Transthyretin Amyloidosis (ATTR) Market Summary

- The Transthyretin Amyloidosis Market is anticipated to expand due to various factors, including increased awareness, advancements in diagnostic tools, new treatment options, and a rise in the prevalence of the condition.

- The leading Transthyretin Amyloidosis Companies such as Alnylam Pharmaceutical, Ionis Pharmaceuticals/Akcea, Eidos Therapeutics, Intellia/Regeneron, and others.

Transthyretin Amyloidosis (ATTR) Market and Epidemiology Analysis

- As per a study by González-Moreno et al. (2021), in Spain, there are two large endemic foci of ATTRv amyloidosis (Majorca and Huelva), and additional cases occur across the country; however, these data may be incomplete, as there is no centralized patient registry. In Majorca, the largest focus in Spain, the prevalence has been estimated to be 5/100,000 inhabitants.

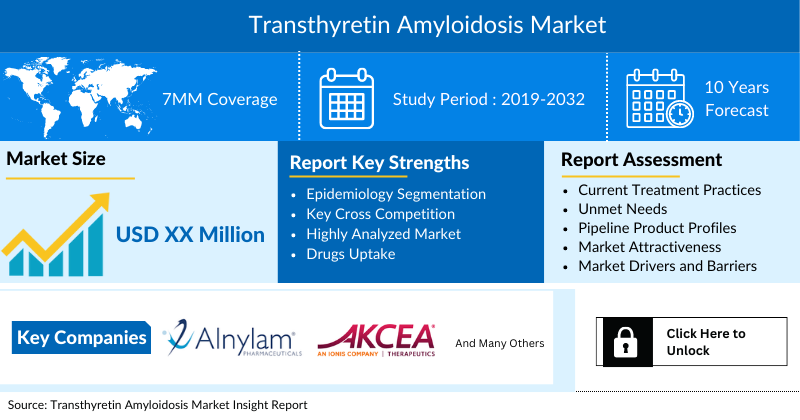

- In 2022, the total diagnosed prevalent population of hATTR in the 7MM was approximately 12,000 cases which are expected to increase in the forecast period (2023–2032).

- hATTR is a systemic autosomal dominant disorder characterized by the extracellular deposition of misfolded TTR protein. hATTR cases are divided into two segments: Familial Amyloid Polyneuropathy (FAP) and Familial Amyloid Cardiomyopathy (FAC) cases.

- Among EU4 and the UK, Italy has the highest diagnosed prevalent population of hATTR, with approximately 1,500 cases, followed by France in 2022. On the other hand, the United Kingdom has the lowest diagnosed prevalent population in the same year.

- In 2022, nearly 500 diagnosed prevalent cases of hATTR were found in Japan. Out of which, approximately 150 cases were of FAP, and 350 cases were of FAC.

Request for unlocking the CAGR of the "Transthyretin Amyloidosis Market"

Factors Impacting the Transthyretin Amyloidosis (ATTR) Market Growth

-

Growing Prevalence of Transthyretin Amyloidosis

The rising prevalence of transthyretin amyloidosis (ATTR), including both hereditary and wild-type forms, is a major market driver. Increasing awareness and improved diagnostic methods are leading to early detection, resulting in a larger diagnosed patient pool that demands effective treatment options.

-

Advancements in Diagnostic Technologies

Advances in diagnostic imaging techniques, biomarker identification, and genetic testing are fueling the ATTR market. Early and accurate diagnosis of ATTR is critical for initiating treatment and managing disease progression, thereby driving the adoption of novel therapies.

-

High Unmet Medical Needs Driving Demand

Despite recent approvals, ATTR still has a high unmet medical need due to its progressive nature and severe complications. This gap encourages heavy R&D investments and ensures high demand for novel therapeutics that can improve survival and quality of life.

-

Rising Awareness and Advocacy Initiatives

Patient advocacy groups and awareness campaigns are playing a crucial role in driving market growth. Enhanced disease education among healthcare providers, patients, and caregivers is improving diagnosis rates and encouraging more patients to seek treatment.

