AL Amyloidosis Market

Key Highlights

- Patients often have a poor prognosis due to the delay in diagnosis of AL amyloidosis, which frequently presents with non-specific symptoms that can mimic other, more common conditions. As many as 30% of patients with AL amyloidosis die within the first year after diagnosis.

- The clinical presentation of AL amyloidosis varies widely and depends on which organs are affected. However, some nonspecific systemic symptoms like fatigue, unintentional weight loss, and weakness are common in many patients, especially early in the disease.

- In AL Amyloidosis, the heart (approximately 80%) and the kidneys (65%) are the most commonly involved organs, followed by soft tissues, liver, peripheral and autonomic nervous system, and gastrointestinal tract.

- The only marketed drug, DARZALEX FASPRO for AL amyloidosis, received accelerated approval in 2021, while the continued approval for this indication is subject to confirmation of clinical benefit through ongoing confirmatory trials.

- The emerging drug pipeline includes investigational therapies from several companies, such as Immix Biopharma (NXC-201), AbbVie (etentamig/ABBV-383), Johnson & Johnson (JNJ-79635322), and AstraZeneca (anselamimab), each aiming to improve disease control through novel mechanisms targeting either the underlying plasma cell clone or amyloid fibrils.

- In May 2025, Prothena Corporation recently faced a setback as its Phase III AFFIRM-AL trial evaluating birtamimab in patients with AL amyloidosis failed to meet its primary endpoint of time to all-cause mortality, resulting in the discontinuation of the therapy’s development.

- Ongoing research in AL amyloidosis aims to address current treatment gaps and improve outcomes. Promising areas include next-generation plasma cell–targeting agents, fibril-clearing monoclonal antibodies, and CAR-T therapies. Efforts are also focused on developing biomarkers for early diagnosis and personalized treatment based on disease stage and organ involvement.

DelveInsight’s "AL Amyloidosis – Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of AL amyloidosis, historical and forecasted epidemiology, as well as the AL amyloidosis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The AL amyloidosis market report provides current treatment practices, emerging drugs, AL amyloidosis share of individual therapies, and current and forecasted AL amyloidosis market size from 2020 to 2034, segmented by seven major markets. The report also covers current AL amyloidosis treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

AL Amyloidosis Epidemiology |

Segmented by

|

|

AL Amyloidosis Companies |

|

|

AL Amyloidosis Therapies |

|

|

AL Amyloidosis Market |

Segmented by

|

|

Analysis |

|

AL Amyloidosis Disease Understanding and Treatment Algorithm

AL Amyloidosis Overview

Primary or light chain (AL) amyloidosis, the most common type of systemic amyloidosis, occurs when the free light chains normally associated with immunoglobulins are produced in excess by clonal or frankly malignant plasma cells. Although AL amyloidosis is not considered a cancer, it shares some similar characteristics and treatments with multiple myeloma. AL amyloidosis is most commonly diagnosed when the affected patient has less than 10% bone marrow plasma cells, the quantity required to make a diagnosis of myeloma, but may also occur in association with full-blown multiple myeloma, non-Hodgkin’s lymphoma, Waldenström’s macroglobulinemia, chronic lymphocytic leukemia, Sjogren’s syndrome, and Behçet syndrome.

AL Amyloidosis Diagnosis

The initial step in diagnosing systemic amyloidosis involves testing for monoclonal proteins using serum and urine electrophoresis with immunofixation, serum free light chains (FLC), and 24-hour urine protein. If a monoclonal protein or abnormal FLC ratio is found, AL amyloidosis should be suspected, and a tissue biopsy should follow. While awaiting biopsy, noninvasive tests like organ-specific biomarkers and imaging can help assess organ involvement. However, monoclonal proteins can also be seen in conditions like MGUS or non-AL amyloidosis. Congo red staining is the gold standard for detecting amyloid, with green birefringence under polarized light. Biopsy can target affected organs or surrogate sites such as abdominal fat or bone marrow; the combination of both improves diagnostic sensitivity to around 85%. If these are negative but suspicion remains, organ biopsy should be pursued. Once amyloid is confirmed, typing is essential, with mass spectrometry–based proteomics as the gold standard. In cardiac amyloidosis, biopsy may be avoided if noninvasive findings (e.g., elevated cardiac markers, ECG or echo changes, cardiac MRI) are strongly suggestive. 99mTc-PYP scanning can diagnose ATTR cardiac amyloidosis if monoclonal protein is absent. However, cardiac biopsy is needed in cases with coexisting monoclonal gammopathy or atypical presentations.

