedeon Richter

- Samsung Bioepis

- Alvotech

- MAbxience

- Shanghai Henlius Biotech, and others

Osteoporosis Market Recent Developments and Breakthroughs

- In September 2025, Shanghai Henlius Biotech and Organon announced that the U.S. FDA approved BILDYOS® (denosumab-nxxp) injection 60 mg/mL and BILPREVDA® (denosumab-nxxp) injection 120 mg/1.7 mL, biosimilars to PROLIA and XGEVA, respectively, for all indications of the reference products. BILDYOS is a RANK ligand (RANKL) inhibitor indicated for osteoporosis treatment in high-risk postmenopausal women and men, glucocorticoid-induced osteoporosis, and bone mass increase in prostate and breast cancer patients receiving specific therapies. Patients with advanced kidney disease face higher risks of severe hypocalcemia, requiring expert supervision before and during treatment.

- In September 2025, Naitive Technologies announced that it received 510(k) clearance from the U.S. FDA for its AI-driven product, OsteoSight. This software enables bone mineral density (BMD) assessment using standard X-rays, helping detect osteoporosis earlier, which is often undiagnosed until fractures occur. OsteoSight supports proactive osteoporosis management and offers growth opportunities for orthopedic practices.

- In September 2025, Biocon Biologics received FDA approval for its biosimilars Bosaya and Aukelso (denosumab-kyqq), referencing Prolia and Xgeva, respectively. Bosaya is approved for multiple osteoporosis-related indications, while Aukelso targets bone-related complications in cancer. Both products were also granted provisional interchangeability status.

- In March 2025, the FDA approved Fresenius Kabi Biopharma's denosumab biosimilars, Conexxence and Bomyntra (denosumab-bnht), for all indications of the reference products Prolia and Xgeva, expanding access to more affordable treatments for osteoporosis, bone metastases, and other bone-related conditions.

- In March 2025, Dr. Reddy’s Laboratories Ltd. and Alvotech announced that the FDA has accepted a 351(k) Biologic License Application (BLA) submission for AVT03, a proposed biosimilar of Prolia® (denosumab) and Xgeva® (denosumab), developed by Alvotech.

- In March 2025, Celltrion announced that the U.S. Food and Drug Administration (FDA) has approved STOBOCLO® (CT-P41, denosumab-bmwo) and OSENVELT® (CT-P41, denosumab-bmwo), biosimilars referencing PROLIA® (denosumab) and XGEVA® (denosumab), respectively, for all indications of the reference products.

- In November 2024, the FDA accepted the biologics license application for HLX14, a denosumab (PROLIA/XGEVA) biosimilar, from Organon and Shanghai Henlius Biotech. Denosumab is FDA-approved for treating postmenopausal women at high fracture risk, those with inadequate responses to other osteoporosis treatments, and patients on long-term corticosteroids.

Osteoporosis Market Segmentation

DelveInsight’s ‘Osteoporosis – Market Insights, Epidemiology, and Market Forecast – 2032’ report provides a detailed outlook of the current and future Osteoporosis market, segmented within countries and by therapies. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Osteoporosis Market Size by Countries

The total Osteoporosis market size is analyzed for individual countries of the 7MM (the United States Market, EU4 (Germany, France, Italy, and Spain) and the UK market, and Japan market). The United States accounted for a larger portion of the 7MM market for Osteoporosis in 2022 due to the high prevalence of the condition and the higher cost of treatments. This dominance is predicted to continue with the potential early entry of new products.

Osteoporosis Market Size by Therapies

Osteoporosis Market Size by Therapies is categorized into Bisphosphonates, Anti-reabsorptive agents, anabolic agents, estrogen replacement selective estrogen receptor modulators, and others. EB613 (PTH 1-34), a drug in the developmental pipeline of EnteraBio, is likely to get approval. EVENITY (romososzumab) by Amgen and UCB is approved by the US FDA for the treatment of Osteoporosis in postmenopausal women at high risk for fracture.

Note: Detailed market segment assessment will be provided in the final report.

