Metastatic HER2 positive Breast Cancer Market Summary

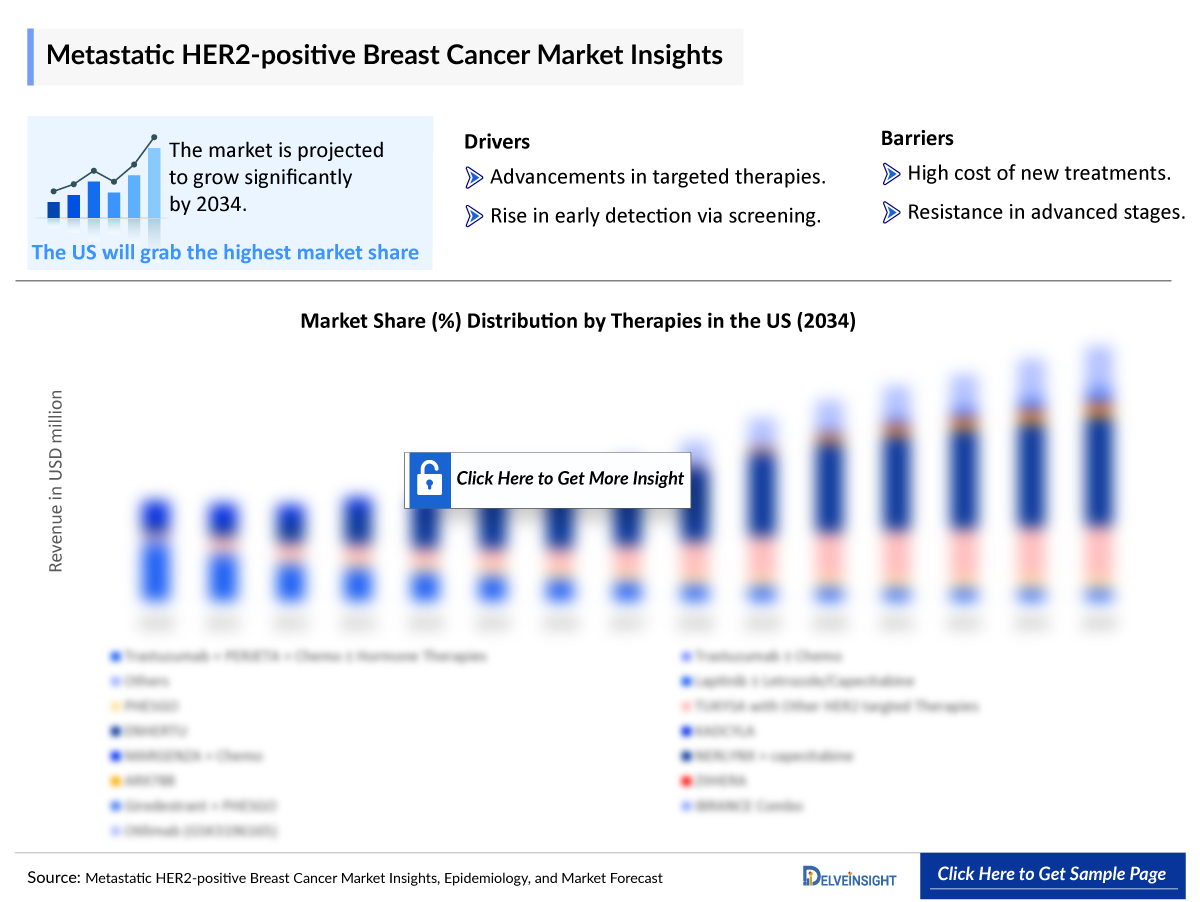

- The Metastatic HER2-positive Breast Cancer Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- In 2023, the HER2-positive breast cancer market in the United States was valued at over USD 1,600 million, with projections indicating growth by 2034.

- The Metastatic HER2-positive Breast Cancer Companies developing therapies include - Seagen, MacroGenics, Byondis, Roche, Taiho Oncology, Carisma Therapeutics, GeneQuantum Healthcare (Suzhou), and others.

Metastatic HER2-positive Breast Cancer Market & Epidemiology Insights

- Recent advancements in HER2 treatments have enhanced HER2-positive breast cancer management, yet relapse remains a primary challenge due to disease heterogeneity and drug resistance mechanisms.

- The approval of HERCEPTIN marked a turning point in HER2-positive breast cancer treatment. HERCEPTIN was the first targeted treatment for a solid tumor and the first drug to be paired with a companion diagnostic.

