Complement Inhibitors Market Forecast and Competitive Landscape

- The complement inhibtors market size is estimated to be approximately USD 7 Billion, in the 7 MM.

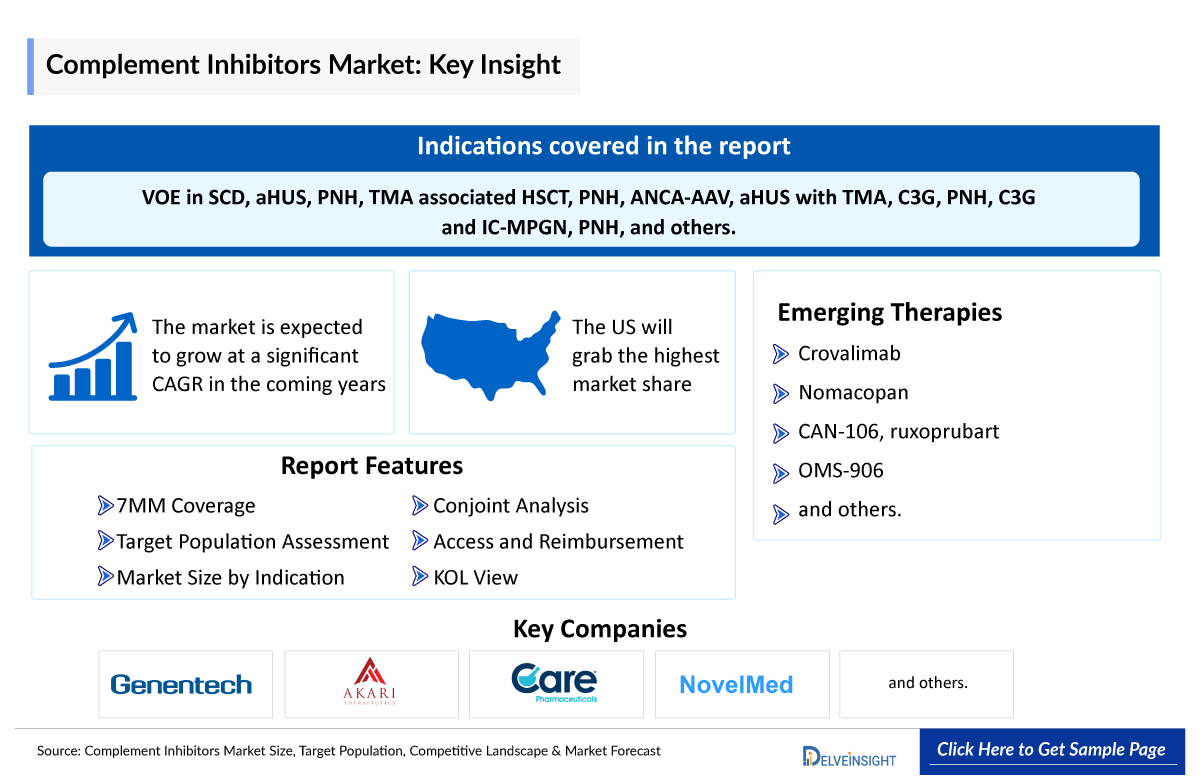

- The complement inhibitors market is expected to grow significantly in the coming years. Since the launch of SOLIRIS and ULTOMIRIS, the complement inhibitor market has seen a lot of traction, and many companies are now developing novel complement inhibitors, potentially paralleling the efficacy and safety profile of eculizumab.

- Complement signaling occurs via three main activation pathways: the classical pathway, the lectin pathway, and the alternative pathway (AP). These three pathways converge at the level of C3 convertase; C3 convertase activates and C5 convertases, ultimately resulting in the production of the highly inflammatory C5a and the formation of C5b-9 or membrane attack complex (MAC).

- Proximal complement is important for functions related to microbial opsonization and immune complex clearance (mediated by C3b). Terminal complement is the effector function of the complement cascade, causing cell destruction through the formation of a pore (C5b-9, the MAC) and the potent anaphylatoxin C5a, resulting in the activation of inflammatory pathways and platelets, leukocytes, and endothelial cells.

