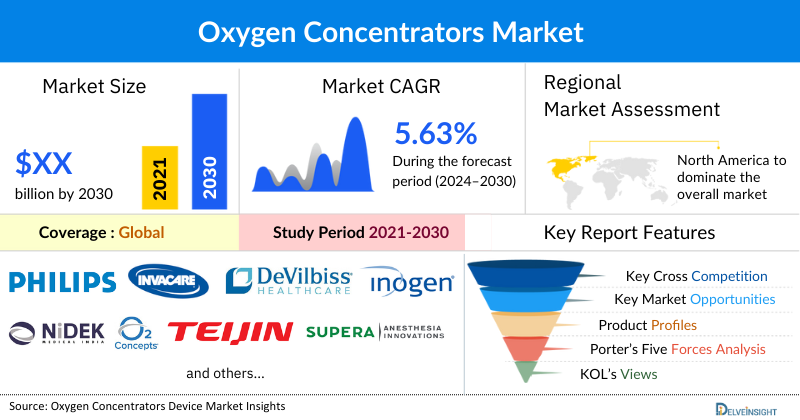

oxygen concentrators market

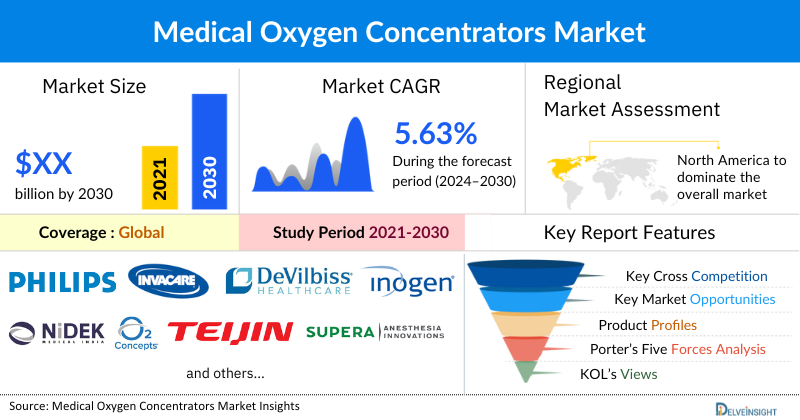

Medical Oxygen Concentrators by Product (Stationary and Portable), Technology (Continuous Flow, Pulse Flow, and Both), End-User (Homecare, Hospitals & Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the increased need for medical oxygen concentrators for geriatric and bedridden patients, rising burden of severe respiratory and cardiovascular disorders, and increase in product launches and approvals by key market players across the globe.

The medical oxygen concentrators market is estimated to advance at a CAGR of 5.63% during the forecast period from 2024 to 2030. The increased need for oxygen concentrators among geriatric and bedridden patients is driving demand. As the global population ages, more elderly individuals face chronic respiratory conditions that necessitate continuous oxygen therapy, which oxygen concentrators can effectively provide. Second, the rising burden of severe respiratory and cardiovascular disorders contributes to market expansion. Chronic diseases such as chronic obstructive pulmonary disease (COPD), emphysema, and heart failure require supplemental oxygen to manage symptoms and improve quality of life. Additionally, the increase in product launches and approvals by key market players worldwide is enhancing market growth. Advances in technology have led to the development of more efficient, compact, and cost-effective oxygen concentrators, catering to diverse patient needs. Together, these factors are expected to escalate the market of medical oxygen concentrators during the forecast period from 2024 to 2030.

Medical Oxygen Concentrators Market Dynamics:

According to the latest data provided by the Australian Institute of Health and Welfare, in 2022, around 8.5 million (34%) people in Australia were estimated to have chronic respiratory conditions.

Additionally, as per the recent data provided by the Global Burden of Disease (2023), approximately, 1 in 20 people globally suffers from chronic respiratory diseases.

Additionally, as per the recent data provided by GLOBOCAN, in 2022, globally the estimated new cases of trachea, bronchus, and lung cancer was 2.48 million, and the projections are expected to rise by 4.25 million by the year 2045.

