Biopharmaceuticals Market

Biopharmaceuticals Market, segmented by Product Type (Monoclonal Antibodies, Recombinant Growth Factors, Purified Protein, Recombinant Protein, Recombinant Hormones, Synthetic Immunomodulators, and Others), Application (Oncology, Inflammatory and Infectious Diseases, Autoimmune Diseases, Metabolic Disorders, Cardiovascular Diseases, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR till 2030 owing to the increasing prevalence of various chronic disease and the increasing awareness for biopharmaceuticals and personalized medicines.

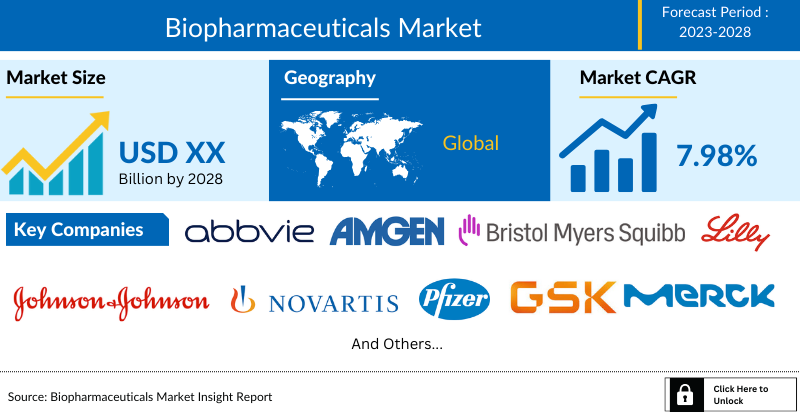

The biopharmaceuticals market is estimated to grow at a CAGR of 7.98% during the forecast period from 2024 to 2030 to reach USD 713.61 billion by 2030. The demand for biopharmaceuticals is primarily driven by the growing burden of chronic, infectious, and neurological diseases and the growing geriatric population worldwide. In addition, increasing acceptance of biopharmaceuticals and personalized medicines, the ability of biopharmaceuticals to treat previously untreatable diseases, rising expenditure for research and development proficiencies, improving the overall healthcare infrastructure, biopharmaceuticals launches and approvals, and innovation in biopharmaceuticals development among others, thereby contribute to the overall biopharmaceuticals market growth during the forecast period from 2024-2030.

Biopharmaceuticals Market Dynamics

The increasing prevalence of chronic diseases such as cancers, neurological diseases, and others across the globe will increase the overall biopharmaceuticals market. For instance, according to the Globocan Statistics 2020, about 19.3 million people were suffering from cancer, and more than 10 million people died from cancer worldwide in 2020.

As per Macmillan Cancer Support 2022, nearly 3 million people were living with cancer in the UK, rising to 3.5 million by 2025, 4 million by 2030, and 5.3 million by 2040.

The increasing cancer prevalence will increase the demand for biopharmaceuticals, as protein-based biopharmaceuticals have significantly extended the lives of millions of cancer patients.

Growing investment in R&D capabilities, particularly in developed and developing nations in medical equipment and technologies, will further generate profitable market expansion prospects. The medical instrument development process is augmenting the market growth rate through research and development proficiencies.

The biopharmaceutical products' capability to address previously untreatable conditions has paved the way for introducing innovative drugs in the market. For instance, in September 2022, Bluebird Bio, Inc.'s SKYSONA (elivaldogene autotemcel) slows the progression of neurologic dysfunction in boys 4-17 years of age with early, active cerebral adrenoleukodystrophy (CALD), was approved by CBER. Similarly, in June 2022, CBER approved PRIORIX, a live vaccine for measles, mumps, and rubella, manufactured by GSK plc.

Also, in February 2022, Johnson and Johnson and its China-focused partner company, Legend Biotech Corp, developed a therapy to treat white blood cell cancer type approved by the US Food and Drug Administration (FDA). New therapies that aid in treating oncologic disorders will add to the biopharmaceutical market growth over the forecast period.

Therefore, the above-mentioned factors will propel the biopharmaceuticals market size during the forecast period from 2024-2030.

However, high-end manufacturing requirements, biopharmaceutical side effects, and others may restrict the overall biopharmaceutical market growth.

Biopharmaceuticals Market Segment Analysis:

Biopharmaceuticals Market, segmented by Product Type (Monoclonal Antibodies, Recombinant Growth Factors, Purified Protein, Recombinant Protein, Recombinant Hormones, Synthetic Immunomodulators, and Others), Application (Oncology, Inflammatory and Infectious Diseases, Autoimmune Diseases, Metabolic Disorders, Cardiovascular Diseases, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the biopharmaceuticals market, the monoclonal antibodies category is expected to amass a significant biopharmaceutical market share in the year 2024. This can be ascribed to the advantages and applications associated with the segment.

Monoclonal antibodies (MABs) are a type of immunotherapy. They work by triggering the immune system and helping it to attack cancer. The therapeutic applications of monoclonal antibodies include cancer, rheumatoid arthritis, multiple sclerosis, and cardiovascular diseases.

The usage of monoclonal antibodies in cancer therapy requires an understanding of the biological role of various antigens involved in tumor growth. Monoclonal antibody (mAb) allows a far more precise understanding of the humoral immune response by allowing dissection of this response into its B-lymphocyte populations. A large number of mAbs have been produced against renal, bladder, and prostate cancer antigens.