DelveInsight’s report titled “Transthyretin Amyloidosis Market Insights, Epidemiology, and Market Forecast – 2032” comprehensively analyzes Transthyretin Amyloidosis. The report includes a detailed examination of the historical and projected epidemiology data that includes diagnosed prevalent cases of Transthyretin Amyloidosis segmented by type and stage. The report offers an in-depth understanding of the various aspects related to the patient population, including diagnosis, prescriptions patterns, physician perspectives, market access, Transthyretin Amyloidosis treatment market, and future market developments for the seven major markets, including the United States, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan from 2019 to 2032.

Scope of the Transthyretin Amyloidosis (ATTR) Market Report | |

|

Study Period |

2019–2032 |

|

Forecast Period |

2023–2032 |

|

Geographies Covered |

|

|

Epidemiology |

|

|

Transthyretin Amyloidosis Market |

|

|

Transthyretin Amyloidosis Market Analysis |

|

|

Transthyretin Amyloidosis Companies in the Market |

|

|

MOA of Emerging Drugs |

|

Transthyretin Amyloidosis Disease Understanding

Transthyretin Amyloidosis Overview

Transthyretin Amyloidosis (ATTR) is a rare genetic disorder characterized by the accumulation of abnormal amyloid protein deposits segmented by two main types: hereditary ATTR (hATTR) and wild-type ATTR (wtATTR). hATTR is caused by inherited mutations in the TTR gene, while wtATTR occurs in individuals without a known genetic mutation and is more commonly associated with aging. There are several challenges in managing Transthyretin Amyloidosis, as it is often underdiagnosed or misdiagnosed due to its rarity and the variability of symptoms, leading to delayed initiation of appropriate treatment. Tailoring treatment plans for individual patients’ needs and characteristics is complex due to disease heterogeneity.

Transthyretin Amyloidosis Diagnosis and Treatment Algorithm

Diagnosis of ATTR amyloidosis typically involves a combination of clinical evaluation, genetic testing to identify TTR mutations, and imaging studies such as cardiac MRI or nuclear scintigraphy to assess organ involvement and amyloid deposition. Treatment options for ATTR amyloidosis include disease-modifying therapies, symptomatic management, and supportive care. Disease-modifying treatments aim to reduce the production of abnormal transthyretin protein or stabilize the existing protein to prevent its deposition as amyloid. These treatments may include medications like TTR stabilizers or gene-silencing therapies.

Transthyretin Amyloidosis Epidemiology

The Transthyretin Amyloidosis epidemiology section provides insights into the historical and current Transthyretin Amyloidosis patient pool and forecasted trends for seven individual major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the report also provides the diagnosed patient pool, its trends, and assumptions undertaken. The epidemiology section on spinal cord injuries report offers information on the patient populations, including historical and projected trends for each of the seven major markets. Examining key opinion leader views from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report.

Key Findings from Transthyretin Amyloidosis Epidemiological Analysis and Forecast

- As per a study by González-Moreno et al. (2021), in Spain, there are two large endemic foci of ATTRv amyloidosis (Majorca and Huelva), and additional cases occur across the country; however, these data may be incomplete, as there is no centralized patient registry. In Majorca, the largest focus in Spain, the prevalence has been estimated to be 5/100,000 inhabitants.

- In 2022, the total diagnosed prevalent population of hATTR in the 7MM was approximately 12,000 cases which are expected to increase in the forecast period (2023–2032).

- hATTR is a systemic autosomal dominant disorder characterized by the extracellular deposition of misfolded TTR protein. hATTR cases are divided into two segments: Familial Amyloid Polyneuropathy (FAP) and Familial Amyloid Cardiomyopathy (FAC) cases.

- Among EU4 and the UK, Italy has the highest diagnosed prevalent population of hATTR, with approximately 1,500 cases, followed by France in 2022. On the other hand, the United Kingdom has the lowest diagnosed prevalent population in the same year.

