Growth Hormone Deficiency Market Summary

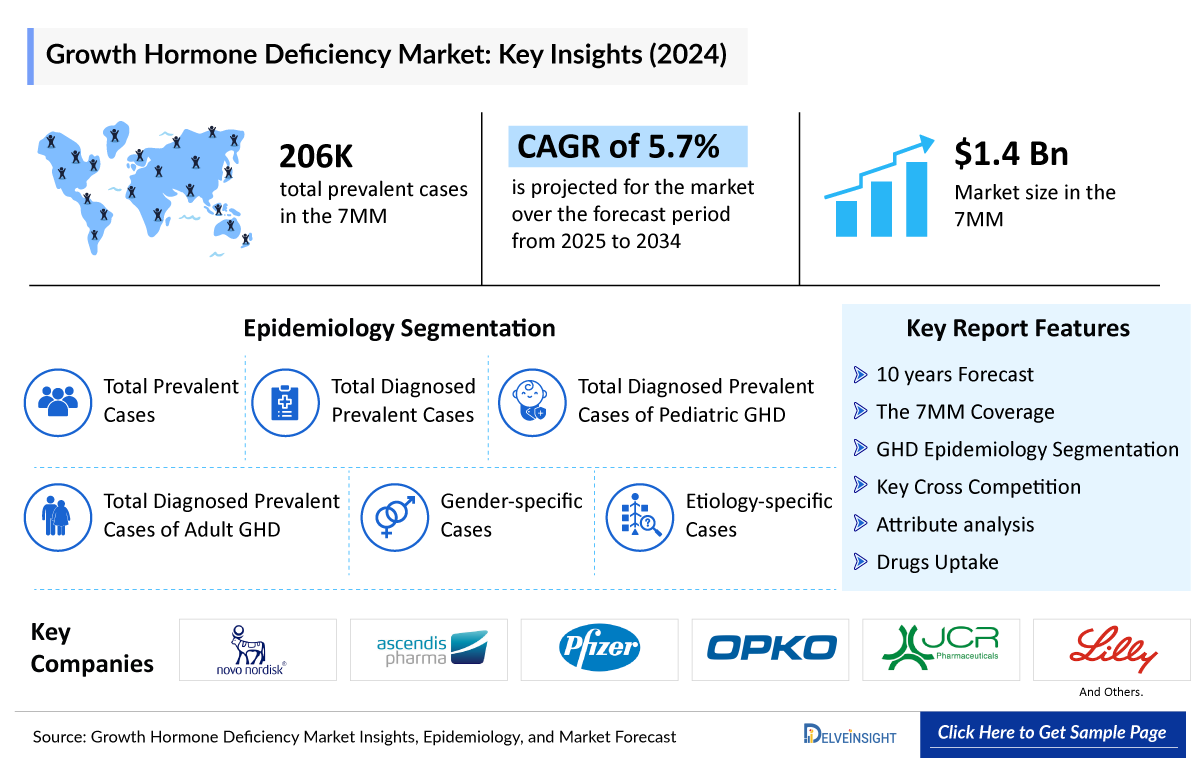

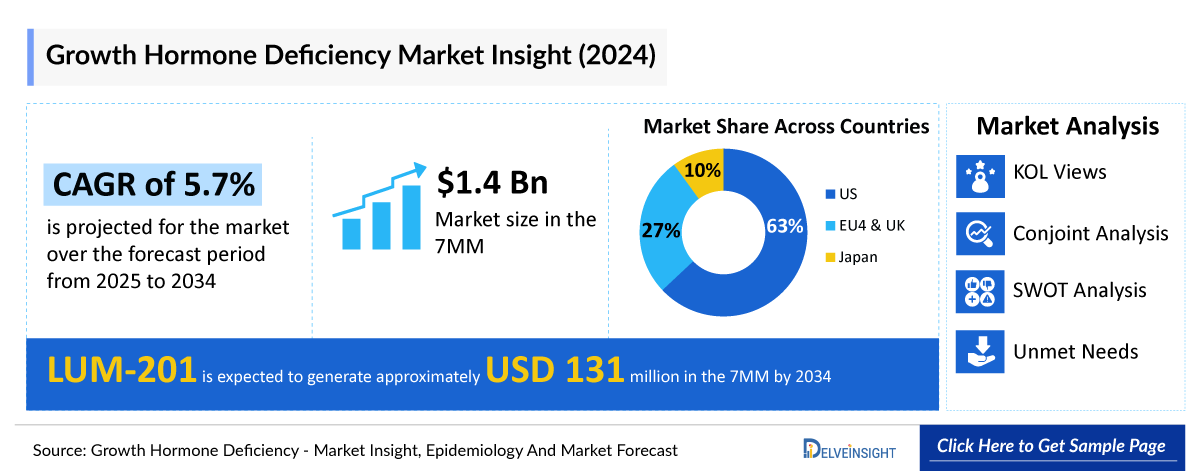

- The Growth Hormone Deficiency market size in the 7MM is expected to grow from USD 1,626 million in 2025 to USD 3,304 million in 2034.

- The Growth Hormone Deficiency market is projected to grow at a CAGR of 5.7% by 2034 in leading countries like US, EU4, UK and Japan.

Growth Hormone Deficiency Market and Epidemiology Analysis

- The Growth Hormone Deficiency market in the 7MM was valued at approximately USD 1.4 Billion in 2023. Over the forecast period from 2025 to 2034, this market is projected to grow at a CAGR of 5.7%.

- The Growth Hormone Deficiency market is projected to see consistent growth, with a robust compound annual growth rate (CAGR) anticipated from 2025 to 2034. This expansion