Stargardt Disease Market Summary

- The Stargardt Disease Market is gaining increasing attention due to rising disease awareness, advancements in genetic diagnostics, and growing research activity focused on inherited retinal disorders.

- The leading Stargardt Disease Companies such as Kubota Vision, Nanoscope Therapeutics, Alkeus Pharmaceuticals, Belite Bio, and Astellas Pharma and others.

Stargardt Disease Market & Epidemiological Analysis

- DelveInsight estimates show that the United States accounted for the highest Stargardt Disease Treatment Market Size, with nearly 55% of the Stargardt Disease Market Share as compared to EU4 and the UK and Japan in 2023.

- During the forecast period (2024–2034), Stargardt Disease Pipeline Candidates such as ALK-001 (gildeuretinol), Tinlarebant (LSB-008), IZERVAY (avacincaptad pegol), Emixustat, and Gene Therapies like MCO-010 (Sonpiretigene Isteparvovec) and others are expected to drive the rise in Stargardt disease Market Size.

- Apart from the lack of appropriate Stargardt Disease Treatment options, heterogeneity of the disease, diagnostic challenges, and lack of Stargardt Disease Prevalence knowledge are some of the other notable unmet needs associated with Stargardt disease.

- Stargardt disease, also known as Stargardt’s macular dystrophy or Juvenile Macular Degeneration, is a rare genetic eye disease that happens when fatty material builds up on the macula — the small part of the retina needed for sharp, central vision. It is the most prevalent form of recessively inherited macular dystrophy in children, estimated to affect approximately 10 to 12.5 per 100,000 individuals in the United States.

- Stargardt Disease Age of onset is a surrogate marker: The earlier the onset, the more severe the disease course.

- Stargardt disease is characterized by central vision loss, evident in color fundus photography showing macular atrophy with yellow–white lipofuscin flecks at the retinal pigment epithelium level.

- Stargardt disease, an autosomal recessive trait, stems from mutations in the ATP-binding cassette, subfamily a, member 4 (ABCA4) gene, leading to an accelerated accumulation of lipofuscin in the retinal pigment epithelium (RPE).

- Stargardt Disease Diagnosis is primarily based on family history, visual acuity, fundus examination, visual field testing, fundus autofluorescence (FAF), and optical coherence tomography (OCT)

- In 2023, the United States accounted for the highest number of Stargardt disease cases, which is 43.0% of the Stargardt Disease diagnosed-prevalent cases in the 7MM.

- Among the EU4 and the UK, out of all Stargardt Disease symptoms, the highest cases accounted for reduced vision, followed by Nyctalopia, Photophobia, and others in 2023.

- Presently, there are no standard treatments to prevent or reverse vision loss for Stargardt disease. Patients are offered low-vision aids and are advised to avoid direct sunlight and Vitamin A supplementation to delay the progression of vision loss. In cases where choroidal neovascularization is present, intravitreal anti-VEGF injections are performed.

Request for Unlocking the Sample Page of the "Stargardt Disease Treatment Market"

Key Factors Impacting the Stargardt Disease Market Growth

-

Rising Awareness and Improved Diagnosis

Growing awareness among ophthalmologists and patients regarding inherited retinal disorders is leading to earlier identification of Stargardt disease. Advances in retinal imaging technologies, such as fundus autofluorescence and optical coherence tomography, are improving diagnostic accuracy, thereby increasing the diagnosed patient pool and supporting market growth.

-

Advancements in Genetic Testing

The expanding adoption of genetic testing for ABCA4 mutations is a major growth driver for the Stargardt disease market. Precise genetic confirmation not only supports early diagnosis but also facilitates patient stratification for clinical trials, accelerating the development of targeted therapies.

-

Robust Pipeline and Innovation in Gene Therapy

An active and evolving therapeutic pipeline, particularly in gene therapy, RNA-based therapies, and stem cell approaches, is significantly boosting market prospects. Continuous innovation aimed at addressing the underlying genetic cause of Stargardt disease is attracting strong interest from biopharmaceutical companies and investors.

-

Increasing Focus on Rare Disease Research

Stargardt disease, as a rare and orphan retinal disorder, is benefiting from heightened focus on rare disease research. Incentives such as orphan drug designations, accelerated development pathways, and extended market exclusivity are encouraging companies to invest in novel treatment development.

