Bone Marrow Failure Market Summary

Key Highlights

- Bone Marrow Failure is a condition in which the marrow cannot adequately produce blood cells, leading to single-lineage cytopenia or pancytopenia. It arises from intrinsic stem-cell defects or disturbances in the marrow microenvironment and is broadly classified into Acquired Bone Marrow Failure (ABMF) and Inherited Bone Marrow Failure Syndromes (IBMFS), each with distinct causes and clinical features.

- BMF is diagnosed through blood tests that reveal reductions in red cells, white cells, and platelets, followed by a bone marrow biopsy to document low marrow cellularity and rule out alternative conditions. After establishing the diagnosis, further workups—such as genetic analyses or investigations for potential acquired triggers—are conducted to identify the underlying cause.

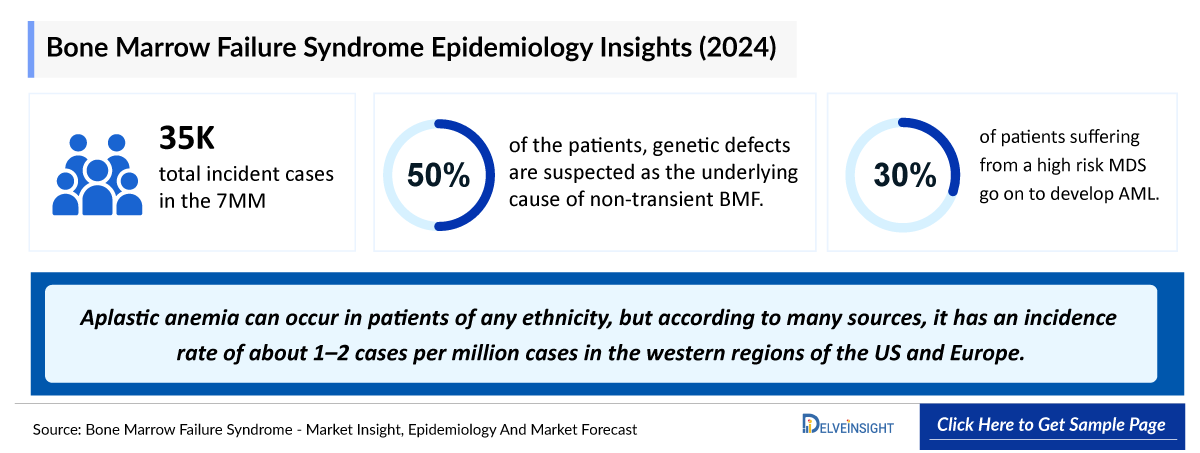

- In 2024, the 7MM recorded roughly 35 thousand incident BMF cases, underscoring the steady clinical burden and the continued need for earlier diagnosis and effective treatment strategies.

- DelveInsight estimates that the United States recorded about 15,600 incident BMF cases in 2024, underscoring the sustained clinical need in this population.2024.

- ROMIPLATE (romiplostim) has seen meaningful regulatory advancement in Japan—its sole market with approval for aplastic anemia—moving from a limited indication for refractory patients in 2019 to full approval for all aplastic anemia cases in 2023, underscoring its growing clinical relevance in the country’s treatment landscape.

- Teva’s 2023 FDA approval of ALVAIZ (eltrombopag choline) for adults with severe aplastic anemia unresponsive to immunosuppressive therapy broadens available treatment options in a clinically underserved population and introduces meaningful competition within the TPO-receptor agonist category.

