Lewy Body Dementia Market

- In 2022, Approximately 11 Million diagnosed dementia cases existed in the 7MM, with around 0.6 million identified as dementia with Lewy bodies (DLB). Factors such as aging populations, improved diagnostic criteria, heightened awareness, and demographic/lifestyle shifts are expected to drive an increase in DLB cases by 2034.

- Analysts at DelveInsight have observed a significant uptick in the Lewy Body Dementia Prevalence. Advancements in scientific knowledge and collaborations are expected to drive market growth including development of targeted therapies.

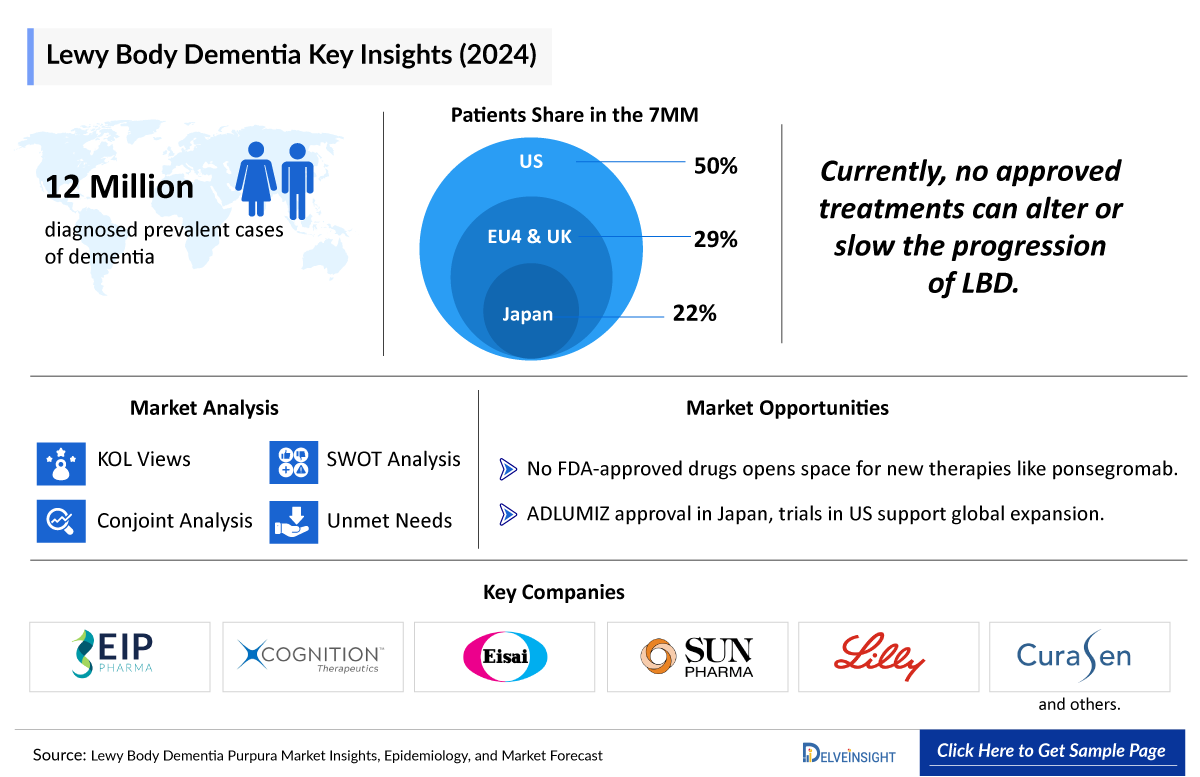

- The leading Lewy Body Dementia Companies, including EIP Pharma Inc., Cognition Therapeutics, and others, are developing assets in the early to mid-stages of development to drive the Lewy Body Dementia Treatment Market forward. Many molecules are in the pipeline to treat Lewy Body Dementia Patients across various countries such as CT1812, Irsenontrine (E2027), Neflamapimod, LY3154207 (mevidalen), and others.

