SGLT2 inhibitors Market Summary

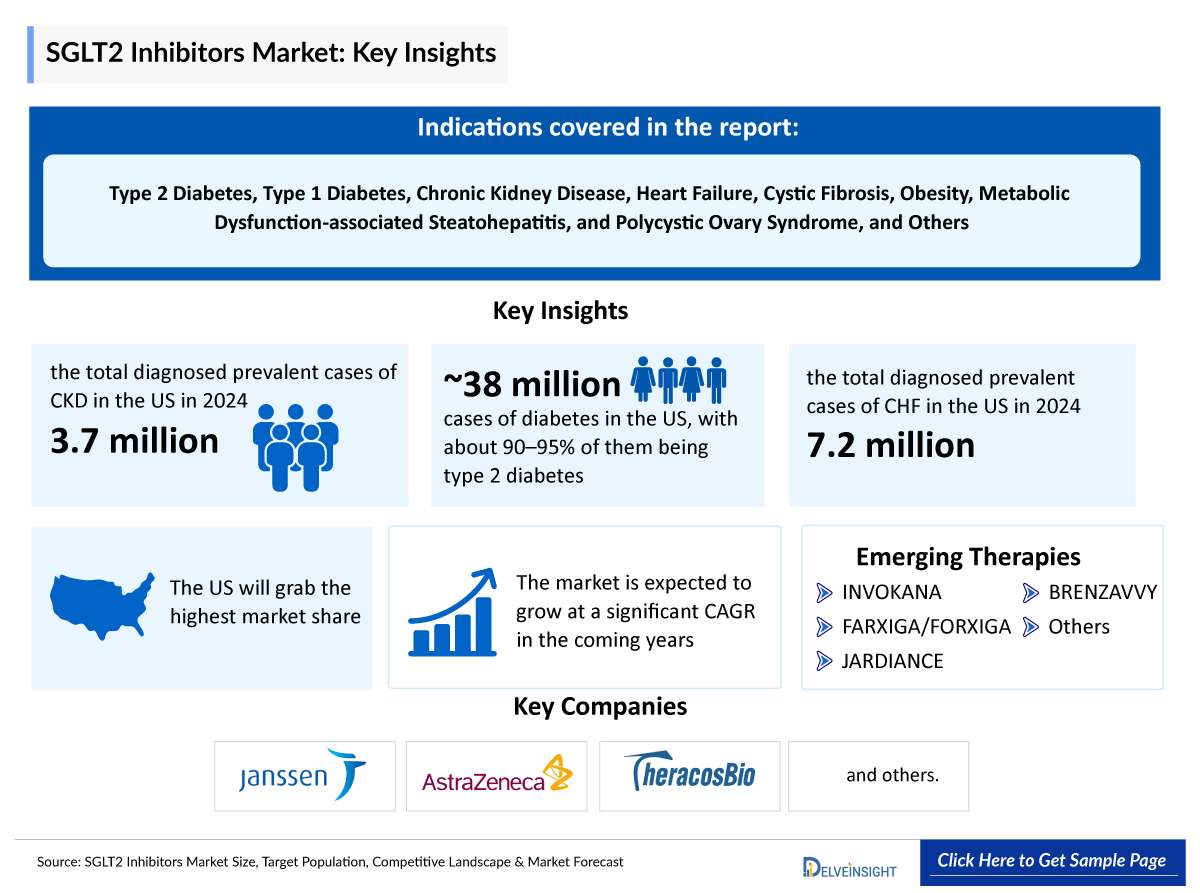

- The SGLT2 inhibitors Companies such as Janssen (J&J), AstraZeneca, Boehringer Ingelheim/Eli Lilly, TheracosBio, Mitsubishi Tanabe Pharma, and others.

SGLT2 Inhibitors Market Insights

- Sodium–glucose cotransporter-2 (SGLT2) inhibitors, including INVOKANA (canagliflozin), FARXIGA/FORXIGA (dapagliflozin), JARDIANCE (empagliflozin), BRENZAVVY (bexagliflozin), and others, are available both as standalone treatments and in combination with other diabetes medications such as metformin.

