EMRELIS Market Summary

Key Factors Driving EMRELIS Growth

1. Market Share Gains and New Patient Starts

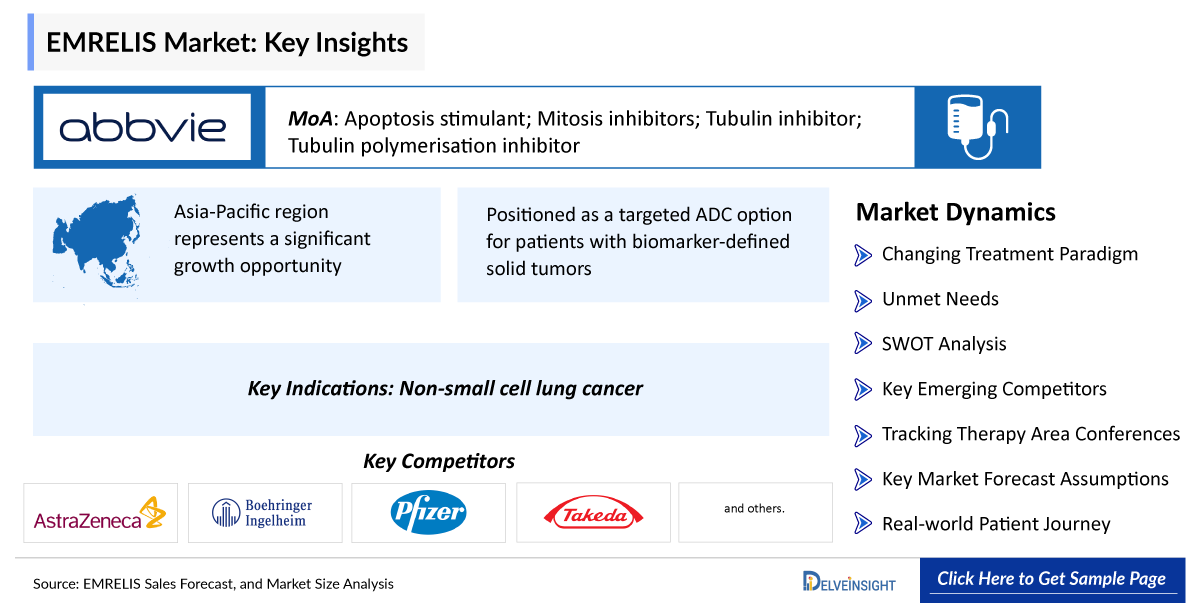

- EMRELIS is positioned as a targeted ADC option for patients with biomarker-defined solid tumors, addressing areas of high unmet need where standard therapies provide limited benefit.

- New patient starts are expected to grow as oncologists increasingly adopt biomarker-guided treatment strategies and integrate ADCs earlier in treatment sequences.

- Clinical interest is supported by meaningful antitumor activity observed in selected patient populations, reinforcing confidence among treating physicians.

- AbbVie’s oncology-focused commercial and medical engagement, including biomarker education and specialist outreach, is expected to drive adoption post-approval.

2. Expansion Across Key Indications

- Non-Small Cell Lung Cancer (NSCLC): EMRELIS is primarily being developed for c-Met–overexpressing NSCLC, particularly in patients who have progressed on prior lines of therapy.

- Biomarker-Defined Solid Tumors: Beyond NSCLC, EMRELIS has potential applicability in other c-Met–expressing tumors, expanding the addressable patient population.

- Later-Line and Refractory Settings: The drug is positioned to fill a critical gap for patients with limited treatment options after chemotherapy, immunotherapy, or targeted agents.

- Pipeline and lifecycle expansion opportunities, including combination strategies, may further broaden EMRELIS’s clinical and commercial reach.

3. Geographic Expansion

- EMRELIS is being advanced with a global development and commercialization strategy, targeting major oncology markets such as the United States, Europe, and Asia.

- The Asia-Pacific region represents a significant growth opportunity, driven by high lung cancer prevalence, increasing access to biomarker testing, and rapid uptake of novel oncology agents.

- AbbVie’s established global oncology infrastructure and regional partnerships are expected to support efficient market entry and uptake.

