Onychomycosis Market

- In 2023, approximately 83,553 thousands diagnosed prevalent cases of Onychomycosis existed in the 7MM. Factors contributing to the rise in prevalent cases of Onychomycosis in the 7MM includes aging populations, lifestyle habits such as poor foot hygiene and tight footwear, and frequent exposure to communal areas like swimming pools increase susceptibility.

- Assessments as per DelveInsight’s analysts showed that in 2023, in the US, distal subungual onychomycosis is the most common subtype of Onychomycosis and accounts for ~90% of onychomycosis cases. In 2023, there were 6,034, thousands cases associated with distal subungual onychomycosis and these cases are further projected to change during the study period (2020-2034).

- In the EU4 and the UK, France accounted for the highest number of Onychomycosis diagnosed prevalent cases, totaling approximately 2,046 thousands cases in 2023, and these cases are further expected to change during the study period (2020-2034).

- Onychomycosis is often described as mild (25% or less nail involvement), moderate (26–74% involvement), and severe (more than 75% involvement). In 2023, there were 70,300, 101,630, and 82,781 mild, moderate, severe cases respectively in Spain. As per DelveInsight’s analysis these cases are further projected to increase during the forecast period (2024-2034).

- Among the currently approved treatments for Onychomycosis, Topical Pharmacotherapy is expected to garner the highest market size by 2034 in the US.

- With the expected approval of new therapies during the forecast period (2024–2034), the overall Onychomycosis therapeutic market is projected to experience a significant upsurge at a substantial CAGR.

- Growth of the Onychomycosis market is expected to be mainly driven by improved diagnostic approaches, an upsurge in the launch of products, and increasing research in pharmaceutical treatment.

DelveInsight’s report titled “Onychomycosis Market Insights, Epidemiology, and Market Forecast – 2034” comprehensively analyzes Onychomycosis. The report provides a comprehensive analysis of historical and projected epidemiological data, covering Total Prevalent cases of Onychomycosis, Total diagnosed Prevalent cases of Onychomycosis, Subtype-specific diagnosed prevalent cases of Onychomycosis, and Severity-specific diagnosed prevalent cases of Onychomycosis.

The Onychomycosis market report provides a comprehensive insight into different facets concerning the patient population, encompassing diagnosis, prescribing trends, physician viewpoints, market accessibility, therapy, and forthcoming market advancements across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan spanning from 2020 to 2034.

The report examines current treatment methodologies and algorithms for Onychomycosis, assessing the overall market potential, identifying business prospects, and addressing the unmet medical requirements.

Onychomycosis Overview

Onychomycosis, a fungal infection of the nail, is the most common nail infection worldwide, causing discoloration and thickening of the affected nail plate. It was initially thought to be caused by dermatophytes predominantly; however, new research has revealed that mixed infections and those caused by nondermatophyte molds (NDMs) are more prevalent than thought previously, especially in warmer climates. When onychomycosis is caused by dermatophytes, it is called tinea unguium. The term onychomycosis encompasses not only the dermatophytes but the yeasts and saprophytic molds infections as well. Although it can infect both fingernails and toenails, onychomycosis of the toenail is much more prevalent. An abnormal nail that is not caused by a fungal infection is a type of dystrophic nail.

Onychomycosis has traditionally been classified into subtypes based on the invasion pattern, which may guide treatment. Distal subungual onychomycosis (DSO) is the most common subtype and occurs when the fungus invades the distal aspect of the nail plate. In superficial white onychomycosis (SWO), fungi invade the most superficial layers of the nail plate. Proximal subungual onychomycosis (PSO) is caused by the infecting organism invading from the undersurface of the proximal nail fold, and the infection then progresses distally. Endonyx onychomycosis (EO) occurs with the fungal invasion of the nail plate without infection of the nail bed. Total dystrophic onychomycosis (TDO) represents end-stage onychomycosis and may follow any of the other subtypes, and secondary onychomycosis (SO) is a non-fungal nail condition (i.e., psoriasis) with a secondary fungal infection, clinically approximating both the fungal and non-fungal nail conditions.

