Antibody Drug Conjugates Market

- The dynamics of the Antibody Drug Conjugate market are anticipated to change as companies across the globe are thoroughly working toward development and expansion to treat a wide array of indications during the forecast period (2025–2034).

- Antibody Drug Conjugates are becoming increasingly prominent in the oncology landscape. Antibody Drug Conjugates represent a paradigm shift in cancer therapeutics, offering a targeted and potent approach with the potential to significantly improve patient outcomes while minimizing adverse effects associated with conventional chemotherapy.

- The first Antibody Drug Conjugate to be approved was MYLOTARG. But later in 2017, MYLOTARG was voluntarily withdrawn from the market after subsequent confirmatory trials failed to verify clinical benefit and demonstrated safety concerns, including a high number of early deaths.

- Daiichi Sankyo is poised to play its part in revolutionizing cancer treatments with its portfolio of Antibody Drug Conjugates. ENHERTU is the primary revenue driver for the company. The next major revenue contributor from Daiichi Sankyo’s ADC pipeline is likely to be Dato DXd, an ADC that targets TROP-2 and has clinical and market potential in both lung and breast cancers. AstraZeneca and Daiichi Sankyo have entered into a global collaboration to develop and commercialize both these products jointly.

- Currently, four Antibody Drug Conjugates have been granted FDA approval for patients with breast cancer, including the HER2-targeted Antibody Drug Conjugates KADCYLA (trastuzumab emtansine), ENHERTU (trastuzumab deruxtecan), the TROP2-targeted Antibody Drug Conjugate TRODELVY (sacituzumab govitecan), and DATROWAY (datopotamab deruxtecan).

- The dynamics of the Antibody Drug Conjugates are anticipated to change in the coming years owing to the improvement in the rise in healthcare spending across the world. Some of the potential drugs in the pipeline include Ifinatamab deruxtecan (Daiichi Sankyo/Merck), Patritumab deruxtecan (Daiichi Sankyo and Merck) ARX788 (Ambrx/Johnson & Johnson Innovative Medicine), AZD8205 (AstraZeneca), Raludotatug deruxtecan (Daiichi Sankyo/Merck), Farletuzumab ecteribulin (Eisai/Bristol-Myers Squibb), among others.

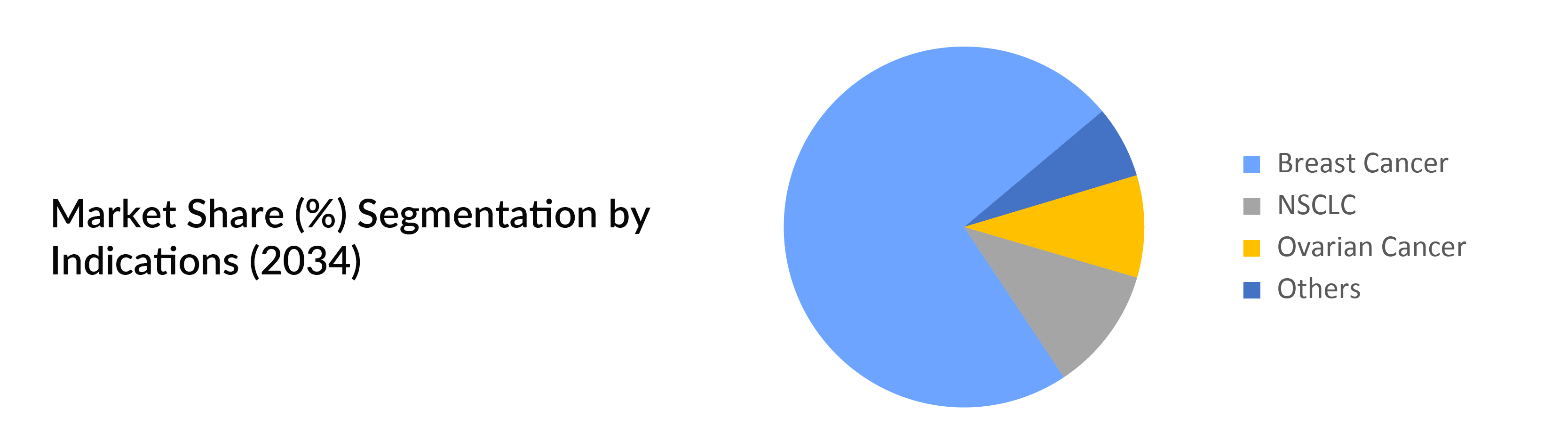

- Given the current limitations in the pipeline, it is crucial to prioritize the development of drugs in this class, as they show significant promise in treating breast cancer, NSCLC, urothelial cancer, and DLBCL, highlighting the need for dedicated efforts in this area.

- In a late-breaking session at the ASCO 2024, GSK announced noteworthy results in the DREAMM-8 Study, particularly in light of GSK's decision in late 2022 to withdraw BLENREP from the US market. The new data could support a case for the reintroduction of BLENREP to the market. Regulatory decision (US, EU, JP) based on DREAMM-7/8 trial in second line and above multiple myeloma and regulatory submission based on DREAMM-8 trial in multiple myeloma is planned in 2025.