- Despite the effectiveness of trastuzumab in combination with chemotherapy, a substantial portion (30–50%) of treatment-naïve HER2-positive metastatic breast cancer patients do not respond well initially, indicating resistance to trastuzumab. This underscores its limitations and the need for ongoing research to tackle resistance issues with novel therapies.

- PERJETA is often used alongside trastuzumab and chemotherapy; pertuzumab’s approval marked a significant milestone. The combination of trastuzumab and pertuzumab has become a standard of care for neoadjuvant and metastatic front-line settings.

- The development of ADCs represents a breakthrough in treating metastatic breast cancer, particularly in HER2-positive breast cancer. Among these, KADCYLA was the first to gain FDA approval for breast cancer treatment.

- Anti-HER2 therapies, such as HERCEPTIN, PERJETA, KADCYLA, ENHERTU, and others, have changed the treatment paradigm of HER2-positive cancers, which were previously associated with more aggressive disease and poorer outcomes.

- Seagen's comprehensive TUKYSA development plan includes a Phase II trial (HER2CLIMB-04) combining TUKYSA with ENHERTU for second-line HER2-positive breast cancer and a Phase III trial (HER2CLIMB-05) evaluating TUKYSA with HERCEPTIN and Roche’s PERJETA as a first-line maintenance regimen.

- Both TUKYSA and KADCYLA are HER2-targeted agents, and both are under pressure from AstraZeneca and Daiichi Sankyo’s ADC ENHERTU, which has handily beaten KADCYLA in a head-to-head trial.

- Companies like Byondis, Hoffmann-La Roche, Ambrx, and Zymeworks/Jazz Pharmaceuticals actively engage in mid and late-stage research and development efforts for HER2-positive breast cancer. The pipeline of HER2-positive breast cancer possesses few potential drugs.

- ARX788 may potentially become the ADC of choice for post-ENHERTU patients with its unique ADC structure.

- As promising novel anti-HER2 treatments emerge, the field will continue to revolutionize, with guidelines beginning to include novel treatment options in the third-line setting and thereafter.

- In 2023, the United States accounted for the maximum share of the total market of HER2-positive breast cancer in the 7MM was around 60%.

DelveInsight’s "Metastatic HER2-positive Breast Cancer Market Insights, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of the HER2-positive breast cancer, historical and forecasted epidemiology as well as the HER2-positive breast cancer therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Metastatic HER2-positive breast cancer market report provides current treatment practices, emerging drugs, HER2-positive breast cancer market share of the individual therapies, and current and forecasted HER2-positive breast cancer market size from 2020 to 2034, segmented by seven major markets. The report also covers current HER2-positive breast cancer treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Metastatic HER2-positive Breast Cancer Market |

|

|

Metastatic HER2-positive Breast Cancer Market Size | |

|

Metastatic HER2-positive Breast Cancer Companies |

Seagen, MacroGenics, Byondis, Roche, Taiho Oncology, Carisma Therapeutics, GeneQuantum Healthcare (Suzhou), and others |

|

Metastatic HER2-positive Breast Cancer Epidemiology Segmentation |

|

Metastatic HER2-positive Breast Cancer Disease Understanding

HER2-positive Breast Cancer Overview

Breast cancer initiates when abnormal cancerous cells in the breast grow and proliferate, creating a tumor. It usually starts in the ducts or lobules of the breast.

Some breast cancers depend on the human epidermal growth factor receptor 2 (HER2) gene to grow. These cancers are called HER2+ and have many copies of the HER2 gene or high levels of the HER2 protein. These proteins are also called “receptors.” The HER2 gene makes the HER2 protein found in cancer cells and is important for tumor cell growth. Human epidermal growth factor receptor-2 positive (HER2+) is breast cancer that tests positive for the HER2 protein. HER2+ breast cancer grows faster and is more likely to spread and return than human epidermal growth factor receptor-2 negative (HER2−) breast cancer. Patients’ HER2 status is determined by whether breast cancer tests are positive or negative for the HER2 protein.

Metastatic HER2-positive Breast Cancer Diagnosis

Various tests such as tumor mutation testing: MSI-H/dMMR mutation, PD-1, and PD-L1 testing, FISH (Fluorescence in Situ Hybridization), Immunohistochemistry (IHC), Next-generation sequencing, Polymerase chain reaction, and genetic risk testing: BRCA tests are employed to determine the presence of HER2-positive breast cancer. The appearance of results in the report will vary based on the specific test conducted. Two widely used tests are the IHC test (Immunohistochemistry) and the FISH test (Fluorescence in Situ Hybridization).

It is important to know which HER2 test the patient had. Generally, only cancers that test IHC 3+ or FISH positive respond to the medicines that target HER2-positive breast cancers. An IHC 2+ test result is called borderline. If the patient has an IHC 2+ result, ask to retest the tissue with the FISH test.