across the 7MM will be driven by the introduction of innovative therapies, including LUM-201 and SCO-240, among others. Furthermore, the rising prevalence of Growth Hormone Deficiency, driven by improved diagnostics, higher survival rates of premature infants, increased pituitary disorders, and environmental factors like endocrine-disrupting chemicals, is expected to drive market growth for growth hormone replacement therapies.

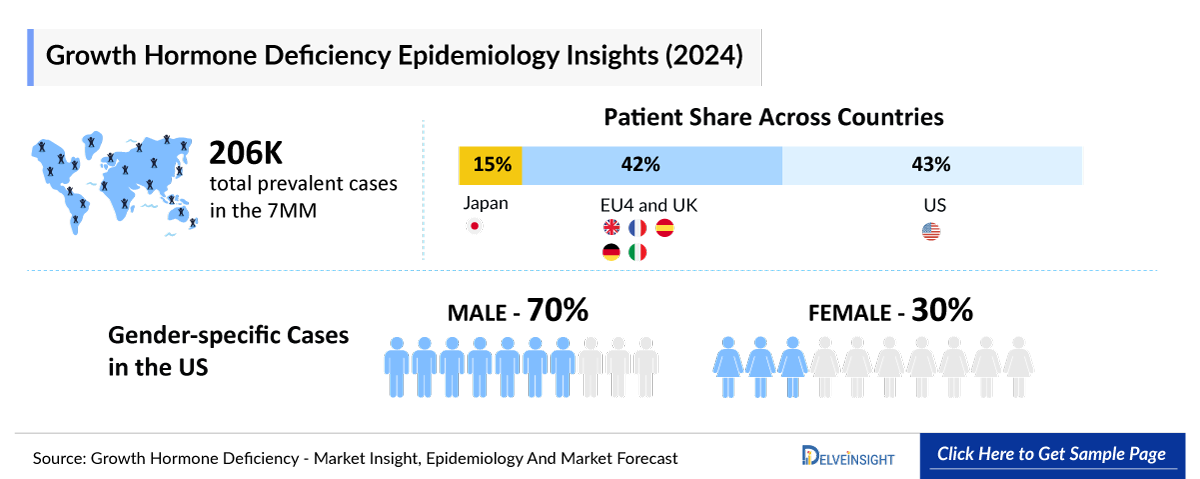

- According to DelveInsight’s estimates, there were approximately 206000 total prevalent cases of Growth Hormone Deficiency in the 7MM in 2023. Among these, around 165000 were diagnosed cases. Of the total diagnosed prevalent cases in the 7MM, the United States accounted for 42.5%, EU4 and the UK collectively made up nearly 41.7%, and Japan represented 15.8%.