Furthermore, as per the recent data provided by the World Health Organization (2023), smoking was a major cause of chronic obstructive pulmonary disease, a common lung condition that led to breathing difficulties and claimed over 3 million lives annually. Approximately 392 million people have COPD, with about 75% living in low- and middle-income countries. In high-income countries, tobacco smoking was responsible for over 70% of COPD cases.

COPD, a progressive and debilitating respiratory condition often exacerbated by smoking, leads to a decline in lung function and oxygen levels in the blood. As the prevalence of COPD rises, driven largely by smoking and other environmental factors, the demand for supplemental oxygen therapy grows. Medical oxygen concentrators become essential for managing the symptoms of COPD, helping patients maintain adequate oxygen levels and improve their quality of life. Smoking, a primary risk factor for COPD, continues to contribute to the high incidence of this disease, further driving the need for oxygen concentrators across the globe.

Furthermore, an increase in indoor air pollutants as well as an increase in pollution of active smokers, is also responsible for propelling the growth of the medical oxygen concentrator market. The increased exposure to air pollution can cause respiratory ailments in people. According to the American Lung Association, in 2021 more than four in ten Americans live where the air quality is not good. As per the same source, more than 135 million people live in counties that received an F for either ozone or particle pollution in “State of the Air” 2021.

Additionally, companies are amplifying their production of medical oxygen concentrators and securing regulatory approvals, thereby strategically expanding their market presence and driving further growth. For instance, in December 2022, Inogen Inc. was granted 510(k) premarket notification clearance by the U.S. Food and Drug Administration (FDA) for its new portable oxygen concentrator, Rove 4, which elevated Inogen’s leadership in the portability of POCs to the next level.

Moreover, the prevalence of geriatric and bedridden patients is another factor responsible for the use of these medical oxygen concentrators. According to the Global Initiative for Chronic Obstructive Lung Disease 2021 report, the prevalence of COPD increased steeply with age, with the highest prevalence among those with more than 60 years of age. The respiratory system becomes weak with age, lowering the oxygen level in the body.

Thus, the factors mentioned above are likely to boost the market of medical oxygen concentrators during the forecasted period.

However, the prolonged use of oxygen concentrators can lead to dryness and irritation of the nasal passages and throat and can cause nasal congestion. and stringent regulatory concerns may hinder the future market of Medical Oxygen Concentrators.

Medical Oxygen Concentrators Market Segment Analysis:

Medical Oxygen Concentrators by Product (Stationary and Portable), Technology (Continuous Flow, Pulse Flow, and Both), End-User (Homecare, Hospitals & Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the technology segment of the medical oxygen concentrators market the pulse flow medical oxygen concentrators are expected to hold a significant share in 2023. This can be ascribed to the various advantages that are associated with the pulse flow oxygen concentrators. Pulse flow oxygen concentrators puff oxygen into the nasal passageway, through a cannula, with each breath. In these concentrators, oxygen is delivered only during inhalation and is stored during exhalation thereby saving the amount of oxygen as well as the life of the battery used to operate the concentrators. This is useful when the patient is doing some other activity like drinking water. These devices are mostly used by the patient in the daytime as compared to nighttime because the breathing rate is not steady while sleeping.

Furthermore, advantageous properties such as more energy efficiency due to a rest period between two breaths, an increase in battery life due to rest period, and smaller size. As well, doctors advise pulse flow oxygen concentrators in moderate to severe respiratory ailments, where these devices are effectively used.

Moreover, various new products are coming into the market which in turn depicts the high demand for these products. For instance, In March 2021, Belluscura announced that the X-PLO2R pulse flow portable oxygen concentrator manufactured by Belluscura has been granted 510(K) clearance from the U.S. Food and Drug Administration (FDA). X-PLO2R is a compact, quiet, weighing only 3.25 pounds, compact and portable oxygen concentrator.

Hence, all the above-mentioned factors are expected to generate considerable revenue for the segment pushing the overall growth of the global medical oxygen concentrators market during the forecast period.