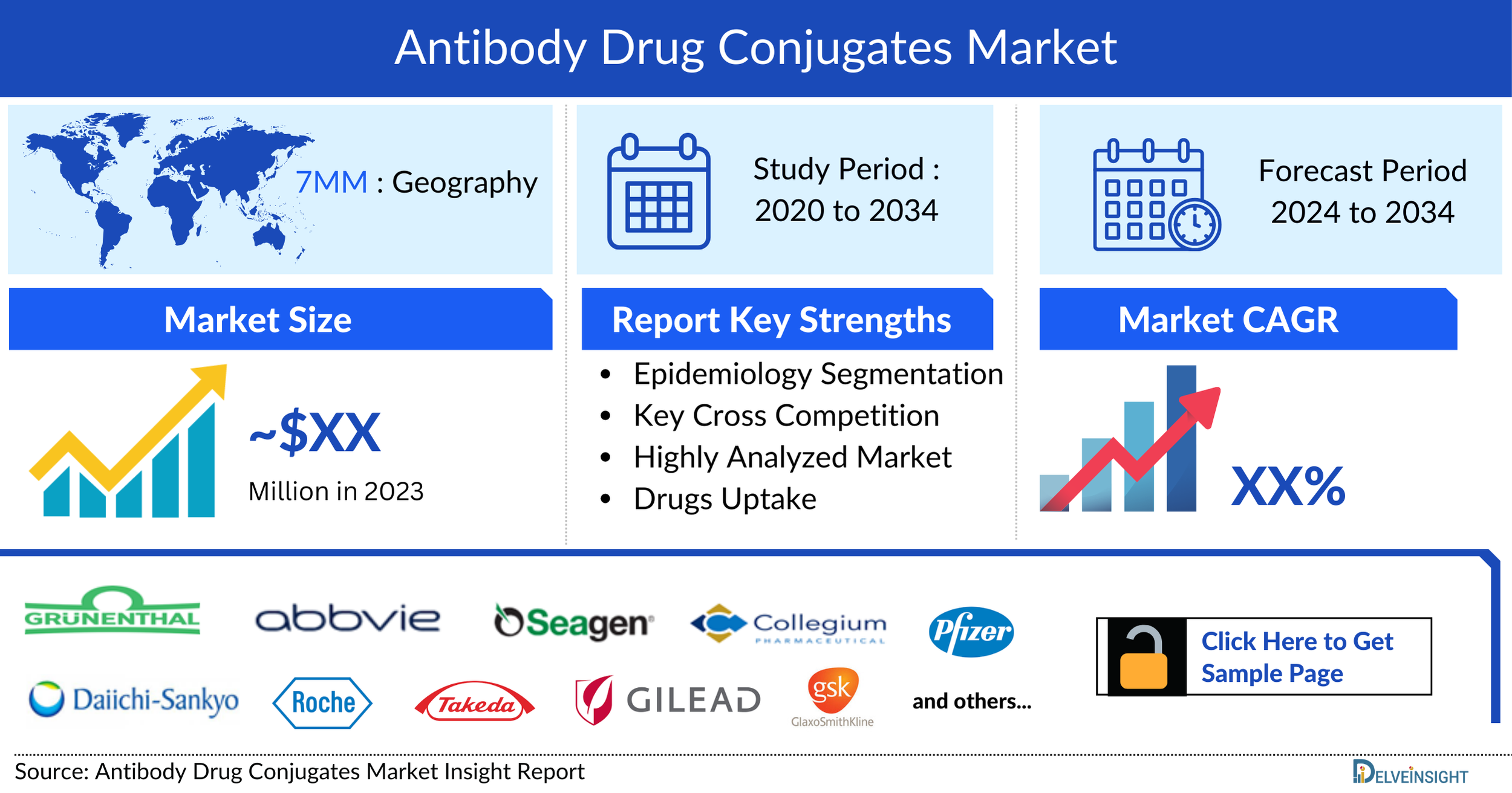

DelveInsight’s “Antibody Drug Conjugate Market Competitive Landscape, and Market Forecast 2034” report delivers an in-depth understanding of the antibody drug conjugates, historical and competitive landscape as well as the antibody drug conjugates market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Antibody Drug Conjugate market report provides current treatment practices, emerging Antibody Drug Conjugates drugs, market share of individual therapies, and current and forecasted 7MM antibody drug conjugate market size from 2020 to 2034. The report also covers current antibody drug conjugates treatment practices/Antibody Drug Conjugates treatment options and unmet medical needs to curate the best opportunities and assess the Antibody Drug Conjugates market potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Antibody Drug Conjugates Epidemiology |

Segmented by:

|

|

Antibody Drug Conjugates Companies |

|

|

Antibody Drug Conjugates Therapies |

|

|

Antibody Drug Conjugates Market |

Segmented by:

|

|

Analysis |

|

Antibody Drug Conjugate Market Understanding

Antibody-drug Conjugates (Antibody Drug Conjugates) Overview

Antibody Drug Conjugates are a class of drugs designed as a targeted therapy for treating disease, but at the moment, are widely used for the management or treatment of cancer. They are complex molecules consisting of an antibody linked to a biologically active cytotoxic payload or drug.

