Metastatic Castration-Resistant Prostate Cancer (mCRPC) Market

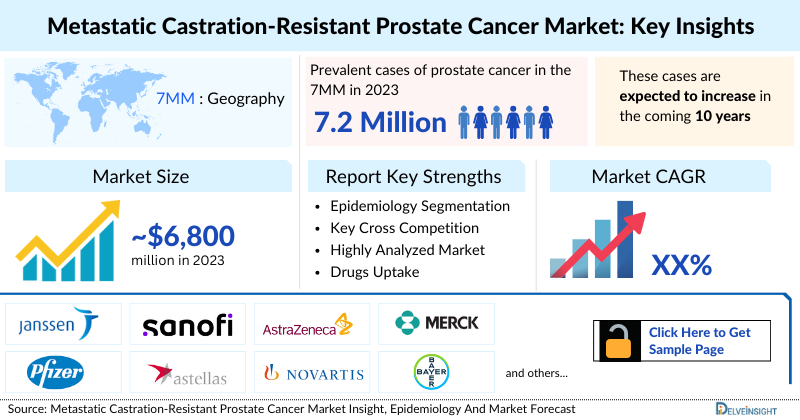

- The total metastatic castration-resistant prostate cancer market size in the 7MM was estimated to be nearly USD 6,800 million in 2023, which is expected to show positive growth by 2034 owing to the increasing prevalence of prostate cancer in emerging markets due to changing lifestyles, aging populations, and improved access to healthcare.

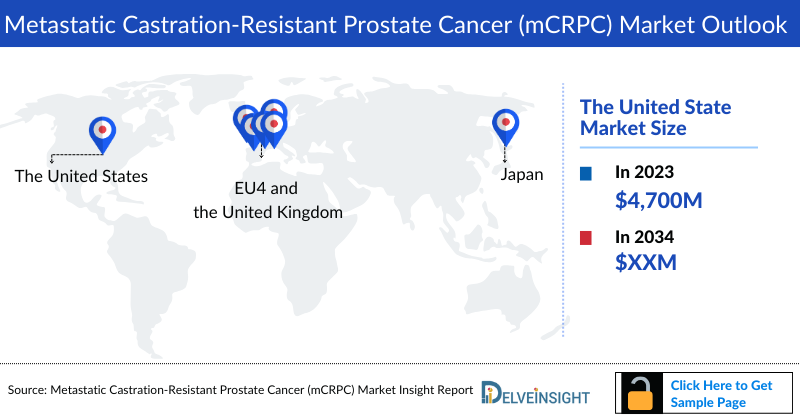

- In 2023, the United States held the highest mCRPC market share in the 7MM, contributing to ~64%, of the total metastatic castrate resistant prostate cancer therapeutic market share.

- Currently, the metastatic castration-resistant prostate cancer treatment market holds a diverse range of therapeutic alternatives for treatment, including PARP inhibitors, androgen receptor inhibitors, CYP17 inhibitors, microtubule inhibitors, ionizing radiation emitters, and others in different lines of treatment.

- Among the two types of Prostate cancer (mCSPC and mCRPC), mCRPC was more prevalent in 2023 in the 7MM

- AKEEGA (niraparib and abiraterone acetate) and a combination of TALZENNA (talazoparib) with XTANDI (enzalutamide) are recently approved therapies (2023) to treat patients with mCRPC. Other approved therapies for treating mCRPC in the past few years include XTANDI, PROVENGE, JEVTANA, ZYTIGA, LYNPARZA, and others. The mCRPC market has witnessed the approval of Novartis’ radioligand therapy, PLUVICTO, in 2022, which has generated unexpected revenue from the third-line mCRPC setting.

- XTANDI and abiraterone acetate are the leading ADTs that have dominated not just in terms of the market but are heavily prescribed in 1st and 2nd lines of mCRPC in real-world prescriptions. In the 7MM, in 2023, among the therapies, XTANDI accounted for the majority of the market share for mCRPC i.e. nearly 41%.

