Anti-integrin Agents Market Forecast

- Anti-integrin agents are a class of biologic medications used to treat various immune-mediated inflammatory disorders. These agents block the interaction between integrins on immune cells and endothelial adhesion molecules, thereby inhibiting the migration of inflammatory cells into affected tissues and reducing inflammation.

- Anti-integrin agents are primarily used in the treatment of moderate to severe inflammatory bowel disease (IBD) such as Crohn’s disease (CD) and ulcerative colitis (UC), and are also approved for the management of Multiple Sclerosis (MS), particularly in patients who have not responded adequately to conventional therapies such as corticosteroids, immunomodulators, or anti-TNF agents.

- TYSABRI (natalizumab) was the first anti-integrin drug approved for Crohns’ and Multiple Sclerosis. It targets the α4-integrin subunit, inhibiting leukocyte adhesion to endothelial cells. While effective, its use is limited due to the risk of progressive multifocal leukoencephalopathy (PML), a rare but serious brain infection.

- In August 2023, FDA approved Tyruko (natalizumab-sztn), developed by Sandoz and Polpharma Biologics, as the first biosimilar to Tysabri (natalizumab), and originally developed by Biogen. Tyruko was approved for the treatment of adults with relapsing forms of multiple sclerosis (MS), providing a more affordable alternative for patients.

