Colorectal Surgical Devices Market Summary

- The global colorectal surgical devices market is expected to increase from USD 20,139.74 million in 2024 to USD 36,776.06 million by 2032, reflecting strong and sustained growth.

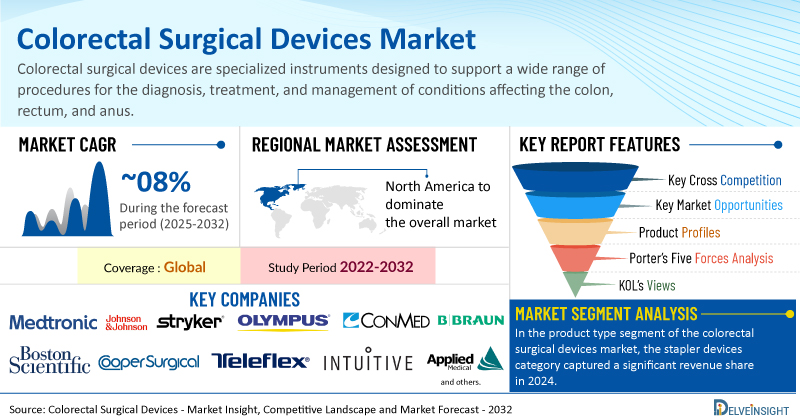

- The global colorectal surgical devices market is growing at a CAGR of 7.87% during the forecast period from 2025 to 2032.

Colorectal Surgical Devices Market Trends & Insights

- The Colorectal Surgical Devices market growth is primarily driven by the increasing cases of colorectal cancer and other related disorders, such as inflammatory bowel disease (IBD), diverticulitis, and Crohn’s disease, coupled with growing awareness and widespread screening programs. This rising demand is further supported by ongoing product development activities among key market players, leading to the introduction of advanced and minimally invasive surgical devices.

- The leading companies in the colorectal surgical device market include Medtronic, Johnson & Johnson Services, Inc., Stryker, Olympus Corporation, CONMED Corporation., B. Braun SE, Boston Scientific Corporation, Cook, Cooper Surgical Inc., Teleflex Incorporated, Intuitive Surgical Operations, Inc., Applied Medical Resources Corporation, Richard Wolf GmbH, Karl Storz, Fujifilm, Volkmann Medizintechnik Gmbh, Ezisurg Medical Co., Ltd., Sontec Instruments, Inc., Mahr Surgical, Thompson Surgical, and others.

- North America is anticipated to dominate the overall Colorectal Surgical Devices market. The region's market growth is primarily driven by a high prevalence of colorectal cancer, advanced healthcare infrastructure, strong screening programs, and early diagnoses. The region also benefits from major market players, high healthcare spending, and ongoing R&D investments, reinforcing its leading position globally.

- In the product type segment of the colorectal surgical devices market, the stapler devices category is projected to capture a significant revenue share in 2024. Stapler devices are playing a pivotal role in boosting the overall market of colorectal surgical devices by enhancing the efficiency, safety, and precision of surgical procedures, particularly in minimally invasive and laparoscopic colorectal surgeries.

Colorectal Surgical Devices Market Size and Forecasts

- 2024 Market Size: USD 20,139.74 million

- 2032 Projected Market Size: USD 36,776.06 million

- Growth Rate (2025-2032): 7.87% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Factors Contributing to the Growth of Colorectal Surgical Devices

- Rising prevalence of colorectal cancer and related disorders such as inflammatory bowel disease (IBD), diverticulitis, and Crohn’s disease.

- Growing awareness and widespread screening programs promoting early detection.

- Increasing demand for timely and effective surgical interventions.

- Ongoing product development and innovation by key market players.

- Introduction of advanced and minimally invasive surgical devices.

- Enhanced diagnosis rates leading to higher surgical volumes.

- Improved treatment options offering better patient outcomes.

- Expanding adoption of innovative surgical technologies across healthcare systems.

What are the latest Colorectal Surgical Devices Market Dynamics and Trends?

According to the World Health Organization (2023), colorectal cancer ranked as the third most common cancer globally, representing about 10% of all diagnosed cancer cases. Projections indicated that by 2040, the number of new colorectal cancer cases annually will rise to approximately 3.2 million, highlighting a growing global health concern. As one of the most commonly diagnosed cancers worldwide, colorectal cancer often requires surgical intervention as a primary mode of treatment, especially in early and localized stages. The increasing number of diagnosed cases is leading to a higher volume of surgical procedures, thereby boosting the demand for advanced surgical tools such as staplers, energy-based devices, and robotic-assisted systems.

