Spinal Implants Market Summary

Spinal Implants Market Trends & Insights

- The Spinal Implants Market is witnessing steady growth driven by the rising prevalence of spinal disorders, increasing incidence of trauma-related injuries, and a growing aging population susceptible to degenerative spine conditions.

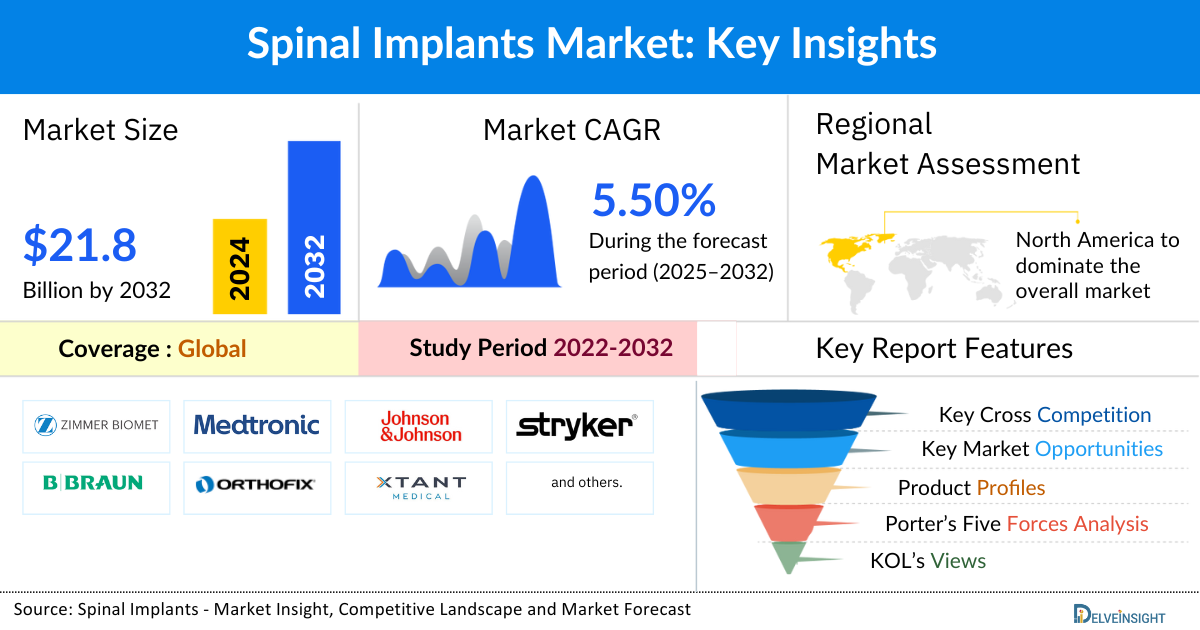

- The leading Spinal Implants Companies such as Zimmer Biomet, Medtronic plc., Johnson & Johnson Services, Inc., Stryker Corporation, B. Braun Melsungen AG, NuVasive®, Inc., Orthofix Medical Inc., XTANT MEDICAL, RTI Surgical, Life Spine, Inc., Globus Medical, Captiva Spine, Inc., Medacta International, ATEC Spine, Inc., Advin Health Care, Auxein Medical, Aurora Spine, Spineology Inc., Camber Spine Technologies, LLC, Exactech, Inc., and others.

Request for Unlocking the Sample Page of the “Spinal Implants Market”

Key Factors Impacting the Spinal Implants Market Growth

-

Rising Prevalence of Spinal Disorders

The increasing incidence of degenerative spinal conditions such as degenerative disc disease, spinal stenosis, scoliosis, and herniated discs is a major driver of the Spinal Implants market. Aging populations worldwide are more susceptible to these disorders, leading to higher demand for surgical interventions that require Spinal Implants.

-

Growing Geriatric Population

The rapid growth of the elderly population has significantly contributed to market expansion. Older adults are more prone to osteoporosis, vertebral fractures, and age-related spinal degeneration, increasing the need for spinal fusion procedures and stabilization devices.