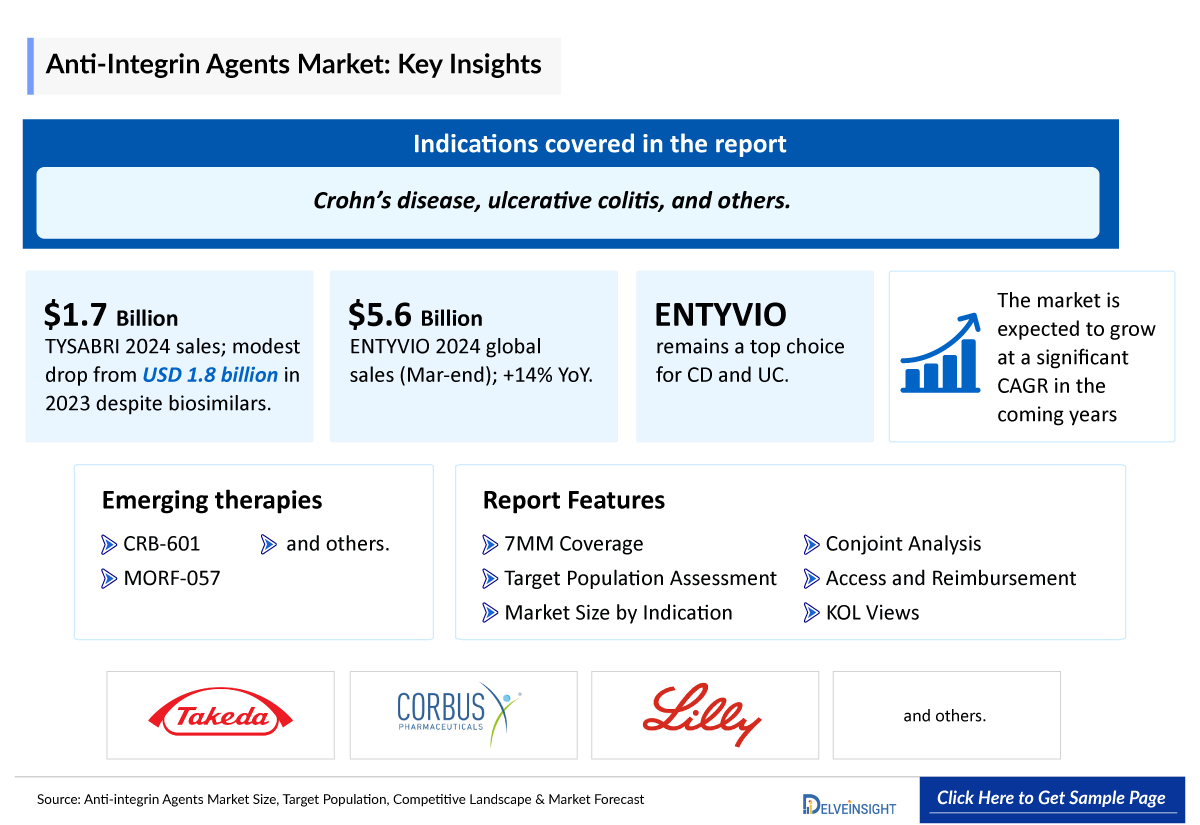

- Despite the availability of biosimilars, TYSABRI maintained strong performance with sales of USD 1,715 million in 2024, reflecting only a modest decline from USD 1,876.9 million in 2023. This suggests that, for now, the impact of biosimilar competition remains limited.

- ENTYVIO (Vedolizumab) is the second anti-integrin drug approved for severe inflammatory bowel disease (IBD) including Crohn’s disease (CD) and ulcerative colitis (UC). It specifically targets the α4β7 integrin, which is predominantly expressed in the gastrointestinal tract, thereby reducing systemic side effects. Vedolizumab has demonstrated efficacy in both induction and maintenance therapy for UC and CD, with clinical response rates up to 47.1% at week 6 and remission rates up to 41.8% at week 52.

- In 2024, ENTYVIO has become a leading treatment option for Crohn’s disease (CD) and ulcerative colitis (UC), with annual sales exceeding JPY 800.9 billion (USD 5.63 billion) globally for the year-end of March 2024, with a y-o-y increase of 14%. Its favorable safety profile and targeted Anti-Integrin Agents mechanism of action have contributed to its widespread adoption in clinical practice.

- In April 2024, the U.S. FDA approved the subcutaneous formulation of Takeda’s ENTYVIO (vedolizumab) for maintenance therapy in moderately to severely active Crohn’s disease. This move is a strategic step by Takeda to strengthen its market position and maintain exclusivity amid growing biosimilar competition, aiming to enhance patient convenience and reinforce brand loyalty.

- Several anti-integrin agents are currently being evaluated in Anti-Integrin Agents Clinical Trials. One of these assets in late stage is Corbus Pharmaceuticals Inc’s., CRB-601 which is in the stage I/II and being developed for Solid tumors, and is anticipated to receive approval during the forecast period.

- In July 2024, Eli Lilly announced to acquire Morphic Holding, a company focused on oral integrin therapies. Morphic’s lead drug, MORF-057, an oral α4β7 integrin inhibitor, is currently in Phase 2 trials for ulcerative colitis and Crohn’s disease, offering a potential new treatment for Crohn’s disease (CD) and ulcerative colitis (UC).

- Some of the other major Anti-integrin agent manufacturers are ProDa BioTech, LLC, Pfizer, and several others, which are currently engaged in the development and production of anti-integrin agents, which has the potential to significantly impact and enhance the anti-integrin agents Market.

Request for Unlocking the Sample Page of the "Anti-Integrin Agents Market"

DelveInsight’s “ Anti-integrin Agents Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the anti-integrin agents, historical and Competitive Landscape as well as the anti-integrin agents Market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Anti-integrin Agents Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Anti-integrin Agents Market size from 2020 to 2034. The report also covers current anti-integrin agents’ treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the Anti-integrin agents market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Anti-Integrin Agents Market |

|

|

Anti-Integrin Agents Market Size | |

|

Anti-Integrin Agents Companies |

|

Anti-integrin Agents Treatment Market: Understanding and Algorithm

Anti-integrin agents are a specialized class of biologic therapies that target integrins—transmembrane receptors expressed on immune cells—which play a key role in the adhesion and migration of these cells to sites of inflammation. These therapies are designed to interrupt the interaction between integrins and endothelial cell adhesion molecules (CAMs), which are essential for leukocyte trafficking across the vascular endothelium into inflamed tissues. By blocking this interaction, anti-integrin agents help reduce the influx of inflammatory cells, thereby mitigating tissue damage and inflammation. This mechanism makes them particularly effective in managing chronic immune-mediated inflammatory disorders, especially inflammatory bowel disease (IBD), which includes Crohn’s disease (CD) and ulcerative colitis (UC).

