Sickle Cell Disease Market

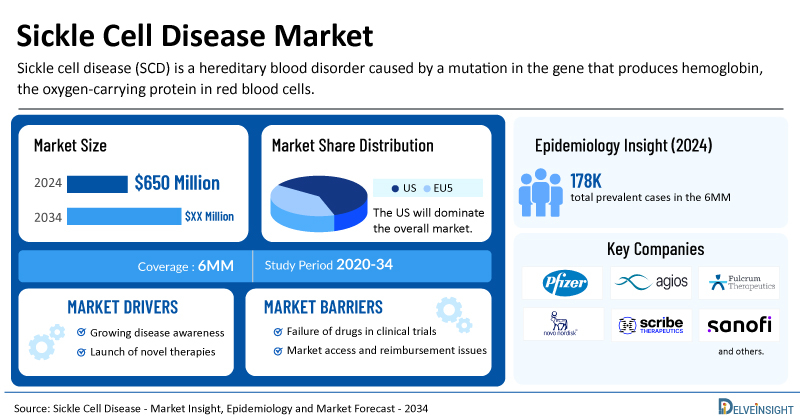

- Among the 6MM countries the Sickle cell disease market size was valued ~USD 650 million in 2023 and is expected to increase through out the forecast period (2024-2034)

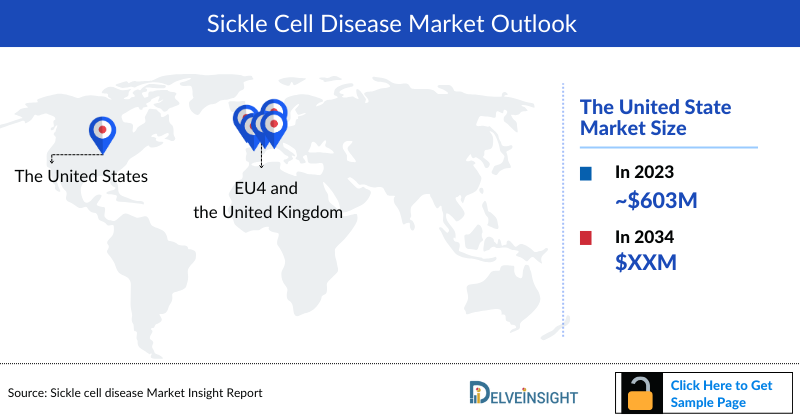

- Among the 6MM, the United States accounted for the highest market share in 2023 accounting for ~USD 603 million, followed by France, and the UK for Sickle Cell Disease.

- Sickle cell disease is a genetic blood disorder characterized by the presence of abnormal hemoglobin, causing red blood cells to become sickle-shaped. Sickle Cell Disease is a global health concern, particularly prevalent in populations with African, Middle Eastern, Mediterranean, and South Asian ancestry.

- The primary cause of Sickle Cell Disease is a mutation in the HBB gene, which affects the production of hemoglobin. Individuals with Sickle Cell Disease inherit two copies of the mutated gene, one from each parent, resulting in abnormal hemoglobin production. The abnormal red blood cells tend to become rigid and sticky, obstructing blood flow and causing episodes of intense pain called sickle cell crises.

- Sickle Cell Disease poses significant challenges for affected individuals, impacting their quality of life and life expectancy. Common complications include anemia, acute chest syndrome, stroke, organ damage (e.g., kidneys, liver), and increased susceptibility to infections.

- Currently, NSAIDs, blood transfusions, chelating agents, nutritional supplements, and broad-spectrum antibiotics are being used for the treatment of Sickle Cell Disease. Moreover, a few therapies that the US FDA has approved for the treatment of sickle cell disease include DROXIA (hydroxyurea), ENDARI (L-glutamine oral powder), ADAKVEO (crizanlizumab-tmca), and OXBRYTA (voxelotor).

