Pharmaceuticals Market

Pharmaceutical Market by Modality Type (Small Molecule and Biologics [Monoclonal Antibodies, Antibody Drug Conjugates, Peptide Drug Conjugates, Nucleic Acid Medicines, Vaccines, and Others]), Product Type (Branded and Generic), Drug Type (Prescription Drugs and Over-the-Counter (OTC) Drugs), Formulation (Solid Dosage Forms, Semi-solid Dosage Forms, and Liquid Dosage Forms), Route of Administration (Oral, Parenteral, and Others), Therapy Area (Oncology, Cardiology, Neurology, Immunology, Endocrinology, Infectious Disease, and Others), Distribution Channel (Hospital & Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising demand for pharmaceutical owing to increase in various acute & chronic diseases and increasing investments and innovations in the research and development of pharmaceutical.

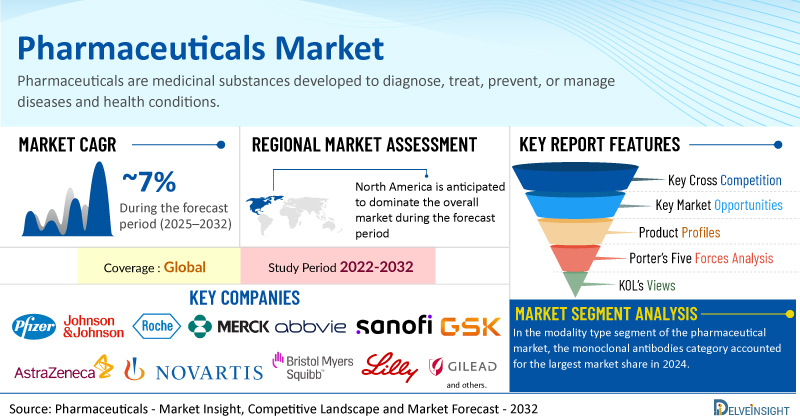

The global pharmaceutical market was valued at USD 1,473 billion in 2024, growing at a CAGR of 6.54% during the forecast period from 2025 to 2032 to reach USD 2,435.53 billion by 2032. The growth of the pharmaceutical market is primarily driven by the rising demand for medications due to the increasing prevalence of various acute and chronic diseases, including cancer, cardiovascular disorders, neurological conditions, and diabetes. There is also a growing demand for biologic drugs, such as monoclonal antibodies, which offer targeted and effective treatment options. Additionally, increased investments and continuous innovations in pharmaceutical research and development are further propelling market expansion. Moreover, the surge in drug development activities among biotech companies and pharmaceutical firms is contributing significantly to this growth. Together, these trends are creating a favorable environment for sustained growth, positioning the pharmaceutical market for robust and consistent expansion throughout the forecast period from 2025 to 2032.

Interested in knowing the pharmaceutical market analytics by 2032? Click to get a snapshot of the Pharmaceuticals Market Analysis

Pharmaceutical Market Dynamics:

According to GLOBOCAN (2023), in 2022, approximately 20 million new cancer cases were reported, with this number projected to rise to 32.6 million by 2045 around the world. As per the data from the World Health Organization (2024), in the WHO Eastern Mediterranean Region, over 788,000 cancer diagnoses were recorded in 2022. This figure is anticipated to double to approximately 1.57 million cases by 2045. Rising cancer cases increase demand for innovative oncology drugs, driving pharmaceutical market growth. For example, the success of immunotherapies like Merck’s Keytruda, which targets multiple cancer types, has significantly boosted sales and spurred further R&D investment in cancer treatments.

According to data published by the British Heart Foundation (2024), approximately 640 million people globally were affected by heart and circulatory diseases, with these numbers anticipated to rise in the coming years. The same source notes that around 67 million individuals were diagnosed with heart or circulatory diseases each year. The growing prevalence of cardiovascular diseases fuels demand for effective medications, expanding the pharmaceutical market. For instance, Pfizer’s cholesterol-lowering drug, Lipitor, and newer anticoagulants like Eliquis from Bristol-Myers Squibb have seen strong sales due to increased patient needs worldwide.

