Hunter Syndrome Market

- The US accounted for the largest Hunter Syndrome Market Size among the 7MM countries in 2023. The anticipated launch of targeted emerging therapies would bring about changes in treatment methodologies and facilitate market growth.

- Hunter Syndrome is an ultra-rare indication. In the United States, there are about 500 Hunter Syndrome Prevalent cases.

- Currently, the Hunter Syndrome treatment includes enzyme replacement therapy (ERT), hematopoietic stem cell transplantation (HSCT), and bone marrow transplantation (BMT).

- Few therapies are already in the market for the treatment of Hunter Syndrome, and few are in the pipeline. The only approved drug by the US FDA is ELAPRASE for Hunter Syndrome. Additionally, IZCARGO and HUNTERASE ICV are only approved in Japan for Hunter Syndrome.

- Current treatment choices affect pain and other symptoms, yet none directly addresses the cognitive component.

- Enzyme replacement therapies are good but do not cross the blood-brain barrier. Thus, the behavior and neurocognitive are never altered with it.

- REGENXBIO’s gene therapy RGX-121 is one of the promising options in the pipeline. RGX-121 can become the first gene therapy option approved for MPS II as the company has a successful pre-BLA meeting with the FDA and gained alignment with the FDA that a surrogate biomarker of CSF levels of D2S6 is a good endpoint for possible accelerated approval.

- Brain dysfunction is present in as many as 70% of these individuals with MPS II. RGX-121 could serve as a treatment option for the long run, as well as aiding in the elimination of its neuronopathic form.

- During the 20th Annual WORLD Symposium, held in February 2024, Denali Therapeutics announced the Phase I/II interim analysis of DNL310, demonstrating sustained normalization of CSF heparan sulfate and robust and sustained reduction in neurofilament light chain (NfL).

Request for unlocking the CAGR of the Hunter Syndrome Drugs Market

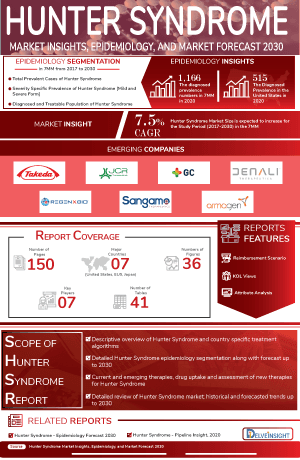

DelveInsight's “Hunter Syndrome Market Insight, Epidemiology, and Market Forecast – 2034” report delivers an in-depth analysis of Hunter Syndrome epidemiology, market, and clinical development in Hunter Syndrome. In addition to this, the report provides historical and forecasted epidemiology and market data as well as a detailed analysis of the hunter syndrome market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

Hunter Syndrome Drugs Market report provides real-world prescription pattern analysis, emerging drugs assessment, market share, and uptake/adoption pattern of individual therapies, as well as historical and forecasted hunter syndrome market size from 2020 to 2034 in 7MM. The report also covers current Hunter Syndrome treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Hunter Syndrome Epidemiology |

Segmented by:

|

|

Hunter Syndrome Companies |

|

|

Hunter Syndrome Key therapies |

|

|

Hunter Syndrome Drugs Market |

Segmented by:

|

|

Hunter Syndrome Market Analysis |

|

Hunter Syndrome Treatment Market

Hunter syndrome is also known as Mucopolysaccharidosis type II (MPS II). It is a condition that affects many different parts of the body and mainly affects males. It is a progressive disorder, but the rate of progression varies among affected individuals. It is a rare, X-linked disorder caused due to a deficiency of the lysosomal enzyme iduronate-2-sulfatase, which plays a major role in the catabolism of glycosaminoglycans (GAG). In patients with mucopolysaccharidosis II, glycosaminoglycans accumulate within tissues and organs, contributing to the signs and symptoms of the disease. Mucopolysaccharidosis II affects multiple organs and physiologic systems and has a variable age of onset and variable rate of progression. Common presenting features include excess urinary glycosaminoglycan excretion, facial dysmorphism, organomegaly, joint stiffness and contractures, pulmonary dysfunction, myocardial enlargement and valvular dysfunction, and neurologic involvement.

