Antibody-mediated Rejection Market Summary

- Antibody Mediated Rejection Market is expected to witness significant growth over the forecast period, mainly driven by the entry of novel therapies with better clinical profiles, increasing awareness about Antibody Mediated Rejection, the introduction of non-invasive biomarkers, rising organ donation rate, and others.

- The Antibody Mediated Rejection Market Landscape in transplant patients is expected to evolve due to ongoing global efforts by companies to develop new drug treatments for this condition. Antibody-mediated Rejection companies like Hansa Biopharma, Sanofi, HI-Bio, and others are actively engaged in developing innovative therapies to address antibody-mediated rejection.

Antibody Mediated Rejection Market Insight and Trends

- Antibody‐mediated rejection (AMR), also termed humoral rejection is a significant complication following organ transplantation that contributes to short‐ and long‐term injury in transplant recipients. The phenotype of AMR ranges from hyperacute rejection, acute Antibody-mediated Rejection, and chronic Antibody-mediated Rejection.

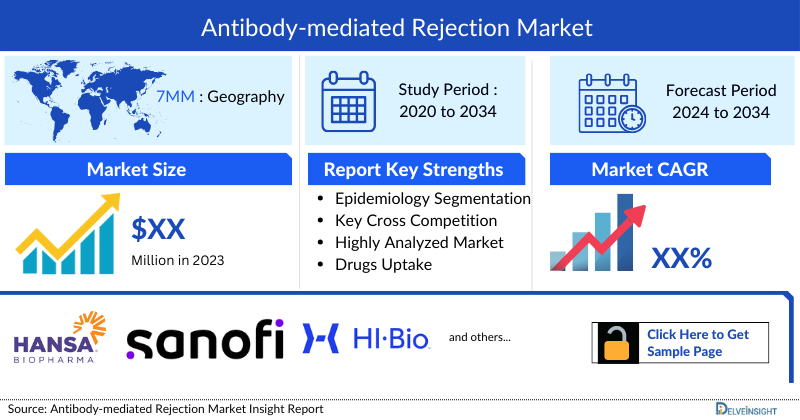

- As per DelveInsight’s estimates, the total incidence of Kidney transplants was more than 42,000 in 2023 in the 7MM, which represents approximately 60% of total transplant incidence cases.

- The primary aim of nearly all therapeutic approaches for AMR are removing circulating donor-specific antibody (DSA) and reducing DSA production.

- Currently, there are no FDA-approved treatments for Antibody-mediated Rejection, and very few randomized controlled trials have been conducted in this area to date. However, various off-label therapies are available in the Antibody-mediated Rejection market including complement inhibitors, anti-CD20 monoclonal antibody, proteasome inhibitors, interleukin-6 inhibitors, and others.

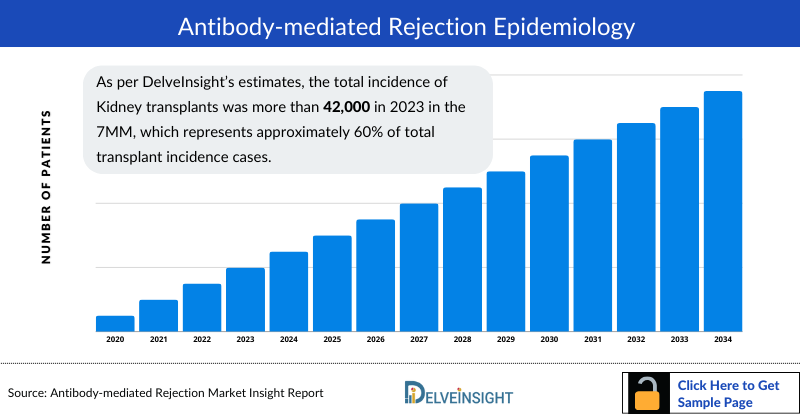

- The United States accounted for the largest Antibody Mediated Rejection Market size (approximately USD 70 Million), in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- In the US, Idefirix (imlifidase) is expected to garner the highest Antibody Mediated Rejection Market share during the forecast period.

- In March 2024, Human Immunology Biosciences (HI-Bio) announced that the US Food and Drug Administration (FDA) has granted Orphan Drug Designation (ODD) for felzartamab for the treatment of antibody-mediated rejection (AMR) in kidney transplant recipients.