Further details related to diagnosis will be provided in the report...

Metastatic HER2-positive Breast Cancer Treatment

Metastatic breast cancer is primarily treated with targeted therapy and hormonal therapy. First-line treatment choice depends on receptor status, including estrogen, progesterone, and HER2 receptors. In cases where both HER2 and estrogen receptors are positive, initial treatment may involve hormonal therapy, HER2-targeted therapy, or a combination of both.

Anti-HER2 therapies (also called HER2 inhibitors or HER2-targeted therapies) are a class of medicines used to treat all stages of HER2-positive breast cancer, from early-stage to metastatic. HERCEPTIN (trastuzumab) treats early-stage and advanced HER2-positive breast cancer and can be given with chemotherapy and sometimes another targeted therapy called PERJETA (pertuzumab). Antibody–drug conjugates such as ENHERTU, KADCYLA, and PHESGO can treat unresectable or metastatic HER2-positive breast cancer. Another therapy, NERLYNX, combines chemotherapy to treat advanced-stage and metastatic HER2-positive breast cancer. Apart from this, TUKYSA (tucatinib) treats metastatic or locally advanced HER2-positive breast cancer that cannot be completely removed with surgery after the cancer has been treated with at least one anti-HER2 medicine.

Further details related to treatment will be provided in the report...