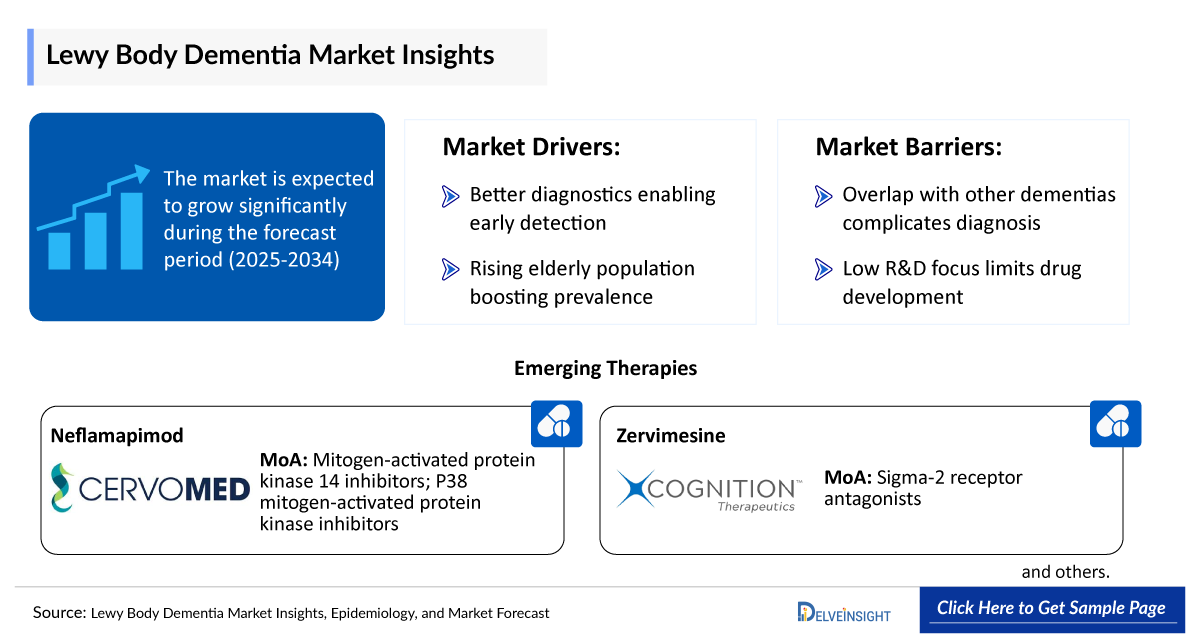

- With the expected approval of these therapies during the forecast period (2023–2034), the overall Lewy Body Dementia Therapeutics Market is projected to experience a significant upsurge at a substantial Compound Annual Growth Rate (CAGR).

Request for unlocking the sample page of the "Lewy Body Dementia Treatment Market"

DelveInsight’s report titled “Lewy Body Dementia Treatment Market Insights, Epidemiology, and Market Forecast – 2034” comprehensively analyzes Lewy Body Dementia. The report provides a comprehensive analysis of historical and projected epidemiological data, covering Total Prevalent Cases of Dementia, Total Diagnosed Prevalent Cases of Dementia, and Total Diagnosed Prevalent Cases of Dementia with Lewy Bodies (DLB). Additionally, it offers detailed segmentation by gender-specific and age-specific diagnosed prevalent cases of DLB, providing valuable insights into the demographic patterns and trends associated with this neurodegenerative disorder.

The Lewy Body Dementia Treatment Market Report offers an in-depth understanding of the various aspects related to the patient population, including diagnosis, prescription patterns, physician perspectives, market access, treatment, and future market developments for the seven major markets, including the United States, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan from 2020 to 2034. To gauge the market’s overall potential and identify business opportunities, the report discusses current Dementia with Lewy Bodies (DLB) treatment practices and algorithms and the related Lewy Body Dementia Unmet Medical Needs.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2023-2034 |

|

Geographies Covered |

|

|

Lewy Body Dementia Market |

|

|

Lewy Body Dementia Market Size | |

|

Lewy Body Dementia Companies |

|

Lewy Body Dementia Treatment Market

Overview

Dementia with Lewy Bodies (DLB) stands as a progressive neurodegenerative condition characterized by cognitive decline, visual hallucinations, and motor symptoms akin to Parkinson's disease. Ranked as the second most prevalent degenerative dementia after Alzheimer's disease, DLB poses diagnostic challenges due to its symptom overlaps with other disorders, necessitating comprehensive assessments blending clinical, imaging, and biomarker data for enhanced accuracy. Its diagnosis demands clinical acumen and a keen awareness, given its fluctuating cognitive patterns, varied motor presentations, and notable visual hallucinations, all of which contribute to its intricate management landscape. Furthermore, the association of DLB with REM sleep behavior disorder underscores its multifaceted nature and emphasizes the need for specialized care approaches to navigate its complexities effectively.