- Companies like Curium, Bristol-Myers Squibb, Merck and Orion, Pfizer, Merus, Zenith Epigenetics, MacroGenics, Laekna Therapeutics, Ipsen, AstraZeneca, Telix International, ESSA Pharma, Arvinas and Novartis, Lantheus, Eli Lilly/POINT Biopharma, Xencor, Promontory Therapeutics, and others are investigating their key products for managing mCRPC across various lines of treatment.

- Quantitatively mCRPC pipeline seems to be quite strong. Key mCRPC companies in the first-line setting include, Merck (Opevesostat), ESSA pharma (Masofaniten), Tavanta (TAVT-45), and others.

- In the second-line setting, CABOMETYX is anticipated to be the first among the emerging therapies to receive approval.

- In the third-line and above setting, Lantheus and Eli Lilly/POINT Biopharma’s radioligand 177Lu-PNT2002, AstraZeneca’s actinium-225-based PSMA-targeting radio-conjugate, FPI-2265, Arvinas and Novartis PROTAC AR degrader, ARV-766 are some of the potential candidates.

- Overall, the mCRPC market is expected to witness significant growth during the forecast period. Extensive market penetration of approved therapies in mCRPC due to label expansions and entry of new emerging therapies will be crucial factors facilitating the mcrpc treatment market growth.

Key Factors Driving Metastatic Castration-Resistant Prostate Cancer (mCRPC) Market

Metastatic Castration-Resistant Prostate Cancer Rising Prevalence

Metastatic castration-resistant prostate cancer (mCRPC) represents the more prevalent subtype of advanced prostate cancer in the 7MM, with the United States accounting for approximately 64% of the total market in 2023. The growing aging population, increased prostate cancer diagnosis, and rising awareness of advanced disease management contribute to the expanding patient pool.

Metastatic Castration-Resistant Prostate Cancer Therapeutic Advancements

The mCRPC treatment landscape is diverse, spanning androgen receptor inhibitors, PARP inhibitors, CYP17 inhibitors, microtubule inhibitors, and radioligand therapies. Approved therapies such as XTANDI, abiraterone acetate, PLUVICTO, AKEEGA, and the TALZENNA plus XTANDI combination have driven significant treatment adoption. First- and second-line treatments are dominated by XTANDI and abiraterone acetate, reflecting strong real-world prescription trends and market penetration.

Metastatic Castration-Resistant Prostate Cancer Market Growth Drivers

The market is witnessing substantial growth fueled by label expansions of approved therapies and the launch of innovative emerging therapies across multiple treatment lines. Radioligand therapies like PLUVICTO have generated notable revenue, while the introduction of novel agents targeting androgen receptor pathways, PSMA, and PROTAC degraders is expected to further accelerate market expansion.

Metastatic Castration-Resistant Prostate Cancer Clinical Trials and Competitive Landscape

Key companies, including Merck, Novartis, AstraZeneca, Eli Lilly/POINT Biopharma, Arvinas, ESSA Pharma, Tavanta, and others, are advancing a robust pipeline of therapies across first-line, second-line, and third-line settings. Emerging candidates such as Opevesostat, Masofaniten, 177Lu-PNT2002, ARV-766, and actinium-225 PSMA-targeting radio-conjugates are undergoing various stages of clinical evaluation.

DelveInsight’s “Metastatic Castration-Resistant Prostate Cancer (mCRPC) Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the metastatic prostate cancer, historical and forecasted epidemiology as well as the mCRPC herapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Metastatic Castration-Resistant Prostate Cancer (mCRPC) market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM mCRPC market size from 2020 to 2034. The mcrpc treatment market report also covers current mCRPC treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

mCRPC Market |

|

|

mCRPCs Market Size | |

|

mCRPC Companies |

PDS Biotechnology, PDC*line Pharma, LG Chem, AVEO Oncology, IO Biotech, Merck, Moderna, Candle Therapeutics, ISA Pharmaceuticals, Archival Farma, and others. |

|

mCRPC Epidemiology Segmentation |

|

Metastatic Castration-Resistant Prostate Cancer Treatment Market

Metastatic Castration-Resistant Prostate Cancer Overview

Prostate Cancer is a type of malignancy that occurs in the prostate gland. This cancer usually grows slowly and is confined to the prostate gland initially, where it may not cause serious harm. It is common in men of 50–64 years and over age 65; however, it can occur in men younger than 50 years. Symptoms of adenocarcinoma of the prostate include blood in the semen, frequent urge to urinate, and painful urination and ejaculation. The symptoms of prostate cancer do not usually appear until the prostate is large enough to affect the tube that carries urine from the bladder out of the penis.

