Emphysema Market Summary

- The emphysema market size is anticipated to sustain a steady Compound Annual Growth Rate (CAGR) during the forecast period (2025–2034). This growth is driven by the rising burden of Chronic Obstructive Pulmonary Disease (COPD)-related cases, expanding use of advanced diagnostic tools, increasing uptake of novel maintenance therapies and biologics, greater awareness of personalized treatment approaches, and ongoing research and development efforts focused on improving patient outcomes.

Emphysema Market & Epidemiology Trends

- The increasing cases of emphysema may be attributed to high rates of smoking, continued exposure to environmental and occupational pollutants, aging populations across major markets, genetic predispositions such as alpha-1 antitrypsin deficiency, and delayed diagnosis that allows the disease to progress unnoticed in its early stages.

- Current treatment of emphysema includes bronchodilators (short- and long-acting β2-agonists and anticholinergics), inhaled corticosteroids, phosphodiesterase-4 inhibitors, biologics such as OHTUVAYRE (ensifentrine) and DUPIXENT (dupilumab), combination therapies like TRELEGY ELLIPTA (fluticasone furoate/umeclidinium/vilanterol), among others, along with supportive measures such as pulmonary rehabilitation and oxygen therapy.

- Despite available therapies, there remains a significant unmet need in emphysema management, including limited options for disease modification, suboptimal control of exacerbations, variability in patient response, and the lack of long-acting therapies that address underlying inflammation and disease progression.

- Novel treatments, including itepekimab, depemokimab, and tozorakimab, among others, are under development to address these gaps. These emerging therapies offer innovative mechanisms of action, potential for improved tolerability, and the possibility of more sustained responses in patients who do not adequately benefit from existing treatments.

- In May 2025, AstraZeneca presented new data at American Thoracic Society (ATS) 2025 highlighting the ability of tozorakimab to reduce inflammation in IL-33–driven diseases, including COPD, asthma, and lower respiratory tract diseases. Key upcoming milestones include anticipated Phase III readouts from the OBERON/TITANIA and MIRANDA trials in 2026.

Request for unlocking the Sample Page of the "Emphysema Market"

Key Factors Driving the Growth of the Emphysema Market

- Rising Prevalence of Chronic Obstructive Pulmonary Diseases (COPD): Emphysema, a major form of COPD, is increasing globally due to smoking, air pollution, and aging populations, expanding the patient pool in need of effective treatments.

- Advancements in Diagnostic and Monitoring Tools: Innovations such as high-resolution CT scans, pulmonary function tests, and digital monitoring devices allow early detection and better disease management, supporting higher treatment adoption.

- Introduction of Novel Therapies: Development of targeted therapies, long-acting bronchodilators, inhaled corticosteroids, and combination treatments is improving patient outcomes, reducing exacerbations, and driving market growth.

- Increasing Awareness and Screening Initiatives: Public health campaigns and clinician education programs are raising awareness about emphysema risk factors, encouraging early diagnosis and consistent management.

- Supportive Reimbursement and Healthcare Policies: Expanded insurance coverage, reimbursement programs, and government initiatives for chronic respiratory diseases facilitate access to advanced treatments, boosting market expansion.

DelveInsight’s comprehensive report titled “Emphysema Market Insights, Epidemiology, and Market Forecast – 2034” offers a detailed analysis of emphysema. The report presents historical and projected epidemiological data covering total diagnosed prevalent cases of COPD, subtype-specific diagnosed prevalent cases of COPD, total diagnosed prevalent cases of emphysema, and treated cases of emphysema. In addition to epidemiology, the market report encompasses various aspects related to the patient population. These aspects include the diagnosis process, prescription patterns, physician perspectives, market accessibility, treatment options, and prospective developments in the market across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan, spanning from 2020 to 2034.

