Insulin Resistance Market Summary

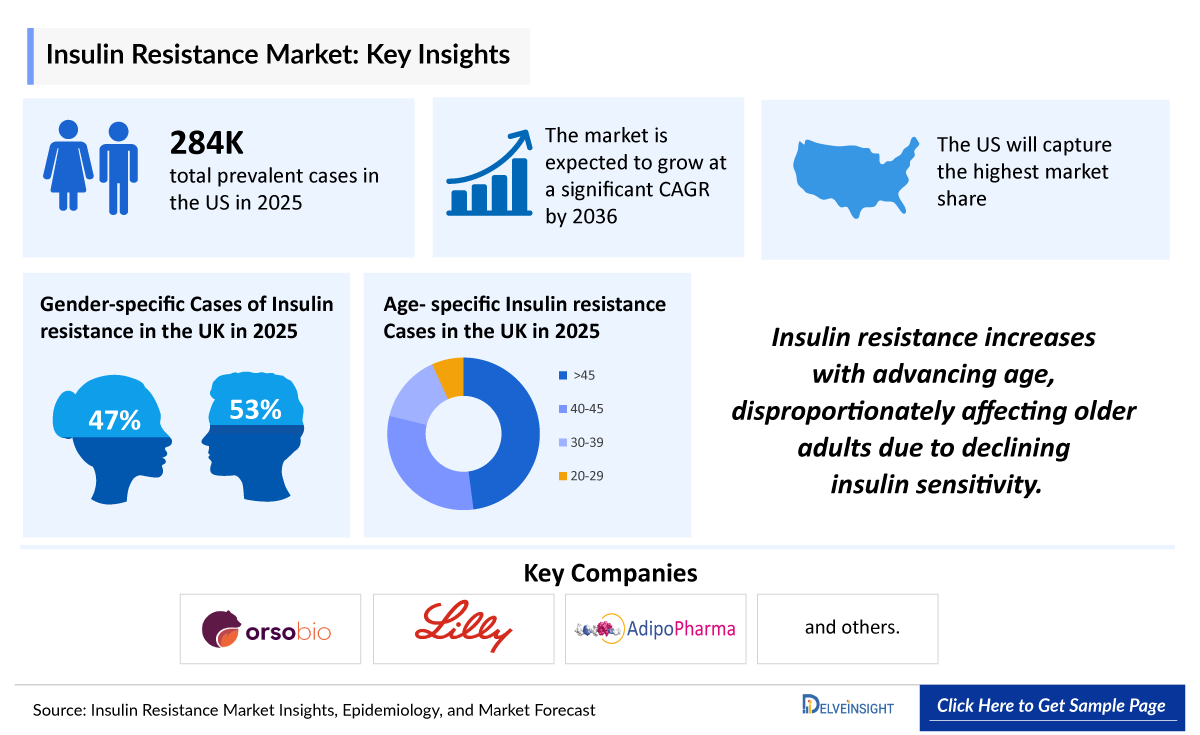

- The Insulin resistance Market Size is anticipated to grow with a significant CAGR during the study period (2022-2036).

- The leading Insulin resistance companies developing therapies include - Sanofi, Boehringer Ingelheim, AstraZeneca, Biocon, Amolyt Pharma, Eli Lilly, Novo Nordisk, Fractyl Health, Glyscend Therapeutics, and others.

Insulin resistance Market and Epidemiology Analysis

- The current approach to managing insulin resistance is primarily indirect, focusing on downstream effects through lifestyle interventions and glucose-lowering medications approved for conditions like type 2 diabetes and obesity. No therapy is currently approved specifically to reverse insulin resistance, highlighting a major unmet need for disease-modifying treatments.

- Insulin resistance is an increasing global public health challenge, strongly associated with the growing rates of obesity, type 2 diabetes mellitus (T2DM), and cardiometabolic risk factors. In 2025, the global pooled prevalence of insulin resistance was estimated at 26.53%, highlighting its broad impact worldwide.

- Recent prevalence estimates indicate that total Insulin resistance prevalence in the United States is 29.5%, with a higher burden in men (53.2%) compared with women (46.8%). Secondary analysis demonstrates a rising and sustained prevalence of insulin resistance among adults.

