Moderate To Severe Acute Pain Market Summary

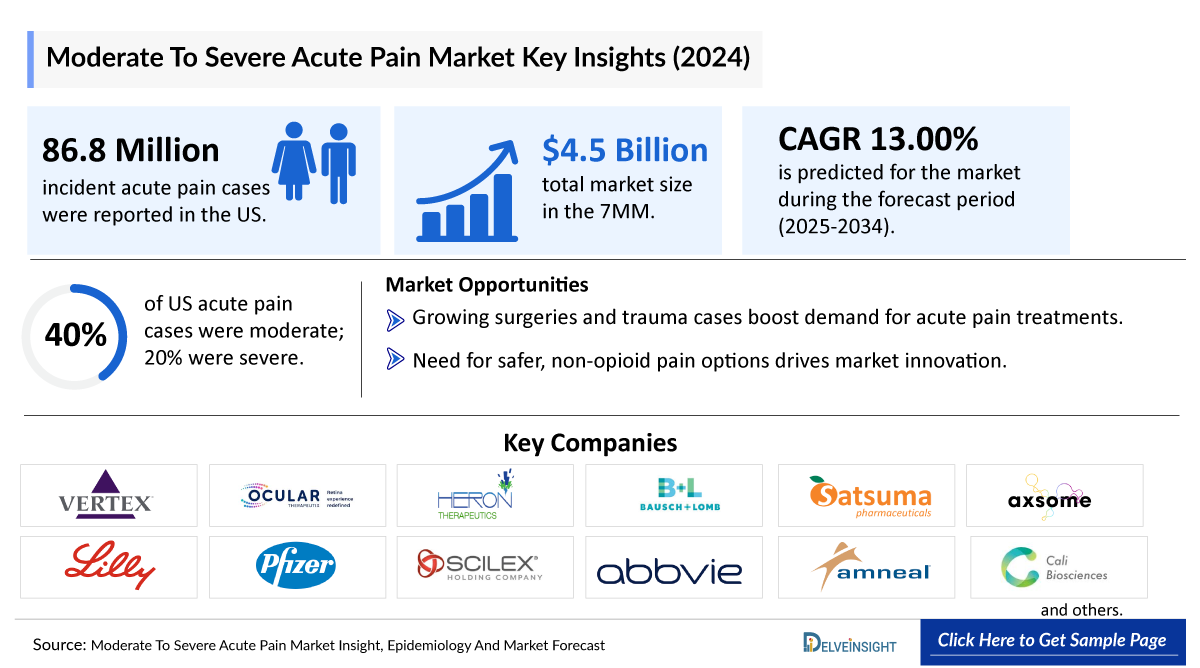

- The Moderate To Severe Acute Pain market in the 7MM was valued at approximately USD 4,536 million in 2025 and is projected to reach USD 13,579 million in 2034 over the forecast period from 2025 to 2034.

- The Moderate To Severe Acute Pain market is projected to grow at a CAGR of 13.00% by 2034 in leading countries (US, EU4, UK and Japan).

- Among the 7MM, the US captured the highest Moderate to Severe Acute Pain Market in 2024, covering nearly USD 3,500 million, followed by Germany, which is anticipated to grow during the forecast period (2025–2034).

Moderate To Severe Acute Pain Market and Epidemiology Analysis

- The highest number of incident cases was estimated in the US, followed by Japan, Germany, France, and the UK in 2024.

- Acute pain is an umbrella term, but the most common symptoms associated with acute pain include fatigue, flu-like symptoms, insomnia, anxiety, burning, etc.

- Acute Pain treatment (both Postoperative and non-postoperative) follows a multimodal approach, combining pharmacological and non-pharmacological therapies. Medications include opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, corticosteroids, anesthetics, and adjuncts like antidepressants, muscle relaxants, and cannabinoids. Non-pharmacological methods such as physical therapy, acupuncture, cognitive-behavioral therapy, massage, and transcutaneous electrical nerve stimulation (TENS) serve as effective complements, aiming to improve outcomes and reduce reliance on any single intervention.

