ROS-1 Market Forecast and Competitive Landscape

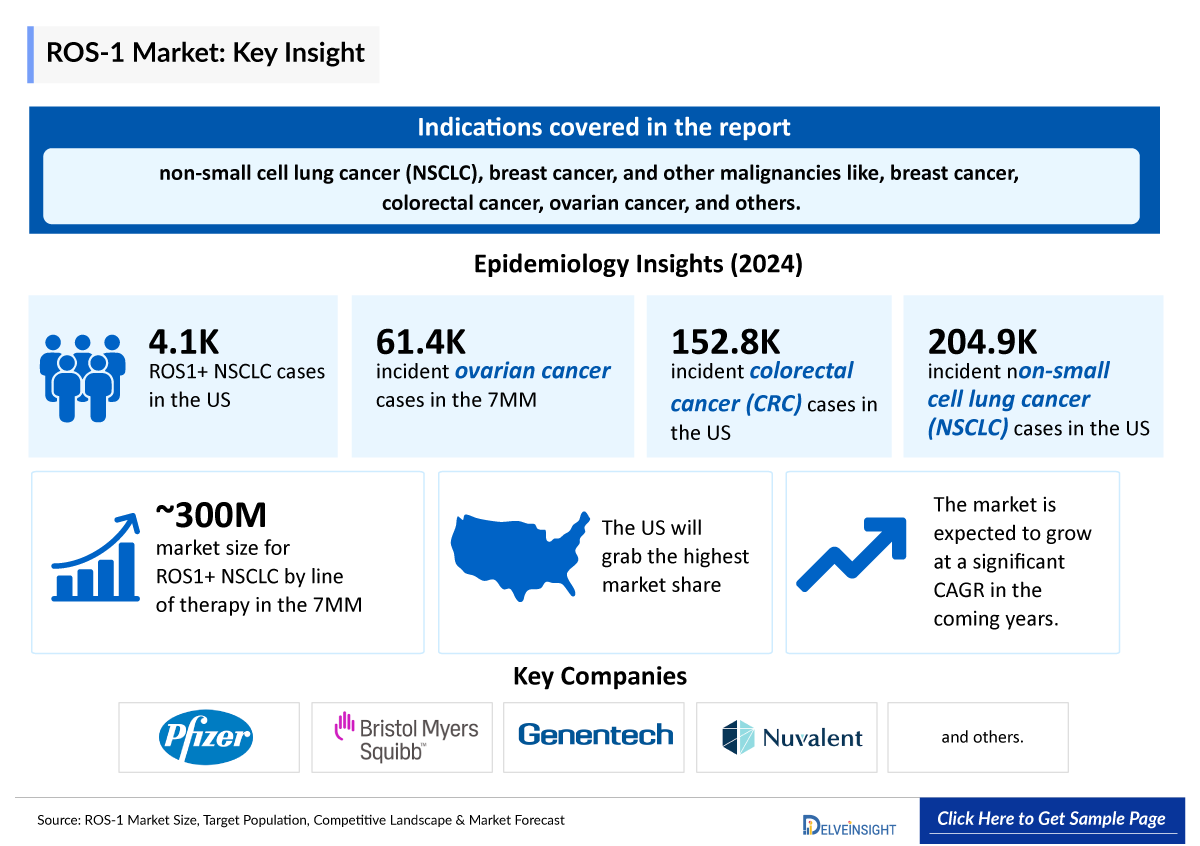

- The total market size in the 7MM for ROS-1 NSCLC by line of therapy was estimated to be nearly USD 300 million in 2024, in which the US accounted for the maximum share of the total market.

- ROS-1 inhibitors are effective treatments for non-small cell lung cancer (NSCLC), breast cancer, colorectal cancer (CRC), ovarian cancer, and others.

- More than 30 ROS-1 fusion partners have been identified in NSCLC, with CD74, EZR, SDC4, and SLC34A2 being the most common. Leading guidelines, including those from NCCN and ESMO, recommend comprehensive molecular testing for ROS-1 fusions in advanced lung adenocarcinoma, large cell, unspecified NSCLC, and consider it for advanced squamous cell carcinoma.

- ROS-1 fusions, which often involve partner genes like CD74, are found in approximately 1–2% of cases and are more frequently observed in younger patients who have never smoked.

