Neuroprotection Devices Market Summary

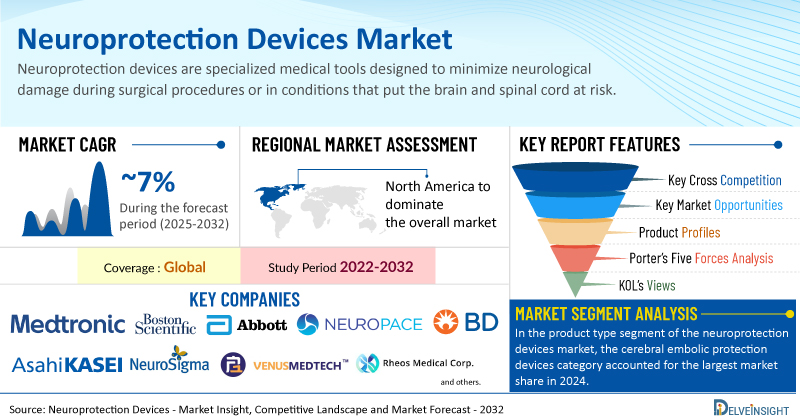

- The Global Neuroprotection Devices Market is growing at a CAGR of 6.87% during the forecast period from 2025 to 2032.

- The leading Neuroprotection Devices Companies such as Medtronic, Boston Scientific Corporation, Abbott Laboratories, NeuroPace, Inc., BD, Asahi Kasei Corporation, NeuroSigma, Inc., Venus Medtech (Hangzhou) Inc., Rheos Medical Corp., Baxter, Aleva Neurotherapeutics, Renishaw plc., Belmont Medical Technologies, BrainCool AB, Contego Medical, Inc., Integer Holdings Corporation, InspireMD Inc., Emboline, Inc., Keystone Heart Ltd., Lepu Medical Technology (Beijing) Co., Ltd., and others.

Neuroprotection Devices Market Trends & Insights

- North America is expected to hold the largest share of the Neuroprotection Devices Market in 2024, primarily due to the rising number of cardiovascular and neurovascular interventions.

- In the product type segment of the neuroprotection devices market, the cerebral embolic protection devices category is estimated to account for the largest market share in 2024. The growth of the cerebral neuroprotection devices (CEPDs) category is primarily driven by the rising prevalence of cardiovascular and neurovascular diseases, along with the various advantages these devices offer in neuroprotection.

Neuroprotection Devices Market Size and Forecasts

- Growth Rate (2025-2032):- 6.87% CAGR

- Largest Neuroprotection Devices Market: North America

- Fastest Growing Market: Asia-Pacific

Neuroprotection Devices Market by Product Type (Cerebral Embolic Protection Devices, Therapeutic Hypothermia Devices, Neuroprotective Drug Delivery Devices, and Others), Application (Cardiovascular Diseases and Neurovascular Diseases), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the growing prevalence of cardiovascular disorders and neurovascular disorders and the growing awareness of the cardiovascular and stroke risks associated with medical procedures.

The Neuroprotection Devices Market is estimated to grow at a CAGR of 6.87% during the forecast period from 2025 to 2032. The demand for neuroprotection devices is being driven by the increasing prevalence of cardiovascular and neurovascular disorders, along with growing awareness of the associated risks during medical procedures. Additionally, heightened product development efforts by key market players are contributing to market expansion. These factors are expected to support steady and robust growth in the neuroprotection devices market from 2025 to 2032.

Factors Contributing to the Neuroprotection Devices Market Growth

-

Rising Prevalence of Neurological Disorders

The increasing global burden of neurological diseases such as ischemic stroke, traumatic brain injuries, and aneurysms is one of the strongest drivers for the neuroprotection devices market. With stroke alone ranking as a leading cause of disability and mortality worldwide, the demand for advanced neuroprotection solutions to prevent secondary brain damage continues to grow.

-

Growing Aging Population

The expanding elderly population is highly vulnerable to cerebrovascular diseases and neurodegenerative conditions. As the risk of stroke, Alzheimer’s disease, and other neurological disorders escalates with age, the adoption of neuroprotection devices becomes increasingly essential, thereby fueling market growth.

