Colorectal Cancer Market

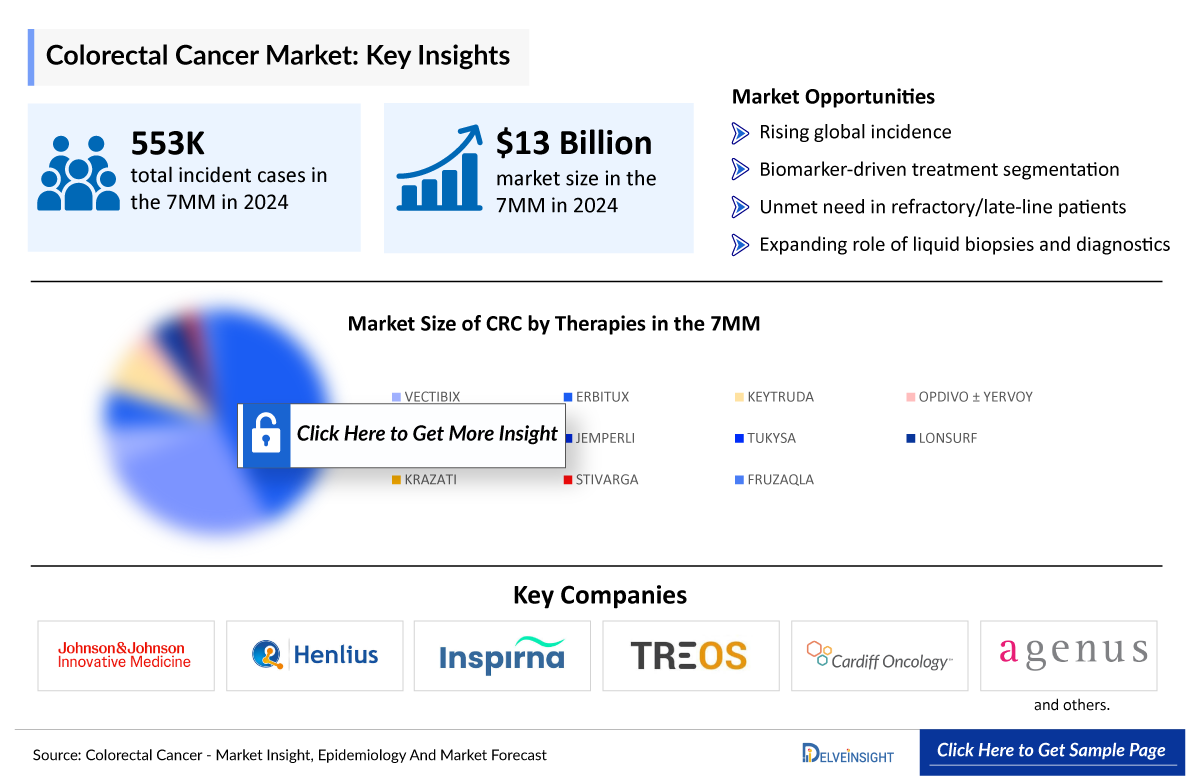

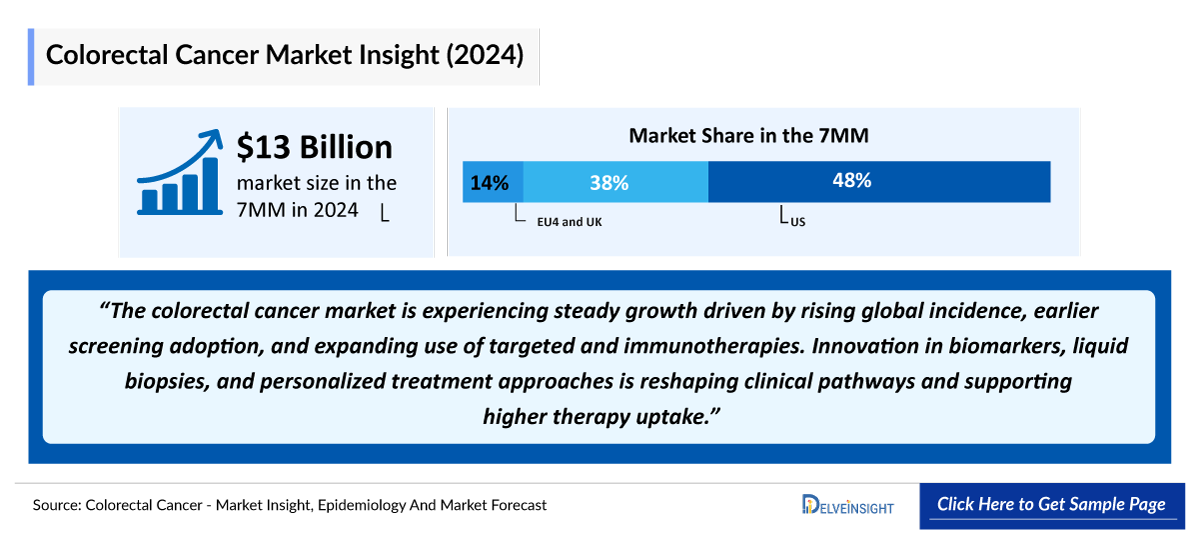

- The total colorectal cancer market size in 2023 was approximately USD 13,000 million in the 7MM, which is expected to grow at a CAGR of ~5% during the forecast period (2024-2034).

- Colorectal cancer is the third most commonly diagnosed cancer in the world. In 2024, it is estimated that there will be approximately 106,600 new cases of the disease in the US; it is the second leading cause of cancer-related deaths in the US among men and women combined.

- Among EU4 and the UK, Germany will capture the maximum Colorectal cancer revenue share, followed by the UK in 2034.

- DelveInsight's analysis reveals that nearly 40 percent of the total colorectal cancer incidence in the US were classified as metastatic colorectal cancer.

- In 2023, the highest number of mutation-specific cases of colorectal cancer in the US were attributed to MSS (Microsatellite Stable) mutations.

- In November 2023, the US FDA approved Takeda’s FRUZAQLA for adults with metastatic colorectal cancer after prior treatment with specific chemotherapies and targeted therapies.

- In April 2024, ENHERTU was approved in the US as first tumour-agnostic HER2-directed therapy for previously treated patients with metastatic HER2-positive solid tumours, including colorectal cancer.

- In June 2024, Bristol Myers Squibb announced US FDA accelerated approval of KRAZATI (adagrasib) in combination with cetuximab for adult patients with previously treated kras G12C-mutated locally advanced or metastatic colorectal cancer.