Onychomycosis Diagnosis and Treatment Algorithm

Microscopy and fungal culture are the gold standard techniques for onychomycosis diagnosis, but high false-negative rates have pushed for more accurate methods, such as histology and PCR. As NDMs are skin and laboratory contaminants, their presence as an infectious agent requires multiple confirmations and repeated sampling. There are several treatment options available, including oral antifungals, topical antifungals, and devices. Oral antifungals have higher cure rates and shorter treatment periods than topical treatments but have adverse side effects such as hepatotoxicity and drug interactions. Terbinafine, itraconazole, and fluconazole are the most commonly used antifungals, with fosravuconazole, a new oral antifungal, currently under evaluation. Topical treatments, such as efinaconazole, tavaborole, ciclopirox, and amorolfine, have less serious side effects but result in lower cure rates generally and much longer treatment regimens. New topical formulations are being investigated as faster-acting alternatives to the currently available topical treatments. Devices such as lasers have shown promise in improving the cosmetic appearance of the nail. However, due to a high variation of study methods and definitions of cure, their effectiveness for onychomycosis has yet to be sufficiently proven. Recurrence rates for onychomycosis are high; once infected, patients should seek medical treatment as soon as possible.

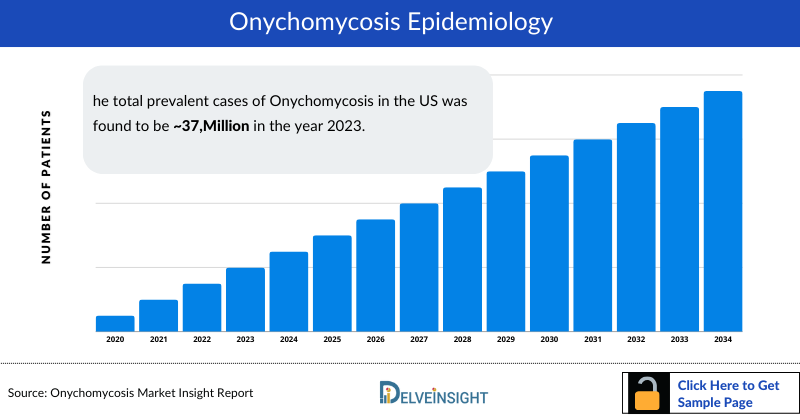

Onychomycosis Epidemiology

The epidemiology section on Onychomycosis offers an analysis of past and present patient populations, along with projected trends across seven major countries (7MM). Drawing from multiple studies and expert opinions, it aims to elucidate the underlying factors driving current and anticipated trends. Additionally, this segment of the report presents data on the diagnosed patient population, highlighting trends and underlying assumptions.

Key Findings

- The total prevalent cases of Onychomycosis in the US was found to be 37,250 thousand in the year 2023. These cases are expected to change significantly by 2034.

- In 2023, when prevalent cases of onychomycosis were segmented based on severity in Germany, moderate cases stood out as the highest, totaling about 726 thousand. These figures are expected to fluctuate during the forecast period from 2024 to 2034.

- In the UK, when Onychomycosis cases were categorized by Subtype, a notable disparity was observed, with a higher prevalence of distal subungual onychomycosis compared to superficial white onychomycosis, proximal subungual onychomycosis, and Candidal onychomycosis. In 2023, approximately 861 thousand cases of Onychomycosis were recorded in the distal subungual onychomycosis, and these figures are expected to undergo further fluctuations throughout the study period spanning from 2020 to 2034.

- In 2023, France had around 11,465 thousand prevalent cases of Onychomycosis. These cases are expected to further change by 2034.

- In 2023, Japan recorded approximately 2,296 thousand diagnosed prevalent cases of Onychomycosis. It is anticipated that these figures will undergo further fluctuations by the year 2034.