- In 2022, nearly 500 diagnosed prevalent cases of hATTR were found in Japan. Out of which, approximately 150 cases were of FAP, and 350 cases were of FAC.

Recent Developments & Breakthroughs in the Transthyretin Amyloidosis Market

- In March 2025, Alnylam Pharmaceuticals announced moderated poster presentations of new data from the HELIOS-B Phase 3 trial, evaluating vutrisiran for treating ATTR amyloidosis with cardiomyopathy (ATTR-CM) in a patient population representative of today’s cases.

- In March 2025, Intellia Therapeutics announced that the FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation to nexiguran ziclumeran (nex-z, also known as NTLA-2001) for treating transthyretin (ATTR) amyloidosis with cardiomyopathy (ATTR-CM).

- In March 2025, Alnylam Pharmaceuticals announced FDA approval of the supplemental New Drug Application (sNDA) for its RNAi therapeutic, AMVUTTRA® (vutrisiran), for treating the cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular mortality, hospitalizations, and urgent heart failure visits.

- In February 2025, BridgeBio Pharma received European approval for acoramidis, a drug treating cardiomyopathy caused by transthyretin amyloidosis (ATTR), a rare metabolic condition. The approval strengthens BridgeBio’s position to compete with Pfizer’s blockbuster drug, currently the standard treatment for ATTR.

- In January 2025, Life Molecular Imaging secured fast-track designation from the U.S. FDA for its amyloid PET radiotracer, used to visualize cardiac amyloid light-chain (AL) and amyloid transthyretin-related (ATTR) amyloidosis.

- On November 26, 2024, Alnylam Pharmaceuticals (ALNY) announced that the FDA has accepted its supplemental new drug application (sNDA) for review, seeking label expansion of Amvuttra (vutrisiran) to treat ATTR amyloidosis with cardiomyopathy (ATTR-CM).

- On November 12, 2024, Attralus, Inc., a clinical-stage biopharmaceutical company focused on developing innovative medicines for systemic amyloidosis, announced that the U.S. Food and Drug Administration (FDA) has granted orphan drug designation to AT-02 for the treatment of transthyretin-associated amyloidosis (ATTR), a rare, progressive, and often fatal condition.

- On August 30, 2024 – Alnylam Pharmaceuticals, Inc., a leader in RNAi therapeutics, announced detailed results from the HELIOS-B Phase III study of vutrisiran, an investigational RNAi therapeutic for ATTR amyloidosis with cardiomyopathy (ATTR-CM).

Transthyretin Amyloidosis Drug Analysis

Transthyretin Amyloidosis Marketed Drugs

-

VYANDAMAX (tafamidis) and VYNDAQEL (tafamidis meglumine): Pfizer

In May 2019, the US FDA approved two therapies, VYNDAQEL (tafamidis meglumine) and VYNDAMAX (tafamidis), for the treatment of the cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular mortality and cardiovascular-related hospitalization. Tafamidis is a selective stabilizer of TTR; it binds to TTR at the thyroxine binding sites, stabilizing the tetramer and slowing dissociation into monomers, the rate-limiting step in the amyloidogenic process.

-

TEGSEDI (inotersen): Akcea and Ionis

In October 2018, Akcea and Ionis received FDA approval for TEGSEDI (inotersen) to treat the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults. It is the world’s first and only SC RNA-targeting drug designed to reduce the production of human transthyretin (TTR) protein. TEGSEDI has also received marketing authorization in the European Union.

Transthyretin Amyloidosis Emerging Drugs

The treatments currently available in the landscape of Transthyretin Amyloidosis aim to mitigate the complications associated with the condition. The Transthyretin Amyloidosis market dynamics are expected to change, primarily due to increased healthcare spending worldwide. Market players such as Alnylam Pharmaceuticals, Ionis Pharmaceuticals/Akcea, Eidos Therapeutics, Intellia/Regeneron, and others actively develop Transthyretin Amyloidosis treatments.