-

Growing Unmet Medical Need

The absence of approved curative treatments for Stargardt disease highlights a substantial unmet need. Progressive vision loss at a young age drives demand for disease-modifying therapies, creating a favorable environment for market expansion as new therapeutic options advance through clinical development.

-

Rising Healthcare Expenditure and Access to Specialized Care

Improving healthcare infrastructure, especially in developed markets, is enhancing access to specialized ophthalmic and genetic services. Increased healthcare spending supports adoption of advanced diagnostics and future premium-priced therapies, further contributing to the growth of the Stargardt disease market.

Stargardt Disease Understanding

Macular Dystrophies (MDs) are a group of inherited retinal disorders that cause significant visual loss, most often as a result of progressive macular atrophy. They are characterized by bilateral, relatively symmetrical macular abnormalities that significantly impair central visual function. Stargardt disease, also known as Stargardt’s macular dystrophy or (Juvenile macular degeneration), stands out as the most prevalent form of macular degeneration in children. Patients grappling with Stargardt disease encounter visual acuity loss, often manifesting in their first or second decades of life, attributed to the atrophy of the retinal pigment epithelium (RPE) and the progressive decline of functional photoreceptors. Stargardt disease invariably results in irreversible decreased vision in nearly all cases.

Stargardt is a genetic disorder. In its typical form (STGD1), it is caused by mutations involving the ABCA4 gene through autosomal recessive homozygous or compound heterozygous transmission. Additionally, autosomal dominant transmission (STGD4) is possible through heterozygous mutations in the PROM1 gene (4p). Stargardt-like macular dystrophies (STGD3), associated with dominant mutations in the ELOVL4 gene (6q14.1), share clinical features with typical Stargardt disease (STGD2). STGD2 was later identified as the same gene as STGD3, leading to the discontinuation of the term STGD2 in 2005.

Further classification is based on the age of disease onset, categorizing STGD1 into three subgroups: early-onset Stargardt Disease Age of Onset = 10 years old), intermediate-onset Stargardt Disease Age of onset between 11 and 45 years old), and late-onset Stargardt Disease Age of Onset > 45 years old). Early-onset STGD1 is the most severe subtype, characterized by fast disease progression, a steep drop in visual acuity in the first years, and the absence of typical STGD1 flecks. Intermediate-onset STGD1 corresponds mostly with the classical STGD1 phenotype, including yellow–white pisciform flecks and slowly evolving central retinal atrophy. Late-onset STGD1 is a milder form with much slower disease progression, often preserving visual acuity for years after onset, resembling age-dependent macular degeneration, and increasing the chance of misdiagnosis.

Stargardt Disease Diagnosis

Diagnostic evaluation of Stargardt disease is based on family history, visual acuity, fundus examination, visual field testing, fluorescein angiography, fundus autofluorescence (FAF), electroretinography (electroretinography market), and optical coherence tomography (OCT). Genetic testing is currently not performed on a routine basis. Visual field testing in Stargardt patients is often normal in early disease stages. Over time, relative central scotomas develop, further progressing to absolute central scotomas variably. Typical Stargardt patients usually preserve their peripheral visual fields. However, in severe cases, with widespread retinal atrophy, visual constriction can occur. Another significant finding is the change in the preferred retinal locus of fixation.

FAF (fundus autofluorescence) imaging provides a fast, non-invasive way to study the health and viability of the RPE. Abnormally increased FAF represents excessive lipofuscin accumulation in the RPE. Inversely, decreased areas of FAF relate to low-level RPE metabolic activity, which normally underlies local atrophy with secondary photoreceptor loss. Therefore, FAF is a perfectly adequate exam to stage and diagnose Stargardt, especially if combined with ultrastructural data derived from OCT.

Stargardt Disease Treatment

Stargardt disease remains an incurable condition. Current therapeutic options include photoprotection and low-vision aids. Pharmacological slow-down of the visual cycle, gene therapy, and other treatment options aim to prevent lipofuscin accumulation and represent prospects of long-term visual rescue. Stargardt Disease patients, already sensitive to light due to impaired ABCA4 function and elevated all-trans-retinal levels, should avoid direct sunlight and Vitamin A supplementation. Ultraviolet-blocking sunglasses are a useful option for Stargardt patients to avoid direct sunlight exposure.

There are currently several ongoing studies and Stargardt Disease clinical trials investigating the potential of various new therapeutic candidates, with gene replacement, stem cell therapy, and pharmacological approaches that may soon bring the scientific and medical community closer to the goal of preventing vision loss in patients with Stargardt disease.