Lewy Body Dementia Diagnosis and Treatment Algorithm

The diagnosis and treatment algorithm for Dementia with Lewy Bodies (DLB) present multifaceted challenges due to the condition's complex symptomatology and overlap with other neurodegenerative disorders. Diagnosing DLB requires a comprehensive assessment integrating clinical evaluation, neuroimaging, and biomarker analysis, given its fluctuating cognitive symptoms, variable motor manifestations, and prominent visual hallucinations, which often lead to misdiagnosis or delayed diagnosis. Effective treatment entails managing symptoms such as cognitive decline, hallucinations, motor dysfunction, and sleep disturbances, although medications may have limited efficacy and potential side effects, necessitating individualized approaches.

A multidisciplinary team approach, involving neurologists, psychiatrists, geriatricians, neuropsychologists, and other healthcare professionals, is crucial for optimal DLB management. Non-pharmacological interventions, including cognitive stimulation therapy, physical exercise, and caregiver support programs, are also essential for enhancing quality of life. Ongoing research aims to develop disease-modifying treatments, improve diagnostic accuracy, and enhance symptom management strategies to address the unique challenges posed by DLB comprehensively.

Lewy Body Dementia Epidemiology

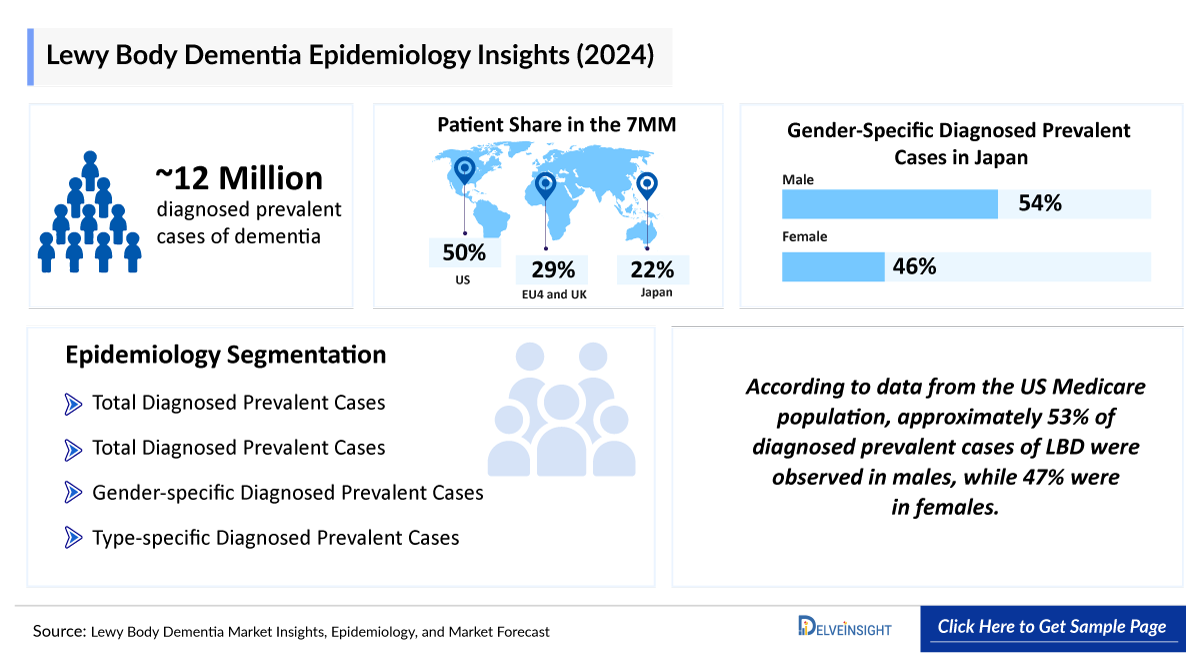

The Lewy Body Dementia epidemiology section provides insights into the historical and current Dementia with Lewy Bodies (DLB) patient pool and forecasted trends for seven individual major countries. It helps recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the report also provides the diagnosed patient pool, its trends, and assumptions undertaken.

Key Findings

- The Lewy Body Dementia Prevalence across the 7MM in 2022 was significant, with an estimated total of approximately 21 million cases, of which around 52% were diagnosed. Projections suggest a continued increase in cases throughout the forecasted period from 2023 to 2034.

- Among the 7MM countries, the United States emerged with the highest diagnosed prevalent cases of dementia, reaching around 5 million individuals. Notably, only approximately 0.3 million, or 5.9% of these cases, were identified as dementia with Lewy bodies, signifying a significant distribution among various dementia subtypes.

- Japan ranked second after the United States in terms of diagnosed prevalent cases of DLB in 2022, accounting for approximately 0.13 million cases, followed by the UK with around 44 thousand cases of all cases across the 7MM.