- In Japan, moderate onychomycosis emerged as the dominant severity category, comprising approximately 916 thousand cases in 2023, followed by severe cases. Mild onychomycosis represented the lowest proportion of cases.

Onychomycosis Drug Chapters

The drug chapter segment of the Onychomycosis report encloses the detailed analysis of Onychomycosis marketed drugs, mid-phase, and late-stage pipeline drugs. It also helps to understand the Onychomycosis clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details of each included drug, and the latest news and press releases.

Marketed Therapies for Onychomycosis

Currently, oral Terbinafine hydrochloride (Lamisil) is the most common treatment for onychomycosis. These 250mg tablets are taken once-a-day for 12 weeks. First approved in 1996 by the US FDA, it has been the mainstay with all its generic versions marketed since the patent expiry in 2007. Other components that make up the total revenue generated by systemic therapies include Itraconazole, Griseofulvin, Fluconazole and Ketoconazole.

Three major Topical treatments are currently on the market with two of them being approved as late as 2014 by the US FDA. Penlac (Valeant Pharmaceuticals, Inc.) was approved way back in 1999, and many generic versions are currently available in the market.

KERYDIN (tavaborole): Pfizer

KERYDIN (tavaborole) topical solution, contains tavaborole, 5% (w/w) in a clear, colorless alcohol-based solution for topical use. The active ingredient, tavaborole, is an oxaborole antifungal. Tavaborole is a white to off-white powder and is slightly soluble in water and freely soluble in ethanol and propylene glycol. Kerydrin contains 43.5 mg of tavaborole/mL of solution. Inactive ingredients include alcohol, edetate calcium disodium, and propylene glycol.

The mechanism of action of tavaborole is inhibition of fungal protein synthesis. Tavaborole inhibits protein synthesis by inhibition of an aminoacyl-transfer ribonucleic acid (tRNA) synthetase (AARS). It penetrates the nail plate because of its small molecular weight and interferes with protein synthesis in fungal cells through its effects on cytoplasmic aminoacyl-tRNA synthetases.

In July 2014, the FDA approved Kerydin to treat onychomycosis of the toenails due to Trichophyton rubrum or Trichophyton mentagrophytes.

JUBLIA/CLENAFIN (efinaconazole): Bausch Health

Efinaconazole 10% nail solution (JUBLIA) is a new topical triazole antifungal designed for the topical treatment of distal and lateral subungual onychomycosis. Efinaconazole has lower minimum inhibitory concentrations than terbinafine, ciclopirox, itraconazole, and amorolfine in Trichophyton rubrum, Trichophyton mentagrophytes, and Candida albicans. The solution-based formula has low surface tension and keratin binding properties that increase penetrance through the nail plate. Safety studies have shown that this formulation is not associated with atopic dermatitis or contact sensitivity. Efinaconazole 10% nail solution is a safe and effective new topical therapy for onychomycosis, which will fill a pressing need for more effective topical therapy in this disease. It is marketed under the brand name JUBLIA in the US and CLENAFIN in Japan.

- In June 2014, the FDA approved JUBLIA for the treatment of onychomycosis of the toenails due to Trichophyton rubrum or Trichophyton mentagrophytes.

- In July 2014, CLENAFIN (efinaconazole) was approved by PMDA for the treatment of onychomycosis in Japan.

Note: Detailed marketed therapies assessment and list of products to be continued in the report...

Emerging Therapies for Onychomycosis

The potential drugs that are expected to be launched in the forecasted period include BB2603, VT-1161, and others.

BB2603: Blueberry Therapeutics

Blueberry Therapeutics’ BB2603 is squalene epoxidase inhibitor BB2603 in a spray formulation is currently ongoing Phase I/II trials to treat onychomycosis and its associated tinea pedis. BB2603 is an innovative new treatment concept using nanotechnology to deliver terbinafine, a potent antifungal, through the nail and into the skin to treat fungal infection.

