Cardiovascular Imaging Equipment Market

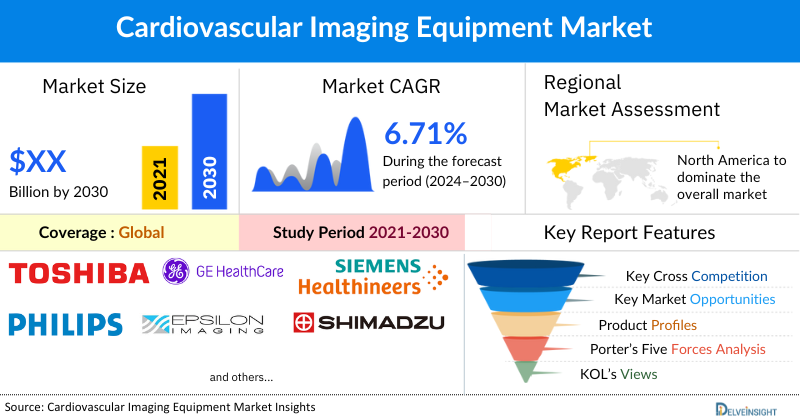

- Cardiovascular Imaging Equipment market is expected to rise at a significant CAGR, estimated DelveInsight.

- Cardiovascular Imaging Equipment companies working in the Cardiovascular Imaging Equipment market are Toshiba, GE Healthcare, Siemens Healthcare, Philips Healthcare, Epsilon Imaging, Canon Inc., Shimadzu Corporation, Agfa-Gevaert Group, Fujifilm Holdings Corporation, TOMTEC IMAGING SYSTEMS, Circle Cardiovascular, Pie Medical Imaging, HeartSciences, MEDIS Medical Imaging Systems, Hitachi Medical Corporation, Ultromics, Abbott, Boston Scientific, Medtronic plc., Merit Medical, and others.

Cardiovascular imaging Equipment Market by Type of Devices (Echocardiography, Angiography, Nuclear Cardiac Imaging, Computed Tomography, Cardiac Positron Emission Tomography (Cardiac PET), and Cardiac Magnetic Resonance Imaging (Cardiac MRI)), Cardiovascular imaging Equipment Market by End-User (Hospitals, Specialty Clinics, Diagnostic Imaging, and Others), and Cardiovascular imaging Equipment Market by Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the rising burden of cardiac diseases, increasing awareness and screening programs, increase in product launches and approvals by key cardiovascular imaging equipment companies across the globe.

The cardiovascular imaging equipment market is estimated to grow at a CAGR of 6.71% during the forecast period from 2024 to 2030. The incidence of cardiovascular diseases (CVDs) is rising due to lifestyle changes, smoking, lack of physical activities, excessive alcohol consumption, obesity, and other factors that are escalating the global market of cardiovascular imaging equipment. Additionally, public health campaigns and initiatives aimed at raising awareness about cardiovascular health encourage individuals to undergo regular check-ups and screenings. Increased public knowledge about the importance of early detection and management of heart diseases leads to higher utilization of cardiovascular imaging services. Furthermore, key cardiovascular imaging equipment manufacturers continuously investing in research and development to introduce innovative cardiovascular imaging technologies, increased partnerships and collaborations, product launches, and approvals ensure that the market remains dynamic and innovative, during the forecast period from 2024 to 2030.

Cardiovascular Imagining Equipment Market Dynamics:

According to recent data provided by the British Heart Foundation (2024), globally, approximately 620 million people, or about 1 in 13 individuals, live with heart and circulatory diseases. Additionally, as per the same source, the prevalence of heart and circulatory diseases was 100 million in Europe and 340 million in Asia and Australia in 2021.

Furthermore, as per the recent data provided by the British Heart Foundation (2024), coronary (ischemic) heart disease, the most commonly diagnosed worldwide, affects an estimated 200 million people globally. Approximately 110 million men and 80 million women are affected. Additionally, around 56 million women and 45 million men are stroke survivors. It's estimated that at least 13 million people worldwide live with congenital heart disease, with potentially millions more undiagnosed.