- In 2003, approximately 22% of US adults aged >20 years were insulin-resistant. Data from 2021 indicate that ~40% of US adults aged 18-44 years are insulin resistant based on HOMA-IR criteria, confirming a significant shift toward younger age groups.

- In the UK, insulin resistance affects ~37% of adults as of 2025, rising from 28% in 2022, with the most rapid growth seen in individuals aged 30-45 years, where prevalence has nearly doubled.

Request for unlocking the Sample Page of the "Insulin resistance Market"

DelveInsight's "Insulin Resistance Market Insights, Epidemiology, and Market Forecast-2036" report delivers an in-depth understanding of the Insulin Resistance, historical and forecasted epidemiology as well as the Insulin Resistance therapeutics market trends in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

The Insulin Resistance market report provides current treatment practices, emerging drugs, Insulin Resistance market share of the individual therapies, current and forecasted Insulin Resistance market Size from 2022 to 2036 segmented by seven major markets. The Report also covers current Insulin Resistance treatment practice/algorithm, market drivers, market barriers and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the Insulin Resistance market.

|

Study Period |

2022 to 2036 |

|

Forecast Period |

2026-2036 |

|

Geographies Covered |

|

|

Insulin Resistance Market |

|

|

Insulin Resistance Market Size | |

|

Insulin Resistance Companies |

Sanofi, Boehringer Ingelheim, AstraZeneca, Biocon, Amolyt Pharma, Eli Lilly, Novo Nordisk, Fractyl Health, Glyscend Therapeutics, and others |

|

Insulin Resistance Epidemiology Segmentation |

|

Insulin Resistance Disease Understanding

The DelveInsight’s Insulin Resistance market report gives a thorough understanding of the Insulin Resistance by including details such as disease definition, symptoms, causes, pathophysiology, diagnosis, and treatment.

Insulin resistance Overview

Insulin resistance is a metabolic condition in which the body’s cells respond poorly to insulin, leading to elevated blood glucose levels. It is closely associated with obesity, type 2 diabetes mellitus (T2DM), metabolic syndrome, and cardiovascular risk factors. Often asymptomatic in early stages, it can progress to prediabetes or diabetes if left unmanaged. Diagnosis typically involves blood tests, such as fasting insulin, glucose levels, and HOMA-IR calculations. Management focuses on lifestyle interventions, weight reduction, and medications that improve insulin sensitivity. Early detection and treatment are key to preventing long-term health complications.

Insulin Resistance Diagnosis

Insulin resistance is typically diagnosed using a combination of clinical assessment, laboratory tests, and risk factor evaluation. Common diagnostic approaches include fasting blood glucose, fasting insulin levels, and the Homeostatic Model Assessment of Insulin Resistance (HOMA-IR). Oral glucose tolerance tests (OGTT) are also used to assess impaired glucose handling. In clinical practice, diagnosis is often supported by associated indicators such as central obesity, dyslipidemia, hypertension, and elevated HbA1c, as there is no single definitive test for insulin resistance.

Insulin Resistance Treatment

Treatment of insulin resistance focuses on improving insulin sensitivity, managing metabolic risk factors, and preventing progression to type 2 diabetes. Lifestyle modifications including diet, regular physical activity, and weight management—remain the first-line approach. Pharmacologic options include metformin, thiazolidinediones, GLP-1 receptor agonists, and SGLT2 inhibitors, which help regulate glucose metabolism and support weight reduction. Emerging therapies targeting inflammation, mitochondrial function, and lipid metabolism are also being explored. Early intervention and individualized treatment plans are critical to improving long-term metabolic outcomes.

Insulin Resistance Epidemiology

The Insulin Resistance epidemiology section provides insights about the historical and current Insulin Resistance patient pool and forecasted trends for individual seven major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the Insulin Resistance market report also provides the diagnosed patient pool and their trends along with assumptions undertaken.

Insulin Resistance Epidemiology Key Findings

- Insulin resistance represents a major and growing global public health burden, closely linked to the rising prevalence of obesity, type 2 diabetes mellitus (T2DM), and cardio metabolic risk factors. Globally, the pooled prevalence of Insulin resistance was estimated at 26.53% in 2025, underscoring its widespread impact across populations.