- Currently, Growth Hormone Deficiency therapies comprising somatotropin, SOGROYA, SKYTROFA/TRANSCON hGH, NGENLA, and GROWJECT, among others are available in the Growth Hormone Deficiency drug market.

- Current Growth Hormone Deficiency therapies rely on subcutaneous injections, with daily and newer weekly options. However, daily injections can be challenging, especially for pediatric patients, leading to poor adherence. To improve compliance, long-acting and oral formulations are being explored.

- Lumos Pharma and SCOHIA PHARMA, among others, are progressing their assets through various clinical trial phases, driving innovation in the Growth Hormone Deficiency market and creating significant growth opportunities.

- In November 2024, Lumos Pharma announced updated Phase II data for its oral therapy LUM-201 (ibutamoren) in pediatric growth hormone deficiency (PGrowth Hormone Deficiency) at the European Society for Paediatric Endocrinology (ESPE) meeting.

Growth Hormone Deficiency Market size and forecast

- 2025 Market Size: USD 1,626 million in 2025

- 2034 Projected Market Size: USD 3,304 million in 2034

- Growth Rate (2025-2034): 5.7% CAGR

- Largest Market: United States

Need More Details on Market Players and Competitors? Download the Growth Hormone Deficiency Report

Key Factors Driving the Growth Hormone Deficiency (GHD) Market

Rising Prevalence of Growth Hormone Deficiency

Growth Hormone Deficiency (GHD) affects both pediatric and adult populations, although adult cases remain significantly underdiagnosed. DelveInsight estimated that in 2024, there were around 207K prevalent cases of GHD in 7MM, with approximately 165K diagnosed. By 2034, prevalent cases are projected to reach about 172K, driven largely by increased adult screening and recognition. This growing awareness is expected to expand the overall GHD market and bolster demand for long-acting GHD treatments.

Competing treatments in GHD management

Recombinant human growth hormone (somatropin) remains the therapeutic cornerstone, with products like HUMATROPE (Eli Lilly), GENOTROPIN (Pfizer), and NORDITROPIN (Novo Nordisk). Long-acting formulations are poised to disrupt adherence and convenience-based submarkets.

GHD competitive landscape

The GHD pipeline focuses on long-acting GH analogs, sustained-release systems, and potential oral mimetics, with key players like Novo Nordisk, Eli Lilly, Ascendis, Pfizer, Sandoz, and OPKO. Emerging assets include LUM-201 (ibutamoren) from Double Point Ventures (Lumos Pharma) and SCO-240 from SCOHIA PHARMA. Outside the 7MM, TJ Biotech is advancing GX-H9 (eftansomatropin alfa), a once-weekly long-acting GH analog for pediatric GHD in Phase III in China. GX-H9 holds orphan drug designations from the FDA (2016) and EMA (2021), underscoring its global potential.

Growth Hormone Deficiency Commercial Outlook

With convenience and reduced injection burden as major competitive differentiators, the success of new GHD treatments will depend heavily on robust adherence data, cost comparisons versus daily GH, and payer favorability, especially in adult populations.

