Interleukin-13 (IL-13) Inhibitors Market Summary

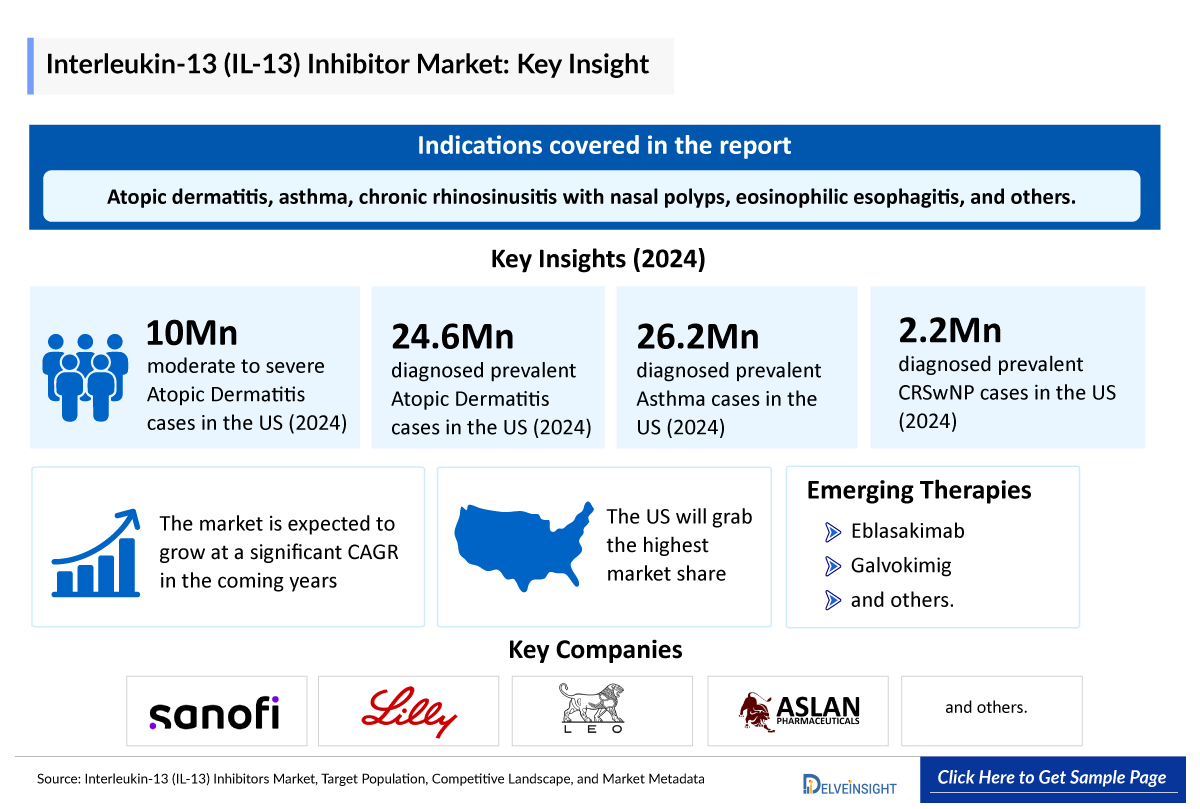

- IL-13 inhibitor market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

Interleukin-13 Inhibitor Market and Targeted Patient Pool Analysis

- IL-13 inhibitors are a class of biologic therapies that target interleukin-13 (IL-13), a key cytokine involved in type 2 inflammation, which plays a major role in the pathogenesis of diseases like atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyps, eosinophilic esophagitis, and others.

- Currently approved IL-13–targeting therapies include DUPIXENT (atopic dermatitis, asthma, CRSwNP, and others), ADBRY (atopic dermatitis), and EBGLYSS (atopic dermatitis).

- There are only a few emerging IL-13 inhibitors in development, with Eblasakimab and Galvokimig among the most notable candidates.

- Major companies involved are Sanofi, Eli Lilly and Company, LEO Pharma, ASLAN Pharmaceuticals, UCB Pharma, and others.

- The US accounted for approximately 9,994,000 cases of moderate to severe atopic dermatitis in 2024.

- More than 3,500 people die of asthma each year, nearly a third of individuals who are of age 65 or older.

