Nf Kappa B Inhibitors Market Summary

- NF-kappa B (NF-κB) is a family of transcription factors that play a key role in regulating immune response, inflammation, cell proliferation, and survival. It exists in an inactive form in the cytoplasm and becomes activated in response to stress, cytokines, or pathogens. Once activated, it translocates to the nucleus to trigger gene expression.

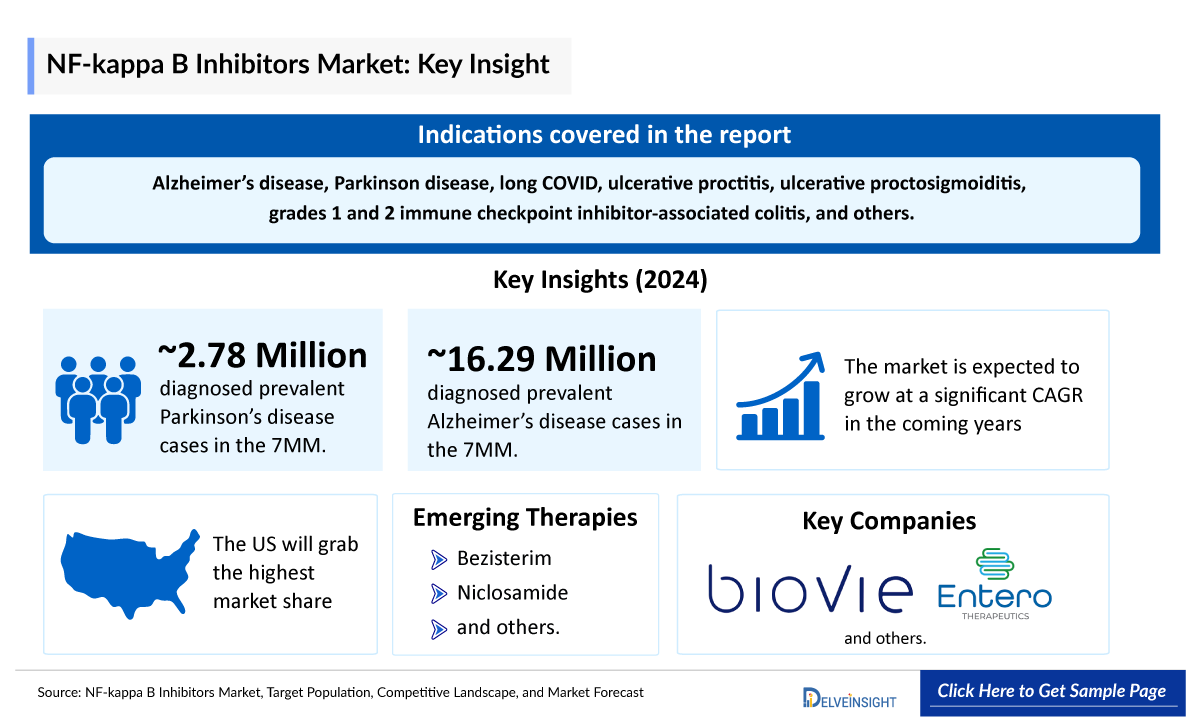

- NF-κB inhibitors are mainly utilized in the treatment of Alzheimer’s disease, Parkinson disease, long COVID, ulcerative proctitis, ulcerative proctosigmoiditis, grades 1 and 2 immune checkpoint inhibitor-associated colitis, and others.

- There are currently no FDA-approved or marketed therapies specifically classified as NF-κB inhibitors, highlighting a significant unmet medical need. Given NF-κB’s central role in driving inflammation, immune dysregulation, and tumorigenesis, developing safe and targeted inhibitors remains a critical focus in drug discovery.

- NF-κB inhibitors has a pipeline consisting of promising products such as bezisterim (NE3107), niclosamide (FW-UP), niclosamide (FW-ICI-AC), and others which are in late- and mid-stage of clinical development.