Metastatic Castration-Resistant Prostate Cancer Diagnosis

Diagnosing prostate cancer involves various methods, including analyzing PSA levels in the blood, conducting a digital rectal exam to feel for abnormalities, performing a biopsy to examine tissue samples, utilizing genetic testing to identify potential risk factors, conducting imaging tests like ultrasound or MRI to visualize the prostate, and occasionally conducting a bone scan to check for metastasis. These tests are typically used together to comprehensively assess prostate health and detect any signs of cancer

Further details related to country-based variations in diagnosis are provided in the report…

Metastatic Castration-Resistant Prostate Cancer (mCRPC) Treatment

Treatment options for prostate cancer include surgery, radiation therapy, hormone therapy, immunotherapy, and chemotherapy. Radiation therapy employs high-energy rays or particles to eliminate cancer cells, with different types used based on the cancer stage and individual factors. Hormone therapy aims to lower levels of male hormones, known as androgens, to halt their role in fueling prostate cancer cells. Immunotherapy involves using medications to prompt the body's immune system to better identify and eradicate cancer cells. Chemotherapy becomes an option when prostate cancer extends beyond the prostate gland and hormone therapy proves ineffective. Chemotherapeutic drugs for prostate cancer may include Docetaxel (Taxotere), Cabazitaxel (JEVTANA), Mitoxantrone (Novantrone), and Estramustine (Emcyt).