- Improving the overall care and outcomes for individuals with Sickle Cell Disease requires a multidisciplinary approach. This includes comprehensive healthcare services, genetic counseling, early detection, and management of complications. Patient education and support programs are crucial for empowering individuals with Sickle Cell Disease to manage their condition effectively and improve their quality of life.

- Research and development efforts are ongoing to explore new treatments and potential cures for Sickle Cell Disease. Gene therapy and gene editing techniques hold promise in correcting the underlying genetic mutation responsible for Sickle Cell Disease. Clinical trials are underway to assess the safety and efficacy of these emerging therapies, providing hope for a future where Sickle Cell Disease can be cured or effectively managed.

- The disease’s life-threatening nature and lack of effective therapies are a big burden, and till the last decade, only hydroxyurea was available for management. Even after being in the market for so long, there remains a challenge of low treatment adherence and high treatment discontinuation rates.

- Adherence and reimbursement of the therapies are also still challenging with the recently approved therapies. With almost three recent introductions in the market, i.e., ENDARI (L-glutamine), ADAKVEO (crizanlizumab), and OXBRYTA (voxelotor). The recently approved OXBRYTA became the first-in-class oral therapy that targets the underlying cause of Sickle Cell Disease with a convenient route of administration.

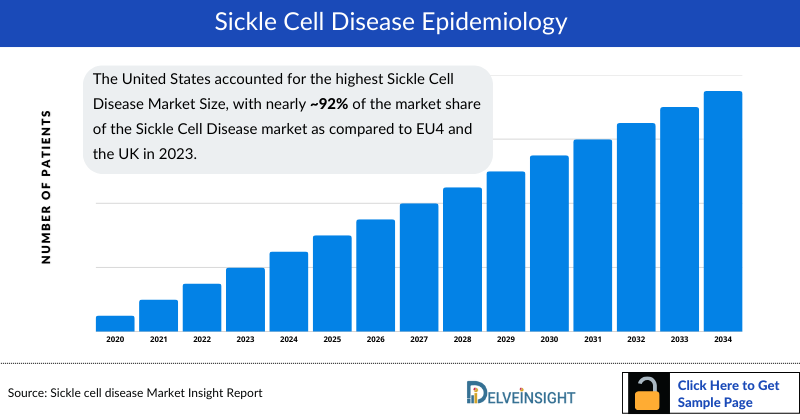

- The United States accounted for the highest Sickle Cell Disease Market Size, with nearly ~92% of the market share of the Sickle Cell Disease market as compared to EU4 and the UK in 2023.

- In 2023, among EU4 and the UK, France accounted for the largest Sickle Cell Disease Market Size, while Spain accounted for the smallest share.

- Few therapies have been recently approved for sickle cell disease, which include CASGEVY (exagamglogene autotemcel [exa-cel]) (Vertex Pharmaceuticals/CRISPR Therapeutics) and LYFGENIA (Lovo-cel) (bluebird bio). Approval of these therapies is expected to have a positive impact on overall growth of the market. In contrast, the emerging pipeline includes drugs like EDIT-301, Mitapivat, Inclacumab (PF-07940370), Osivelotor (GBT-601), and others.

- Delays in diagnosis, serious complications of Sickle Cell Disease, economic burden, and lack of proper understanding of the disease will be going to hit the Sickle Cell Disease market.

- In conclusion, Sickle Cell Disease is a complex genetic blood disorder characterized by abnormal hemoglobin, leading to complications and reduced life expectancy. However, advancements in treatment approaches and ongoing research efforts offer hope for improved management and potential cures. Enhancing healthcare services, raising awareness, and supporting individuals with Sickle Cell Disease are essential steps toward addressing the challenges associated with this disease in the 6MM.