- DelveInsight's findings highlighted a gender disparity in DLB prevalence across the 7MM, with more cases identified among males compared to females in 2022. Projections suggest a further increase by 2034, urging deeper exploration into factors such as genetic susceptibility and healthcare-seeking behaviors driving this trend.

- In the segmented age groups of 60–69 years, 70–74 years, 75–79 years, 80–84 years, and 85+ years, the highest number of diagnosed cases of DLB was estimated to be in the 85+ years group.

Lewy Body Dementia Treatment Market

The Lewy Body Dementia treatment market anticipates growth driven by increased awareness and healthcare infrastructure spending. With the rising prevalence of DLB and advancements in understanding the disorder, targeted therapies are expected to drive market expansion. However, the current treatment landscape primarily focuses on symptomatic management, lacking curative options. Mainstay treatments include Acetylcholinesterase inhibitors, Anti-depressants, Anti-psychotics/Mood stabilizers, and Other therapies, aiming to alleviate symptoms. While Japan has seen Donepezil approval, the US and EU4, and the UK await exclusive treatment opportunities, indicating ongoing shifts in treatment patterns and the quest for improved therapeutic options.

The Dementia with Lewy Bodies treatment market suggests a promising landscape with opportunities for innovation, improved treatment options, and better outcomes for individuals affected by this neurodegenerative disorder. According to DelveInsight, the Dementia with Lewy Bodies (DLB) market in the 7MM is expected to change during the study period 2020–2034 significantly.

Lewy Body Dementia Marketed Drugs

The current Lewy Body Dementia treatment market landscape primarily focuses on symptomatic management, lacking curative or disease-modifying therapies. In 2014, donepezil (ARICEPT) became the first approved DLB treatment in Japan, followed by an expanded approval for zonisamide (TRERIEF) in 2018, the world's first drug indicated for parkinsonism in DLB. Both drugs have gone generic in the Japanese market. While no EMA and FDA-approved DLB treatments exist, off-label use of Alzheimer's drugs like cholinesterase inhibitors, antipsychotics, and other medications such as memantine and zonisamide are common. Cholinesterase inhibitors like donepezil and rivastigmine are recommended as first-line treatments for DLB, targeting cognitive and psychiatric symptoms.

Lewy Body Dementia Emerging Drugs

The Lewy Body Dementia drugs market dynamics are expected to change, primarily due to increased healthcare spending worldwide. Lewy Body Dementia Companies such as Cognition Therapeutics, Athira Pharma, Eisai Inc., Eli Lilly and Company, EIP Pharma Inc. and others are actively involved in developing Lewy Body Dementia treatments.

- Neflamapimod: EIP Pharma Inc.

EIP Pharma Inc.’s Neflamapimod is a brain-penetrant, oral small molecule that inhibits the intracellular enzyme p38 MAP kinase alpha (p38α). While p38 alpha protects cells from an acute injury, chronically activated p38 alpha activity within neurons can damage synapses and contribute to alpha-synuclein-associated toxicity. In November 2020, the US FDA granted FTD to neflamapimod to investigate treating DLB. The drug has completed a Phase IIa study showing that neflamapimod improves cognitive function in patients with mild-to-moderate DLB. Additionally, the company has initiated a confirmatory Phase IIb clinical trial for DLB.CT1812: Cognition Therapeutics

Cognition Therapeutics’ CT1812, is an orally administered drug. By acting to inhibit the formation of the deleterious α-synuclein oligomers responsible for DLB and the toxic Aβ oligomers driving Alzheimer's disease, CT1812 has the potential to halt the advancement of both diseases. During the course of a 24-week double-blind treatment phase, patients with dementia with Lewy bodies were being investigated for the safety and efficacy of CT1812. The clinical development is currently in Phase II trial in the US.

Lewy Body Dementia Market Segmentation

DelveInsight’s ‘Lewy Body Dementia Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future Dementia with Lewy Bodies (DLB) market, segmented within countries and by therapies. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Lewy Body Dementia Market Size by Countries

The total Lewy Body Dementia market size is analyzed for individual countries (the United States Market, EU4 (Germany, France, Italy, and Spain) and the UK market, and Japan). The United States accounted for a larger portion of the 7MM market for Dementia with Lewy Bodies (DLB) in 2022 due to the high prevalence of the condition and the higher cost of treatments. This dominance is predicted to continue with the potential early entry of new products.