The report analyzes the existing treatment practices and unmet medical requirements in emphysema. It evaluates the market potential and identifies potential business prospects for enhancing therapies or interventions. This valuable information enables stakeholders to make well-informed decisions regarding product development and strategic planning for the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Emphysema Market |

|

|

Emphysema Market Size | |

|

Emphysema Companies |

Verona Pharma, Regeneron Pharmaceuticals / Sanofi, GSK, AstraZeneca, Mereo BioPharma, United Therapeutics, Boehringer Ingelheim, Pfizer, Mylan, Novartis, and others |

|

Emphysema Epidemiology Segmentation |

|

Emphysema Disease Understanding

Emphysema Overview

Emphysema is a progressive lung disease and a form of COPD, characterized by permanent enlargement of air spaces, destruction of alveolar walls, and loss of lung elasticity, leading to airflow limitation and impaired gas exchange. It is primarily caused by long-term exposure to harmful inhalants, most commonly cigarette smoke, though environmental pollutants, biomass fuels, e-cigarettes, recurrent lung infections, and passive smoke also contribute. A rare genetic factor, alpha-1 antitrypsin deficiency, can predispose to early-onset emphysema. COPD, which includes emphysema and chronic bronchitis, is a leading cause of death worldwide.

Emphysema Diagnosis

The diagnosis of emphysema is primarily based on pulmonary function testing, particularly spirometry, with post bronchodilator FEV1/FVC less than 0.7 confirming airflow limitation that is partially or fully irreversible. GOLD staging classifies severity as mild (FEV1 ≥80% predicted), moderate (<80%), severe (<50%), and very severe (<30%). Lung volume measurements typically show increased residual volume and total lung capacity, while diffusing capacity for carbon monoxide is reduced due to alveolar destruction. Chest X-rays may reveal hyperinflation, diaphragm flattening, and an elongated heart in advanced cases but are not diagnostic in mild disease. Arterial blood gases are reserved for severe cases or oxygen saturation below 92%, and young patients with emphysema should be evaluated for alpha-1 antitrypsin deficiency to guide early management.

Emphysema Treatment

There is no definitive cure for emphysema, but treatment focuses on slowing disease progression, managing symptoms, and improving quality of life. Medical therapy includes inhaled bronchodilators, such as β2-agonists and anticholinergics, often combined with inhaled corticosteroids or oral phosphodiesterase-4 inhibitors for severe cases. Patients with alpha-1 antitrypsin deficiency may receive intravenous augmentation therapy. Supportive measures include long-term oxygen therapy for severe hypoxemia, noninvasive ventilation for respiratory failure, pulmonary rehabilitation, nutritional support, vaccinations, and palliative care to manage advanced disease symptoms. Interventional options, such as lung volume reduction surgery or lung transplantation, are considered in advanced emphysema. Preventive strategies, particularly smoking cessation and reducing exposure to environmental pollutants, are essential to limit disease progression.

Emphysema Epidemiology

The emphysema epidemiology section of the market report offers information on the patient populations, including historical and projected trends for each of the seven major markets. Examining key opinion leader views from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report.

This section also presents the data with relevant tables and graphs, offering a clear and concise view of the prevalence of emphysema. Additionally, the report discloses the assumptions made during the analysis, ensuring data interpretation and presentation transparency. This epidemiological data is valuable for understanding the disease burden and its impact on the patient population across various regions.