- In October 2024, U.S. regulators have prolonged their evaluation of Amgen's LUMAKRAS (sotorasib) for second-line colorectal cancer (CRC) by three months, delaying a possible approval decision until January 17 of next year. This extension also temporarily reduces competitive pressure on Bristol Myers Squibb's competing KRAS-inhibitor, KRAZATI (adagrasib).

Request for unlocking the Sample Page of the "Colorectal Cancer Treatment Market"

DelveInsight’s "Colorectal Cancer Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of the colorectal cancer historical and forecasted epidemiology as well as the colorectal cancer market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Colorectal Cancer Treatment Market Report provides current treatment practices, emerging drugs, colorectal cancer market share of individual therapies, and current and forecasted colorectal cancer market size from 2024 to 2034, segmented by seven major markets. The report also covers current colorectal cancer treatment market practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Colorectal Cancer Market |

|

|

Colorectal Cancers Market Size | |

|

Colorectal Cancer Companies |

Mirati Therapeutics, Exelixis, Enterome, Arcus Biosciences, Lyell Immunopharma, AstraZeneca, Novartis Pharmaceuticals, Surgimab, Numab Therapeutics, SOTIO Biotech, Amgen, Sichuan Baili Pharmaceutical, Qilu Pharmaceutical, Bristol-Myers Squibb, NGM Biopharmaceuticals, Takeda, PureTech, Pfizer, Kezar Life Sciences, Salubris Biotherapeutics, and others. |

|

Colorectal Cancer Epidemiology Segmentation |

|

Key Factors Driving the Growth of the Colorectal Cancer Market

Increasing Colorectal Cancer Incidence

The growing global incidence of colorectal cancer is a primary market driver, attributed to aging populations, lifestyle changes, and rising risk factors such as obesity, sedentary habits, diets high in processed meats, smoking, and alcohol consumption.