In November 2023, Blueberry Therapeutics announced that BB2603, a novel topical terbinafine antifungal product, has met the primary endpoint in the Phase IIb trial (BBTAF202) in patients with onychomycosis, showing superiority over placebo (vehicle) with a high level of statistical significance.

VT-1161: Mycovia Pharmaceuticals

VT-1161 is a potent and selective, orally available inhibitor of fungal CYP51. In in vitro and in vivo studies, VT-1161 has demonstrated broad-spectrum activity against Candida species, a broad family of fungi that resemble yeasts and frequently cause infections in humans, and dermatophytes, a broad family of fungi that frequently cause skin, nail, and hair infections. Based on their research to date, the company believes that VT-1161 is highly active against most species of Candida. In addition, the drug is highly active against Trichophyton rubrum and Trichophyton mentagrophytes – the two most common dermatophyte species that cause onychomycosis. As VT-1161 is highly selective for fungal CYP51, it is believed that it may avoid the side effects that limit the use of commonly prescribed antifungals, including fluconazole, itraconazole, posaconazole, terbinafine, and voriconazole.

Note: Detailed emerging therapies assessment and list of products to be continued in the report...

Onychomycosis Market Outlook

Onychomycosis is primarily a fungal infection of the nail bed. It is commonly referred to as ‘toenail fungus’ because toenail infections constitute the majority of onychomycosis cases. Toenail disorders are one of the most prevalent foot complaints for which adults seek over-the-counter treatments and professional care. The infection typically begins as a small white or yellow spot beneath the nail plate, causing nail discoloration and thickening and splitting of the nail. It is estimated that the disease affects nearly 3% of the general adult population with around ~20% of the individuals between the ages of 40 and 60 years being affected.

The current treatment landscape can be divided into components based on routes of administration, namely; Systemic (Oral) and Topical Medications.

It is to be noted that although, there have been numerous attempts to develop remedies for toenail fungus to date the few products FDA/EMA/PMDA approved that are currently dominating the market are poor treatment options largely for two major reasons. Topical formulations deliver low cure rates and suboptimal efficacy because they cannot penetrate the nail plate to reach the infected nail bed in adequate concentrations to kill the fungus and may require debridement of the nail plate prior to application. On the other hand, in case of the leading oral product terbinafine, the agent must be taken daily for 3 months, and the amount of drug in the body can lead to adverse systemic events. The complete cure rates are extremely low in both the treatment modalities and hepatotoxicity is a common side effect associated with its prolonged usage. Patients are required to undertake periodic lab tests to ensure that their liver is functioning properly while on the product.

Note: Detailed market outlook to be continued in the report….

Onychomycosis Market Segmentation

DelveInsight’s ‘Onychomycosis – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future Onychomycosis market, segmented within countries and by therapies. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

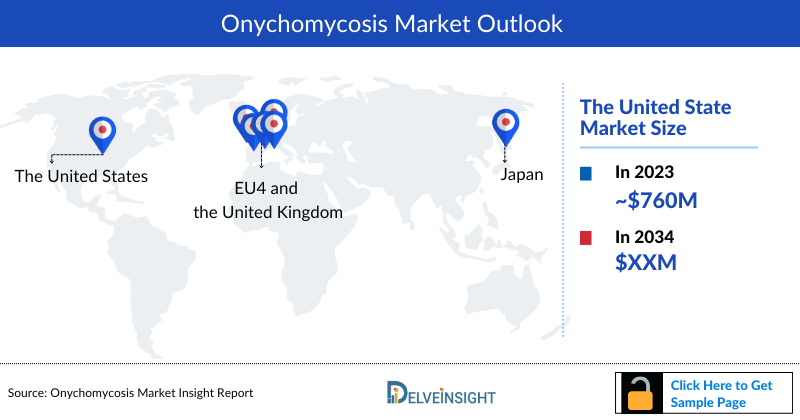

Onychomycosis Market Size by Countries

The total Onychomycosis market size is analyzed for individual countries (the United States Market, EU4 (Germany, France, Italy, and Spain) and the UK market, and Japan). The United States accounted for a larger portion of the 7MM market for Onychomycosis in 2023 due to the higher cases of the condition and high treatment cost. This dominance is predicted to continue with the potential early entry of new products.

