Hearing Aid Devices Market Summary

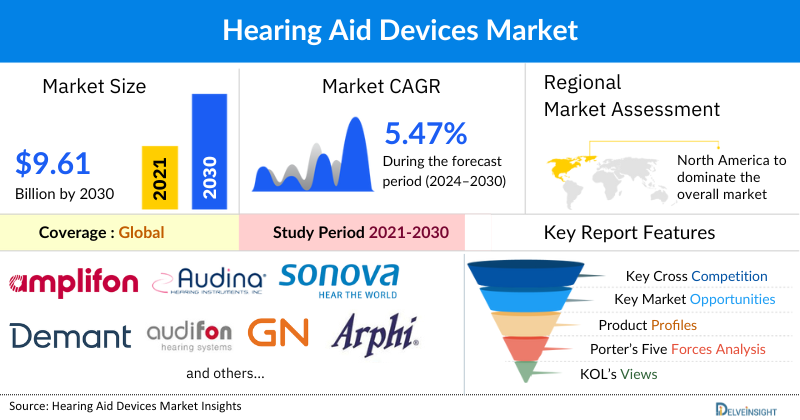

- The global hearing aid devices market was valued at USD 6.69 billion in 2023 and projected to reach USD 9.20 billion by 2030.

- Global Hearing Aid Devices Market size is expected to grow at a CAGR of 5.45% during the forecast period from 2024 to 2030.

Hearing Aid Devices Market Trends & Insights

- Asia-Pacific is expected to account for the highest proportion of the hearing aid devices market in 2023, out of all regions. This can be ascribed to the increasing prevalence of hearing loss, increase government initiatives coupled with increased awareness programs for hearing disorders, and the presence of key Hearing Aid Devices manufacturers engaged in merges, acquisition, product launches, and other market activities across the region are expected to escalate the Hearing Aid Devices market during the forecast period.

- In the technology segment of hearing aid devices market the digital device are expected to hold a significant share in 2023. Digital hearing aids are significantly boosting the overall Hearing Aid Devices market for hearing aid devices by driving technological innovation, enhancing user experience, and expanding the range of functionalities available to users.

- Key Hearing Aid Devices Companies include Amplifon, Audina Hearing Instruments, Inc., Sonova, Demant A/S, audifon GmbH & Co. KG, GN Store Nord A/S, Arphi Electronics Private Limited, Foshan Vohom Technology Co., Ltd., RION Co., Ltd., Eargo Inc, Elkon Pvt Ltd., Starkey Laboratories, Inc., WS Audiology Denmark A/S, Horentek Hearing Diagnostics, Bernafon, Unitron, MDHearingAid, Istok Audio Trading LLC, AlgorKorea Co., Ltd., Microson, and others.

Hearing Aid Devices Market Size and Forecasts

- 2023 Market Size: USD 6.69 billion

- 2030 Projected Market Size: USD 9.20 billion

- Growth Rate (2025-2032): 5.45% CAGR

- Largest Market: Asia-Pacific

- Fastest Growing Market: North America

- Market Structure: Moderately Consolidated

Factors Driving the Growth of the Hearing Aid Devices Market

Rising Global Prevalence of Hearing Loss

Growing incidence of age-related hearing loss, noise-induced hearing disorders, ototoxic drug exposure, and congenital conditions continues to expand the patient pool, directly driving demand for hearing aids.

Ageing Population Worldwide

Hearing impairment increases significantly with age. Rapid population ageing in North America, Europe, Japan, and emerging Asian economies is a major long-term growth accelerator.

Technological Advancements in Hearing Aid Design

Innovations such as AI-powered sound processing, Bluetooth-enabled connectivity, rechargeable batteries, miniaturized devices, real-time noise reduction, and tinnitus masking technologies are improving user satisfaction and fueling device adoption.

Rising Adoption of Over-the-Counter (OTC) Hearing Aids

Regulatory approvals for OTC devices, especially in the US, are improving accessibility, reducing cost barriers, and expanding the overall user base, particularly among individuals with mild-to-moderate hearing loss.

Increasing Awareness & Early Diagnosis of Hearing Impairment

Public health campaigns, newborn hearing screening programs, and workplace hearing conservation initiatives are increasing diagnosis rates, leading to higher usage of hearing aid solutions.

Expanding Access to Audiology Services in Developing Regions

Improved healthcare infrastructure, tele-audiology, and mobile diagnostic units in Asia-Pacific, Latin America, and the Middle East are bridging accessibility gaps and supporting market expansion.