DelveInsight’s “IL-13 Inhibitors– Target Population, Competitive Landscape, and Market Forecast–2034” report delivers an in-depth understanding of the IL-13, historical and Competitive Landscape as well as the IL-13 inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The IL-13 inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM IL-13 inhibitors market size from 2020 to 2034. The report also covers current IL-13 treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

IL-13 Inhibitors Epidemiology |

Segmented by:

|

|

IL-13 Inhibitors Key Companies |

|

|

IL-13 Inhibitors Key Therapies |

|

|

IL-13 Inhibitor Market Segmentation |

Segmented by:

|

|

IL-13 Inhibitor Market Analysis |

|

Key Factors Driving the Interleukin-13 Inhibitors Market

Domination of DUPIXENT in the IL-13 market

DUPIXENT (dupilumab), a blockbuster biologic developed by Sanofi and Regeneron, currently dominates the market by targeting IL-4 and IL-13 through IL-4Rα inhibition, and holds approvals for a broad range of type 2 inflammatory conditions.

Large and growing addressable disease burden

Rising prevalence and recognition of type-2 inflammatory diseases, especially moderate-to-severe atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps (CRSwNP), expand the eligible patient pool for IL-13–targeted biologics. According to DelveInsight analysis, the total number of diagnosed prevalent asthma cases is expected to reach 57 million by 2034.

Shift toward next-generation IL-13 inhibitors

Innovation in the IL-13 space is now shifting toward next-generation and more selective IL-13 inhibitors, such as Eblasakimab (ASLAN Pharmaceuticals), which targets IL-13Rα1 to specifically block IL-13 signaling while sparing IL-4, potentially offering a better safety/efficacy balance. Positive Phase II data in dupilumab-experienced patients highlight its promise as a differentiated option. Another emerging asset is Galvokimig (UCB pharma), a bispecific antibody targeting IL-13 along with IL-17A/F, aiming to address overlapping inflammatory pathways in atopic dermatitis and other dermatoses.

Interleukin-13 (IL-13) Inhibitors Understanding

Interleukin-13 (IL-13) Inhibitors Overview

IL-13 inhibitors are a class of biologic therapies that target interleukin-13 (IL-13), a key cytokine involved in type 2 inflammation, which plays a major role in the pathogenesis of diseases like atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyps, and eosinophilic esophagitis. By blocking IL-13 signaling, these therapies help reduce inflammation, improve skin and airway symptoms, and restore barrier function. Currently approved IL-13–targeting therapies include DUPIXENT (dupilumab), which inhibits both IL-4 and IL-13 via IL-4Rα blockade, and is approved for multiple indications including moderate-to-severe atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps (CRSwNP); ADBRY (tralokinumab), a direct IL-13 inhibitor approved for atopic dermatitis in the US and EU; and EBGLYSS (lebrikizumab), recently approved in the EU and US for atopic dermatitis.

Further details related to country-based variations are provided in the report…

IL-13 Inhibitors Epidemiology

The IL-13 inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for IL-13 inhibitor, total eligible patient pool for IL-13 inhibitor in selected indication, and total treated cases in selected indication for IL-13 inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from IL-13 Inhibitor Targeted Patient Pool Analyses and Forecast

- The US accounted for approximately 9,994,000 cases of moderate to severe atopic dermatitis in 2024.

- Among EU4 and the UK, the highest number of cases of atopic dermatitis was found in the UK, whereas Spain accounted for the lowest cases in 2024.

- 7.7% of Americans have asthma. Of these roughly 24.9 million, 20.2 million are adults and 4.6 million are children. Asthma prevalence is higher in adults (8%) than in children (6.5%), and higher in females (9.7%) than in males (6.2%).

- More than 3,500 people die from asthma each year, with nearly one-third of these deaths occurring in individuals aged 65 and older.

- According to DelveInsight’s analysis, the majority of the patients have a higher type-2 asthma endotype.

- According to DelveInsight’s analysis for CRSwNP, the gender distribution of the disease suggests a male predominance in the US.

- Nasal polyps are considered a subtype of chronic rhinosinusitis. Around 20-30% people with CRS have nasal polyps (CRSwNP).