Stargardt Epidemiology

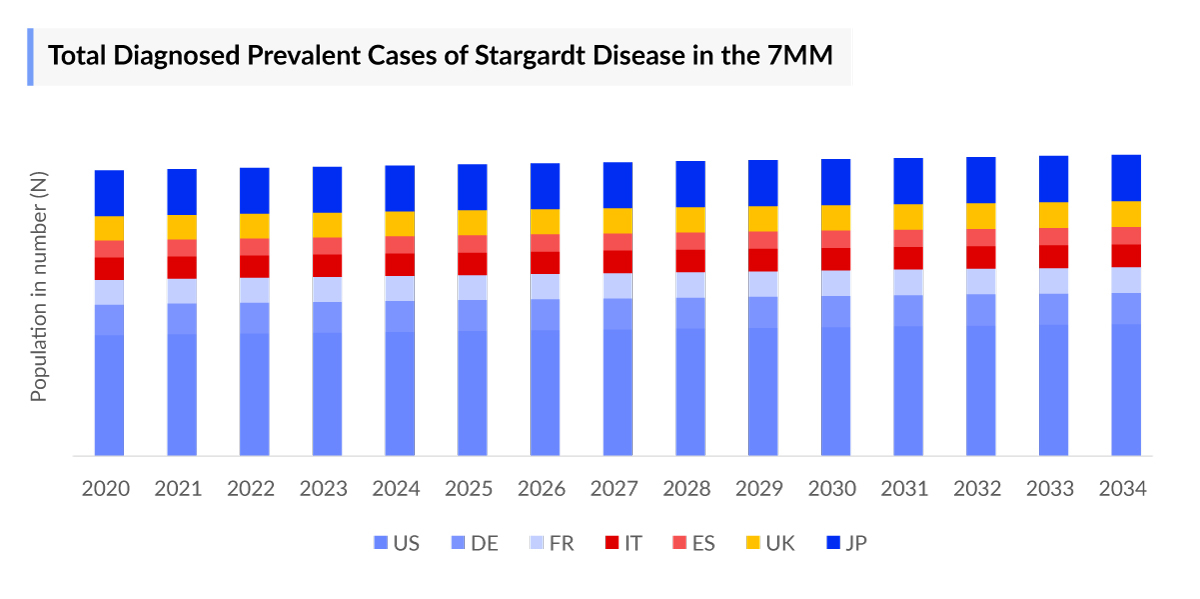

The Stargardt epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by diagnosed prevalent cases, onset-age specific cases, type-specific cases, symptom-specific and treated cases in the United States, EU4 countries (Germany, France, Italy, Spain), and the United Kingdom, and Japan from 2020 to 2034.

Key findings from Stargardt Epidemiological Analysis and Forecast

- Among the 7MM, the United States accounted for the highest number of Stargardt Disease Diagnosed Prevalent Cases, which is 43.0% of the Stargardt Disease diagnosed-incident cases in 2023.

- In the US, out of all age groups, the highest onset age-specific cases accounted for >20 years, followed by 20-39 years in 2020. In contrast, the least onset age-specific cases were observed in =60 years age groups.

- Among the EU4 and the UK, Germany accounted for the highest number of Stargardt Disease prevalence cases, followed by the UK, whereas Spain accounted for the lowest number of prevalent cases.

- In Japan, the highest symptoms-specific cases of Symptomatic Stargardt Disease were for reduced vision, followed by Nyctalopia, Photophobia, and other cases, respectively, in 2023.

Stargardt Disease Epidemiology Segmentation in the 7MM

- Stargardt Disease Diagnosed Prevalent Cases

- Stargardt Disease Onset-Age Specific Cases

- Stargardt Disease Type-specific Cases

- Stargardt Disease Symptom-specific and Treated Cases

Stargardt Disease Therapeutics Market

- In 2023, the total Stargardt Disease treatment market size was around USD 27 million, which is expected to increase by 2034 during the study period (2020 – 2034) in the 7MM.

- Among the 7MM, the United States accounted for the highest Stargardt Disease market size in 2023, followed by Japan for Stargardt.

- Stargardt Disease Companies such as Kubota Vision, Nanoscope Therapeutics, Alkeus Pharmaceuticals, Belite Bio, Astellas Pharma, and others, are involved in developing therapies for Stargardt. The expected launch of emerging therapies and other treatments will lead to a significant increase in the Stargardt Disease treatment market size during the forecast period [2024–2034].

