Bioanalytical Testing Services Market

Bioanalytical Testing Services Market by Service Type (Pharmacokinetics (PK) and Pharmacodynamics (PD) Testing, Bioavailability and Bioequivalence Testing, Toxicology Testing, Biomarker Analysis, and Others), Bioanalytical Testing Services Market by Phase (Discovery, Preclinical, and Clinical), Bioanalytical Testing Services Market by Molecule Type (Small Molecule Bioanalysis and Large Molecule Bioanalysis), Bioanalytical Testing Services Market by End-Users (Biopharmaceutical and Pharmaceutical Companies, Biotechnology Companies, and Others), and Bioanalytical Testing Services Market by Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a robust CAGR forecast till 2032 owing to the growing prevalence of chronic and infectious diseases and increasing funding and investment for more extensive drug discovery and development activities.

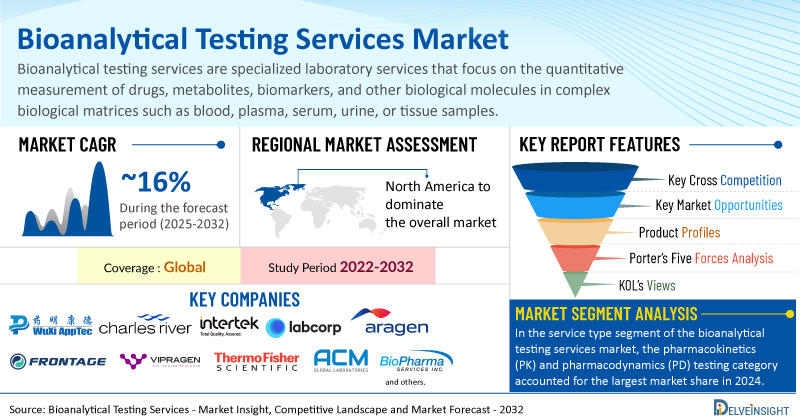

The bioanalytical testing services market was valued at USD 3,913.46 million in 2024, growing at a CAGR of 16.11% during the forecast period from 2025 to 2032 to reach USD 12,866.66 million by 2032. The demand for bioanalytical testing services is experiencing significant growth, primarily driven by the rising prevalence of chronic and infectious diseases. The increasing demand for biopharmaceuticals and biologics has further accelerated the expansion of this market. Additionally, the pharmaceutical and biotechnology sectors are actively expanding their R&D pipelines, particularly in areas such as biologics, biosimilars, and advanced therapies, including gene and cell therapies. This growth is further supported by a surge in research collaborations and strategic partnerships, which have collectively led to an increase in the number of clinical trials. These developments have heightened the need for comprehensive bioanalytical testing services. Collectively, these factors are expected to propel the bioanalytical testing services market toward robust and sustained growth throughout the forecast period from 2025 to 2032.

Bioanalytical Testing Services Market Dynamics:

According to the World Health Organization (2024), an estimated 20 million new cancer cases were reported globally in 2022, with projections expected to surpass 35 million by 2050. Similarly, the International Diabetes Federation (2023) reported that 537 million adults aged 20–79 were living with diabetes in 2021, a figure projected to rise to 643 million by 2030 and 783 million by 2045. Infectious diseases remain a critical concern, with the WHO (2023) estimating that 10.8 million people developed tuberculosis in 2023 alone. This growing disease burden is increasing the demand for innovative diagnostics and therapies, which in turn is driving the need for robust bioanalytical testing to support drug development, regulatory submissions, and clinical trial progression.

The global rise in clinical trial activity further reinforces this trend. ClinicalTrials.gov reported that by December 2024, over 518,210 clinical trials were registered, up from 477,219 in 2023, highlighting the surge in drug development initiatives. These trials require extensive PK/PD, bioavailability, and bioequivalence studies across all phases, significantly boosting the demand for bioanalytical services.

Additionally, increased investment in R&D is fueling market expansion. As per data from the Pharmaceutical Research and Manufacturers of America (PhRMA), global biopharmaceutical R&D investment reached $276 billion in 2022, across 4,191 companies. This surge is particularly evident in biologics, biosimilars, gene, and cell therapies, which demand highly precise PK/PD data, immunogenicity assessments, and biomarker assays—core offerings of bioanalytical service providers.