-

Vutrisiran (ALN-TTRsc02): Alnylam Pharmaceuticals

Vutrisiran is designed to be administered via SC injection, aiming to provide long-lasting and durable suppression of TTR production. Ongoing Transthyretin Amyloidosis clinical trials evaluate its efficacy, safety, and tolerability in different forms of ATTR, including hereditary ATTR (hATTR) and wild-type ATTR (wtATTR) in Phase III of Transthyretin Amyloidosis clinical trials development.

-

Eplontersen: Ionis Pharmaceuticals/Akcea

Eplontersen, a novel LIgand-Conjugated Antisense (LICA) medication, is currently under investigation to suppress the production of the transthyretin (TTR) protein. This monthly self-administered SC injection is being developed as a therapeutic option for all types of Transthyretin Amyloidosis (ATTR).

In March 2023, Ionis reported positive topline 66-week results of eplontersen Phase III study for patients with ATTRv-PN.

-

Acoramidis (AG10): Eidos Therapeutics

Acoramidis, also known as AG10, is a small molecule currently undergoing investigation in Phase III Transthyretin Amyloidosis clinical trials for patients with Transthyretin Amyloid Cardiomyopathy (ATTR-CM) and Transthyretin Amyloid Polyneuropathy (ATTR-PN). These clinical trials, known as ATTRibute-CM and ATTRibute-PN, evaluate the safety and efficacy of acoramidis (AG10). The results of these trials will provide valuable insights into the potential benefits of acoramidis (AG10) in treating these conditions.

-

NTLA-2001: Intellia/Regeneron

NTLA-2001 is the first investigational CRISPR therapy candidate to be administered systemically or through a vein to edit genes inside the human body and could potentially be the first single-dose treatment for ATTR amyloidosis. The company plans to initiate a global pivotal NTLA-2001 trial for ATTR-CM by year-end 2023 and prepare for a Phase III study of NTLA-2001 to treat ATTRv-PN.

In October 2022, Regeneron collaborated with Intellia and announced successful clinical trials of their CRISPR Cas9-based gene editing treatment, NTLA-2001.

Transthyretin Amyloidosis Market Outlook

In the past, the management of transthyretin amyloidosis was limited in terms of available treatment options. However, recent advancements have introduced disease-modifying therapies that significantly improve patient outcomes. Recently, a few drugs have been approved for treating hereditary transthyretin amyloidosis (hATTR). These include TEGSEDI (inotersen), ONPATTRO (patisiran), VYNDAQEL (tafamidis meglumine), and VYNDAMAX (tafamidis). These approved therapies have provided new avenues for managing hATTR and have shown promise in improving the quality of life for affected individuals.

Efforts are underway to expand the Market further through ongoing Transthyretin Amyloidosis clinical trials, research and development, and the potential introduction of additional innovative therapies. According to DelveInsight, the Transthyretin Amyloidosis market size in the 7MM is expected to change during the study period 2019–2032 significantly.

Transthyretin Amyloidosis Market Segmentation

DelveInsight’s ‘Transthyretin Amyloidosis – Market Insights, Epidemiology, and Market Forecast – 2032’ report provides a detailed outlook of the current and future Transthyretin Amyloidosis market, segmented within countries, by therapies, and by classes. Further, the Market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Market Size by Countries

The total Market of Transthyretin Amyloidosis is analyzed for individual countries (the United States Market, EU4 (Germany, France, Italy, and Spain) and the UK market, and Japan). The United States accounted for a larger portion of the 7MM market for spinal cord injuries in 2022 due to the high prevalence of the condition and the higher cost of treatments. This dominance is predicted to continue with the potential early entry of new products.

Market Size by Therapies

The market size for therapies targeting Transthyretin Amyloidosis is influenced by several treatment approaches. This includes disease-modifying therapies such as TTR stabilizers and gene-silencing therapies, symptomatic management options, and supportive care measures. The market size is determined by regional variations, the availability, and adoption of novel therapies, regulatory approvals, reimbursement policies, and the increasing awareness and diagnosis of Transthyretin Amyloidosis. Ongoing Transthyretin Amyloidosis clinical trials, advancements in diagnostic tools, and the rising prevalence of the condition further contribute to the growth and expansion of the Market for Transthyretin Amyloidosis therapies.

