Diabetic Neuropathy Market Summary

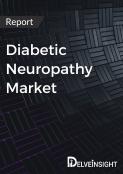

- In 2023, the total Diabetic Neuropathy Market Size was around ~USD 2,800 million which is expected to increase by 2034 during the study period (2020–2034) in the 7MM.

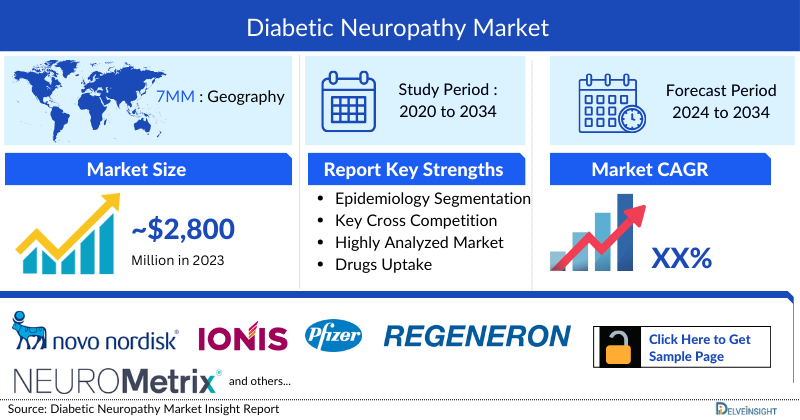

- In the 7MM, the United States accounted for the highest market size, with nearly ~80% of the market share of diabetic neuropathy market as compared to EU4 and the UK and Japan in 2023.

Diabetic Neuropathy Market and Epidemiology Analysis

- In 2023, among EU4 and the UK, the UK accounted for the largest Diabetic Neuropathy market size, while Spain accounted for the smallest Diabetic Neuropathy market share.

- The growth of the diabetic neuropathy market is expected to be mainly driven by the growing geriatric population, the rise in the prevalence of diabetic mellitus, technological advancements in the healthcare industry, etc.

- In the current Diabetic Nephropathy Market, NSAIDs accounted for the majority of the share in 2023, while NUCYNTA ER was the second-highest revenue generator.

- Diabetic Neuropathy is the most common microvascular complication encountered in diabetes mellitus individuals; after 20 years of disease progression, more than 50% of diabetes mellitus patients are affected by this complication with a significant impact on their life quality, considering the characteristic chronic pain in their lower limbs.

- As per the American Diabetes Association, the most common among diabetic neuropathies is chronic DSPN, accounting for about 75% of diabetic neuropathies.

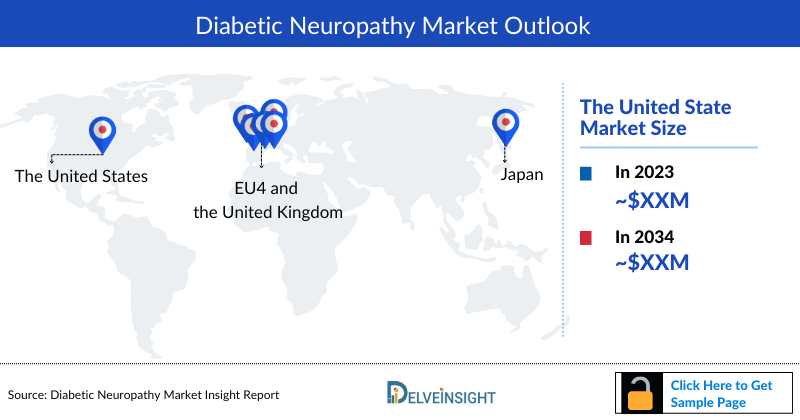

- In 2023, United States accounted for the highest number of Diabetic Neuropathy Diagnosed Prevalent Cases in the 7MM.

- The current treatment for diabetic neuropathic pain involves two major aims: to target the underlying pathophysiological processes to prevent nerve fiber loss, and symptomatic treatments aim to alleviate the painful symptoms of painful diabetic neuropathy to normalize physical and psychological functioning.

- Most guidelines generally suggest the use of tricyclic agents (TCAs), serotonin–norepinephrine reuptake inhibitors (SNRIs), or γ-aminobutyric acid (GABA) analogs (gabapentin or pregabalin) as first-line agents, followed by opioids and topical treatments. TCAs, SNRIs, and GABA analogs are commonly used to treat DNPs.

- Few therapies are being investigated for the Diabetic Neuropathy treatment. The leading Diabetic Nephropathy Companies such as Helixmith, Pure Green, Vertex Pharmaceuticals, Lexicon Pharmaceuticals, and others.

- In the United States, the highest cases of type specific was found to be of peripheral type,constituting approximately 60% of the total cases.

- In 2023,among EU4 and the UK, Germany accounted for the highest cases of the total diagnosed prevalent cases of diabetic neuropathy, whereas Spain accounted for the least number of cases.