Chemotherapy is a therapeutic option for cancer treatment. Chemotherapy, with its poor specificity towards tumor cells/tissues, is often associated with a poor therapeutic response and substantial toxicities to normal healthy tissues. Unlike chemotherapy, Antibody Drug Conjugates target and kill tumor cells without harming healthy cells by integrating the antigen specificity of monoclonal antibodies with antibody fragments.

The emergence of monoclonal antibodies has changed the paradigm of cancer therapy through precise targeting of tumor surface antigens; however, treatment using monoclonal antibodies alone is often insufficient, potentially due to less satisfactory lethality against cancer cells compared to chemotherapy. Hence, a novel concept, known as Antibody Drug Conjugate, was conceived to bridge the gap between the monoclonal antibody and cytotoxic drug for the improvement of the therapeutic window. ADC consists of a tumor-targeting monoclonal antibody conjugated to a cytotoxic payload through a sophisticatedly designed chemical linker, enabling the ability of precise targeting and potent effectiveness simultaneously. Moreover, owing to the conjugation of a large hydrophilic antibody, the antigen-independent uptake of cytotoxic payload in those antigen-negative cells is limited, contributing to widening the therapeutic index.

Further details related to country-based variations are provided in the report.

Antibody-drug Conjugates Treatment

The primary antitumor action of Antibody Drug Conjugates is via targeting of the cytotoxic payload to the tumor cells. On binding of the monoclonal antibody to the target antigen, the ADC is internalized into the tumor cell. The eventual linker breakdown promotes the intracellular release of the payload, where it exerts its microtubule- or DNA-damaging effects. The process of antibody binding and internalization may be subject to further pharmacologic manipulation or enhancement. For instance, recent work has highlighted the potential to increase antigen availability through the use of statins or increase internalization and lysosomal sorting through the use of kinase inhibitors. These and other studies highlight the multistep process of ADC-mediated killing, which may be enhanced through such drug combinations and may also prove to be relevant to drug resistance.

In addition to the canonical payload release mechanism of drug action, the antibody moiety can exert anticancer effects in a payload-independent manner. The binding of the antibody to its target antigen can disrupt the antigen's downstream function by preventing interaction with its binding partners or promoting its degradation. Furthermore, ADC antitumor action can also be mediated through antibody-dependent activation of immune response, including ADCC, such as trastuzumab. Indeed, some of these particular effects may be insufficient as a single agent but provide critical support to the chemotherapy combination, much like trastuzumab, which combines with chemotherapy to achieve synergistic antitumor effects.

The thirteen US FDA-approved Antibody drug Conjugates are KADCYLA, ADCETRIS, BESPONSA, EMRELIS, LUMOXITI, POLIVY, PADCEV, TRODELVY, ENHERTU, BLENREP, ZYNLONTA, TIVDAK, and ELAHERE.

Further details related to country-based variations are provided in the report…

Antibody drug Conjugates Epidemiology

The Antibody Drug Conjugates epidemiology chapter in the Antibody Drug Conjugate market report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for Antibody Drug Conjugates, total eligible patients of selected indication, total treated cases in selected indication for Antibody Drug Conjugates in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

