RET Fusion Market Forecast and Competitive Landscape

- The RET fusion targeted therapies Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- RET fusion targeted therapies are designed to inhibit aberrant RET kinase activity caused by gene fusions, common in certain thyroid and lung cancers. Drugs like RETEVMO and GAVRETO selectively block RET signaling, leading to tumor regression. These therapies show high response rates and manageable safety profiles in fusion-positive patients.

- Moreover, several RET fusion-targeted therapies are under investigation in clinical trials. These therapies aim to specifically target and treat cancers with RET gene fusions, offering potential benefits for patients with tumors harboring this genetic alteration.

- According to the Surveillance, Epidemiology, and End Results (SEER) database, approximately 1 million individuals were living with thyroid cancer in the US in 2022, indicating a significant survivorship burden. This reflects improved detection and treatment outcomes, alongside the cancer's typically indolent progression and high survival rates.

- As per DelveInsight secondary analysis, over 200 thousand adults in the US are estimated to be affected with lung cancer in 2024. Lung cancer remains the leading cause of cancer-related deaths, with non-small cell lung cancer (NSCLC) accounting for nearly 80–85% of all cases. Additionally, RET fusions are present in approximately 1–2% of NSCLC patients.

- In September 2022, the first tissue-agnostic approval was granted to RETEVMO for adult patients with locally advanced or metastatic solid tumors harboring RET gene fusions, beyond NSCLC and thyroid cancer. This approval targeted patients who had progressed on prior treatments or had no satisfactory alternatives. Additionally, in May 2024, accelerated approval was granted for pediatric patients aged 2 years and older with RET fusion-positive or RET-mutant advanced or metastatic solid tumors, including thyroid cancers.

- In February 2024, Rigel Pharmaceuticals acquired the US rights to GAVRETO (pralsetinib) from Blueprint Medicines, expanding its oncology portfolio. The acquisition aligns with Rigel’s institutional and community-based infrastructure. In 2023, GAVRETO generated approximately USD 28 million in US net product sales, indicating a modest but established market presence. This move strengthens Rigel’s position in the precision oncology space and leverages an already commercialized asset with a defined biomarker-driven indication.