Further details related to diagnosis will be provided in the report…

AL Amyloidosis Treatment

Treatment of AL amyloidosis focuses on eliminating the underlying plasma cell clone responsible for producing the light chains that form amyloid deposits. The mainstay of therapy involves anti-plasma cell regimens similar to those used in multiple myeloma. The current standard first-line treatment includes DARZALEX FASPRO in combination with bortezomib, cyclophosphamide, and dexamethasone. This regimen has shown high hematologic and organ response rates and is FDA-approved for newly diagnosed patients. For eligible patients, autologous stem cell transplantation (ASCT) may be considered, particularly in those with preserved organ function and low treatment-related risk. Supportive care is critical and includes management of heart failure, kidney dysfunction, and other organ-specific complications. In cases of relapsed or refractory disease, options include second-line agents like lenalidomide, pomalidomide, or repeat bortezomib-based therapies. Emerging therapies under investigation include novel proteasome inhibitors, monoclonal antibodies, and CAR T-cell therapies targeting plasma cells. Treatment choice depends on disease stage, organ involvement, performance status, and availability of therapies.

Further details related to treatment will be provided in the report…

AL Amyloidosis Epidemiology

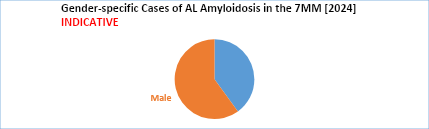

The AL amyloidosis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total incidence cases of AL amyloidosis, gender-specific cases of AL amyloidosis, and age-specific cases of AL amyloidosis in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In the US, there are approximately 1275 to 3200 new cases per year. The annual proportion of new cases with AL is 78%.

- In 2021, the annual incidence of AL was estimated to be 16.7 patients per million in the general population, with an annual growth rate of 7.7% since 2019.

- In the gender-specific cases of AL amyloidosis, men are slightly more affected than women.

- In age-specific cases, the incidence of AL amyloidosis increases with age for the following age groups: 18–34, 35–54, 55–64, and 65 + years.

- AL (light-chain) amyloidosis primarily affects older adults, with a median age at diagnosis between 63 and 65 years, and exhibits a slight predominance in males. Although most cases occur in individuals aged 50 to 80 years, the disease can occasionally be diagnosed in younger patients, with fewer than 5% of cases occurring in those under 40 years old.

AL Amyloidosis Drug Chapters

Marketed Drugs

DARZALEX FASPRO (daratumumab and hyaluronidase-fihj): Johnson & Johnson

DARZALEX FASPRO is the only CD38-directed antibody approved to be given subcutaneously to treat patients with multiple myeloma and now AL amyloidosis. DARZALEX FASPRO is co-formulated with recombinant human hyaluronidase PH20 (rHuPH20), which is part of Halozyme’s ENHANZE drug delivery technology.

In January 2021, DARZALEX FASPRO got accelerated approval from the US Food and Drug Administration (FDA) for the treatment of adult patients with newly diagnosed light chain (AL) amyloidosis. The drug is given subcutaneously in combination with bortezomib, cyclophosphamide, and dexamethasone.

Emerging Drugs

Anselamimab (CAEL-101): AstraZeneca

Anselamimab is being investigated in a Phase III clinical programme in patients with AL amyloidosis. By removing amyloid fibrils from affected organs, anselamimab has the potential to be the first treatment to address the devastating organ damage caused by amyloidosis on top of standard of care. It has been granted the orphan drug designation (ODD) by the US FDA. The company anticipated the data readout of Phase III trials in H2 2025.

-

AstraZeneca is currently running three clinical trials for AL amyloidosis, including two Phase III trials targeting patients with Mayo Stage IIIa and IIIb disease, and a Phase II trial focused on patients with Mayo Stages I, II, and IIIa.

NXC-201: Immix Biopharma

NXC-201 is a sterically optimized BCMA-targeted chimeric antigen receptor T (CAR-T) cell therapy. NXC-201 is being studied for the treatment of patients with r/r AL amyloidosis, with the potential to expand into autoimmune indications. NXC-201 has been awarded ODD and regenerative medicine advanced therapy designation in the US by the FDA and ODD in Europe by the European Medicines Agency in r/r AL Amyloidosis.

