Regulatory T cells (Tregs) Market Summary

- The Regulatory T cells market in the 7MM is projected to grow at a significant CAGR by 2034 in the leading countries (US, EU4, UK and Japan).

Regulatory T Cells (Tregs) Market and Epidemiology Analysis

- Among the 7MM, the United States is estimated to have the largest market size, i.e., approximately 76% of the overall market by 2034.

- Treg-based therapies and targeting Tregs have a meaningful effect on autoimmune disease, oncology, and neurodegenerative disorders.

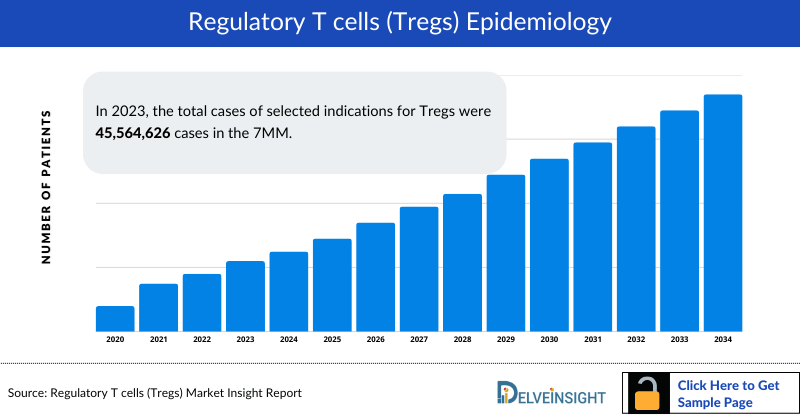

- In 2023, the total cases of selected indications for Tregs were 45,564,626 cases in the 7MM. These cases are expected to increase by 2034. Among all the indications, atopic dermatitis accounted for the highest number of cases.

- Despite the promising advancements in Treg therapies targeting a wide range of diseases, there are currently no approved treatments, highlighting a significant unmet need. This gap underscores the potential for first-mover advantage in the field, with opportunities to address critical therapeutic areas.

- The Treg therapy pipeline is highly promising, featuring numerous key assets in mid- and early-stage development. Key players, such as Rapa Therapeutics (RAPA-501), TRACT Therapeutics and Taiwan Bio Therapeutics (TRK-001), Quell Therapeutics (QEL-001), Nektar (rezpegaldesleukin) Georgiamune (GIM-531), Sangamo Therapeutics (TX200), Abata Therapeutics (ABA-101), Novabio Therapeutics (NP001 cell injection), Cellenkos (CK0801), Cellenkos and Incyte (CK0804), ILTOO Pharma (ILT-101), Coya Therapeutics and Dr. Reddy’s Laboratories (Coya 302), among others are developing effective Treg therapies targeting a wide range of diseases.

- The pipeline features a diverse range of Treg-augmenting biologics, Treg-derived exosome technologies, and both autologous and allogeneic Treg cell therapies, with emerging allogeneic "off-the-shelf" products offering the potential to improve scalability and reduce costs.

- In October 2024, Nektar announced to publishing of the results from Phase Ib studies of rezpegaldesleukin in atopic dermatitis and psoriasis in nature communications.

- In October 2024, Egle Therapeutics presented preclinical efficacy data for EGL-001, a CTLA-4/CD25 antagonist fusion protein at the Society for Immunotherapy of Cancer Meeting.

- In October 2024, REGiMMUNE and Kiji Therapeutics announced an intention to merge companies, which will create a pan-global Treg specialist to use multiple modalities to target Tregs for several indications.

- In September 2024, Sonoma Biotherapeutics announced that it had received a USD 45 million milestone payment from Regeneron Pharmaceuticals under the terms of its active collaboration to discover, develop, and commercialize engineered Tregs therapies for autoimmune diseases.

- In August 2024, the FDA cleared the IND application for TRX103 to treat patients with refractory Crohn’s disease.

- In August 2024, Abata Therapeutics announced the US FDA granted Fast Tract Designation (FTD) for ABA-101 for the treatment of patients with progressive multiple sclerosis.

- In March 2024, Sonoma Biotherapeutics and Regeneron Pharmaceuticals announced a collaboration for the discovery, development, and commercialization of novel Tregs therapies for autoimmune diseases.

- Among the leading indication in the Treg pipeline includes the prevention of rejection in transplant (Liver, Kidney and HSCT) with key assets such as TRK-001 for preventing allograft rejection in living donor kidney transplants and QEL-001 for liver transplant rejection prevention, while Orca-T with Tacrolimus and RGI-2001 targets the prevention of Graft versus Host Disease (GvHD) in advanced hematologic malignancies undergoing alloHSCT. Amyotrophic lateral sclerosis is another key focus in the pipeline, with notable therapies in development including RAPA-501, COYA 302, and ILT-101.