4. New Indication Approvals

- Regulatory progress for EMRELIS in NSCLC would significantly broaden AbbVie’s oncology portfolio, particularly in precision oncology.

- Future approvals in additional biomarker-defined indications could diversify revenue streams and strengthen competitive positioning in the expanding ADC market.

- Given the high unmet need in c-Met–driven cancers, EMRELIS may benefit from regulatory flexibility or expedited pathways in select indications.

5. Strong Momentum in Lung Cancer Segments

- Lung cancer remains a major volume driver, with large patient populations and continued demand for effective post-immunotherapy treatment options.

- Increasing routine use of biomarker testing (including c-Met expression) is improving patient identification and supporting treatment uptake.

- AbbVie’s recent oncology updates highlight continued clinical momentum and investigator engagement, supporting sustained adoption potential.

6. Competitive Differentiation and Market Trends

- EMRELIS’s ADC design enables targeted delivery of a potent cytotoxic payload, differentiating it from conventional chemotherapy and some targeted agents.

- A biomarker-driven approach enhances the likelihood of clinical benefit and aligns with precision oncology trends.

- Broader market dynamics such as growth in Antibody Drug Conjugates platforms, personalized cancer therapy, and combination regimens support EMRELIS’s positioning.

- Increasing reliance on real-world evidence (RWE) in oncology is expected to strengthen payer and prescriber confidence following broader clinical use.

EMRELIS Recent Developments

- In May 2025, AbbVie announced that EMRELIS (telisotuzumab vedotin-tllv) had been granted accelerated approval by the US Food and Drug Administration (FDA) for the treatment of adult patients with locally advanced or metastatic, non-squamous non-small cell lung cancer (NSCLC) with high c-Met protein overexpression (OE) who have received a prior systemic therapy. High c-Met protein overexpression is defined as ≥ 50% of tumor cells with strong (3+) staining as determined by an FDA-approved test.

“EMRELIS Sales Forecast, and Market Size Analysis - 2034” report provides comprehensive insights of EMRELIS for approved indication like Non-small cell lung cancer in the 7MM. A detailed picture of EMRELIS’s existing usage in anticipated entry and performance in approved indications in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan for the study period 2020 –2034 is provided in this report along with a detailed description of the EMRELIS for approved indications. The EMRELIS market report provides insights about EMRELIS’s sales forecast, mechanism of action (MoA), dosage and administration, as well as research and development including regulatory milestones, along with other developmental activities. Further, it also consists of historical and current EMRELIS performance, future market assessments inclusive of the EMRELIS market forecast analysis for approved indications in the 7MM, SWOT, analysts’ views, comprehensive overview of market competitors, and brief about other emerging therapies in respective indications. It also provides analysis of EMRELIS sales forecasts, along with factors driving its market.

EMRELIS Drug Summary

EMRELIS is a c-Met-directed antibody-drug conjugate (ADC) containing telisotuzumab vedotin-tllv, consisting of a humanized IgG1-kappa monoclonal antibody targeting the c-Met receptor covalently linked to monomethyl auristatin E (MMAE) via a protease-cleavable valine-citrulline linker. It binds to c-Met overexpressed on tumor cells, such as in non-squamous non-small cell lung cancer (NSCLC), undergoes internalization, releases MMAE in lysosomes, and inhibits microtubule polymerization, leading to G2/M phase arrest and apoptosis. FDA-approved on May 2025, for adults with locally advanced or metastatic non-squamous NSCLC with high c-Met overexpression (≥50% tumor cells with 3+ staining, confirmed by FDA-approved test), it is administered intravenously at 2.4 mg/kg every 3 weeks after reconstitution and dilution in 0.9% sodium chloride. The report provides EMRELIS’s sales, growth barriers and drivers, post usage and approvals in multiple indications.

Scope of the EMRELIS Market Report

The report provides insights into:

- A comprehensive product overview including the EMRELIS MoA, description, dosage and administration, research and development activities in approved indication like Non-small cell lung cancer.

- Elaborated details on EMRELIS regulatory milestones and other development activities have been provided in EMRELIS market report.

- The report also highlights EMRELIS‘s cost estimates and regional variations, reported and estimated sales performance, research and development activities in approved indications across the United States, Europe, and Japan.