Advances in Molecular Profiling for Precision Oncology

The increased use of molecular profiling (MSI-H, BRAF V600E, HER2, and KRAS G12C) enables more personalized and effective treatment strategies.

Emerging Molecular Targets Driving Next-Gen Therapies

Emerging targets such as KRAS G12C, NTRK fusions, and PIK3CA mutations provide new opportunities for drug development.

Growing CRC Clinical Trial Activities

Several colorectal cancer therapies are currently being evaluated in clinical trials, including Serplulima (HLX10) + Bevacizumab + Chemotherapy (Shanghai Henlius Biotech), Botensilimab ± Balstilimab (Agenus), TTX-080 (Tizona Therapeutics), SGM-101 (Surgimab), HRO761 (Novartis), BXQ-350 + FOLFOX + bevacizumab (Bexion Pharmaceuticals), Revumenib (Syndax Pharmaceuticals), Zanzalintinib + atezolizumab vs. regorafenib (Exelixis), Temab-A (ABBV-400) (AbbVie), TSN333 and TSN1611 (Tyligand Pharmaceuticals), Pumitamig (Bristol Myers Squibb), E7386 (Eisai), BOLD-100 in combination with FOLFOX Chemotherapy (Bold Therapeutics), and others.

Colorectal Cancer Treatment Market

Colorectal cancer originates in the colon or rectum, typically from precancerous polyps that gradually transform into malignancies. It is one of the most prevalent cancers worldwide, with risk factors including age, family history, inflammatory bowel disease, and lifestyle factors such as a diet high in red and processed meats, sedentary behavior, and smoking. Genetic mutations, both inherited (e.g., Lynch syndrome) and acquired, play a crucial role in its development. Colorectal cancer often progresses silently, with symptoms like changes in bowel habits, rectal bleeding, and abdominal discomfort manifesting in later stages.

This delay in noticeable symptoms underscores the importance of regular screening, particularly in high-risk populations. The disease's impact is significant, not only because of its high incidence but also due to the profound physical and emotional toll it takes on patients and their families. The journey through colorectal cancer is often marked by challenges that extend beyond the medical, encompassing the psychological and social dimensions of coping with a life-threatening illness.

While advancements in understanding its molecular basis have improved prevention and management strategies, colorectal cancer remains a formidable public health concern, demanding continued awareness and research.

Colorectal Cancer Diagnosis

Colorectal cancer (CRC) diagnosis typically starts with routine screening or evaluation of symptoms. The primary diagnostic tool is colonoscopy, where a camera inspects the colon for polyps or tumors, with biopsies taken if needed. Stool-based tests like the fecal immunochemical test (FIT) detect hidden blood, often leading to further colonoscopy if positive. CT colonography offers a non-invasive alternative for visualizing the colon, but abnormalities require follow-up colonoscopy.

When CRC is suspected, imaging tests such as CT scans or MRI are used to assess tumor size, lymph node involvement, and metastasis, crucial for staging the disease and planning treatment. Early detection through these methods is key to improving outcomes.

Further details related to diagnosis will be provided in the report...

Colorectal Cancer Treatment

Colorectal cancer treatment is tailored based on the cancer's type, stage, and the patient’s overall health. The primary options include:

- Surgery: The main treatment, especially for early stages, involves removing the cancerous part of the colon and possibly nearby lymph nodes. Advanced procedures may require creating a colostomy.

- Chemotherapy: Uses drugs to kill cancer cells, either before surgery to shrink tumors, after surgery to eliminate remaining cells, or for advanced cases.

- Radiation Therapy: Targets and kills cancer cells, mainly used in later stages or when the cancer has spread to nearby areas.