DelveInsight’s “Growth Hormone Deficiency Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Growth Hormone Deficiency, historical and forecasted epidemiology, as well as the Growth Hormone Deficiency market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Growth Hormone Deficiency Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Growth Hormone Deficiency market size from 2020 to 2034. The report also covers Growth Hormone Deficiency treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Growth Hormone Deficiency Treatment Market and Disease Overview

Growth Hormone Deficiency Overview

Growth Hormone Deficiency is an uncommon condition resulting from inadequate Growth Hormone production by the anterior pituitary gland. Its origins are typically divided into congenital (due to genetic mutations or structural defects in the pituitary), acquired (stemming from trauma, infections, tumors, or radiation), and idiopathic, where no specific cause is found. This classification underscores the complex interactions between genetic, environmental, and diagnostic factors that contribute to Growth Hormone Deficiency's varied presentation, while idiopathic cases highlight ongoing challenges in fully understanding its underlying mechanisms.

Growth Hormone Deficiency Diagnosis

Diagnosing Growth Hormone Deficiency demands precise biochemical testing due to its vague clinical signs. Confirmation is generally required only when clear pituitary dysfunction (e.g., from trauma, tumors, radiation, or surgery) is present. Because Growth Hormone is secreted in pulses, random measurements fall short, making validated provocative tests essential. The insulin tolerance test remains the gold standard, though alternatives like GHRH/arginine, glucagon stimulation, and macimorelin offer specific benefits and drawbacks. Standardized assays and strict cutoffs are crucial to avoid misdiagnosis, particularly in patients with confounding factors like obesity or advanced age, and while low IGF-1 levels support the diagnosis, they are not definitive on their own.

Further details related to country-based variations are provided in the report…

Growth Hormone Deficiency Treatment

Treatment for Growth Hormone Deficiency is tailored to individual needs, addressing the distinct challenges faced by children, who mainly suffer from growth failure, and adults, who often experience changes in body composition, reduced bone density, and lower quality of life. The primary therapy involves subcutaneous injections of recombinant human growth hormone, with doses adjusted based on age, metabolic status, and any additional hormonal deficiencies. For instance, older, diabetic, or obese patients typically require lower doses, and women on oral contraceptives may need further adjustments. Effective management also demands regular monitoring of IGF-I levels, metabolic markers, and bone density (using bone densitometer), alongside careful modification of any concurrent endocrine treatments to maximize benefits and minimize side effects.

Growth Hormone Deficiency Epidemiology

As the market is derived using a patient-based model, the Growth Hormone Deficiency epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases of Growth Hormone Deficiency, total diagnosed prevalent cases of Growth Hormone Deficiency, total diagnosed prevalent cases of pediatric Growth Hormone Deficiency, total diagnosed prevalent cases of adult Growth Hormone Deficiency, gender-specific cases of Growth Hormone Deficiency, and etiology-specific cases of Growth Hormone Deficiency in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Growth Hormone Deficiency Epidemiological Analysis and Forecast:

- DelveInsight estimates that the Growth Hormone Deficiency prevalence was around 206000 across the 7MM in 2023. This number is projected to grow at a CAGR of 0.4%, reaching higher levels by 2034.

- DelveInsight estimates that in 2023, there were around 165000 total diagnosed Growth Hormone Deficiency prevalence across the 7MM. This number is expected to increase with a CAGR of 0.4% over the study period (2020–2034).

- Among the 7MM, the US accounted for approximately 51%, EU4 and the UK for nearly 36%, and Japan for around 13% of the diagnosed prevalent cases of pediatric Growth Hormone Deficiency in 2023.

- Among the 7MM, the US accounted for approximately 40%, EU4 and the UK for nearly 43%, and Japan for around 17% of the diagnosed prevalent cases of adult Growth Hormone Deficiency in 2023.

- In 2023, the US recorded approximately 49000 male and 21000 female cases of Growth Hormone Deficiency, with these numbers expected to rise by 2034.

- In 2023, the EU4 and the UK reported around 42000 male and 26000 female cases of Growth Hormone Deficiency, with these numbers expected to rise by 2034.