-

Advancements in Neurointerventional Procedures

Continuous innovation in minimally invasive neurointerventional procedures, such as thrombectomy and aneurysm repair, has enhanced the effectiveness and safety of treatments. Neuroprotection devices play a critical role in these procedures, boosting their clinical adoption and driving market expansion.

-

Rising Demand for Minimally Invasive and Safer Solutions

Patients and healthcare providers increasingly prefer minimally invasive, safer, and more effective solutions for managing neurological conditions. Neuroprotection devices that reduce procedural risks and improve patient outcomes are becoming central to this trend, boosting market demand.

What are the latest Neuroprotection Devices Market Dynamics and Trends?

According to the British Heart Foundation (2025), approximately 640 million people worldwide were living with heart and circulatory diseases. Many medical procedures to treat these conditions carry the risk of embolization, where dislodged plaque or clots can travel to vital organs like the brain, causing stroke. Embolic Protection Devices (EPDs) play a critical role in capturing or deflecting this debris, reducing complications and improving patient outcomes.

Furthermore, neurovascular disorders such as ischemic stroke and transient ischemic attacks (TIAs) are becoming increasingly prevalent, putting patients at higher risk during endovascular or surgical interventions. Recent data from the British Heart Foundation (2024) reported that coronary (ischemic) heart disease affected around 200 million people globally, with approximately 110 million men and 80 million women impacted. Additionally, about 56 million women and 45 million men were stroke survivors, and an estimated 13 million people lived with congenital heart disease, with many more potentially undiagnosed.

According to the Parkinson’s Foundation (2022), more than 10 million people worldwide were living with Parkinson’s disease, a number that continues to rise. These conditions are closely linked to a high risk of embolic events during interventional procedures. The growing number of patients undergoing treatments such as percutaneous coronary intervention (PCI) and carotid artery stenting has intensified the need for neuroprotection devices to prevent stroke and other neurological damage.

As a result, the rising incidence of cardiovascular and neurovascular disorders is fueling demand for neuroprotection devices, which help safeguard brain health and improve clinical outcomes. However, the complications associated with neuroprotection devices and stringent Regulatory requirements for product approval, among others, are some of the key constraints that may limit the growth of the neuroprotection devices market.

Neuroprotection Devices Market Segment Analysis

Neuroprotection Devices Market by Product Type (Cerebral Embolic Protection Devices, Therapeutic Hypothermia Devices, Neuroprotective Drug Delivery Devices, and Others), Application (Cardiovascular Diseases and Neurovascular Diseases), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the neuroprotection devices market, the cerebral embolic protection devices category is estimated to account for the largest market share in 2024. The growth of the cerebral neuroprotection devices (CEPDs) category is primarily driven by the rising prevalence of cardiovascular and neurovascular diseases, along with the various advantages these devices offer in neuroprotection.

CEPDs are designed to capture or deflect embolic debris generated during procedures such as transcatheter aortic valve replacement (TAVR), carotid artery stenting, and transcatheter valve repair. By preventing embolic debris from reaching the cerebral circulation, these devices significantly reduce the incidence of stroke and transient ischemic attacks (TIAs) immediately following such interventions.

Additionally, CEPDs allow for the collection of captured debris for pathological analysis, enhancing the understanding of embolic sources and informing future procedural strategies. These devices create a more controlled procedural environment by isolating the intervention site and minimizing the risk of emboli traveling to the brain or other vital organs. Their versatility also enables use across a range of procedures, including saphenous vein graft interventions and certain neurovascular procedures, further expanding their clinical utility.

CEPDs are particularly beneficial in complex anatomies and high-risk patients, offering enhanced safety and improving overall procedural outcomes, making them a preferred choice for many clinicians. Moreover, ongoing product development and regulatory approvals are accelerating market growth. For instance, in June 2025, InspireMD announced CE Mark approval for its CGuard® Prime Embolic Prevention System (EPS) under the European Medical Device Regulation (MDR) for stroke prevention.

Thus, the factors mentioned above are likely to boost the market segment and thereby increase the overall market of neuroprotection devices across the globe.