The goal is to remove the cancer, prevent its spread, and manage symptoms. Treatment plans are personalized for each patient.

Colorectal Cancer Epidemiology

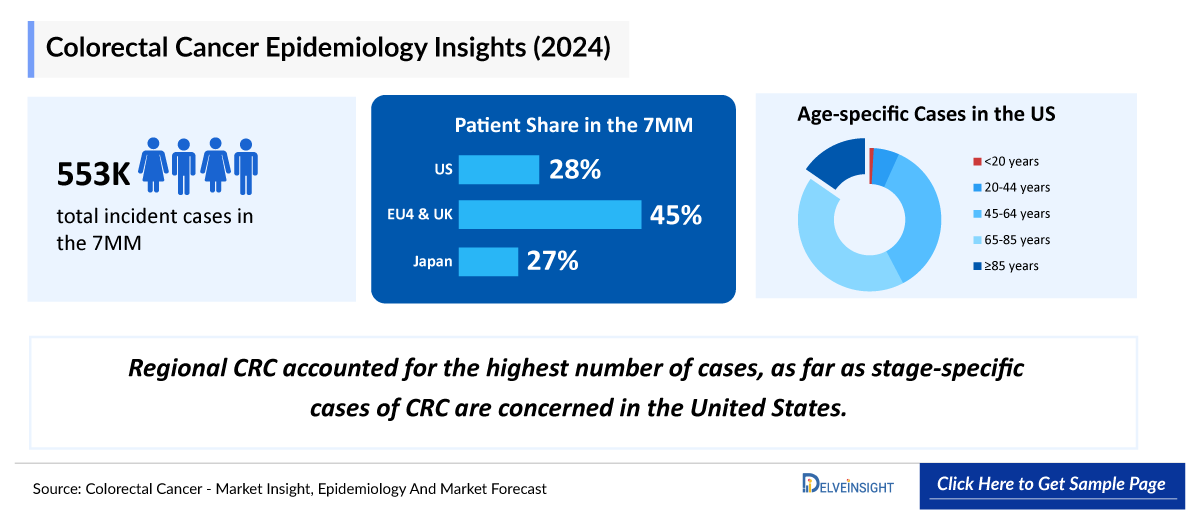

The colorectal cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Incident Cases of CRC, Gender-specific Cases of CRC, Age-specific Cases of CRC, Tumor Localization-specific Cases of CRC, Stage-specific Cases of CRC, Mutation-specific Cases of CRC, Total Treated Cases of CRC by Line of Therapies in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, the United States accounted for ~30% of the total incident cases of Colorectal cancer in the 7MM.

- Approximately 68,400 cases of CRC were reported among individuals aged 65-84 years in the United States, in 2023

- In 2023, ~52,000 cases of CRC were localized in the right colon in the United States.

- In 2023, localized CRC accounted for the highest number of cases, as far as stage-specific cases of CRC are concerned in the US.

- Surveillance, Epidemiology, and End Results (SEER), published age and gender data for CRC patients. As per the registry, percentages of cases by stages was segregated as localized, regional, distant and unknown which comprised of 38%, 35%, 22% and 4% respectively.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Colorectal Cancer Prevalence

Recent Developments in Colorectal Cancer Clinical Trials

- In September 2025, Biocartis Group of Companies announced that its Idylla™ CDx MSI Test, developed in partnership with Bristol Myers Squibb, has received the first-ever Premarket Approval (PMA) from the U.S. FDA. This approval marks a significant achievement for the cartridge-based, fully automated "sample-to-result" companion diagnostic test.

- In September 2025, Rgenta Therapeutics received FDA Orphan Drug Designation for RGT-61159, an oral small molecule targeting MYB via RNA splicing modulation, for the treatment of adenoid cystic carcinoma (ACC). The drug is currently in a Phase 1a/b trial for relapsed/refractory ACC and colorectal cancer.

- In Aug 2025, Quest Diagnostics’ Haystack MRD® test received FDA Breakthrough Device Designation for detecting MRD-positive stage II colorectal cancer patients who may benefit from adjuvant therapy.