Similarly, the global diabetes burden is rising rapidly. The International Diabetes Federation reported in 2023 that 537 million adults aged 20-79 were living with diabetes in 2021, a number expected to increase to 643 million by 2030 and 783 million by 2045. Rising diabetes cases boost demand for advanced treatments, propelling pharmaceutical market growth. For example, Novo Nordisk’s GLP-1 agonists like Ozempic and Wegovy have rapidly gained popularity, driving strong sales and innovation in diabetes care.

According to the World Health Organization (2024), in 2023, epilepsy affected approximately 50 million people worldwide, making it one of the most common neurological disorders. Similarly, depression remains a major global health concern. As per the WHO (2023), in 2023, an estimated 280 million people worldwide were living with depression. Increasing neurological disease cases, such as Alzheimer’s disease and Parkinson’s disease, drive demand for specialized therapies, expanding the pharma market. For example, Biogen’s Aduhelm, targeting Alzheimer’s, represents a breakthrough in treatment, stimulating further research and investment in neurological drugs.

The surge in R&D investment is further supported by government initiatives aimed at fostering industry-led research. For example, in August 2024, the UK government allocated EUR 12 million from the Innovate UK Cancer Therapeutics Programme to support the development of life-changing cancer treatments, including therapies for childhood and young adult cancers. Such public and private sector investments are fueling the development of new treatments and technologies, thereby propelling the market growth.

Additionally, the rising number of prescription drug dispensations is significantly contributing to the growth of the pharmaceutical market. According to data from PAGB (2022), over-the-counter (OTC) medicines also play a crucial role in supporting self-care for millions of individuals. In the UK, 96% of the population experiences at least one self-treatable condition annually, with 43% experiencing more than four. In 2022, a total of 983 million OTC packs were sold, equivalent to 1,870 packs every minute. Furthermore, 92% of people used OTC medications to manage their health independently, with an average monthly spend of £4.50 per person on 1.3 packs. Similarly, data from the National Institutes of Health (NIH, 2022) indicates that an average of 27.5 prescriptions are dispensed per person each year in Australia, reflecting the growing reliance on pharmaceutical for ongoing health management.

In parallel, major industry players are increasingly focusing on strategic collaborations and partnerships to accelerate drug development. For example, in June 2025, AstraZeneca announced a strategic research collaboration with China-based CSPC Pharmaceutical Group. This partnership aims to leverage AI-driven drug discovery to identify novel oral drug candidates targeting high-priority diseases across multiple therapeutic areas.

Furthermore, regulatory approvals of innovative treatments are also driving market growth. In July 2025, PTC Therapeutics, Inc. received U.S. FDA approval for SEPHIENCE™ (sepiapterin) for the treatment of phenylketonuria (PKU) in both adults and children as young as one month old. The drug has been approved for the treatment of hyperphenylalaninemia (HPA) in patients responsive to sepiapterin, offering a new oral treatment option for this rare metabolic disorder.

However, the stringent guidelines by regulatory bodies and governments and extensive time required for drug development in clinical trials, among others, are some of the key constraints that may limit the growth of the pharmaceutical market.

Get a sneak peek at the pharmaceuticals market dynamics @ Global Pharmaceutical Market Trends

Pharmaceutical Market Segment Analysis:

Pharmaceutical Market by Modality Type (Small Molecule and Biologics [Monoclonal Antibodies, Antibody Drug Conjugates, Peptide Drug Conjugates, Nucleic Acid Medicines, Vaccines, and Others]), Product Type (Branded and Generic), Drug Type (Prescription Drugs and Over-the-Counter (OTC) Drugs), Formulation (Solid Dosage Forms, Semi-solid Dosage Forms, and Liquid Dosage Forms), Route of Administration (Oral, Parenteral, and Others), Therapy Area (Oncology, Cardiology, Neurology, Immunology, Endocrinology, Infectious Disease, and Others), Distribution Channel (Hospital & Retail Pharmacies and Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the modality type segment of the pharmaceutical market, the Monoclonal Antibodies category is estimated to account for the largest market share in 2024. The growth of the monoclonal antibodies (mAbs) segment is primarily driven by the rising prevalence of chronic diseases, particularly cancer and autoimmune disorders. According to the World Health Organization (WHO, 2022), more than 2.3 million individuals were diagnosed with cancer annually in the South-East Asia Region, with approximately 1.4 million deaths attributed to the disease. Similarly, the European Commission (2023) reported 2.74 million cancer cases in Europe in 2022 alone. This growing disease burden is fueling the demand for monoclonal antibody-based therapies, thereby propelling the segment’s expansion.