North America is expected to dominate the overall Neuroprotection Devices Market

North America is expected to hold the largest share of the neuroprotection devices market in 2024, primarily due to the rising number of cardiovascular and neurovascular interventions. This dominance is further supported by strong clinical demand, advanced healthcare infrastructure, and significant investment in research and development. Collectively, these factors establish North America as the leading region in the global neuroprotection devices market.

According to recent data from the Centers for Disease Control and Prevention (2024), in 2022, approximately 4.9% of adults were diagnosed with coronary heart disease. Furthermore, by 2023, an estimated 12.1 million individuals in the United States were projected to have atrial fibrillation. Additionally, each year, over 795,000 people in the U.S. experience a stroke, with around 610,000 of these being first-time strokes.

Similarly, data from the Parkinson’s Foundation (2022), approximately 90,000 individuals are diagnosed with Parkinson's disease (PD) each year in the United States. Projections suggested that the number of people affected by PD was expected to reach 1.2 million by 2030. Thus, these disorders often require neuroprotection devices such as cerebral protection and hypothermia devices, which provide controlled cooling to reduce brain metabolism, slowing harmful cascades triggered by a lack of oxygen during arrest.

The increasing geriatric population, which is more susceptible to neurovascular and cardiovascular diseases, is significantly driving market growth in the region. According to data from the Population Reference Bureau published in January 2024, there were approximately 58 million individuals aged 65 and older in the United States in 2022, a number projected to rise to 82 million by 2050. As the global demographic of elderly individuals expands, the demand for neuroprotection devices that address age-related cognitive and mobility decline is also on the rise, thereby propelling the market growth.

Rising product development activities by key companies are expected to further drive the growth of the neuroprotection devices market in the country. For instance, in October 2024, Contego Medical announced that it received FDA premarket approval (PMA) for the Neuroguard IEP® System, which features the company’s clinically-proven Integrated Embolic Protection™ (IEP) technology. Therefore, the combination of a rising number of neurovascular conditions and associated risk factors and ongoing product launches in the domain of neuroprotection devices is expected to significantly propel the growth of the neuroprotection devices market in North America from 2025 to 2032.

Who are the major players in Neuroprotection Devices?

The following are the leading Neuroprotection Devices Companies. These companies collectively hold the largest Neuroprotection Devices Market Share and dictate industry trends.

Neuroprotection Devices Companies

The leading Neuroprotection Devices Companies such as Medtronic, Boston Scientific Corporation, Abbott Laboratories, NeuroPace, Inc., BD, Asahi Kasei Corporation, NeuroSigma, Inc., Venus Medtech (Hangzhou) Inc., Rheos Medical Corp., Baxter, Aleva Neurotherapeutics, Renishaw plc., Belmont Medical Technologies, BrainCool AB, Contego Medical, Inc., Integer Holdings Corporation, InspireMD Inc., Emboline, Inc., Keystone Heart Ltd., Lepu Medical Technology (Beijing) Co., Ltd., and others.

Recent Developmental Activities in the Neuroprotection Devices Market

- In May 2025, Terumo Interventional Systems announced the commercial launch of its FDA-approved ROADSAVER™ Carotid Stent System. Designed for use with the Nanoparasol® Embolic Protection System, the ROADSAVER Stent System is intended to treat carotid artery stenosis in patients at elevated risk of complications from carotid endarterectomy.

Key takeaways from the neuroprotection devices market report study

- Neuroprotection Devices Market Size analysis for the current neuroprotection devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the neuroprotection devices market.

- Various opportunities available for the other competitors in the neuroprotection devices market space.

- What are the top-performing segments in 2024? How will these segments perform in 2032?

- Which are the top-performing regions and countries in the current neuroprotection devices market scenario?

- Which are the regions and countries where Neuroprotection Devices Companies should have concentrated on opportunities for the neuroprotection devices market growth in the future?

The Target audience who can benefit from this neuroprotection device market report study

- Neuroprotection devices product providers

- Research organizations and consulting Neuroprotection Devices Companies

- Neuroprotection devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up Neuroprotection Devices Companies, venture capitalists, and private equity firms

- Distributors and traders dealing in neuroprotection devices

- Various end-users who want to know more about the neuroprotection devices market and the latest technological developments in the neuroprotection devices market.

Stay updated with us for Recent Articles @ New DelveInsight Blogs