-

Advancements in Implant Technology

Continuous technological innovations, including minimally invasive Spinal Implants, 3D-printed implants, motion-preserving devices, and advanced biomaterials, are improving surgical outcomes. These advancements enhance implant durability, biocompatibility, and patient recovery, thereby accelerating adoption among surgeons and healthcare providers.

-

Increasing Adoption of Minimally Invasive Spine Surgeries

The shift toward minimally invasive surgical techniques has boosted demand for specialized Spinal Implants. These procedures offer reduced hospital stays, lower postoperative complications, faster recovery, and improved patient outcomes, making them a preferred choice for both patients and clinicians.

-

Rising Healthcare Expenditure and Infrastructure Development

Improved healthcare infrastructure, especially in emerging markets, along with increasing healthcare spending, is facilitating greater access to advanced spinal surgeries. The expansion of specialized orthopedic and neurosurgical centers further supports market growth.

-

Favorable Reimbursement Policies in Developed Markets

Supportive reimbursement frameworks for spinal procedures in several developed countries encourage patients to opt for surgical treatment. This financial support improves procedure affordability and positively impacts the uptake of Spinal Implants.

-

Growing Awareness and Early Diagnosis

Enhanced awareness regarding spinal health, coupled with improved diagnostic imaging technologies, is enabling earlier detection of spinal disorders. Early diagnosis often leads to timely surgical intervention, driving consistent demand for spinal implant solutions.

-

Increasing Sports Injuries and Trauma Cases

The rising number of sports-related injuries, road accidents, and traumatic spinal injuries has increased the need for spinal stabilization and reconstructive procedures, further fueling the growth of the Spinal Implants market.

Spinal Implants Market by Product Type (Spinal Fusion & Fixation Devices [Thoracolumbar Devices, Cervical Fixation Devices, and Interbody Fusion Devices], Motion Preservation/Non-Fusion Devices [Artificial Disc Replacement, Dynamic Stabilization Devices, Annulus Repair Devices, and Others], Vertebral Compression Fracture Treatment Devices/Spine Augmentation Devices [Vertebroplaty Devices, Balloon Kyphoplasty Devices], Spine Biologics [Demineralized Bone Matrix, Bone Morphogenetic Proteins, Allografts, and Others]), By End-User (Hospitals, Orthopedic Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising cases of spinal disorders, increasing sports and accident-related injuries, rising demand for non-fusion and motion preservation devices, increase in product development activities among the key market players across the globe.

The global Spinal Implants Market was valued at USD 14,324.12 million in 2024, growing at a CAGR of 5.50% during the forecast period from 2025 to 2032 to reach USD 21,899.24 million by 2032. The rising cases of spinal disorders particularly among aging populations have significantly increased the demand for corrective surgical interventions. Simultaneously, the surge in sports-related and accident-induced spinal injuries is fueling the need for advanced implantable solutions. Moreover, there is a growing preference for non-fusion and motion preservation devices that maintain spinal mobility and enhance patient outcomes, especially among younger and more active individuals. Coupled with this is the uptick in product development activities and technological innovations by key market players globally, which is expanding the range of available solutions and improving surgical success rates. Together, these trends are accelerating the adoption of Spinal Implants and driving the overall market during the forecast period from 2025 to 2032.

What are the Spinal Implants Market Dynamics and Trends?

According to data provided by the World Health Organization (2024), globally, over 15 million people are living with Spinal Cord Injury (SCI). Spinal Cord Injuries (SCIs), often caused by road accidents, falls, and sports injuries, frequently require surgical intervention for stabilization, decompression, or realignment. Spinal Implants play a critical role in restoring stability, protecting the spinal cord, and aiding recovery. The rising incidence of such injuries, along with the need for rapid and minimally invasive surgical solutions, is driving the demand for advanced spinal implant systems and boosting the overall market.