- As of now ROS-1 targeting therapies are majorly in development for NSCLC. The approved drugs targeting ROS-1 positive NSCLC include XALKORI (crizotinib, Pfizer), ROZLYTREK (entrectinib, Roche (Genentech), AUGTYRO (repotrectinib, Bristol Myers Squibb), IBTROZI (taletrectinib), and others.

- Several companies, including Pfizer, Bristol Myers Squibb, Genentech, Nuvalent, and others are engaged in the development of ROS-1 inhibitors with a range of approved and emerging drugs.

- In February 2024, NVL-520 received the Breakthrough Therapy Designation (BTD) from the US Food and Drug Administration (FDA) for the treatment of patients with metastatic ROS1-positive NSCLC who previously received at least 2 ROS1 TKIs.

- In June 2025, the US FDA approved Nuvation Bio’s IBTROZI for adult patients with locally advanced or metastatic ROS1-Positive NSCLC.

- Lorlatinib is indeed not officially approved for the treatment of ROS-1 fusion-positive NSCLC. However, the National Comprehensive Cancer Network (NCCN) Clinical Practice Guidelines in Oncology list lorlatinib as a treatment option for patients with ROS-1 fusion-positive NSCLC who have been previously treated with a tyrosine kinase inhibitor (TKI).

- In a nutshell, it is estimated that the ROS-1 treatment space will experience significant changes during the forecast period of 2025–2034 due to an increase in awareness and developments in the ROS-1 segment.

DelveInsight’s “ROS Proto-oncogene 1 (ROS-1) Inhibitors Target Population, Competitive Landscape, and Market Forecast—2034” report delivers an in-depth understanding of the ROS-1 inhibitor, historical and Competitive Landscape, and ROS-1 inhibitor therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The ROS-1 inhibitor market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM ROS-1 inhibitor market size from 2020 to 2034. The report also covers current ROS-1 inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

ROS Proto-oncogene 1 (ROS-1) Inhibitors Market |

|

|

ROS Proto-oncogene 1 (ROS-1) Inhibitors Market Size | |

|

ROS Proto-oncogene 1 (ROS-1) Inhibitors Companies |

Bristol-Myers Squibb, Genentech, Pfizer, Nuvation Bio, Innovent Biologics, Daiichi Sankyo, Nippon Kayaku, Nuvalent, Beijing Avistone Pharmaceuticals Biotechnology, and others. |

|

ROS Proto-oncogene 1 (ROS-1) Inhibitors Epidemiology Segmentation |

|

ROS Proto-oncogene 1 (ROS-1) Inhibitors Understanding

ROS Proto-oncogene 1 (ROS-1) Inhibitor Overview

ROS-1 inhibitors are TKIs that specifically target the ROS-1 protein, which is often activated in certain types of cancers, particularly NSCLC. ROS-1 (Receptor tyrosine kinase) is a pivotal transmembrane receptor protein tyrosine kinase that regulates several cellular processes like apoptosis, survival, differentiation, proliferation, cell migration, and transformation. Other than NSCLC, it plays an important role in different malignancies, including glioblastoma, CRC, gastric adenocarcinoma, inflammatory myofibroblastic tumors, ovarian cancer, and others. ROS-1 inhibitor is a substance that blocks the activity of an abnormal protein called ROS-1 fusion protein, which is found in some types of cancer cells. Blocking the ROS-1 fusion protein may help keep cancer cells that have it from growing and spreading. Some ROS-1 inhibitors are used to treat cancer. They are a type of targeted therapy. All ROS-1 inhibitors are multi‐kinase inhibitors that can inhibit Anaplastic Lymphoma Kinase (ALK), Mesenchymal Epithelial Transition (MET), and other kinases in addition to ROS. ROS-1 kinase inhibitors primarily affect the kinase domain of ROS-1.

Seventy-seven Conventional kinases can be classified into DFG‐in (active, type I) and DFG‐out (inactive, type II) kinases, depending on the domain conformation.

Further details related to country-based variations are provided in the report....

ROS Proto-oncogene 1 Inhibitor Epidemiology

The ROS-1 inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for ROS-1 inhibitors, total eligible patient pool for ROS-1 inhibitors in selected indications, total treated cases in selected indications for ROS-1 inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, the total number of NSCLC cases related to ROS-1 gene fusions in the US was approximately ~4,100.