Unlike broader immunosuppressants, anti-integrin therapies offer a more targeted approach, often with fewer systemic side effects. ENTYVIO (Vedolizumab), a monoclonal antibody targeting the α4β7 integrin, is one of the most widely used agents, providing significant clinical benefit in both induction and maintenance phases of Crohn’s disease (CD) and ulcerative colitis (UC) treatment.

Anti-integrin Agents Treatment

The treatment pattern of anti-integrin therapy in Crohn’s disease (CD) and ulcerative colitis (UC) typically follows a stepwise approach, particularly for patients with moderate to severe disease who have not responded to conventional treatments such as corticosteroids, immunomodulators, or anti-TNF agents.

Anti-integrin agents, like ENTYVIO, are often introduced when first-line biologics fail or are not tolerated. ENTYVIO is administered via intravenous infusion, typically every 8 weeks after an initial induction phase at weeks 0, 2, and 6. This selective gut-targeted therapy is preferred for patients with a history of infections or those at risk of systemic immunosuppression due to its favorable safety profile. Clinicians closely monitor clinical response, biomarkers like C-reactive protein (CRP) and fecal calprotectin, and endoscopic findings to evaluate treatment success.

Other anti-integrin agents, such as CRB-601 and MORF-057, are undergoing clinical trials. These drugs target different integrins and adhesion molecules, aiming to provide additional options for patients with Crohn’s disease (CD) and ulcerative colitis (UC).

Anti-integrin Drugs Market Chapters

The drug chapter segment of the Anti-integrin Agents drugs market reports encloses a detailed analysis of Anti-integrin Agents Marketed drugs and late-stage (Phase III and Phase II) Anti-Integrin Agents pipeline drugs. It also helps understand the Anti-integrin Agents' clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Anti-Integrin Agents Marketed Drugs

- ENTYVIO (Vedolizumab): Takeda

ENTYVIO (Vedolizumab) is a gut-selective biologic therapy approved for the treatment of moderate to severe IBD, including Crohn’s disease (CD) and ulcerative colitis (UC) in adults. It offers targeted relief for patients who have not responded adequately to conventional treatments or other biologic therapies. It is a monoclonal antibody that works by binding to the α4β7 integrin, a protein on the surface of certain white blood cells. This integrin plays a key role in guiding immune cells to the gut. By blocking this interaction, ENTYVIO helps prevent immune cells from entering inflamed gut tissue, thereby reducing inflammation and promoting healing.

ENTYVIO first received US FDA approval in May 2014, for the treatment of UC and CD, while it also received approval as maintenance therapy in Sep 2023 and its subcutaneous administration got approval in April 2024. In Europe, ENTYVIO received EMA approval in May 2014 while it received approval in Japan in July 2018.

|

Product |

Company |

Indication |

|

ENTYVIO (Vedolizumab) |

Takeda |

ENTYVIO is an integrin receptor antagonist indicated in adults for the treatment of: • moderately to severely active ulcerative colitis. • moderately to severely active Crohn’s disease. |

Anti-Integrin Agents Emerging Drugs

- CRB-601: q

CRB-601 is an investigational anti-integrin monoclonal antibody designed to inhibit the activation of TGFβ, a key driver of tumor growth and immune evasion. By targeting integrins involved in TGFβ activation on cancer cells, CRB-601 aims to enhance anti-tumor immunity and improve therapeutic outcomes in solid tumors. It is currently in the phase I/II of Anti-Integrin Agents Clinical Trials.

- MORF-057: Eli Lilly

MORF-057 is an investigational oral small molecule inhibitor targeting the α4β7 integrin, currently in development for the treatment of inflammatory bowel disease, including Crohn’s disease (CD) and ulcerative colitis (UC). By selectively blocking lymphocyte trafficking to the gut, MORF-057 aims to reduce intestinal inflammation and offer a convenient, non-injectable alternative to current biologic therapies. The program is now part of Eli Lilly’s pipeline following its acquisition of Morphic Therapeutics. It is currently under phase II of Anti-Integrin Agents Clinical Trials.

|

List of Emerging Drugs | |||||

|

CRB-601 |

Corbus Pharmaceuticals |

Solid Tumors |

I/II |

NCT06603844 | |

|

MORF-057 |

Eli Lilly |

Crohn’s disease (CD) and ulcerative colitis (UC) |

II |

NCT05291689 | |

Note: The emerging drug list is indicative, the full list will be given in the final report.