- In 2023, EU4 and the UK reported around 62000 idiopathic cases of Growth Hormone Deficiency and 7000 organic cases of Growth Hormone Deficiency.

- In 2023, Japan recorded approximately 21000 total diagnosed prevalent cases of adult Growth Hormone Deficiency. These figures are expected to rise by 2034.

Growth Hormone Deficiency Epidemiology Segmentation:

- Total prevalent cases of Growth Hormone Deficiency

- Total diagnosed prevalent cases of Growth Hormone Deficiency

- Total diagnosed prevalent cases of pediatric Growth Hormone Deficiency

- Total diagnosed prevalent cases of adult Growth Hormone Deficiency

- Gender-specific cases of Growth Hormone Deficiency

- etiology-specific cases of Growth Hormone Deficiency

Growth Hormone Deficiency Drug Analysis

The drug chapter segment of the Growth Hormone Deficiency Drugs Market Report encloses a detailed analysis of Growth Hormone Deficiency-marketed drugs and pipeline drugs. It also helps understand the Growth Hormone Deficiency clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Growth Hormone Deficiency Marketed Drugs

Novo Nordisk: SOGROYA (somapacitan-beco)

SOGROYA (somapacitan-beco) is a human growth hormone analog that replicates natural GH activity. It is indicated for pediatric patients aged 2.5 years and older with growth failure due to insufficient GH secretion, as well as for adults requiring Growth Hormone replacement therapy. By binding to a dimeric Growth Hormone receptor, somapacitan-beco initiates intracellular signaling, leading to pharmacodynamic effects that are partly mediated by liver-produced IGF-1 and partly through direct action.

SOGROYA was approved for various indications across different regions: in April 2023, the US FDA approved SOGROYA for children aged 2.5 years and older with growth failure due to inadequate endogenous GH secretion; in June 2023, the PMDA approved it for short stature caused by Growth Hormone Deficiency before epiphyseal closure; in March 2021, the EMA approved SOGROYA for Growth Hormone Deficiency treatment; in January 2021, the PMDA approved SOGROYA for adult Growth Hormone Deficiency in Japan; and in August 2020, the US FDA approved it for adult Growth Hormone Deficiency as a replacement for endogenous GH.

Ascendis Pharma: SKYTROFA/TRANSCON hGH (lonapegsomatropin-tcgd)

SKYTROFA (TRANSCON hGH, lonapegsomatropin-tcgd) is a pegylated human growth hormone approved for pediatric patients aged 1 year and older (weighing at least 11.5 kg) with growth failure from inadequate endogenous GH secretion. Administered via once-weekly subcutaneous injection, somatropin binds to GH receptors, triggering intracellular signaling that produces both direct tissue and metabolic effects, as well as IGF–1–mediated actions. These mechanisms promote chondrocyte differentiation and proliferation, enhance hepatic glucose output, stimulate protein synthesis, and induce lipolysis—ultimately supporting skeletal growth by acting on the long bone growth plates.

TRANSCON hGH (lonapegsomatropin) was granted marketing authorization by the EC in January 2022 as a once-weekly subcutaneous injection for children and adolescents aged 3–18 years with growth failure due to insufficient endogenous GH secretion. Similarly, in August 2021, the US FDA approved SKYTROFA for pediatric patients aged 1 year and older, weighing at least 11.5 kg, with growth failure caused by inadequate endogenous GH secretion.

It is also being evaluated in a global Phase III trial for adult Growth Hormone Deficiency and Phase III trials in Japan for pediatric Growth Hormone Deficiency.

|

MoA |

RoA |

|

Somatotropin receptor agonists |

SC |

|

Human GH replacements |

SC |

|

XXX |

XX |

Growth Hormone Deficiency Emerging Drugs

Double Point Ventures (Lumos Pharma): LUM-201 (ibutamoren)

LUM-201, also known as ibutamoren, is an investigational, orally administered small molecule designed for once-daily use to promote the secretion of GH from the pituitary gland. By acting as a potent agonist of the Growth Hormone secretagogue receptor, LUM-201 increases the amplitude of endogenous pulsatile Growth Hormone secretion, effectively mirroring the body’s natural GH release pattern. This targeted mechanism supports its potential role in therapies that require the enhancement of natural Growth Hormone production. LUM-201 received orphan drug designation (ODD) in the US and the European Union for treating Growth Hormone Deficiency.