Among the EU4 and the UK, Germany had the highest number of ROS-1 NSCLC cases, while Spain had the lowest number in 2024. - According to the American Cancer Society (2024), an estimated 152,810 new cases of CRC were reported in 2024, with 81,540 cases in men and 71,270 cases in women in the US.

- As per estimates, total incident cases of ovarian cancer in the 7MM were ~61,400 in 2024.

- In 2024, the American Cancer Society estimates approximately 310,720 new cases of invasive breast cancer among women in the US. Of these, roughly 15–20% will be classified as TNBC.

|

Target Pool Assessment of ROS Proto-oncogene 1 Inhibitor | |

|

Indication |

Estimated Incident Cases in the US (2024) |

|

CRC |

~152,810 |

|

NSCLC |

~204,850 |

|

Breast cancer (invasive) |

~310,720 |

|

Ovarian cancer |

~19,700 |

Note: Indications are selected based on pipeline activity

ROS Proto-oncogene 1 Inhibitor Drug Analysis

The drug chapter segment of the ROS-1 inhibitor reports encloses a detailed analysis of ROS-1 inhibitor-marketed drugs and mid and late-stage pipeline drugs. It also helps understand the ROS-1 inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

ROS Proto-oncogene 1 Inhibitor Marketed Drugs

IBTROZI (taletrectinib): Nuvation Bio/Innovent Biologics/Daiichi Sankyo/Nippon Kayaku

IBTROZI is an oral, potent, central nervous system-active, and selective, next-generation ROS-1 inhibitor specifically designed for the treatment of patients with advanced ROS-1-positive NSCLC. The US FDA previously granted taletrectinib Breakthrough Therapy Designation (BRD) for the treatment of patients with locally advanced or metastatic ROS-1 positive NSCLC who either have or have not previously been treated with ROS-1 TKIs, and Orphan Drug Designation (ODD) for the treatment of patients with ROS-1 positive NSCLC and other NSCLC indications. Nuvation Bio has initiated an Expanded Access Program (EAP) for taletrectinib in the US for the treatment of patients with locally advanced or metastatic ROS-1-positive NSCLC when no comparable or satisfactory alternative therapy options are available. Nuvation Bio also announced the launch of NuvationConnect, a program designed to support patients prescribed IBTROZI. The program will offer financial assistance, access to resources and personalized support for eligible patients.

The FDA approval of IBTROZI is supported by one of the largest global clinical trial programs in ROS1 positive NSCLC to date, with over 300 patients enrolled in the pivotal TRUST-I and TRUST-II studies.

AUGTYRO (repotrectinib): Bristol Myers Squibb

AUGTYRO is an oral prescription medicine developed by Bristol Myers Squibb. It is a kinase inhibitor indicated for the treatment of adult patients with locally advanced or metastatic ROS-1-positive NSCLC and adult and pediatric patients 11 years of age and older with solid tumors that have a neurotrophic tyrosine receptor kinase (NTRK) gene fusion and are locally advanced or metastatic or where surgical resection is likely to result in severe morbidity or has progressed following treatment or have no satisfactory alternative therapy.

In November 2023, the FDA approved AUGTYRO for the treatment of adult patients with locally advanced or metastatic ROS-1-positive NSCLC. In June 2024, the FDA announced its accelerated approval for the treatment of adult and pediatric patients 12 years of age and older with solid tumors that have an NTRK gene fusion, are locally advanced or metastatic, or where surgical resection is likely to result in severe morbidity, and have progressed following treatment or have no satisfactory alternative therapy. The approval is received based on the trial TRIDENT-1. In September 2024, AUGTYRO was approved in Japan for the treatment of ROS-1 fusion gene-positive unresectable advanced or recurrent NSCLC.

ROZLYTREK (enrectinib): GENENTECH

ROZLYTREK is an oral prescription medicine developed by Genentech. It is used to treat adults with NSCLC that has spread to other parts of the body and is caused by an abnormal ROS-1 gene. It is also used to treat adults and children 1 month of age and older with solid tumors (cancer) that are caused by certain abnormal NTRK genes and have spread or if surgery to remove their cancer is likely to cause severe complications.