Request for Unlocking the CAGR of the "Antibody-Mediated Rejection Drugs Market"

Factors Affecting Antibody Mediated Rejection Market Growth

Rising number of solid-organ transplants and transplant candidates.

As transplant volumes increase (kidney, heart, lung, liver), demand for AMR prevention/diagnostics/therapies grows.

Advances in diagnostics and monitoring (DSA testing, single-antigen assays, molecular pathology).

Better detection of donor-specific antibodies and earlier AMR diagnosis expands the addressable market for diagnostics and tailored therapies.

Emerging targeted therapies and R&D activity.

Novel biologics (e.g., complement inhibitors, anti-IL-6 agents, Ig-degrading enzymes like imlifidase) and repositioning of existing immunomodulators create new treatment categories and revenue streams.

Growing awareness and guideline standardization.

Increased clinician awareness and clearer diagnostic/treatment pathways raise uptake of diagnostic testing and standardized AMR management.

DelveInsight's “Antibody‐mediated Rejection Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of antibody‐mediated rejection, historical and forecasted epidemiology as well as the antibody‐mediated rejection market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Antibody-Mediated Rejection Drug Market Report provides real-world prescription pattern analysis, Antibody-Mediated Rejection emerging drugs, Antibody Mediated Rejection Market share of individual therapies, and historical and forecasted 7MM Antibody Mediated Rejection Market Size from 2020 to 2034. The report also covers current Antibody-Mediated Rejection Treatment Market practices/algorithms and Antibody-Mediated Rejection Unmet Needs to curate the best opportunities and assess the market’s underlying potential.

Scope of the Antibody Mediated Rejection Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Antibody‐mediated Rejection Epidemiology |

Segmented by:

|

|

Antibody‐mediated Rejection Companies |

|

|

Antibody‐mediated rejection Drugs |

|

|

Antibody‐mediated Rejection Market |

Segmented by:

|

|

Antibody‐mediated Rejection Drugs Market Analysis |

|

Antibody-Mediated Rejection: Disease Understanding

Antibody-mediated rejection (AMR), also termed humoral rejection, accounts for up to 76% of death-censored graft failures beyond the first year of transplantation. In the past, antibody-mediated rejection (AMR) or humoral rejection after renal transplantation was a devastating event that inevitably led to allograft loss. AMR often represents a pathological spectrum that co-exists with T-cell-mediated rejection. Active (acute) AMR is characterized by serological evidence of DSA, peritubular capillaritis, glomerulitis, cellular necrosis, thrombotic microangiopathy, and a relatively rapid decline in allograft function. The response to currently available therapies is often favorable.

Antibody-Mediated Rejection Diagnosis

The Antibody-Mediated Rejection diagnosis - as defined by the modified Banff 97 and recently revised in the Banff 2019 classification - requires three cardinal features, including (a) functional evidence of allograft dysfunction, (b) morphological evidence of acute tissue injury, and evidence of Ab-dependent activation of the classical pathway of the complement system (i.e., C4d deposition in the peritubular capillaries), and detection of circulating DRSA.

The antibody‐mediated rejection report provides an overview of antibody‐mediated rejection pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report

Antibody‐mediated Rejection Treatment

Antibody-Mediated Rejection Treatment includes majorly immunosuppressive medications, plasmapheresis or plasma exchange (PLEX), intravenous immunoglobulin (IVIG), and complement inhibitors. It also includes the anti-CD20 monoclonal antibody, proteasome inhibitor, and IL-6 inhibitor. Sometimes surgical splenectomy, splenic embolization, and splenic radiation are used as a salvage procedure for severe early AMR. The primary aims of nearly all therapeutic approaches for Antibody-mediated Rejection are removing circulating DSA and reducing DSA production. In this sense, the strongholds for contemporary treatment of Antibody-mediated Rejection are represented by plasma exchange (PLEX) and IVIG, although neither of these has FDA approval.

Over the last decade, the complement system has attracted increasing attention as an important contributor to Antibody-Mediated Rejection. Eculizumab is a high-affinity monoclonal, humanized antibody directed against complement component C5 and has been proposed for Antibody-mediated Rejection treatment. Bortezomib is a proteasome inhibitor approved for the treatment of multiple myeloma that directly targets antibody-producing plasma cells making it an attractive candidate for the treatment of Antibody-mediated Rejection.

Antibody‐mediated Rejection Epidemiology

The Antibody-Mediated Rejection epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The antibody‐mediated rejection epidemiology is segmented with detailed insights into Transplant Incidence Cases and Antibody‐mediated Rejection Cases.