Hunter Syndrome Diagnosis

The diagnosis of Hunter Syndrome is established in a male by identifying the deficient iduronate 2-sulfatase (I2S) enzyme activity in white cells, fibroblasts, or plasma in the presence of normal activity of at least one other sulfatase. Detection of a hemizygous pathogenic variant in IDS confirms the diagnosis in a male with an unusual phenotype or a phenotype that does not match the results of GAG testing. The diagnosis of this indication is usually established in a female with suggestive clinical features by identification of a heterozygous IDS pathogenic variant on molecular genetic testing.

Further details related to country-based variations in diagnosis are provided in the report

Hunter Syndrome Treatment

While there is no cure for Hunter Syndrome, there are two types of treatment to help improve patient’s symptoms and quality of life and lengthen their lifespan:

- Hematopoietic stem cell transplantation (HSCT) is when blood stem cells (a type of cell that helps the body create red and white blood cells and platelets, or cells that help repair and build red blood cells) from the bone marrow (spongy inner part of the bones) are taken from one person and given through an IV to the child with Hunter Syndrome.

- Enzyme replacement therapy can give the body the enzymes it cannot make. An infusion of the enzyme is introduced back into the body through an IV; this can improve many symptoms of Hunter Syndrome.

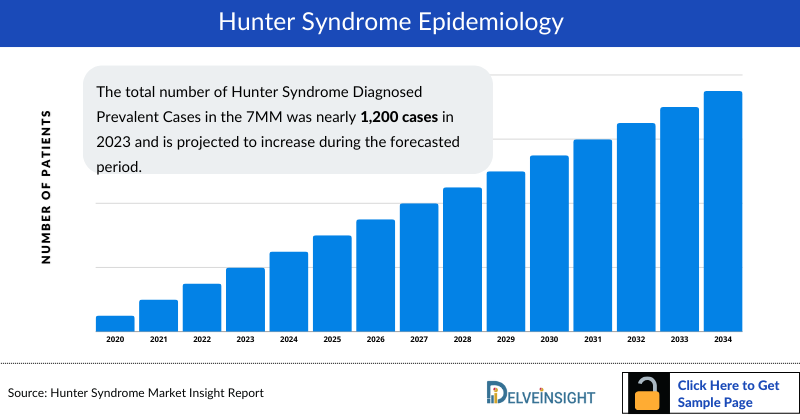

Hunter Syndrome Epidemiology

The Hunter Syndrome epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as the Total Diagnosed Prevalent Cases of Hunter Syndrome and Severity-specific Cases of Hunter Syndrome in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The total number of Hunter Syndrome Diagnosed Prevalent Cases in the 7MM was nearly 1,200 cases in 2023 and is projected to increase during the forecasted period.

- The total number of Hunter Syndrome Diagnosed Prevalent Cases in EU4 and the UK for hunter syndrome was estimated to be nearly 350 cases in 2023. Germany had the highest prevalent cases followed by the UK.

- MPS II typically affects only males, with symptoms becoming apparent at approximately 2–4 years of age.

- It is estimated that about two-third of MPS II patients develop cognitive impairment with onset of symptoms between 1 to 3 years of age in the neuronopathic form.

- Patients with MPS II are often classified as severe MPS II or mild MPS II. Severe form accounts for 65–70% of the cases. However, it slightly varies from country to country.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Hunter Syndrome Incidence

Hunter Syndrome Recent Developments

- In May 2025, REGENXBIO Inc. (Nasdaq: RGNX) announced that the FDA has accepted its Biologics License Application (BLA) for accelerated approval of clemidsogene lanparvovec (RGX-121) to treat Mucopolysaccharidosis II (Hunter syndrome). The FDA granted Priority Review with a PDUFA target date of November 9, 2025.

Hunter Syndrome Drug Chapters

The drug chapter segment of the Hunter Syndrome Drugs Market Report encloses a detailed analysis of Hunter Syndrome marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into Hunter Syndrome's pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Hunter Syndrome Marketed Drugs

- ELAPRASE (idursulfase): Takeda Pharmaceuticals

ELAPRASE is the first enzyme replacement therapy to be approved for people suffering from Hunter syndrome and it was launched in the US in July 2006 and in 2007 in the EU and Japan. ELAPRASE has been shown to improve walking capacity in patients 5 years and older. In patients 16 months to 5 years of age, no data are available to demonstrate improvement in disease-related symptoms or long term clinical outcome; however, treatment with ELAPRASE has reduced spleen volume similarly to that of adults and children 5 years of age and older. The safety and efficacy of ELAPRASE have not been established in pediatric patients less than 16 months of age.