As the prevalence of cardiac diseases increases, the demand for cardiovascular imaging equipment, including technologies like echocardiography, MRI, CT scans, and nuclear imaging, will also increase as they play a crucial role in diagnosing and monitoring these conditions. Cardiovascular imaging enables early diagnosis, helps assess disease progression, and guides personalized treatment plans. This preventive approach encourages healthcare facilities to invest in advanced imaging technologies thereby escalating the market. Additionally, the shift towards personalized medicine and patient-centric care drives the adoption of cardiovascular imaging. These technologies allow healthcare providers to tailor treatment strategies based on individual patient characteristics, improving overall patient outcomes and satisfaction.

Additionally, technological advancements play a pivotal role in accelerating the market growth of cardiovascular imaging equipment by enhancing diagnostic accuracy, speed, and patient outcomes. Innovations such as 3D imaging, high-resolution ultrasound, faster MRI sequences, and artificial intelligence-driven image analysis are revolutionizing how cardiovascular diseases can be diagnosed and managed easily. For instance, in June 2024, Royal Philips introduced a new AI-enabled cardiovascular ultrasound platform aimed at accelerating cardiac ultrasound analysis and easing the workload in echocardiography labs. This next-generation technology, integrated into their EPIQ CVx and Affiniti CVx ultrasound systems, includes FDA-cleared AI applications that enhance cardiovascular imaging and diagnosis.

Furthermore, the regulatory approvals for cardiovascular imaging equipment further boost the overall market across the globe. For instance, in May 2022, Abbott received the European CE mark for its new interventional imaging platform powered by Ultreon 1.0 Software. These approvals facilitate market entry for manufacturers, allowing them to introduce advanced imaging systems and innovations that enhance diagnostic accuracy and patient care thereby escalating the market.

Thus, the factors mentioned above are likely to boost the market of cardiovascular imaging equipment during the forecasted period.

However, risk factors like imaging techniques that use ionizing radiation, such as CT scans and nuclear imaging (e.g., SPECT, PET scans), carry a risk of radiation exposure, adverse reaction to contrast agents, and stringent regulatory concerns for product approval may hinder the future market of cardiovascular imagining equipment.

Cardiovascular Imagining Equipment Market Segment Analysis:

Cardiovascular Imagining Equipment Market by Type of Devices (Echocardiography, Angiography, Nuclear Cardiac Imaging, Computed Tomography, Cardiac Positron Emission Tomography (Cardiac PET), and Cardiac Magnetic Resonance Imaging (Cardiac MRI)), Cardiovascular imaging Equipment Market by End-User (Hospitals, Specialty Clinics, Diagnostic Imaging, and Others), and Cardiovascular imaging Equipment Market by Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the type of device segment of the cardiovascular imagining equipment market, angiography is projected to hold a considerable market share in 2023. Angiography is a key diagnostic procedure in cardiology and plays a pivotal role in driving the market for cardiovascular imaging equipment through several mechanisms. Angiography provides detailed visualization of blood vessels, particularly the coronary arteries, helping cardiologists accurately diagnose and assess conditions such as coronary artery disease (CAD), peripheral artery disease (PAD), and congenital heart defects. Beyond diagnosis, angiography serves as a crucial tool for guiding interventional procedures such as angioplasty, stent placement, and transcatheter valve interventions. Real-time imaging during these procedures allows for precise catheter navigation, optimal device deployment, and immediate assessment of treatment outcomes, thereby improving procedural success rates and patient safety.

Additionally, the ongoing technological advancements in angiography systems, including improvements in image quality, faster acquisition times, and integration with advanced imaging modalities (such as intravascular ultrasound and optical coherence tomography), enhance procedural efficiency and diagnostic accuracy. For instance, in August 2023, Canon Medical launched the Alphenix / Evolve Edition in Europe, integrating real-time AI technology into interventional cardiology suites. This advanced system uses Deep Learning to enhance imaging quality, reduce procedure time, and minimize radiation exposure during Percutaneous Coronary Intervention (PCI) and Structural Heart Disease (SHD) procedures. The technology aims to enhance safety for both clinicians and patients. Thus, these innovations attract healthcare providers looking to invest in state-of-the-art equipment to deliver high-quality care thereby boosting the market of angiography across the globe.