Epidemiology of Selected Indications | |

|

Indication |

Estimated Cases in the US (2024) |

|

Atopic Dermatitis |

~ 24,645,000 (Diagnosed Prevalent) |

|

Asthma |

~26,239,000 (Diagnosed Prevalent) |

|

CRSwNP |

~2,227,000 (Diagnosed Prevalent) |

Note: The List is not exhaustive and will be provided in the report.

IL-13 Drug Chapters

The drug chapter segment of the IL-13 inhibitor reports encloses a detailed analysis of late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the IL-13 inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed IL-13 Inhibitors

ADBRY (tralokinumab): LEO Pharma

ADBRY is an interleukin-13 antagonist indicated for the treatment of moderate-to-severe atopic dermatitis in adults and pediatric patients 12 years of age and older whose disease is not adequately controlled with topical prescription therapies or when those therapies are not advisable. ADBRY can be used with or without topical corticosteroids. ADBRY received approval from the US FDA in December 2021 for the treatment of moderate-to-severe atopic dermatitis in adults. Subsequently, in December 2023, the indication was expanded to include pediatric patients 12 years and older. The autoinjector received approval in June 2024 for adult patients.

EBGLYSS (lebrikizumab): Eli Lilly and Company

EBGLYSS is an injectable medicine used to treat adults and children 12 years of age and older who weigh at least 88 pounds (40 kg) with moderate-to-severe eczema (atopic dermatitis) that is not well controlled with prescription therapies used on the skin (topical), or who cannot use topical therapies. In September 2024, the US FDA approved EBGLYSS. It is not known if EBGLYSS is safe and effective in children less than 12 years of age or children 12 years to less than 18 years of age who weigh less than 88 pounds (40 kg).

|

Product |

Company |

RoA |

Indication |

Initial US FDA Approval |

|

ADBRY (tralokinumab) |

LEO Pharma |

SC |

Moderate-to-severe atopic dermatitis |

2021 |

|

EBGLYSS (lebrikizumab) |

Eli Lilly and Company |

SC |

Moderate-to-severe atopic dermatitis |

2024 |

|

DUPIXENT (dupilumab) |

Sanofi and Regeneron |

SC |

Moderate-to-severe atopic dermatitis |

2017 |

|

Asthma |

2018 | |||

|

Chronic Rhinosinusitis with Nasal Polyps |

2019 | |||

|

* DUPIXENT is approved for a broad range of diseases beyond those mentioned in the table, including eosinophilic esophagitis, prurigo nodularis, and more recently, COPD with type 2 inflammation. | ||||

Note: The list is not exhaustive. Detailed current therapies assessment will be provided in the full report…..

Emerging IL-13 Inhibitors

Eblasakimab: ASLAN Pharmaceuticals

Eblasakimab is an investigational monoclonal antibody developed by ASLAN Pharmaceuticals that selectively targets IL-13 receptor alpha-1 (IL-13Rα1), inhibiting IL-13 signaling while sparing IL-4. It is in Phase II development for moderate-to-severe atopic dermatitis. In mid-2024, ASLAN announced positive interim results from the ongoing Phase II TREK-DX trial, which is evaluating Eblasakimab in patients previously treated with dupilumab. In the study, 60% of patients receiving 400 mg Eblasakimab weekly achieved EASI-90 at 16 weeks, showing promising efficacy even in those.

Galvokimig: UCB Pharma

Galvokimig is a bispecific investigational antibody designed to target IL-13 and IL-17A, and IL-17F, which are key mediators of inflammation. It is being studied for the treatment of moderate-to-severe atopic dermatitis, a type of eczema associated with inflammation of the skin, which causes the skin to become itchy, red, dry, and cracked. Currently in Phase I/II of the development phase.

|

Product |

Company |

RoA |

Phase |

Indication |

|

Eblasakimab |

ASLAN Pharmaceuticals |

SC |

II |

Moderate-to-severe atopic dermatitis |

|

Galvokimig |

UCB Pharma |

IV |

I/II |

Atopic dermatitis |

Note: A Detailed emerging therapies assessment will be provided in the final report.

IL-13 Inhibitor Market Outlook

The IL-13 inhibitor class has rapidly gained traction as a targeted treatment approach for atopic dermatitis, asthma, CRSwNP, and others. IL-13 plays a central role in tissue inflammation and barrier dysfunction in these conditions. By blocking IL-13 or its receptor, these biologics reduce downstream inflammation, restore barrier function, and offer steroid-sparing, disease-modifying effects.