- Recent prevalence estimates indicate that total Insulin resistance prevalence in the United States is 29.5%, with a higher burden in men (53.2%) compared with women (46.8%). Secondary analysis demonstrates a rising and sustained prevalence of insulin resistance among adults.

- In 2003, approximately 22% of US adults aged >20 years were insulin-resistant. Data from 2021 indicate that ~40% of US adults aged 18-44 years are insulin resistant based on HOMA-IR criteria, confirming a significant shift toward younger age groups.

- In the UK, insulin resistance affects ~37% of adults as of 2025, rising from 28% in 2022, with the most rapid growth seen in individuals aged 30-45 years, where prevalence has nearly doubled

- In the US, insulin resistance drives 70-90% of type 2 diabetes cases via beta-cell exhaustion and precedes metabolic syndrome in 25-40% of affected adults. It accounts for 60-80% of NAFLD and 30-50% of cardiovascular risk. These global data highlight insulin resistance as a primary target for preventing diabetes, NAFLD, CVD, and PCOS worldwide.

- Among European countries, Spain exhibited the highest prevalence of insulin resistance, with an overall prevalence of 30.4%. In France, the overall prevalence is 26.0%, with higher prevalence in men (62.7%) compared with women (37.3%). In Japan, total insulin resistance prevalence is 25.5%, with similar rates between women and men.

Country Wise- Insulin Resistance Epidemiology

The epidemiology segment also provides the Insulin Resistance epidemiology data and findings across the United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan.

Insulin Resistance Epidemiology Segmentation

- Total Prevalent cases of Insulin resistance in the 7MM

- Total Diagnosed Prevalent cases of Insulin resistance in the 7MM

- Age-specific cases of Insulin resistance in the 7MM

- Total Diagnosed Prevalent cases of Insulin resistance in the 7MM\

- Gender-specific cases of Insulin resistance in the 7MM

- Comorbidity-specific cases of Insulin resistance in the 7MM

- Treated cases of Insulin resistance in the 7MM

Recent Developments In The Insulin Resistance Treatment Landscape

- In June 2025, AdipoPharma’s PATAS, a novel adipocyte-targeting, disease-modifying insulin sensitizer was recognized at the ADA 85th Annual Meeting, supported by strong preclinical data and positioned to enter clinical trials later in 2025.

- In December 2025, Eli Lilly and Company announced positive topline results from its Phase III TRIUMPH-4 trial of Retatrutide, highlighting its potential to improve insulin resistance through its triple agonism, with additional Phase III studies ongoing in type 2 diabetes and obesity.

Insulin Resistance Drug Analysis

The drug chapter segment of the Insulin Resistance report encloses the detailed analysis of Insulin Resistance marketed drugs and late-stage (Phase-III and Phase-II) Insulin Resistance pipeline drugs. It also helps to understand the Insulin Resistance clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Insulin Resistance Marketed Drugs

Marketed drugs for insulin resistance primarily aim to improve insulin sensitivity, manage blood glucose, and reduce associated metabolic risks. Key therapies include metformin, thiazolidinediones (e.g., pioglitazone), GLP-1 receptor agonists (e.g., semaglutide, liraglutide), and SGLT2 inhibitors (e.g., empagliflozin, dapagliflozin). These medications are widely used in patients with type 2 diabetes, prediabetes, and obesity-related insulin resistance. They help regulate glucose metabolism, promote weight loss, and reduce cardiovascular risk, forming the cornerstone of pharmacologic management alongside lifestyle interventions.

Insulin Resistance Emerging Drugs

Several therapies are under development, including OrsoBio’s TLC-3595, Eli Lilly’s Retatrutide, AdipoPharma’s PATAS, among others, which are anticipated to further drive growth in the market. The report provides the details of the emerging therapies under the late and mid-stage of development for Insulin Resistance treatment.

TLC-3595: OrsoBio

TLC-3595 is a novel, selective acetyl-CoA carboxylase 2 (ACC2) inhibitor being developed to improve insulin sensitivity in patients with type 2 diabetes by enhancing fatty acid oxidation and reducing ectopic lipid accumulation in skeletal muscle and liver, and is also being explored for its potential role in heart failure with preserved ejection fraction (HFpEF).