- In August 2025, Anbogen Therapeutics announced that the FDA approved its Investigational New Drug (IND) application for ABT-301. This approval enables the start of a Phase 1/2 trial combining ABT-301 with tislelizumab and bevacizumab to treat metastatic colorectal cancer patients with proficient mismatch repair or non-MSI-high tumors. The multi-center study will enroll 66 patients in Taiwan and Australia.

- In August 2025, Agilent Technologies announced that its MMR IHC Panel pharmDx (Dako Omnis) received FDA approval as a companion diagnostic for colorectal cancer, helping identify mismatch repair deficient colorectal cancer patients eligible for treatment with Opdivo (nivolumab) alone or in combination with Yervoy (ipilimumab).

- In June 2025, Guardant Health, Inc. (Nasdaq: GH) announced that its Shield multi-cancer detection (MCD) test received Breakthrough Device designation from the FDA. The methylation-based blood test is designed to screen for multiple cancers—including bladder, colorectal, esophageal, gastric, liver, lung, ovarian, and pancreatic—in adults aged 45+ at average risk.

- In May 2025, UTR Therapeutics Inc. announced the submission of an IND application to the FDA for UTRxM1-18, a novel therapy designed to target c-MYC driven cancers, including triple-negative breast, pancreatic, colorectal, and ovarian cancers. Leveraging its 3’UTR engineering platform, UTRxM1-18 selectively degrades cancer-specific transcripts while sparing healthy cells. In preclinical studies, the drug showed strong, dose-dependent efficacy across tumor types with no dose-limiting toxicities.

- In April 2025, Verastem Oncology received FDA clearance for its IND application of VS-7375, an oral KRAS G12D (ON/OFF) inhibitor, and plans to begin a Phase 1/2a study by mid-year targeting advanced solid tumors including pancreatic, colorectal, and non-small cell lung cancers.

- In April 2025, the FDA approved nivolumab (Opdivo) combined with ipilimumab (Yervoy) for adults and pediatric patients (12+) with unresectable or metastatic MSI-H or dMMR colorectal cancer. The FDA also granted full approval to single-agent nivolumab for MSI-H or dMMR metastatic CRC patients aged 12 and older whose disease progressed after standard chemotherapy.

- In February 2025, Averto Medical announced that the FDA granted Breakthrough Device Designation for its ColoSeal™ Intraluminal Colonic Diversion (ICD) System, which aims to improve outcomes for colorectal surgery patients by eliminating the need for a temporary ostomy.

- In January 2025, the FDA approved Amgen's KRAS G12C inhibitor, Lumakras, in combination with Vectibix for treating advanced colorectal cancer.

- In December 2024, EndoQuest Robotics gained FDA IDE approval for a clinical trial to evaluate its surgical robot in colorectal lesion removal. The trial will involve 50 participants across five US sites, focusing on the safety and performance of the system in ESD procedures (NCT06133387).

Colorectal Cancer Drug Chapters

The drug chapter segment of the colorectal cancer drugs market report encloses a detailed analysis of the marketed, late-stage (Phase III), and mid-stage (Phase II) pipeline drugs. The marketed drugs segment encloses KRAZATI, ENHERTU, TUKYSA, KEYTRUDA, FRUZAQLA, BRAFTOVI, and others.

Furthermore, the current key Colorectal Cancer Companies for emerging drugs and their respective drug candidates include Merck (Favezelimab), Amgen (LUMAKRAS), Cardiff Oncology (Onvansertib), EpicentRx (Nibrozetone (RRx-001)) and others. The drug chapter also helps understand the colorectal cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest Colorectal Cancer news and press releases.