The increasing adoption of mAbs is further supported by their numerous therapeutic advantages. Monoclonal antibodies are highly specific proteins engineered to recognize and bind to unique antigens, enabling them to target diseased cells such as cancer cells or inflammatory mediators, while minimizing harm to healthy tissues. This precision significantly reduces the side effects often associated with conventional treatments like chemotherapy.

mAbs are now widely used in treating a range of conditions, including cancers (e.g., trastuzumab for HER2-positive breast cancer), autoimmune disorders (e.g., adalimumab for rheumatoid arthritis), and infectious diseases (e.g., COVID-19 neutralizing antibodies). Additionally, they can be engineered to deliver cytotoxic agents, radioisotopes, or other therapeutic payloads directly to target sites, further enhancing treatment outcomes. Their long half-life allows for extended dosing intervals, improving patient compliance and overall treatment experience.

Advances in biotechnology have also streamlined the large-scale production of monoclonal antibodies, increasing accessibility and affordability. Moreover, the growing trend toward personalized medicine has accelerated their integration into treatment protocols, with therapies now tailored to a patient’s specific genetic and molecular profile for optimal efficacy and safety.

Reflecting this momentum, key pharmaceutical companies are actively expanding their monoclonal antibody pipelines. For instance, in June 2025, the U.S. FDA approved Merck’s ENFLONSIA™ (clesrovimab-cfor) for the prevention of respiratory syncytial virus (RSV) lower respiratory tract disease in infants during their first RSV season. Similarly, in April 2025, Johnson & Johnson received FDA approval for IMAAVY™ (nipocalimab-aahu), a new FcRn blocker designed to provide long-lasting disease control in patients with generalized myasthenia gravis (gMG).

Thus, the factors mentioned above are likely to boost the market segment and thereby increase the overall market of pharmaceuticals across the globe.

North America is expected to dominate the overall pharmaceutical market:

North America is projected to dominate the global pharmaceutical market in 2024, holding the largest market share due to several key growth drivers. The region's leadership can be attributed to the rising demand for pharmaceutical products, fueled by the increasing prevalence of acute and chronic diseases. Additionally, significant investments in research and development, along with a high volume of clinical trials, are accelerating innovation and therapeutic advancements. The growing trend of strategic research collaborations and partnerships among pharmaceutical companies is further enhancing drug development capabilities. Together, these factors are fostering a robust and dynamic pharmaceutical ecosystem, positioning North America as a leading contributor to global market growth.

As per the data from GLOBOCAN (2024) revealed that the number of cancer cases in the U.S. reached 2,380,189 in 2022, with projections suggesting an increase to 2,791,752 cases by 2030. According to the data from the American Cancer Society in January 2025, 2,041,910 new cancer cases are expected to be diagnosed in 2025 in the United States.

According to the American Heart Association (2024), approximately 9.7 million adults were living with undiagnosed diabetes, while 29.3 million have been diagnosed. Furthermore, 115.9 million Americans were reported to be dealing with pre-diabetes as of 2021.

Furthermore, the Centers for Disease Control and Prevention (CDC, 2024) reported that in 2022, there were an estimated 31,800 new cases of HIV infection in the United States.

According to an article published by the Centers for Disease Control and Prevention (2024), approximately 6.2 million adults were suffering from heart failure in the United States in 2022. The prevalence of coronary heart disease (CHD) is also a major driver of market growth. According to CDC data from 2024, around 20.5 million Americans were living with CHD as of 2022. Furthermore, an estimated 6.5 million individuals aged 40 and older were diagnosed with peripheral artery disease (PAD) in the same year.

The rising cases of acute and chronic diseases like cancer, diabetes, and heart conditions are increasing demand for effective and long-term treatments, fueling pharmaceutical market growth. For example, the global surge in diabetes has driven strong sales of Novo Nordisk’s GLP-1 drugs like Ozempic and Wegovy.