- In March 2023, OrsoBio announced that the first patient was dosed in a Phase IIa clinical trial of TLC3595, a selective ACC2 inhibitor being evaluated for its insulin-sensitizing effects in patients with insulin resistance.

Retatrutide: Eli Lilly

Retatrutide is an investigational, once-weekly, triple hormone receptor agonist designed as a single molecule that simultaneously activates GIP, GLP-1, and glucagon receptors. Eli Lilly is currently evaluating Retatrutide across multiple Phase III clinical trials to assess its efficacy and safety in a broad range of cardio metabolic and obesity-related conditions.

- In December 2025, Eli Lilly and Company announced positive topline results from its Phase III TRIUMPH-4 trial of Retatrutide, the investigational once-weekly GIP/GLP-1/glucagon triple hormone receptor agonist, which demonstrated significant weight loss and improvement in knee osteoarthritis pain, and noted that seven additional Phase III trials, including those in obesity and type 2 diabetes are expected to complete in 2026.

PATAS: AdipoPharma

In June 2025, AdipoPharma announced that PATAS, its novel insulin-sensitizing peptide targeting adipocyte dysfunction, was recognized at the American Diabetes Association’s 85th Annual Meeting in Chicago and featured through a company-submitted video highlighting its unique, disease-modifying approach to treating insulin resistance, the root cause of type 2 diabetes. Supported by robust preclinical data demonstrating insulin-independent glucose uptake in adipocytes, restoration of healthy lipid biosynthesis, and reductions in insulin resistance and HbA1c, PATAS has also shown potential to address key diabetes-related complications, including neuropathy, cardiovascular dysfunction, liver disease, and muscle loss, with the program expected to enter clinical trials in 2025. According to recent secondary research, PATAS entered Phase I clinical evaluation in January 2026.

Insulin Resistance Market Outlook

The Insulin Resistance market outlook of the report helps to build a detailed comprehension of the historic, current, and forecasted Insulin Resistance market trends by analyzing the impact of current Insulin Resistance therapies on the market, unmet needs, drivers and barriers, and demand for better technology.

This segment gives a thorough detail of Insulin Resistance market trend of each marketed drug and late-stage pipeline therapy by evaluating their impact based on the annual cost of therapy, inclusion and exclusion criteria's, mechanism of action, compliance rate, growing need of the market, increasing patient pool, covered patient segment, expected launch year, competition with other therapies, brand value, their impact on the market and view of the key opinion leaders. The calculated Insulin Resistance market data are presented with relevant tables and graphs to give a clear view of the market at first sight.

According to DelveInsight, the Insulin Resistance market in 7MM is expected to witness a major change in the study period 2022-2036.

Key Findings

This section includes a glimpse of the Insulin Resistance market in 7MM.

The United States Insulin Resistance Market Outlook

This section provides the total Insulin Resistance market size and market size by therapies in the United States.

EU-5 Countries Insulin Resistance Market Outlook

The total Insulin Resistance market size and market size by therapies in Germany, France, Italy, Spain, and the United Kingdom is provided in this section.

Japan Insulin Resistance Market Outlook

The total Insulin Resistance market size and market size by therapies in Japan is also mentioned.

Insulin Resistance Competitive Landscape

The insulin resistance competitive landscape is characterized by the presence of established pharmaceutical companies, emerging biotech firms, and generic drug manufacturers. Key players focus on antidiabetic agents such as metformin, GLP-1 receptor agonists, SGLT2 inhibitors, thiazolidinediones, and newer combination therapies targeting insulin sensitivity and metabolic control. Innovation is driven by pipeline candidates addressing underlying metabolic dysfunction, inflammation, and weight management, alongside digital therapeutics and lifestyle-based interventions. Strategic collaborations, clinical trial expansions, and geographic market penetration—particularly in the US, EU, and Asia-Pacific shape competition in this space.