- Moderate To Severe Acute Pain Therapies for postoperative acute pain include JOURNAVX (suzetrigine) (Vertex Pharmaceuticals), COMBOGESIC IV/MAXIGESIC IV (acetaminophen and ibuprofen) (Hikma Pharmaceuticals, Hyloris Pharmaceuticals, and AFT Pharmaceuticals), ZYNRELEF (bupivacaine and meloxicam) (Heron Therapeutics), LOTEMAX SM (loteprednol etabonate ophthalmic gel) (Bausch & Lomb), and others.

- In 2025, three innovative Moderate To Severe Acute Pain therapies received US FDA approval for the acute treatment of migraine: ATZUMI (dihydroergotamine mesylate), SYMBRAVO (meloxicam and rizatriptan), and BREKIYA (dihydroergotamine mesylate) (Amneal Pharmaceuticals).

- QUTENZA topline results are anticipated in Q4 2025 and, assuming positive data, Averitas Pharma aims to submit a supplemental new drug application (sNDA) for QUTENZA (capsaicin) 8% topical system in 2026.

- In Japan, the availability of approved therapies for acute pain remains limited, with only a few drugs receiving approval, including EMGALITY and REYVOW/RAYVOW, alongside a range of off-label Moderate To Severe Acute Pain therapies.

- Non-opioid formulations such as XARACOLL, POSIMIR, and others were similarly removed due to Market adoption issues or unfavorable risk profiles. The ophthalmic drug PROLENSA (bromfenac sodium) remains on the Market but has become largely genericized. These trends reflect ongoing regulatory, safety, and Market access challenges in the acute pain therapy landscape.

- There is a critical need for a safe, effective, non-opioid solution for postoperative pain management. Ketorolac, a well-established non-opioid analgesic, has shown comparable efficacy to morphine in this context. A novel, late-stage, alcohol-free formulation of ketorolac, offered in a convenient pre-mixed bag for continuous infusion, provides 24-hour, opioid-level pain relief for moderately severe pain, without the risks of opioids or the limitations of short-acting alternatives.

- For non-postoperative acute pain, major Moderate To Severe Acute Pain Companies include Teikoku Pharma (TK-254Rx), Cessatech (CT001), Vaneltix Pharma (ALENURA), Allodynic Therapeutics (naltrexone/acetaminophen), and other notable companies in the field.

- The Moderate To Severe Acute Pain Companies for postoperative acute pain include Arthritis Innovation /Medincell (F14), Oculis (OCS-01), PainReform (PRF-110), Cali Biosciences (CPL-01), Neumentum (NTM-001), Tris Pharma (cebranopadol (TRN-228)), Viatris (meloxicam (MR 107A 02 )), Xgene Pharmaceutical (XG005), Allay Therapeutics (ATX101), Latigo Biotherapeutics (LTG-001 ), Halia Therapeutics (HT-6184), and others.

Moderate To Severe Acute Pain Market size and Forecast

- 2025 Moderate To Severe Acute Pain Market Size: USD 4,536 million

- 2034 Projected Moderate To Severe Acute Pain Market Size: USD 13,579 million

- Moderate To Severe Acute Pain Growth Rate (2025-2034): 13.00% CAGR

- Largest Moderate To Severe Acute Pain Market: United States

DelveInsight’s “Moderate To Severe Acute Pain Market Insights, Epidemiology, and Market Forecast 2034” report delivers an in-depth understanding of the Moderate To Severe Acute Pain, historical and forecasted epidemiology and the Moderate To Severe Acute Pain Market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Moderate To Severe Acute Pain Therapeutics Market report provides current treatment practices, emerging Moderate To Severe Acute Pain drugs, Market share of individual therapies, and current and forecasted 7MM Moderate To Severe Acute Pain Market size from 2020 to 2034. The report also covers current Moderate To Severe Acute Pain treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying Moderate To Severe Acute Pain Market potential.