Currently, it is being evaluated in Phase II of clinical trials for treating Growth Hormone Deficiency.

- In December 2024, Double Point Ventures acquired Lumos Pharma via a tender offer, paying USD 4.25 per share plus contingent rights.

- In November 2024, Lumos Pharma announced updated Phase II data for its oral therapy LUM-201 (ibutamoren) in PGrowth Hormone Deficiency at the European Society for Paediatric Endocrinology (ESPE) meeting. The results highlighted sustained growth over 24 months and linked the drug’s pulsatile GH secretion mechanism to improved outcomes.

- In May 2024, Lumos Pharma held a Phase II meeting with the FDA, during which they received guidance that a placebo-controlled Phase III trial is acceptable for LUM-201.

- In March 2024, Lumos Pharma announced it received a Notice of Allowance from the USPTO for its patent on improved LUM-201 formulations, extending protection until November 2042—well beyond the current exclusivity ending in 2036.

SCOHIA PHARMA: SCO-240

SCO-240, developed by SCOHIA PHARMA, is an orally available, selective antagonist of Somatostatin Receptor 5 (SSTR5). Somatostatin, a peptide hormone secreted by the pituitary gland, pancreas, and gastrointestinal endocrine cells, regulates the secretion of various hormones through five G-protein-coupled receptors (SSTR1–5). Although the precise in vivo role of SSTR5 in humans remains unclear, SCO-240 has emerged as a promising candidate for modulating GH secretion.

In a Phase I trial involving healthy subjects, SCO-240 elicited a robust GH secretion without impacting other pituitary hormones, providing the first clinical evidence of the pivotal role of SSTR5 antagonism in stimulating GH release.

In June 2023, SCOHIA PHARMA presented the results of its Phase I clinical trial for SCO-240, an orally bioavailable SSTR5 antagonist, at the 96th Annual Congress of the Japan Endocrine Society in Kanagawa, Japan. The data underscored that this novel SSTR5 antagonism strategy holds significant promise as a new approach for treating growth hormone-related disorders.

|

MoA |

RoA |

Company |

|

Agonist of the GH secretagogue receptor to stimulate GH release |

Oral |

Double Point Ventures (Lumos Pharma) |

|

Selective antagonist of SSTR5 |

Oral |

SCOHIA PHARMA |

Growth Hormone Deficiency Drug Class Analysis

The current hallmark of treatment for Growth Hormone Deficiency is somatropins. Pharmacological treatments include somatropins, somapacitan-beco, lonapegsomatropin-tcgd, and somatrogon-ghla.

Somatropin (GROWJECT, HUMATROPE, and GENOTROPIN) is an rhGH used to treat Growth Hormone Deficiency and related disorders. While traditional formulations require daily injections, newer long-acting GH analogs like somapacitan, lonapegsomatropin, and somatrogon extend GH activity, allowing for less frequent dosing and improved adherence.

Somapacitan-beco (SOGROYA), lonapegsomatropin-tcgd (SKYTROFA), and somatrogon-ghla (NGENLA) are long-acting rhGH analogs designed for once-weekly dosing in Growth Hormone Deficiency. Each uses a distinct modification to extend GH activity: somapacitan-beco incorporates an albumin-binding moiety to delay clearance, lonapegsomatropin-tcgd is a PEGylated prodrug that gradually releases somatropin, and somatrogon-ghla is a fusion protein linking GH with a C-terminal peptide (CTP) from human chorionic gonadotropin (hCG) to prolong its half-life. These advancements improve adherence by reducing injection frequency while maintaining efficacy.