ROZLYTREK (entrectinib) was approved for ROS-1-positive metastatic NSCLC by the FDA in August 2019, the European Commission (EC) in August 2020 for treatment-naïve patients, and in Japan in February 2020 for unresectable, advanced, or metastatic ROS-1 fusion-positive NSCLC.

Table 1: Comparison of Key ROS Proto-oncogene 1 Inhibitor Marketed Drugs | |||

|

Product |

Company |

Initial Approval in the US |

Indication |

|

IBTROZI |

Nuvation Bio/Innovent Biologics/Daiichi Sankyo/Nippon Kayaku |

2025 |

ROS-1-positive NSCLC |

|

AUGTYRO |

Bristol Myers Squibb |

2023 |

ROS-1-positive locally advanced or metastatic NSCLC |

|

ROZLYTREK |

Genentech |

2019 |

ROS-1-positive metastatic NSCLC |

|

XALKORI |

Pfizer |

2016 |

ROS-1-positive metastatic NSCLC |

Note: Detailed current therapies assessment will be provided in the full report of ROS-1 Inhibitors..

ROS Proto-oncogene 1 Inhibitor Emerging Drugs

Zidesamtinib (NVL-520): Nuvalent

Zidesamtinib is a novel brain-penetrant ROS-1-selective inhibitor created to overcome several limitations observed with currently available therapies. Zidesamtinib received BTD from the US FDA for the treatment of patients with ROS-1-positive metastatic NSCLC who have been previously treated with two or more ROS-1 TKIs. The Phase II portion of the ARROS-1 Phase I/II (NCT05118789) clinical trial of zidesamtinib for patients with advanced ROS-1-positive NSCLC and other solid tumors is now enrolling.

In April 2025, Nuvalent announced the publication of a manuscript in Molecular Cancer Therapeutics, a journal of the American Association for Cancer Research, which supports the rational molecular design of zidesamtinib, its novel and selective ROS-1 inhibitor.

Comparison of Key ROS Proto-oncogene 1 Inhibitor Emerging Drugs | ||||

|

Product |

Company |

RoA |

Phase |

Indication |

|

Zidesamtinib |

Nuvalent |

Oral |

I/II |

ROS-1 positive NSCLC and other solid tumors |

|

ANS03 |

Avistone Biotechnology |

Oral |

I |

Advanced or metastatic solid tumors harboring ROS-1 alterations |

Note: Detailed emerging therapies assessment will be provided in the final report...

ROS Proto-oncogene 1 Inhibitor Drug Class Insights

The ROS-1 NSCLC current market is mainly dominated by TKIs such as XALKORI at present and is anticipated to be dominated by AUGTYRO, IBTROZI, and NVL-520 by 2034. XALKORI is a tyrosine kinase receptor inhibitor, targetting the ALK or ROS-1 kinases (proteins), which turn on the ALK or ROS-1 gene, thus preventing the expression of oncogenic fusion proteins from activating gene expression. AUGTYRO is a next-generation TKI known for its efficient ability to cross the blood-brain barrier. Another marketed drug, which is IBTROZI, functions as a comprehensive inhibitor targeting TRK and ROS-1 with selectivity. IBTROZI has demonstrated activity against the challenging ROS-1 solvent-front mutation G2032R.

ROS Proto-oncogene 1 Inhibitor Market Outlook

The market for ROS-1 inhibitors is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with different types of cancers, the growing awareness of ROS 1 inhibitors, and the increasing number of ROS-1 inhibitors that are under clinical trials and filed for approval by various companies.

ROS-1 inhibitors demonstrate the highest efficacy in treating NSCLC, whether these are established therapies with regulatory approval or emerging treatments. ROS-1 inhibitors have revolutionized the management of NSCLC, representing a pivotal therapeutic approach. Established treatments such as ROZLYTREK and ZYKADIA (off-label) have demonstrated significant efficacy in ROS-1-positive NSCLC, with expanded indications spanning various disease stages. Additionally, experimental drugs like Zidesamtinib (NVL-520) offer potential effects by inhibiting ROS-1, addressing metastatic solid tumors. With ongoing clinical trials and regulatory advancements, the market outlook for ROS-1 inhibitors is promising, fostering continued innovation and progress in prostate cancer therapeutics. This evolution holds the potential to improve patient outcomes and redefine standards of care in NSCLC management globally.