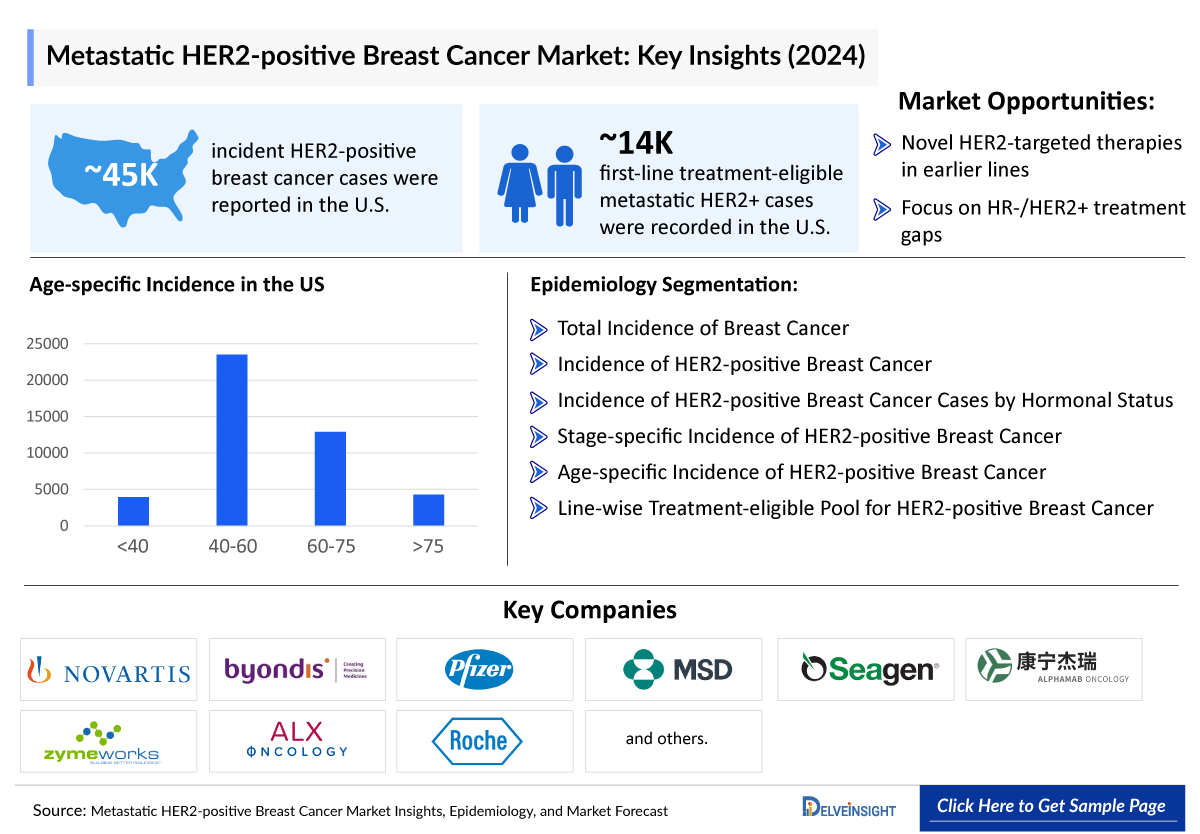

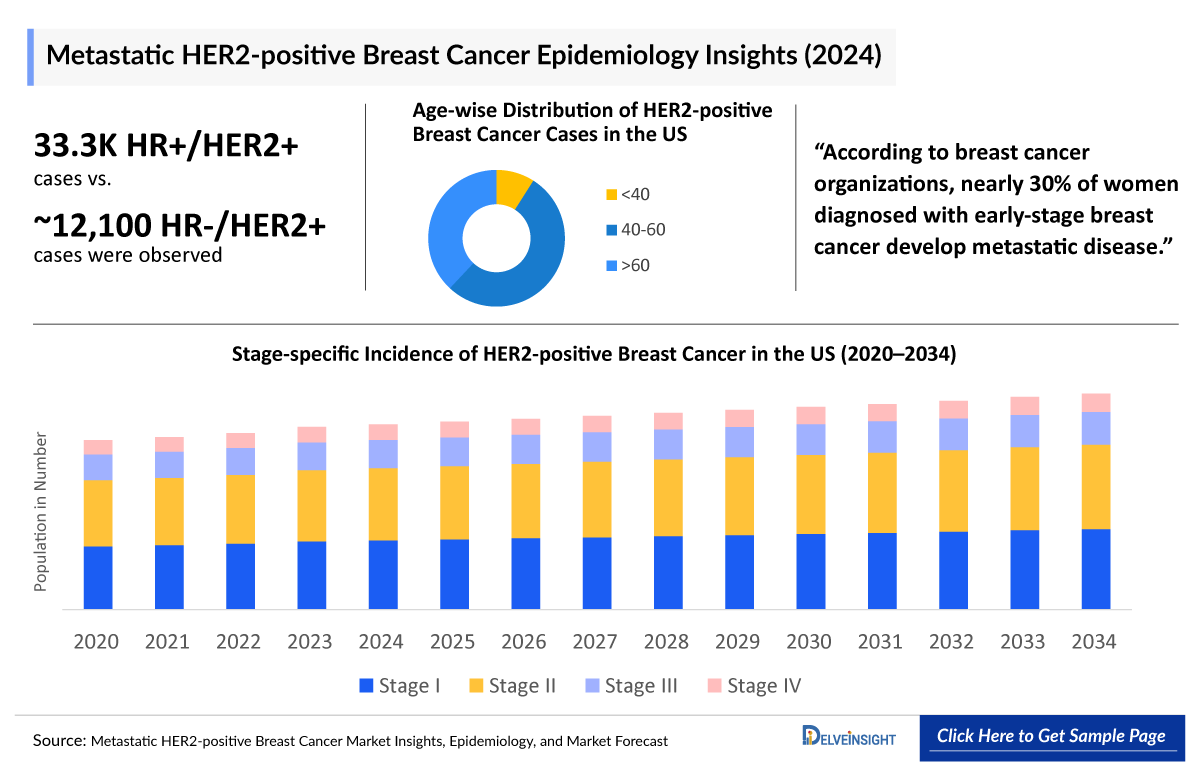

Metastatic HER2-positive Breast Cancer Epidemiology

The HER2-positive breast cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incidence of breast cancer, total incident cases of HER2-positive breast cancer, hormonal status of HER2-positive breast cancer, age-specific cases of HER2-positive breast cancer, stage-specific cases of HER2-positive breast cancer, and Treatment-eligible Cases of HER2-positive Breast Cancer in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Metastatic HER2-positive Breast Cancer Epidemiology Key Insights

- According to the estimates, the total incident population of HER2-positive breast cancer in the seven major markets was nearly 102,000 cases in 2023. The cases in the 7MM are expected to increase during the forecast period, i.e., 2024–2034.

- The HR+/HER2+ breast cases were highest in the United States, accounting for ~32,000 cases.

- According to the estimates, most cases of HER2-positive breast cancer occur in people between 40 and 60 in the United States, accounting for ~52% of total cases in 2023.

- Among EU4 and the UK, Germany had the maximum total incident cases of HER2-positive breast cancer, with ~11,000 cases in 2023, while Spain accounted for the least number of cases.

- In Japan, stage-specific cases of HER2-positive breast cancer were highest in Stage II, accounting for ~6,000 cases in 2023.