- Currently, there are 13 complement inhibitors in the market approved for various complement dysregulation disorders.

- Alexion’s SOLIRIS (eculizumab) was the first complement inhibitor approved in 2007 for Paroxysmal Nocturnal Hemoglobinuria (PNH), it was later approved for additional three indications namely, Atypical Hemolytic Uremic Syndrome (aHUS), Neuromyelitis Optica Spectrum Disorder (NMOSD), and Generalized Myasthenia Gravis (gMG).

- ULTOMIRIS (ravulizumab), successor of SOLIRIS was launched by the same company, Alexion Pharmaceuticals (now a subsidiary of AstraZeneca) with a more patient compliant dosage regimen, was approved in 2018 for PNH and then for additional indications in the subsequent years.

- Current complement inhibitors market landscape include C5, C3, Factor-B, and Factor-D inhibitors. Besides Alexion Pharmaceuticals (a subsidiary of AstraZeneca), the market consists of major complement inhibitors companies, including but not limited to Novartis’ FABHALTA (iptacopan), Apellis’ EMPAVELI (pegcetacoplan), Astellas’ IZERVAY (avacincaptad pegol), and UCBs’ ZILBRYSQ (zilucoplan)

- A few of the potential emerging complement inhibitors are crovalimab (C5 inhibitor), nomacopan (C5/LTB4 inhibitor), CAN-106 (C5 inhibitor), ruxoprubart (Anti-Bb antibody), and OMS-906 (MASP inhibitor)

- In February 2024, FDA has granted Orphan Drug Designation (ODD) to ruxoprubart for the treatment of PNH.

- AstraZeneca/Alexions’ VOYDEYA (danicopan) was approved by the FDA in April 2024, for use as add-on therapy to ravulizumab or eculizumab for extravascular hemolysis in PNH. The companys’ another drug, ULTOMIRIS also received an indication expansion by the FDA for NMOSD in March 2024.

DelveInsight’s “Complement inhibitor Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the complement inhibitors, historical and forecasted epidemiology, competitive landscape as well as the complement inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The complement inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM C5 inhibitors market size from 2020 to 2034. The complement inhibitors market report also covers current C5 inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the complement inhibitors market’s potential.

Complement Inhibitors Market: Understanding and Treatment Algorithm

Complement Inhibitors Overview

The complement system is part of the innate immune response system, composed of more than 50 distinct plasma and serum proteins that interact to opsonize pathogens and induce inflammatory responses to fight infection. In the absence of pathogenic or altered self-derived threats, the complement core components C3 and C5 circulate mostly in inactive forms. C3 and C5 processing into biologically active fragments can be initiated via three distinct activation pathways, the classical pathway (CP), the lectin pathway (LP), and the alternative pathway (AP). The three pathways are triggered by distinct pathogen- or danger-associated molecular pattern (PAMPs and DAMPs) but share several common components and lead to the assembly of C3 activating CP/LP and AP C3 convertases, C5 activating CP/LP and AP C5 convertases, and the induction of the pathogen-killing terminal pathway (TP). Atypical hemolytic uremic syndrome (aHUS), C3 glomerulopathy (C3G), and paroxysmal nocturnal hemoglobinuria (PNH) are prototypical disorders of complement dysregulation. Further, the numbers of diseases in which complement dysregulation has conclusively been identified as a pathology driver is increasing.

Further details related to complement dysregulation disorders are provided in the report

Complement Inhibitors Treatment

There is ample opportunity to block unwanted complement activation pharmacologically. For example, complement inhibitors can be targeted to the DAMP or PAMP recognition component of complement, the specific activation pathways (LP, CL, and AP), the C3/C5convertases, C3 or C5 itself, and their activation effector molecules or complexes (for example, C3a, C5a and their respective receptors, CR3, and the MAC etc.)