Transthyretin Amyloidosis Drugs Uptake

This section focuses on the sales uptake of potential drugs that have recently launched or are anticipated to be launched in the Transthyretin Amyloidosis market between 2019 and 2032. It estimates the market penetration of the drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the Market. The Transthyretin Amyloidosis emerging therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the Transthyretin Amyloidosis unmet need they fulfill in the Market.

Transthyretin Amyloidosis Market Access and Reimbursement

DelveInsight’s ‘Transthyretin Amyloidosis Market Insights, Epidemiology, and Market Forecast – 2032’ report provides a descriptive overview of the market access and reimbursement scenario of Transthyretin Amyloidosis.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

Transthyretin Amyloidosis KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as the Amyloidosis Center at Boston University School of Medicine in the US Department of Neurology at Nagoya University Graduate School of Medicine in Japan.

“Hereditary ATTR (hATTR) is patients are seen more than wild-type ATTR (wtATTR).”

“There are many cases that are misdiagnosed and underdiagnosed.”

Note: Detailed assessment of KOL Views will be provided in the full report of Transthyretin Amyloidosis.

Transthyretin Amyloidosis Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Transthyretin Amyloidosis Market using various Competitive Intelligence tools, including SWOT analysis, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Transthyretin Amyloidosis Pipeline Development Activities

The Transthyretin Amyloidosis pipeline segment provides insights into therapeutic candidates in Phase II and III stages. It also analyses Transthyretin Amyloidosis companies involved in developing targeted therapeutics.

Latest KOL Views on Transthyretin Amyloidosis

To keep up with current market trends and fulfill gaps in secondary findings, we interview KOLs and SMEs’ working in the Transthyretin Amyloidosis domain. Their opinion helps understand and validate current and Transthyretin Amyloidosis emerging therapies and treatment patterns or Transthyretin Amyloidosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Market and the Transthyretin Amyloidosis unmet needs.

Transthyretin Amyloidosis Market Forecast Report Insights

- Patient-based Transthyretin Amyloidosis Market Forecasting

- Therapeutic Approaches

- Transthyretin Amyloidosis Pipeline Analysis

- Transthyretin Amyloidosis Market Size and Trends

- Market Opportunities

- Impact of Upcoming Therapies

Transthyretin Amyloidosis Market Forecast Report Key Strengths

- 10 Years Transthyretin Amyloidosis Market Forecast

- The 7MM Coverage

- Transthyretin Amyloidosis Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Transthyretin Amyloidosis Drugs Uptake

Transthyretin Amyloidosis Treatment Market Report Assessment

- Current Transthyretin Amyloidosis Treatment Market Practices

- Transthyretin Amyloidosis Unmet Needs

- Transthyretin Amyloidosis Pipeline Drugs Profiles

- Transthyretin Amyloidosis Market Attractiveness

Key Questions Answered in the Transthyretin Amyloidosis Market

Transthyretin Amyloidosis Market Insights

- What are the key findings of the Market across the 7MM, and what country will have the largest Transthyretin Amyloidosis market size during the forecast period (2023–2032)?

- What are the challenges in the management of Transthyretin Amyloidosis?

- At what CAGR is the Transthyretin Amyloidosis market, and is epidemiology expected to grow in the 7MM during the forecast period (2023–2032)?

- In what ways would the unmet needs impact market dynamics and subsequently influence the analysis of related trends?

- What would be the forecasted patient pool of Transthyretin Amyloidosis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- Which medications have received approval for the treatment of Transthyretin Amyloidosis? How would the expiration of their patents impact the Market?

- What are the latest advancements in novel therapies, targets, mechanisms of action, and technologies being developed to address the limitations of existing therapies for Transthyretin Amyloidosis?

- How many companies are currently engaged in the development of therapies for the treatment of Transthyretin Amyloidosis?

For More In-depth Information:-