- Metastatic HER2-positive Breast Cancer Cases by Age in the United States in 2023

Metastatic HER2-positive Breast Cancer Epidemiology Segmentation

- Total Incidence of Breast Cancer in the US

- Incidence of HER2-positive Breast Cancer in the US

- Incidence of HER2-positive Breast Cancer Cases by Hormonal Status in the US

- Stage-specific Incidence of HER2-positive Breast Cancer in the US

- Age-specific Incidence of HER2-positive Breast Cancer in the US

- Line-wise Treatment-eligible Pool for HER2-positive Breast Cancer in the US

Recent Developments In The Metastatic HER2-positive Breast Cancer Treatment Landscape

- In April 2025, AstraZeneca and Daiichi Sankyo announced positive high-level results from the planned interim analysis of the DESTINY-Breast09 Phase III trial. The trial demonstrated that Enhertu (trastuzumab deruxtecan) in combination with pertuzumab provided a statistically significant and clinically meaningful improvement in progression-free survival (PFS) compared to the current 1st-line standard of care regimen of taxane, trastuzumab, and pertuzumab (THP) for patients with HER2-positive metastatic breast cancer. This marks the first trial in over a decade to show superior efficacy across a broad HER2-positive metastatic patient population.

- In February 2025, the FDA approved a label expansion for the PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody to help determine if patients with hormone receptor–positive, HER2-ultralow metastatic breast cancer are suitable candidates for fam-trastuzumab deruxtecan-nxki (T-DXd; Enhertu).

Metastatic HER2-positive Breast Cancer Drug Analysis

The drug chapter segment of the HER2-positive breast cancer report encloses a detailed analysis of the marketed and late-stage (Phase III) pipeline metastatic HER2-postive breast cancer drugs. The marketed drugs segment encloses drugs such as HERCEPTIN (Roche), ENHERTU (Daiichi Sankyo/AstraZeneca), KADCYLA (Roche/Chugai), and others. Furthermore, the current key players for emerging drugs and their respective drug candidates include Ambrx (ARX788), Zymeworks/Jazz Pharmaceuticals (Zanidatamab), and others. The drug chapter also helps understand the HER2-positive breast cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Metastatic HER2-positive Breast Cancer Marketed Drugs

ENHERTU (fam-trastuzumab deruxtecan-nxk): Daiichi Sankyo/AstraZeneca

ENHERTU is a HER2-directed ADC. Designed using Daiichi Sankyo’s proprietary DXd ADC technology, ENHERTU is the lead ADC in the oncology portfolio of Daiichi Sankyo and the most advanced program in AstraZeneca’s ADC scientific platform. ENHERTU comprises a HER2 monoclonal antibody attached to topoisomerase I inhibitor payload, an exatecan derivative, via a stable tetrapeptide-based cleavable linker. In December 2019, the FDA approved ENHERTU for treating adult patients with unresectable or metastatic HER2-positive breast cancer who have received two or more prior anti-HER2-based regimens in the metastatic setting. This indication was approved under accelerated approval based on tumor response rate and duration of response. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial. In January 2021, ENHRTU got FDA approval in a second-line setting.

AstraZeneca is conducting multiple Phase III trials of ENHERTU for neoadjuvant, adjuvant, and first-line therapy in HER2-positive breast cancer patients.

KADCYLA (ado-trastuzumab emtansine): Roche/Chugai

KADCYLA is an antibody–drug conjugate. It comprises the anit-HER2 humanized monoclonal antibody, trastuzumab, and a chemotherapeutic drug, DM1, attached using a stable linker. In February 2013, the FDA approved KADCYLA for treating people with HER2-positive metastatic breast cancer who have received prior treatment with HERCEPTIN (trastuzumab) and taxane chemotherapy. KADCYLA became the standard of care in the second-line setting with a significant market share; however, after approval in the second line, ENHERTU has replaced KADCYLA and became the standard of care in the second-line. In 2019, KADCYLA got approval for early breast cancer, giving Roche a much-needed booster.

Comparison of Metastatic HER2-positive Breast Cancer Marketed Drugs | |||||||||

|

Drugs |

Company Name |

Combination |

MoA |

Approval |

Patient Segment | ||||

|

US |

EU4 and the UK |

JP | |||||||

|

HERCEPTIN |

Roche |

Monotherapy |

HER2 inhibitor targeted therapy |

1998 |

2000 |

2001 |

Metastatic Breast Cancer | ||

|

2006 |

2006 |

2008 |

Early Breast Cancer | ||||||

|

HERCEPTIN HYLECTA |

Roche |

Monotherapy |

HER2 inhibitor targeted therapy |

2019 |

2013 |

NA |

Early and Metastatic Breast Cancer | ||

|

TUKYSA |

Seagen |

Trastuzumab + capecitabine |

Tyrosine kinase inhibitor |

2020 |

2021 |

NA |

Metastatic Breast Cancer | ||

|

MARGENZA |

MacroGenics |

Chemotherapy |

HER2 inhibitor |

2020 |

NA |

NA |

Metastatic Breast Cancer | ||

Metastatic HER2-positive Breast Cancer Emerging Drugs

ARX788: Ambrx

ARX788, an anti-HER2 ADC, is currently being investigated in multiple clinical trials for the treatment of breast cancer, gastric/gastroesophageal junction (GEJ) cancer, and other solid tumors, including ongoing Phase II/III clinical trials for the treatment of HER2-positive metastatic breast cancer and gastric cancer.