Emphysema Epidemiology Insights

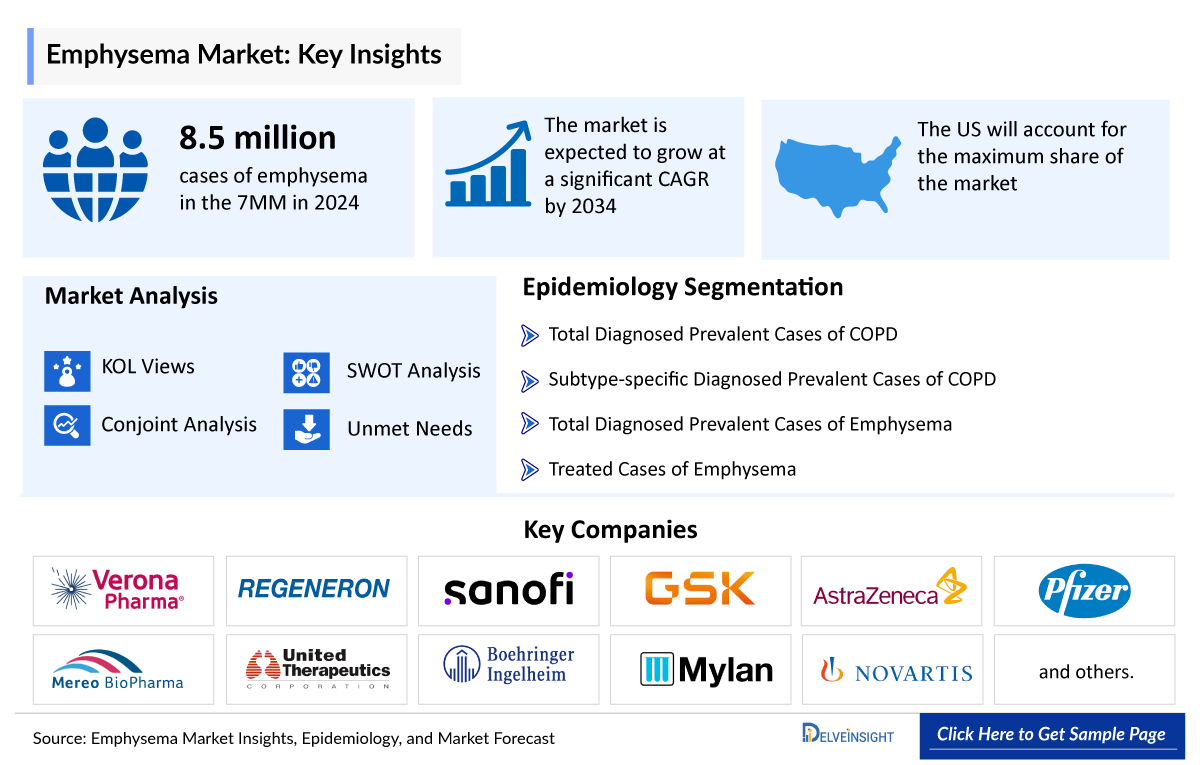

- In 2024, DelveInsight estimated that the 7MM had around 31 million diagnosed cases of COPD, including approximately 8.5 million cases of emphysema, with prevalence projected to grow throughout the forecast period (2025–2034).

- In 2024, the US accounted for an estimated 4 million diagnosed cases of emphysema within the 7MM.

- Across the EU4 and the UK, approximately 4.1 million people were diagnosed with emphysema in 2024, with numbers expected to increase throughout the forecast period.

- In 2024, within the EU4 and the UK, Germany had the highest number of diagnosed emphysema cases at approximately 1.4 million, while the UK had the lowest at around 360,000.

- In 2024, Japan had an estimated 250,000 diagnosed cases of emphysema, with prevalence projected to rise throughout the 2025–2034 forecast period.

- The epidemiology of emphysema is expected to change during the forecast period (2025-2034).

Emphysema Epidemiology Segmentation

- Total Diagnosed Prevalent Cases of COPD

- Subtype-specific Diagnosed Prevalent Cases of COPD

- Total Diagnosed Prevalent Cases of Emphysema

- Treated Cases of Emphysema

Emphysema Drug Analysis

The drug chapter segment of the Emphysema drugs market report encloses the detailed analysis of Emphysema marketed drugs, mid-phase, and late-stage Emphysema pipeline drugs. It also helps to understand the Emphysema clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details of each included drug, and the latest news and press releases.