Additionally, increased investment in R&D is fueling market expansion. As per data from the Pharmaceutical Research and Manufacturers of America (PhRMA), global biopharmaceutical R&D investment reached $276 billion in 2022, across 4,191 companies. Rising investment in biopharmaceuticals is accelerating innovation and expanding the global pharmaceutical market. For instance, in July 2025, AstraZeneca announced $50 billion U.S. investment through 2030, including new manufacturing and R&D facilities, aiming to bolster its oncology and cardiovascular drug pipelines, targeting $80 billion in annual revenue by 2030. Similarly, India's biopharma sector is projected to reach $63 billion by 2025, driven by advancements in biosimilars, biologics, and vaccines.

The global rise in clinical trial activity further reinforces this trend. ClinicalTrials.gov reported that by 2024, over 518,210 clinical trials were registered, up from 477,219 in 2023, highlighting the surge in drug development initiatives. Such a rising number of trials is further propelling the market expansion in the region.

Moreover, key industry players are actively launching new products across various therapeutic areas, further accelerating market growth in the North American region. For instance, in July 2025, LEO Pharma, a global leader in medical dermatology, received U.S. FDA approval for ANZUPGO® (delgocitinib) cream (20 mg/g) for the topical treatment of moderate-to-severe chronic hand eczema (CHE) in adults. Similarly, in the same month, KalVista Pharmaceutical announced the FDA approval of EKTERLY® (sebetralstat), the first and only oral, on-demand treatment for hereditary angioedema (HAE). Such product approvals and launches not only address unmet medical needs but also significantly contribute to the expanding pharmaceutical landscape in North America, reinforcing its position as a market leader.

In summary, the growing incidence of chronic and infectious diseases, combined with rapid technological innovation, is positioning North America as a leader in the harmaceuticals market.

To know more about why North America is leading the market growth in the pharmaceuticals market, get a snapshot of the Pharmaceuticals Market Research

Pharmaceutical Market Key Players:

Some of the key market players operating in the pharmaceutical market include Pfizer Inc., Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., AbbVie, Inc., Sanofi, AstraZeneca, Novartis AG, Bristol-Myers Squibb Company, GSK plc, Eli Lilly and Company, Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Novo Nordisk A/S, Teva Pharmaceutical Industries Ltd., Amgen Inc., Boehringer Ingelheim International GmbH, Viatris Inc., Bayer AG, Regeneron Pharmaceutical Inc., Astellas Pharma Inc., and others.

Recent Developmental Activities in the Pharmaceutical Market:

- In July 2025, Sanofi announced the completion of its acquisition of Blueprint Medicines Corporation. This strategic acquisition expands Sanofi’s portfolio by adding a commercialized medicine, a promising pipeline, and the expertise of Blueprint Medicines in treating systemic mastocytosis (SM), a rare immunological disorder, as well as other KIT-driven diseases.

- In July 2025, Regeneron Pharmaceutical, Inc. announced that the U.S. Food and Drug Administration (FDA) granted accelerated approval for LYNOZYFIC (linvoseltamab-gcpt). This treatment is indicated for adult patients with relapsed or refractory (R/R) multiple myeloma (MM) who have undergone at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody.

- In July 2025, PTC Therapeutics, Inc. received U.S. FDA approval for SEPHIENCE™ (sepiapterin) for the treatment of phenylketonuria (PKU) in both adults and children as young as one month old. The drug has been approved for the treatment of hyperphenylalaninemia (HPA) in patients responsive to sepiapterin, offering a new oral treatment option for this rare metabolic disorder.

- In July 2025, AstraZeneca announced a $50 billion U.S. investment through 2030, including new manufacturing and R&D facilities, aimed at bolstering its oncology and cardiovascular drug pipelines and targeting $80 billion in annual revenue by 2030.

- In July 2025, LEO Pharma, a global leader in medical dermatology, received U.S. FDA approval for ANZUPGO® (delgocitinib) cream (20 mg/g) for the topical treatment of moderate-to-severe chronic hand eczema (CHE) in adults.

- In July 2025, KalVista Pharmaceutical announced the FDA approval of EKTERLY® (sebetralstat), the first and only oral, on-demand treatment for hereditary angioedema (HAE).

- In June 2025, AstraZeneca announced a strategic research collaboration with China-based CSPC Pharmaceutical Group. This partnership aims to leverage AI-driven drug discovery to identify novel oral drug candidates targeting high-priority diseases across multiple therapeutic areas.

