Wilson Disease Market Summary

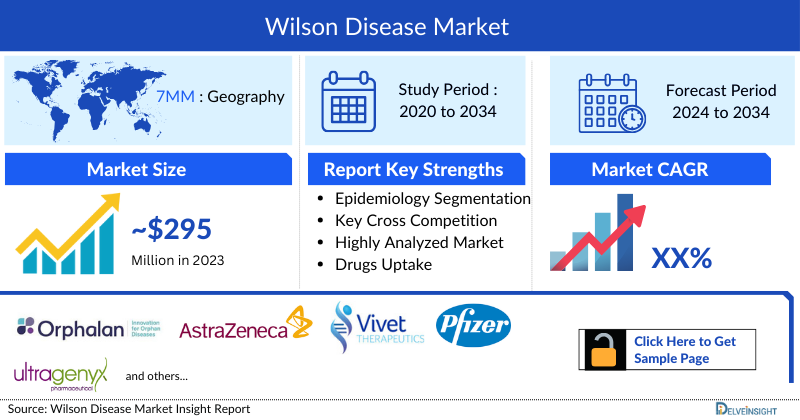

- The Wilson’s disease market in the 7MM is projected to grow at a significant CAGR by 2034 in the leading countries (US, EU4, UK and Japan).

Wilson’s Disease Market and Epidemiology Analysis

- According to DelveInsight's estimate, the total diagnosed prevalent cases of Wilson’s disease in the 7MM were approximately 8000 in 2023. These cases are expected to increase during the forecast period (2024–2034).

- In 2023, the market size of Wilson’s Disease was highest in the US among the 7MM, accounting for approximately USD 126 million, which is further expected to increase at a CAGR of 13%.

- The current treatment strategies mainly rely upon the use of Chelating agents (D-penicillamine, trientine), Zinc Salts, and others. Chelating agents accounted for highest market share of ~123 million in 2023, for the Wilson’s Disease treatment in the US.

- In May 2022, the FDA approved Orphalan's CUVRIOR (trientine tetrahydrochloride) for the treatment of adults with stable Wilson's disease who are decoppered and tolerant to penicillamine.

- The Wilson’s Disease treatment market in the 7MM is driven by increasing awareness and early diagnosis, advancements in genetic testing, and ongoing research into new therapies. Increased prevalence and growing healthcare investment in rare diseases also contribute to market growth. Additionally, patient advocacy plays a role in pushing for improved treatments and driving market expansion.

- In January 2026, Hyloris Pharmaceuticals obtained exclusive license rights in Europe and Turkey from ArborMed for an investigational next-generation Wilson's Disease therapy, with first-in-human trials planned for 2026 and patient studies by 2027.

- In November 2025, Monopar Therapeutics presented Phase 2 copper balance study data (ALXN1840-WD-204) at the American Association for the Study of Liver Diseases (AASLD) annual meeting, demonstrating rapid and sustained reduction in daily copper balance through increased fecal copper excretion.

- In March, 2025, European Association for the Study of the Liver (EASL) and European Reference Network (ERN) published new Clinical Practice Guidelines on Wilson's Disease, introducing significant advancements in diagnosis, monitoring, and treatment recommendations.

- The FDA has granted Fast Track designation to VTX-801, Vivet’s gene therapy currently in clinical stages for treating Wilson's Disease. This designation is part of the FDA’s Fast Track program, which aims to accelerate the development and review of innovative therapies that address serious conditions and unmet medical needs.

Factors Impacting the Wilson Disease Market Growth

-

Emergence of gene therapy as curative approach

Multiple gene therapy clinical trials are underway aiming to deliver functional copies of the ATP7B gene directly into the liver, offering potential one-time treatments that address the underlying genetic cause rather than lifelong symptom management

-

Development of novel targeted de-coppering therapies

Next-generation oral chelators designed to selectively bind and remove copper from tissues and blood are demonstrating superior copper mobilization compared to standard-of-care treatments, with late-stage candidates receiving orphan drug designations and showing statistically significant improvements in clinical trials

-

Patient intolerance to traditional chelating agents

Growing evidence of neurological worsening and adverse reactions with conventional treatments like penicillamine and trientine is driving pharmaceutical companies to develop newer treatment options with improved safety profiles and better tolerability