Marketed Emphysema Drugs

OHTUVAYRE (ensifentrine): Verona Pharma

OHTUVAYRE is a first-in-class selective dual inhibitor of phosphodiesterase 3 and 4, combining bronchodilator and nonsteroidal anti-inflammatory effects in a single molecule. It demonstrated statistically significant and clinically meaningful improvements in lung function by meeting the primary endpoints in both the ENHANCE-1 and ENHANCE-2 trials. A fixed-dose combination of OHTUVAYRE and glycopyrrolate, a long-acting muscarinic antagonist, is also under development for the maintenance treatment of COPD. Regulatory efforts are actively underway to pursue marketing authorization applications for OHTUVAYRE in the European Union and the UK.

- In June 2024, the US FDA approved OHTUVAYRE for maintenance treatment of COPD in adults. In July 2025, Merck entered into a definitive agreement to acquire Verona Pharma for approximately USD 10 billion, with the transaction expected to close in the fourth quarter of 2025. This acquisition will expand Merck’s portfolio to include OHTUVAYRE and strengthens its pipeline in cardio-pulmonary diseases, with most of the purchase price being capitalized as an intangible asset for the drug.

DUPIXENT (dupilumab): Regeneron Pharmaceuticals/Sanofi

DUPIXENT (dupilumab), developed by Regeneron Pharmaceuticals and Sanofi, is a subcutaneous biologic therapy for adults with uncontrolled COPD characterized by elevated blood eosinophils. It is the first biologic approved in Europe and the US for this indication, offering a novel treatment option that reduces exacerbations, improves lung function, and enhances health-related quality of life. The approval follows pivotal Phase III studies demonstrating its efficacy and safety, marking a significant advancement in COPD management and expanding DUPIXENT’s global presence as a versatile therapy for multiple inflammatory conditions.

In terms of regulatory approvals, DUPIXENT received European approval in July 2024 as the first targeted therapy for COPD, based on two pivotal Phase III trials. The US FDA approved it in September 2024 as an add-on maintenance treatment for adults with inadequately controlled eosinophilic COPD. In March 2025, Japan also approved DUPIXENT as the first biologic therapy for COPD, supported by positive outcomes from the Phase III BOREAS and NOTUS trials. These milestones represent its sixth indication in the EU and seventh globally, with additional submissions under review in other regions.

TRELEGY ELLIPTA (fluticasone furoate/umeclidinium/ vilanterol): GSK

TRELEGY ELLIPTA combines three molecules in a single inhaler that only needs to be taken in a single inhalation once a day. It contains fluticasone furoate, an ICS, umeclidinium, a LAMA, and vilanterol, a LABA agonist, delivered in GSK’s Ellipta dry powder inhaler. It is approved for the maintenance treatment of patients with COPD and the maintenance treatment of asthma in patients aged 18 years and older.

TRELEGY ELLIPTA, a once-daily single-inhaler triple therapy combining fluticasone furoate, vilanterol, and umeclidinium, is approved for long-term maintenance treatment of COPD, including chronic bronchitis and emphysema. In the US, it was approved in September 2017 for patients needing additional therapy to manage airflow obstruction or already receiving fluticasone furoate and vilanterol with umeclidinium, with an expanded indication in April 2018 for a broader COPD population. In Europe, it was approved in November 2017 for patients inadequately controlled on ICS/LABA or LABA/LAMA combinations, and in March 2019, it received approval in Japan to relieve COPD symptoms, establishing it as a key global treatment option for the disease.

Note: Detailed marketed therapies assessment will be provided in the final report...

|

Drug |

MoA |

RoA |

Company |

Logo |

|

OHTUVAYRE (ensifentrine) |

PDE3 and PDE4 dual inhibitor |

Oral |

Verona Pharma |

|

|

DUPIXENT (dupilumab) |

Inhibitor IL-4 and IL-13 |

SC |

Regeneron Pharmaceuticals/ Sanofi |

|

|

c (fluticasone furoate/ umeclidinium/ vilanterol) |

Beta-2 adrenergic receptor agonists; muscarinic receptor antagonists |

Oral |

GSK |

|

|

XX |

XX |

X |

XXX |

|

Emerging Emphysema Drugs

The emphysema market is expected to evolve gradually, driven by the multiple emerging therapies currently in development. Key players such as itepekimab, depemokimab, tozorakimab, among others are showing active commitment to addressing this unmet need, with ongoing efforts to advance novel treatment options for this complex condition.