- Biovie, Entero Therapeutics, and several other companies are currently engaged in the development and production of NF-κB inhibitors, which have the potential to significantly impact and enhance the NF-κB inhibitors market.

DelveInsight’s “NF-κB Inhibitors– Target Population, Competitive Landscape, and Market Forecast–2034” report delivers an in-depth understanding of the NF-κB, historical and Competitive Landscape as well as the NF-κB inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The NF-κB inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM NF-κB inhibitors market size from 2020 to 2034. The report also covers current NF-κB treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Scope of the NF-κB Inhibitors Market Report | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

NF-κB Inhibitor Epidemiology |

Segmented by:

|

|

NF-κB Inhibitor Key Companies |

|

|

NF-κB Inhibitor Key Therapies |

|

|

NF-κB Inhibitor Market Segmentation |

Segmented by:

|

|

NF-κB Inhibitor Analysis |

|

Key Factors Driving the NF-κB Inhibitors Market

Growing unmet disease burden

NF-κB sits at the crossroads of inflammation and tumor biology, so the pathway’s involvement across autoimmune, neuroinflammatory and many cancers creates broad clinical demand for effective inhibitors.

Strong interest in neurodegenerative and neurological applications

Because NF-κB signaling is implicated in Alzheimer’s, Parkinson’s, long-COVID neurological symptoms and other CNS disorders, pipeline activity aimed at neurodegeneration (and the need for blood-brain-barrier-permeable molecules) is expanding market opportunity. BioVie’s bezisterim (NE3107) programs illustrate that trend.

Expanding NF-κB inhibitors clinical activity

NF-κB inhibitors has a pipeline consisting of promising products such as BioVie’ bezisterim (NE3107), Entero Therapeutics’ niclosamide (FW-UP), niclosamide (FW-ICI-AC), Accendatech’s ACT001, BioMimetix’s BMX-001, and others.

NF-κB Inhibitor Understanding

NF-κB Inhibitor Overview

NF-κB (Nuclear Factor kappa-light-chain-enhancer of activated B cells) represents a family of inducible transcription factors that play a central role in the regulation of immune and inflammatory responses. Commonly referred to as NF-κB, these molecules typically exist as dimers, with the canonical heterodimer composed of p50 and p65 (NF-κB1/RelA) subunits being the most studied.

NF-κB is a ubiquitously expressed and highly pleiotropic transcription factor that integrates signals from a wide variety of stimuli—including cytokines, pathogens, stress signals, and cellular damage. It serves as a critical end-point effector of complex intracellular signaling cascades, modulating the expression of genes involved in inflammation, innate and adaptive immunity, cellular proliferation, differentiation, survival, and apoptosis. NF-κB is especially pivotal in orchestrating immune responses to pathogens and maintaining immune homeostasis.

Dysregulated NF-κB signaling is implicated in the pathogenesis of numerous diseases, particularly chronic inflammatory conditions and malignancies. Constitutive or aberrant activation of NF-κB contributes to tumor initiation, progression, chemoresistance, and immune evasion, and is a hallmark in diseases such as rheumatoid arthritis, multiple sclerosis, inflammatory bowel disease, and various hematologic and solid tumors. Accordingly, the NF-κB signaling cascade has emerged as a strategic target for therapeutic intervention. A diverse array of NF-κB inhibitors has been developed or identified, encompassing natural phytochemicals, synthetic small molecules, metallic complexes, metabolic byproducts, peptides, and biologically derived macromolecules from cellular, viral, bacterial, and fungal sources, as well as specific physical stimuli. These inhibitors act at multiple levels of the NF-κB pathway, offering potential for disease-specific modulation and therapeutic benefit.

Further details related to country-based variations are provided in the report…

NF-κB Inhibitor Epidemiology

The NF-ΚB inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for NF-κB inhibitor, total eligible patient pool for NF-κB inhibitor in selected indication, and total treated cases in selected indication for NF-κB inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The total diagnosed prevalent cases of Parkinson’s disease in the 7MM were ~2,777,700 in 2024.