Request for unlocking the sample page of the "Sickle Cell Disease Treatment Market"

Key Factors Driving Sickle Cell Disease Market

Rising SCD Prevalence

According to DelveInsight’s assessment, in 2024 the total prevalent cases of sickle cell disease (SCD) in the 6MM were nearly 178.5K. These cases are anticipated to increase by 2034, with the majority occurring in individuals aged 18–44 years, followed by those aged 45–64 years, and fewer in younger (0–17 years) and older (65+ years) populations.

Sickle Cell Disease Standard of Care

The present treatment landscape for SCD includes NSAIDs, blood transfusions, chelating agents, nutritional supplements, and broad-spectrum antibiotics to manage complications. Established disease-modifying therapies include DROXIA (hydroxyurea), ENDARI (L-glutamine oral powder), and ADAKVEO (crizanlizumab-tmca). However, in September 2024, all lots of OXBRYTA were withdrawn across all markets, creating a treatment gap in the standard of care.

Sickle Cell Disease Market Outlook

The total SCD market size in the 6MM was approximately USD 650 million in 2024 and is projected to grow by 2034. Market expansion will be driven by a rising patient pool, advances in understanding disease mechanisms, and the development of novel targeted therapies and gene-editing approaches.

Sickle Cell Disease Competitive Landscape

The SCD pipeline is robust, with key players such as Novo Nordisk (etavopivat; NDec), Pfizer (osivelotor; inclacumab), Agios Pharmaceuticals (mitapivat), and Fulcrum Therapeutics (pociredir) advancing candidates across early and late phases of development. In comparison to currently available therapies, gene-based treatments such as CASGEVY and LYFGENIA are anticipated to emerge as market leaders, transforming the treatment landscape and significantly influencing the 6MM SCD market by 2034.

Sickle Cell Disease Treatment Market Report Summary

- The report offers extensive knowledge regarding the epidemiology segments (by region, total prevalent cases of Sickle Cell Disease trait, total prevalent cases of Sickle Cell Disease, diagnosed cases of Sickle Cell Disease, age-specific prevalent cases of Sickle Cell Disease, and type-specific prevalence of Sickle Cell Disease) and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies such as Mitapivat, EDIT-301 (Renizgamglogene autogedtemcel, or reni-cel), Inclacumab (PF-07940370), Osivelotor (GBT-601) and the elaborative profiles of late and mid-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Sickle Cell Disease market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 6MM region.

- The report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 6MM Sickle Cell Disease market.

The table given below further depicts the key segments provided in the report:

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK |

|

Sickle Cell Disease Market |

|

|

Sickle Cell Diseases Market Size | |

|

Sickle Cell Disease Companies |

|

|

Sickle Cell Disease Epidemiology Segmentation |

|

Sickle Cell Disease Treatment Market Insights:

- Various key players, such as Pfizer, Agios Pharmaceuticals, Editas Medicine, Hoffmann-La Roche and others, are involved in developing therapies for Sickle Cell Disease. The expected launch of emerging therapies and other treatments will lead to a significant increase in the market size during the forecast period [2024–2034].

- In 2023, the total market size of Sickle Cell Disease was approximately USD 650 million, which is expected to increase by 2034 during the study period (2020–2034) in the 6MM.

- Among the 6MM, the United States accounted for the highest market share in 2023 accounting for ~USD 603 million, followed by France, and the UK for Sickle Cell Disease.

- During the forecast period (2024–2034), pipeline candidates such as Etavopivat, Inclacumab (PF-07940370), Reni-cel (EDIT-301) and Osivelotor (GBT-601) are expected to be the major contributors for driving the rise in Sickle Cell Disease market size.

- Among the emerging therapies, Casgevy (Exa-cel) is expected to garner the largest market share by 2034 in the 6MM.

- Gene therapies come up with many challenges, such as market access and reimbursements, and target a niche pool hence having a lower market share.

Sickle Cell Disease Recent Developments

- In December 2024, Safi Biotherapeutics, a biotech company producing stem-cell derived human red blood cell (RBC) products, announced that the FDA granted Rare Pediatric Disease Designation (RPDD) and Orphan Drug Designation (ODD) to their manufactured red blood cells (mRBCs) for use in chronic transfusions for sickle cell patients.