Onychomycosis Market Size by Therapies

Numerous players have targeted this high unmet need to tap the market, and one such major player is Blueberry Therapeutics with its leading product BB2603. The company uses its potent nanotechnology-based topical drug delivery platform to maintain the efficacy of the oral gold standard treatment, but at a lower dose. Targeted delivery by penetrating the nail bed ensures lower dosage and reduced systemic side effects.

Another pipeline candidate in contention is Mycovia Pharmaceuticals’ VT-1161. It is the only oral candidate, which was chemically designed to using advanced technology to have greater selectivity, fewer side effects and improved potency as compared to currently available antifungal agents. A lesser amount of side effects can primarily be attributed to the fact that the molecule is highly selective for fungal CYP51. This, in turn, will render it as a fierce competitor of the currently used SOC antifungals including fluconazole and terbinafine.

It is believed that the Onychomycosis treatment market could change by 2034, in the US with the launch of novel therapies with better and broader efficacy, treatment duration, better dosages, and enhanced convenience.

Key Findings

- The market size of Onychomycosis in the US was approximately USD 760 million in 2023, which is further expected to increase by 2034 at a significant Compound Annual Growth Rate (CAGR) for the study period (2020–2034).

- The United States accounts for the largest market size for Onychomycosis accounting for around 61% of the total 7MM market size.

- Upcoming therapies such as BB2603, and others have the potential to create a significant positive shift in the Onychomycosis market size.

- The market size of EU4 and the UK was approximately USD 364 million, which is further expected to increase during the forecast period.

- Among the European countries, France had the highest market size with approximately USD 123 million in 2023.

- The expected Launch of potential therapies may increase market size in the coming years, assisted by an increase in the prevalent cases of Onychomycosis.

Note: Detailed market segment assessment will be provided in the final report...

Onychomycosis Drugs Uptake

This section focuses on the sales uptake of potential Onychomycosis drugs that have recently launched or are anticipated to be launched in the Onychomycosis market between 2020 and 2034. It estimates the market penetration of the Onychomycosis drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the drug’s probability of success (PoS) in the Onychomycosis market.

For example, for BB2603, we expect the drug uptake to be medium with a probability-adjusted peak share of around 6%, and years to the peak is expected to be 5 years from the year of launch in the US.

Note: Detailed assessment of drug uptake will be provided in the full report on Onychomycosis...

Onychomycosis Market Access and Reimbursement

DelveInsight’s ‘Onychomycosis – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of Onychomycosis.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views

To keep up with current Onychomycosis market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Onychomycosis domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Onychomycosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Onychomycosis unmet needs.

Onychomycosis: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as Foot and Ankle Specialists of Mid-Atlantic, US, Department of Podiatric Medicine, Kent State University, Department of Dermatology, People’s Hospital of Southern Medical University, Institute of Physical Chemistry Rocasolano, Spanish National Research Council, Mediprobe Research Inc., UK, and others.

“The reason why patients take OTC is due to the immediacy and the thought that fungi are the cause (although they are not always because the alteration of the nail can be due to psoriasis, traumatic nail). Based on my experience, the ratio of OTC versus prescription is 3:7.”

“OTC topicals are frequently attempted by patients before they come to me for treatment. Many podiatrists and dermatologists sell the OTC product to control (not cure) the disease and make profit from in-office dispensing of product that otherwise would go to the drug stores. The in-office dispensing is included in OTC: 25% do OTC and 75% do prescription.”