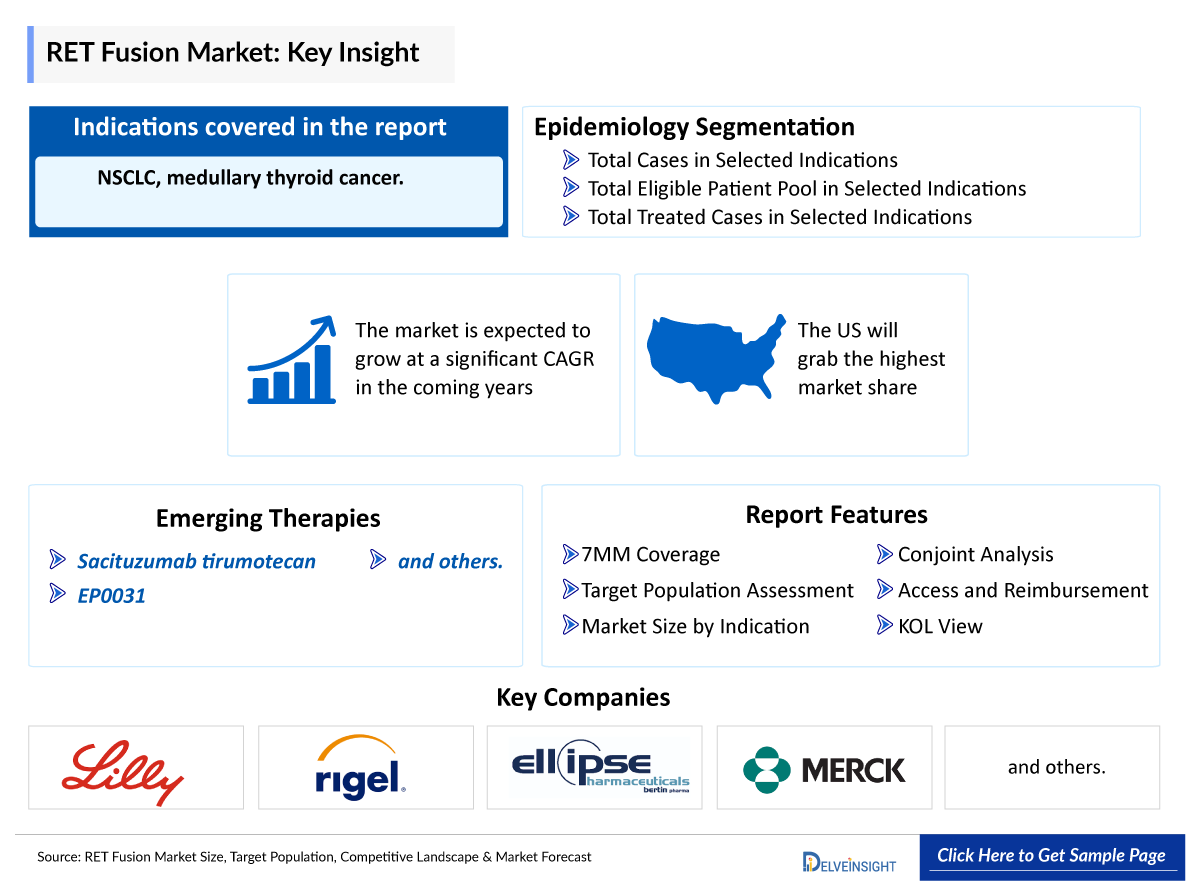

DelveInsight’s “RET Fusion Targeted Therapies Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the RET fusion targeted therapies, historical and projected epidemiological data, competitive landscape as well as the RET fusion targeted therapies market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The RET fusion targeted therapies market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM RET fusion targeted therapies market size from 2020 to 2034. The report also covers current RET fusion targeted therapies treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

RET Fusion Targeted Therapies Epidemiology |

|

|

RET Fusion Targeted Therapies Companies |

|

|

RET Fusion Targeted Therapies Key Therapies |

|

|

RET Fusion Targeted Therapies Market |

|

|

Analysis |

|

RET Fusion Targeted Therapies Understanding and Treatment Algorithm

RET Fusion Targeted Therapies Overview

RET fusion-targeted therapies are designed to treat cancers with RET gene fusions, which occur when the RET gene combines with another gene, leading to uncontrolled cell growth. These fusions are primarily found in NSCLC, thyroid cancer, and other solid tumors. RET gene fusions drive cancer progression by activating signaling pathways that promote tumor growth.

Targeted therapies, such as selective RET inhibitors (e.g., selpercatinib and pralsetinib), aim to block RET activation, offering more effective treatment with fewer side effects compared to traditional chemotherapy. These therapies have shown significant promise in clinical trials, leading to accelerated approvals by regulatory agencies like the FDA. Ongoing studies continue to explore their efficacy in various cancers and in combination with other therapies, expanding the potential for broader application in personalized oncology.

RET Fusion Targeted Therapies Treatment

The treatment landscape for RET fusion-positive cancers has evolved significantly with the approval of RET inhibitors like selpercatinib and pralsetinib. These targeted therapies offer a breakthrough in precision oncology, providing a more effective and tailored treatment approach compared to chemotherapy. RET inhibitors have shown substantial efficacy in treating RET fusion-positive NSCLC and thyroid cancer, with ongoing trials expanding their use across additional tumor types. The integration of these therapies into clinical practice marks a shift toward molecularly guided treatments, improving outcomes for patients with RET-driven cancers while reducing toxicity associated with traditional therapies.

Further details related to country-based variations are provided in the report…

RET Fusion Targeted Therapies Epidemiology

The RET fusion targeted therapies epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for RET fusion targeted therapies, total eligible patient pool in selected indications for RET fusion targeted therapies, and total treated cases in selected indications for RET fusion targeted therapies in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- According to the Robert Koch Institute, in 2020, nearly 3,980 women and 1,780 men in Germany were diagnosed with thyroid cancer. The average diagnosis age was 51 for women and 55 for men. Incidence has increased globally, primarily driven by widespread use of advanced imaging, which detects more subclinical tumors. This trend reflects diagnostic sensitivity rather than true disease growth. Consequently, most thyroid cancers are identified at early stages, supporting high 5-year survival rates: 94% in women and 88% in men.

- According to SEER data, between 2010 and 2017, approximately 1.3 million new NSCLC cases were reported in the US, with the majority occurring in males (53%). During this period, overall incidence declined, particularly among younger patients, while the incidence of stage I disease increased. Additionally, the 5-year relative survival rates varied significantly by stage: 65% for localized, 37% for regional, and 9% for distant disease, with an overall survival rate of 28% across all stages. These trends emphasize the critical importance of early detection in improving NSCLC outcomes.

- According to DelveInsight secondary analysis, mutation frequencies in advanced thyroid cancer in Japan were assessed in patients with unresectable or metastatic thyroid carcinoma. Gene panel testing revealed that 17.7% had anaplastic thyroid carcinoma (ATC), 70.8% had papillary thyroid carcinoma (PTC), 7.3% had follicular thyroid carcinoma, and 6.3% had poorly differentiated thyroid carcinoma (PDTC). Additionally, RET fusion was found in 5.9% of ATC cases.

Note: Indications are selected based on pipeline activity...