-

Advancements in diagnostic technologies

Integration of nanotechnology-driven formulations, novel biomarkers, advanced imaging modalities, and innovative biosensors is enhancing early and accurate detection capabilities, addressing critical challenges in timely clinical diagnosis that have historically limited treatment success

-

Updated clinical practice guidelines and expanded treatment protocols

Revised international guidelines are introducing significant refinements in diagnosis, therapy monitoring, and management protocols, including recognizing neurological symptoms as valid indications for liver transplantation and detailed protocols for managing acute liver failure with chelation therapy and high-volume plasma exchange

-

Growing investment from major pharmaceutical companies

The mid-stage pipeline is becoming increasingly crowded with substantial attention from large pharmaceutical players focusing on gene therapies, cell-based therapies, and chelators targeting specific cell types, driven by recognition of significant unmet needs in preventing clinical deterioration despite existing treatments

DelveInsight’s “Wilson’s Disease– Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Wilson’s Disease, historical and forecasted epidemiology as well as the Wilson’s Disease market trends in the United States, EU4 (Germany, France, Italy, Spain), the United Kingdom, and Japan.

The Wilson’s Disease market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Wilson’s Disease market size from 2020 to 2034. The Report also covers current Wilson’s Disease treatment practices, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Scope of the Wilson’s Disease Market Report | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2026-2034 |

|

Geographies Covered |

|

|

Wilson’s Disease Market |

|

|

Wilson’s Disease Market Size | |

|

Wilson’s Disease Epidemiology Segmentation |

|

|

Wilson’s Disease Companies |

Orphalan, Ultragenyx Pharmaceutical, Vivet Therapeutics, and others |

Wilson’s Disease Understanding

According to the European Association for the study of the Liver (EASL), Wilson’s disease is an inherited disorder in which defective biliary excretion of copper leads to its accumulation, particularly in the liver and brain.

The disease is progressive and, if left untreated, may cause liver (hepatic) disease, central nervous system dysfunction, and death. Early diagnosis and treatment may prevent serious long-term disability and life-threatening complications. The features of this condition include a combination of liver disease and neurological and psychiatric problems. Liver disease is typically the initial feature of Wilson Disease in affected children and young adults; individuals diagnosed at an older age usually do not have symptoms of liver problems, although they may have very mild liver disease. The signs and symptoms of liver disease include yellowing of the skin or whites of the eyes (jaundice), fatigue, loss of appetite, and abdominal swelling. Nervous system or psychiatric problems are often the initial features in individuals diagnosed in adulthood and commonly occur in young adults with Wilson Disease. Signs and symptoms of these problems can include clumsiness, tremors, difficulty walking, speech problems, impaired thinking ability, depression, anxiety, and mood swings. A mutation in the ATP7B gene, which codes for copper transportation, causes Wilson Disease. A person must inherit the gene from both parents to have Wilson Disease.

Wilson’s Disease Diagnosis

The diagnostic approach is based on a complex set of clinical findings from patient history, physical examination, laboratory, and imaging diagnostic testing. Moreover, screening is recommended for anyone with a sibling, cousin, or parent with Wilson’s Disease for early diagnosis.Clinicians typically look for symptoms such as liver dysfunction, neurological symptoms, and psychiatric disturbances. Key diagnostic tests include measuring serum ceruloplasmin levels, which are often low in affected individuals, and analyzing urinary copper excretion, which is usually elevated.

Additionally, a liver biopsy can be performed to assess copper accumulation in liver tissues. Genetic testing can confirm the diagnosis by identifying mutations in the ATP7B gene, which is responsible for copper metabolism. Early and accurate diagnosis is crucial for effective management of this genetic disorder.

Further details related to diagnosis are provided in the report…

Wilson’s Disease Treatment

People with Wilson’s Disease need lifelong treatment to manage symptoms and reduce or prevent organ damage. The treatment is based on removing excess copper by chelating agents such as D-penicillamine and trientine or by blocking the intestinal copper absorption with zinc salts. Furthermore, if the disease causes acute liver failure or cirrhosis with liver failure, the patient might need a liver transplant.