- In EU4 and the UK, Germany accounted for the highest number of Parkinson’s disease treated cases with approximately 501,500 in 2024.

- The total diagnosed prevalent cases of Alzheimer’s disease in the 7MM were ~16,289,000 in 2024.

- Ulcerative proctitis, a form of ulcerative colitis limited to the rectum, accounts for approximately 20–30% of ulcerative colitis cases. It can be particularly challenging to manage due to its substantial burden of distressing and disabling symptoms.

Epidemiology of Selected Indications | |

|

Indication |

Estimated Incidence Cases in the US (2024) |

|

Alzheimer’s Disease |

~7,236,000 |

|

Parkinson’s Disease |

~1,248,000 |

Note: Indications are selected based on pipeline activity

NF-κB Drug Chapters

The drug chapter segment of the NF-ΚB inhibitor reports encloses a detailed analysis of late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the NF-ΚB inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Emerging NF-ΚB Inhibitors

Bezisterim (NE3107): Biovie

Biovie’s bezisterim is currently being studied in Alzheimer’s disease, Parkinson’s disease and Long COVID. As part of the clinical trials in these core indications, Biovie is also exploring bezisterim’s potential impact on longevity by measuring its ability to reduce DNA methylation in study participants.

Bezisterim is an oral small molecule, blood-brain barrier (BBB) permeable, anti-inflammatory insulin sensitizer that binds extracellular signal-regulated kinase. Bezisterim has been shown to selectively inhibit inflammation-driven ERK- and NF-κB-stimulated inflammatory mediators, including tumor necrosis factor alpha (TNF-α), without inhibiting their homeostatic functions.

In June 2021, BioVie announced acquisition of the biopharmaceutical assets of NeurMedix, including bezisterim.

Emerging NF-κB Inhibitor Therapies Comparision | |||||

|

Product |

Company |

RoA |

MoA |

Indication |

Phase |

|

Bezisterim (NE3107) |

Biovie |

Oral |

NF-κB inhibitor |

Alzheimer Disease |

III |

|

Parkinson Disease |

II | ||||

|

Long COVID |

II | ||||

|

Niclosamide (FW-UP) |

Entero Therapeutics |

Oral |

NF-κB inhibitor |

Ulcerative Proctitis And Ulcerative Proctosigmoiditis |

II |

|

Niclosamide (FW-ICI-AC) |

Grades 1 and 2 Immune Checkpoint Inhibitor-Associated Colitis |

II | |||

Note: Detailed emerging therapies assessment will be provided in the final report.

NF-κB Inhibitor Market Outlook

The NF-κB (nuclear factor kappa-light-chain-enhancer of activated B cells) signaling pathway plays a pivotal role in the regulation of immune responses, inflammation, cell proliferation, and survival. Dysregulation of this pathway has been strongly implicated in a wide range of diseases including cancer, neurodegenerative disorders, autoimmune conditions, and chronic inflammation, making it a compelling therapeutic target. Despite its central role in pathophysiology, there are currently no NF-κB inhibitors approved for clinical use, underscoring the unmet medical need and the complexity of targeting this pathway effectively and safely.

Several emerging therapies are now progressing through clinical trials, reflecting renewed interest and innovation in this space. Bezisterim (NE3107), developed by Biovie, is the most advanced candidate, currently in a Phase III trial for Alzheimer’s disease, and in Phase II studies for Parkinson’s disease and long COVID. Its oral administration and anti-inflammatory mechanism via NF-κB inhibition position it as a potentially disease-modifying treatment in neurodegeneration—an area with limited effective options. If successful, it could become the first-in-class NF-κB inhibitor in neurology.

In oncology, ACT001 from Accendatech is in Phase II trials for recurrent glioblastoma, and is also being explored for diffuse intrinsic pontine gliomas (DIPG). Its targeted oral delivery and blood-brain barrier penetration make it a promising candidate for CNS tumors, where treatment options remain limited. There is no recent updates regarding the drug development on the company’s pipeline. Similarly, BMX-001 from BioMimetix is advancing through trials in rectal, ovarian, and endometrial cancers, with a focus on enhancing the effect of chemoradiation by reducing oxidative stress and inflammation through NF-κB modulation. However, there are no recent updates regarding the drug development on both the company’s pipeline.

