Lyfgenia or Casgevy: Who Will Lead the Sickle Cell Disease Treatment Space?

Dec 15, 2023

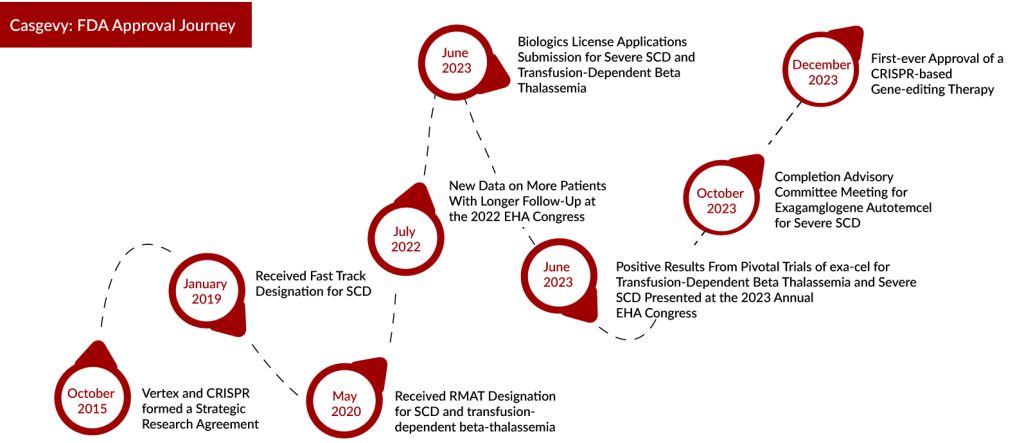

History has been created as the world captures the significance of the FDA’s approval of Casgevy (exa-cel), a collaboration between Vertex Pharmaceuticals and CRISPR Therapeutics, for the treatment of sickle cell disease (SCD). This groundbreaking therapy represents a long-awaited potential cure for the debilitating and life-threatening condition that afflicts over 100,000 individuals in the United States. DelveInsight’s analysis reveals that the overall prevalent population of sickle cell disease in the US was reported as ~105K in 2022. Within this, the prevalent population of sickle cell disease patients in the 18-44 years of age group specifically was identified to be ~7K in the same year.

Notably, it marks the inaugural use of the revolutionary CRISPR gene-editing system, a technology that garnered its inventors a Nobel Prize in 2020 and holds immense promise in addressing diseases lacking viable treatments. This approval for Vertex and CRISPR relies on findings from a crucial combined trial (Phase I/II/III) and an extensive study on safety and effectiveness. These results collectively showed that Casgevy could notably reduce severe vaso-occlusive incidents and hospital admissions.

Dr. Reshma Kewalramani, CEO and President of Vertex, highlighted the historic achievement of CASGEVY receiving FDA approval. As the first CRISPR-based gene-editing therapy in the U.S., CASGEVY represents a groundbreaking advancement, providing a one-time transformative therapy for eligible sickle cell disease patients. Dr. Kewalramani expressed profound gratitude to the patients and investigators whose trust propelled the program to this significant milestone.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Hemophilia B Market: How Pipeline Therapies are Transforming the Treatment Hemisphere?

- Notizia

- Sarepta’s deal; Fund raisings for Apexigen; Novo funded rare disease startup

- The Business Cocktail(Therapeutics)

- Takeda’s ADZYNMA Approved by FDA; AskBio Presents Preliminary Data from Phase I Trial of Gene The...

“From the outset, our company’s vision was to apply CRISPR technology to revolutionize therapeutic approaches. Witnessing the U.S. approval of the first-ever CRISPR gene-edited medicine is nothing short of breathtaking. This is a profoundly humbling moment for me and for our entire organization,” shared Dr. Samarth Kulkarni, Chairman and CEO of CRISPR Therapeutics.

Casgevy, characterized by its specific criteria for stem cell transplantation, necessitates a considerable degree of specialized expertise. Vertex is actively collaborating with proficient hospitals to establish a network of independently operated authorized treatment centers (ATCs) throughout the United States, ensuring broad access for patients.

Lyfgenia: Another Gene Therapy for Sickle Cell Disease Treatment

On an unexpected note, the FDA approved bluebird bio’s Lyfgenia (lovo-cel) on 08 December, a second gene therapy for sickle cell disease. The decision, originally anticipated by December 20, covers its application in treating SCD among individuals aged 12 and older with a history of vaso-occlusive events (VOEs). LYFGENIA, designed as a one-time gene therapy, seeks to tackle the underlying cause of Sickle Cell Disease and potentially alleviate vaso-occlusive events. The FDA’s endorsement of LYFGENIA is built upon extensive research spanning decades into lentiviral vector gene addition therapy and represents the most expansive clinical development initiative for any gene therapy targeting Sickle Cell Disease. The label’s validation is grounded in data derived from participants in the Phase I/II HGB-206 study.