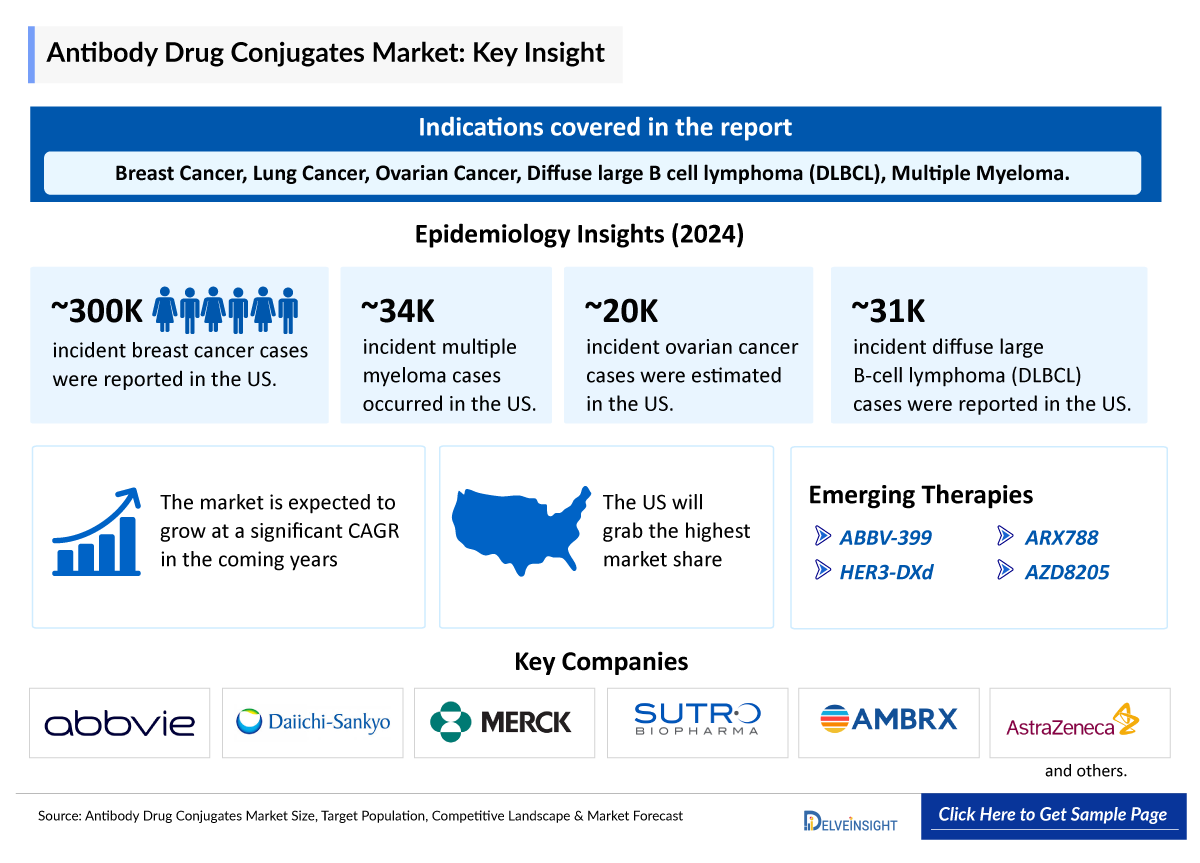

- The total incident cases of breast cancer in the US comprised around 300,000 cases in 2024.

- Among EU4 and the UK, the highest number of incident cases of DLBCL was found in Germany, which was approximately 25% of the cases in the EU and the UK, followed by France.

- In 2024, the estimated incidence of ovarian cancer in Japan was approximately 13,000 cases.

- In 2024, there were an estimated 34,000 incident cases of multiple myeloma in the US.

- The estimated incidence of non-small cell lung cancer (NSCLC) in the US was nearly 200,000 cases in 2024.

|

List of Few Selected Indications | |

|

Indication |

Incident Cases in 2024 |

|

∼ 300,000 | |

|

∼ 200,000 | |

|

∼ 20,000 | |

|

∼ 31,000 | |

|

∼ 37,000 | |

The full list will be provided in the report

Antibody Drug Conjugate Recent Developments

- In September 2025, Raludotatug deruxtecan (R-DXd) received Breakthrough Therapy Designation (BTD) from the U.S. FDA for the treatment of adult patients with platinum-resistant epithelial ovarian, primary peritoneal, or fallopian tube cancers expressing CDH6, who have previously been treated with bevacizumab. R-DXd is a potential first-in-class CDH6-targeted antibody-drug conjugate (ADC) discovered by Daiichi Sankyo and is being developed in partnership with Merck.

Antibody Drug Conjugate Drug Chapters

The drug chapter segment of the antibody drug conjugate market reports encloses a detailed analysis of antibody-drug conjugate marketed drugs and late-stage (Phase III and Phase II) pipeline Antibody Drug Conjugates drugs. It also helps understand the Antibody Drug Conjugates clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Antibody Drug Conjugate Drugs

ENHERTU (fam-trastuzumab deruxtecan-nxki): AstraZeneca/Daiichi Sankyo

ENHERTU is a HER2-directed antibody and topoisomerase inhibitor conjugate. It is an antibody-drug conjugate composed of three components: a humanized anti-HER2 IgG1 monoclonal antibody, covalently linked to a topoisomerase inhibitor, via a tetrapeptide-based cleavable linker. Deruxtecan is composed of a protease-cleavable maleimide tetrapeptide linker and the topoisomerase inhibitor, DXd, which is an exatecan derivative. It is indicated for the treatment of adult patients with unresectable or metastatic HER2-positive breast cancer who have received a prior anti-HER2-based regimen either: in the metastatic setting, or the neoadjuvant or adjuvant setting, adult patients with unresectable or metastatic non-small cell lung cancer (NSCLC) whose tumors have activating HER2 (ERBB2) mutations, and others.

According to the company's 2025 presentation, the Phase III readout for the DESTINY-Breast09 and DESTINY-Breast11 trials in 1L and early HER2-positive breast cancer, respectively, is expected in the first half of 2025.

According to the company's 2025 presentation, the Phase III readout for the DESTINY-Breast05 trial in early HER2-positive breast cancer is expected in the second half of 2025.