- During the forecast period (2024–2034), Stargardt Disease Pipeline candidates such as ALK-001 (gildeuretinol), Tinlarebant (LSB-008), IZERVAY (avacincaptad pegol), MCO-010 (Sonpiretigene Isteparvovec), and Emixustat are expected to drive the rise in Stargardt disease market size.

- By 2034, MCO-010 (Sonpiretigene Isteparvovec) is expected to garner the highest market share, followed by ALK-001 (gildeuretinol) in the 7MM.

Stargardt Disease Market Recent Developments

- In Sept 2025, VeonGen Therapeutics received FDA’s RMAT designation for VG801, a gene therapy targeting Stargardt disease and other retinal dystrophies linked to ABCA4 mutations. VG801 uses a dual AAV vector and the proprietary vgRNA REVeRT platform to deliver a functional ABCA4 gene via an engineered vgAAV capsid to photoreceptor cells.

- In August 2025, AAVantgarde Bio received FDA Fast Track Designation for AAVB-039, its next-generation gene therapy for Stargardt disease secondary to biallelic ABCA4 mutations. The FDA also cleared the IND application for AAVB-039 to proceed, supporting advancement toward clinical development.

- In Feb 2025, Ocugen, Inc. announced that it reached alignment with the FDA to proceed with a Phase 2/3 pivotal confirmatory clinical trial for OCU410ST, a modifier gene therapy candidate for Stargardt disease, which could support a biologics license application (BLA) submission if successful.

Stargardt Disease Drugs Analysis

The section dedicated to drugs in the Stargardt therapeutics market report provides an in-depth evaluation of Stargardt Disease Pipeline Drugs analysis(Phase III, Phase II, and Phase I). The drug chapters section provides valuable information on various aspects related to the Stargardt Disease clinical trials such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Stargardt.

Emerging Stargardt Disease Therapies

-

Emixustat: Kubota Pharmaceuticals

Emixustat, developed by Kubota Pharmaceuticals, is an oral drug initially designed to target the dry form of age-related macular degeneration. It functions by slowing the buildup of toxic waste products that contribute to retinal degeneration in various retinal conditions, including Stargardt disease.

The Stargardt Disease mechanism of action involves the modulation of the visual cycle by inhibiting a critical enzyme in this pathway, Retinal pigment epithelium-specific 65 kDa protein (RPE65). By slowing the visual cycle, Emixustat reduces the availability of vitamin A derivatives (11-cis-and all-trans-retinal) to form precursors of A2E and related compounds. In animal models of Stargardt disease and retinal degeneration, Emixustat has demonstrated the ability to decrease the accumulation of A2E and protect the retina from light-induced damage.

In human clinical studies, orally delivered Emixustat has been generally well tolerated. An interesting pharmacological observation is a delayed dark adaptive response in an electrical retinogram, which is considered a common sign of Emixustat’s effect. In August 2020, Kubota Vision Inc., a clinical-stage ophthalmology company and a wholly-owned subsidiary of Kubota Pharmaceutical, announced that the US FDA Office of Orphan Products Development (OOPD) had awarded an orphan products clinical trial grant to support the Phase III study of emixustat in Stargardt disease.

-

MCO-010: Nanoscope Therapeutics

Nanoscope’s MCO-010 is an optogenetic gene therapy that utilizes a convenient and well-established intraocular injection to deliver a gene encoding the ambient light-sensitive MCO protein into retinal cells. Multi-Characteristic Opsin (MCO) re-sensitize the retina for detecting low light levels to restore vision in blind patients, specifically for the treatment of Stargardt disease, with the goal of improving visual function. The company’s lead asset, MCO-010, holds the potential to restore vision in millions of visually impaired individuals suffering from retinal degenerative diseases, including Stargardt Disease and others. The company has fully enrolled in the Phase II STARLIGHT trial of MCO-010 therapy in Stargardt patients.

In January 2023, Nanoscope Therapeutics Inc. announced that the US FDA had granted Fast Track Designation (FTD) to MCO-010.