Itepekimab (SAR440340/REGN3500): Regeneron Pharmaceuticals/Sanofi

Itepekimab is a fully human mAb that binds to and inhibits IL-33, an initiator and amplifier of broad inflammation in COPD. IL-33 is thought to be involved in different types of inflammation and is particularly elevated in the lungs of former smokers. Sanofi and Regeneron are jointly developing Itepekimab under a global collaboration agreement.

- In May 2025, Sanofi reported that the AERIFY-1 Phase III study of itepekimab in former smokers with inadequately controlled COPD met its primary endpoint, showing a significant reduction in moderate or severe exacerbations, while AERIFY-2 did not meet the same endpoint despite early benefits. Earlier, in April 2025, Sanofi noted that itepekimab’s Phase III COPD readouts were expected in the second half of 2025. Itepekimab was granted Fast Track Designation (FTD) by the US FDA in January 2023.

Depemokimab: GSK

Depemokimab is the first ultra-long-acting biologic in Phase III development, with high binding affinity and potency for interleukin-5 (IL-5), allowing for dosing intervals of up to six months. IL-5 plays a central role as a key cytokine in type 2 inflammation.

Tozorakimab: AstraZeneca

Tozorakimab is a human monoclonal antibody with a dual mechanism that blocks IL-33 activity through the ST2 and RAGE/EGFR pathways and has received FTD from the US FDA. At European Respiratory Society (ERS) 2024, AstraZeneca reported that the drug did not meet the primary endpoint in a Phase II trial; however, as it had already advanced into Phase III in populations showing stronger signals, the company maintained confidence in its potential.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Itepekimab (SAR440340/REGN3500) |

IL33 inhibitor |

SC |

Regeneron Pharmaceuticals/Sanofi |

|

III |

|

Depemokimab |

Long-acting anti-IL5 |

SC |

GSK |

|

III |

|

Tozorakimab |

IL-33 inhibitor |

SC |

AstraZeneca |

|

III |

|

XX |

XX |

X |

XXX |

|

XX |

Note: Detailed emerging therapies assessment will be provided in the final report....

Emphysema Market Outlook

The emphysema therapeutics market is further expected to increase by the major drivers, such as the rising prevalence population, technological advancements, and upcoming therapies in the forecast period (2025–2034).

With ongoing research and continued dedication, the future holds hope for even more effective treatments and, ultimately, a cure for this challenging condition. According to DelveInsight, the emphysema market in the 7MM is expected to change significantly during the forecast period 2025–2034.

Emphysema Market Segmentation

DelveInsight’s ‘Emphysema – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future emphysema market, segmented within countries, by therapies, and by classes. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Emphysema Market Size by Countries

The emphysema market size is assessed separately for various countries, including the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan. In 2024, the United States held a significant share of the overall 7MM (Seven Major Markets) emphysema market, primarily attributed to the country’s higher prevalence of the condition and the elevated cost of the available treatments. This dominance is projected to persist, especially with the potential early introduction of new products.

Emphysema Market Size by Therapies

Emphysema Market Size by Therapies is categorized into current and emerging markets for the study period 2020–2034.

Note: Detailed market segment assessment will be provided in the final report....

Emphysema Drugs Uptake

This section focuses on the sales uptake of potential emphysema drugs that have recently been launched or are anticipated to be launched in the emphysema market between 2020 and 2034. It estimates the market penetration of emphysema drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the emphysema market.

The emerging emphysema therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the emphysema market.