“Introducing LYFGENIA to individuals grappling with sickle cell disease represents a significant achievement that bluebird has diligently pursued for nearly a decade—an accomplishment eagerly awaited by members of the sickle cell disease community for an even longer duration,” stated Andrew Obenshain, CEO of bluebird bio. “LYFGENIA holds the potential to bring about a transformative impact for patients currently navigating the challenges of unpredictable and debilitating vaso-occlusive events. This approval also solidifies bluebird’s position as a leader in gene therapy, marking our third FDA-approved ex vivo gene therapy for a rare genetic disease and our second FDA approval for an inherited hemoglobin disorder.”

The application drew upon safety data from 54 patients initiating stem cell collection. The effectiveness of LYFGENIA was confirmed through data from the Phase I/II HGB-206 Group C study, involving 36 patients. This data reflected adjustments made to treatment and manufacturing processes during clinical development. Within this group, 32 patients were evaluated for attaining complete resolution of vaso-occlusive events (VOEs) and severe VOEs in the 6-18 months following infusion, which included 8 adolescent patients.

The ongoing Phase I/II trial, HGB-206, for LYFGENIA, has completed both enrollment and treatment. Concurrently, the Phase III trial, HGB-210, investigating LYFGENIA, is in progress. Furthermore, bluebird bio is undertaking a follow-up study, LTF-307, dedicated to assessing the long-term safety and efficacy of LYFGENIA in individuals with sickle cell disease who were part of clinical studies sponsored by bluebird bio.

Does Casgevy’s Lower Price Tag Make it a Stronger Contender Against Lyfgenia?

In addition to the groundbreaking approval for the inaugural therapy employing the Nobel Prize-winning CRISPR/Cas9 gene-editing technology, the FDA has granted clearance for bluebird bio’s competing gene replacement therapy, Lyfgenia, designed for sickle cell disease. However, bluebird faces potential challenges, including a higher cost, a black box warning, and the lack of a crucial financial boost, as anticipated by several analysts. Despite the early FDA approval, bluebird’s stock witnessed a sharp 40% decline on the day of approval.

Bluebird has set the wholesale acquisition cost of Lyfgenia at $3.1 million, which is approximately 40% higher than the $2.2 million list price assigned by Vertex for its Casgevy, developed in partnership with CRISPR Therapeutics. Earlier, the Institute for Clinical and Economic Review (ICER), a U.S. drug cost watchdog, suggested that both therapies could be considered cost-effective at a price of up to $2.05 million after factoring in discounts.

Tom Klima, bluebird’s chief commercial & operating officer, highlighted on a conference call that Lyfgenia’s cost mirrors its clinical worth and the favorable influence it exerts on both the healthcare system and patients. However, he acknowledged that this doesn’t clarify the significant disparity in pricing between two gene therapies with closely comparable efficacy.

Both the sickle cell disease treatments involve single infusions, but their mechanisms differ. Lyfgenia employs a lentiviral vector to introduce genetic changes into the patient’s blood stem cells, prompting the production of a specific hemoglobin A variant to replace faulty ones. Before these approvals, bluebird had gained FDA endorsement for Zynteglo, a related medication to Lyfgenia, for treating beta-thalassemia. In contrast, Casgevy utilizes CRISPR technology to modify blood stem cells, boosting the production of fetal hemoglobin.

Black Box Warning: Another Hurdle For Lyfgenia Over Casgevy

In addition to the elevated cost, Lyfgenia’s label features a black box warning that emphasizes the potential for hematologic malignancy, whereas Vertex and CRISPR’s Casgevy approval did not carry such a boxed warning.

In the clinical trial of Lyfgenia, researchers had previously documented two instances of acute myeloid leukemia occurring post-treatment. However, it was determined that these cases were unlikely to be linked to the viral vector insertion in the gene therapy. Bluebird emphasized that the current commercial production of Lyfgenia utilizes a different manufacturing process.

Initially, Lyfgenia’s clinical trial faced a suspension following a patient’s suspected myelodysplastic syndrome, which was later reevaluated and reclassified as transfusion-dependent anemia. The individual was identified to have an alpha thalassemia trait, and this condition is currently acknowledged in the “Limitations of Use” section on Lyfgenia’s label.

Additionally, the approval of Casgevy came with a rare disease priority review voucher (PRV) from the FDA. However, the bluebird was unsuccessful in obtaining an FDA priority review voucher, a strategic move it had intended to execute by selling it to Novartis for $103 million, to bolster its financial standing.

Having introduced two gene therapies, bluebird generated $21.7 million in revenue throughout the initial nine months of 2023. In contrast, Vertex, renowned for its cystic fibrosis portfolio, amassed approximately $7.4 billion in product revenues within the corresponding timeframe.

Despite facing financial challenges, bluebird has a positive aspect in Lyfgenia’s favor. Since Zynteglo gained FDA approval 14 months ago, the company has established a network of accredited treatment centers. Out of the 35 current Zynteglo centers, 27 are prepared to accept referrals for Lyfgenia patients, with the remaining set to be fully operational by the conclusion of the first quarter of 2024. In contrast, Vertex has nine centers for Casgevy, with six of them also providing treatment for Lyfgenia.

Bluebird anticipates initiating cell collection for the initial Lyfgenia patients in the first quarter of 2024. According to Bluebird CEO Andrew Obenshain, the company will recognize revenue upon the completion of the final product infusion, and the manufacturing process for the product may span a duration of 70 to 105 days.

Downloads

Article in PDF