In response to this growing demand, key players are expanding their capabilities. For instance, in May 2025, Ardena announced a milestone at its newly established bioanalytical laboratory at Pivot Park in Oss, Netherlands. The facility is purpose-built to support both small and large molecule programs and is equipped with state-of-the-art LC-MS/MS systems and advanced immunochemistry platforms such as MSD and Gyrolab. This expansion underscores the industry’s commitment to providing high-quality, scalable bioanalytical solutions across therapeutic modalities and clinical stages.

Collectively, these factors position the bioanalytical testing services market for robust and sustained growth through 2032, driven by escalating healthcare needs, clinical development activity, and technological innovation.

However, the high cost of advanced bioanalytical testing technologies and the complexity of analytical method development and validation, among others, are some of the key constraints that may limit the growth of the bioanalytical testing services market.

Get a sneak peek at the bioanalytical testing services market dynamics @ Bioanalytical Testing Services Market Trends

Bioanalytical Testing Services Market Segment Analysis:

Bioanalytical Testing Services Market by Service Type (Pharmacokinetics (PK) and Pharmacodynamics (PD) Testing, Bioavailability and Bioequivalence Testing, Toxicology Testing, Biomarker Analysis, and Others), Bioanalytical Testing Services Market by Phase (Discovery, Preclinical, and Clinical), Bioanalytical Testing Services Market by Molecule Type (Small Molecule Bioanalysis and Large Molecule Bioanalysis), Bioanalytical Testing Services Market by End-Users (Biopharmaceutical and Pharmaceutical Companies, Biotechnology Companies, and Others), and Bioanalytical Testing Services Market by Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the service type segment of the bioanalytical testing services market, the pharmacokinetics (PK) and pharmacodynamics (PD) testing category is estimated to account for the largest market share in 2024. This dominance is primarily driven by the growing volume of drug development activities worldwide and the critical role PK/PD testing plays in the drug development lifecycle. According to data from the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA, 2022), over 9,000 medicines were in development globally, underscoring the scale of innovation requiring robust analytical support.

PK/PD testing provides detailed insights into how a drug is absorbed, distributed, metabolized, and excreted (PK), as well as how it interacts with its biological target to produce therapeutic effects (PD). These studies are essential for determining the optimal dose, dosing frequency, and therapeutic window, which are crucial for maximizing efficacy while minimizing toxicity. They also enable the establishment of exposure-response relationships, helping developers correlate drug concentration with safety and efficacy outcomes.

Beyond guiding dose optimization, PK/PD testing plays a key role in personalized medicine by identifying variability in drug response among patient populations, allowing for targeted and individualized treatment strategies. Moreover, regulatory agencies such as the FDA and EMA mandate comprehensive PK/PD data for clinical trial approvals and marketing authorization, further highlighting their significance.

These services also mitigate development risks by identifying safety and efficacy issues early, thereby improving clinical trial success rates and accelerating time-to-market.

|

Bioanalytical Testing Services Study Period |

2022 to 2032 |

|

Bioanalytical Testing Services Market Forecast Period |

2025 to 2032 |

|

Geographies Covered |

Global |

|

Bioanalytical Testing Services Market |

|

|

Bioanalytical Testing Services Companies |

|

Key industry players are actively expanding their capabilities to meet this growing demand. For instance:

- WuXi AppTec offers GLP toxicokinetics (TK) and PK sample analysis to support regulatory submissions.

- Charles River provides Bioanalytical Mass Spectrometry Services for detailed PK assessments.

- Biocytogen delivers comprehensive PK/PD services, supporting both preclinical and clinical stages of drug development.

These offerings ensure that pharmaceutical and biotechnology companies can successfully advance their therapeutic candidates through the development pipeline with robust analytical support.

Given these factors, the PK/PD testing segment is expected to generate significant revenue and serve as a major contributor to the overall growth of the bioanalytical testing services market during the forecast period.

North America is expected to dominate the overall bioanalytical testing services market:

North America is expected to hold the largest share of the global bioanalytical testing services market in 2024, driven by a combination of key structural and strategic advantages. This is mainly due to the increasing number of patients with chronic and infectious diseases and the growing focus on drug discovery and development. The rising demand for biopharmaceuticals and biologics, along with higher R&D investments, is boosting market growth. In addition, more research collaborations and partnerships between pharmaceutical and biotech companies are leading to a higher number of clinical trials, further driving the demand for bioanalytical testing services in the region.