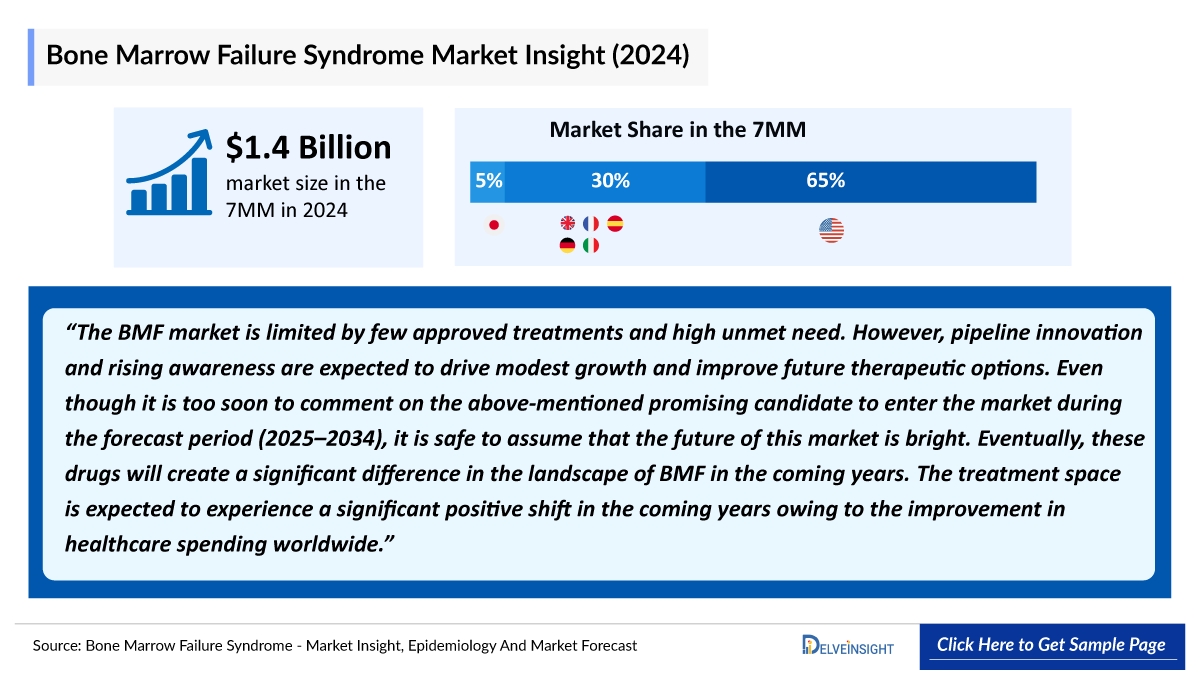

- In 2024, the US dominated the BMF market among the 7MM, capturing approximately 65% of the total 7MM market share.

- The BMF market across the 7MM reached approximately USD 1.4 billion in 2024, underscoring the sustained clinical burden and the ongoing dependence on foundational treatment approaches even as early innovation begins to shape future care pathways.

- In December 2025, Faron Pharmaceuticals presented full Phase I/II BEXMAB data at ASH 2025, showing improved survival and new evidence of hematopoietic recovery in higher-risk MDS patients treated with bexmarilimab plus azacitidine.

- In November 2025, Faron Pharmaceuticals reported that two Phase I/II BEXMAB abstracts were accepted for ASH 2025, including an oral presentation on the efficacy and molecular findings of bexmarilimab plus azacitidine in TP53-mutated higher-risk MDS.

- Emerging BMF therapies such as CK0801, EXG-34217, sonrotoclax (BGB-11417), and bexmarilimab + SoC reflect a new wave of mechanism-driven approaches targeting immune dysfunction, telomere biology, apoptotic pathways, and macrophage activity, signaling meaningful progress toward more effective, disease-modifying treatment options.

Report Summary

- The report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Bone Marrow Failure (BMF) market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM BMF market.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Epidemiology |

Segmented by:

|

|

Market |

Segmented by:

|

|

Market Analysis |

|

Bone Marrow Failure (BMF) Drug Chapters

The section dedicated to drugs in the BMF report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to BMF. The drug chapters section provides valuable information on various aspects related to clinical trials of BMF, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting BMF.