- IZCARGO: JCR Pharmaceuticals

IZCARGO is the world’s first biological drug applied with the brain drug delivery technology J-Brain Cargo., which utilizes the transferrin receptor-mediated Fe/transferrin transport to the brain and was launched in Japan to treat patients with all forms of MPS II. In March 2021, JCR received approval in Japan for IZCARGO (10 mL, intravenous drip infusion), the first enzyme replacement therapy capable of crossing the blood-brain barrier. Sales of IZCARGO increased more than 10% year-on-year and progressing well. The revenue reached from JPY 1,070 million in Q1 2022 to JPY 1,372 in Q1 2024.

At present, JCR is conducting a global Phase III trial for Hunter syndrome and completed the enrollment of more than 60% of the eligible patients in Cohort A.

Note: Detailed current therapies assessment will be provided in the full report of Hunter Syndrome

Hunter Syndrome Emerging Drugs

- Tividenofusp alfa (DNL310): Denali Therapeutics

Tividenofusp alfa (DNL310) is a fusion protein composed of IDS fused to Denali’s proprietary Enzyme Transport Vehicle (ETV), which is engineered to cross the BBB via receptor-mediated transcytosis into the brain and to enable broad delivery of IDS into cells and tissues throughout the body with the goal of addressing the behavioral, cognitive, and physical manifestations of MPS II. In March 2021, the US Food and Drug Administration granted Fast Track Designation to DNL310 for the treatment of patients with MPS II. In May 2022, the European Medicines Agency granted DNL310 Priority Medicines designation.

In April 2024, Denali completed enrollment of 47 participants with MPS II in a Phase I/II study. The COMPASS Phase II/III study is expected to finish enrollment in 2024. In July, a review was published, discussing heparan sulfate as a potential biomarker for accelerated approval in neuronopathic MPS disorders. Following a workshop in February 2024, the FDA expressed openness to discussing an accelerated approval pathway for tividenofusp alfa with cerebrospinal fluid heparan sulfate as a surrogate biomarker. Denali plans to file for accelerated approval and will update in the second half of 2024.

- RGX-121: Regenxbio

RGX121 is an investigational adeno-associated Virus (AAV) therapeutic for the treatment of MPS II. RGX121 is designed to use the NAV AAV9 vector to deliver the human IDS gene to cells in the Central Nervous System (CNS). RGX-121 is the only product in late-stage development with the potential to address neurocognitive development in patients diagnosed under the age of 2 years. In May 2023, RGX-121 received Regenerative Medicine Advanced Therapy (RMAT) designation. Moreover, the drug has also received Orphan Drug Designation (ODD, 2015), Rare Pediatric Drug Designation (RPDD, 2016), and Fast Track Drug Designation (FTD, 2018) from the US FDA. In October 2017, the EMA granted ODD to REGENXBIO for recombinant adeno-associated viral vector serotype 9 containing the human IDS gene.

In June 2024, REGENXBIO successfully concluded a Pre-BLA meeting with the FDA for RGX-121, outlining the BLA submission details. The FDA will consider cerebrospinal fluid heparan sulfate D2S6 as a surrogate endpoint for accelerated approval. REGENXBIO plans to start a rolling BLA submission in Q3 2024, with a confirmatory study set to begin in H2 2025. A priority review could lead to a Rare Pediatric Disease Priority Review Voucher in 2025.

Read More Insights @ RGX121 Market

|

Drug name |

Company |

MoA |

Phase |

Indication |

|

DNL310 |

Denali Therapeutics |

Iduronate Sulfatase Replacement Therapy |

II/III |

Hunter syndrome |

|

RGX-121 |

Regenxbio |

Human IDS gene delivery to CNS |

II/III |

Hunter syndrome |

|

JR-141 |

JCR Pharmaceuticals |

Iduronate Sulfatase Replacement Therapy |

II/III |

Hunter syndrome |

Note: Detailed emerging therapies assessment will be provided in the final report.