Emphysema Pipeline Development Activities

The Emphysema pipeline report offers an analysis of Emphysema clinical trials within Phase II and I stages and examines companies involved in developing targeted therapeutics for emphysema. It provides valuable insights into the advancements and progress of potential treatments in clinical development for this condition.

Emphysema Pipeline Activities

The Emphysema clinical trials analysis report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging emphysema therapies.

Note: Detailed assessment of drug uptake and attribute analysis will be provided in the full report on emphysema...

Emphysema Market Access and Reimbursement

DelveInsight’s ‘Emphysema – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of emphysema.

OHTUVAYRE

- Verona Pathway Plus Patient Assistance Program

- Verona Pathway Plus Co-pay Program

- OHTUVAYRE Bridge Program

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views on Emphysema Market Report

To keep up with current emphysema market trends and fill gaps in secondary findings, we interview KOLs and SMEs’ working in the emphysema domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or emphysema market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the emphysema unmet needs.

Emphysema: KOL Insights

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as University of Michigan, US, Harvard Medical School, US, Drexel University, US, University of Marburg, Germany, Intercommunal Hospital of Creteil, France, University of Ferrara, Italy, Vall d'Hebron University Hospital, Spain, Imperial College, UK, University of Manchester, UK, and Nagoya City University, Japan, among others.

“Emphysema is characterized by the irreversible destruction of alveoli, leading to impaired gas exchange, progressive airflow limitation, and reduced lung elasticity, with disease progression strongly influenced by genetic susceptibility, smoking, and chronic inflammation.”

“Accurate diagnosis of emphysema relies on spirometry to confirm persistent airflow obstruction, while advanced imaging techniques such as quantitative CT provide greater precision in detecting early structural changes, assessing severity, and monitoring progression beyond traditional lung function tests.”

“Treatment of emphysema integrates long-acting bronchodilators, inhaled therapies, and pulmonary rehabilitation, while interventional approaches such as lung volume reduction surgery and endobronchial valves offer benefits for selected patients with advanced disease, alongside ongoing exploration of biologics to address underlying inflammation.”

Note: Detailed assessment of KOL Views will be provided in the full report on Emphysema....

Emphysema Competitive Intelligence Analysis

We conduct a Competitive and Market Intelligence analysis of the emphysema Market, utilizing various Competitive Intelligence tools such as SWOT analysis and Market entry strategies. The inclusion of these analyses is contingent upon data availability, ensuring a comprehensive and well-informed assessment of the market landscape and competitive dynamics.

Emphysema Market Report Insights

- Emphysema Patient Population

- Emphysema Therapeutic Approaches

- Emphysema Pipeline Analysis

- Emphysema Market Size and Trends

- Emphysema Market Opportunities

- Impact of Upcoming Emphysema Therapies

Emphysema Market Report Key Strengths

- 10 Years Forecast

- The 7MM Coverage

- Emphysema Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Emphysema Market

- Emphysema Drugs Uptake

Emphysema Market Report Assessment

- Emphysema Current Treatment Practices

- Emphysema Unmet Needs

- Emphysema Pipeline Product Profiles

- Emphysema Market Attractiveness

- Emphysema Market Drivers

- Emphysema Market Barriers

Key Questions Answered In The Emphysema Market Report:

- How common is emphysema?

- What are the key findings of emphysema epidemiology across the 7MM, and which country will have the highest number of patients during the study period (2020–2034)?

- What are the currently available treatments for emphysema?

- What are the disease risk, burden, and unmet needs of emphysema?

- At what CAGR is the emphysema market and its epidemiology is expected to grow in the 7MM during the forecast period (2025–2034)?

- How would the unmet needs impact the emphysema market dynamics and subsequently influence the analysis of the related trends?

- What would be the forecasted patient pool of emphysema in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- Among EU4 and the UK, which country will have the highest number of patients during the forecast period (2025–2034)?

- How many companies are currently developing therapies for the treatment of emphysema?

Reasons to buy Emphysema Market Forecast Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the emphysema market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of current treatment in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the attribute analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.