- These drugs work by blocking the SGLT2 proteins in the kidneys' proximal convoluted tubules, preventing the reabsorption of filtered glucose and thus promoting its excretion in urine. As a result, SGLT2 inhibitors effectively lower blood sugar by driving glucose out of the body through urine.

- Beyond glucose control, they also provide multiple clinical benefits, including slowing the progression of chronic kidney disease, reducing heart failure flare-ups, lowering urinary albumin-to-creatinine ratio (uACR) in albuminuria, and offering cardiovascular protection.

- Regulatory approvals currently include indications for Type 2 diabetes mellitus (T2DM), Chronic kidney disease (CKD), and heart failure.

- In the United States, recent milestones include FDA approval of BRENZAVVY (bexagliflozin) for glycemic control in 2023 and expansion of JARDIANCE into CKD. INPEFA, a dual SGLT1/2 inhibitor, was approved in 2023 for heart failure, with new 2025 data showing a 23% reduction in heart attacks, strokes, and cardiovascular deaths.

- In Japan, dapagliflozin gained approvals for CKD with or without diabetes, and in 2025, Mitsubishi Tanabe launched CANALIA, the first once-daily oral combination of a DPP-4 inhibitor and an SGLT2 inhibitor.

- In the UK, SGLT2 inhibitors are being considered as first-line therapy in NHS guidelines, with dapagliflozin and empagliflozin already widely used for diabetes, heart failure, and CKD.

Request for Unlocking the Sample Page of the "SGLT2 Inhibitors Market"

Key Factors Driving the SGLT2 Inhibitors Market

-

Growing SGLT2 inhibitors target population

Global diabetes prevalence and the rising burden of CKD and heart failure expand the addressable market; demographic trends (aging population, obesity) magnify demand. Public-health scale means long-term SGLT2 inhibitors market tailwinds. With obesity affecting over 650 million adults globally and type 2 diabetes impacting more than 400 million individuals, these drugs have the potential to improve the lives of millions. According to DelveInsight’s consultant, there were 191 million prevalent cases of obesity (adults and children) in the US in 2024, while over 32 million incident cases were of type 2 diabetes in the US in the same year.

-

Expansion of clinical indications for SGLT2 inhibitors beyond T2D

SGLT2 inhibitors now have strong evidence and approvals for heart failure (HFrEF/HFpEF) and chronic kidney disease, which enlarged the treatable patient pool well beyond people with type 2 diabetes. The therapeutic landscape for SGLT2 inhibitors is expanding, with ongoing research exploring their use in conditions such as obesity, NASH, and PCOS.

-

Ongoing SGLT2 inhibitors clinical trial activity

Key pharmaceutical companies active in the SGLT2 inhibitors market include Janssen, AstraZeneca, Boehringer Ingelheim/Eli Lilly, TheracosBio, Mitsubishi Tanabe Pharma, and others. Promising SGLT2 inhibitors in clinical trials include YG1699 (Youngene Therapeutics), JP-2266 (Jeil Pharmaceuticals), and others.

DelveInsight’s “ Sodium-glucose co-transporter-2 (SGLT2) inhibitors – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the SGLT2 inhibitors, historical and Competitive Landscape as well as the SGLT2 inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The SGLT2 inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM SGLT2 inhibitors market size from 2020 to 2040. The report also covers current SGLT2 inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the SGLT2 Inhibitors Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

SGLT2 Inhibitors Epidemiology |

Segmented by:

|

|

SGLT2 Inhibitors Companies |

|

|

SGLT2 Inhibitors Therapies |

|

|

SGLT2 Inhibitors Market |

Segmented by:

|

|

SGLT2 Inhibitors Market Analysis |

|

SGLT2 Inhibitors Understanding

SGLT2 Inhibitors Overview

SGLT2 inhibitors are oral prescription medications commonly used in people with CKD to protect kidney function by supporting glomerular health and lowering the urine albumin-creatinine ratio (uACR), a key marker of kidney damage. Clinical trials have also shown that these drugs reduce the risk of heart attack, stroke, and heart failure flare-ups. Additionally, for individuals with type 2 diabetes, SGLT2 inhibitors help improve blood sugar control. An important trend is the growing attention to solid tumors in the realm of SGLT2 inhibitors. While initially approved for hematological cancers, there's optimism that advancements in tolerability and efficacy might broaden their application to include solid tumors as well.