- As per DelveInsight's estimates, Kidney, Lung, and Liver transplant cases were top three contributors in total cases of antibody-mediated rejection in the 7MM in 2023.

- According to DelveInsight’s epidemiology model, the US accounted for majority of the AMR cases, representing more than 60% of cases in the 7MM in 2023.

- Among EU4 and the UK, the highest number of Antibody-Mediated Rejection cases was found in France, followed by Spain and the UK, respectively.

Unlock comprehensive insights! Click Here to Purchase the Full Report @ Antibody-Mediated Rejection Prevalence

Antibody‐mediated Rejection Market Recent Developments and Breakthroughs

- On October 9, 2024, Biogen revealed that its investigational anti-CD38 monoclonal antibody, felzartamab, received Breakthrough Therapy Designation (BTD) from the FDA for treating late antibody-mediated rejection (AMR) in kidney transplant patients. This designation reflects felzartamab's potential to become a novel treatment option for those suffering from this severe condition that threatens transplant success.

Antibody‐mediated Rejection Drug Analysis

The drug chapter segment of the Antibody Mediated Rejection treatment Market report encloses a detailed analysis of antibody‐mediated rejection marketed drugs and late-stage (Phase III and Phase II) Antibody-Mediated Rejection pipeline drugs. It also deep dives into the pivotal antibody‐mediated rejection clinical trials details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Emerging Antibody-Mediated Rejection Drugs

- Imlifidase: Hansa Biopharma

Imlifidase is a unique antibody-cleaving enzyme originating from Streptococcus pyogenes that specifically targets IgG and inhibits IgG-mediated immune response. It has a rapid onset of action, cleaving IgG-antibodies and inhibiting their reactivity within hours after administration. In October 2018, the US Food and Drug Administration (FDA) granted imlifidase Fast Track Designation for the investigation of imlifidase for transplantation. Currently, it is being investigated under a Phase III clinical trial.

- Riliprubart (SAR445088/BIVV020): Sanofi

Riliprubart (SAR445088), formerly known as BIVV020, is a humanized monoclonal antibody that targets complement C1s, developed by Sanofi for the prevention and treatment of Antibody-mediated Rejection. It binds to and inhibits the classical pathway (CP) specific serine protease (C1s), thereby inhibiting CP activity. Activation of the CP of complement is associated with various immune disorders involving the presence of autoantibodies. The drug is currently recruiting for its Phase II open-label study to assess the preliminary efficacy, safety, and pharmacokinetics of BIVV020 to prevent and treat Antibody-mediated Rejection in adult kidney transplant recipients

Note: Detailed emerging therapies assessment will be provided in the final report.

Emerging Antibody-Mediated Rejection Drugs Analysis | ||||

|

Drugs |

Company |

Phase |

ROA |

MoA |

|

Imlifidase |

Hansa Biopharma |

III |

Intravenous |

IgG antibody-cleaving enzyme |

|

Riliprubart (SAR445088) |

Sanofi |

II |

Intravenous |

Complement C1s inhibitor |

Antibody‐mediated Rejection Market Outlook

Key Antibody-Mediated Rejection companies, such as Sanofi, Hansa Biopharma, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of antibody‐mediated rejection.

- The United States represents approximately 70% of the Antibody Mediated Rejection Market Size, surpassing the combined market size of Germany, Spain, Italy, France (referred to as EU4), the United Kingdom, and Japan.

- By 2034, imlifidase is anticipated to achieve the prominent Antibody Mediated Rejection Market Share in the 7 major markets.

- France accounts for the second highest Antibody Mediated Rejection Market Size in the 7MM during the forecast period 2024–2034.

- The Antibody Mediated Rejection Market Size is expected to grow during the forecast period, i.e., 2024–2034, due to rising transplant rates and improved diagnostic capabilities. Ongoing research and development efforts are also expanding the range of effective therapies, driving Antibody Mediated Rejection market expansion.

Antibody‐mediated Rejection Drugs Uptake

This section focuses on the uptake rate of potential Antibody-Mediated Rejection drugs expected to be launched in the Antibody Mediated Rejection market during 2024-2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key Antibody-Mediated Rejection companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Antibody‐mediated Rejection Clinical Trial Analysis

The Antibody-Mediated Rejection pipeline segment provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Antibody-Mediated Rejection Companies involved in developing targeted therapeutics.