Marketed Colorectal Cancer Drugs

- FRUZAQLA (fruquintinib): Takeda

FRUZAQLA is a selective oral inhibitor of VEGFR -1, -2 and -3. VEGFR inhibitors play a pivotal role in blocking tumor angiogenesis. FRUZAQLA was designed to have enhanced selectivity that limits off-target kinase activity, allowing for high drug exposure, sustained target inhibition, and flexibility for the potential use as part of combination therapy. FRUZAQLA is the First Targeted Therapy Approved for mCRC regardless of biomarker status or prior types of therapies in more than a decade. In November 2023, Takeda received US FDA approval of FRUZAQLA for previously treating metastatic colorectal cancer.

- TUKSYA (tucatinib): Genentech/Seagen

TUKYSA is an oral medicine that is a tyrosine kinase inhibitor of the HER2 protein, a protein that contributes to cancer cell growth. HER2 is overexpressed in multiple cancers, including colorectal cancers. In preclinical in vitro studies, the drug inhibited phosphorylation of HER2 and HER3, resulting in inhibition of downstream MAPK and AKT signaling and cell growth (proliferation), and showed anti-tumor activity in HER2-expressing tumor cells. The combination of TUKYSA and trastuzumab have also been shown to increase anti-tumor activity in vitro and in vivo compared to either medicine alone.

- ENHERTU (trastuzumab deruxtecan): AstraZeneca and Daiichi Sankyo

In April 2024, AstraZeneca and Daiichi Sankyo's ENHERTU has received FDA accelerated approval in the US for treating adults with unresectable or metastatic HER2-positive (IHC 3+) solid tumors who have exhausted other treatment options. This approval, the first of its kind for a HER2-directed antibody-drug conjugate (ADC) across various tumor types, is based on the objective response rate and duration of response from the DESTINY-PanTumor02, DESTINY-Lung01, and DESTINY-CRC02 Phase II trials. Continued approval will depend on confirmatory trials demonstrating clinical benefit.

|

Approved Drug |

Company |

Molecule Type |

MoA |

RoA |

|

FRUZAQLA (fruquintinib) |

Takeda |

Small molecule |

VEGFR1 x VEGFR2 x VEGFR3 |

Oral |

|

TUKSYA (tucatinib) |

Genentech/Seagen |

Small molecule |

HER2 antagonists |

Oral |

|

ENHERTU (trastuzumab deruxtecan) |

AstraZeneca/ Daiichi Sankyo |

Biologic |

HER2 antagonists;TOP1 inhibitor |

IV |

|

KEYTRUDA (pembrolizumab) |

Merck |

Biologic |

IV |

Detailed Marketed therapy assessment will be provided in the final report...

Emerging Colorectal Cancer Drugs

- Favezelimab + pembrolizumab: Merck

Favezelimab is an investigational anti-lymphocyte activation gene-3 (LAG-3) antibody designed to restore T cell effector function by preventing LAG-3 from binding to its primary ligand, major histocompatibility complex (MHC) class II molecules. Pembrolizumab is a monoclonal antibody that binds to the PD-1 receptor and blocks its interaction with PD-L1 and PD-L2, releasing PD-1 pathway-mediated inhibition of the immune response.

The combination of Favezelimab and Pembrolizumab is currently being evaluated in the Phase III KEYFORM-007 trial for colorectal cancer.

- LUMAKRAS (sotorasib): Amgen

LUMAKRAS is a KRASG12C small molecule inhibitor under investigation for the treatment of advanced colorectal cancer. LUMAKRAS is being investigated in previously treated KRAS G12C-mutated CRC in combination with other therapies. In August 2023, Amgen announced that the US Food and Drug Administration (FDA), granted Breakthrough Therapy Designation to LUMAKRAS.

|

Comparison of Emerging Therapies | |||||

|

Emerging Drug |

Company |

Phase |

Molecule Type |

MoA |

RoA |

|

Favezelimab + pembrolizumab |

Merck |

III |

Biologics |

CD223 antigen inhibitors/ PD1 inhibitor |

IV |

|

LUMAKRAS (sotorasib) |

Amgen |

III |

Small molecule |

KRAS protein inhibitors |

Oral |

|

Onvansertib |

Cardiff Oncology |

II |

Small molecule |

Oral | |

|

Nibrozetone (RRx-001) |

EpicentRx |

II |

Small molecule |

IV | |

Detailed emerging therapies assessment will be provided in the final report...