- The emerging therapies such as LX9211, VX-548, Engenesis/VM202 (donaperminogene seltoplasmid), and sublingual Cannabidiol (CBD), are expected to enter the market in different regions across the 7MM countries, during the forecast period

- Delays in diagnosis, serious complications of diabetic neuropathy, economic burden, and lack of proper understanding of the disease will be going to hit the diabetic neuropathy market.

Diabetic Neuropathy Market size and forecast

- 2023 Diabetic Neuropathy Market Size: ~USD 2,800 million

- Largest Diabetic Neuropathy Market: United States

Factors affecting Diabetic Neuropathy Market Growth

-

Rising Prevalence of Diabetes

Increasing global diabetes cases directly fuel the growth of diabetic neuropathy.

-

Growing Geriatric Population

Higher risk of neuropathy complications among elderly patients boosts demand.

-

Advancements in Diagnostics

Improved tools such as nerve conduction studies and biomarkers enhance early detection.

-

Therapeutic Innovations

Development of novel pain management drugs and disease-modifying therapies strengthens market potential.

-

Expansion of Healthcare Infrastructure

Better access to care and facilities in emerging economies accelerates adoption.

-

Favorable Reimbursement & Policies

Insurance coverage and supportive clinical guidelines increase treatment uptake.

-

Focus on Quality of Life

Rising emphasis on pain management and complication prevention drives product demand.

-

Digital Health & Telemedicine Growth

Remote monitoring and digital platforms support long-term disease management.

Request for unlocking the sample page of the "Diabetic Neuropathy Treatment Market"

Diabetic Neuropathy Treatment Market Report Summary

- The Diabetic Neuropathy drugs market report offers extensive knowledge regarding the epidemiology segments (by type-specific, diagnosed prevalent cases of peripheral diabetic neuropathy,and total treated cases) and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies such as VM202 (donaperminogene seltoplasmid), VX-548 and the elaborative profiles of late and mid-stage (Phase III and Phase II) and prominent therapies that would impact the current Diabetic Neuropathy treatment market landscape and result in an overall market shift has been provided in the report.

- The Diabetic Neuropathy treatment market report also encompasses a comprehensive analysis of the diabetic neuropathy drugs market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The Diabetic Neuropathy therapeutics market report also includes drug outreach coverage in the 7MM region.

- The Diabetic Neuropathy treatment market report includes qualitative insights that provide an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM diabetic neuropathy therapeutics market.

The table given below further depicts the key segments provided in the report:

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Diabetic Neuropathy Epidemiology |

Segmented by:

|

|

Diabetic Neuropathy Treatment Market |

Segmented by:

|

|

Diabetic Neuropathy Drugs Market Analysis |

|

Diabetic Neuropathy Drugs Market Landscape

Various key Diabetic Neuropathy Companies such as Helixmith, Lexicon Pharmaceuticals, Pure Green Pharmaceuticals and others, are involved in developing therapies for diabetic neuropathy. Expected launch of emerging therapies and other treatments, will lead to a significant increase in the market size during the forecast period [2024–2034].

- In 2023, the total Diabetic Neuropathy Market Size was around ~USD 2,800 million which is expected to increase by 2034 during the study period (2020–2034) in the 7MM.

- Among the 7MM, the United States accounted for the highest Diabetic Neuropathy Market Size in 2023 followed by Germany for diabetic neuropathy.

- During the forecast period (2024–2034), Diabetic Neuropathy pipeline candidates such as VM202 (donaperminogene seltoplasmid), VX-548, LX9211 and others, are expected to drive the rise in diabetic neuropathy market size.

- By 2034, LX9211 is expected to garner the largest Diabetic Neuropathy Market Share in the 7MM.

Diabetic Neuropathy Drug Analysis

The section dedicated to drugs in the diabetic neuropathy drugs market report provides an in-depth evaluation of pipeline drugs (Phase III, and Phase II) related to diabetic neuropathy. The drug chapters section provides valuable information on various aspects related to clinical trials of diabetic neuropathy, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting diabetic neuropathy.

Diabetic Neuropathy Marketed Therapies

- QUTENZA: Grünenthal and Averitas Pharma

QUTENZA (capsaicin) 8% topical system contains capsaicin in a localized dermal delivery system. The capsaicin in QUTENZA is a synthetic equivalent of the naturally occurring compound found in chili peppers. Capsaicin is soluble in alcohol, acetone, and ethyl acetate and very slightly soluble in water. QUTENZA is a single-use topical system stored in a foil pouch.