In March 2023, Ambrx Biopharma announced that an interim analysis for ACE-Breast-02 met its prespecified interim primary efficacy endpoint with statistical significance, demonstrating a greater progression-free survival (PFS) benefit than the active control.

Zanidatamab: Zymeworks/Jazz Pharmaceuticals

Zanidatamab is an investigational bispecific antibody based on Zymeworks' Azymetric platform that can simultaneously bind two non-overlapping epitopes of HER2, known as biparatopic binding.

Zymeworks, along with collaborators Jazz and BeiGene, are developing zanidatamab in multiple clinical trials as a targeted treatment option for patients with solid tumors that express HER2. Currently, the drug is being evaluated in a Phase II clinical trial for treating HER2-positive breast cancer.

Comparison of Metastatic HER2-positive Breast Cancer Emerging Drugs | |||||

|

Drug Name |

Company |

Indication |

Phase |

Molecule Type |

Designation |

|

SYD985 (Trastuzumab duocarmazine) |

Byondis |

HER2-positive Metastatic Breast Cancer |

III |

ADC |

Fast Track Designation |

|

Giredestrant + PHESGO |

Roche |

ER+/HER2+ Locally-Advanced or Metastatic Breast Cancer |

III |

Small molecule |

- |

|

TAS2940 |

Taiho Oncology |

HER2-positive Metastatic Breast Cancer |

I |

Small molecule |

- |

|

CT-0508 |

Carisma Therapeutics |

HER2-positive Metastatic Breast Cancer failed approved therapies |

I |

Chimeric antigen receptor macrophage |

Fast Track Designation |

|

GQ1001 |

GeneQuantum Healthcare (Suzhou) |

HER2-positive Metastatic Breast Cancer |

I |

ADC |

- |

Detailed emerging therapies assessment will be provided in the final report....

Metastatic HER2-positive Breast Cancer Drug Class Insight

The ongoing and future avenues include efforts to de-escalate therapy in HER2-positive breast cancer, improve the sequencing of available CDK4/6 inhibitors, and introduce new biomarker-guided therapies into the armamentarium for both HER2-positive and triple-negative breast cancer (TNBC). There has also been considerable interest in improving the benefit conferred by antibody-drug conjugates (ADC), particularly fam-trastuzumab deruxtecan-nxki (ENHERTU), after the agent’s establishment as a standard of care in HER2-positive breast cancer.

Antibody-drug conjugate (ADC)

An antibody-drug conjugate (ADC) is a monoclonal antibody linked to a chemotherapy drug. In this case, the anti-HER2 antibody acts like a homing signal by attaching to the HER2 protein on cancer cells, bringing the chemo directly to them. Roche’s first ADC, KADCYLA, received approval from the FDA in 2013 for HER2-positive metastatic breast cancer treatment after prior treatment with Roche’s own HERCEPTIN and chemotherapy. The second ADC to gain approval from the FDA and EMA is ENHERTU (trastuzumab deruxtecan).

Tyrosine kinase inhibitor

HER2 is a type of protein known as a kinase. Kinases are proteins in cells that normally relay signals (such as telling the cell to grow). Drugs that block kinases are called kinase inhibitors. TUKYSA (Tucatinib) is a kinase inhibitor taken as a pill, typically twice daily. It is used to treat advanced breast cancer after at least one other anti-HER2 targeted drug has been tried. NERLYNX (Neratinib) is also a kinase inhibitor pill taken daily. It is used to treat early-stage breast cancer after a woman has been treated with trastuzumab for 1 year and is usually given for 1 year. It can also be given along with the chemo drug capecitabine to treat people with metastatic disease, typically after trying at least two other anti-HER2 targeted drugs.

When patients progress to multiple strategies, there are several HER2-targeted therapies available; however, treatment options are still limited, and the potential combination with other drugs, immune checkpoint inhibitors, CAR-T cells, CAR-NK, CAR-M, and vaccines is an interesting and appealing field that is still in development.

HER2-positive Breast Cancer Market Outlook

Numerous treatment options for HER2-positive breast cancer are available, falling into pharmacological and nonpharmacological categories. Recent advancements in HER2 treatments have enhanced HER2-positive breast cancer management, yet relapse remains a primary challenge due to disease heterogeneity and drug resistance mechanisms.