Several key players, including Genentech, Pfizer, Bristol Myers Squibb, Nuvalent, and others, are involved in developing drugs for ROS-1 inhibitors for various indications such as NSCLC, breast cancer, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of ROS-1 inhibitors and define their role in the therapy of cancer.

ROS Proto-oncogene 1 Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging ROS-1 inhibitors expected to be launched in the market during 2025–2034.

ROS Proto-oncogene 1 Inhibitor Pipeline Development Activities

The ROS Proto-oncogene 1 Inhibitor pipeline report provides insights into different ROS-1 Inhibitor clinical trials within Phase III, Phase II, and Phase I and analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for ROS-1 inhibitors market growth over the forecast period.

ROS Proto-oncogene 1 Inhibitor Pipeline Development Activities

The ROS-1 Inhibitor clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for ROS-1 inhibitor therapies.

KOL Views on ROS Proto-oncogene 1 Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on ROS-1 inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Baptist Health Medical Group and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or ROS-1 inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“In Japan, we see a notable incidence of ROS-1 mutations among younger, non-smoking patients. Our clinical experience with TKIs has been positive, but we need to address issues related to brain metastases more effectively.” MD, Keio University School of Medicine, Japan |

ROS-1 Inhibitor Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

ROS-1 Inhibitor Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

The abstract list is not exhaustive, will be provided in the final report

Key Updates on ROS-1 Inhibitor

- In May 2025, Nuvation Bio announced that new data from a matching-adjusted indirect comparison study evaluating taletrectinib versus entrectinib in ROS-1-positive NSCLC was presented in a poster session at ISPOR 2025.

- In May 2025, Nuvation Bio presented new data from the pivotal clinical studies of taletrectinib in advanced ROS1-Positive NSCLC at ASCO 2025 annual meeting.

- In its Q1 2025 presentation, Nuvalent anticipated topline pivotal data for zidesamtinib in the Tyrosine kinase inhibitors (TKIs) pre-treated ROS-1-positive NSCLC population in the first half of 2025, supporting its planned first New Drug Application (NDA) submission by mid-year 2025.

- In January 2025, the European Medicines Agency (EMA) granted a conditional marketing authorization valid throughout Europe for AUGTYRO for the treatment of adult patients with advanced NSCLC.

- In June 2024, Innovent Biologics and Nuvation Bio announced, at the Annual Meeting of ASCO 2024, data from the pivotal Phase II TRUST-I study of its investigational taletrectinib. Tumors shrank in 91% of taletrectinib-treated patients with advanced ROS-1-positive NSCLC who were ROS-1 TKI-naïve and 52% of those who were ROS-1 TKI-pretreated in the study.

Scope of the ROS-1 Inhibitor Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the ROS-1 inhibitor, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the ROS-1 inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM ROS-1 inhibitor market.

ROS-1 Inhibitor Market Report Insights

- ROS-1 inhibitors Targeted Patient Pool

- ROS-1 Inhibitor Therapeutic Approaches

- ROS-1 Inhibitor Pipeline Analysis

- ROS-1 Inhibitor Market Size and Trends

- Existing and future Market Opportunity

ROS-1 Inhibitor Market Report Key Strengths

- Ten years Forecast

- The 7MM Coverage

- Key Cross Competition

- ROS-1 Inhibitor Drugs Uptake

- Key ROS-1 Inhibitor Market Forecast Assumptions

ROS-1 Inhibitor Market Report Assessment

- Current ROS-1 Inhibitor Treatment Practices

- ROS-1 Inhibitor Unmet Needs

- ROS-1 Inhibitor Pipeline Product Profiles

- ROS-1 Inhibitor Market Attractiveness

- Qualitative Analysis (SWOT)

- ROS-1 Inhibitor Market Drivers

- ROS-1 Inhibitor Market Barriers

Key Questions Answered In The ROS-1 Inhibitor Market Report:

- What was the ROS-1 inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for ROS-1 inhibitors?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for ROS-1 inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with ROS-1 inhibitors? What will be the growth opportunities across the 7MM for the patient population of ROS-1 inhibitors?

- What are the key factors hampering the growth of the ROS-1 inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for ROS-1 inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the ROS-1 inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.