Further details are provided in the full report…

SGLT2 Inhibitors Target Population

The SGLT2 inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by target pool (Incident Cases by Indication, Eligible and Treatable Cases by Indication) in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In the 7MM, the largest eligible population for promising SGLT2 inhibitor indications in 2024 was observed in the United States, followed by the EU4 countries and the United Kingdom, with Type 2 diabetes mellitus being the leading condition.

- As per DelveInsight, the total diagnosed prevalent cases of CKD in the US were ~3,770,000 in 2024.

- As per the American Diabetes Association, in the US, there are approximately 38 million cases of diabetes, with about 90–95% of them being type 2 diabetes.

- As per DelveInsight, the total diagnosed prevalent cases of CHF in the US were ~7,200,000 in 2024.

Epidemiology of Selected Indications | |

|

Indication |

Estimated Incidence/Prevalence Cases in the US (2024) |

|

T2DM |

~38,000,000 (Prevalence Cases) |

|

CKD |

~3,770,000 (Prevalence Cases) |

|

CHF |

~7,200,000 (Prevalence Cases) |

SGLT2 Inhibitors Drug Analysis

The drug chapter segment of the SGLT2 inhibitors Market Report encloses a detailed analysis of SGLT2 inhibitors, marketed drugs, and late-stage (Phase III and Phase II) SGLT2 Inhibitors Pipeline Drugs. It also helps understand the SGLT2 inhibitor's clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

SGLT2 Inhibitor Marketed Drugs

-

BRENZAVVY (bexagliflozin): TheracosBio

BRENZAVVY, an oral SGLT2 inhibitor, is indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes. BRENZAVVY is not recommended for patients with type 1 diabetes mellitus or the treatment of diabetic ketoacidosis.

The FDA approval is based on results from a clinical program that evaluated the safety and efficacy of BRENZAVVY in 23 clinical trials enrolling more than 5,000 adults with type 2 diabetes mellitus. Phase 3 studies showed BRENZAVVY significantly reduced hemoglobin A1c and fasting blood sugar after 24 weeks, either as a monotherapy, in combination with metformin, or as an add-on to standard-of-care treatment consisting of a variety of regimens, including metformin, sulfonylureas, insulin, DPP4 inhibitors, or combinations of these agents.

-

JARDIANCE (empagliflozin): Boehringer Ingelheim/Eli Lilly

JARDIANCE is an oral SGLT2 inhibitor developed by Boehringer Ingelheim and Eli Lilly, first approved by the US FDA in August 2014 for the treatment of type 2 diabetes. It works by blocking the sodium-glucose co-transporter 2 in the kidneys, which reduces glucose and sodium reabsorption, leading to increased glucose excretion through urine and improved blood sugar control. Beyond its role in diabetes, JARDIANCE has shown significant benefits in cardiovascular and kidney health.

In June 2023, the FDA approved JARDIANCE for the treatment of type 2 diabetes in children 10 years and older.