Key Factors Driving the Moderate to Severe Acute Pain Market

- Growing Moderate to Severe Acute Pain Incidence

The total number of incident cases of moderate-to-severe acute pain in the 7MM were around 180 million in 2024. These numbers are further expected to increase by 2034.

- Shift From Opioids Toward Non-opioid Therapies

There is a growing demand for non-opioid therapies that match opioid-level efficacy but with fewer side effects and lower dependency risks, creating a significant opportunity for innovative drug development.

- Robust Postoperative Acute Pain Clinical Trial Activity

The emerging pipeline for postoperative acute pain treatments is quite robust, featuring numerous mid- and late-stage development products such as Arthritis Innovation/Medincell (F14), Oculis (OCS-01), Neumentum (NTM-001), Tris Pharma (cebranopadol [TRN-228]), Viatris (meloxicam [MR 107A 02]), Xgene Pharmaceutical (XG005), Allay Therapeutics (ATX101), and others, which hold significant potential for improving pain management options.

- Emergence of Novel Drug Classes

Emerging drugs with novel mechanisms of action, like NaV1.8 channel inhibitors (e.g., VX-548) and corticosteroids (e.g., SVT-15473), show high potential in acute pain management, offering strong efficacy with fewer side effects.

Moderate To Severe Acute Pain Disease Understanding

Moderate To Severe Acute Pain Overview

Pain is a sensory response to tissue damage or dysfunction and can be acute or chronic. Acute pain appears suddenly—often due to injury, surgery, or infection—and usually resolves within three months. Its perception varies widely between individuals, influenced by differences in nerve signaling and brain processing. Acute pain ranges from mild, self-limiting conditions like headaches or muscle strains to severe trauma requiring hospitalization and surgical intervention. Treatment depends on severity, from over-the-counter analgesics and rest to stronger medications like opioids for intense pain. Elective procedures also cause varying pain levels. Minor interventions typically require only local anesthetics or cold therapy. Moderate procedures such as dental or laparoscopic surgeries may involve short-term opioid use, while major surgeries like joint replacements demand multimodal pain management. Pain can present as stabbing, dull, aching, throbbing, or tingling, and can disrupt sleep, appetite, and emotional well-being. If unaddressed, acute pain may lead to psychological effects or medication dependence.

Moderate To Severe Acute Pain Diagnosis

Pain diagnosis begins with a clinical evaluation, including a review of symptoms, pain location and intensity, and relevant history such as injury, surgery, or illness. In children, tools like the Faces Pain Scale may be used to assess pain. Diagnostic tests may include blood work, imaging (X-ray, CT, MRI, ultrasound), dye studies, or nerve conduction tests. To assess pain more objectively, clinicians use various tools. Unidimensional scales measure pain intensity alone and are best for acute pain. These include the Visual Analog Scale (VAS), where patients mark a line to indicate pain severity; the Verbal Rating Scale (VRS), which uses descriptive terms; the Wong-Baker Faces Scale, commonly used in children; and the Numeric Rating Scale (NRS), which asks patients to rate pain from 0 to 10. While simple and quick, these scales may oversimplify chronic pain.

Multidimensional tools offer a more comprehensive view. The McGill Pain Questionnaire (MPQ) uses 78 descriptors to evaluate sensory, affective, and evaluative aspects of pain. The Brief Pain Inventory (BPI) measures pain severity and its impact on daily activities and emotional well-being. The Indiana Polyclinic Combined Pain Scale (IPCPS) assesses pain, function, depression, and anxiety, and includes a screening tool for opioid misuse. These tools help providers better understand and treat complex, chronic pain conditions.

Further details related to country-based variations are provided in the report...