Recently, CUVRIOR (trientine tetrahydrochloride) became the first treatment approved by US FDA for the condition in 52 years. The drug was approved in Europe 5 years ago as a second-line treatment.

The current FDA-approved therapies requires lifelong treatment, and around 30–40% of Wilson’s patients have already developed a penicillamine intolerance. Furthermore, innovative medicines such as gene therapy, hepatocyte transplant, and stem cell transplant are needed due to poor compliance, significant side effects, and paradoxical neurological deterioration.

Further details related to treatment are provided in the report…

Wilson’s Disease Epidemiology

As the market is derived using a patient-based model, the Wilson’s Disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Prevalent Cases of Wilson’s disease, Diagnosed Prevalent Cases of Wilson’s Disease, Prevalent Cases of Wilson’s disease based on Clinical Manifestation, and Prevalent Cases of Wilson’s disease based on Symptoms, in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), THE United Kingdom, and Japan from 2020 to 2034.

Key Findings from the Wilson’s Disease Epidemiology Analysis

- Wilson’s Disease accounted for ~37 thousand prevalent cases in 2023 in the 7MM, the treatment market of Wilson’s Disease lacks approved therapy specific to Wilson’s Disease treatment.

- As per the analysis, it was observed that the US accounted for the highest diagnosed prevalent cases of Wilson’s disease accounting for approximately 2,600 cases among the 7MM in 2023 followed by Japan with nearly 2,200 cases. On the other hand, Spain had the lowest diagnosed prevalent cases of Wilson’s disease accounting for approximately 300 cases.

- In 2023, there were approximately 1,300 cases with hepatic manifestation, 500 cases with neurologic manifestation, 350 neuro-hepatic cases, and 400 cases with other manifestations of Wilson’s disease in the US.

- Among the EU4 and the UK, France accounted for the highest number of diagnosed prevalent cases of Wilson’s disease with approximately 1,000 cases in 2023 followed by Germany with nearly 900 cases and the UK with approximately 650 cases.

- There were approximately 87% symptomatic and 13% asymptomatic cases of Wilson’s disease in Japan in 2023.

- In Japan, there were approximately 1,100, 400, 300, and 420 cases of hepatic, neurologic, neuro-hepatic, and other manifestations of Wilson’s disease in 2023.

Wilson’s Disease Epidemiology Segmentation

- Prevalent Cases of Wilson’s disease

- Diagnosed Prevalent Cases of Wilson’s Disease

- Prevalent Cases of Wilson’s disease based on Clinical Manifestation

- Prevalent Cases of Wilson’s disease based on Symptoms

Wilson’s Disease Recent Developments and Breakthroughs

- In January 2026, Hyloris Pharmaceuticals obtained exclusive license rights in Europe and Turkey from ArborMed for an investigational next-generation Wilson's Disease therapy, with first-in-human trials planned for 2026 and patient studies by 2027.

- In November 2025, Monopar Therapeutics presented Phase 2 copper balance study data (ALXN1840-WD-204) at the American Association for the Study of Liver Diseases (AASLD) annual meeting, demonstrating rapid and sustained reduction in daily copper balance through increased fecal copper excretion.

- In March, 2025, European Association for the Study of the Liver (EASL) and European Reference Network (ERN) published new Clinical Practice Guidelines on Wilson's Disease, introducing significant advancements in diagnosis, monitoring, and treatment recommendations.

- In March 2025, Eton Pharmaceuticals, Inc. announced the launch of Galzin® (zinc acetate) capsules, now available exclusively through Optime Care. Galzin is the only FDA-approved zinc therapy for Wilson disease, a rare genetic disorder causing excessive copper accumulation in the body.

Wilson’s Disease Drug Analysis

The drug chapter segment of the Wilson’s Disease report encloses a detailed analysis of Wilson’s Disease off-label drugs and late-stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the Wilson’s Disease clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Wilson’s Disease Marketed Drugs

CUVRIOR/CUPRIOR (trientine tetrahydrochloride): Orphalan

CUVRIOR (trientine tetrahydrochloride), developed by Orphalan is a copper chelator indicated for the treatment of adult patients with stable Wilson Disease who are de-coppered and tolerant to penicillamine. CUVRIOR is an oral trientine formulation. The active substance trientine is a chelating agent, and it works by attaching to copper in the body and forming a complex that is then eliminated in the urine.