Marketed Therapies

ROMIPLATE (romiplostim): Kyowa Kirin/Amgen

ROMIPLATE is a recombinant protein that activates the thrombopoietin receptor and was developed by Kyowa Kirin under license from Amgen K-A, Inc. It was first introduced in Japan for the treatment of Idiopathic Thrombocytopenic Purpura (ITP) in April 2011, and later, in June 2019, it received approval for use in aplastic anemia in patients who did not respond adequately to standard therapy.

- In June 2019, Kyowa Hakko Kirin announced that it had received partial change approval for Romiplate for the additional indication of treating aplastic anemia in patients who had an inadequate response to conventional therapy from Japan’s Ministry of Health, Labour and Welfare (MHLW).

- In September 2023, Kyowa Kirin received approval from the Japanese MHLW for the hematopoietic stimulating agent ROMIPLATE to change the approved indication from “aplastic anemia in patients who had an inadequate response to conventional therapy” to “aplastic anemia” in Japan.

ALVAIZ (eltrombopag choline): Teva Pharmaceuticals

ALVAIZ (eltrombopag choline) is a thrombopoietin receptor agonist approved for adults with severe aplastic anemia who do not respond adequately to immunosuppressive therapy. It binds to the transmembrane region of the TPO receptor (cMpl), activating downstream signaling pathways that promote megakaryocyte proliferation and maturation, ultimately increasing platelet production.

In November 2023, Teva Pharmaceuticals received FDA approval for ALVAIZ (eltrombopag choline) for the treatment of adult patients with severe aplastic anemia who have not responded adequately to immunosuppressive therapy.

|

Drug Name |

Company |

MoA |

RoA |

Approval |

Molecule Type |

Indication |

Designations |

|

ROMIPLATE (romiplostim) |

Kyowa Kirin/Amgen |

Thrombopoietin receptor agonist |

SC |

JP: 2019 |

Recombinant protein |

Aplastic anemia patients who have not responded sufficiently to conventional treatments |

N/A |

|

ALVAIZ (eltrombopag choline) |

Teva Pharmaceuticals |

Thrombopoietin receptor agonist |

Oral |

US: 2023 |

Small molecule |

Severe aplastic anemia patients who have had an insufficient response to immunosuppressive therapy |

N/A |

Emerging Therapies

CK0801: Cellenkos

CK0801 is an investigational, first-in-class allogeneic regulatory T-cell therapy in development by Cellenkos for acquired aplastic anemia. Derived from healthy donor cord blood using the company’s proprietary manufacturing platform, CK0801 delivers highly functional T-regulatory cells aimed at correcting immune dysregulation by modulating key inflammatory pathways.

In April 2025, Cellenkos announced that the US FDA has granted ODD to CK0801, an allogeneic cord blood-derived Tregs product, for the treatment of aplastic anemia.

EXG-34217: Elixirgen Therapeutics

EXG-34217 is a dose of autologous CD34+ HSCs that have transiently expressed Zinc finger and SCAN domain containing Protein 4 (ZSCAN4), a protein responsible for regulating telomere elongation and genome stability that can lengthen telomeres independently of telomerase. EXG-34217 is currently being studied in an ongoing Phase I/II trial for the treatment of patients with Telomere Biology Disorders (TBDs) with BMF.

In February 2025, Elixirgen Therapeutics reported early Phase I/II results showing the first documented, durable telomere elongation in two patients with a TBDxs treated with EXG-34217. No treatment-related safety issues were identified during follow-up periods of 24 months and 5 months after infusion.