Key Insulin Resistance Market Drivers:

- Rising global prevalence of obesity, type 2 diabetes mellitus (T2DM), and metabolic syndrome

- Growing awareness and early diagnosis of insulin resistance and prediabetes

- Expanding adoption of novel drug classes such as GLP-1 and dual-agonist therapies

- Increasing focus on preventive care and personalized metabolic treatment approaches

- Favorable reimbursement scenarios and strong pipeline activity in major markets

Leading Insulin Resistance Companies In The Treatment Market:

The insulin resistance market is led by major pharmaceutical companies with strong portfolios in diabetes and metabolic disorders. Key players include Sanofi, Boehringer Ingelheim, AstraZeneca, Biocon, Amolyt Pharma, Eli Lilly, Novo Nordisk, Fractyl Health, Glyscend Therapeutics, and others, which offer widely used insulin sensitizers, GLP-1 receptor agonists, and SGLT2 inhibitors. Emerging biotech firms are also contributing through novel mechanisms targeting inflammation, mitochondrial function, and weight-related insulin resistance. Additionally, generic manufacturers and digital health companies play a supporting role by improving affordability, adherence, and long-term metabolic management.

Insulin Resistance Drugs Uptake

This section focuses on the rate of uptake of the potential Insulin Resistance drugs recently launched in the Insulin Resistance market or expected to get launched in the market during the study period 2022-2036. The analysis covers Insulin Resistance market uptake by drugs; patient uptake by therapies; and sales of each drug.

Insulin Resistance Drugs Uptake helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allow the comparison of the drugs on the basis of Insulin Resistance market share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Insulin Resistance Clinical Trials Activities

The Insulin Resistance pipeline report provides insights into Insulin Resistance clinical trials within Phase II, and Phase III stage. It also analyses Insulin Resistance key players involved in developing targeted therapeutics.

Insulin Resistance Pipeline Development Activities

The Insulin Resistance clinical trials analysis report covers the detailed information of collaborations, acquisition, and merger, licensing, patent details, and other information for Insulin Resistance emerging therapies.

KOL- Views on Insulin Resistance Market Report

To keep up with current Insulin Resistance market trends, we take KOLs and SMEs ' opinion working in the Insulin Resistance domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps to understand and validate current and emerging therapies treatment patterns or Insulin Resistance market trends. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on Insulin Resistance Patient Trends?

Key Opinion Leaders (KOLs) in endocrinology and metabolic health note that insulin resistance is increasingly recognized as a critical precursor to type 2 diabetes mellitus (T2DM) and cardiometabolic diseases. They emphasize rising patient complexity due to concurrent obesity, sedentary lifestyles, and aging populations. KOLs highlight a shift toward early screening and intervention especially in high-risk groups to prevent progression to overt diabetes. There is growing interest in therapies that go beyond glycemic control to address weight reduction, inflammation, and metabolic flexibility. Additionally, experts underscore the role of lifestyle modification, digital monitoring tools, and multidisciplinary care pathways in improving patient adherence and long-term outcomes. Overall, KOLs view the patient trend as moving from reactive treatment of diabetes complications toward proactive, personalized management of insulin resistance itself.

Insulin Resistance Report Qualitative Analysis

The qualitative analysis in an insulin resistance report examines non-numerical insights to provide a deeper understanding of the market and disease landscape. It evaluates factors such as treatment adoption trends, patient behavior, unmet medical needs, regulatory environment, competitive positioning, and KOL opinions. This analysis complements quantitative data, highlighting market drivers, challenges, opportunities, and strategic considerations for stakeholders in the insulin resistance space.

Insulin Resistance Market Reimbursement Scenario

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In a report, we take reimbursement into consideration to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

Insulin Resistance Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Insulin Resistance Market by using various Competitive Intelligence tools that include - SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Insulin Resistance Market Report

- The report covers the descriptive overview of Insulin Resistance, explaining its causes, signs and symptoms, pathophysiology, diagnosis and currently available therapies

- Comprehensive insight has been provided into the Insulin Resistance epidemiology and treatment in the 7MM

- Additionally, an all-inclusive account of both the current and emerging therapies for Insulin Resistance is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape

- A detailed review of the Insulin Resistance market; historical and forecasted is included in the report, covering drug outreach in the 7MM

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the global Insulin Resistance market