CUVRIOR is the first innovative treatment for treating Wilson Disease. The drug is also approved in Europe as CUPRIOR. With increasing intolerance towards penicillamine, the current standard of care, the drug represents a well-tolerated and effective alternative

Further detail in the report…

Wilson’s Disease Emerging Drugs

VTX-801: Vivet Therapeutics

VTX-801 is a novel investigational gene therapy for Wilson’s Disease, which has been granted Orphan Drug Designation (ODD) by the US FDA and the European Commission and Fast Track designation by the US FDA.

VTX-801 is a novel, investigational rAAV-based gene therapy vector designed to deliver a miniaturized ATP7B transgene encoding, a functional protein that has been shown to restore copper homeostasis, reverse liver pathology and reduce copper accumulation in the brain of a mouse model of Wilson Disease. VTX-801’s rAAV serotype was selected based on its demonstrated tropism for transducing human liver cells.

Recently, in April 2024, Vivet Therapeutics dosed its first patient with its lead program VTX-801 in Cohort II, Phase I/II of its ongoing GATEWAY clinical trial for the treatment of Wilson’s Disease The start of Cohort II commenced after successfully completing Cohort I and receiving approval from independent Data Monitoring Committee (DMC) to proceed.

Further detail in the report…

UX701: Ultragenyx Pharmaceutical

UX701 is an investigational AAV9 gene therapy designed to deliver a modified form of the ATP7B gene, which is otherwise too large to package in an AAV vector. Preclinical studies demonstrated reduced liver copper accumulation, increased ceruloplasmin levels, and improved liver pathology following administration of UX701. Ultragenyx has initiated the seamless Cyprus2+ Phase I/II/II study of a single intravenous infusion of UX701 in Wilson disease. UX701 leverages Ultragenyx’s Pinnacle PCL Platform.

- UX701 was granted ODD in the US and European Union and Fast Track Designation in the US.

- Recently, in January 2024, Ultragenyx completed the dosing of UX701 across the three dose-escalation cohorts in Stage I (Phase I/II) of its pivotal Phase I/II/III Cyprus2+ study.

Further detail in the report…

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

VTX-801 |

Gene transference |

IV |

Vivet Therapeutics |

|

I/II |

|

XXX |

XXX |

XXX |

XXX |

|

II |

Note: Detailed emerging therapies assessment will be provided in the final report of Wilson’s Disease.

Wilson’s Disease Market Outlook

A number of drugs are available to treat Wilson’s disease, including D-penicillamine, trientine, zinc, tetrathiomolybdate, and dimercaprol. Once the diagnosis has been made, the indication requires lifelong treatment.

Treatment for Wilson’s disease includes three types of medications: first those that remove (chelate) copper from the body by urinary excretion, such as penicillamine (CUPRIMINE) and trientine dihydrochloride (SYPRINE), second, zinc salts to prevent the gut from absorbing copper from the diet, and third, tetrathiomolybdate which both prevents absorbing copper and binds up toxic copper in the blood making it nontoxic.

- The therapeutic market size of Wilson’s Disease in the 7MM was approximately USD 295 million in 2023.

- The market size in the 7MM will increase at a CAGR of 12% due to increasing awareness of the disease, better diagnosis, and the launch of the emerging therapy.

- The United States accounted for the highest market size of Wilson’s Disease approximately 43% of the total market size in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Among the European countries, France had the highest market size with nearly USD 32 million in 2023, while Spain had the lowest market size of Wilson’s Disease with ~USD 9 million in 2023.

- The market size for Wilson’s Disease in Japan was estimated to be ~USD 68 million in 2023, which accounts for 23% of the total 7MM market.

- With the expected launch of upcoming therapies, such as VTX-801 the total market size of Wilson’s Disease is expected to show change in the upcoming years.

Wilson’s Disease Drug Class Analysis

Trientine

A chelator of several metals, including copper, zinc, and iron, trientine was developed and introduced in 1969 as an alternative for patients intolerant to D-penicillamine and favors urinary excretion of copper. The recommended dose is 750–1500 mg/day in two or three divided doses, while the maintenance dose is 750–1000 mg/day in two or three divided doses.