According to GLOBOCAN (2024), the number of cancer cases in the United States reached 2,380,189 in 2022, with projections indicating a rise to 2,791,752 cases by 2030. In addition, the American Cancer Society reported in January 2025 that approximately 2,041,910 new cancer cases were expected to be diagnosed in the U.S. in 2025. Similarly, the Centers for Disease Control and Prevention (2024) reported that in 2022, over 31,800 new HIV infections were reported in the United States. The rising burden of chronic and infectious diseases is increasing the demand for innovative diagnostics and effective therapies, which in turn is driving the need for bioanalytical testing services to support drug development and regulatory submissions.

Moreover, the market is being fueled by rising R&D investment by leading pharmaceutical companies in the region. According to the Pharmaceutical Research and Manufacturers of America (PhRMA, 2022), R&D investment in the U.S. pharmaceutical sector reached USD 102.3 billion. This growing investment is driving demand for advanced analytical capabilities to validate drug candidates, optimize dosing, and ensure compliance with regulatory standards across all development phases.

The United States also leads globally in clinical trial activity, accounting for 29% of all clinical trials worldwide, with 159,403 trials listed as of 2025, according to ClinicalTrials.gov. The increasing number of clinical trials is directly boosting demand for bioanalytical testing services, particularly for PK/PD analysis, biomarker testing, and immunogenicity assessment, which are critical to demonstrating drug safety and efficacy.

In response to this demand, key industry players are expanding their service capabilities. For example, in August 2024, SGS launched new specialized bioanalytical testing services in the North American market. These services support all stages of drug development, from discovery through Phase I–III clinical trials, and include method transfer, development and validation, PK/PD bioanalysis, immunogenicity testing, ELISA, multiplex assays, and other essential bioassays.

Together, these factors are positioning North America as a leading market for bioanalytical testing services, driven by a strong healthcare demand, high R&D activity, and continuous expansion of analytical infrastructure.

To know more about why North America is leading the market growth, get a snapshot of the Bioanalytical Testing Services Market Outlook

Bioanalytical Testing Services Companies:

Some of the key market Bioanalytical Testing Services players operating in the bioanalytical testing services market include WuXi AppTec, Charles River Laboratories, Intertek Group plc, Labcorp, Aragen Life Sciences Ltd., Precision Medicine Group, LLC, Frontage Labs, SGS Société Générale de Surveillance SA, Vipragen, Pace Labs, Thermo Fisher Scientific Inc., ACM Global Laboratories, BioPharma Services Inc., Eurofins Scientific, Medpace Holdings, Inc., Anapharm Bioanalytics, ICON plc, Almac Group, BioAgilytix Labs, Quotient Sciences, and others.

Which MedTech key players in the bioanalytical testing services market are set to emerge as the trendsetter explore @ Bioanalytical Testing Services Analysis

Recent Developmental Activities in the Bioanalytical Testing Services Market:

- In October 2024, Synexa Life Sciences expanded its bioanalytical capabilities through the acquisition of CRO Alderley Analytical. This strategic move marks a significant milestone in Synexa’s growth journey and reinforces its position as a scientific partner of choice for biomarker and bioanalytical solutions. The acquisition enhances Synexa’s service offerings and strengthens its global presence in bioanalysis testing.

- In May 2024, BBI Solutions OEM Limited announced a partnership agreement with BioAgilytix, a leading global bioanalytical laboratory. This collaboration aims to combine BBI’s expertise in producing high-quality custom antibody reagents with BioAgilytix’s advanced bioanalytical testing services. The partnership is expected to enhance the development and delivery of reliable testing solutions across a wide range of therapeutic and diagnostic applications.

- In December 2023, SGS announced a partnership with Agilex Biolabs, Australia’s largest and most advanced regulated bioanalytical laboratory. This collaboration represents a strategic move to strengthen SGS’s global footprint in the bioanalytical services sector, enhancing its capabilities and reach in regulated bioanalysis.

Key takeaways from the bioanalytical testing services market report study

- Bioanalytical Testing Services Market size analysis for the current bioanalytical testing services market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key Bioanalytical Testing Services companies dominating the bioanalytical testing services market.

- Various opportunities available for the other competitors in the bioanalytical testing services market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current bioanalytical testing services market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the bioanalytical testing services market growth in the future?

Target audience who can benefit from this bioanalytical testing services market report study

- Bioanalytical testing services product providers

- Research organizations and consulting Bioanalytical Testing Services companies

- Bioanalytical testing services-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in bioanalytical testing services

- Various end-users who want to know more about the bioanalytical testing services market and the latest technological developments in the bioanalytical testing services market.

Get detailed insights @ DelveInsight Blogs