Colorectal Cancer Drugs Market Insights

KRAS inhibitors are a class of targeted therapies designed to inhibit the activity of the KRAS protein, which is often mutated in various cancers, including colorectal cancer. These mutations lead to uncontrolled cell growth and cancer progression. KRAS inhibitors specifically target the mutated form of the KRAS protein, particularly the G12C mutation. By binding to this mutant protein, they lock it in an inactive state, preventing it from sending growth signals to the cancer cells. These inhibitors are used in patients with specific KRAS mutations and have shown effectiveness in shrinking tumors and delaying disease progression. They are often used when other treatments have failed.

- HER2 inhibitors

HER2 inhibitors are targeted therapies used to treat cancers that overexpress the HER2 protein, such as certain types of breast cancer. HER2 (human epidermal growth factor receptor 2) is a protein that promotes cell growth, and its overexpression can lead to aggressive cancer behavior. HER2 inhibitors work by blocking the HER2 receptors on cancer cells, preventing them from receiving growth signals. This can slow or stop the growth of HER2-positive cancer cells.

Colorectal Cancer Market Outlook

The colorectal cancer therapeutics market is expected to grow at a CAGR of ~5% through 2034, driven by an aging population, increased screening, and innovative treatments. Key trends include the rise of targeted therapies, such as KRAS inhibitors, and advancements in immunotherapy, including checkpoint inhibitors and CAR-T therapies. Early detection methods, such as liquid biopsies and genetic screening, are enhancing diagnosis and shifting treatment approaches. The competitive landscape features major Colorectal cancer companies like Pfizer, Merck, and Roche, though high costs and tumor resistance present challenges. Opportunities lie in emerging markets and personalized medicine, promising growth and improved patient outcomes.

Key Findings

- In 2023, the United States held the largest Colorectal Cancer Market Share among the 7MM, accounting for approximately 40% of the total market.

- The Colorectal Cancer Drugs Market is expanding due to targeted therapies addressing specific mutations, such as RAS and BRAF. EGFR and BRAF inhibitors are particularly effective for these genetic subgroups, driving market growth.

- Immune checkpoint inhibitors targeting PD-1/PD-L1 have revolutionized colorectal cancer treatment, especially for microsatellite instability-high (MSI-H) tumors. This advancement has led to broader adoption and market expansion.

- Rising healthcare spending in developed regions fuels investments in colorectal cancer research and development. Enhanced infrastructure and favorable reimbursement policies further support market growth.

- Partnerships between pharmaceutical Colorectal Cancer Companies, academia, and research institutions accelerate innovation in colorectal cancer therapies and diagnostics, enhancing market dynamics.

Advances in understanding colorectal cancer's molecular mechanisms are driving personalized medicine. Biomarker testing enables more targeted and effective treatments, aligning with market growth trends.

Colorectal Cancer Drug Uptake

This section focuses on the uptake rate of potential Colorectal Cancer drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Colorectal Cancer Pipeline Development Activities

The Colorectal Cancer therapeutics market report provides insights into Colorectal Cancer clinical trials within Phase III, Phase II, and Phase I/II. It also analyzes key Colorectal Cancer Companies involved in developing targeted therapeutics. Colorectal Cancer Companies like Merck, Amgen, Cardiff Oncology, EpicentRx and others are actively engaging their product in research and development efforts for colorectal cancer. The pipeline of colorectal cancer possesses many potential drugs and there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034).