Moderate To Severe Acute Pain Treatment

The WHO’s three-step pain ladder guides pain treatment from non-opioids and non-drug methods to low-dose opioids, then stronger opioids or invasive options for severe pain. Modified versions allow skipping steps for intense pain or adjusting based on symptoms. The aim is tolerable pain that supports function with minimal side effects or misuse risk. Multimodal analgesia—using different therapies acting at various pain pathways—can improve relief, reduce opioid use, and support recovery activities like mobility and rehab. Mild-to-moderate acute pain often responds to acetaminophen, NSAIDs, or topical agents. These may be combined with opioids for greater effect and fewer side effects. NSAIDs carry risks like GI issues, bleeding, or kidney problems, especially in older adults. Topicals are safer but limited to surface pain. For neuropathic or complex pain, adjuvants like anticonvulsants or local anesthetics may help. Ketamine is used for severe acute pain at low doses. When opioids are needed, short-acting forms like oxycodone or tramadol are preferred at the lowest effective dose.

Moderate To Severe Acute Pain Epidemiology

As the Moderate To Severe Acute Pain Market is derived using the patient-based model, the Moderate To Severe Acute Pain Epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Incident Cases of Acute Pain, Total Diagnosed Incident Cases of Acute Pain, and Severity-specific Diagnosed Incident Cases of Acute Pain, in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan, from 2020 to 2034.

Key Findings from Moderate to Severe Acute Pain Epidemiological Analyses and Forecast

- In the 7MM, the US accounted for the highest number of incident cases of acute pain, with nearly 86,800,000 cases in 2024.

- Among EU4 and the UK, the maximum cases were reported in Germany, followed by France, and the least cases were found in Spain.

- In the US, about 40% of cases observed were of moderate acute pain, and 20% for severe acute pain.

- In the UK, approximately 4,417,000 cases of trauma pain, 3,492,000 cases of postoperative pain, and 3,306,000 cases of acute medical illness in 2024.

- Japan accounted for about 8,419,000 cases of moderate acute pain and about 2,078,000 cases of severe acute pain, in 2024.

Moderate to Severe Acute Pain Epidemiology Segmentation

- Total Incident Cases of Acute Pain

- Total Diagnosed Incident Cases of Acute Pain

- Severity-specific Diagnosed Incident Cases of Acute Pain

Moderate to Severe Acute Pain Market Recent Developments and Breakthroughs

- On August 28, 2025, Shanghai Yidian Pharmaceutical Technology Development Co., Ltd. initiated a study designed to evaluate the safety, efficacy, and pharmacokinetic (PK) parameters of the HL-1186 tablet in patients experiencing moderate to severe acute postoperative pain

Moderate To Severe Acute Pain Drug Chapters

The drug chapter segment of the Moderate To Severe Acute Pain report encloses a detailed analysis of acute pain marketed drugs and late-stage (Phase III and Phase II) Moderate To Severe Acute Pain pipeline drugs. It also understands acute pain clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Moderate-to-Severe Acute Pain Marketed Drugs

-

JOURNAVX: Vertex Pharmaceuticals

JOURNAVX (formally known as VX-548) is a first-in-class, oral, nonopioid, highly selective pain signal inhibitor that is selective for NaV1.8 relative to other NaV channels. Because JOURNAVX blocks pain signals only found in the periphery, not in the brain, JOURNAVX provides effective relief of pain without the limitations of currently available therapies, including the addictive potential of opioids.

-

- In January 2025, the US FDA approved JOURNAVX to treat moderate- to-severe acute pain in adults. JOURNAVX reduces pain by targeting a pain-signaling pathway involving sodium channels in the peripheral nervous system, before pain signals reach the brain. Launch of this drug in the US is underway.

- In October 2024, Vertex Pharmaceuticals announced the Phase III data highlighting Suzetrigine’s potential as a first-in-class, highly selective pain signal inhibitor at the American Society of Anesthesiologists Annual Meeting.

-

ATZUMI (dihydroergotamine): Satsuma Pharmaceuticals

ATZUMI (dihydroergotamine) nasal powder is the first and only DHE nasal powder indicated for the acute treatment of migraine with or without aura in adults, delivered through a convenient, portable device. It is also the first and only product to utilize the proprietary SMART (Simple MucoAdhesive Release Technology) platform, which combines advanced powder formulation with innovative device technology to enable simplified and effective intranasal delivery of dihydroergotamine.