Rising Healthcare Expenditure & Insurance Coverage

Broader reimbursement policies, inclusion of hearing care in national insurance schemes, and growing consumer willingness to invest in hearing technologies are boosting uptake.

Growth of Wireless & Smart Wearable Ecosystems

Integration with smartphones, apps for remote adjustments, and seamless connectivity with other smart devices enhance user experience and promote higher adoption.

Hearing Aid Devices by Product Type (Behind the Ear (BTE), Receiver in the Ear Canal (RIC), in the Ear (ITE), Completely in Canal (CIC), and Others), Technology (Analog and Digital), Patient Type (Adult and Pediatrics), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the rising burden of hearing loss, rise in exposure to high intensity sounds leading to increase noise-induced hearing loss, and increase in product development activities by key Hearing Aid Devices manufacturers across the globe.

The global hearing aid devices market was valued at USD 6.69 billion in 2023, growing at a CAGR of 5.45% during the forecast period from 2024 to 2030, to reach USD 9.20 billion by 2030. The rising burden of hearing loss is a major factor boosting the hearing aid market. Additionally, the rise in exposure to high-intensity sounds, often from environmental noise or occupational hazards, contributes to an increase in noise-induced hearing loss, which will further propel the hearing aid devices market. Further, increasing awareness and screening programs regarding hearing loss and increasing surge in product development activities are some of the key factors boosting the hearing aid devices market during the forecast period from 2024 to 2030.

Scope of the Hearing Aid Devices Market | |

|

Study Period |

2021 to 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2030 |

|

CAGR | |

|

Hearing Aid Devices Market Size |

USD 9.61 billion by 2030 |

|

Key Hearing Aid Devices Companies |

Amplifon, Audina Hearing Instruments, Inc., Sonova, Demant A/S, audifon GmbH & Co. KG, GN Store Nord A/S, Arphi Electronics Private Limited, Foshan Vohom Technology Co., Ltd., RION Co., Ltd., Eargo Inc, Elkon Pvt Ltd., Starkey Laboratories, Inc., WS Audiology Denmark A/S, Horentek Hearing Diagnostics, Bernafon, Unitron, MDHearingAid, Istok Audio Trading LLC, AlgorKorea Co., Ltd., Microson, and others.. |

What are the latest Hearing Aid Device Market Dynamics and Trends?

According to the latest data provided by the World Health Organization (2024), by 2050, nearly 2.5 billion people were projected to have experienced some degree of hearing loss, with at least 700 million requiring hearing rehabilitation. Over 1 billion young adults are at risk of permanent, avoidable hearing loss due to unsafe listening practices. Nearly 80% of individuals with disabling hearing loss had lived in low- and middle-income countries. The prevalence of hearing loss had increased with age, with over 25% of those older than 60 years being affected by disabling hearing loss.

Additionally, according to data from the Australian Government published in 2024, approximately 3.6 million people had experienced some level of hearing loss. Additionally, over one in three Australians had suffered noise-related ear damage.

As the number of individuals affected by hearing loss rises due to aging populations, environmental factors, and increased noise exposure, the demand for advanced hearing solutions, such as hearing aid devices, is growing. Efforts to reduce the stigma associated with hearing loss and hearing aids have made individuals more willing to use these devices thereby boosting the overall Hearing Aid Devices market.

Furthermore, World Hearing Day is held annually on March 3rd, this global event, is organized by the World Health Organization (WHO), aims to raise awareness about hearing loss and promote ear and hearing care. In 2023, the theme was ""Ear and Hearing Care for All,"" emphasizing the need for accessible hearing care worldwide. Awareness programs educate the public about hearing loss and thus increasing the demand of hearing aid devices.

Additionally, Hearing Aid companies are amplifying their production of hearing aid devices and securing regulatory approvals, thereby strategically expanding their market presence and driving further growth. For instance, in October 2021, Signia announced the launch of Insio Charge&Go AX, the world's first custom hearing aids featuring contactless charging, Bluetooth, and streaming capabilities for both Android and Apple iOS devices.

Thus, the factors mentioned above are likely to boost the Hearing Aid Devices market during the forecasted period.

However, the reduced battery life, requiring regular charging or replacement and improper use or inadequate cleaning of hearing aids can lead to ear infections or skin irritation in the ear canal which may hinder the future of hearing aid devices market.