Stargardt Disease Market Outlook

Stargardt disease is a rare genetic eye disease that occurs when fatty material builds up on the macula, the small part of the retina responsible for sharp, central vision. It is caused by a mutation in the ABCA4 gene (also caused by other genes in some instances), which prevents the production of a protein that cleans up the fatty material left over from vitamin A metabolism. As a result, the fatty material accumulates in yellowish clumps on the macula, eventually killing the light-sensitive cells and destroying central vision.

Currently, no treatment modality is recommended by the FDA to prevent or reverse visual loss in Stargardt Disease Patients. Stargardt Disease Patients are advised to avoid smoking, avoid taking supplements containing vitamin A, and also to use photoprotection to delay the disease progression. Low-vision aids are also recommended for visual assistance in those with visual field loss, and proper refractive correction is prescribed. Intravitreal anti-vascular endothelial growth factor (VEGF) injections are the preferred treatment modality for patients developing choroidal neovascular membrane, which is a rare and late complication.

Many new molecules with novel mechanisms, like emixustat, gildeuretinol, tinlarebant, avacincaptad pegol, among others, and gene therapies like MCO-010 and others, are being developed for the treatment of Stargardt disease by key Stargardt Disease Companies like Kubota Vision, Nanoscope Therapeutics, Alkeus Pharmaceuticals, Belite Bio, Astellas Pharma, among others.

In conclusion, despite the lack of appropriate treatment in the current Stargardt Disease treatment market landscape, many potential therapies with novel mechanisms are expected to enter the market, resolving a dire unmet need and leading to significant improvement in the treatment outcome of Stargardt disease patients. Hence, with the upcoming availability of new treatment options and increasing healthcare spending across the 7MM, the Stargardt Disease treatment market scenario is expected to experience significant growth during the forecast period (2024–2034). The expected launch of innovative therapies during the forecast period (2024–2034), coupled with an expanding diagnosed patient pool, is anticipated to significantly boost the Stargardt disease market. Advances in gene therapy, visual cycle modulation, and other targeted approaches underscore the growing commitment of biotech companies to bring transformative solutions to patients. Collectively, these efforts are set to drive a major positive shift in the market landscape in the coming years.

Latest KOL Views on Stargardt Disease

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research. We have reached out to industry experts to gather insights on various aspects of Stargardt, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 10 KOLs across the 7MM. We contacted institutions such as the UCL Institute of Ophthalmology, the National Institute of Sensory Organs, the University of California, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Stargardt treatment market forecast, which will assist our clients in analyzing the overall epidemiology and market scenario.

Stargardt Disease Qualitative Analysis Report

We perform Qualitative and Stargardt Disease Drugs Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Stargardt Disease treatment market landscape.

Conjoint Analysis analyzes multiple approved and Stargardt Disease emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Stargardt Disease Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities. The Stargardt Disease therapeutics market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Stargardt Disease Market Report Scope

- The Stargardt Disease therapeutics market report offers extensive knowledge regarding the epidemiology segments (by region, Stargardt Disease prevalence cases, type, and total Stargardt Disease diagnosed cases) and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies such as ALK-001 (gildeuretinol), Tinlarebant (LSB-008), and the elaborative profiles of late and mid-stage (Phase III and Phase II) and prominent therapies that would impact the current Stargardt Disease Treatment Market Landscape and result in an overall market shift has been provided in the report.

- The Stargardt Disease Therapeutics Market Report also encompasses a comprehensive analysis of the Stargardt market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The Stargardt Disease therapeutics market report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM Stargardt drugs market.

Stargardt Disease Therapeutics Market Report Insights

- Patient-based Stargardt Disease Market Forecasting

- Stargardt Disease Therapeutic Approaches

- Stargardt Treatment Market Size and Trends

- Existing Stargardt Disease Drugs Market Opportunity

Stargardt Disease Market Report Key Strengths

- 11-year Stargardt Disease Market Forecast

- The 7MM Coverage

- Stargardt Epidemiology Segmentation

- Key Cross Competition

Stargardt Disease Market Report Assessment

- Current Stargardt Disease Treatment Market Practices

- Reimbursements

- Stargardt Disease Drugs Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet Needs)

Key Questions Answered in the Stargardt Disease Market Report

- Would there be any changes observed in the current Stargardt Disease treatment approach?

- Will there be any improvements in Stargardt management recommendations?

- Would research and development advances pave the way for future tests and therapies for Stargardt?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Stargardt?

- What kind of uptake will the new therapies witness in the coming years in Stargardt patients?

Stay updated with us for Recent Articles

.jpg)

.jpg)