Furthermore, according to the International Burden of Disease (2023), in 2022, approximately 1 in every 123 people in the UK had either Crohn’s disease or ulcerative colitis, amounting to nearly half a million individuals living with inflammatory bowel disease (IBD) across the country. These chronic, progressive conditions often lead to severe intestinal damage, strictures, fistulas, or complications that require surgical intervention when medication is no longer effective, thus increasing the number of colorectal surgical procedures. This growing demand for surgical treatment is driving the need for specialized colorectal surgical devices.

Additionally, the ongoing advancement in product development has further boosted the market for colorectal surgical devices. For instance, in May 2024, Ethicon, a Johnson & Johnson MedTech company, launched the ECHELON LINEAR™ cutter in the U.S., the first linear cutter with 3D-stapling and Gripping Surface Technology (GST). It reduces staple line leaks by 47%, improving surgical outcomes and patient safety, especially in colorectal procedures.

Moreover, the growing implementation of colorectal cancer screening and awareness programs is significantly boosting the global market for colorectal surgical devices. Early detection through methods like colonoscopy and FIT has increased the identification of precancerous polyps and early-stage cancer, leading to more surgical interventions. Initiatives by organizations like Digestive Cancers Europe (DiCE) and the American Academy of Physician Associates (AAPA), in collaboration with companies such as Exact Sciences, are significantly boosting the global market for colorectal diagnostic and surgical devices. These efforts focus on increasing awareness and early detection, particularly among younger and underserved populations, promoting the use of non-invasive screening tools like FIT and stool DNA tests, and advocating for earlier screening guidelines and improved access to diagnostic resources.

Thus, the above-mentioned factors are expected to boost the overall market of colorectal surgical devices during the forecast period from 2025 to 2032.

However, the postoperative complications and risk factors, such as infection, bleeding, anastomotic leakage, among others, and stringent regulatory concerns for product approval, may potentially hinder market growth during the forecast period.

Colorectal Surgical Devices Market Segment Analysis

Colorectal Surgical Devices Market by Product Type (Endoscopes, Stapler Devices, Cutters, Sealing Devices, and Accessories), Surgery Type (Open Surgery and Minimally Invasive), End-User (Hospitals & Clinics, Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the colorectal surgical devices market, the stapler devices category is projected to capture a significant revenue share in 2024. Stapler devices are playing a pivotal role in boosting the overall market of colorectal surgical devices by enhancing the efficiency, safety, and precision of surgical procedures, particularly in minimally invasive and laparoscopic colorectal surgeries.

Additionally, these devices enable faster, secure anastomosis with minimal manual suturing, reducing operative time and complications like leakage or infection. The rising use of circular and linear staplers in colorectal surgeries, such as low anterior resection, is driven by their ability to ensure consistent tissue approximation and hemostasis. Products like Johnson & Johnson’s ECHELON series and Medtronic’s EEATM Circular Stapler with Tri-Staple™ Technology offer improved staple formation, tissue compression, and articulation for both open and minimally invasive procedures.

Moreover, with advancements in stapling technology, including powered and robotic-compatible staplers, the surgical outcomes have improved in terms of reduced blood loss, faster recovery, and lower rates of postoperative morbidity. These benefits make staplers highly favorable among surgeons and healthcare facilities striving for better patient outcomes and operational efficiency. For instance, in July 2024, Ethicon, the surgical technologies company of Johnson & Johnson MedTech, announced the launch of ECHELON™ 3000 Stapler, a digitally enabled device that provides surgeons with one-handed powered articulation to help address the unique needs of their patients.

Thus, the factors mentioned above are expected to boost the market of the segment, thereby escalating the overall market of colorectal surgical devices across the globe.

Colorectal Surgical Devices Market Regional Analysis

North America is expected to dominate the overall colorectal surgical devices market:

North America is projected to account for the largest share of the colorectal surgical device market in 2024. This dominance in the colorectal surgical device market is driven by a high prevalence of colorectal cancer, advanced healthcare infrastructure, strong screening programs, and early diagnoses. The region also benefits from major market players, high healthcare spending, and ongoing R&D investments, reinforcing its leading position globally.