- On October 26, 2024, Kind Pharmaceutical (Hangzhou Andao Pharmaceutical Ltd. and Kind Pharmaceuticals LLC) announced that the FDA’s Office of Orphan Products Development has granted Orphan Drug Designation (ODD) to AND017 for the treatment of Sickle Cell Disease (SCD).

Sickle Cell Disease Drug Chapters

The section dedicated to drugs in the Sickle Cell Disease treatment market report provides an in-depth evaluation of Sickle Cell Disease pipeline drugs analysis (Phase III and Phase II) related to Sickle Cell Disease. The drug chapters section provides valuable information on various aspects related to Sickle Cell Disease clinical trials, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Sickle Cell Disease.

Sickle Cell Disease Marketed Therapies

- CASGEVY (exagamglogene autotemcel): Vertex Pharmaceuticals/CRISPR Therapeutics

CASGEVY is a genome-edited cellular therapy consisting of autologous CD34+ hematopoietic stem cells (HSCs) edited by CRISPR/Cas9 technology at the erythroid-specific enhancer region of the BCL11A gene. CASGEVY is intended for one-time administration via a hematopoietic stem cell transplant procedure where the patient’s own CD34+ cells are modified to reduce BCL11A expression in erythroid lineage cells, leading to increased fetal hemoglobin (HbF) production. HbF is the form of the oxygen-carrying hemoglobin that is naturally present during fetal development, which then switches to the adult form of hemoglobin after birth. CASGEVY has been shown to reduce or eliminate vaso-occlusive crises for patients with Sickle Cell Disease.

In December 2023, Vertex Pharmaceuticals and CRISPR Therapeutics announced that the US FDA had approved CASGEVY (exagamglogene autotemcel [exa-cel]), a CRISPR/Cas9 genome-edited cell therapy, for the treatment of sickle cell disease (Sickle Cell Disease) in patients 12 years and older with recurrent vaso-occlusive crises (VOCs).

CASGEVY was later granted conditional marketing authorization in Great Britain by the UK. Medicines and Healthcare Products Regulatory Agency and by the National Health Regulatory Authority in Bahrain for patients 12 years of age and older with Sickle Cell Disease characterized by recurrent vaso-occlusive crises or transfusion-dependent beta-thalassemia (TDT), for whom hematopoietic stem cell transplantation is appropriate and a human leukocyte antigen matched related hematopoietic stem cell donor is not available.

- ENDARI (L-glutamine): Emmaus Life Sciences

ENDARI (L-glutamine) is an oral-administered pharmaceutical grade L-glutamine (PGLG), an amino acid formulation to relieve pain, swelling, and other complications of sickle cell anemia in adults and children 5 years and older. ENDARI reduces oxidant damage to red blood cells by improving the redox potential of nicotinamide adenine dinucleotide (NAD), a coenzyme identified as the primary regulator of oxidation.

ENDARI received Orphan Drug designation (ODD) in the US, Orphan Medicinal Product designation in the EU, and Fast Track designation (FTD) from the FDA.

In July 2017, the FDA approved ENDARI (L-glutamine oral powder) to reduce the severe complications of sickle cell disease in adult and pediatric patients aged 5 and older.

Note: Detailed assessment will be provided in the final report of Sickle Cell Disease…

Emerging Sickle Cell Disease Therapies

- Mitapivat: Agios Pharmaceuticals

Mitapivat is a novel, first-in-class oral small molecule allosteric activator of the pyruvate kinase enzyme. It has been shown to significantly upregulate both wild-type and numerous mutant forms of erythrocyte pyruvate kinase (PKR), increasing adenosine triphosphate (ATP) production and reducing levels of 2,3-diphosphoglycerate. In February 2022, the FDA approved PYRUKYND (mitapivat) to treat hemolytic anemia in adults with pyruvate kinase deficiency.