Further details are provided in the report…

Growth Hormone Deficiency Market Outlook

- The total market size of Growth Hormone Deficiency in the 7MM was approximately USD 1,380.5 million in 2023 and is projected to increase during the forecast period (2025–2034).

- The market size for Growth Hormone Deficiency in the US was approximately USD 873.4 million in 2023 and is anticipated to increase due to the launch of emerging therapies.

- The total market size of EU4 and the UK was calculated to be approximately USD 370.2 million in 2023, which was nearly 27% of the total market revenue for the 7MM.

- In 2023, Germany dominated the market among EU4 and the UK, generating around USD 96.5 million. The UK followed closely with approximately USD 86.2 million, while France recorded around USD 82.0 million.

- In 2023, the total market size of Growth Hormone Deficiency was approximately USD 137.0 million in Japan which is anticipated to increase during the forecast period (2025–2034).

- Estimates suggest that LUM-201 is expected to generate approximately USD 131.1 million in the 7MM by 2034.

Growth Hormone Deficiency Treatment Market

Growth Hormone Deficiency occurs when the anterior pituitary produces inadequate GH, leading to stunted growth in children and metabolic issues in adults. Diagnosis involves growth assessments, biochemical tests (GH stimulation and IGF-1 levels), and imaging studies. While treatment has traditionally relied on recombinant human GH replacement, recent advances aim to enhance adherence and more closely replicate natural GH secretion patterns.

Approved Growth Hormone Deficiency therapies include both daily and long-acting formulations. Long-acting options like SOGROYA (somapacitan), SKYTROFA (lonapegsomatropin), and NGENLA (somatrogon) allow for once-weekly injections. SOGROYA utilizes an albumin-binding moiety to slow clearance, SKYTROFA acts as a prodrug that gradually releases unmodified GH via transient PEGylation, and NGENLA fuses GH with segments of human chorionic gonadotropin’s C-terminal peptide to extend its half-life. In contrast, traditional treatments such as HUMATROPE and GENOTROPIN, as well as devices like GROWJECT, require daily injections, often increasing the treatment burden due to frequent administration and discomfort.

In April 2023, the US FDA-approved SOGROYA (somapacitan-beco) injections (5 mg, 10 mg, and 15 mg) for children aged 2.5 years and older with growth failure caused by inadequate endogenous GH secretion. Somapacitan-beco binds to a dimeric GH receptor on the target cell membrane, triggering intracellular signal transduction and various pharmacodynamic effects. Some of these effects are primarily driven by IGF-1 produced in the liver, while others result directly from somapacitan-beco’s action.

In January 2022, the EC granted marketing authorization for lonapegsomatropin, developed as TRANSCON hGH, as a once-weekly subcutaneous injection for children and adolescents aged 3–18 years with growth failure caused by insufficient endogenous GH secretion. In August 2021, the US FDA-approved SKYTROFA for pediatric patients aged 1-year and older, weighing at least 11.5 kg (25.4 lb), with growth failure due to inadequate endogenous GH secretion

Companies like Lumos Pharma’s LUM-201 and SCOHIA PHARMA’s SCO-240 are involved in the development of Phase II and Phase I drugs.

Growth Hormone Deficiency Drugs Uptake

This section focuses on the uptake rate of potential Growth Hormone Deficiency Drugs expected to be launched in the market during 2020–2034.

Further detailed analysis of emerging therapies drug uptake in the report…

Growth Hormone Deficiency Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline development activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for Growth Hormone Deficiency.