Comparison of Marketed SGLT2 Inhibitors | |||

|

Product |

Company |

Approval |

Indication |

|

BRENZAVVY (bexagliflozin) |

TheracosBio |

2023 |

Adults with type 2 diabetes |

|

JARDIANCE (empagliflozin) |

Eli Lilly |

2014, 2023 |

Type 2 diabetes in children 10 years and older and adults |

SGLT2 Inhibitor Emerging Drugs

-

YG1699: Youngene Therapeutics

YG1699 is a dual systemic inhibitor of SGLT1 and SGLT2. It blocks SGLT2 activity in the early proximal tubule and SGLT1 activity in the late proximal tubule of the nephron. In the small intestine, it reduces SGLT1-mediated glucose absorption while stimulating GLP-1 and PYY secretion. These combined effects may provide advantages over selective SGLT2 inhibitors, including improved glycemic control, enhanced glomerular filtration, and better kidney oxygenation, ultimately helping to delay the progression of kidney and heart failure by preserving renal function.

The therapy is currently in Phase II clinical trials for type 2 diabetes mellitus (T2DM) and in Phase I trials for cystic fibrosis, diabetes with severe chronic kidney disease (CKD), type 1 diabetes, and heart failure.

- Dapagliflozin (Farxiga)

Dapagliflozin (Farxiga) is a selective SGLT2 inhibitor approved for the treatment of type 2 diabetes mellitus, heart failure, and chronic kidney disease. It lowers blood glucose by promoting urinary glucose excretion independent of insulin, while also providing cardiovascular and renal protection, blood pressure reduction, and modest weight loss. Administered orally once daily, dapagliflozin continues to be evaluated in Phase III studies to further strengthen its role in diabetes management.

-

JP-2266: Jeil Pharmaceuticals

JP-2266 is a small-molecule dual inhibitor of SGLT1/2 currently in Phase II development. It is being investigated for the treatment of type 2 diabetes to improve glycemic control, as well as type 1 diabetes in patients who fail to achieve adequate control despite optimal insulin therapy. The drug acts by inhibiting renal SGLT2, promoting significant urinary glucose excretion similar to existing SGLT2 inhibitors, while also blocking intestinal SGLT1 to delay glucose absorption and reduce postprandial glucose levels.

Comparison of Marketed SGLT2 Inhibitors | |||

|

Product |

Company |

Phase |

Indication |

|

YG1699 |

Youngene Therapeutics |

II, I |

T2DM Cystic fibrosis, CKD, Heart failure, type 1 diabetes |

|

JP-2266 |

Jeil Pharmaceuticals |

II |

Type 2 diabetes |

Note: A Detailed emerging therapies assessment will be provided in the full report of SGLT2 inhibitors.

SGLT2 Inhibitors Market Outlook

SGLT2 inhibitors, originally developed to manage type 2 diabetes, have evolved into key therapies for CKD and heart failure, demonstrating strong cardiovascular and renal benefits beyond glucose control. Agents like empagliflozin, dapagliflozin, and canagliflozin have maintained widespread use due to their favorable safety profiles, especially when compared to other drug classes like SGLT2 inhibitors, which face limitations due to severe adverse effects and black box warnings.

The SGLT2 Inhibitors Market Landscape is expanding, with ongoing research exploring their use in conditions such as obesity, NASH, and PCOS. Additionally, combination approaches pairing SGLT2 inhibitors with GLP-1 receptor agonists or mineralocorticoid receptor antagonists are gaining traction, aiming to enhance efficacy and minimize side effects. The future of SGLT2 inhibitors lies in innovative, multi-targeted strategies that address complex chronic diseases beyond diabetes.

SGLT2 Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging SGLT2 inhibitors expected to be launched in the market during 2025–2034. The addition of BRENZAVVY to the standard of care treatment significantly delayed disease progression and has the potential to extend survival for people with T2DM, CKD, and Heart failure who harbor SGLT2 mutations.

SGLT2 Inhibitors Pipeline Development Activities

The SGLT2 Inhibitors Market Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key SGLT2 Inhibitors Companies involved in developing targeted therapeutics. The presence of numerous drugs at different stages is expected to generate immense opportunities for the SGLT2 inhibitors market growth over the forecast period. The report covers information on designation, collaborations, acquisitions and mergers, licensing, and patent details for SGLT2 inhibitors, emerging therapies. The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion.