The company has initiated a Phase II/III trial to evaluate mitapivat in sickle cell patients.

In June 2023, Agios Pharmaceuticals announced that the Phase II portion of the global RISE UP study of mitapivat in sickle cell disease had met its primary endpoint of hemoglobin response for patients in both the 50 mg and 100 mg twice daily (BID) mitapivat arms.

- Inclacumab: Pfizer

Inclacumab is a novel, fully human monoclonal antibody that selectively targets P-selectin. This protein mediates cell adhesion and is clinically validated to reduce pain due to VOCs in people with Sickle Cell Disease. Preclinical results suggest that inclacumab can be a best-in-class option for reducing VOCs in people with Sickle Cell Disease, with the potential for quarterly rather than monthly dosing. The company has completed one Phase II study, and it is currently in the Phase III stage of clinical development for the treatment of Sickle cell disease.

In October 2022, Pfizer competed the acquisition of Global Blood Therapeutics (GBT), a biopharmaceutical company dedicated to the discovery, development, and delivery of life-changing treatments that provide hope to underserved patient communities, starting with sickle cell disease.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Sickle Cell Disease Treatment Drugs

|

Drug Name |

Company |

Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

Inclacumab |

Pfizer |

III |

SCD |

Intravenous |

P-selectin inhibitor |

Small molecule |

|

Ndec |

Novo Nordisk |

III |

SCD |

Oral |

DNA methyltransferase 1 (DNMT1) inhibitor, cytidine deaminase (CDA) inhibitor |

Small Molecule |

Sickle Cell Disease Market Outlook

An effective cure for a disease is the utmost requirement in Sickle Cell Disease patients. Current therapies only provide symptomatic treatment such as relief in pain crises, inflammation, reduction in the frequency of vaso-occlusive crisis, improved oxygen supply, etc., enhancing quality of life. Recurring blood transfusion and cell therapies also sustain symptom management in Sickle Cell Disease patients. Sickle Cell Disease is the reality of many people across the US. Yet, patients often experience poor care, especially from non-specialist healthcare providers who may lack the training to provide good, comprehensive care. It shows the scarcity of healthcare infrastructure to provide holistic treatment, which fuels unsatisfactory symptom management.

The treatment pattern currently consists of different approaches classified into pharmacologic and nonpharmacological therapies. The pharmacological therapies, including DROXIA (hydroxyurea), ENDARI (L-glutamine), ADAKVEO (crizanlizumab), OXBRYTA (voxelotor) CASGEVY (exagamglogene autotemcel [exa-cel]) (Vertex Pharmaceuticals/CRISPR Therapeutics) and LYFGENIA (Lovo-cel) (bluebird bio). Pain management agents are segregated into opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, corticosteroids, etc. Acute vaso-occlusive crisis is generally managed using opioids and nonsteroidal anti-inflammatory drugs (NSAIDs). Further, non-pharmacological therapies include cognitive behavioral therapy, biofeedback, relaxation techniques, acupuncture, hypnosis, etc.

Hydroxyurea is an oral medicine that has been shown to reduce sickling and reduce or prevent several complications of Sickle Cell Disease. This was the first medication approved by the FDA to treat Sickle Cell Disease and is still used as a first-line treatment. If hydroxyurea does not control symptoms enough, the newer FDA-approved drugs are typically added on top of hydroxyurea treatment for combination therapy.

In December 2023, CASGEVY and LYFGENIA, CRISPR-based gene therapies, received approval from the FDA for sickle cell anemia. These therapies work in different ways; however, both therapies utilize the Nobel-winning CRISPR/Cas 9 genome editing technology.