Hearing Aid Devices Market Segmentation

Hearing Aid Devices Market by Product Type

- Behind the Ear (BTE)

- Receiver in the Ear Canal (RIC)

- in the Ear (ITE)

- Completely in Canal (CIC)

Hearing Aid Devices Market by Technology

- Analog

- Digital

Hearing Aid Devices Market by Patient Type

- Adult

- Pediatrics

Hearing Aid Devices Market by Geography

North America Cataract Surgery Devices Market

- United States Cataract Surgery Devices Market

- Canada Cataract Surgery Devices Market

- Mexico Cataract Surgery Devices Market

Europe Cataract Surgery Devices Market

- United Kingdom Cataract Surgery Devices Market

- Germany Cataract Surgery Devices Market

- France Cataract Surgery Devices Market

- Italy Cataract Surgery Devices Market

- Spain Cataract Surgery Devices Market

- Rest of Europe Cataract Surgery Devices Market

Asia-Pacific Cataract Surgery Devices Market

- China Cataract Surgery Devices Market

- Japan Cataract Surgery Devices Market

- India Cataract Surgery Devices Market

- Australia Cataract Surgery Devices Market

- South Korea Cataract Surgery Devices Market

- Rest of Asia-Pacific Cataract Surgery Devices Market

Rest of the World Cataract Surgery Devices Market

- South America Cataract Surgery Devices Market

- Middle East Cataract Surgery Devices Market

- Africa Cataract Surgery Devices Market

Hearing Aid Devices Market Segment Analysis

In the technology segment of hearing aid devices market the digital device are expected to hold a significant share in 2023. Digital hearing aids are significantly boosting the overall Hearing Aid Devices market for hearing aid devices by driving technological innovation, enhancing user experience, and expanding the range of functionalities available to users. Their advanced technology allows for superior sound processing compared to analog devices, providing clearer and more customizable hearing experiences. By converting sound waves into digital signals, digital hearing aids enable precise manipulation of sound frequencies, reducing background noise and improving speech clarity. This adaptability caters to a diverse range of hearing needs and environments, making hearing aids more effective and appealing to a broader audience. The inclusion of features such as noise reduction, directional microphones, and connectivity options like Bluetooth enhances the functionality of digital hearing aids, further driving their adoption. Additionally, digital hearing aids often offer integration with smartphones and other devices, allowing users to control settings and stream audio directly, which adds convenience and modernity to the user experience. The increased awareness of these advanced features, coupled with greater public acceptance and improved insurance coverage, is accelerating Hearing Aid Devices market growth. As technology continues to advance, digital hearing aids are becoming more accessible and affordable, thus attracting a larger segment of the population and contributing to a robust and expanding Hearing Aid Devices market.

Additionally, an increase in product development activities are also anticipated to augment the digital hearing aid market growth. For instance, in Feburary 2024, GN, a global leader in hearing aid innovation, announced the expansion of its ReSound Nexia family, offering enhanced options for individuals with hearing loss to benefit from advanced technology and next-generation Bluetooth connectivity.

Therefore, owing to the above-mentioned factors, the digital hearing aid category is expected to generate considerable revenue thereby pushing the overall growth of the global hearing aid devices market during the forecast period.

Hearing Aid Devices Regional Analysis

Europe is expected to dominate the Overall Hearing Aid Devices Market

Asia-Pacific is expected to account for the highest proportion of the hearing aid devices market in 2023, out of all regions. This can be ascribed to the increasing prevalence of hearing loss, increase government initiatives coupled with increased awareness programs for hearing disorders, and the presence of key Hearing Aid Devices manufacturers engaged in merges, acquisition, product launches, and other market activities across the region are expected to escalate the Hearing Aid Devices market during the forecast period.

Furthermore, as per the recent data and stats provided by the Australian Government Department of Health and Aged Care (2024), it was estimated that the number of individuals with hearing impairment was expected to double, reaching an estimated 7.8 million by 2060.

For instance, according a survey report published by the Ministry of Health and Family Welfare (Government of India), in 2021, disabling hearing loss affected 2.9% of the population in the India. Additionally, as per the recent data provided by the National Council of Aging (2024), approximately, 136.5 million people in Australia, China, Japan, and New Zealand had some kind of hearing loss.