Note: Further Details are provided in the final report

Metastatic Castration-Resistant Prostate Cancer Epidemiology

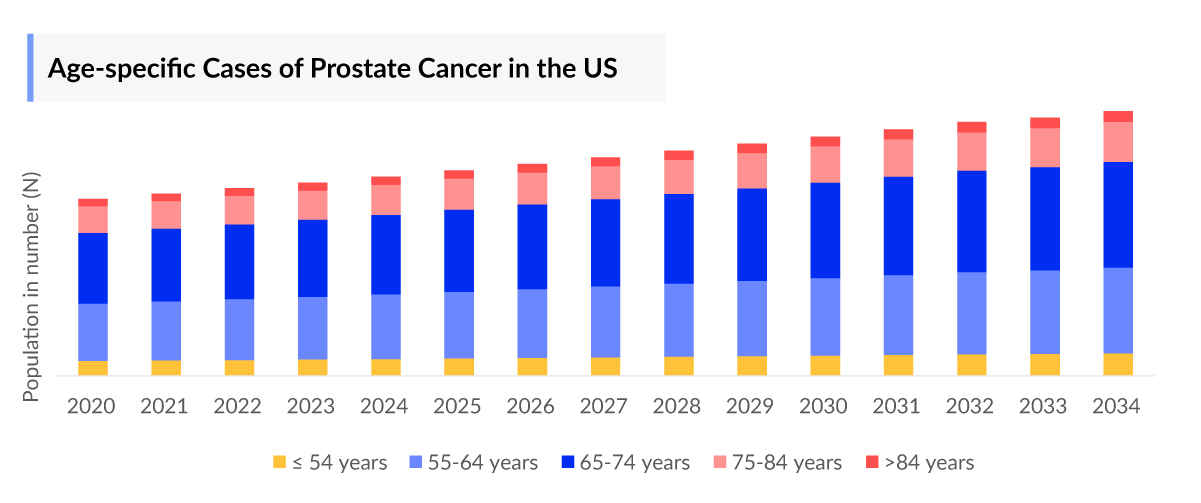

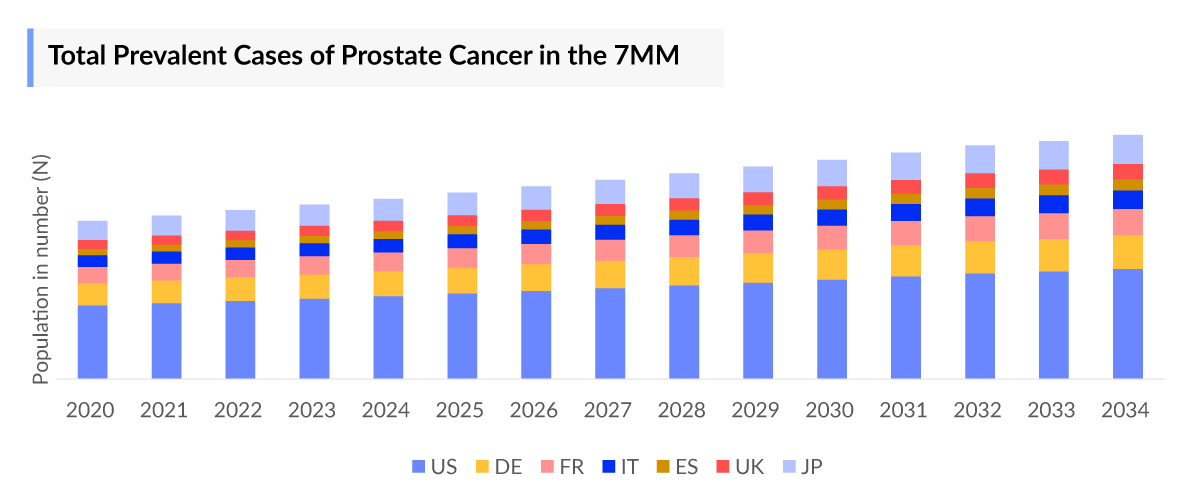

As the Metastatic Castration-Resistant Prostate Cancer treatment market is derived using a patient-based model, the Metastatic Castration-Resistant Prostate Cancer (mCRPC) epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Prevalent cases of Prostate cancer, Five–year Prevalent cases of Prostate cancer, Age-specific cases of Prostate cancer, Total cases of Prostate cancer by clinical stages, Total Prevalent cases of mCRPC in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, the 7MM had approximately 7,279,500 prevalent cases of prostate cancer. These are expected to rise due to the growing geriatric population and advancements in diagnostic capabilities during the forecast period (2024-2034).

- The five-year prevalent cases of prostate cancer in the US was ~1,093,300 in 2023.

- Among the EU4 and the UK, Germany accounted for the highest number of metastatic CRPC cases while, Spain had the lowest cases, in 2023.

- As per the analysis, in the United States, approximately 40% of prostate cancer cases are diagnosed in individuals aged 65-74 years, representing the most common age group for this disease.

- As per the estimates, in the US, majority of the cases were found to be localized/locally advanced cases (Stage I-III), comprising approximately 56% of total cases, while nearly 33% belonged to biochemical recurrence/ progressive cases, and ~11% belonged to metastatic cases.

- The total cases of mCRPC in the US comprised approximately 51,100 cases in 2023 and are projected to increase during the forecast period.

Recent Developments Metastatic Castration-Resistant Prostate Cancer (mCRPC) Market

- In May 2025, the FDA’s Oncologic Drugs Advisory Committee (ODAC) unanimously voted against approving talazoparib (Talzenna) combined with enzalutamide (Xtandi) for non-HRR-mutant metastatic castration-resistant prostate cancer (mCRPC), based on phase 3 TALAPRO-2 trial data.

- In March 2025, the FDA expanded the indication for lutetium Lu 177 vipivotide tetraxetan (Pluvicto, Novartis) to include adults with prostate-specific membrane antigen (PSMA)-positive metastatic castration-resistant prostate cancer (mCRPC) who have undergone ARPI therapy and are suitable to delay taxane-based chemotherapy.

- In March 2025, Novartis announced that the FDA approved Pluvicto® (lutetium Lu 177 vipivotide tetraxetan) for patients with PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) who have received ARPI therapy and are suitable candidates to delay chemotherapy.

- In September 2024, Ipsen announced that the Phase III CONTACT-02 trial for Cabometyx® and atezolizumab in mCRPC showed a non-significant improvement in overall survival but met the progression-free survival (PFS) endpoint.

- In September 2024, Foundation Medicine received FDA approval for FoundationOne®CDx and Liquid CDx as companion diagnostics for Lynparza® in BRCA-mutated mCRPC.