In June 2024, AstraZeneca announced detailed positive results from the DESTINY-Breast06 Phase III trial in which ENHERTU demonstrated a statistically significant and clinically meaningful improvement in progression-free survival compared to standard-of-care chemotherapy in patients with HR-positive, HER2-low metastatic breast cancer, and the overall trial population.

ADCETRIS (brentuximab vedotin): Pfizer (Seagen)/Takeda

ADCETRIS is a CD30-directed antibody and microtubule inhibitor conjugate consisting of three components: the chimeric IgG1 antibody cAC10, specific for human CD30, the microtubule disrupting agent MMAE, and a protease-cleavable linker that covalently attaches MMAE to cAC10. It is indicated for the treatment of adult patients with previously untreated Stage III or IV classical Hodgkin lymphoma (cHL), in combination with doxorubicin, vinblastine, and dacarbazine, adult patients with systemic anaplastic large cell lymphoma (sALCL) after failure of at least one prior multi-agent chemotherapy regimen, adult patients with primary cutaneous anaplastic large cell lymphoma (pcALCL) or CD30-expressing mycosis fungoides (MF) who have received prior systemic therapy, and others.

In February 2025, Pfizer announced that the US FDA has approved the supplemental Biologics License Application (sBLA) for ADCETRIS in combination with lenalidomide and a rituximab product for the treatment of adult patients with relapsed or refractory large B-cell lymphoma (LBCL), including DLBCL.

In June 2024, Pfizer announced detailed overall survival results from the Phase III ECHELON-3 study of Antibody Drug Conjugates ETRIS in combination with lenalidomide and rituximab for the treatment of patients with relapsed/refractory DLBCL.

The full list will be provided in the report

|

Comparison of Key Marketed Drugs | |||||

|

Product |

Generic name |

Company |

Target |

Initial approval date |

Indication in which drug is approved |

|

EMRELIS |

Telisotuzumab vedotin-tllv |

AbbVie |

cMet |

May 2025 (Accelerated approval) |

NSCLC |

|

ELAHERE |

Mirvetuximab soravtansine |

AbbVie |

FRα |

2024 (full approval) |

Ovarian Cancer |

|

TIVDAK |

Tisotumab vedotin-tftv |

Genmab/Pfizer |

Tissue Factor |

2024 (full approval) |

Cervical cancer |

|

ENHERTU |

Trastuzumab deruxtecan |

Daiichi Sankyo/AstraZeneca |

HER2 |

2019 |

HER2+ breast cancer |

|

PADCEV |

Enfortumab vedotin-ejfv |

Astellas/Pfizer (Seagen) |

Nectin-4 |

2019 |

Locally advanced or metastatic urothelial cancer |

|

KADCYLA |

Trastuzumab emtansine |

Roche |

HER2 |

2013 |

HER2+ metastatic and early breast cancer |

|

ADCETRIS |

Brentuximab vedotin |

Pfizer (Seagen)/Takeda |

CD30 |

2011 |

Relapsed/ refractory Hodgkin lymphoma |

Emerging Antibody Drug Conjugate Drugs

Telisotuzumab vedotin (ABBV-399): AbbVie

Telisotuzumab vedotin is an antibody-drug conjugate targeting cMet that is being investigated in the Phase III trial to treat NSCLC. In January 2022, AbbVie announced that the US FDA granted Breakthrough Therapy Designation (BTD) to investigational telisotuzumab vedotin for the treatment of patients with advanced/metastatic epidermal growth factor receptor wild type, non-squamous NSCLC with high levels of c-Met overexpression whose disease has progressed on or after platinum-based therapy.

In November 2023, the company announced topline results from the single-arm Phase II LUMINOSITY trial evaluating telisotuzumab vedotin in patients with c-Met protein overexpression, EGFR wild type, advanced/metastatic nonsquamous NSCLC.

Patritumab deruxtecan (HER3-DXd): Daiichi Sankyo/Merck

Patritumab deruxtecan is an investigational HER3-directed antibody-drug conjugate. Designed using Daiichi Sankyo’s proprietary DXd antibody-drug conjugate technology, patritumab deruxtecan is composed of a fully human antiHER3 IgG1 monoclonal antibody attached to several topoisomerase I inhibitor payloads (an exatecan derivative, DXd) via tetrapeptide-based cleavable linkers. It was granted BTD by the US FDA in December 2021 for the treatment of patients with EGFR-mutated locally advanced or metastatic NSCLC. The drug is being evaluated in various early-stage, and late-stage trials.

-

In May 2025, Merck announced that the Biologics License Application (BLA) seeking accelerated approval in the US for Daiichi Sankyo and Merck’s patritumab deruxtecan, based on the HERTHENA-Lung01 Phase II trial for the treatment of adult patients with locally advanced or metastatic EGFR-mutated NSCLC, has been voluntarily withdrawn.