Capsaicin is an agonist for the transient receptor potential vanilloid I receptor (TRPV1), an ion channel-receptor complex expressed on nociceptive nerve fibers in the skin. Topical administration of capsaicin causes an initial enhanced stimulation of the TRPV1-expressing cutaneous nociceptors that may be associated with painful sensations. This is followed by pain relief thought to be mediated by a reduction in TRPV1-expressing nociceptive nerve endings. Over several months, painful neuropathy may gradually re-emerge due to TRPV1 nerve fiber reinnervation of the treated area.

- In November 2018, Grünenthal extended its commercial footprint to the US, acquiring Averitas Pharma. Averitas Pharma will commercialize the pain patch Qutenza for Grünenthal in the US. Grünenthal had recently acquired the remaining global rights from Acorda Therapeutics.

- In July 2020, Grünenthal’s US subsidiary Averitas Pharma, Inc. received US FDA approval for a QUTENZA (capsaicin) 8% patch for treating neuropathic pain associated with DPN of the feet in adults.

Note: Detailed assessment will be provided in the final report of diabetic neuropathy…

Diabetic Neuropathy Emerging Therapies

- ENGENSIS/VM202 (donaperminogene seltoplasmid): Helixmith

ENGENSIS/VM202 (donaperminogene seltoplasmid) is a first-in-class, proprietary, nonviral, potentially regenerative plasmid DNA gene therapy. It is a novel genomic cDNA hybrid human hepatocyte growth factor (HGF) gene with a novel and proprietary coding sequence (HGF-X7) expressing two isoforms (HGF728 and HGF723) – a configuration that closely mimics HGF productions in humans that is needed for optimal therapeutic benefits (ViroMed, n.d.). As there is no change in the coding region of the HGF gene in VM202, the generated HGF proteins are identical to wild-type human HGF proteins. When introduced into the body through a simple series of intramuscular injections, HGF protein is expressed from VM202, induces the formation of new blood vessels (angiogenesis), suppresses levels of selected pain mediators (CSF-1, IL-6, α2δ1, 5-HTT, and others), support regeneration/repair of damaged peripheral nerves, and ameliorates the atrophic condition of skeletal muscle.

In May 2018, the US FDA granted RMAT (Regenerative Medicine Advanced Therapy) designation to VM202-DPN, as it reverses the underlying cause of neuropathy through an angio-neurorestorative effect.

- LX9211: Lexicon Pharmaceuticals

LX9211 is an orally-delivered small molecule compound Lexicon is developing to treat diabetic peripheral neuropathic pain. Lexicon’s scientists identified the target of LX9211, adapter-associated kinase 1, or AAK1, in their target discovery efforts based on their discovery that mice lacking AAK1 exhibited increased resistance to induced neuropathic pain in preclinical models. LX9211 and another development candidate were discovered by scientists working within the drug discovery alliance with Bristol Myers Squibb, from which the company holds exclusive development and commercialization rights.

Preclinical studies of LX9211 demonstrated central nervous system penetration and reduction in pain behavior in models of neuropathic pain without affecting opiate pathways. LX9211 has received FTD from the FDA for development in diabetic peripheral neuropathic pain.

|

Drug Name |

Company |

Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

MEDI7352 |

AstraZeneca |

II |

Painful DPN |

Intravenous |

NGF/TNF bispecific mAb |

Bispecific antibodies |

|

NB-01/ DA-9801 |

NeuroBo Pharmaceuticals/ Don-A ST/ MThera Pharma |

II |

Painful DPN |

Oral |

Nerve growth factor stimulants |

Small Molecule |

Diabetic Neuropathy Market Outlook

Due to a lack of treatments that target the underlying nerve damage, prevention is the key component of diabetes care. Screening for symptoms and signs of diabetic neuropathy is also critical in clinical practice, as it may detect the earliest stages of neuropathy, enabling early intervention. Prevention of diabetic neuropathy focuses primarily on glucose control and lifestyle modifications, which have the potential to prevent the disease or slow its progression.

The current modality of treatment largely focuses on the provision of symptomatic relief through pain management in diabetic peripheral neuropathy. Despite the major recent advances in elucidating the pathogenesis of diabetic neuropathy, there remains a lack of treatment options that effectively target the natural history of the disease or reverse it once established.

Following is a list of approved therapies for the management of pain associated with diabetic peripheral neuropathy:

- Duloxetine is an antidepressant approved across the 7MM

- Pregabalin is an anticonvulsant approved across the 7MM

- Extended-release tapentadol is an opioid that is approved in the US

- TARLIGE (mirogabalin) is an anticonvulsant approved in Japan

- QUTENZA (a high-potency capsaicin topical patch) is a topical, non-systemic, non-opioid analgesic approved in the US and EU4 and the UK.

Although regulatory authorities do not approve gabapentin and tricyclic antidepressants, they are frequently used as an “off-label” treatment approach, but they should be used with caution given the higher risk of serious side effects and also taking into account patients’ socioeconomic status, comorbidities, and potential drug interactions.