Complement inhibition has also shown some effect in connection with C3-glomerulopathy (C3GN) (including dense deposit disease, DDD), antibody-mediated acute rejection of kidney transplants, severe antiphospholipid syndrome, vasculitis associated with antineutrophil cytoplasmatic antibodies (ANCA), myasthenia gravis and neuromyelitis optica.

Further details related to treatment overview are provided in the report

NOTE: Figure is indicative and is subject to change as per report updation

Complement Inhibitors Drug Chapters

The drug chapter segment of the complement inhibitors market reports encloses a detailed analysis of complement inhibitors’ marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the complement inhibitors' clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed complement inhibitors Drugs

Currently, there are 13 marketed complement inhibitors in various indications.

VOYDEYA - AstraZeneca/Alexion

VOYDEYA (danicopan) is a first-in-class oral Factor D inhibitor. The medication works by selectively inhibiting Factor D, a complement system protein that plays a key role in the amplification of the complement system response. When activated in an uncontrolled manner, the complement cascade over-responds, leading the body to attack its own healthy cells. Voydeya has been granted breakthrough therapy designation by the US FDA and PRIority MEdicines (PRIME) status by the European Medicines Agency. Voydeya has also been granted orphan drug designation in the US, EU and Japan for the treatment of PNH.

AstraZeneca/Alexion is also evaluating VOYDEYA as a potential monotherapy for geographic atrophy in a Phase II clinical trial.

ZILBRYSQ (zilucoplan) - UCB Pharma

Zilucoplan is a once-daily, subcutaneous, self-administered peptide inhibitor of complement component 5 (C5 inhibitor). As the only once-daily gMG target therapy for self-administration by adult patients with anti-AChR antibody-positive gMG, zilucoplan inhibits complement-mediated damage to the neuromuscular junction through its targeted mechanism of action. The drug received FDA approval in October 2023.

Moroever, in September 2023, the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) issued a positive opinion recommending granting marketing authorization for zilucoplan in the European Union (EU) as an add-on to standard therapy for the treatment of generalized myasthenia gravis (gMG) and was later granted marketing authorization by EMA in December 2023. Also in the same year, Japanese Ministry of Health, Labour and Welfare (MHLW) approved zilucoplan for the treatment of gMG in adult patients who inadequately respond to steroids or other immunosuppressants.

Note: Detailed current therapies assessment will be provided in the full report of Complement Inhibitors

Emerging Complement Inhibitors Drugs

Crovalimab: Genentech

Crovalimab is an investigational, novel anti-C5 recycling monoclonal antibody designed to block the complement system. Crovalimab works by binding to C5, blocking the last step of the complement cascade and is also recycled within the bloodstream, enabling rapid and sustained complement inhibition. Crovalimab’s recycling properties also enable low dose subcutaneous (SC) administration every four weeks. In addition, crovalimab binds to a different C5 binding site from current treatments, which has the potential to provide a treatment option for people with specific C5 gene mutations who do not respond to current therapies. It is also being evaluated in atypical hemolytic uremic syndrome, sickle cell disease, and other complement mediated diseases

In September 2023, FDA accepted the Biologics License Application (BLA) for crovalimab, for the treatment of paroxysmal nocturnal hemoglobinuria (PNH). If approved, crovalimab will be the first monthly subcutaneous treatment for PNH, with the option to self-administer outside of a supervised healthcare setting

IONIS-FB-LRx/RG6299: Ionis/Roche

IONIS-FB-LRx, RG6299 is an antisense oligonucleotide that inhibits complement factor B gene expression by binding with factor B mRNA. It is being studied for the treatment of geographic atrophy as well as for the treatment of IgA nephropathy in a Phase II study.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