-

In October 2023, Daiichi Sankyo and Merck entered into a global development and commercialization agreement for three of Daiichi Sankyo’s DXd ADC candidates: patritumab deruxtecan, ifinatamab deruxtecan (I-DXd), and raludotatug deruxtecan (R-DXd).

Ifinatamab deruxtecan: Daiichi Sankyo/Merck

Ifinatamab deruxtecan is an investigational, potential first-in-class B7-H3-directed Antibody Drug Conjugates. Ifinatamab deruxtecan is comprised of a humanized anti-B7-H3 IgG1 monoclonal antibody attached to several topoisomerase I inhibitor payloads (an exatecan derivative, DXd) via tetrapeptide-based cleavable linkers.

In addition to IDeate-Esophageal01, ifinatamab deruxtecan is being evaluated in a global development program that includes IDeate-Lung01, a Phase II monotherapy trial in patients with previously treated extensive-stage small cell lung cancer (ES-SCLC); IDeate-Lung02, a Phase III trial in patients with relapsed SCLC versus investigator’s choice of chemotherapy; IDeate-Lung03, a Phase Ib/II trial in patients with ES-SCLC in combination with atezolizumab with or without carboplatin as first-line induction or maintenance therapy; IDeate-PanTumor02, a Phase II monotherapy trial in patients with recurrent or metastatic solid tumors. Ifinatamab deruxtecan has been granted orphan drug designation in the EU, Japan, Taiwan, and the US for the treatment of SCLC.

In May 2025, Merck announced that the first patient had been dosed in the IDeate-Esophageal01 Phase III trial evaluating the efficacy and safety of investigational ifinatamab deruxtecan versus the investigator’s choice of chemotherapy in patients with unresectable advanced or metastatic esophageal squamous cell carcinoma.

|

Comparison of Emerging Drugs | ||||

|

Drug |

Company |

Indication |

MoA |

Phase |

|

Telisotuzumab vedotin (ABBV-399) |

AbbVie |

NSCLC |

cMet Inhibitor |

III |

|

Patritumab deruxtecan (HER3-DXd) |

Daiichi Sankyo/Merck |

NSCLC |

HER3 Inhibitor |

III |

|

Ifinatamab deruxtecan |

Daiichi Sankyo/Merck |

NSCLC |

TOP1 Inhibitor |

III |

|

Luveltamab tazevibulin |

Sutro Biopharma |

Ovarian cancer |

FRα Inhibitor |

III |

|

ARX788 |

Ambrx |

Breast cancer |

HER2 Inhibitor |

II |

|

AZD8205 |

AstraZeneca |

Breast cancer |

B7-H4 Inhibitor |

II |

|

Raludotatug deruxtecan |

Daiichi Sankyo/Merck |

Ovarian cancer |

TOP1 Inhibitor |

II |

|

Farletuzumab ecteribulin |

Eisai/ Bristol-Myers Squibb |

NSCLC |

FRα Inhibitor |

II |

The full list will be provided in the report

Antibody Drug Conjugate Market Outlook

The use of antibody-drug conjugates is revolutionizing the treatment of solid tumors, especially HER2+ breast cancer, delaying progression and prolonging survival in one of the most aggressive subtypes of the disease. These successes have encouraged the evaluation of ADC across a spectrum of cancers expressing a variety of tumor antigens. ENHERTU is expected to alter the way that major cancer types are treated.

Due to Antibody Drug Conjugate Market penetration and label expansion for additional indications, ENHERTU’s sales are steadily rising. AstraZeneca and Daiichi Sankyo are reporting data from the DESTINY-Breast09 trial at ASCO 2025, which could move ENHERTU one line earlier into second-line HER2-low breast cancer and potentially in patients with even lower expression of HER2 than the current HER2-low definition. TRODELVY was the first antibody-drug conjugate with overall survival benefit, and it has also shown overall survival benefit in HR+/HER2- breast cancer, which is the largest form of breast cancer. Advances in linker chemistry, antibody technology, and the use of potent drugs have enabled the targeting of tumors regardless of the level of antigen expression, thus extending the benefit of these agents to a broader pool of patients. However, the use of these novel antibody-drug conjugates is associated with unique toxicities and mandates vigilance and careful monitoring of patients.

The dynamics of the Antibody Drug Conjugate market are anticipated to change as companies across the globe are thoroughly working toward development and expansion to treat a wide array of indications during the forecast period (2025–2034). Over ~200 antibody-drug conjugates are in pre-clinical/clinical development, which suggests the world is embracing a new era of targeted cancer therapy. The Antibody Drug Conjugates market is currently dominated by Roch, but Daiichi Sankyo is expected to lead a new era of Antibody Drug Conjugates.

- The total sales of ENHERTU comprised nearly USD 1,470 million in 2023 in the US.

- The annual revenue generated by KAntibody Drug ConjugatesYLA accounted for nearly USD 760 million in the US in 2023.