- In July 2025, immix Biopharma announced accelerated US NEXICART-2 clinical trial progress in r/r AL Amyloidosis. NEXICART-2 now includes 18 clinical trial sites in its national footprint.

- In June 2025, Immix Biopharma announced meeting its primary endpoint of complete response rate for cell therapy NXC-201 at an oral presentation of interim results at the 2025 American Society of Clinical Oncology Annual Meeting (ASCO 2025) in Chicago, Illinois.

|

Comparison of Emerging Drugs Under Development | ||||

|

Drug Name |

Company |

Phase |

Indication |

MoA |

|

Anselamimab |

AstraZeneca |

III |

Mayo Stage IIIa AL Amyloidosis |

Targets amyloid light chains |

|

Etentamig (ABBV-383) |

AbbVie |

I/II |

AL Amyloidosis |

BCMA × CD3 bispecific T‑cell engager |

|

NXC-201 |

Immix Biopharma |

I |

r/r AL Amyloidosis |

BCMA‑targeted CAR‑T therapy |

|

JNJ-79635322 |

Janssen Research & Development |

I |

r/r Multiple Myeloma or Previously Treated AL Amyloidosis |

Trispecific T‑cell engager |

Note: Detailed emerging therapies assessment will be provided in the final report.

Drug Class Insight

In the current class of marketed drugs, a cornerstone of therapy is the use of CD38-targeting monoclonal antibodies, such as DARZALEX FASPRO, while for emerging therapies the class includes BCMA-targeted CAR-T therapies (NXC-201) and bispecific T-cell engagers (etentamig), which aim to enhance clonal eradication or directly clear amyloid fibrils, offering hope for deeper and more durable responses.

BCMA-targeted CAR-T therapy

BCMA-targeted CAR-T therapy refers to a type of chimeric antigen receptor T-cell therapy specifically engineered to recognize and destroy B-cell maturation antigen (BCMA)-expressing plasma cells. BCMA is a surface protein highly expressed on malignant plasma cells, including those involved in multiple myeloma and AL amyloidosis. By redirecting a patient’s own T cells to attack BCMA-positive cells, this therapy aims to eliminate the source of amyloidogenic light chains and halt disease progression. Examples include NXC-201.

Bispecific T-cell engagers

Bispecific T-cell engagers are engineered antibodies designed to bind two different targets simultaneously: one arm binds to CD3 on T cells, and the other to a tumor-specific antigen (such as BCMA on malignant plasma cells in AL amyloidosis). By physically bringing T cells into proximity with cancerous plasma cells, these agents trigger T-cell–mediated cytotoxicity, leading to targeted cell death. In AL amyloidosis, bispecifics like etentamig (ABBV-383) are being investigated to eliminate the clonal cells producing amyloidogenic light chains, offering a promising therapeutic strategy beyond conventional chemotherapy.

AL Amyloidosis Market Outlook

The therapeutic landscape for AL (light-chain) amyloidosis has advanced considerably in recent years, transitioning from supportive care and non-specific chemotherapies to targeted and mechanism-driven treatments. Historically, management has focused on suppressing the underlying clonal plasma cells responsible for producing pathogenic light chains, primarily through regimens borrowed from multiple myeloma. Autologous stem cell transplantation (ASCT) was once the standard for eligible patients, but its applicability is limited by age, organ dysfunction, and procedural risk. The current first-line therapy, DARZALEX FASPRO, has become the backbone of treatment, offering robust hematologic and organ response rates and representing the first FDA-approved regimen specifically for AL amyloidosis.

Despite these advancements, conventional therapies primarily target the source of amyloid production rather than promoting the removal of existing amyloid deposits or addressing end-organ damage. This limitation has spurred the development of next-generation therapies that go beyond clonal suppression. Emerging strategies include BCMA-targeted CAR-T cell therapies (NXC-201), bispecific T-cell engagers (etentamig), and trispecific antibodies (JNJ-79635322), all designed to enhance T-cell–mediated clearance of abnormal plasma cells.

Simultaneously, a new class of fibril-directed agents, such as anselamimab, a monoclonal antibody that binds directly to amyloid fibrils to promote immune-mediated clearance, is under investigation. These therapies represent a shift toward dual-action approaches that both halt amyloid production and facilitate the removal of deposited material.