Patients with metastatic HER2+ breast cancer were traditionally treated with conventional chemotherapy regimens until trastuzumab became available. Roche responded actively to the rise of biosimilars by introducing a subcutaneous (SC) formulation of HERCEPTIN in the EU in 2013 and the US in 2019, despite the availability of biosimilars. In continuing efforts of Roche to extend the HER2 franchise, Roche’s first ADC, KADCYLA, received approval from the FDA in 2013 for HER2-positive metastatic breast cancer treatment after prior treatment with Roche’s own HERCEPTIN and chemotherapy. The second ADC to gain approval from the FDA and EMA is ENHERTU (trastuzumab deruxtecan). This achievement could disrupt the second-line treatment landscape and be a game-changer for AstraZeneca and Daiichi.

An emerging therapy, SYD985, has taken steps to enter this competitive landscape, including filing a Biologics License Application (BLA) in the US and EU. Many potential companies such as Pfizer, Roche, Spectrum Pharmaceuticals, Hoffmann-La Roche, Eli Lilly and Company, and Ambrx also engage in mid- and late-stage research and development for HER2-positive breast cancer. The HER2-positive breast cancer therapeutics market is anticipated to grow during the projected period.

Metastatic HER2-positive Breast Cancer Market Highlights

- The total market size in the United States for HER2-positive breast cancer was estimated to be more than USD 1,600 million in 2023, which is expected to grow by 2034.

- Among the EU4 countries, Germany captured the maximum market share in 2023, whereas Spain was at the bottom of the ladder in the same year in HER2-positive breast cancer.

- The US market for HER2-positive breast cancer holds therapies like NERLYNX, TUKYSA, ENHERTU, KADCYLA, and others.

- In the current market, the majority of the share was accounted for by the combination drug trastuzumab + PERJETA + chemotherapy, which was around USD 470 million in 2023 in the US.

- The market size of HER2-positive breast cancer in EU4 and the UK in 2023 was more than USD 800 million, which is expected to increase during the study period (2020–2034).

- ENHERTU is expected to benefit the most during the forecast period. Among all the therapies for HER2-positive breast cancer in the US, ENHERTU is expected to garner the maximum market share by 2034, followed by TUKYSA with other HER2-targeted therapies.

- The total market size of HER2-positive breast cancer in Japan was nearly USD 200 million in 2023.

Metastatic HER2-positive Breast Cancer Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2034–2034. The landscape of HER2-positive breast cancer treatment has experienced a profound transformation with the uptake of novel drugs. Innovative therapies are redefining standards of care. Furthermore, the increased uptake of transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Among the array of first-line treatment options for HER2-positive breast cancer, both PHESGO and ENHERTU ± Pertuzumab have exhibited medium to fast uptake rates. PHESGO, with a median progression-free survival (PFS) of 18.5 months, has gained approval for use in combination with PERJETA and HERCEPTIN. Its subcutaneous route of administration offers enhanced convenience for patients, prompting a transition from intravenous to subcutaneous formulations. On the other hand, ENHERTU ± Pertuzumab is currently under evaluation for first-line use, and while the company has not yet published results in this setting, its anticipated launch is expected by 2026.

Metastatic HER2-positive Breast Cancer Pipeline Development Activities

The Metastatic HER2-positive Breast Cancer pipeline report provides insights into Metastatic HER2-positive Breast Cancer clinical trials within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics. Companies like Byondis, Hoffmann-La Roche, Ambrx, and Zymeworks/Jazz Pharmaceuticals actively engage in mid and late-stage research and development efforts for HER2-positive breast cancer. The pipeline of HER2-positive breast cancer possesses few potential drugs. However, there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034).

Furthermore, as patients progress through various treatment strategies, several HER2-targeted therapies are available. However, treatment options remain limited. The potential combination of these therapies with other drugs, such as immune checkpoint inhibitors, CAR-T cells, CAR-NK, CAR-M, and vaccines, represents an intriguing and promising field that is still under development.

Metastatic HER2-positive Breast Cancer Pipeline Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for HER2-positive breast cancer emerging therapy.