Explore more about the emerging therapies and key companies actively working in the market: Osteoporosis Drugs

Osteoporosis Drugs Uptake

This section focuses on the sales uptake of potential Osteoporosis drugs that have recently launched or are anticipated to be launched in the osteoporosis market between 2019 and 2032. It estimates the market penetration of Osteoporosis drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the Osteoporosis market.

Note: Detailed assessment of drug uptake and attribute analysis will be provided in the full report on Osteoporosis.

Osteoporosis Market Access and Reimbursement

DelveInsight’s ‘Osteoporosis Market Insights, Epidemiology, and Market Forecast – 2032’ report provides a descriptive overview of the market access and reimbursement scenario of Osteoporosis.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

Latest KOL Views on Osteoporosis

To keep up with current Osteoporosis market trends and fill gaps in secondary findings, we interview KOLs and SMEs’ working in the Osteoporosis domain. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Osteoporosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Osteoporosis unmet needs.

What KOLs are saying on Osteoporosis Patient Trends?

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals like the University of California at Davis Medical Center, Sacramento, CA, Maine Medical Center Research Institute, Scarborough, Maine, IGES Institute for Healthcare and Social Research Ltd., Wichmannstrasse Berlin, Germany and Others.

“Although the fracture patients usually present themselves at the emergency rooms or fracture clinics, it has proven very difficult to organize a post-fracture investigation for osteoporosis.”

Note: Detailed assessment of KOL Views will be provided in the full report on Osteoporosis.

Osteoporosis Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Osteoporosis Market using various Competitive Intelligence tools, including SWOT analysis, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Osteoporosis Clinical Trial Analysis

The report provides insights into Osteoporosis Clinical Trials within Phase II and III stages. It also analyses Osteoporosis companies developing targeted therapeutics.

Osteoporosis Pipeline Development Activities

The report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Osteoporosis therapies.

Osteoporosis Market Report Insights

- Osteoporosis Patient Population

- Osteoporosis Therapeutic Approaches

- Osteoporosis Pipeline Analysis

- Osteoporosis Market Size and Trends

- Osteoporosis Market Opportunities

- Impact of Upcoming Osteoporosis Therapies

Osteoporosis Market Report Key Strengths

- 10 Years Forecast

- The 7MM Coverage

- Osteoporosis Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Osteoporosis Market

- Osteoporosis Drugs Uptake

Osteoporosis Market Report Assessment

- Osteoporosis Current Treatment Practices

- Osteoporosis Unmet Needs

- Osteoporosis Pipeline Product Profiles

- Osteoporosis Market Attractiveness

- Osteoporosis Market Drivers

- Osteoporosis Market Barriers

Key Questions Answered In The Osteoporosis Market Report

- What are the key findings of the market across the 7MM, and what country will have the largest Osteoporosis market size during the forecast period (2025–2034)?

- What are the major causes of Osteoporosis, and how is it diagnosed?

- What are the marketed drugs for Osteoporosis in the 7MM?

- At what CAGR is the Osteoporosis market, and is epidemiology expected to grow in the 7MM during the forecast period (2025–2034)?

- How would the unmet needs impact the Osteoporosis market dynamics and subsequently influence the analysis of related trends?

- What would be the forecasted patient pool of Osteoporosis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- What are the current treatment guidelines and options for Osteoporosis in the US, Europe, and Japan?

- What are the latest advancements in novel therapies, targets, mechanisms of action, and technologies being developed to address the limitations of existing therapies for Osteoporosis?

- How many Osteoporosis companies are currently engaged in the development of therapies for the treatment of Osteoporosis?

Read Our Recent Articles:-

- What All You Need to Know About Evolving Osteoporosis Therapeutic Landscape?

- How Is Osteoporosis Impacting The Quality Of Life?

- Emerging drugs bring a positive shift in Global Osteoporosis Market

- World Osteoporosis Day

- New Osteoporosis Drug promises to rebuild Bone

- FDA approves Bonsity for Osteoporosis treatment

- Latest DelveInsight Blogs