Antibody Mediated Rejection Pipeline Development Activities

The Antibody-Mediated Rejection pipeline segment covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging antibody‐mediated rejection therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Antibody-Mediated Graft Rejection Pipeline

Latest KOL Views on Antibody-Mediated Rejection

To keep up with the real-world scenario in current and emerging Antibody Mediated Rejection Market Trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on the evolving Antibody-Mediated Rejection Treatment Market Landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as Johns Hopkins Hospital, University of California, Centre Hospitalier Universitaire de Bordeaux, Osaka University, etc., were contacted. Their opinion helps understand and validate current and emerging Antibody-Mediated Rejection treatment patterns of antibody‐mediated rejection. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Antibody Mediated Rejection Market and the Antibody-Mediated Rejection Unmet Needs.

What KOLs are saying on Antibody-Mediated Rejection Trends? | |

|

Region |

KOL Views |

|

United States |

“Newer studies evaluating rituximab showed little or no difference to early graft survival, and the efficacy of bortezomib and complement inhibitors for the treatment of AMR remains unclear. Despite the evidence uncertainty, plasmapheresis and IVIG have become standard-of-care for the treatment of acute AMR.” |

|

France |

“Chronic antibody-mediated rejection has very few effective therapeutic options. The traditional approach consist of high dose of intravenous immunoglobulin, rituximab, eculizumab, proteasome inhibitors, and others. Additionally, Interleukin-6 is an attractive target to treat chronic AMR because of its involvement in inflammation and humoral immunity. Therefore, it can be a potential therapeutic option to treat chronic AMR kidney-transplant recipients.” |

Antibody-Mediated Rejection Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Antibody Mediated Rejection Market Access and Reimbursement

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers’ concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

The Antibody Mediated Rejection treatment Market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Antibody Mediated Rejection Market Report Scope

- The Antibody Mediated Rejection Market size report covers a segment of key events, an executive summary, descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the Antibody-Mediated Rejection epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current Antibody-Mediated Rejection treatment market landscape.

- A detailed review of the antibody‐mediated rejection drug market, historical and forecasted Antibody Mediated Rejection Market size, Antibody Mediated Rejection Market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Antibody Mediated Rejection treatment market size report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM antibody‐mediated rejection treatment market.

Antibody Mediated Rejection Market Forecast Report Insights

- Patient-based Antibody Mediated Rejection Market Forecasting

- Therapeutic Approaches

- Antibody‐mediated Rejection Pipeline Analysis

- Antibody‐mediated Rejection Market Size

- Antibody Mediated Rejection Market Trends

- Existing and Future Antibody-Mediated Rejection Drug Market Opportunity

Antibody‐mediated Rejection Market Forecast Report Key Strengths

- 11 Years- Antibody Mediated Rejection Market Forecast

- 7MM Coverage

- Antibody‐mediated Rejection Epidemiology Segmentation

- Inclusion of Country Specific Treatment Guidelines

- KOL’s Feedback On Approved and Emerging Therapies

- Key Cross Competition

- Conjoint Analysis

- Antibody-Mediated Rejection Drugs Uptake

- Key Antibody Mediated Rejection Market Forecast Assumptions

Antibody‐mediated Rejection Market Report Assessment

- Current Antibody-Mediated Rejection Treatment Market Practices

- Antibody-Mediated Rejection Unmet Needs

- Antibody-Mediated Rejection Pipeline Product Profiles

- Antibody Mediated Rejection Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Frequently Asked Questions on Antibody-Mediated Rejection Market Report

- What is the growth rate of the 7MM antibody‐mediated rejection treatment market?

- What was the antibody‐mediated rejection market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the Antibody Mediated Rejection Market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the Antibody-Mediated Rejection treatment?

- How many Antibody Mediated Rejection companies are developing therapies for the Antibody-Mediated Rejection treatment?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing Antibody Mediated Rejection therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Antibody Mediated Rejection therapies?

Reasons to buy Antibody-Mediated Rejection Market Report

- The Antibody Mediated Rejection Market outlook report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the antibody‐mediated rejection market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing Antibody-Mediated Rejection drug market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Antibody-Mediated Rejection companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging Antibody Mediated Rejection therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the Antibody-Mediated Rejection unmet needs of the existing market so that the upcoming Antibody-Mediated Rejection companies can strengthen their development and launch strategy.

Stay Updated with us