Anti-integrin Agents Market Outlook

The anti-integrin agents market is projected to expand significantly in the coming years, driven by the rising prevalence of immune-mediated diseases such as inflammatory bowel disease (IBD), increased diagnosis rates, and a growing demand for targeted biologic therapies. The market is also benefiting from advancements in drug development, increasing awareness, and strong investment from major pharmaceutical companies in this space.

Anti-integrin therapies are gaining traction as effective treatment options for conditions like ulcerative colitis, Crohn’s disease, and certain cancers. These agents have demonstrated promising clinical outcomes by specifically inhibiting leukocyte migration to sites of inflammation, offering targeted efficacy with fewer systemic side effects. ENTYVIO (Vedolizumab), the leading approved anti-integrin agent, has shown consistent success in the market and continues to expand its global footprint.

The pipeline is rich, with several anti-integrin candidates such as MORF-057 (now part of Eli Lilly following its acquisition of Morphic Therapeutic) and CRB-601 in various stages of clinical development. MORF-057, in Phase II Anti-Integrin Agents Clinical Trials, aims to offer a convenient oral alternative to current biologics. Meanwhile, CRB-601 is being investigated for oncology indications, focusing on blocking TGFβ activation in tumors.

Major Anti-Integrin Agents Companies including Eli Lilly, Corbus Pharmaceuticals Inc’s., ProDa BioTech, LLC, Pfizer, and others, are involved in developing Anti-Integrin Agents drugs for various indications such as Crohn’s disease (CD) and ulcerative colitis (UC), multiple sclerosis, solid tumors, and others. With a strong pipeline, increasing clinical adoption, and strategic corporate investments, the anti-integrin agents market is poised to become a key segment within immunology and oncology therapeutics in the near future.

Anti-integrin Agents Drug Uptake

This section focuses on the uptake rate of potential approved and emerging Anti-integrin Agents expected to be launched in the market during 2020–2034.

Anti-integrin Agents Pipeline Development Activities

The Anti-Integrin Agents Therapeutics Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Anti-Integrin Agents Companies involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense opportunity for anti-integrin agents Anti-Integrin Agents Market growth over the forecasted period.

Anti-Integrin Agents Clinical Trial Activities

The Anti-Integrin Agents Therapeutics Market Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for anti-integrin agents emerging therapies. The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion. For example, in July 2024 Eli Lilly completed its acquisition of Morphic Therapeutics Inc. for approximately USD 3.2 billion.

KOL Views on Anti-Integrin Agents

To keep up with current and future Anti-Integrin Agents market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on anti-integrin agents' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility. DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as American College of Gastroenterology (AGA), the Crohn's & Colitis Foundation, and others. Their opinion helps understand and validate current and emerging therapy treatment patterns or anti-integrin agents market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Anti-Integrin Agents market and the unmet needs.

|

KOL Views |

|

“Oral anti-integrin therapies could open up new possibilities for earlier intervention in diseases like ulcerative colitis, and also provide the potential for combination therapy to help patients with more severe disease.” |

|

“If MORF-057 generates positive data and wins approval, it could potentially challenge Takeda Pharmaceutical’s already-marketed intravenous, subcutaneous, and injector pen versions of its injectable drug ENTYVIO (vedolizumab), an integrin receptor agonist indicated for moderately and severely active UC and Crohn’s.” |

Anti-Integrin Agents Therapeutics Market: Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Anti-Integrin Agents Therapeutics Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The EntyvioConnect Co-Pay Program offers financial assistance to eligible, commercially insured patients, covering out-of-pocket medication costs such as co-pays, co-insurance, and deductibles. Subject to terms and conditions, the Maximum Annual Benefit is USD 20,000 per calendar year. However, if a patient is enrolled in a co-pay maximizer or accumulator program, this benefit is reduced to USD 9,000 annually. This reimbursement only applies to medication costs—not administration or infusion fees—and may vary depending on the patient’s insurance and claim frequency. Reimbursement cannot be combined with other programs like FSAs, HSAs, or third-party assistance and requires submission of documentation such as Explanation of Benefits (EOB).