Insulin Resistance Market Report Highlights

- In the coming years, the Insulin Resistance market is set to change due to the rising awareness of the disease, and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence Insulin Resistance R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- Major players are involved in developing therapies for Insulin Resistance. The launch of emerging therapies will significantly impact the Insulin Resistance market

- A better understanding of disease pathogenesis will also contribute to the development of novel therapeutics for Insulin Resistance

- Our in-depth analysis of the pipeline assets across different stages of development (Phase III and Phase II), different emerging trends and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

Insulin Resistance Market Report Insights

- Insulin Resistance Patient Population

- Insulin Resistance Therapeutic Approaches

- Insulin Resistance Pipeline Analysis

- Insulin Resistance Market Size and Trends

- Insulin Resistance Market Opportunities

- Impact of upcoming Insulin Resistance Therapies

Insulin Resistance Market Report Key Strengths

- 11 Years Forecast

- 7MM Coverage

- Insulin Resistance Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

Insulin Resistance Market Report Assessment

- Current Treatment Practices

- Insulin Resistance Unmet Needs

- Insulin Resistance Pipeline Product Profiles

- Insulin Resistance Market Attractiveness

- Insulin Resistance Market Drivers

- Insulin Resistance Market Barriers

Key Questions Answered In The Insulin Resistance Market Report:

Insulin Resistance Market Insights:

- What was the Insulin Resistance drug class share (%) distribution in 2022 and how it would look like in 2036?

- What would be the Insulin Resistance total market size as well as market size by therapies across the 7MM during the forecast period (2022-2036)?

- What are the key findings pertaining to the market across 7MM and which country will have the largest Insulin Resistance market size during the forecast period (2022-2036)?

- At what CAGR, the Insulin Resistance market is expected to grow by 7MM during the forecast period (2022-2036)?

- What would be the Insulin Resistance market outlook across the 7MM during the forecast period (2022-2036)?

- What would be the Insulin Resistance market growth till 2036, and what will be the resultant market Size in the year 2036?

- How would the unmet needs affect the market dynamics and subsequent analysis of the associated trends?

Insulin Resistance Epidemiology Insights:

- What are the disease risk, burden, and regional/ethnic differences of the Insulin Resistance?

- What are the key factors driving the epidemiology trend for seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What is the historical Insulin Resistance patient pool in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What would be the forecasted patient pool of Insulin Resistance in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- Where will be the growth opportunities in the 7MM with respect to the patient population pertaining to Insulin Resistance?

- Out of all 7MM countries, which country would have the highest prevalent population of Insulin Resistance during the forecast period (2022-2036)?

- At what CAGR the patient population is expected to grow in 7MM during the forecast period (2022-2036)?

Current Insulin Resistance Treatment Scenario, Marketed Drugs and Emerging Therapies:

- What are the current options for the Insulin Resistance treatment in addition to the approved therapies?

- What are the current treatment guidelines for the treatment of Insulin Resistance in the USA, Europe, and Japan?

- What are the Insulin Resistance marketed drugs and their respective MOA, regulatory milestones, product development activities, advantages, disadvantages, safety and efficacy, etc.?

- How many companies are developing therapies for the treatment of Insulin Resistance?

- How many therapies are in-development by each company for Insulin Resistance treatment?

- How many are emerging therapies in mid-stage, and late stage of development for Insulin Resistance treatment?

- What are the key collaborations (Industry - Industry, Industry - Academia), Mergers and acquisitions, licensing activities related to the Insulin Resistance therapies?

- What are the recent novel therapies, targets, mechanisms of action and technologies being developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Insulin Resistance and their status?

- What are the current challenges faced in drug development?

- What are the key designations that have been granted for the emerging therapies for Insulin Resistance?

- What are the global historical and forecasted market of Insulin Resistance?

Reasons to buy Insulin Resistance Market Forecast Report

- The report will help in developing business strategies by understanding trends shaping and driving the Insulin Resistance market

- To understand the future market competition in the Insulin Resistance market and Insightful review of the key market drivers and barriers

- Organize sales and marketing efforts by identifying the best opportunities for Insulin Resistance in the US, Europe (Germany, Spain, Italy, France, and the United Kingdom) and Japan

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for Insulin Resistance market

- To understand the future market competition in the Insulin Resistance market