- In February 2024, AbbVie closed a USD 10.1 billion deal acquiring ImmunoGen. With the agreement, AbbVie gained ELAHERE, the only antibody-drug conjugate approved by the US FDA as a treatment for ovarian cancer. AbbVie also acquired two antibody, drug conjugate candidates in ImmunoGen’s pipeline as a result of the deal, pivekimab sunirine and IMGN-151.

- In January 2024, RemeGen announced that RC88, a mesothelin-targeting antibody, drug conjugate, was granted Fast Track Designation (FTD) from the US FDA to potentially treat platinum-resistant recurrent epithelial ovarian, fallopian tube, and primary peritoneal cancer.

- In January 2024, Debiopharm announced that they have extended their exclusive licensing deal with SunRock Biopharma to create innovative antibody, drug conjugates. SunRock Biopharma will benefit from Debiopharm’s Multilink technology to produce an enhanced HER3-EGFR bispecific antibody, drug conjugate.

Detailed market outlook will be provided in the report

Antibody Drug Conjugates Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the Antibody Drug Conjugate drugs market during 2025–2034, which depends on the competitive landscape, safety, and efficacy data, along with the order of entry. It is important to understand that the key Antibody Drug Conjugate companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake. Patritumab deruxtecan is under review by the US FDA for patients with previously treated locally advanced or metastatic EGFR-mutated NSCLC.

Further detailed analysis will be provided in the report

Antibody Drug Conjugates Pipeline Development Activities

The Antibody Drug Conjugate Market report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key Antibody Drug Conjugates companies involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for the Antibody Drug Conjugates market growth over the forecasted period.

Antibody Drug Conjugate Clinical Trial Activities

The Antibody Drug Conjugate Market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging Antibody Drug Conjugates.

KOL Views on Antibody Drug Conjugate

To keep up with the real-world scenario in current and emerging Antibody Drug Conjugate market trends, we take opinions from key industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts, including medical/scientific writers, oncologists, doctors, and professors at Dana-Farber Cancer Institute, oncologists at the Johns Hopkins Hospital, and others, were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the MD Anderson Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or ADC market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“When we talk about trastuzumab deruxtecan, we often think of interstitial lung disease as a major side effect. It is a potentially serious adverse event. However, the primary side effect of TDXD is nausea and vomiting. Interstitial lung disease will occur in 10% to 15% of patients. Some may be asymptomatic, or Grade 1, which may be identified while conducting imaging. Imaging is indicated every 6 weeks for these patients.” |

|

“Because of the highly specific targeting of antibodies equipped with Antibody Drug Conjugates technology – only targeting tumor cells and sparing healthy cells - the side effects associated with this second generation type of cancer treatment are reduced compared to the conventional cytotoxic treatment protocols, which are non-selective and therefore also kill many healthy cells, which is the major cause of side effects in oncology treatments.” |

Antibody Drug Conjugate Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyses multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Antibody Drug Conjugate Market Access and Reimbursement

Market Access refers to the ability of all patients to have access to a given product quickly, conveniently, and affordably. Reimbursement is the negotiation of a price between the manufacturer and payer that allows the manufacturer access to that market. It is provided to reduce the high costs and make essential drugs affordable. Reimbursement is the price negotiation between the manufacturer and payer that allows the manufacturer access to that market. It is provided to reduce the high costs and make essential drugs affordable. In the US healthcare system, both Public and Private health insurance coverage are included. In addition, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The Antibody Drug Conjugate drugs market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Recent Developments in Antibody Drug Conjugate Clinical Trials

- In June 2025, AstraZeneca announced that the DESTINY-Breast09 Phase III trial showed ENHERTU plus pertuzumab significantly improved progression-free survival over THP as a first-line treatment for HER2-positive metastatic breast cancer. Results were presented at the 2025 ASCO Annual Meeting.

- In February 2025, Pfizer announced today that the US Food and Drug Administration (FDA) has approved the supplemental Biologics License Application (sBLA) for ADCETRIS in combination with lenalidomide and a rituximab product for the treatment of adult patients with relapsed or refractory large B-cell lymphoma (LBCL), including diffuse large B-cell lymphoma (DLBCL).

- In March 2025, Moderna, Inc. (NASDAQ: MRNA) announced that Australia’s Therapeutic Goods Administration (TGA) approved mRESVIA® (mRNA-1345), an mRNA vaccine for preventing lower respiratory tract disease caused by RSV in adults aged 60 and older. This approval marks the first mRNA vaccine in Australia authorized for a disease other than COVID-19.

- In March 2025, Radiance Biopharma announced that the U.S. Food and Drug Administration (FDA) cleared its Investigational New Drug (IND) application for RB-164™, an ROR-1 targeted Antibody Drug Conjugate for hematologic and solid malignancies.

- In May 2025, Merck announced that the Biologics License Application (BLA) seeking accelerated approval in the US for Daiichi Sankyo and Merck’s patritumab deruxtecan, based on the HERTHENA-Lung01 Phase II trial for the treatment of adult patients with locally advanced or metastatic EGFR-mutated NSCLC, has been voluntarily withdrawn.