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on Anti-integrin Agents

- In July 2024, Eli Lilly announced to acquire Morphic Holding, a company focused on oral integrin therapies. Morphic’s lead drug, MORF-057, an oral α4β7 integrin inhibitor, is currently in Phase 2 trials for ulcerative colitis and Crohn’s disease, offering a potential new treatment for Crohn’s disease (CD) and ulcerative colitis (UC).

- In April 2024, U.S. FDA Approved Subcutaneous Administration of Takeda’s ENTYVIO (vedolizumab) for Maintenance Therapy in Moderately to Severely Active Crohn’s Disease.

- In September 2023, Morphic Therapeutic announced positive primary results from the phase 2a EMERALD-1 study evaluating the safety and efficacy of MORF-057 for adults with moderate to severe ulcerative colitis (UC). The results were presented in United European Gastroenterology Week 2023, which showed 25.7% of treated patients demonstrated endoscopic improvement and 45.7% achieved clinical response at week 12.

- In August 2023, the FDA approved Tyruko (natalizumab-sztn), developed by Sandoz and Polpharma Biologics, as the first biosimilar to Tysabri (natalizumab), and originally developed by Biogen. Tyruko was approved for the treatment of adults with relapsing forms of multiple sclerosis (MS), providing a more affordable alternative for patients.

Anti-Integrin Agents Market Report Scope

- The Anti-Integrin Agents Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its mechanism and therapies (current and emerging).

- Comprehensive insight into the Anti-Integrin Agents Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current Anti-Integrin Agents Treatment Market Landscape.

- A detailed review of the Anti-integrin Agents Treatment Market, historical and forecasted Anti-Integrin Agents Market Size, Anti-Integrin Agents Drugs Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Anti-Integrin Agents Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM Anti-integrin Agents Drugs Market.

Anti-integrin Agents Market Report Insights

- Anti-integrin Agents Targeted Patient Pool

- Anti-integrin Agents Therapeutic Approaches

- Anti-integrin Agents Pipeline Drugs Analysis

- Anti-integrin Agents Market Size

- Anti-Integrin Agents Market Trends

- Existing and Future Anti-Integrin Agents Drugs Market Opportunity

Anti-integrin Agents Market Report Key Strengths

- 10 years Anti-Integrin Agents Market Forecast

- The 7MM Coverage

- Key Cross Competition

- Anti-Integrin Agents Drugs Uptake

- Key Anti-Integrin Agents Market Forecast Assumptions

Anti-integrin Agents Treatment Market Report Assessment

- Current Anti-Integrin Agents Treatment Practices

- Anti-Integrin Agents Unmet Needs

- Anti-Integrin Agents Pipeline Drugs Profiles

- Anti-Integrin Agents Drugs Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the anti-integrin agents treatment market size, the market size by therapies, Anti-Integrin Agentsd drugs market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for anti-integrin agents?

- Which Anti-Integrin Agents drug type segment accounts for maximum anti-integrin therapy sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for anti-integrin agents evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with anti-integrin agents? What will be the growth opportunities across the 7MM for the patient population on Anti-integrin Agents?

- What are the key factors hampering the growth of the anti-integrin agents Market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for anti-integrin agents?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Anti-Integrin Agents therapies?

Reasons to buy

- The Anti-Integrin Agents Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing dynamics driving the anti-integrin agents Drugs Market.

- Understand the existing Anti-Integrin Agents market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming Anti-Integrin Agents companies in the Anti-Integrin Agents Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Anti-Integrin Agents Drugs Market so that the upcoming Anti-Integrin Agents companies can strengthen their development and launch strategy.

Stay updated with us for Recent Articles @ Latest DelveInsight Blogs