- In July 2024, the ARANOTE trial showed that NUBEQA® plus ADT significantly improved radiological PFS in metastatic hormone-sensitive castrate-resistant prostate cancer (mHSPC).

- In July 2024, the FDA granted fast-track designation to SYNC-T SV-102 for metastatic castrate-resistant prostate cancer (mCRPC).

- In June 2024, Kangpu Biopharmaceuticals received FDA approval for a Phase II/III trial of KPG-121 with Abiraterone for mCRPC.

- In May 2024, Fusion Pharmaceuticals began the Phase 2 AlphaBreak trial of FPI-2265 in mCRPC patients.

- In April 2024, Astellas Pharma received European approval for XTANDI™ in high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer (nmHSPC).

- In April 2024, FibroGen announced positive Phase 1 trial data for FG-3246 in mCRPC

Metastatic Castration-Resistant Prostate Cancer (mCRPC) Drug Chapters

The drug chapter segment of the Metastatic Castration-Resistant Prostate Cancer (mCRPC) drugs market report encloses a detailed analysis of mCRPC emerging drugs or late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the mCRPC clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed mCRPC Drugs

JEVTANA (Cabazitaxel): Sanofi

JEVTANA (cabazitaxel) injection is an antineoplastic agent for IV use in the taxane class. It is a microtubule inhibitor indicated in combination with prednisone for treating patients with mCRPC previously treated with a docetaxel-containing treatment regimen, initially approved in June 2010 by the US FDA. The product is marketed in over 75 countries. The US FDA approved Breckenridge’s Cabazitaxel IV Powder (generic for JEVTANA Kit) in August 2022. Regulatory authorization was granted to Breckenridge for the strength of 60 mg/1.5 mL (40 mg/mL). In Europe, generic competition started for JEVTANA at the end of March 2021. In the US, the JEVTANA composition of matter patent expired in September 2021.

XOFIGO (radium-223): Bayer

XOFIGO (radium-223 dichloride) monotherapy or in combination with LHRH analog is indicated for the treatment of adult patients with mCRPC, symptomatic bone metastases, and unknown visceral metastases in progression after at least two prior lines of systemic therapy for mCRPC (other than LHRH analogs), or ineligible for any available systemic mCRPC treatment. In May 2013, the US FDA approved XOFIGO (radium Ra 223 dichloride) for the treatment of patients with castration-resistant prostate cancer (CRPC), symptomatic bone metastases, and no known visceral metastatic disease. In November 2013, Radium-223 dichloride was initially licensed in Europe for treating adults with mCRPC, symptomatic bone metastases, and unknown visceral metastases, based on the results of the ALSYMPCA trial.

|

Company |

Combination |

MoA |

RoA |

Approval |

Patient Segment | ||

|

EU4 & the UK | |||||||

|

Janssen Research and Development/Tesaro |

Prednisone |

PARP inhibitor |

Oral |

August 2023 |

April 2023 |

- |

BRCA-positive mCRPC |

|

Sanofi |

Prednisone |

Sanofi |

IV |

June 2010 |

March 2011 |

July 2014 |

MCRPC was previously treated with a docetaxel-containing treatment regimen. |

|

September 2017 (lower dose) | |||||||

|

AstraZeneca/Merck Sharp and Dohme |

- |

PARP inhibitor |

Oral |

May 2020 |

November 2020 |

December 2020 |

HRR gene-mutated mCRPC who have progressed following prior treatment with enzalutamide or abirateron. |