According to the data provided by the Colorectal Cancer Alliance (2024), in 2024, approximately 152,810 new cases of colorectal cancer were estimated in the United States. Men accounted for 81,540 cases, and women accounted for 71,270 cases. Of these, 106,590 cases were of colon cancer, and 46,220 cases were of rectal cancer. Thus, due to an increase in colorectal cancer cases, there is an increased demand for surgical procedures such as colectomies, low anterior resections, and abdominoperineal resections. This growing surgical volume drives the need for advanced colorectal surgical devices, including staplers, energy devices, laparoscopes, and robotic surgical systems, which enhance precision, reduce operative time, and improve patient outcomes.

Moreover, screening and awareness programs related to colorectal health further promote early detection and treatment of colorectal diseases such as colorectal cancer, inflammatory bowel disease, and other conditions requiring surgical intervention. For example, National Colorectal Cancer Awareness Month is conducted every year in March in the United States. It promotes awareness of colorectal cancer and the importance of screening.

Additionally, product development activities further boost the market across the region. For instance, in May 2023, Olympus announced FDA clearance of its new EVIS X1™ endoscopy system along with two compatible gastrointestinal endoscopes: the GIF-1100 for the upper digestive tract and the CF-HQ1100DL/I for the lower digestive tract. The system offers advanced imaging technologies to aid physicians in diagnosing, treating, and observing GI diseases such as acid reflux, ulcers, Crohn's disease, and colorectal cancer.

In April 2025, Intuitive announced that the U.S. FDA cleared its fully wristed SP SureForm 45 stapler for use with the da Vinci SP single-port robotic surgical system in thoracic, colorectal, and urologic procedures. This stapler was the first designed specifically for single-port robotic surgery, which incorporates SmartFire technology that continuously monitors tissue compression before and during firing to optimize staple line integrity and reduce tissue damage.

In conclusion, North America will be the largest market for colorectal surgical devices during the forecast period from 2024 to 2032.

Who are the Major Players in Colorectal Surgical Devices?

The following are the leading companies in Colorectal Surgical Devices market. These companies collectively hold the largest Colorectal Surgical Devices market share and dictate industry trends.

Colorectal Surgical Devices Companies:

- Medtronic

- Johnson & Johnson Services, Inc.

- Stryker

- Olympus Corporation

- CONMED Corporation

- B. Braun SE

- Boston Scientific Corporation

- Cook

- Cooper Surgical Inc.

- Teleflex Incorporated

- Intuitive Surgical Operations, Inc.

- Applied Medical Resources Corporation

- Richard Wolf GmbH

- Karl Storz

- Fujifilm

- Volkmann Medizintechnik GmbH

- Ezisurg Medical Co., Ltd.

- Sontec Instruments, Inc.

- Mahr Surgical

- Thompson Surgical

- Others

Recent Developmental Activities in the Colorectal Surgical Devices Market:

- In September 2024, Odin Medical Ltd., an Olympus Corporation company, received FDA 510(k) clearance for CADDIE™, the first cloud-based AI computer-aided detection (CADe) device for colonoscopy, designed to assist gastroenterologists in real-time detection of suspected colorectal polyps by analyzing video and providing visual alerts.

- In August 2024, Olympus Corporation launched two new jaw designs in its POWERSEAL™ Sealer/Divider line: the Straight Jaw, Double-action (SJDA) and the Curved Jaw, Single-action (CJSA). They are approved for use in the U.S., Canada, the EU, and other regions. These devices provide efficient sealing, dissection, and grasping in both laparoscopic and open surgeries. They are indicated for multiple procedures, including colorectal, general, gynecological, and bariatric surgeries, while requiring less force to close the jaws.

- In August 2024, Colospan received FDA Breakthrough Device Designation for its CG-100 intraluminal bypass device. The device is intended for colorectal cancer patients undergoing anastomosis with a protective stoma.

Key takeaways from the colorectal surgical devices market report study

- Market size analysis for the current colorectal surgical devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the colorectal surgical devices market.

- Various opportunities available for the other competitors in the colorectal surgical devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current colorectal surgical devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the colorectal surgical devices market growth in the future?

Target audience who can benefit from this colorectal surgical devices market report study

- Colorectal surgical devices product providers

- Research organizations and consulting companies

- Colorectal surgical devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in colorectal surgical devices

- Various end-users who want to know more about the colorectal surgical devices market and the latest technological developments in the colorectal surgical devices market.