“There is the same high failure to comply with the long-term use of any topical, prescribed, or OTC. One could argue that a patient who pays for the cost of JUBLIA or KERYDIN (out of pocket when not covered by insurance) is more likely to comply with the daily application since they paid for the medicine but, again, no studies to quote, purely anecdotal information. Compliance with oral medicine is almost always complete. Reasons, I believe, are most likely because it is easier to take a pill daily and patients take a pill more seriously than applying a solution.”

Note: Detailed assessment of KOL Views will be provided in the full report of Onychomycosis...

Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Onychomycosis market using various Competitive Intelligence tools, including SWOT analysis, conjoint analysis, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

The emerging Onychomycosis therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the Onychomycosis market.

Note: Detailed assessment of SWOT analysis and conjoint analysis will be provided in the full report on Onychomycosis...

Onychomycosis Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase II and III stages. It also analyzes Onychomycosis Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Onychomycosis therapies.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of Onychomycosis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression along with treatment guidelines

- Additionally, an all-inclusive account of both the current and emerging therapies along with the elaborative profiles of late-stage and prominent therapies will have an impact on the current treatment landscape

- A detailed review of the Onychomycosis market; historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preference that help in shaping and driving the 7MM Onychomycosis market

Onychomycosis Report Insights

- Patient Population

- Therapeutic Approaches

- Onychomycosis Pipeline Analysis

- Onychomycosis Market Size and Trends

- Existing and future Market Opportunity

Onychomycosis Report Key Strengths

- 11 Years Forecast

- 7MM Coverage

- Onychomycosis Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Onychomycosis Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Market Insights:

- What was the Onychomycosis total market size, the market size by therapies, and market share (%) distribution in 2020, and how it would all look in 2034? What are the contributing factors for this growth?

- What are the unmet needs are associated with the current treatment market of Onychomycosis?

- How is BB2603 going to contribute to the market of Onychomycosis after approval?

- Which drug is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What are the disease risk, burden, and unmet needs of Onychomycosis? What will be the growth opportunities across the 7MM concerning the patient population of Onychomycosis?

- What is the historical and forecasted Onychomycosis patient pool in the United States, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan?

- What factors are affecting the diagnosis and treatment of the indication?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the treatment of Onychomycosis? What are the current treatment guidelines for the treatment of Onychomycosis in the US and Europe?

- How many companies are developing therapies for the treatment of Onychomycosis?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Onychomycosis?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Onychomycosis?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What are the 7MM historical and forecasted market of Onychomycosis?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Onychomycosis Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of current treatment in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders’ around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy.

Frequently Asked Questions

1. What are the treatment goals for Onychomycosis?

The goals for treating onychomycosis, a fungal nail infection, are to eliminate the fungus, improve nail appearance, prevent spread, relieve symptoms, and minimize recurrence. Treatment options include topical or oral antifungal medications, and in severe cases, surgical nail removal.

2. What are the challenges in managing Onychomycosis?

Managing onychomycosis presents challenges due to its stubborn nature, incomplete cure rates, long treatment duration, potential side effects of medications, high costs, risk of fungal resistance, and limited penetration of topical treatments. Achieving successful outcomes involves a tailored approach that combines different treatments and emphasizes patient adherence to therapy.

3. What are the key factors driving the growth of the Onychomycosis market?

The Onychomycosis market is propelled by factors like increasing cases, medical advancements, rising awareness, and the introduction of novel therapies by key pharmaceutical players. These elements fuel demand for innovative treatments, addressing unmet medical needs and driving market expansion.

4. How will the Onychomycosis Market and Epidemiology Forecast Report benefit the clients?

The report will provide comprehensive insights into the current Onychomycosis market landscape, emerging therapies, competitive dynamics, regulatory requirements, and market access considerations, enabling informed decision-making, strategic planning, and optimization of business strategies to capitalize on market opportunities and drive growth.

.jpg&w=3840&q=75)