- The EMRELIS market report also covers the patents information, generic entry and impact on cost cut.

- The EMRELIS market report contains current and forecasted EMRELIS sales for approved indications till 2034.

- Comprehensive coverage of the late-stage emerging therapies for respective indications.

- The EMRELIS market report also features the SWOT analysis with analyst views for EMRELIS in approved indications.

EMRELIS Methodology

The EMRELIS market report is built using data and information sourced primarily from internal databases, primary and secondary research and in-house analysis by DelveInsight’s team of industry experts. Information and data from the secondary sources have been obtained from various printable and nonprintable sources like search engines, news websites, global regulatory authorities websites, trade journals, white papers, magazines, books, trade associations, industry associations, industry portals and access to available databases.

EMRELIS Analytical Perspective by DelveInsight

In-depth EMRELIS Market Assessment

This EMRELIS sales market forecast report provides a detailed market assessment of EMRELIS for approved indication like Non-small cell lung cancer in the seven major markets, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan. This segment of the report provides current and forecasted EMRELIS sales data uptil 2034.

EMRELIS Clinical Assessment

The EMRELIS market report provides the clinical trials information of EMRELIS for approved indications covering trial interventions, trial conditions, trial status, start and completion dates.

EMRELIS Competitive Landscape

The report provides Insights on competitors and marketed products within the domain, along with a summary of emerging products and their respective launch dates, posing significant competition in the market.

EMRELIS Market Potential & Revenue Forecast

- Projected market size for the EMRELIS and its key indications

- Estimated EMRELIS sales potential (EMRELIS peak sales forecasts)

- EMRELIS Pricing strategies and reimbursement landscape

EMRELIS Competitive Intelligence

- Number of competing drugs in development (pipeline analysis)

- EMRELIS Market positioning compared to existing treatments

- EMRELIS Strengths & weaknesses relative to competitors

EMRELIS Regulatory & Commercial Milestones

- EMRELIS Key regulatory approvals & expected launch timelines

- Commercial partnerships, licensing deals, and M&A activity

EMRELIS Clinical Differentiation

- EMRELIS Efficacy & safety advantages over existing drugs

- EMRELIS Unique selling points

EMRELIS Market Report Highlights

- In the coming years, the EMRELIS market scenario is set to change due to strong adoption, increased prescriptions and broader uptake in multiple immunological indications; which would expand the size of the market.

- The EMRELIS companies are developing therapies that focus on novel approaches to treat/improve the disease condition, assess challenges, and seek opportunities that could influence EMRELIS’s dominance.

- Other emerging products for Non-small cell lung cancer are expected to give tough market competition to EMRELIS and launch of late-stage emerging therapies in the near future will significantly impact the market.

- A detailed description of regulatory milestones, and developmental activities, provide the current development scenario of EMRELIS in approved indications.

- Analyse EMRELIS cost, pricing trends and market positioning to support strategic decision-making in the immunology landscape.

- Our in-depth analysis of the forecasted EMRELIS sales data uptil 2034 will support the clients in decision-making process regarding their therapeutic portfolio by identifying the overall scenario of EMRELIS in approved indications.

Key Questions Answered In The EMRELIS Market Report

- What is the class of therapy, route of administration and mechanism of action of EMRELIS? How strong is EMRELIS’s clinical and commercial performance?

- What is EMRELIS’s clinical trial status in each individual indications such as Non-small cell lung cancer and study completion date?

- What are the key collaborations, mergers and acquisitions, licensing and other activities related to the EMRELIS Manufacturers?

- What are the key designations that have been granted to EMRELIS for approved indications? How are they going to impact EMRELIS’s penetration in various geographies?

- What is the current and forecasted EMRELIS market scenario for approved indications? What are the key assumptions behind the forecast?

- What are the current and forecasted sales of EMRELIS in the seven major countries, including the United States, Europe (Germany, France, Italy, Spain) and the United Kingdom, and Japan?

- What are the other emerging products available and how are these giving competition to EMRELIS for approved indications?

- Which are the late-stage emerging therapies under development for the treatment of approved indications?

- How cost-effective is EMRELIS? What is the duration of therapy and what are the geographical variations in cost per patient?