D-penicillamine, introduced in 1956 as the first oral treatment for Wilson’s disease, chelates copper and other metals. Initially, the racemic mixture required co-administration with pyridoxine to prevent vitamin B6 deficiency, and supplementation (25–50 mg daily) remains recommended. The drug promotes copper excretion via urine and enhances endogenous metallothionein, which reduces copper absorption and facilitates its elimination in feces. Improvement in hepatic function can be seen within 2–6 months, with enhancements in liver function, ascites, and jaundice. The starting dose is 250–500 mg/day, increasing by 250 mg every 4–7 days up to a maximum of 1–1.5 g/day, divided into two to four doses for symptomatic cases.

Zinc salts, initially zinc chloride and later zinc sulfate, were first used in the early 1960s to treat Wilson’s disease, but their recognition came in 1978. Zinc acetate is preferred for better gastric tolerance, though all zinc salts have similar efficacy. Zinc works by inducing metallothionein in enterocytes, which binds free copper and promotes its elimination in feces, effectively normalizing copper levels in the blood.

Ammonium tetrathiomolybdate (TTM) is a copper-chelating drug with antiangiogenic properties, used to treat Wilson’s disease in Europe since 2008. It promotes copper elimination via urine and feces and is effective, especially for severe neurological symptoms. Side effects include elevated transaminases and bone marrow suppression. TTM is not yet FDA-approved in the US.

Few new agents are being developed and tested as potential treatments for Wilson’s Disease; the emerging drugs include VTX-801 by Vivet Therapeutics, UX701 by Ultragenyx Pharmaceutical, and others.

Further detailed analysis of emerging therapies drug uptake in the report…

Wilson’s Disease Clinical Trial Analysis

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Wilson’s Disease emerging therapies.

Latest KOL Views on Wilson’s Disease

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Wilson’s Disease evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Internal Medicine, Rutgers Robert Wood Johnson Medical School US; Medicine, Division of Gastroenterology and Hepatology, US; Biostatistics and Epidemiology, Rutgers Robert Wood Johnson Medical School, US; Department of Gastroenterological, Endocrine and Metabolic Sciences, Fondazione Policlinico Universitario Gemelli, Italy; Children's Hospital NHS Trust, Birmingham, UK; Department of Pediatrics, Toho University School of Medicine; Department of Neurology Chang Gung Memorial Hospital, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Wilson’s Disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Wilson’s Disease Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Wilson’s Disease Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Wilson’s Disease, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Wilson’s Disease market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Wilson’s Disease market.

Wilson’s Disease Report Insights

- Patient Population

- Therapeutic Approaches

- Wilson’s Disease Pipeline Analysis

- Wilson’s Disease Market Size and Trends

- Existing and Future Market Opportunities

Wilson’s Disease Report Key Strengths

- 9 years Forecast

- The 7MM Coverage

- Wilson’s Disease Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Wilson’s Disease Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Wilson’s Disease Market Report

Wilson’s Disease Market Insights

- What was the Wilson’s Disease market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Wilson’s Disease total market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Wilson’s Disease market size during the forecast period (2024–2034)?

- At what CAGR, the Wilson’s Disease market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the Wilson’s Disease market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the Wilson’s Disease market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Wilson’s Disease Epidemiology Insights

- What are the disease risk, burden, and unmet needs of Wilson’s Disease?

- What is the historical Wilson’s Disease patient population in the United States, EU4 (Germany, France, Italy, Spain) and the UK, and Japan?

- What would be the forecasted patient population of Wilson’s Disease at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Wilson’s Disease?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Wilson’s Disease during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Wilson’s Disease Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Wilson’s Disease along with the approved therapy?

- What are the current treatment guidelines for the treatment of Wilson’s Disease in the US, Europe, And Japan?

- What are the Wilson’s Disease-marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many companies are developing therapies for the treatment of Wilson’s Disease?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Wilson’s Disease?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to the Wilson’s Disease therapies?

- What are the recent therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Wilson’s Disease and their status?

- What are the key designations that have been granted for the emerging therapies for Wilson’s Disease?

- What are the 7MM historical and forecasted market of Wilson’s Disease?