Opioid analgesics are recommended as the primary choice of pain relief in VOC management. They include codeine, hydrocodone/paracetamol (hydrocodone/acetaminophen), hydrocodone/ibuprofen, oxycodone (and with codeine), morphine, hydromorphone, oxymorphone, methadone, diamorphine, and fentanyl. Opioids are generally available in healthcare settings and are often delivered as intravenous (IV) morphine every 4–6 h. However, the adverse effects of analgesic opioids include respiratory depression, constipation, vomiting, nausea, pruritus and hives, addiction, withdrawals, etc., limit their prescriptions.

The Sickle Cell Disease pipeline possesses potential drugs in the late and mid-development stages. The current key Sickle Cell Disease Companies and their respective drug candidates include Global Blood Therapeutics/Pfizer (Inclacumab), Forma Therapeutics/Novo Nordisk (etavopivat), Novo Nordisk (NDEC), Bluebird Bio (lovo-cel), Global Blood Therapeutics/Pfizer (GBT-601), Agios Pharmaceuticals (mitapivat), Bausch Health Americas (rifaximin), Editas Medicine (EDIT-301), and others.

In a nutshell, a few potential therapies are being investigated for the management of Sickle Cell Disease. Even though it is too soon to comment on the above-mentioned promising candidate to enter the market during the forecast period (2024–2034), it is safe to assume that the future of this market is bright. Eventually, the drug will create a significant difference in the landscape of Sickle Cell Disease in the coming years. The treatment space is expected to experience a positive impact in the coming years owing to the improvement in the rise in the number of healthcare spending across the world.

Further details are provided in the report…

Sickle Cell Disease Disease Therapeutics Market

Sickle Cell Disease (Sickle Cell Disease) is a group of lifelong inherited conditions that affect hemoglobin. It is characterized as a chronic hemolytic disorder marked by the tendency of hemoglobin molecules within red blood cells to polymerize and deform the red cell into sickle (or crescent) shape (Hb S), resulting in characteristic vaso-occlusive events and accelerated hemolysis.

Sickle Cell Disease is classified as a large-vessel vasculitis but also involves medium and small arteritis; sickle cell disease is inherited in an autosomal fashion, whether in the homozygous or double heterogeneous state. Sickle cell disease is called sickle cell anemia (SCA) when there is an inheritance in the homozygous state. Other known Sickle Cell Disease genotypes include hemoglobin SC disease, sickle beta plus thalassemia, sickle beta zero thalassemia (which has similar severity with sickle cell anemia), hemoglobin SD Punjab disease, hemoglobin SO Arab disease, and others. Hemoglobin S (Hb S) differs from normal hemoglobin (Hb A) because of the substitution of valine for glutamic acid in the sixth position in the ß-globin gene.

Screening for HbS at birth is currently mandatory in the United States. For the first 6 months of life, infants are largely protected by elevated levels of fetal hemoglobin (HbF). Sickle Cell Disease usually manifests early in childhood with various signs and symptoms. Acute and chronic pain, particularly vaso-occlusive crises, are the most distinguishing clinical features of Sickle Cell Disease, often presenting as bone pain in the long bones of the extremities due to bone marrow infarction

Symptoms of sickle cell disease usually do not occur until the age of 4 months; the prevalent symptom includes painful episodes. This pain can last from a few hours to days; these painful episodes are also known as crises. Some people have one episode every year; others have many episodes each year. Crises can be severe, which leads to hospital stays. All the symptoms of sickle cell disease are because of a lack of oxygen.

Further details are provided in the report…

Sickle Cell Disease Diagnosis

Sickle cell disease diagnosis starts with a blood test that is analyzed for defective genes or hemoglobin cells. Various screening programs also help in the early diagnosis of the disease during the prenatal or infancy period. Sickle Cell Disease management focuses on preventing and treating pain episodes and other complications. Various screening programs are also there that help in early diagnosis of the disease during the prenatal or infancy period.

Blood tests

A person can go for the screening blood test to differentiate sickle hemoglobin (hemoglobin S) or another hemoglobin (such as C, ß-thalassemia, E).