|

PARP inhibitor |

Oral |

May 2023 |

December 2022 |

August 2023 |

BRCA mCRPC | ||

|

Pfizer/ Astellas Pharma |

Enzalutamide |

PARP inhibitor |

Oral |

June 2023 |

January 2024 |

January 2024 |

HRR gene-mutated mCRPC |

|

BRCA mutation-positive mCRPC in Japan as mono. | |||||||

|

Bayer |

- |

Ionizing radiation emitters |

IV |

May 2013 |

November 2013 (combination) |

March 2016 |

mCRPC |

|

Luteinizing Hormone-releasing Hormone (LHRH) analog. | |||||||

|

Astellas Pharma/ Pfizer |

- |

Androgen receptor inhibitor |

Oral |

April 2012 |

June 2013 |

March 2014 |

mCRPC |

|

December 2014 |

October 2014 | ||||||

|

Janssen Biotech |

Prednisone |

CYP17 inhibitor |

Oral |

April 2011 |

September 2011 |

- |

MCRPC who had received prior docetaxel chemotherapy. |

|

January 2013 |

July 2014 |

Metastatic CRPC who had not received prior cytotoxic chemotherapy. | |||||

|

Novartis |

SOC (US); ADT ± AR (EU) |

PSMA-targeted radioligand therapy |

IV |

March 2022 |

December 2022 |

- |

PSMA-positive mCRPC |

|

Pharma& Schwiez (Pharmaand GmbH) |

- |

PARP1, PARP2, and PARP3 inhibitor |

Oral |

May 2020 |

- |

- |

BRCA1/2-mutated mCRPC |

Stay updated on how PARP inhibitors are shaping the future of first-line metastatic Castrate-resistant prostate cancer (CRPC) treatment!

Emerging mCRPC Drugs

Opevesostat (MK-5684; ODM-208): Merck and Orion

Opevesostat is an oral, non-steroidal, and selective inhibitor of CYP11A1 discovered and developed by Orion and is being investigated for the treatment of hormone-dependent cancers, such as prostate cancer. In July 2024, Merck and Orion announced a mutual exercise of options providing Merck global exclusive rights to opevesostat for the treatment of mCRPC.

Merck and Orion initiated OMAHA1 (NCT06136624) and OMAHA2a (NCT06136650), two pivotal Phase III clinical trials of Metastatic Castration-Resistant Prostate Cancer evaluating opevesostat in combination with hormone replacement therapy (HRT), for the treatment of certain patients with mCRPC. Final results from the OMAHA1 trial are expected in 2028 and OMAHA2a trial final results are anticipated in 2030. In addition to these, Merck has also presented updated CYPIDES Phase II results of opevesostat mCRPC at ESMO Congress 2024.

TRUQAP (capivasertib, AZD 5363): AstraZeneca

Capivasertib is a novel pyrrolopyrimidine derivative and an orally available inhibitor of the serine/threonine-protein kinase AKT (protein kinase B) with potential antineoplastic activity.

The company has completed the Phase Ib and Phase I/II trial of capivasertib for the treatment of prostate cancer. Moreover, AstraZeneca is currently investigating capivasertib in combination with ZYTIGA in the Phase III clinical stage in the CAPItello-281 study for the treatment of mHSPC and LCM* projects’ clinical development in combination with docetaxel in the CAPItello-280 study for the treatment of mCRPC. As per AstraZeneca H1 2024 clinical trial appendix report published in July 2024, the company anticipates data of Phase III CAPItello-280 study for mCRPC in 2025+.

Metastatic Castration-Resistant Prostate Cancer Drug Class Insights

Currently, the Metastatic Castration-Resistant Prostate Cancer therapeutics market holds a diverse range of therapeutic alternatives for treatment, including PARP inhibitors, androgen receptor inhibitors, CYP17 inhibitors, microtubule inhibitors, radioligand therapies, GnRH receptor antagonists, and others in different lines of treatment.

Androgen receptor pathway inhibitors are a mainstay of treatment for patients with metastatic castration-resistant prostate cancer. There are currently four approved androgen receptor pathway inhibitors in the United States: three anti-androgens — apalutamide, enzalutamide, and darolutamide, as well as an androgen receptor pathway inhibitor, abiraterone acetate. In men with mCRPC and select HRR pathway alterations, PARPi treatment has been shown to induce objective tumor responses and improve progression-free and overall survival. The FDA has approved four PARP inhibitors (olaparib, niraparib, rucaparib, and talazoparib) for men with metastatic castration-resistant prostate cancer. FDA-approved targeted radioligand therapy, PLUVICTO (177lutetium (177Lu)-PSMA-617), proved to be an important clinical advancement for people with progressing mCRPC, as it can significantly improve survival rates for those who have limited treatment options. ADCs that target B7-H3 are generating early excitement among investigators in prostate cancer, which has been largely unresponsive to currently approved ICIs. MGC018 and DS-7300 have both displayed encouraging results in mCRPC clinical trials involving patients. Amgen and Xencor are currently evaluating xaluritamig (AMG 509), a STEAP1 x CD3 XmAb 2 + 1 bispecific antibody, in a Phase I study in patients with mCRPC. STEAP1 is highly expressed in prostate cancers, representing an attractive target for treating mCRPC.