KOL- Views on Metastatic HER2-positive Breast Cancer Market Report

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the HER2-positive breast cancer evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including oncologists, radiation oncologists, surgical oncologists, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as the Institute for Personalized Cancer Therapy, Aichi Cancer Center, University Hospital Ulm, Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or HER2-positive breast cancer market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“ARX788 offers us additional advantages in advanced disease: it delivers a toxin or payload that patients will not have seen. It has a different mechanism of action than the toxin that is attached to trastuzumab deruxtecan. I think that has a big benefit. In addition, the toxin is highly potent, meaning you can deliver a fairly small amount of toxin per antibody-drug conjugate to have efficacy. Then, there is a high antibody–drug conjugate uptake within the tumor cell.” |

|

“The possibility of zanidatamab has always been fascinating. As we work to improve care for metastatic breast cancer, prior data showed that the use of pertuzumab (Perjeta) or trastuzumab (Herceptin) as single medicines resulted in poor activity, but zanidatamab monotherapy demonstrated a greater degree of activity selection.” |

Metastatic HER2-positive Breast Cancer Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Metastatic HER2-positive Breast Cancer Market Access and Reimbursement

Herceptin has been the foundation of traditional HER2+ cancer treatment. It targets HER2 receptors, which may keep the cancer from growing. The Genentech Oncology Copay Assistance Program helps people with commercial health insurance. The Genentech Patient Foundation gives free Herceptin to people who do not have insurance coverage or who have financial concerns. If a patient needs help with the Genentech medicine copay, Herceptin Access Solutions can refer the patient to an independent copay assistance foundation. Independent copay assistance foundations help patients with public or commercial health insurance.

The MARGENZA Copay Assistance Program is available for commercially insured eligible patients. It offers eligible patients financial assistance with their out-of-pocket costs related to MARGENZA. The program will pay for the entirety of the commercially insured eligible patient’s remaining cost share, including coinsurance and copays for MARGENZA, up to a maximum of USD 26,000 during 12 months.

As per IQWIG, Pertuzumab/trastuzumab is indicated as adjuvant treatment for adult patients with HER2-positive early breast cancer at high risk of recurrence. Moreover, the dossier assessment results reveal that the added benefit is not proven.

Detailed market access and reimbursement assessment will be provided in the final report.

Scope of the Metastatic HER2-positive Breast Cancer Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of HER2-positive breast cancer, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the HER2-positive breast cancer market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM HER2-positive breast cancer market.

Metastatic HER2-positive Breast Cancer Market Report Insights

- Metastatic HER2-positive Breast Cancer Patient Population

- Metastatic HER2-positive Breast Cancer Therapeutic Approaches

- HER2-positive Breast Cancer Pipeline Analysis

- HER2-positive Breast Cancer Market Size and Trends

- Existing and Future Market Opportunity

Metastatic HER2-positive Breast Cancer Market Report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- HER2-positive Breast Cancer Epidemiology Segmentation

- Key Cross Competition

- Metastatic HER2-positive Breast Cancer Drugs Uptake

- Key Metastatic HER2-positive Breast Cancer Market Forecast Assumptions

Metastatic HER2-positive Breast Cancer Market Report Assessment

- Current Metastatic HER2-positive Breast Cancer Treatment Practices

- Metastatic HER2-positive Breast Cancer Unmet Needs

- Metastatic HER2-positive Breast Cancer Pipeline Product Profiles

- Metastatic HER2-positive Breast Cancer Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views)

- Metastatic HER2-positive Breast Cancer Market Drivers

- Metastatic HER2-positive Breast Cancer Market Barriers

FAQs Regarding the Metastatic HER2-positive Breast Cancer Market Report:

- What was the HER2-positive breast cancer market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- What can be the future treatment paradigm for HER2-positive breast cancer?

- What are the disease risks, burdens, and unmet needs of HER2-positive breast cancer? What will be the growth opportunities across the 7MM concerning the patient population with HER2-positive breast cancer?

- What is the impact of biosimilars on the sales of HERCEPTIN?

- Who is the major competitor of ENHERTU in the market?

- How much market share will antibody–drug conjugate (ADC) capture by 2034?

- What are the current options for the treatment of HER2-positive breast cancer? What are the current guidelines for treating HER2-positive breast cancer in the US, Europe, and Japan?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in HER2-positive breast cancer?

Reasons to Buy Metastatic HER2-positive Breast Cancer Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the HER2-positive breast cancer market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles:-

- Metastatic HER2-Positive Breast Cancer

- Estrogen Receptor Positive Breast Cancer: Market Outlook

- Global HR+/ HER2- Breast Cancer Market Scenario

- How HR+/ HER2- Breast Cancer Emerging Drugs Will Transform the Market?

- HR-positive/ HER2-negative Breast Cancer Market Insights: Upcoming Therapies and Market Analysis

- Breast Cancer: Understand Your Breasts, Recognize the Symptoms

- Key Facts To Know About Triple-Negative Breast Cancer In The Breast Cancer Awareness Month

- 7 Most Common Myths About Breast Cancer Demystified

- Roche’s HER2-Positive Breast Cancer Treatment Franchise

- Latest DelveInsight Blogs