-

- In April 2025, the US FDA approved ATZUMI (dihydroergotamine) nasal powder for the acute treatment of migraine in adults, with or without aura.

Moderate To Severe Acute Pain Emerging Drugs

-

mdc-CWM (F14): MedinCell/Arthritis Innovation Corporation (AIC)

F14 is a sustained-release formulation of the NSAID, celecoxib, designed to reduce pain and inflammation and enhance recovery after TKR. mdc-CWM is administered into the intra-articular space at the end of TKR surgery and may provide pain relief over several weeks post-surgery. The drug is currently being evaluated in the Phase III trial for the pain management of total knee replacement.

-

- In December 2024, Medincell announced that AIC is scheduled to meet with the US FDA in Q1 2025 to establish the approval pathway for F14/mdc-CWM.

- In December 2024, MedinCell and Arthritis Innovation Corporation (AIC) announced positive results from a subgroup analysis of their Phase III trial for mdc-CWM, a sustained-release celecoxib formulation for postoperative pain relief following total knee replacement.

-

LTG-001: Latigo Biotherapeutics

LTG-001 is an oral, investigational selective inhibitor of Nav1.8, a key sodium channel involved in pain signaling. LTG-001 works by blocking peripheral sensory neurons responsible for pain signals, thus preventing the transmission of these pain signals to the central nervous system. As a result, LTG-001 may provide effective pain relief without the risks associated with opioids.

-

- In March 2025, Latigo Biotherapeutics announced that the US FDA granted FTD to LTG-001, the company’s oral, investigational selective Nav1.8 inhibitor for the treatment of acute pain. The FTD follows positive Phase I results, which demonstrated a favorable safety, tolerability, and pharmacokinetic profile for LTG-001.

- In March 2025, Latigo Biotherapeutics announced it has closed USD 150 million in a Series B financing. Proceeds from the financing will support the advancement of the company’s highly selective Nav1.8 inhibitors currently in clinical development for the nonopioid treatment of pain, as well as the development of Latigo’s broader pipeline

-

Cebranopadol: Tris Pharma

Cebranopadol is a first-in-class investigational therapy that targets two key receptors, the Nociceptin/Orphanin FQ Peptide (NOP) and µ-opioid Peptide (MOP) receptors (a dual-NMR agonist), for the treatment of moderate-to-severe pain, as well as Opioid Use Disorder. These receptors are partially homologous to each other, and they play both complementary and distinct roles to modulate pain biology pathways.

-

- In May 2025, Tris Pharma announced presentation of data from cebranopadol was featured in three poster presentations during the 50th Annual Regional Anesthesiology and Acute Pain Medicine Meeting (ASRA).

- In March 2025, Tris Pharma announced positive topline results from its ALLEVIATE-2 Phase III pivotal clinical trial evaluating cebranopadol for the treatment of Moderate To Severe Acute Pain in patients following bunionectomy surgery. The company also plans to submit an NDA to the FDA in 2025

Moderate to Severe Acute Pain Drugs Analysis

The drug chapter segment of the Moderate to Severe Acute Pain market report encloses a detailed analysis of Moderate to Severe Acute Pain Marketed Drugs and mid to late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the Moderate to Severe Acute Pain clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Moderate To Severe Acute Pain Market Outlook

The current Moderate to Severe Acute Pain treatment approach consists of various methods, which are divided into pharmacological and non-pharmacological therapies. Pharmacological treatments include analgesics, which are further categorized into opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, corticosteroids, anesthetics, and more. Acute pain is also addressed with benzodiazepines, muscle relaxants, antidepressants, alpha-2 agonists, gamma-aminobutyric acid (GABA) agonists, and cannabinoids.

The Moderate To Severe Acute Pain Market is expected to experience positive growth with the approval of potential Moderate To Severe Acute Pain drugs like mdc-CWM (F14), OCS-01, MR-301, TK-254Rx, DEPADE, and others.