The increasing number of product development activities in the region is further going to accelerate the growth of the hearing aid devices market. For example, in April 2023, Rexton announced the launch of the breakthrough BiCore B-Li M Rugged, the most resilient Behind-The-Ear (BTE) hearing aid it had ever made. The company also expanded its BiCore portfolio with three new BTE hearing aids the BiCore BTE M, BiCore BTE P, and BiCore BTE HP—offering durable and reliable solutions to a wider range of consumers.

Therefore, the above-mentioned factors are expected to bolster the growth of the hearing aid devices market in the Asia-Pacific during the forecast period.

Who are the major players in Hearing Aid Devices?

The following are the leading companies in Hearing Aid Devices. These companies collectively hold the largest Hearing Aid Devices market share and dictate industry trends.

Hearing Aid Devices Companies

Some of the key Hearing Aid Devices companies operating in the hearing aid devices market include Amplifon, Audina Hearing Instruments, Inc., Sonova, Demant A/S, audifon GmbH & Co. KG, GN Store Nord A/S, Arphi Electronics Private Limited, Foshan Vohom Technology Co., Ltd., RION Co., Ltd., Eargo Inc, Elkon Pvt Ltd., Starkey Laboratories, Inc., WS Audiology Denmark A/S, Horentek Hearing Diagnostics, Bernafon, Unitron, MDHearingAid, Istok Audio Trading LLC, AlgorKorea Co., Ltd., Microson, and others.

Recent Developmental Activities in the Hearing Aid Devices Market

- In February 2025, EssilorLuxottica's Nuance Audio Glasses, which combine hearing aids with spectacles, received approval for sale in the U.S. and European markets. The company plans to distribute them through its retail network, audiology practices, and optical wholesalers. The glasses are marketed as a "breakthrough in hearing technology," offering an OTC hearing aid integrated into smart glasses for mild to moderate hearing loss in adults aged 18 and over.

- On October 15, 2024, the acclaimed innovator ELEHEAR was excited to announce the introduction of its newest product, ELEHEAR beyond Hearing Aids, aimed at transforming the hearing aid industry.

- On September 12, 2024, the FDA approved Apple’s over-the-counter Hearing Aid feature for its second-generation AirPods Pro. Designed for individuals with mild to moderate hearing loss, this feature allows the AirPods Pro to function as OTC hearing aids. The approval follows the FDA’s 2022 policy enabling adults with less-than-severe hearing impairment to use consumer hearing devices without a professional fitting. The FDA reported that the AirPods Pro’s software-based Hearing Test feature demonstrated benefits comparable to professional fittings and observed no adverse events.

- In August 2023, Lucid Hearing, LLC announced the release of its latest hearing aid, Tala™, the highest premium option in its OTC product line. The Fort Worth-based company revealed that Tala would initially be available on lucidhearing.com and at Best Buy, with additional retailers to be added soon. Priced at $1,299, Tala would be followed by future products featuring the company's new Precision Directional Listening System (PDL) to address a full spectrum of hearing loss.

- In March 2023, USound, a leading provider of advanced audio solutions, announced its collaboration with partners to develop and deliver a reference design for a cutting-edge over-the-counter (OTC) hearing aid. The reference design integrated USound’s Kore 4.0 audio module, ASE’s Micro SiP (System-in-Package), and OBO Pro2’s innovative hearing aid design, delivering one of the most advanced hearing aids on the market.

Structural Heart Devices Market Recent Industry Trends and Milestones (2022-2025) | |

|---|---|

| Category | Key Trends / Milestones (2022–2025) |

| Product Launches / New Devices |

|

| Regulatory / Approvals |

|

| Partnerships & Strategic Collaborations |

|

| Acquisitions / M&A / Business Consolidation |

|

| Company Strategy Shifts |

|

| Emerging Technology & Innovation Trends |

|

Key Takeaways from the Hearing Aid Devices Market Report Study

- Market size analysis for current hearing aid devices market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key Hearing Aid product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key Hearing Aid companies dominating the hearing aid devices market.

- Various opportunities available for the other competitors in the hearing aid devices market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current hearing aid devices market scenario?

- Which are the regions and countries where Hearing Aid companies should have concentrated on opportunities for hearing aid devices market growth in the coming future?

Target Audience who can be benefited from the Hearing Aid Devices Market Report Study

- Hearing aid devices product providers

- Research organizations and consulting companies

- Hearing aid devices -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in hearing aid devices

- Various end-users who want to know more about the hearing aid devices market and the latest technological developments in the hearing aid devices market.