RET Fusion Targeted Therapies Drug Analysis

The drug chapter segment of the RET fusion targeted therapies report encloses a detailed analysis of RET fusion targeted therapies marketed drugs and early-, mid-, and late-stage (Phase I, Phase II and Phase III) pipeline drugs. It also helps understand the RET fusion targeted therapies clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

RET Fusion Targeted Therapies Marketed Drugs

RETEVMO (Selpercatinib): Eli Lilly

RETEVMO (Selpercatinib) also known as LY3527723, is a selective RET kinase inhibitor targeting cancers driven by RET gene alterations. It blocks aberrant RET signaling that promotes tumor growth. RETEVMO is approved for RET-altered cancers, including RET fusion-positive NSCLC, RET-mutant MTC, and other RET-driven thyroid cancers or solid tumors. Indications span adult and pediatric patients. Approvals are based on response data, with continued approval pending confirmatory trials demonstrating clinical benefit.

Currently, it is under Phase III evaluation for adjuvant RET fusion-positive NSCLC post-surgery or chemoradiotherapy.

GAVRETO (pralsetinib): Rigel Pharmaceuticals

GAVRETO (pralsetinib) is a once-daily, oral RET kinase inhibitor FDA-approved for treating adult patients with metastatic RET fusion-positive NSCLC and adults and pediatric patients (≥12 years) with advanced or metastatic RET fusion-positive thyroid cancer requiring systemic therapy, who are radioactive iodine-refractory. These approvals are under the FDA’s accelerated program based on overall response and duration; continued approval may depend on confirmatory trial results.

GAVRETO is the only once-daily RET-selective inhibitor targeting RET-driven cancers. The recommended dose is 400 mg orally once daily on an empty stomach—no food for at least 2 hours before and 1 hour after dosing. Recent updates as per the latest label of the product, include removal of previous indications for RET-mutant medullary thyroid cancer and dose adjustments for CYP3A/P-gp inhibitors and inducers. GAVRETO should be prescribed only after confirming RET gene fusion via an FDA-approved test. The therapy enhances precision oncology treatment for eligible NSCLC and thyroid cancer patients.

|

Product |

Company |

Indication |

|

RETEVMO (Selpercatinib) |

Eli Lilly |

|

|

GAVRETO (pralsetinib) |

Rigel Pharmaceuticals |

|

|

XX |

XX |

XX |

Note: Detailed current therapies assessment will be provided in the full report of RET fusion targeted therapies

RET Fusion Targeted Therapies Emerging Drugs

Sacituzumab tirumotecan: Merck & Co.

Sacituzumab tirumotecan, also known as MK-2870, is an investigational antibody-drug conjugate targeting trophoblast cell-surface antigen 2 (TROP2). It links an antibody to a belotecan-derived payload. Developed in collaboration with Sichuan Kelun-Biotech, it is currently in Phase III for NSCLC.

The ongoing study compares sacituzumab tirumotecan with chemotherapy (docetaxel or pemetrexed) in previously-treated NSCLC patients with EGFR mutations (exon 19del or exon 21 L858R), or genomic alterations such as ALK, ROS1, BRAF V600E, NTRK, MET exon 14 mutations, RET rearrangements, and rare EGFR mutations. The trial aims to evaluate its efficacy in these diverse genetic subgroups.

EP0031: Ellipses Pharma

EP0031 is a next-generation selective RET inhibitor under evaluation in a Phase I/II trial for adults with advanced RET-altered solid tumors, including NSCLC.

In May 2024, Phase I data presented at ASCO 2024 demonstrated a favorable safety and tolerability profile. No dose-limiting toxicities or treatment-related deaths occurred. The most common treatment-emergent adverse events (TEAEs) were Grade 1 or 2, with few Grade 3 cases. TEAEs were typically manageable through temporary dose interruptions, and no patient discontinued treatment due to side effects. Only a small number required dose reductions. These results support the continued clinical development of EP0031 in RET-driven malignancies.

Note: Detailed emerging therapies assessment will be provided in the final report.

List of RET Fusion Targeted Therapies Emerging Drugs | |||||

|

Drug Name |

Company |

Indication |

MoA |

Phase |

NCT ID |

|

Sacituzumab tirumotecan |

Merck & Co. |

NSCLC

|

RET inhibitor |

III |

NCT06074588 |

|

EP0031 |

Ellipses Pharma |

advanced RET-altered solid tumors, including NSCLC |

RET inhibitor |

I/II |

NCT05443126 |

|

XX |

XX |

XX |

XX |

XX |

XX |

Note: The emerging drug list is indicative, the full list will be given in the final report.