North America is expected to dominate the overall Medical Oxygen Concentrators Market:

North America is expected to account for the highest proportion of the medical oxygen concentrators market in 2023, out of all regions. Factors such as the growing prevalence of various respiratory ailments like COPD, hypoxia, and others, increasing prevalence of geriatric and bedridden patients, and increase in air pollution and smoking are some of the key factors that are expected to aid in the growth of North America medical oxygen concentrators market.

As per the data provided by the Centre for Disease Control and Prevention (2024), in 2022, 4.6% of adults had been diagnosed with COPD, emphysema, or chronic bronchitis in the United States. These respiratory conditions, often caused by long-term exposure to irritants like tobacco smoke, lead to severe and progressive lung damage, impairing patients' ability to oxygenate their blood effectively. As these conditions worsen, patients frequently require supplemental oxygen to maintain adequate oxygen levels and alleviate symptoms. This growing need for oxygen therapy drives demand for medical oxygen concentrators, which provide a reliable and continuous source of oxygen thereby boosting the overall market across the region.

Furthermore, as per the recent data and stats provided by the State of Sleep Health in America (2023), sleep apnea affects about 20% of U.S. adults, of which 90% of adults are undiagnosed. Additionally, as per the recent data provided by the National Council of Aging (2024), approximately 39 million U.S. adults have obstructive sleep apnea (OSA).

Individuals with sleep apnea often experience intermittent oxygen deprivation during sleep, which can lead to chronic low oxygen levels and exacerbate other health issues. As awareness of sleep apnea and its complications increases, more patients are seeking effective treatments to manage their condition, including supplemental oxygen. Medical oxygen concentrators provide a reliable source of oxygen for patients with sleep apnea who require additional support to maintain adequate oxygen levels, particularly during the night thereby escalating the market across the region.

The increasing number of product development activities in the region is further going to accelerate the growth of the medical oxygen concentrators market. For instance, in July 2023, Emerson launched the ASCO™ Series 588 Stationary Oxygen Concentrator Manifold, the industry’s first turnkey manifold solution designed to optimize respiratory therapy device designs and accelerate product speed to market.

Therefore, the above-mentioned factors are expected to bolster the growth of the medical oxygen concentrators market in North America during the forecast period.

Medical Oxygen Concentrators Market Key Players:

Some of the key market players operating in the Medical Oxygen Concentrators market include Koninklijke Philips N.V., Invacare Corporation, DeVilbiss Healthcare LLC, Inogen, Inc., Nidek Medical, O2 Concepts, Teijin Limited, Supera Anesthesia Innovations, GCE Group, CAIRE, OxyGo, LLC, Precision Medical, Inc., Graham Field, Belluscura, Besco Medical Limited, OSI - Oxygen Solutions Inc, NGK Spark Plug Co Ltd, Yuwell (Jiangsu Yuyue Medical Equipment & Supply Co., Ltd.), Narang Medical Limited, Topson, and others.

Recent Developmental Activities in the Medical Oxygen Concentrators Market:

- In March 2022, Belluscura signed a three-year manufacturing agreement for its X-PLO2r portable oxygen concentrator with InnoMax Medical Technology in China.

- In March 2021, OxyGo announced that they had acquired LIFE Corporation, a manufacturer of portable emergency oxygen and CPR administration equipment. The acquisition will allow OxyGo to further expand its expertise in the oxygen market.

Key Takeaways from the Medical Oxygen Concentrators Market Report Study

- Market size analysis for current medical oxygen concentrators size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the medical oxygen concentrators market.

- Various opportunities available for the other competitors in the medical oxygen concentrators market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current medical oxygen concentrators market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for medical oxygen concentrators market growth in the coming future?

Target Audience who can be benefited from this Medical Oxygen Concentrators Market Report Study

- Medical oxygen concentrator product providers

- Research organizations and consulting companies

- Medical oxygen concentrators -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in medical oxygen concentrators

- Various end-users who want to know more about the medical oxygen concentrators market and the latest technological developments in the medical oxygen concentrators market.