They can be used as therapeutic agents on their own or in combination with other treatments. Monoclonal antibodies have been successful in neutralizing pathogens, blocking cell receptors, modulating immune responses, and delivering therapeutic payloads, making them versatile tools for disease management.

The expansion of this market is mostly dependent on expanding research spending, growing clinical trials, and growing approvals. For instance, in July 2023, Transcenta Holding Limited received approval from the China Center for Drug Evaluation (CDE) to initiate a Phase II clinical trial of TST002 (Blosozumab), a humanized anti-sclerostin monoclonal antibody. This study aims to evaluate the safety, tolerability, and pharmacokinetics of TST002 (Blosozumab) after single and multiple intravenous administrations in patients with reduced bone mineral density.

Also, in October 2022, PT217, a bispecific anti-Delta-like ligand 3 (DLL3)/anti-Cluster of Differentiation 47 (CD47) antibody, was developed by Phanes Therapeutics, Inc. It is a clinical-stage biotech company focused on oncology for patients with small cell lung cancer (SCLC) and other neuroendocrine cancers. It received Phase I clearance from the US Food and Drug Administration (FDA).

Therefore, owing to the above-mentioned factors, the monoclonal antibodies category is expected to register significant growth, thereby driving the overall biopharmaceuticals market growth during the forecast period.

North America is expected to dominate the overall Biopharmaceuticals Market:

Among all the regions, North America is estimated to account for the largest biopharmaceuticals market share in the year 2023. Owing to the significance of key growth factors such as the prevalence and incidence of chronic diseases, surging elderly population base, strong base of healthcare facilities, availability of advanced treatment options that specifically target the underlying causes of these complex diseases, providing improved therapeutic outcomes and enhanced patient outcomes, presence of key biopharmaceuticals manufacturers, and the increasing launches and approvals, among others, the biopharmaceuticals market is expected to witness prosperity in the region during the forecast period 2024-2030.

The International Trade Administration (ITA), in 2019, stated that the US is the largest market for biopharmaceuticals manufacturers, accounting for one-third of the global market, and is the world leader in biopharmaceutical R&D. In 2019, more than 800,000 people worked in the biopharmaceutical industry in the United States across a broad range of occupations, including scientific research, technical support, and manufacturing. The US attracts the majority of global venture capital investments in biopharmaceutical enterprise startups.

Additionally, the growing FDA approvals and new product launches for various indications will drive the segment. For instance, in February 2022, the US FDA issued an Emergency Use Authorization (EUA) for a new monoclonal antibody to treat COVID-19 that retains activity against the omicron variant. The EUA for Bebtelovimab treats mild to moderate COVID-19 among adults and pediatric patients with a positive COVID-19 test who are at high risk for progression to severe COVID-19, including hospitalization or death. It is also for those for whom alternative COVID-19 treatment options approved or authorized by the FDA are not accessible or clinically appropriate.

Also, in May 2022, Eli Lilly and Company announced an investment of over USD 2 billion to expand its manufacturing footprint in Indiana, United States.

Thus, the above-mentioned factors are likely to propel the biopharmaceuticals market growth in the region during the forecast period from 2024-2030.

Key Biopharmaceutical Companies In The Market:

Some of the key biopharmaceuticals companies operating in the market include AbbVie Inc., Amgen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Johnson & Johnson, Novartis AG, Novo Nordisk AS, Pfizer Inc., GSK plc., F. Hoffmann-La Roche Ltd, Merck KGaA, Sanofi SA, AstraZeneca PLC, Bayer AG, Takeda Pharmaceutical Company Limited, UCB S.A., Boehringer Ingelheim International GmbH, DAIICHI SANKYO COMPANY, LIMITED, Biogen, Serum Institute of India, and others.

Recent Developmental Activities in the Biopharmaceuticals Market:

- In March 2022, BioNTech SE reported the expansion of its strategic collaboration with Regeneron to advance the Company’s FixVac candidate BNT116 in combination with LIBTAYO (cemiplimab), a PD-1 inhibitor, in advanced non-small cell lung cancer (NSCLC). Under the terms of the agreement, the companies plan to jointly conduct clinical trials to evaluate their combination in different patient populations with advanced NSCLC.

- In January 2022, Amgen collaborated with Generate Biomedicines to discover and create protein therapeutics for five clinical targets across several therapeutic areas and multiple modalities.

- In May 2021, Amgen Inc. received FDA approval for LUMAKRAS (sotorasib), a targeted therapy for non-small cell lung cancer (NSCLC) with specific genetic mutations.

Key Takeaways from the Biopharmaceuticals Market Report Study

- Current biopharmaceuticals market size analysis (2024), and the biopharmaceuticals market forecast for 6 years (2024-2030)

- The top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key biopharmaceutical companies dominate the biopharmaceuticals market.

- Various opportunities available for the other competitors in the biopharmaceuticals market space.

- What are the top-performing segments in 2024? How will these segments perform in 2030?

- Which are the top-performing regions and countries in the current biopharmaceuticals market landscape?

- Which are the regions and countries where companies should concentrate for biopharmaceutical market growth opportunities in the future?

Target Audience that can benefit from the Biopharmaceuticals Market Report Study

- Biopharmaceutical Manufacturers

- Research organizations and consulting companies

- Biopharmaceuticals-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Biopharmaceutical distributors and traders

- Various End-users who want to know more about the biopharmaceuticals market and the latest technological developments in the market.