- In June 2025, the U.S. FDA approved Merck’s ENFLONSIA (clesrovimab-cfor) for the prevention of respiratory syncytial virus (RSV) lower respiratory tract disease in infants during their first RSV season.

- In April 2025, Johnson & Johnson received FDA approval for IMAAVY (nipocalimab-aahu), a new FcRn blocker designed to provide long-lasting disease control in patients with generalized myasthenia gravis (gMG).

- In April 2025, Roche announced a commitment to invest USD 50 billion in pharmaceuticals within the United States over the next five years. This substantial investment will support the development of new state-of-the-art research and development (R&D) centers, as well as the establishment and expansion of manufacturing facilities across Indiana, Pennsylvania, Massachusetts, and California.

To read more about the latest highlights related to the pharmaceuticals market, get a snapshot of the key highlights entailed in the Global Pharmaceuticals Market Report

Key Takeaways from the Pharmaceutical Market Report Study

- Market size analysis for the current pharmaceutical market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the pharmaceutical market.

- Various opportunities available for the other competitors in the pharmaceutical market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current pharmaceutical market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the pharmaceutical market growth in the future?

Target Audience Who Can Benefit from this Pharmaceutical Market Report Study

- Pharmaceutical product providers

- Research organizations and consulting companies

- Pharmaceutical-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in pharmaceutical

- Various end-users who want to know more about the pharmaceutical market and the latest technological developments in the pharmaceutical market.

Frequently Asked Questions for the Pharmaceutical Market:

1. What are pharmaceuticals?

Pharmaceuticals are drugs used to treat, prevent, or cure a wide range of diseases and medical conditions. These compounds can be synthetic, semi-synthetic, or derived from natural sources such as plants and microorganisms. They play a crucial role in modern healthcare by improving patient outcomes, managing chronic illnesses, and preventing disease progression. Pharmaceuticals encompass various forms, including small molecules, biologics, vaccines, and advanced therapies, making them indispensable tools in both acute and long-term medical care.

2. What is the market for pharmaceuticals?

The global pharmaceutical market was valued at USD 1,473 billion in 2024, growing at a CAGR of 6.54% during the forecast period from 2025 to 2032 to reach USD 2,435.53 billion by 2032.

3. What are the drivers for the pharmaceutical market?

The growth of the pharmaceutical market is primarily driven by the rising demand for medications due to the increasing prevalence of various acute and chronic diseases, including cancer, cardiovascular disorders, neurological conditions, and diabetes. There is also a growing demand for biologic drugs, such as monoclonal antibodies, which offer targeted and effective treatment options. Additionally, increased investments and continuous innovations in pharmaceutical research and development are further propelling market expansion. Moreover, the surge in drug development activities among biotech companies and pharmaceutical firms is contributing significantly to this growth. Together, these trends are creating a favorable environment for sustained growth, positioning the pharmaceutical market for robust and consistent expansion throughout the forecast period from 2025 to 2032.

4. Who are the key players operating in the pharmaceutical market?

Some of the key market players operating in the pharmaceutical market include Pfizer Inc., Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., AbbVie, Inc., Sanofi, AstraZeneca, Novartis AG, Bristol-Myers Squibb Company, GSK plc, Eli Lilly and Company, Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, Novo Nordisk A/S, Teva Pharmaceutical Industries Ltd., Amgen Inc., Boehringer Ingelheim International GmbH, Viatris Inc., Bayer AG, Regeneron Pharmaceutical Inc., Astellas Pharma Inc., and others.

5. Which region has the highest share in the pharmaceutical market?

North America is projected to dominate the global pharmaceutical market in 2024, holding the largest market share due to several key growth drivers. The region's leadership can be attributed to the rising demand for pharmaceutical products, fueled by the increasing prevalence of acute and chronic diseases. Additionally, significant investments in research and development, along with a high volume of clinical trials, are accelerating innovation and therapeutic advancements. The growing trend of strategic research collaborations and partnerships among pharmaceutical companies is further enhancing drug development capabilities. Together, these factors are fostering a robust and dynamic pharmaceutical ecosystem, positioning North America as a leading contributor to global market growth.