|

Drug Name |

Company |

MoA |

RoA |

Phase |

Molecule Type |

Indication |

Designations |

|

CK0801 |

Cellenkos |

T lymphocyte replacements |

IV |

I |

Allogeneic Tregs therapy | Aplastic anemia |

ODD |

|

EXG-34217 |

Elixirgen Therapeutics |

ZSCAN4 |

IV |

I |

Autologous CD34+ HSCs |

TBDs with BMF |

ODD, RMAT, and RPDD |

|

Sonrotoclax (BGB-11417) |

BeOne Medicines |

BCL-2 inhibitor |

Oral |

I |

Small molecule |

MDS |

NA |

|

Bexmarilimab + SoC |

Faron Pharmaceuticals |

Clever-1 receptor inhibitor |

IV |

I/II |

mAb |

MDS |

ODD and FTD |

Bone Marrow Failure (BMF) Market Outlook

During the forecast period (2025–2034), pipeline candidates such as Cellenkos’ CK0801, Elixirgen Therapeutics’ EXG-34217, Faron Pharmaceuticals’ Bexmarilimab + SoC, and others are expected to drive the rise in BMF market size

In 2024, the EU4 and the UK represented around 30% of the total BMF market across the 7MM, reflecting a region where established clinical practices, strong healthcare infrastructure, and consistent diagnostic pathways continue to drive meaningful market contribution.

In 2024, Germany accounted for the largest share of the BMF market among the EU4 and the UK, followed by France, Italy, and the UK, highlighting regional disparities in diagnosis and treatment access.

The Japan BMF market was valued at around USD 100 million in 2024, reflecting a stable, mature landscape where established therapies continue to guide clinical practice.

The BMF market is limited by few approved treatments and high unmet need. However, pipeline innovation and rising awareness are expected to drive modest growth and improve future therapeutic options. Even though it is too soon to comment on the above-mentioned promising candidate to enter the market during the forecast period (2025–2034), it is safe to assume that the future of this market is bright. Eventually, these drugs will create a significant difference in the landscape of BMF in the coming years. The treatment space is expected to experience a significant positive shift in the coming years owing to the improvement in healthcare spending worldwide.

Further details are provided in the report…

Bone Marrow Failure (BMF) Understanding and Treatment

Bone Marrow Failure (BMF) Overview

Bone Marrow Failure (BMF) refers to a condition in which the bone marrow cannot sufficiently generate one or more blood cell lineages, leading to diminished or absent hematopoietic precursors and resulting cytopenias. This impaired hematopoiesis may present as single-lineage deficits or pancytopenia and can arise from intrinsic stem cell abnormalities or disturbances within the marrow microenvironment.

Acquired BMF is the most common form in adolescents and adults—arises from immune-mediated injury, toxic exposures, infections, radiation, or clonal disorders and includes aplastic anemia, Pure Red Cell Aplasia (PRCA), acquired amegakaryocytic thrombocytopenia, MDS, and Paroxysmal Nocturnal Hemoglobinuria (PNH), which often overlaps with aplastic anemia. These disorders typically present with fatigue, recurrent infections, and bleeding due to cytopenias. In contrast, inherited BMF syndromes result from germline defects in DNA repair, telomere biology, or ribosomal function and include Fanconi anemia, dyskeratosis congenita, Diamond–Blackfan Anemia (DBA), Shwachman–Diamond syndrome (SDS), Severe Congenital Neutropenia (SCN), and Congenital Amegakaryocytic Thrombocytopenia (CAT), generally presenting in childhood but sometimes diagnosed later because of variable severity.

Further details are provided in the report…

Bone Marrow Failure (BMF) Diagnosis

Evaluation of BMF begins with peripheral smear assessment and bone marrow biopsy to evaluate cellularity, dysplasia, and clonal abnormalities while excluding nutritional deficiencies, infections, toxic exposures, and secondary causes such as PNH. IBMFS are considered when there is early-onset disease, family history, or congenital anomalies. Screening includes chromosome breakage testing for Fanconi anemia, telomere length measurement for dyskeratosis congenita, and genetic sequencing for disorders such as SDS, CAT, DBA, and reticular dysgenesis.