RET Fusion Targeted Therapies Market Outlook

The market for RET fusion-targeted therapies is poised for substantial growth due to increasing recognition of the role of RET gene fusions in cancer and the promising results from clinical trials. As more targeted therapies like selpercatinib and pralsetinib receive approvals for RET fusion-positive cancers, the landscape of oncology treatments is shifting toward precision medicine. RET inhibitors are positioned as a cornerstone of treatment for NSCLC, medullary thyroid cancer, and other cancers driven by RET fusions.

The adoption of these therapies will likely expand as clinical evidence accumulates, showcasing their ability to provide durable responses with a better safety profile compared to traditional chemotherapy. Their integration into treatment regimens will not only enhance outcomes but also offer an alternative for patients with limited therapeutic options, particularly those with metastatic or advanced cancers.

Furthermore, the development of combination therapies involving RET inhibitors is an area of significant interest. These combinations could enhance efficacy and address resistance mechanisms, potentially broadening the market for RET-targeted treatments. As personalized medicine becomes more prevalent, therapies targeting specific genetic alterations like RET fusions are expected to play a pivotal role in reshaping cancer treatment paradigms, leading to improved survival rates and better quality of life for patients. The market for these therapies will continue to expand with ongoing research and a growing understanding of genetic mutations.

RET Fusion Targeted Therapies Drug Uptake

This section focuses on the uptake rate of potential approved and emerging RET fusion-targeted therapies expected to be launched in the market during 2020–2034.

RET Fusion Targeted Therapies Pipeline Development Activities

The RET Fusion Targeted Therapies pipeline report provides insights into different RET Fusion Targeted Therapies clinical trials within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for RET fusion targeted therapies market growth over the forecasted period.

RET Fusion Targeted Therapies Pipeline Development Activities

The RET Fusion Targeted Therapies clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for RET fusion targeted therapies emerging therapies.

Recent RET Fusion Targeted Therapies Key Events

The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion.

- In March 2024, Ellipses Pharma reported that the US FDA granted Fast Track Designation (FTD) to EP0031, a next-generation selective RET inhibitor, for RET-fusion positive NSCLC. The designation aims to speed development of treatments for serious conditions. Supporting data came from an ongoing Phase I/II study, where EP0031/A400 showed durable tumor responses in previously treated NSCLC patients, regardless of RET fusion type or brain metastases. This follows Orphan Drug Designation (ODD) status granted in November 2023.

- In September 2020, Blueprint Medicines reported that the US FDA approved GAVRETO (pralsetinib) for adult patients with metastatic RET fusion-positive NSCLC, identified through an FDA-approved test. This approval was based on results from the Phase I/II ARROW trial, which demonstrated GAVRETO’s efficacy in patients regardless of prior treatment, RET fusion partner, or central nervous system involvement. GAVRETO represents a precision therapy targeting genomically defined cancers, expanding treatment options for RET-driven NSCLC.

KOL Views on RET Fusion Targeted Therapies

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on RET fusion targeted therapies evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or RET fusion targeted therapies market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

RET Fusion Targeted Therapies Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

RET Fusion Targeted Therapies Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the RET Fusion Targeted Therapies Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of RET fusion targeted therapies, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the RET fusion targeted therapies market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM RET fusion targeted therapies market.

RET Fusion Targeted Therapies Market Report Insights

- RET Fusion Targeted Therapies Targeted Patient Pool

- RET Fusion Targeted Therapies Therapeutic Approaches

- RET Fusion Targeted Therapies Pipeline Analysis

- RET Fusion Targeted Therapies Market Size and Trends

- Existing and Future Market Opportunity

RET Fusion Targeted Therapies Market Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- RET Fusion Targeted Therapies Drugs Uptake

- Key RET Fusion Targeted Therapies Market Forecast Assumptions

RET Fusion Targeted Therapies Market Report Assessment

- Current RET Fusion Targeted Therapies Treatment Practices

- RET Fusion Targeted Therapies Unmet Needs

- RET Fusion Targeted Therapies Pipeline Product Profiles

- RET Fusion Targeted Therapies Market Attractiveness

- Qualitative Analysis (SWOT)

- RET Fusion Targeted Therapies Market Drivers

- RET Fusion Targeted Therapies Market Barriers

Key Questions Answered In The RET Fusion Targeted Therapies Market Report:

- What was the RET fusion targeted therapies total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for RET fusion targeted therapies?

- Which drug accounts for maximum RET fusion targeted therapies sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for RET fusion targeted therapies evolved since the first one was approved? Do patients face any access issues driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with RET fusion targeted therapies? What will be the growth opportunities across the 7MM for the patient population on RET fusion targeted therapies?

- What are the key factors hampering the growth of the RET fusion targeted therapies market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for RET fusion targeted therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy RET Fusion Targeted Therapies Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the RET fusion targeted therapies market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- Highlights of Market Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.