Therefore, owing to the above-mentioned factors, the angiography category is expected to generate considerable revenue thereby pushing the overall growth of the global cardiovascular imagining equipment market during the forecast period.

|

Report Metrics |

Details |

|

Study Period |

2020 to 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2024 to 2030 |

|

Cardiovascular Imagining Equipment CAGR |

6.71% |

|

Key Cardiovascular Imagining Equipment Companies |

Toshiba, GE Healthcare, Siemens Healthcare, Philips Healthcare, Epsilon Imaging, Canon Inc., Shimadzu Corporation, Agfa-Gevaert Group, Fujifilm Holdings Corporation, TOMTEC IMAGING SYSTEMS, Circle Cardiovascular, Pie Medical Imaging, HeartSciences, MEDIS Medical Imaging Systems, Hitachi Medical Corporation, Ultromics, Abbott, Boston Scientific, Medtronic plc., Merit Medical, and Many Others. |

North America is expected to dominate the overall cardiovascular imagining equipment market:

North America is expected to account for the highest proportion of the cardiovascular imagining equipment market in 2023, out of all regions. This can be ascribed to the increasing prevalence of cardiac disease, increased government initiatives coupled with increased awareness programs for cardiac disease, and the presence of key market players engaged in mergers, acquisitions, product launches, and other market activities across the region are expected to escalate the market of cardiovascular imagining equipment.

According to recent data from the British Heart Foundation (2024), in 2021 the estimated prevalence of heart and circulatory disease in North America was 48 million.

Additionally, as per the recent data provided by the Centre for Disease Control and Prevention (2024), in 2022, approximately 4.9% of adults have been diagnosed with coronary heart disease. Physician offices record around 13.0 million visits annually where coronary atherosclerosis and chronic ischemic heart disease are the primary diagnoses. Additionally, 6.9% of visits indicate coronary artery disease, ischemic heart disease, or a history of myocardial infarction in the medical records. Thus, the increase in cardiac diseases increases the demand for cardiovascular imaging equipment, including technologies like CT angiography, MRI, and echocardiography, as they play a crucial role in early detection, treatment planning, and monitoring of heart diseases.

Additionally, the awareness programs in the United States aimed at addressing cardiac diseases focus on education, prevention, and early detection and also boost the market of cardiovascular imagining equipment across the region as public awareness campaigns educate individuals about the importance of regular screenings and preventive measures. For example, February is designated as American Heart Month, during which various organizations, including the American Heart Association (AHA) and the Centers for Disease Control and Prevention (CDC), promote awareness through campaigns, events, and educational materials. These efforts emphasize the importance of heart health, risk factors, and preventive measures.

Furthermore, product approval across the region further boosts the market of cardiovascular equipment. For instance, in January 2022, Ultromics received FDA clearance for EchoGo Pro, a first-of-kind solution to help diagnose Coronary artery disease (CAD).

Therefore, the above-mentioned factors are expected to bolster the growth of the cardiovascular imaging equipment market in North America during the forecast period.

Cardiovascular Imagining Equipment Manufacturers:

Some of the Cardiovascular Imagining Equipment manufacturers operating in the cardiovascular imagining equipment market include Toshiba, GE Healthcare, Siemens Healthcare, Philips Healthcare, Epsilon Imaging, Canon Inc., Shimadzu Corporation, Agfa-Gevaert Group, Fujifilm Holdings Corporation, TOMTEC IMAGING SYSTEMS, Circle Cardiovascular, Pie Medical Imaging, HeartSciences, MEDIS Medical Imaging Systems, Hitachi Medical Corporation, Ultromics, Abbott, Boston Scientific, Medtronic plc., Merit Medical, and others.

Recent Developmental Activities in the Cardiovascular Imagining Equipment Market:

- In May 2024, Royal Philips announced that hospitals in Hong Kong had started using Philips' VeriSight Pro real-time 3D Intracardiac Echocardiography (ICE) catheter for minimally-invasive procedures with guided imaging.