Hunter Syndrome Drugs Market Insights

Targeted therapies for mutations such as enzyme replacement therapy (ERT), hematopoietic stem cell transplantation (HSCT), and Bone Marrow Transplantation (BMT) mainly dominate the existing Hunter Syndrome treatment.

Enzyme replacement therapy with idursulfase

ELAPRASE is approved with an active ingredient called idursulfase. Hunter disease is a progressive X-linked lysosomal storage disorder characterized by impaired lysosomal degradation of the glycosaminoglycans (GAG) heparan and dermatan sulfate, is caused by variants in the Iduronate 2-sulfatase (IDS) gene that encodes IDS enzyme. Enzyme replacement therapy (ERT) with recombinant idursulfase (ELAPRASE) has shown positive effects on overall survival, growth, physical and respiratory function, and reduction of GAG levels in the spleen, liver, heart, and urine. Many drugs are in the emerging pipeline with ERT with IDS, such as DNL310, RGX-121, and others, which will face competition with already approved drugs.

Hunter Syndrome Market Outlook

The Hunter Syndrome Market is mainly dominated by ERT, along with a few major emerging products in the pipeline that are also based on the same principle of iduronate 2-sulfatase (I2S) ERT. The only approved therapy with idursulfase is ELAPRASE. However, one of the major drawbacks of ELAPRASE is its inability to cross the blood-brain barrier (BBB), which affects the product’s efficacy.

Since IV ERT cannot cross the BBB, it does not improve or even halt the neurological symptoms and neurodegeneration in patients with neuronopathic forms of Hunter Syndrome. However, hematopoietic stem cell transplantation is still improving to be secure and accessible after developing new protocols and techniques and creating bone marrow donor registries and umbilical cord banks. Additionally, the emergence of gene therapies, which can target and subsequently edit specific stretches of a genetic code, can also prove to be a big competition soon for ERT-based therapies.

Researchers at the Center for Genomic Engineering have found Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) gene therapies to be 99% accurate. ERT is a therapy that needs to be continued for years, making it expensive for the patients of idursulfase for MPS II. Studies also indicate that symptoms after ERT discontinuation included several adverse events such as recurrent respiratory infections (severe pneumonia) with respiratory insufficiency, difficulty with walking/standing, increased joint stiffness, decreased hematological parameters, renal insufficiency, and death. As a result, gene editing, mainly through CRISPR and zinc-finger nucleases (ZFNs), has become a cost-effective and quick way to cure such diseases that previously required complicated treatments.

The Hunter Syndrome Therapeutics Market comprises a robust pipeline with the advent of promising emerging products by several key Hunter Syndrome Companies, namely, JR-141 (JCR Pharmaceuticals), DNL310 (Denali Therapeutics), RGX-121 (Regenxbio), and others. The promising emerging pipeline therapies will fuel the market during the forecast period (2020–2034).

Key Findings

- Approval of IZCARGO in Japan under the SAKIGAKE designation is a key milestone in JCR Pharmaceuticals’ global expansion. It comes on the heels of Fast Track designation from the US FDA, Orphan Designation from the European Medicines Agency, and the FDA’s acceptance of the JR-141 Investigational New Drug application, enabling JCR to begin Phase III trial in the US.

- The US accounted for the largest Hunter Syndrome Market Size among the 7MM countries in 2023. The anticipated launch of targeted emerging therapies would bring about changes in treatment methodologies and facilitate market growth.

- Current ERT fall significantly short in addressing the CNS manifestations of the disease, owing to their inability to cross the blood-brain barrier. Hunter Syndrome Therapies like DNL310 with their ability to cross blood-brain barrier will have a significant opportunity to capture the larger market share.

- RGX-121 is likely to become the first gene therapy to reach the market for Hunter Syndrome, this treatment option could become the leading product in Hunter Syndrome market.

- Even after the positive outlook, emerging therapies are not expected to achieve the blockbuster therapy status in the 7MM, owing to factors like smaller target pool, market and reimbursement challenges and competition from marketed (enzyme replacement therapies).