Furthermore, lower back pain can significantly boost the market for Spinal Implants, especially when the condition becomes chronic or results from structural spinal issues. According, to the data provided by the World Health Organization (2023), in 2020, low back pain (LBP) affected 619 million people globally, projected to rise to 843 million by 2050 due to aging and population growth. Additionally, as per the same source, specific LBP often results from structural spinal issues or nerve root compression, sometimes causing radiating leg pain, numbness, or weakness. These symptoms often require surgical intervention when conservative treatments fail. As such cases increase, the demand for Spinal Implants to restore stability and relieve nerve pressure is expected to grow, boosting the overall spinal implant market.

Moreover, the rising product development activities by key market players are driving the growth of the Spinal Implants market. Companies are investing in R&D to create advanced solutions like minimally invasive implants, 3D-printed and patient-specific devices, bioactive coatings, and motion preservation technologies. Collaborations, increased patent filings, and regulatory approvals are further accelerating innovation and the launch of new products, boosting market expansion. For instance, in December 2024, Carlsmed, Inc. announced FDA 510(k) clearance for its aprevo® Cervical ACDF Interbody System, marking a significant milestone in AI-enabled personalized spine surgery. The FDA had previously granted breakthrough device designation to aprevo® for treating cervical spine disease, recognizing its potential to address unmet clinical needs. Carlsmed’s portfolio of aprevo® interbody fusion devices for lumbar spine disease was already commercially available in the U.S.

Thus, the factors mentioned above are expected to boost the overall market of Spinal Implants across the globe during the forecast period from 2025 to 2032. However, the risk of complications and revision surgeries, such as infection, implant failure, and nerve damage, along with the strict regulatory requirements for gaining approval, pose challenges for the Spinal Implants market. The lengthy and complex process of meeting stringent safety and efficacy standards can delay product launches and increase development costs for manufacturers, which may slightly hinder the growth of the market.

Spinal Implants Market Segment Analysis

Spinal Implants Market by Product Type (Spinal Fusion & Fixation Devices [Thoracolumbar Devices, Cervical Fixation Devices, and Interbody Fusion Devices], Motion Preservation/Non-Fusion Devices [Artificial Disc Replacement, Dynamic Stabilization Devices, Annulus Repair Devices, and Others], Vertebral Compression Fracture Treatment Devices/Spine Augmentation Devices [Vertebroplaty Devices, Balloon Kyphoplasty Devices], Spine Biologics [Demineralized Bone Matrix, Bone Morphogenetic Proteins, Allografts, and Others]), By End-User (Hospitals, Orthopedic Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the Spinal Implants market, the cervical fixation devices sub-segment under the segment of spinal fusion & fixation devices segment is expected to hold a significant share in 2024. Cervical fixation devices are significantly boosting the overall market of Spinal Implants due to their crucial role in treating a wide range of cervical spine disorders, including degenerative disc disease, trauma, spinal stenosis, and tumors that eventually metastasize to the spine. These devices such as plates, screws, rods, and interbody cages are used to stabilize the cervical spine and promote fusion after surgical interventions. Thus, the rising incidence of cervical spine issues boosts the demand for cervical fixation devices has surged globally. According, to the data provided by the World Health Organization (2024), in 2022, cervical cancer was the fourth most common cancer in women globally with around 660 000 new cases.

Additionally, cervical fixation devices offer essential mechanical support for stabilizing and realigning the cervical spine after trauma, degeneration, or surgery. They aid in maintaining vertebral alignment and promoting bone fusion, particularly post-discectomy. Companies like Zimmer Biomet with its VENTURE™ Anterior Cervical Plate System and Globus Medical’s REFLECT® Cervical Plating System provide advanced solutions that enhance surgical stability and flexibility.

Moreover, in June 2024, 4WEB Medical, an orthopedic implant company, launched the Cervical Spine Truss System Integrated Plating Solution (CSTS-IPS), the latest addition to its portfolio. The system featured a plate mechanically attached to the interbody fusion device, offering strong fixation and a stable environment for spinal fusion. Indicated for up to two contiguous disc levels, the integrated implant provided a user-friendly alternative to other standalone cervical implants.

This shows how technological innovation in cervical fixation systems is shaping the market by improving surgical accuracy and patient recovery. The adoption of minimally invasive techniques in cervical spine surgery is further driving the demand for these devices, as they reduce muscle disruption, shorten hospital stays, and enable faster rehabilitation. Advantages such as better spinal alignment, enhanced fusion rates, and reduced reoperation risks make cervical fixation devices indispensable in spine care.