As the field evolves, the focus is increasingly on precision medicine, with treatment strategies tailored to the patient's disease stage, organ involvement, and genetic markers. This evolving paradigm aims to achieve deeper responses, improve organ function, and ultimately enhance quality of life and survival outcomes for patients with this complex, multi-systemic disease.

Further details will be provided in the report….

AL Amyloidosis Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034. The landscape of AL amyloidosis treatment has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

AL Amyloidosis Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase I/II, and Phase I stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for AL amyloidosis emerging therapies.

KOL- Views

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like the MD, Professor and Vice Chair of the Department and Director, PhD, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or AL amyloidosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as the Washington University School of Medicine, University Medical Center Hamburg-Eppendorf, and the University Graduate School of Medicine, etc., were contacted. Their opinion helps understand and validate AL amyloidosis epidemiology and market trends.

|

KOL Views |

|

“Those with a higher burden of disease, as manifested by high levels of free light chains, increased numbers of bone marrow plasma cells, and more severe end-organ involvement, are more likely to experience treatment failure and diminished survival. It is important that careful staging and assessment of prognostic factors be carried out before diagnosis and following the initiation of therapy so that patients can receive the most appropriate treatment and guidance regarding goals of care.” MD, Houston Methodist Hospital, Houston, Texas, US |

|

“From the currently available data, it has been determined that approximately 2/3 of the AL amyloidosis patients are male. The age range of AL amyloidosis usually affects people from ages 50-80, although there are cases of people being diagnosed and treated at younger ages, with less than 5% of the patients being under 40 years old.” PhD, Canary Wharf, London, UK |

Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT and Conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Further detailed analysis will be provided in the report….

Scope of the Report

- The report covers a descriptive overview of AL amyloidosis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into AL amyloidosis epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for AL amyloidosis is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the AL amyloidosis market, historical and forecasted, is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM AL amyloidosis market.

AL Amyloidosis Report Insights

AL Amyloidosis Report Insights

- Patient Population

- Therapeutic Approaches

- AL Amyloidosis Pipeline Analysis

- AL Amyloidosis Market Size and Trends

- Market Opportunities

- Impact of Upcoming Therapies

AL Amyloidosis Report Key Strengths

- Ten-Year Forecast

- 7MM Coverage

- AL Amyloidosis Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

AL Amyloidosis Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What was the AL amyloidosis market share (%) distribution in 2020, and what would it look like in 2034?

- What would be the AL amyloidosis total market size, as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings about the market across the 7MM, and which country will have the largest AL amyloidosis market size during the study period (2020–2034)?

- At what CAGR, the AL amyloidosis market expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the AL amyloidosis market growth till 2034?

- What are the disease risks, burdens, and unmet needs of AL amyloidosis?

- What is the historical AL amyloidosis patient pool in the United States, the EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of AL amyloidosis?

- Among the 7MM, which country would have the most incidence cases of AL amyloidosis?

- At what CAGR is the population expected to grow across the 7MM during the study period (2020–2034)?

- How many companies are developing therapies for the treatment of AL amyloidosis?

- How many emerging therapies are in the mid-stage and late-stage of development for the treatment of AL amyloidosis?

- What are the key collaborations (industry–industry, industry-academia), mergers and acquisitions, and licensing activities related to AL amyloidosis therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for AL amyloidosis and their status?

- What are the key designations that have been granted for the emerging therapies for AL amyloidosis?

- What are the 7MM historical and forecasted market of AL amyloidosis?

Reasons to buy

- The report will help in developing business strategies by understanding trends shaping and driving the AL amyloidosis market.

- To understand the future market competition in the AL amyloidosis market and insightful review of the SWOT analysis of AL amyloidosis.

- Organize sales and marketing efforts by identifying the best opportunities for AL amyloidosis in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- To understand the future market competition in AL amyloidosis.

Read More Articles

- Assessing How Emerging Therapies Will Transform the AL Amyloidosis Treatment Dynamics

- TLX66 in AL Amyloidosis; Takeda’s Dengue Shot; Innovent’s Cholangiocarcinoma Clinical Trial; Another Failed NASH Drug

- Plaque psoriasis drug outshines in phase III trial; Immunovant announces pause in trial of IMVT-1401; Prothena brings AL amyloidosis drug back; Canon Medical expands its MRI AI programs

- AL Amyloidosis Market Infographics

- Latest DelveInsight Blogs