- The Moderate To Severe Acute Pain market in the 7MM was valued at approximately USD 4,536 million in 2025 and is projected to reach USD 13,579 million in 2034 at a CAGR of 13.00% over the forecast period from 2024 to 2034.

- Among the 7MM, the US captured the highest Moderate to Severe Acute Pain Market in 2024, covering nearly USD 3,500 million, followed by Germany, which is anticipated to grow during the forecast period (2025–2034).

- In 2024, EU4 and the UK captured nearly 15% of the Moderate to Severe Acute Pain Market in the 7MM.

- Among the forecasted emerging therapies, NURTEC ODT/VYDURA (rimegepant) is expected to capture the highest Moderate to Severe Acute Pain Market in the 7MM by 2034.

- ATX101 (bupivacaine + biopolymer formulation) is expected to launch in the forecast period, gaining a significant Market size by 2034 in the 7MM. This therapy targets postoperative moderate-to-severe acute Pain patients.

Moderate To Severe Acute Pain Drug Class Insight

NTM-001 and Meloxicam utilize the mechanism of Cyclo-oxygenase 1/2 inhibitor for the treatment of Moderate To Severe Acute Pain.

Cyclo-oxygenase 1/2 inhibitor

COX-1/2 inhibitors, particularly those with COX-2 selectivity or preference, play a crucial role in managing postoperative acute pain by inhibiting prostaglandin synthesis and reducing inflammation. NTM-001, a non-opioid intravenous COX-2 preferential NSAID, is being developed to treat moderately severe acute pain that typically requires opioid-level analgesia in postoperative settings. It is designed to provide effective pain relief while minimizing the risks associated with opioid use, such as dependence and respiratory depression. Similarly, meloxicam (MR-107A-02), a preferential COX-2 inhibitor, is being evaluated for acute postoperative pain following procedures such as bunionectomy, herniorrhaphy, and dental surgery. With favorable dosing characteristics and a reduced risk of gastrointestinal side effects compared to non-selective NSAIDs, these agents offer promising options for opioid-sparing pain management in surgical care.

Moderate To Severe Acute Pain Market Outlook

Acute pain typically lasts less than 7 days but can extend up to 30 days. It is a common cause of emergency visits and is prevalent in primary care and inpatient settings. Effective management aims to alleviate pain, promote recovery, and minimize opioid use. A key challenge is selecting interventions that provide adequate relief while reducing opioid overuse. Proper management can lower the risk of chronic pain, but gaps remain. Factors such as age, sex, pain severity, comorbidities, and clinical setting influence treatment decisions. The shift toward multimodal analgesia (MMA) has proven more effective than opioids alone, reducing dependency by targeting multiple pain pathways with lower drug doses. This approach facilitates earlier patient discharge, particularly in ambulatory care. Non-opioid alternatives are increasingly emphasized due to the opioid epidemic. While opioids are effective for severe pain, their use is limited by side effects. Alternatives like NSAIDs, local anesthetics, and nerve blocks reduce opioid reliance. However, opioids remain dominant, especially in patient-controlled analgesia.

Local anesthetics are preferred for preoperative and intraoperative pain management, though their postoperative use is limited by duration. Long-acting anesthetics like EXPAREL offer extended relief and are supported by adjuvants such as epinephrine. NSAIDs, commonly prescribed after surgery, reduce opioid use by up to 50%. Combination therapies like ZYNRELEF and SEGLENTIS enhance efficacy while minimizing opioid reliance. ZYNRELEF provides up to 72 hours of relief, gaining traction in the US Innovations such as DEXTENZA and JOURNAVX offer long-lasting, non-opioid options for specific conditions. EXPAREL remains a leading choice for post-surgical pain relief. The acute pain management landscape is evolving, with a growing focus on multimodal analgesia and non-opioid alternatives, supported by innovations from companies like Biohaven, Cessatech, and Teikoku Seiyaku.