Latest KOL Views on Growth Hormone Deficiency

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Growth Hormone Deficiency evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the UW Health American Family Children's Hospital, US, Children's Hospital Los Angeles, US, Lucile Packard Foundation for Children's Health, US, University Hospital Heidelberg, Germany, Angers University Hospital Center, France, Cochin Hospital, France, Policlinico Sant'Orsola-Malpighi, Italy, Instituto de Investigación Sanitaria y Biomédica de Alicante (ISABIAL), Spain, University of Manchester, UK, Tanaka Growth Clinic, Japan, and Keio University, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Growth Hormone Deficiency market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Growth Hormone Deficiency Physician’s View

As per the KOLs from the US, many children receiving growth hormone therapy are otherwise healthy, with no identifiable medical cause for their short stature. Despite low growth hormone levels in tests, their MRI scans are normal. This raises concerns about over-prescription, ethical implications, and the need for stricter diagnostic criteria to ensure appropriate and justified treatment.

As per the KOLs from Germany, the diagnosis of Growth Hormone Deficiency in childhood is more challenging compared to deficiencies in thyroid hormone, cortisol, or sex hormones. No single clinical finding is both sensitive and specific enough to confirm Growth Hormone Deficiency with certainty, except in rare cases such as homozygous Growth Hormone-1 (GH-1) gene deletions or severe congenital pituitary malformations, where the diagnosis becomes more straightforward.

As per the KOLs from Japan, Growth hormone has traditionally been administered through daily SC injections. However, in Japan, near-adult height outcomes remain suboptimal, likely due to lower therapeutic doses compared to the US and Europe. While treatment continues to improve, the burden of daily injections over several years remains a challenge, potentially affecting adherence, clinical outcomes, quality of life, and overall healthcare costs.

Growth Hormone Deficiency Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Growth Hormone Deficiency Market Access and Reimbursement

SOGROYA

SOGROYA savings card

Eligible commercially insured patients may reduce or completely eliminate their annual co-pay costs for SOGROYA using the SOGROYA savings card, with a maximum savings of USD 5,000 per calendar year.

The Patient Assistance Program (PAP) provides eligible patients with access to therapy at no cost. For those with limited or no insurance, assistance may be available. Patients facing gaps, delays, or inadequate coverage for their SOGROYA prescription may qualify for a limited supply of the medication at no cost.

Further details will be provided in the report......

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Growth Hormone Deficiency Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Growth Hormone Deficiency, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Growth Hormone Deficiency market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Growth Hormone Deficiency market.

Growth Hormone Deficiency Market Report Insights

- Patient Population

- Therapeutic Approaches

- Growth Hormone Deficiency Pipeline Analysis

- Growth Hormone Deficiency Market Size and Trends

- Existing and Future Market Opportunity

Growth Hormone Deficiency Market Report key strengths

- 10 years Forecast

- The 7MM Coverage

- Growth Hormone Deficiency Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Drugs Uptake and Key Market Forecast Assumptions

Growth Hormone Deficiency Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions answered through Growth Hormone Deficiency Market Report:

Growth Hormone Deficiency Market Insights

- What was the total market size of Growth Hormone Deficiency, the market size of Growth Hormone Deficiency by therapies, and market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will LUM-201 affect the treatment paradigm of Growth Hormone Deficiency?

- How will SORGOYA compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Growth Hormone Deficiency Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of Growth Hormone Deficiency? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Growth Hormone Deficiency?

- What is the historical and forecasted Growth Hormone Deficiency patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent Growth Hormone Deficiency population during the forecast period (2025–2034)?

- What factors are contributing to the growth of Growth Hormone Deficiency cases?

Current Growth Hormone Deficiency Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Growth Hormone Deficiency? What are the current clinical and treatment guidelines for treating Growth Hormone Deficiency?

- How many companies are developing therapies for the treatment of Growth Hormone Deficiency?

- How many emerging therapies are in the mid-stage and late stage of development for treating Growth Hormone Deficiency?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of Growth Hormone Deficiency?

Reasons to Buy our Growth Hormone Deficiency Market Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Growth Hormone Deficiency market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for Growth Hormone Deficiency, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-market.png&w=256&q=75)

-pipeline.png&w=256&q=75)