- In May 2025, Merck announced that the first patient had been dosed in the IDeate-Esophageal01 Phase III trial evaluating the efficacy and safety of investigational ifinatamab deruxtecan versus the investigator’s choice of chemotherapy in patients with unresectable advanced or metastatic esophageal squamous cell carcinoma.

Antibody Drug Conjugate Clinical Trials: ASCO Updates

The ASCO 2025 Annual Meeting underscored major advancements in Antibody Drug Conjugates, with leading Antibody Drug Conjugate companies including AstraZeneca, Gilead Sciences, Daiichi Sankyo, Astellas Pharma, Merck, RemeGen, Sichuan Kelun-Biotech Biopharmaceutical, Shanghai Miraogen, and Pfizer—presenting pivotal clinical updates.

|

Company |

Drug |

Trial ID/ Acronym |

Patient Segment |

Phase |

Abstract ID |

Session type |

|

AstraZeneca |

Trastuzumab deruxtecan + pertuzumab |

NCT04784715 (DESTINY-Breast09) |

HER2+ metastatic breast cancer |

III |

#LBA1008 |

Oral |

|

Gilead Sciences |

Sacituzumab govitecan + pembrolizumab |

NCT05382286 (ASCENT-04) |

TNBC |

III |

#LBA109 |

Oral |

|

Daiichi Sankyo |

Trastuzumab deruxtecan |

NCT04704934 (DESTINY-Gastric04) |

HER2+ metastatic and/or unresectable gastric or gastro-esophageal junction (GEJ) adenocarcinoma |

III |

#LBA4002 |

Oral |

|

Daiichi Sankyo |

Patritumab deruxtecan |

NCT05338970 (HERTHENA-Lung02) |

EGFRm advanced NSCLC |

III |

#8506 |

Oral |

|

Astellas Pharma |

Enfortumab vedotin + pembrolizumab |

NCT04223856 |

Locally advanced or metastatic urothelial cancer conditions |

III |

#4502 |

Oral |

|

Gilead Sciences, Merck |

Pembrolizumab+ Sacituzumab Govitecan |

NCT05535218 (SURE-02) |

Muscle-invasive Bladder Cancer |

II |

#4518 |

Rapid Oral |

|

Pfizer |

Brentuximab vedotin (BV) + pembrolizumab |

NCT04609566 |

HNSCC |

II |

#6015 |

Rapid Oral |

|

Daiichi Sankyo |

Datopotamab deruxtecan |

NCT04526691 (TROPION-Lung02) |

Advanced or metastatic NSCLC |

I |

#8501 |

Oral |

Scope of the Antibody Drug Conjugate Market Report

- The Antibody Drug Conjugates market forecast report covers a segment of key events, an executive summary, and a descriptive overview of antibody drug conjugates, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging Antibody Drug Conjugates therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the antibody drug conjugates market, historical and forecasted Antibody Drug Conjugate market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Antibody Drug Conjugates market forecast report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM antibody drug conjugates market.

Antibody Drug Conjugates Treatment Market Report Insights

- Antibody Drug Conjugates Patient Pool

- Antibody Drug Conjugates Therapeutic Approaches

- Antibody Drug Conjugates Pipeline Analysis

- Antibody Drug Conjugates Market Size

- Antibody Drug Conjugates Market Trends

- Existing and future Antibody Drug Conjugates Market Opportunity

Antibody Drug Conjugates Treatment Market Report Key Strengths

- Eleven years of Antibody Drug Conjugates market forecast

- The 7MM Coverage for Antibody Drug Conjugates market

- Key Cross Competition

- Antibody Drug Conjugates Drugs Uptake

- Key Antibody Drug Conjugates Market Forecast Assumptions

Antibody Drug Conjugates Treatment Market Report Assessment

- Current Treatment Practices

- Antibody Drug Conjugates Unmet Needs

- Antibody Drug Conjugates Pipeline Product Profiles

- Antibody Drug Conjugates Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

- What was the Antibody Drug Conjugates market size, the Antibody Drug Conjugates market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which Antibody Drug Conjugate is going to be the largest contributor in 2034?

- What will be the Antibody Drug Conjugates market size of ENHERTU in 2025?

- Which is the most lucrative market for antibody drug conjugates?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape for antibody drug conjugates evolved since the first one has was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with antibody drug conjugates? What will be the growth opportunities across the 7MM for the patient population of antibody drug conjugates?

- What are the key factors hampering the growth of the antibody drug conjugates market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy as per real-world scenarios?

Reasons to buy

- The Antibody Drug Conjugates market forecast report will help develop business strategies by understanding the latest trends and changing dynamics driving the antibody drug conjugates market.

- Understand the existing Antibody Drug Conjugate market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming Antibody Drug Conjugate companies in the ADC market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Antibody Drug Conjugate market so that the upcoming Antibody Drug Conjugate companies can strengthen their development and launch strategy.

Get detailed insights @ DelveInsight Blogs