Diagnosis of acquired conditions relies on characteristic features: acquired aplastic anemia is defined by pancytopenia with hypocellular marrow; PRCA shows isolated anemia with severe reticulocytopenia; MDS is identified by persistent cytopenias, dysplasia, and clonal cytogenetic or molecular mutations; PNH is confirmed by flow cytometry showing loss of GPI-anchored proteins; and acquired amegakaryocytic thrombocytopenia is diagnosed through isolated thrombocytopenia with markedly reduced megakaryocytes on marrow biopsy.

Further details related to country-based variations are provided in the report…

Bone Marrow Failure (BMF) Treatment

Hematopoietic stem cell transplantation (HSCT) is the only curative therapy for inherited bone marrow failure syndromes (IBMFS), as immunosuppressive therapy has no role in these genetic conditions. Transplant planning requires careful selection of conditioning regimens—often reduced intensity due to heightened toxicity in disorders such as Fanconi anemia, dyskeratosis congenita, and SDS—and ensuring that related donors are not affected carriers. Supportive care, including transfusions, infection prevention, and iron chelation, remains essential, while glucocorticoids may benefit certain conditions such as DBA. Assisted reproductive technologies and cord blood banking offer additional options for families with inherited marrow failure.

Treatment of acquired marrow failure depends on the specific disorder. In acquired aplastic anemia, younger fit patients with matched donors undergo allogeneic HSCT, while others receive immunosuppressive therapy, often combined with eltrombopag to enhance hematologic recovery. PRCA is managed with supportive transfusions and targeted therapy based on etiology, including immunosuppression for autoimmune forms or correction of secondary triggers. MDS is treated with supportive care, erythropoiesis-stimulating agents, hypomethylating agents, or lenalidomide. In PNH with marrow failure, supportive care and immunosuppression may improve counts, while allogeneic HSCT is considered for severe cytopenias or refractory disease.

Further details related to treatment and management are provided in the report…

Bone Marrow Failure (BMF) Epidemiology

The BMF epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total BMF cases, incident cases of BMF in the associated indication, age-specific cases of BMF in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, incident BMF cases in the United States were overwhelmingly concentrated in acquired indications, with 15 thousand cases attributed to acquired BMF, forming the clear majority of the burden. In contrast, inherited BMF indications accounted for nearly 300 incident cases.

- Based on DelveInsight estimates, pediatric patients accounted for around one-third of all BMF cases in the United States in 2024, with adults representing the dominant share at roughly 70%.

- DelveInsight estimates that Japan recorded approximately 4 thousand BMF cases in 2024, highlighting a meaningful clinical burden that underscores the need for improved diagnostic pathways and expanded therapeutic options within this patient population.

KOL Views

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of BMF, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 10 KOLs across the 7MM. We contacted institutions such as the University of Minnesota, the Newcastle University, and Kanazawa University, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the BMF market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for BMF, one of the most important primary endpoints was achieving overall response rate, etc. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

In the United States, patient access programs help individuals prescribed ALVAIZ initiate and sustain therapy. Teva’s ALVAIZ (eltrombopag tablets) Savings Program offers financial support to eligible patients, allowing them to access treatment at a significantly reduced cost—with some patients paying as little as USD 0. The program provides guidance on insurance coverage, supports prior authorization processes, and helps minimize out-of-pocket expenses, ensuring broader accessibility to eltrombopag therapy.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Bone Marrow Failure Report Insights

- Patient Population

- Therapeutic Approaches

- Bone Marrow Failure Market Size and Trends

- Existing Market Opportunity

Bone Marrow Failure Report Key Strengths

- Ten-year Forecast

- The 7MM Coverage

- BMF Epidemiology Segmentation

- Key Cross Competition

Bone Marrow Failure Report Assessment

- Current Treatment Practices

- Reimbursements

- Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in BMF management recommendations?

- Would research and development advances pave the way for future tests and therapies for BMF?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of BMF?

- What kind of uptake will the new therapies witness in the coming years in BMF patients?