Hunter Syndrome Drugs Uptake

The current Hunter syndrome treatment involves patients receiving infusion of the IDS enzyme, usually once a week. These infusions can help break down the accumulated glycosaminoglycans and can help alleviate symptoms and slow disease progression. However, the enzyme does not cross the blood-brain barrier, so the treatment does not help with cognitive or developmental symptoms.

REGENXBIO’s neurodegenerative disease program has RGX-121, which is in a pivotal study enrolling patients for the phase I/II/III CAMPSIITE trial. The company is planning to file a BLA in 2024. RGX-121 is expected to become the first gene therapy in this indication. Apart from REGENXBIO, Denali Therapeutics is also moving forward with DNL310 (or ETV:IDS) in MPS-II/Hunter’s disease. DNL310 is a recombinant IDS enzyme engineered to cross the blood-brain barrier and to replace the IDS enzyme and treat neuropathic and systemic forms of the disease. In June 2023, Denali disclosed a 64% decrease from baseline in the biomarker NfL, which has been widely accepted in the industry as a biomarker of neurodegeneration across neurodegenerative diseases. This makes the DNL310 program promising. In light of the drug's safety profile up to 85 weeks of dosage and the normalization of heparan sulfate levels, Denali is in discussions with the FDA about whether it might be eligible for accelerated approval.

This section focuses on the uptake rate of potential Hunter Syndrome drugs expected to be launched in the market during 2020–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Hunter Syndrome Pipeline Development Activities

The Hunter Syndrome theraeutics market report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Hunter Syndrome Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Hunter Syndrome treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Hunter Syndrome therapies.

KOL Views

To keep up with the real-world scenario in current and emerging Hunter Syndrome market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Professors, and Others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as UT Health San Antonio MD Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Hunter Syndrome market trends.

|

KOL Views |

|

“Since the cost of ELAPRASE is quite high for the patients to bear for the treatment of MPS II, there are several organizations and authorities, which can avail reimbursement relief to the patients. Elaprase must be considered medically necessary to be covered under Medicare, Medicaid, or Medicaid managed care.” Professor, Emory University, US |

Qualitative Analysis

We perform Qualitative and Hunter Syndrome Therapeutics Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging Hunter Syndrome therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Hunter Syndrome Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The Hunter Syndrome drugs market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of Hunter Syndrome Market Report

- The Hunter Syndrome therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the Hunter Syndrome epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Hunter Syndrome therapeutics market, historical and forecasted Hunter Syndrome treatment market size, Hunter Syndrome market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Hunter Syndrome therapeutics market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Hunter Syndrome market.

Hunter Syndrome Treatment Market Report Insights

- Patient-based Hunter Syndrome Market Forecasting

- Therapeutic Approaches

- Hunter Syndrome Pipeline Analysis

- Hunter Syndrome Market Size

- Hunter Syndrome Market Trends

- Existing and future Hunter Syndrome Market Opportunity

Hunter Syndrome Market Report Key Strengths

- 11 Years Hunter Syndrome Market Forecast

- 7MM Coverage

- Hunter Syndrome Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Hunter Syndrome Drugs Uptake

- Key Hunter Syndrome Market Forecast Assumptions

Hunter Syndrome Therapeutics Market Report Assessment

- Current Hunter Syndrome Treatment Market Practices

- Hunter Syndrome Unmet Needs

- Hunter Syndrome Pipeline Product Profiles

- Hunter Syndrome Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the historical and forecasted Hunter Syndrome patient pool/patient burden in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Which treatment approaches will have a significant impact on the Hunter Syndrome treatment market size?

- How would the market drivers, barriers, and future opportunities affect the Hunter Syndrome market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the treatment of Hunter Syndrome?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

- How many key Hunter Syndrome companies are developing therapies for Hunter Syndrome?

- Which drug will be the major contributor to the Hunter Syndrome market by 2034?

Reasons to Buy

- The Hunter Syndrome Treatment Market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the hunter syndrome drugs market.

- Insights on patient burden/disease Hunter Syndrome Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Hunter Syndrome Treatment Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Hunter Syndrome Companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Hunter Syndrome Treatment Market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with new articles:-