Metastatic Castration-Resistant Prostate Cancer Market Outlook

The current standard therapy for patients with CRPC apart from ADT includes sipuleucel-T, chemotherapy (docetaxel if no prior use, or cabazitaxel if prior docetaxel), abiraterone acetate, enzalutamide, olaparib, and rucaparib (for molecularly selected patients with mutations in DNA damage repair genes), and radium-223 (for bone metastases). However, mCRPC remains a lethal diagnosis, and more effective therapeutic approaches against mCRPC are necessary to improve clinical outcomes further.

Docetaxel was the only agent available for the treatment of mCRPC until 2010, which showed an increase in overall survival compared with the standard of care. It was approved in 2004 for mCRPC with prednisone. Patients failed to first-line docetaxel for many years, and no standard treatment option was approved. However, in the last few years, several drugs such as PROVENGE, JEVTANA, ZYTIGA, XTANDI, LYNPARZA, TALZENNA, AKEEGA, and others have received regulatory approval for mCRPC in the United States.

The recent successful development of PARP inhibitors for patients with mCRPC and mutations in DNA damage repair genes has added to the treatment armamentarium and improved personalized treatments for prostate cancer. PARP inhibitors have shown tremendous development in this area with AKEEGA (Janssen), followed by TALZENNA (Pfizer/Astellas Pharma) and LYNPARZA in combination (AstraZeneca/Merck) getting approved in mCRPC in the year 2023. Also, Novartis' PLUVICTO, a PSMA-targeted radioligand therapy, received FDA approval in 2022 for the treatment of adult patients with a specific type of advanced cancer known as prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer (PSMA-positive mCRPC).

Currently, several Metastatic Castration-Resistant Prostate Cancer companies have indulged themselves in initiating mcrpc clinical trials that investigate new treatment options or studying how to use existing treatment options. mCRPC Companies like Curium, Bristol-Myers Squibb, Merck and Orion, Pfizer, Merus, Zenith Epigenetics, MacroGenics, Laekna Therapeutics, Ipsen, AstraZeneca, Telix International, ESSA Pharma, Arvinas and Novartis, Lantheus, Eli Lilly/POINT Biopharma, Xencor, Promontory Therapeutics, and others are investigating their key products for managing mCRPC across various lines of treatment.

- The total Metastatic Castration-Resistant Prostate Cancer (mCRPC) Market size in the United States was approximately USD 4,400 million in 2023 and is projected to increase during the forecast period (2024–2034).

- Among EU4 countries, Germany accounted for the maximum Metastatic Castration-Resistant Prostate Cancer (mCRPC) market size in 2023, while Spain occupied the bottom of the ladder.

- In 2023, XTANDI accounted for the majority of the Metastatic Castration-Resistant Prostate Cancer (mCRPC) drug market share i.e. ~USD 1,500 million in the United States.

- As per DelveInsight analysis, by 2034, among the therapies, the highest mCRPC revenue is expected to be generated by PLUVICTO in the US. While in the EU4 and the UK, XTANDI is expected to have the highest mCRPC drug market share by 2034.

Metastatic Castration-Resistant Prostate Cancer Drugs Uptake

This section focuses on the uptake rate of potential mCRPC drugs expected to be launched in the Metastatic Castration-Resistant Prostate Cancer market during 2024–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key Metastatic Castration-Resistant Prostate Cancer (mCRPC) companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

A medium-fast uptake of POINT Biopharma’s PSMA [Lu-177]-PNT2002Iis expected. The approval of PLUVICTO has increased the pressure on the drug. For POINT’s PSMA [Lu-177]-PNT2002 to gain a significant Metastatic Castration-Resistant Prostate Cancer market share, it must demonstrate superior clinical performance and cost-effectiveness compared to PLUVICTO.