Colorectal Cancer Pipeline Development Activities

The Colorectal Cancer therapeutics market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Colorectal Cancer emerging therapy.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Colorectal Cancer Treatment Drugs

KOL Views on Colorectal cancer

To keep up with current Colorectal cancer market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the Colorectal Cancer evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Professors, Medical Oncologists, Surgical Oncologist, Gastroenterologist, and others.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as the Johns Hopkins Hospital, Dana-Farber Cancer Institute, Memorial Sloan Kettering Cancer Center, Massachusetts General Hospital, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or colorectal cancer market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“The KRAS p.G12C mutation holds significant clinical importance in patients with metastatic colorectal cancer. Investigating and extensively exploiting it as a therapeutic target is one of the priorities in oncology for the near future.” |

|

“We are encouraged by the tumor response rates seen in patients with previously-treated advanced colorectal cancer and we will continue to explore the potential of ENHERTU to address this unmet medical need.” |

|

“Often patients firstly diagnosed with colorectal cancer ask about surgery. However, surgery should not be the preferred first choice of therapy. It is important to know the stage of the cancer.” |

|

“As the first-and-only targeted regimen for people with BRAFV600E-mutant metastatic CRC who have received prior therapy, BRAFTOVI in combination with cetuximab is a much-needed new treatment option for these patients.” |

Colorectal Cancer Drugs Market: Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Colorectal Cancer Therapeutics Market Access and Reimbursement

The Colorectal Cancer therapeutics market report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Detailed market access and reimbursement assessment will be provided in the final report...

Colorectal Cancer Treatment Market Report Scope

- The Colorectal Cancer treatment market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the colorectal cancer drugs market, historical and forecasted Colorectal Cancer treatment market size, Colorectal Cancer market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Colorectal Cancer treatment market report provides an edge while developing business strategies by understanding trends through SWOT analysis and KOL views, patient journey, and treatment preferences that help shape and drive colorectal cancer drugs market.

Colorectal Cancer Treatment Market Report Insights

- Patient-based Colorectal Cancer Market Forecasting

- Colorectal Cancer Therapeutic Approaches

- Colorectal Cancer Pipeline Analysis

- Colorectal Cancer Market Size

- Colorectal cancer Market Trends

- Existing and Future Colorectal Cancer Drugs Market Opportunity

Colorectal Cancer Treatment Market Report Key Strengths

- 11 Years Colorectal Cancer Market Forecast

- The 7MM Coverage

- Colorectal Cancer Epidemiology Segmentation

- Key Cross Competition

- Colorectal Cancer Drugs Uptake

- Key Colorectal Cancer Market Forecast Assumptions

Colorectal Cancer Market Report Assessment

- Current Colorectal Cancer Treatment Market Practices

- Colorectal Cancer Unmet Needs

- Colorectal Cancer Pipeline Product Profiles

- Colorectal Cancer Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Colorectal Cancer Market Drivers

- Colorectal Cancer Market Barriers

FAQs

- What was the colorectal cancer treatment market size, the Colorectal Cancer market size by therapies, Colorectal Cancer market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future treatment paradigm for colorectal cancer?

- What are the disease risks, burdens, and Colorectal Cancer Unmet Needs? What will be the growth opportunities across the 7MM concerning the patient population with colorectal cancer?

- What are the current options for the treatment of colorectal cancer? What are the current guidelines for treating colorectal cancer in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in colorectal cancer?

Reasons to Buy

- The Colorectal Cancer therapeutics market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the colorectal cancer drugs market.

- Insights on patient burden/disease Colorectal Cancer prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Colorectal Cancer drugs market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming Colorectal cancer companies in the Colorectal Cancer drugs market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of current therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Colorectal Cancer drugs market so that the upcoming Colorectal cancer companies can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- Merck's CAPVAXIVE Vaccine Yields Strong Immune Response in Adults Vulnerable to Pneumococcal Disease; FDA Postpones LUMAKRAS Colorectal Cancer Verdict to Early 2025

- Phase I/II trial of copanlisib in combination with nivolumab for microsatellite stable (MSS) colorectal cancer (CRC)

- KRYSTAL-1: A pooled phase 1/2 efficacy and safety of adagrasib (MRTX849) in combination with cetuximab in patients with metastatic colorectal cancer (CRC) harboring a KRASG12C mutation

- Novel and Emerging Metastatic Colorectal Cancer Treatment Drugs Anticipated to Change Market Dynamics

- Colorectal Cancer Awareness Month

- Colorectal Cancer Market Analysis and Market Forecast