Newborn screening

Diagnosing Sickle Cell Disease early in a child is very important to prevent further complications. All babies born in most developed countries are offered screening for sickle cell disease shortly following the birth. In newborn screening programs, blood from a heel prick test is collected in “spots” on a special paper. A second test should be done to confirm the diagnosis if the test is positive.

Prenatal diagnosis

Prenatal diagnosing is done on the baby before it is born to know whether the baby is suffering from any particular disease. Different types of tests that are used include:

- Chorionic villus sampling

- Fetal blood sampling

- Amniocentesis

DNA analysis

This test can be used to investigate alterations and mutations in the gene that produces hemoglobin components. This test may be performed to determine whether someone has one or two copies of the Hb S mutation or has two different mutations in hemoglobin genes (e.g., Hb S and Hb C). Genetic testing is most often used for prenatal testing. This is done using a sample of amniotic fluid, the liquid in the sac surrounding a growing embryo, or a tissue taken from the placenta.

Further details related to country-based variations are provided in the report…

Sickle Cell Disease Therapeutics Market Landscape

The Sickle Cell Disease treatment goals aims to relieve pain, prevent infections, and specifically manage complications. Sickle Cell Disease treatment can be divided into First line treatment and second line treatment. The first line treatment includes management of pain, vaso-occlusive crisis, and chronic symptoms by using various medications, Second line treatment includes gene therapy and bone marrow transplantation.

Patients with Sickle Cell Disease use medications to make their disease less severe and treat symptoms. FDA approved medications include Voxelotor, Crizanlizumab, Hydroxyurea, L-glutamine, and others. Moreover, NSAIDS, Opioids, Iron chelating agents, Antibiotics, Folic acid and others are used for the pain and other complications associated with Sickle Cell Disease.

Acute sickle cell crises are managed primarily with drug therapy, psychologic supportive care, including oxygen. The standard treatment approach includes opioid analgesics, adequate hydration, and rest. Initial management should be aimed at providing rapid pain control. Pain management should follow the three-step “analgesic ladder” recommended by the World Health Organization for treating cancer-related pain. The choice of analgesic and dosage should be based on the severity of pain in the individual patient.

Patients with mild pain can often be treated with oral fluids and non-narcotic analgesics at home. Acetaminophen with or without codeine or oxycodone (Roxicodone), depending on pain severity, is started first. Nonsteroidal anti-inflammatory drugs (NSAIDs) can be used unless specifically contraindicated due to peptic ulcer disease, renal disease, or hepatic dysfunction. Narcotic analgesics can be used in patients with moderate to severe pain. Pain which is sufficiently severe that require an emergency department visit or hospitalization should be treated with stronger opioids.

Supportive care with oxygen therapy, hydration using fluid replacement, antibiotics in case of infection and transfusion should be considered while managing vaso-occlusive crises in Sickle Cell Disease patients. The major goals in chronic disease management are symptom control and prevention of disease complications. Hydroxyurea should be used in patients with severe complications who can reliably follow the regimen. Hydroxyurea reduces the frequency of painful crises and the need for blood transfusions in patients with recurrent painful crises.

The only chance for a cure for Sickle Cell Disease is bone marrow or stem cell transplantation. The bone marrow nurtures stem cells, which are early cells that mature into red and white blood cells and platelets. Normal hemoglobin may be produced by destroying the sickle cell patient’s diseased bone marrow and stem cells and transplanting healthy bone marrow from a genetically-matched donor.

Further details related to treatment and management are provided in the report…

Sickle Cell Disease Epidemiology

The Sickle Cell Disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases of Sickle Cell Disease trait, total prevalent cases of Sickle Cell Disease, diagnosed cases of Sickle Cell Disease, age-specific prevalent cases of Sickle Cell Disease and type-specific prevalence of Sickle Cell Disease cases in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 6MM, the United States accounted for the highest number of total Sickle Cell Disease prevalent cases in 2023.