- In May 2024, GE Healthcare introduced Caption AI on the Vscan Air SL wireless handheld ultrasound system, aiming to assist clinicians in capturing high-quality cardiac images for diagnostics.

- In August 2022, Royal Philips announced the launch of its digital experience during the virtual European Society of Cardiology (ESC) 2022 Congress. It will showcase its latest suite of solutions to help improve outcomes for patients with cardiovascular disease by enabling quick, confident diagnoses, and efficient, effective treatments.

Key Takeaways from the Cardiovascular Imagining Equipment Market Report Study:

- Cardiovascular Imagining Equipment Market size analysis for current cardiovascular imagining equipment size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key Cardiovascular Imagining Equipment companies dominating the cardiovascular imagining equipment market.

- Various opportunities available for the other competitors in the cardiovascular imagining equipment market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current cardiovascular imagining equipment market scenario?

- Which are the regions and countries where Cardiovascular Imagining Equipment companies should have concentrated on opportunities for cardiovascular imagining equipment market growth in the coming future?

Target Audience who can be Benefited From This Cardiovascular Imagining Equipment Market Report Study:

- Cardiovascular imagining equipment product providers

- Research organizations and consulting Cardiovascular Imagining Equipment companies

- Cardiovascular imagining equipment -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up Cardiovascular Imagining Equipment companies, venture capitalists, and private equity firms

- Distributors and traders dealing in cardiovascular imagining equipment

- Various end-users who want to know more about the cardiovascular imagining equipment market and the latest technological developments in the cardiovascular imagining equipment market.

Frequently Asked Questions for the Cardiovascular Imagining Equipment Market:

1. What are cardiovascular imagining equipment?

Cardiovascular Imaging refers to non-invasive imaging of the heart using ultrasound, magnetic resonance imaging (MRI), computed tomography (CT), or nuclear medicine (NM) imaging with PET or SPECT.

2. What is the market for cardiovascular imagining equipment?

The cardiovascular imaging equipment market is estimated to grow at a CAGR of 6.71% during the forecast period from 2024 to 2030.

3. What are the drivers for the cardiovascular imagining equipment market?

The global incidence of cardiovascular diseases (CVDs) is rising due to lifestyle changes, smoking, lack of physical activities, excessive alcohol consumption, obesity, and other factors that are escalating the global market of cardiovascular imaging equipment. Additionally, public health campaigns and initiatives aimed at raising awareness about cardiovascular health encourage individuals to undergo regular check-ups and screenings. Increased public knowledge about the importance of early detection and management of heart diseases leads to higher utilization of cardiovascular imaging services. Furthermore, key market players continuously investing in research and development to introduce innovative cardiovascular imaging technologies, increased partnerships and collaborations, product launches, and approvals ensure that the market remains dynamic and innovative, during the forecast period from 2024 to 2030.

4. Who are the key players operating in the cardiovascular imagining equipment market?

Some of the key market players operating in the Cardiovascular Imagining Equipment market include Toshiba, GE Healthcare, Siemens Healthcare, Philips Healthcare, Epsilon Imaging, Canon Inc., Shimadzu Corporation, Agfa-Gevaert Group, Fujifilm Holdings Corporation, TOMTEC IMAGING SYSTEMS, Circle Cardiovascular, Pie Medical Imaging, HeartSciences, MEDIS Medical Imaging Systems, Hitachi Medical Corporation, Ultromics, Abbott, Boston Scientific, Medtronic plc., Merit Medical, and others.

5. Which region has the highest share in the cardiovascular imagining equipment market?

North America is expected to account for the highest proportion of the cardiovascular imagining equipment market in 2023, out of all regions. This can be ascribed to the increasing prevalence of cardiac disease, increased government initiatives coupled with increased awareness programs for cardiac disease, and the presence of key market players engaged in mergers, acquisitions, product launches, and other market activities across the region are expected to escalate the market of cardiovascular imagining equipment.

Get insights through our recent blogs @ DelveInsight Blogs