Lewy Body Dementia Market Size by Therapies

Lewy Body Dementia market size for therapies is segmented into the current market and the emerging market for the study period spanning from 2020 to 2034. Presently, there are no drugs approved by the FDA and EMA for managing DLB. However, in Japan, Donepezil and Zonisamide were previously approved but now face competition from generics. Emerging drugs expected to launch during the forecast period include Neflamapimod and others, with anticipated availability soon. These drugs have demonstrated promising safety and tolerability profiles. Despite a limited pipeline, there are few emerging drugs in the forecast, as clinical trials in DLB treatment primarily encounter challenges, with many trials failing by Phase II.

Lewy Body Dementia Drugs Uptake

This section focuses on the sales uptake of potential Lewy Body Dementia drugs that have recently launched or are anticipated to be launched in the Dementia with Lewy Bodies (DLB) market between 2020 and 2034. It estimates the market penetration of the Dementia with Lewy Bodies (DLB) drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the drug’s probability of success (PoS) in the Dementia with Lewy Bodies (DLB) market. The emerging Lewy Body Dementia Therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the Lewy Body Dementia Market.

Lewy Body Dementia Treatment Market Access and Reimbursement

DelveInsight’s ‘Lewy Body Dementia Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of Dementia with Lewy Bodies (DLB). This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views

To keep up with current Dementia with Lewy Bodies (DLB) market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Dementia with Lewy Bodies (DLB) domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Dementia with Lewy Bodies (DLB) market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Dementia with Lewy Bodies (DLB) unmet needs.

Lewy Body Dementia Drugs Market: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as the Department of Psychiatry and Psychology, US; National Institute on Ageing, US; Memory Resource and Research Centre, France; Department of Neurology, Hospital Universitario Río Hortega, Spain; Institute for Ageing and Health, Newcastle University, UK; Department of Neurology and Neurobiology of Aging, Kanazawa, Japan; and others.

“DLB is often misdiagnosed due to the lack of accuracy in diagnostic criteria. Established diagnosis criteria have limited sensibility and specificity; hence, the availability of biomarkers can improve diagnosis.” “DLB is the second most common neurodegenerative dementia after Alzheimer’s disease in autopsy studies, accounting for about 15%–20% of dementia but observed to be around 5–7% in dementia subtype epidemiology studies.”

Competitive Intelligence Analysis

We perform Competitive and Lewy Body Dementia Drugs Market Intelligence analysis of the Dementia with Lewy Bodies (DLB) Market using various Competitive Intelligence tools, including SWOT analysis, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Lewy Body Dementia Pipeline Development Activities

The Lewy Body Dementia therapeutics market report provides insights into therapeutic candidates in Phase II and III stages. It also analyzes Lewy Body Dementia Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Lewy Body Dementia therapeutics market report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Lewy Body Dementia therapies.

Lewy Body Dementia Treatment Market Report Insights

- Patient-based Lewy Body Dementia Market Forecasting

- Therapeutic Approaches

- Lewy Body Dementia Pipeline Analysis

- Lewy Body Dementia Market Size and Trends

- Lewy Body Dementia Drugs Market Opportunities

- Impact of Upcoming Therapies

Lewy Body Dementia Treatment Market Report Key Strengths

- 12 Years Lewy Body Dementia Market Forecast

- The 7MM Coverage

- Lewy Body Dementia Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Dementia with Lewy Bodies Drugs Market

- Lewy Body Dementia Drugs Uptake

Lewy Body Dementia Treatment Market Report Assessment

- Current Lewy Body Dementia Treatment Market Practices

- Unmet Needs

- Lewy Body Dementia Pipeline Product Profiles

- Lewy Body Dementia Drugs Market Attractiveness

Key Questions

- What are the key findings of the Lewy Body Dementia Market across the 7MM, and what country will have the largest Lewy Body Dementia Market Size during the forecast period (2023–2034)?

- At what CAGR is the Lewy Body Dementia Drugs Market, and is epidemiology expected to grow in the 7MM during the forecast period (2023-2034)?

- What are the key drivers of growth in the Lewy Body Dementia Drugs Market (2023–2034)?

- What are the most commonly prescribed medications for Lewy Body Dementia Market (2023–2034)?

- Are regulatory or reimbursement challenges affecting the Lewy Body Dementia Market (2023–2034)?

- Are there any market barriers or challenges hindering the growth of the Dementia with Lewy Bodies (DLB) market (2023–2034)?

- What strategies are pharmaceutical Lewy Body Dementia Companies adopting to capture a larger share of the Dementia with Lewy Bodies (DLB) market (2023–2034)?

Stay updated with us for Recent Articles

-epidemiolog.png&w=256&q=75)