- In the US, among the Sickle Cell Disease type-specific prevalent cases, Sickle cell anemia (hemoglobin S/S or hemoglobin S/ß0-thalassemia) was the major subtype of Sickle Cell Disease in 2023.

- Among the EU4 and the UK, France accounted for the highest number of prevalent Sickle Cell Disease cases, followed by the UK, whereas Spain accounted for the lowest number of prevalent Sickle Cell Disease cases.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Sickle Cell Disease Prevalence

KOL Views

To stay abreast of the latest trends in the Sickle Cell Disease Drugs Market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Sickle Cell Disease, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 10 KOLs across the 6MM. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Sickle Cell Disease market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Sickle Cell Disease Therapeutics Market: Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Sickle Cell Disease Therapeutics Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Sickle Cell Disease Treatment Market Report Insights

- Patient-based Sickle Cell Disease Market Forecasting

- Sickle Cell Disease Therapeutic Approaches

- Sickle Cell Disease Market Size

- Sickle Cell Disease Market Trends

- Existing Sickle Cell Disease Drugs Market Opportunity

Sickle Cell Disease Treatment Market Report Key Strengths

- 11 -year Sickle Cell Disease Market Forecast

- The 6MM Coverage

- Sickle Cell Disease Epidemiology Segmentation

- Key Cross Competition

Sickle Cell Disease Treatment Market Report Assessment

- Current Sickle Cell Disease Treatment Market Practices

- Reimbursements

- Sickle Cell Disease Drugs Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

- Sickle Cell Disease Market Drivers

- Sickle Cell Disease Market Barriers

Key Questions Answered

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in Sickle Cell Disease management recommendations?

- Would research and development advances pave the way for future tests and therapies for Sickle Cell Disease?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Sickle Cell Disease?

- How much market share will newly approved gene therapy will be able to capture and what are the chances of getting reimbursement across the 6MM.

- What kind of uptake will the new therapies witness in coming years in Sickle Cell Disease patients?

Stay Updated with us for Recent Articles

- FDA Grants Orphan Status to MDL-101 for LAMA2-CMD; Pfizer’s ABRYSVO Approved for High-Risk Adults (18-59); KIND’s AND017 Gains Orphan Designation for Sickle Cell Disease; HiberCell’s HC-7366 Fast-Tracked for AML; ORLYNVAH Approved for Uncomplicated UTIs

- IntraBio’s AQNEURSA Niemann-Pick Disease Approval; FDA Approves Novel Schizophrenia Drug After 35 Years; Selpercatinib Gets FDA Nod for RET-Mutated MTC; DUPIXENT Receives First-Ever COPD Approval; Pfizer Withdraws OXBRYTA for Sickle Cell Disease from Global Market

- Lyfgenia or Casgevy: Who Will Lead the Sickle Cell Disease Treatment Space?

- FDA Approves Lexicon’s INPEFA (Sotagliflozin); PTC Therapeutics’s Vatiquinone MOVE-FA Registration-Directed Trial; EU Approval to Novartis's Sickle Cell Disease Drug; EMA Approves Neoadjuvant Nivolumab/Chemotherapy in Resectable NSCLC; FDA Grants Priority Review to Fruquintinib for mCRC; FDA Orphan Drug Designation to Vega Therapeutics’s VGA039

- Janssen’s AKEEGA Approval; FDA Approves Roche's Polivy Combo for Frontline B-cell Lymphoma; Daiichi Sankyo’s Quizartinib for Adults With FLT3-ITD-Positive AML; bluebird bio BLA for lovo-cel for Patients with Sickle Cell Disease; Fast Track Designation for Lu-PNT2002 for mCRPC Treatment; FDA Orphan Drug Designation to XORTX’s Oxypurinol

- Novel treatment approval promises a better future for Sickle cell disease patients

- Sickle Cell Disease Market: Infographics

- Latest DelveInsight Blogs

-pipeline.png&w=256&q=75)

.jpg&w=3840&q=75)