The market is currently led by DUPIXENT (dupilumab), a blockbuster biologic from Sanofi and Regeneron that inhibits both IL-4 and IL-13 via IL-4Rα, with approvals across a wide spectrum of type 2 inflammatory diseases. Direct IL-13 blockers ADBRY (tralokinumab) by LEO Pharma and EBGLYSS (lebrikizumab) by Eli Lilly have entered the market more recently, targeting moderate-to-severe AD in both adult and adolescent populations. These agents offer alternatives for patients intolerant or unresponsive to IL-4Rα inhibitors, with comparable efficacy and differentiated dosing and delivery.

Innovation in the IL-13 space is now shifting toward next-generation and more selective IL-13 inhibitors, such as Eblasakimab (ASLAN Pharmaceuticals), which targets IL-13Rα1 to specifically block IL-13 signaling while sparing IL-4, potentially offering a better safety/efficacy balance. Positive Phase II data in dupilumab-experienced patients highlight its promise as a differentiated option. Another emerging asset is Galvokimig (UCB pharma), a bispecific antibody targeting IL-13 along with IL-17A/F, aiming to address overlapping inflammatory pathways in atopic dermatitis and other dermatoses.

IL-13 Inhibitor Drug Uptake

This section focuses on the uptake rate of potential emerging IL-13 expected to be launched in the market during 2025–2034.

IL-13 Inhibitor Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for the IL-13 inhibitor market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for IL-13 inhibitor therapies.

Latest KOL Views on IL-13 Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on IL-13 Inhibitor's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the University of California, Yale University / Central Connecticut Dermatology, Kyoto University, University of Manchester / Salford Royal NHS Trust, and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or IL-13 market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

Among biologics approved for moderate-to-severe AD, lebrikizumab is characterized by a unique mechanism of action and an attractive maintenance regimen, besides good efficacy and safety profiles. Moreover, clinical evidence suggests that patients naive or pre-treated with other biologics and affected by AD localized in sensitive areas and by type 2 comorbidities might be successfully treated with lebrikizumab.” MD, University of California, US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on IL-13 Inhibitors Market

- In 2025, Bristol Myers Squibb discontinued cendakimab, its IL-13–targeting antibody for eosinophilic esophagitis (EoE), despite meeting Phase III endpoints. The move is part of the CEO's expanded USD 3.5 billion cost-cutting plan, which raises the bar for commercial viability. This exit cements DUPIXENT’s lead in the EoE market, with no near-term IL-13 competitor from BMS.

- In April 2024, ASLAN announced positive interim results from a Phase II Study (TREK-DX) of Eblasakimab in moderate-to-severe atopic dermatitis adult patients previously treated with dupilumab. ASLAN entered into an exclusive license with Zenyaku Kogyo in June 2023 to develop and commercialize Eblasakimab to treat atopic dermatitis in Japan.

- LEO Pharma presented long-term data at the 2024 Fall Clinical Dermatology Conference showing that ADBRY (tralokinumab) maintains a consistent safety profile for up to 6 years in patients aged 12 and above with moderate-to-severe atopic dermatitis, including effectiveness in challenging areas like the hands, feet, and genitals.

The list is not exhaustive and will be provided in the final report

Scope of the IL-13 Inhibitor Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of IL-13, explaining its mechanism and therapies.

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborate profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the IL-13 market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM IL-13 market.

IL-13 Inhibitor Report Insights

- IL-13 Targeted Patient Pool

- Therapeutic Approaches

- IL-13 Pipeline Analysis

- IL-13 Market Size and Trends

- Existing and Future Market Opportunities

IL-13 Inhibitor Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

IL-13 Inhibitor Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

Key Questions Answered in the IL-13 Inhibitor Market Report

- What was the IL-13 inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for IL-13 Inhibitor?

- What are the risks, burdens, and unmet needs of treatment with IL-13-based/targeting therapies? What will be the growth opportunities across the 7MM for the patient population of IL-13-based/targeting therapies?

- What are the key factors hampering the growth of the IL-13 Inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for IL-13 inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy IL-13 Inhibitor Market Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the IL-13 Inhibitor Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.