Company |

Drug |

Indication |

MoA |

RoA |

Phase status |

NCTID |

|

Genentech |

Crovalimab |

VOE in SCD |

SC |

II |

NCT05075824 | |

|

aHUS |

C5 inhibitor |

SC |

III |

NCT04861259 | ||

|

PNH |

C5 inhibitor |

SC |

III |

NCT04654468 | ||

|

AKARI Therapeutics |

Nomacopan |

TMA associated HSCT |

C5/LTB4 inhibitor |

SC |

III |

NCT04784455 |

|

CARE Pharma |

CAN-106 |

PNH |

C5 inhibitor |

IV |

II |

NCT05539248 |

|

NovelMed Therapeutics

|

ruxoprubart

|

C3Bb inhibitor |

SC |

II |

NCT06226662 | |

|

aHUS with TMA (Thrombotic Microangiopathy) |

Anti-Bb antibody |

SC |

II |

NCT05684159 | ||

|

C3G |

Anti-Bb antibody |

SC |

II |

NCT05647811 | ||

|

PNH |

Anti-Bb antibody |

SC |

II |

NCT05646524 | ||

|

Omeros Corporation

|

OMS-906

|

C3G and IC-MPGN |

MASP-3 inhibitor |

SC |

II |

NCT06209736 |

|

PNH |

MASP-3 inhibitor |

SC |

II |

NCT06298955 | ||

|

VOE in SCD - Vaso-Occlusive Episodes in Sickle Cell Disease, ANCA-AAV - ANCA-Associated Vasculitis, IC-MPGN - Immune Complex-Mediated Glomerulonephritis | ||||||

Complement Inhibitors Market Outlook

Complement Inhibitors Drugs Uptake

Complement Inhibitors Pipeline Development Activities

- In 2021, AstraZeneca acquired Alexion for USD 39 billion, with an aim to create a dedicated rare disease unit and enter into the complement inhibitors market of other complement mediated disorders through Alexions’ pipeline.

- In 2022, Amgen acquired ChemoCentryx for USD 3.7 billion, in order to retain its share in the inflammatory disease market with ChemoCentryxs’ TAVNEOS (avocapan). Avocapan is approved for ANCA-associated vasculitis and is currently being evaluated for Hidradenitis Suppurativa in a phase II study.

- In 2023, Astellas acquired Iveric Bio for USD 5.9 billion. Iveric Bio’s IZERVAY (avacincaptad pegol) is approved for geographic atrophy.

|

KOL Views |

|

“The complement inhibitors offer a more targeted approach to inflammation, potentially eliminating the need for prolonged systemic glucocorticoid use. Additionally, it is crucial to focus on the development of biomarkers associated with complement activation, which can effectively identify patients with elevated complement activity. This approach enables a more personalized and precise treatment strategy ” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Scope of the Complement Inhibitors Market Report

- The Complement Inhibitors market report covers a segment of key events, an executive summary, and a descriptive overview of Complement Inhibitors, explaining their mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies that will impact the current landscape.

- A detailed review of the Complement Inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Complement Inhibitors market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM Complement inhibitors market.

Complement Inhibitors Market Report Insights

- Complement Inhibitors Targeted Patient Pool

- Therapeutic Approaches

- Complement inhibitors Pipeline Analysis

- Complement inhibitors Market Size

- Complement Inhibitors Market Trends

- Existing and future Complement Inhibitors Market Opportunity

Complement inhibitors Market Report Key Strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- Complement Inhibitors Drugs Uptake

- Key Complement Inhibitors Market Forecast Assumptions

Complement Inhibitors Market Report Assessment

- Current Treatment Practices

- Complement Inhibitors Unmet Needs

- Complement Inhibitors Pipeline Product Profiles

- Complement Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the Complement inhibitor market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which Complement Inhibitors is going to be the largest contributor in 2034?

- Which is the most lucrative market for Complement inhibitors?

- Which drug type segment accounts for maximum Complement inhibitor sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for Complement inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with Complement inhibitors? What will be the growth opportunities across the 7MM for the patient population of Complement inhibitors?

- What are the key factors hampering the growth of the Complement inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for Complement inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved Complement Inhibitors therapies?

Reasons to buy

- The Complement Inhibitors market report will help develop business strategies by understanding the latest trends and changing dynamics driving the Complement inhibitors Market.

- Understand the existing Complement Inhibitors market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming Complement Inhibitors companies in the Complement Inhibitors market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Complement Inhibitors market so that the upcoming Complement Inhibitors companies can strengthen their development and launch strategy