In the inflammatory disease space, niclosamide, a repurposed anthelmintic with NF-κB inhibitory properties, is being developed by Entero Therapeutics. FW-UP is in Phase II for ulcerative proctitis and proctosigmoiditis, while FW-ICI-AC is targeting immune checkpoint inhibitor (ICI)-associated colitis, a rising complication in immuno-oncology. The repositioning of niclosamide for inflammatory bowel diseases and ICI toxicities reflects the broad applicability of NF-κB inhibition in controlling pathological inflammation without full systemic immunosuppression.

However, despite encouraging preclinical and early clinical data, the development of NF-κB inhibitors has historically been challenged by concerns over off-target effects and immunosuppression, given NF-κB’s ubiquitous role in immune homeostasis. Future success will depend on the ability to achieve pathway specificity, optimize dosing, and identify disease contexts where modulation of NF-κB offers a clear benefit-risk advantage.

NF-κB Drugs Uptake

This section focuses on the uptake rate of potential emerging NF-ΚB expected to be launched in the market during 2025–2034.

NF-κB Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for NF-ΚB inhibitor market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for NF-ΚB inhibitor therapies.

Latest KOL Views on NF-κB Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on NF-ΚB Inhibitor's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center, UCSF Health; Memorial Sloan Kettering Cancer Center; Columbia University, Division of Hematology & Oncology, University of Illinois Health; Oncology Department at San Luigi Hospital Center for Thoracic Cancers at the Massachusetts General Hospital; Dana-Farber Brigham Cancer Center, and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or NF-ΚB market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“NF-κB plays a central role in immune regulation and inflammation. The success of selective NF-κB inhibitors in preclinical autoimmune and neurodegenerative models offers hope for safer, disease-modifying therapies—especially compared to broad immunosuppressants.” MD, Columbia University, US |

NF-κB Inhibitor Market Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on NF-κB Inhibitors

- In April 2025, BioVie announced that patient enrollment is now open for the Phase II SUNRISE-PD clinical trial evaluating the safety and efficacy of bezisterim on motor and non-motor symptoms in patients with Parkinson’s disease (PD) who haven’t been treated with carbidopa/levodopa. The first patient in the trial has been enrolled, and the Company anticipates topline data to be available in late 2025 or early 2026.

- In May 2025, BioVie announced first patient enrollment in the Phase II ADDRESS-LC clinical trial (NCT06847191) evaluating bezisterim for the treatment of neurological symptoms associated with long COVID. The Company anticipates topline data to be available in the first half of 2026.

- In February 2025, Accendatech in collaboration with Nationwide Children's Hospital plans a Phase II trial for Glioma in USA in July 2025 (NCT06838676).

The abstract list is not exhaustive, will be provided in the final report

Scope of the NF-κB Inhibitor Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the NF-κB, explaining its mechanism, and therapies (emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the NF-κB market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM NF-κB market.

NF-κB Inhibitor Report Insights

- NF-ΚB Targeted Patient Pool

- Therapeutic Approaches

- NF-ΚB Pipeline Analysis

- NF-ΚB Market Size and Trends

- Existing and Future Market Opportunity

NF-κB Inhibitor Report Key Strengths

- Ten years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

NF-κB Inhibitor Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

Key Questions Answered in the NF-κB Inhibitor Market Report

- What was the NF-κB inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for NF-κB Inhibitor?

- What are the risks, burdens, and unmet needs of treatment with NF-κB -based/targeting therapies? What will be the growth opportunities across the 7MM for the patient population of NF-κb -based/targeting therapies?

- What are the key factors hampering the growth of the NF-κB Inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for NF-κB inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy NF-κB Inhibitor Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the NF-κB Inhibitor Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.