Moderate To Severe Acute Pain Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to launch in the Moderate To Severe Acute Pain Market during 2025–2034. For example CA-008, NTM-001, Cebranopadol, and many others are expected to be launched in the US by 2026.

Further detailed analysis of emerging therapies drug uptake in the report…

Moderate To Severe Acute Pain Pipeline Development Activities

The Moderate To Severe Acute Pain pipeline report provides insights into different Moderate To Severe Acute Pain clinical trials within Phase III, Phase II, and Phase I stage. It also analyzes key players involved in developing targeted therapeutics.

Moderate To Severe Acute Pain Pipeline Development Activities

The Moderate To Severe Acute Pain clinical trials report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging Moderate To Severe Acute Pain therapies.

Latest KOL Views on Moderate To Severe Acute Pain

To keep up with current Market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Moderate To Severe Acute Pain evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from University of Iowa, Stanford University School of Medicine, McGovern Medical School, King’s College, Queen Mary University of London, Marche Polytechnic University, University of Tokyo, and others.

What KOLs are saying on Moderate To Severe Acute Pain Patient Trends?

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Moderate To Severe Acute Pain Market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Market and the unmet needs.

Moderate To Severe Acute Pain Market Access and Reimbursement

The high cost of therapies for the Moderate To Severe Acute Pain treatment is a major factor restraining the growth of the Moderate To Severe Acute Pain drug Market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Moderate To Severe Acute Pain Report Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Scope of the Moderate To Severe Acute Pain Treatment Market Report

- The Moderate To Severe Acute Pain treatment Market report covers a segment of key events, an executive summary, descriptive overview of Moderate To Severe Acute Pain, explaining its causes, signs, and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will affect the current treatment landscape.

- A detailed review of the Moderate To Severe Acute Pain Market, historical and forecasted Moderate To Severe Acute Pain Market size, Market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The Moderate To Severe Acute Pain treatment Market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preference that help shape and drive the 7MM Moderate To Severe Acute Pain Market.

Moderate To Severe Acute Pain Treatment Market Report Insights

- Moderate To Severe Acute Pain Patient Population

- Moderate To Severe Acute Pain Therapeutic Approaches

- Moderate To Severe Acute Pain Pipeline Analysis

- Moderate To Severe Acute Pain Market Size and Trends

- Existing and Future Market Opportunity

Moderate To Severe Acute Pain Treatment Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Moderate To Severe Acute Pain Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Moderate To Severe Acute Pain Drugs Uptake

- Key Moderate To Severe Acute Pain Market Forecast Assumptions

Moderate To Severe Acute Pain Treatment Market Report Assessment

- Current Moderate To Severe Acute Pain Treatment Practices

- Moderate To Severe Acute Pain Unmet Needs

- Moderate To Severe Acute Pain Pipeline Product Profiles

- Moderate To Severe Acute Pain Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Moderate To Severe Acute Pain Market Drivers

- Moderate To Severe Acute Pain Market Barriers

Frequently Asked Questions

- What was the Moderate To Severe Acute Pain Market share (%) distribution in 2020, and what will it look like in 2034?

- At what CAGR is the Moderate To Severe Acute Pain Market expected to grow at the 7MM level during the study period (2020–2034)?

- What are the disease risks, burdens, and unmet needs of Moderate To Severe Acute Pain?

- What is the historical Moderate To Severe Acute Pain patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Moderate To Severe Acute Pain?

- At what CAGR is the population expected to grow across the 7MM during the study period (2020–2034)?

- How many companies are developing therapies for the treatment of Moderate To Severe Acute Pain?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to Moderate To Severe Acute Pain?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Moderate To Severe Acute Pain?

Reasons to Buy Moderate To Severe Acute Pain Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Moderate To Severe Acute Pain Market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the Market will help devise strategies that will help get ahead of competitors.

- Detailed analysis, ranking of class-wise potential current, and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet need of the existing Market so that the upcoming players can strengthen their development and launch strategy.

Read latest blogs @ DelveInsight Blogs