Lates KOL Views on SGLT2 Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on the SGLT2 inhibitor evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as MD Anderson Cancer Center, Cancer Research UK Barts Centre in London, and Rutgers University etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or SGLT2 inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

KOL Views |

|

“Meta-analyses and reviews confirm that the benefits of SGLT2 inhibitors reduced all-cause mortality, cardiovascular death, and hospitalization for heart failure.” -MD, PhD, Harvard Medical School / Dana-Farber Cancer Institute, US |

|

“The natriuretic and osmotic diuretic effects of SGLT2 inhibitors as key drivers of cardiovascular protection, helping reduce cardiac preload and afterload. Additionally, these agents appear to improve myocardial energetics, reduce oxidative stress, and enhance vascular function, providing broad cardiometabolic advantages.” -PhD, The Institute of Cancer Research, London, UK |

SGLT2 Inhibitor Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival. Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

SGLT2 Inhibitors Market Access and Reimbursement

NICE Decision for JARDIANCE (Empagliflozin)

Empagliflozin is recommended as an option for treating chronic kidney disease (CKD) in adults, only if:

- It is an add-on to optimised standard care, including the highest tolerated licensed dose of angiotensin-converting enzyme (ACE) inhibitors or angiotensin-receptor blockers (ARBs), unless these are contraindicated.

- If people with the condition and their clinicians consider empagliflozin to be 1 of a range of suitable treatments (including dapagliflozin), after discussing the advantages and disadvantages of all the options, use the least expensive. Take into account of administration costs, dosage, price per dose, and commercial arrangements.

- This recommendation is not intended to affect treatment with empagliflozin that was started in the NHS before this guidance was published. People having treatment outside this recommendation may continue without change to the funding arrangements in place for them before this guidance was published, until they and their NHS clinician consider it appropriate to stop.

The SGLT2 Inhibitors Market Report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

SGLT2 Inhibitor Market Report Scope

- The SGLT2 Inhibitors Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining their mechanism and applications in different indications.

- Comprehensive insight into the competitive landscape, forecasts, and future growth potential has been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborate profiles of late-stage and prominent therapies are expected to impact the current treatment landscape.

- A detailed review of the SGLT2 inhibitor Market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The SGLT2 Inhibitors Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM SGLT2 inhibitor market.

SGLT2 Inhibitors Market Report Insights

- SGLT2 Targeted Patient Pool

- SGLT2 Inhibitors Pipeline Analysis

- SGLT2 Inhibitors Market Size and Trends

- Existing and future Market Opportunity

SGLT2 Inhibitors Market Report key strengths

- 11-year SGLT2 Inhibitors Market Forecast

- The 7MM Coverage

- Key Cross Competition

- SGLT2 Inhibitors Drugs Uptake

- Key SGLT2 Inhibitors Market Forecast Assumptions

SGLT2 Inhibitors Market Report assessment

- Current SGLT2 Inhibitors Treatment Practices

- SGLT2 Inhibitors Unmet Needs

- SGLT2 Inhibitors Pipeline Drugs Profiles

- SGLT2 Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the SGLT2 Inhibitor Market Report

- What was the SGLT2 inhibitors market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative SGLT2 inhibitors Market?

- Which indication accounts for maximum SGLT2 inhibitor sales?

- What are the pricing variations among different geographies for approved therapies?

- Do patients have any access issues that are driven by reimbursement decisions?

- What will be the growth opportunities across the 7MM concerning the patient population for SGLT2 inhibitors?

- What are the key factors hampering the growth of the SGLT2 inhibitor market?

- What are the recent novel therapies, targets, and technologies developed to overcome the limitations of existing therapies?

- What key designations have been granted for the emerging therapies for SGLT2 inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy SGLT2 Inhibitor Market Report

- The SGLT2 Inhibitors Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the SGLT2 inhibitor market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the SGLT2 Inhibitors Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing SGLT2 Inhibitors Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles @ New DelveInsight Blogs