Diabetic Neuropathy Understanding

Diabetic neuropathy may be defined as the presence of certain signs or specific symptoms that are suggestive of neuropathy in patients with diabetes mellitus after excluding other possible causes of neuronal damage. The most common form of diabetic neuropathy is distal symmetric polyneuropathy (DSPN). Distal symmetric polyneuropathy manifests with a ‘stocking and glove’ distribution, commonly affecting the hands and lower limbs. Other diffuse neuropathies secondary to diabetes can occur and include the constellation of autonomic neuropathies, such as cardiac autonomic neuropathy, gastrointestinal dysmotility, and diabetic cystopathy and impotence. Focal neuropathies, although less common, include dysfunction of individual peripheral nerves leading to isolated mononeuropathies or, less commonly, to nerve roots leading to radiculopathy or polyradiculopathy

Diabetic Neuropathy Diagnosis

For the vast majority of patients, the diagnosis of diabetic neuropathy is based solely on the history and examination, and no additional testing is needed. Objective confirmatory testing is most commonly used in research or as part of the diagnostic work-up of patients with atypical clinical presentations.

Quantitative sensory testing (QST) is a technique for evaluating sensory neuropathy.

High-frequency ultrasound measures the size, blood vessels, echo, and mobility of the diseased nerve to show the damage to the nerve tissue, which can effectively improve the diagnostic efficiency of diabetic peripheral neuropathy and reduce the missed diagnosis rate and the misdiagnosis rate.

Further details related to country-based variations are provided in the report…

Diabetic Neuropathy Treatment

To date, no treatment can reverse or reliably prevent disease progression. Treatment modalities focus on optimized diabetic management and symptomatic relief. Glycemic control is the first step in the approach to disease management and has been shown to improve the occurrence of falls and the presence of foot ulcers. The three main principles of treatment for peripheral neuropathy are glycemic control, foot care, and pain management. Glycemic control has not been shown to reduce the symptoms among peripheral neuropathy patients effectively; thus, both glycemic control and foot care efforts are largely preventative. The available treatment options available are as follows:

- Tricyclic antidepressants

- Serotonin–norepinephrine reuptake inhibitors

- Calcium channel α2-δ ligands

- Sodium channel antagonists

- Topical agents

Diabetic Neuropathy Epidemiology Analysis

The diabetic neuropathy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Diabetic Nephropathy Prevalent Cases, Diabetic Nephropathy Type-Specific cases, Diabetic Nephropathy Prevalent Cases, and Diabetic Nephropathy Treated Cases in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Diabetic Neuropathy Epidemiological Analyses and Forecast

- In the 7MM, United States accounted for the highest number of Diabetic Nephropathy Prevalent Cases, which is ~60% of the diagnosed prevalent cases of diabetic neuropathy in 2023.

- Among EU4 and the UK, Germany accounted for the highest cases of total Diabetic Nephropathy Diagnosed Prevalent Cases, whereas Spain accounted for the least number of cases.

- In 2023, the maximum number of type-specific cases of diabetic neuropathy were observed for peripheral diabetic neuropathy in the 7MM, which might increase by 2034.

Diabetic Neuropathy Epidemiology Segmentation

- Diabetic Nephropathy Prevalent Cases

- Diabetic Nephropathy Type-Specific cases

- Diabetic Nephropathy Prevalent Cases

- Diabetic Nephropathy Treated Cases

- Latest KOL Views on Diabetic Neuropathy

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research. We have reached out to industry experts to gather insights on various aspects of diabetic neuropathy, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 10 KOLs across the 7MM. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the diabetic neuropathy market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Diabetic Neuropathy Report Qualitative Analysis

We perform Qualitative and Diabetic Neuropathy Drugs Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.In efficacy, the trial’s primary and secondary outcome measures are evaluated. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Diabetic Neuropathy Treatment Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The Diabetic Neuropathy treatment market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Diabetic Neuropathy Market Report Insights

- Patient-based Diabetic Neuropathy Market Forecasting

- Therapeutic Approaches

- Diabetic Neuropathy Market Size and Trends

- Existing Diabetic Neuropathy Drugs Market Opportunity

Diabetic Neuropathy Market Report Key Strengths

- 11 -year Diabetic Neuropathy Market Forecast

- The 7MM Coverage

- diabetic neuropathy Epidemiology Segmentation

- Key Cross Competition

Diabetic Neuropathy Market Report Assessment

- Current Diabetic Neuropathy Treatment Market Practices

- Reimbursements

- Diabetic Neuropathy Drugs Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions Answered in the Diabetic Neuropathy Market Report

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in diabetic neuropathy management recommendations?

- Would research and development advances pave the way for future tests and therapies for diabetic neuropathy?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of diabetic neuropathy?

- What kind of uptake will the new therapies witness in coming years in diabetic neuropathy patients?

Stay updated with us for Recent Articles