Collectively, the increased clinical application, technological advancements, and growing patient acceptance of cervical fixation devices are expanding their use beyond traditional spine surgeries, thereby contributing substantially to the growth and evolution of the global spinal implant market. Thus, the factors mentioned above are expected to boost the segment thereby boosting the overall market of Spinal Implants across the globe.

The Spinal Implants Market Size is anticipated to be dominated by North America

North America is expected to account for the highest proportion of the Spinal Implants market in 2024, out of all regions. The region has a high prevalence of spinal disorders, advanced healthcare infrastructure, and a strong presence of key market players. The region also benefits from increased adoption of innovative technologies, favorable reimbursement policies, and a growing number of spinal surgeries. Additionally, rising awareness about minimally invasive procedures and continuous product development further contribute to North America's leading market position.

According to the recent data provided by the American Association of Neurological Surgeons (2024), approximately, 450,000 people in the United States were living with a SCI. Every year, an estimated 17,000 new SCIs occur in the U.S. Additionally, according to a study published by the National Institute of Health, in 2022, approximately 1.6 million spinal surgeries were performed in North America. Most spinal cord injuries are caused by trauma to the vertebral column, which affects the spinal cord’s ability to transmit messages between the brain and the body’s systems that control sensory, motor, and autonomic functions below the level of injury. This has led to an increased demand for Spinal Implants, thereby boosting the overall market across the region.

Furthermore, the growing product development activities among the key market players of Spinal Implants further escalate the market. For instance, in September 2023, ZimVie Inc. announced that the FDA approved its Mobi-C® Cervical Disc Hybrid Investigational Device Exemption (IDE) application. This approval allowed ZimVie to begin enrolling U.S. patients for a study on simultaneous cervical disc arthroplasty (CDA) and anterior cervical discectomy and fusion (ACDF) at adjacent levels between C3 and C7. The Mobi-C disc, which had already been implanted over 200,000 times since 2004, became the first FDA-approved cervical disc for one and two levels in 2013. Its low-profile endplates make it ideal for two-level disc replacements and hybrid constructs with fusion, offering both clinical and economic benefits to patients and healthcare providers.

Thus, the above-mentioned factors are expected to escalate the market of Spinal Implants in the region.

Who are the major players in Spinal Implants?

The following are the leading companies in Spinal Implants. These companies collectively hold the largest Spinal Implants market share and dictate industry trends.

- Zimmer Biomet

- Medtronic plc.

- Johnson & Johnson Services Inc.

- Stryker Corporation

- B. Braun Melsungen AG

- NuVasive® Inc.

- Orthofix Medical Inc.

- XTANT MEDICAL

- RTI Surgical, Life Spine Inc.

- Globus Medical

- Captiva Spine Inc.

- Medacta International

- ATEC Spine, Inc.

- Advin Health Care

- Auxein Medical

- Aurora Spine

- Spineology Inc.

- Camber Spine Technologies LLC

- Exactech Inc.

Recent Developmental Activities in the Spinal Implants Market:

- In January 2025, Stryker, a global leader in medical technologies, announced a definitive agreement to sell its U.S. Spinal Implants business to Viscogliosi Brothers, LLC, a family-owned investment firm specializing in the neuro-musculoskeletal space, to create a newly formed company called VB Spine, LLC.

Key Takeaways From the Spinal Implants Market Report Study

- Market size analysis for current Spinal Implants size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the Spinal Implants market.

- Various opportunities available for the other competitors in the Spinal Implants market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Spinal Implants market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for spinal implant market growth in the coming future?

Target Audience Who Can be Benefited From This Spinal Implants Market Report Study

- Spinal Implants product providers

- Research organizations and consulting companies

- Spinal Implants-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in Spinal Implants

- Various end-users who want to know more about the Spinal Implants market and the latest technological developments in the Spinal Implants market.

Stay updated with us for Recent Articles @ New DelveInsight Blogs