Further detailed analysis of emerging therapies drug uptake in the report…

Metastatic Castration-Resistant Prostate Cancer Activities

The Metastatic Castration-Resistant Prostate Cancer treatment market report provides insights into mCRPC clinical trials within Phase III and II. It also analyzes key mCRPC companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Metastatic Castration-Resistant Prostate Cancer (mCRPC) treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for mCRPC emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging mCRPC market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific Writers, Professors, and others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 18+ KOLs in the 7MM. Centers such as Emory University School of Medicine, Anderson Cancer Center, Southwestern Medical Center etc. were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Metastatic Castration-Resistant Prostate Cancer (mCRPC) market trends.

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided

The analyst views analyze multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Metastatic Castration-Resistant Prostate Cancer (mCRPC) Market Access and Reimbursement

Reimbursement is a crucial factor that affects the drug’s access to the market. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, many payment models are being considered by payers and other industry insiders.

TALZENNA is covered by 96% of the commercially insured population. Copay assistance is available for commercially insured patients who may pay as little as USD 0 per month regardless of income. There are no income requirements, forms, or faxing to enroll.

In 2023, IQWIG reported a hint of minor added benefit of olaparib in patients with treatment-naive mCRPC <65 years, a hint of lesser benefit in patients with treatment-naive mCRPC =65 years, and added benefit could not be proven in patients with pretreated mCRPC in whom chemotherapy is not clinically indicated.

Note: Further Details are provided in the final report...

Scope of the mCRPC Market Report

- The Metastatic Castration-Resistant Prostate Cancer therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview of Metastatic Castration-Resistant Prostate Cancer, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will impact the current treatment landscape.

- A detailed review of the Metastatic Castration-Resistant Prostate Cancer market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Metastatic Castration-Resistant Prostate Cancer treatment market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Metastatic Castration-Resistant Prostate Cancer Market.

Metastatic Castration-Resistant Prostate Cancer Report Insights

- mCRPC Patient Population

- mCRPC Therapeutic Approaches

- mCRPC Pipeline Analysis

- mCRPC Market Size

- mCRPC Market Trends

- Existing and future mCRPC Market Opportunity

Metastatic Castration-Resistant Prostate Cancer Market Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- mCRPC Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- mCRPC Drugs Uptake

- Key Metastatic Castration-Resistant Prostate Cancer Market Forecast Assumptions

mCRPC Market Report Assessment

- Current Metastatic Castration-Resistant Prostate Cancer Treatment Practices

- mCRPC Unmet Needs

- mCRPC Pipeline Product Profiles

- mCRPC Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- mCRPC Market Drivers

- mCRPC Market Barriers

FAQs

- What is the historical and forecasted Metastatic Castration-Resistant Prostate Cancer patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the total Metastatic Castration-Resistant Prostate Cancer market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like in 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved and off-label mCRPC therapies?

- How would the market drivers, barriers, and future opportunities affect the mCRPC market dynamics and subsequent analysis of the associated trends?

- Although multiple expert guidelines recommend testing for targetable mutations prior to therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for treating Metastatic Castration-Resistant Prostate Cancer?

- How many mCRPC companies are developing therapies to treat Metastatic Castration-Resistant Prostate Cancer?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Metastatic Castration-Resistant Prostate Cancer Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Metastatic Castration-Resistant Prostate Cancer therapies?

Reasons to buy mCRPC Market Forecast Report:

- The mCRPC drug market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Metastatic Castration-Resistant Prostate Cancer Market.

- Insights on mCRPC prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing mCRPC market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved Metastatic Castration-Resistant Prostate Cancer products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming Metastatic Castration-Resistant Prostate Cancer companies in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming mCRPC Companies can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- Roche’s Ipatasertib (RG7440) in Metastatic Castration-resistant Prostate Cancer (mCRPC)

- Phase III trial of [177Lu]Lu-PSMA-617 in taxane-naive patients with metastatic castration-resistant prostate cancer

- Pfizer’s TALA (talazoparib) in metastatic castration-resistant prostate cancer (mCRPC)

- Emerging Immune Checkpoint Molecule in Metastatic CRPC

- Latest DelveInsight Blogs

-market.png&w=256&q=75)