- In addition to these early-to-late-stage therapies, the field also features a diverse pipeline of preclinical candidates targeting a wide range of autoimmune diseases, including Quell Therapeutics’s QEL-004, QEL-002, QEL-003, Abata Therapeutics’s ABA 201, Parvus Therapeutics’ PVT401, and several others.

- Looking ahead, Treg therapies are poised for significant growth, driven by a robust pipeline, precision medicine advancements, and rising autoimmune and inflammatory disease prevalence.

Factors Impacting the Regulatory T Cells Market Growth

- Expanding disease burden: Increasing incidence of autoimmune conditions including Crohn's disease, multiple sclerosis, rheumatoid arthritis, type 1 diabetes, and inflammatory bowel diseases where immune dysregulation is prevalent

- Demographic shift: Significant rise in geriatric population with enhanced life expectancy leading to higher incidence of age-related immune disorders and chronic conditions

- Metabolic and neurological disorders: Increasing prevalence of age-associated metabolic and neurological conditions amenable to Treg-based immune modulation

- Enhanced understanding of immune regulation: Heightened scientific understanding of Tregs' immunoregulatory functions and their role in maintaining immune tolerance

- Manufacturing innovations: Advancements in stem cell therapy technologies and scalable manufacturing processes improving product yield and accessibility

- Precision immunotherapy: Shift toward targeted immunotherapies addressing specific immune dysregulation rather than broad immunosuppression

- Collaborative innovation: Strategic partnerships between academic institutions, biopharmaceutical companies, and regulatory bodies accelerating clinical advancement and knowledge sharin

DelveInsight’s "Regulatory T cells (Tregs) Market Size, Target Population, Competitive Landscape & Market Forecast – 2034" report delivers an in-depth understanding of Tregs, historical and forecasted epidemiology as well as the Tregs therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Tregs market report provides current treatment practices, emerging drugs, Tregs market share of individual therapies, and current and forecasted Tregs market size from 2020 to 2034, segmented by seven major markets. The report also covers current Tregs treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Regulatory T cells Market |

|

|

Regulatory T cells Market Size | |

|

Regulatory T cells Companies |

Orca Bio, Rapa Therapeutics, Tract Therapeutics and Taiwan Bio Therapeutics, ILTOO Pharma, Nektar, PolTREG, REGiMMUNE, Quell Therapeutics, Georgiamune, Sangamo Therapeutics, Egle Therapeutics, RAPT Therapeutics, Tr1X, Nanjing Immunophage Biotech, Cellenkos and Incyte, Abata Therapeutics, Novabio Therapeutics, Cellenkos, Sonoma Biotherapeutics, Coya Therapeutics and Dr. Reddy’s Laboratories, Cugene/AbbVie, Dialectic Therapeutics, and others. |

|

Regulatory T cells Epidemiology Segmentation |

|

Regulatory T Cells Understanding

Tregs Overview

Over the last decade, T-cell therapy has taken a huge revolution. T cells are classified broadly into proinflammatory and anti-inflammatory populations that form three main groups, proinflammatory CD8 T, CD4 T Helper (Th) cells, and Regulatory T cells (Tregs). Tregs suppress inflammatory responses, promote immunological tolerance, and control immune responses to prevent autoimmunity. Treg-mediated immunosuppression involves several immune-suppressive mechanisms, including CTLA4-mediated APC suppression, IL-2 consumption, and immunosuppressive cytokines and metabolite production. Furthermore, the Treg-mediated inhibitory pathways impeding various immune cells have been classified as direct pathways, where Tregs induce a direct response on the immune cell, and indirect pathways, under which another cell or molecule is influenced, which in turn inhibit the immune cells.

Tregs development is more prominently rooted in immunology due to their role in maintaining immune balance or homeostasis. While Tregs are indeed a cornerstone of immunological research, their relevance to cancer is also seen, particularly in the Tumor Microenvironment (TME).

Further details related to treatment will be provided in the report…

Regulatory T Cells Epidemiology

Tregs epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Cases of Selected Indication for Tregs, Indication-wise Eligible Cases, and Indication-wise Treated Cases, in the 7MM, covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Regulatory T Cells Epidemiology Analysis and Forecast

- In 2023, the total cases of selected indications for Tregs were approximately 45,564,626 cases in the 7MM, which is anticipated to increase by 2034.

- Among all the indications, Atopic Dermatitis accounted for highest number of cases, while Aplastic Anemia occupied the bottom of the ladder.

- In the 7MM, Atopic Dermatitis accounted for highest number of indication-wise eligible cases, i.e., nearly 39,046,011 cases, in 2023.

Regulatory T Cells Epidemiology Segmentation

- Total Cases of Selected Indications

- Indication-wise Eligible Cases

- Indication-wise Treated Cases

Regulatory T Cells Drug Chapters

Regulatory T Cells Emerging Drugs

Orca-T: Orca Bio

Orca-T is an investigational allogeneic T-cell immunotherapy being evaluated in clinical trials for the treatment of multiple hematologic malignancies.

Orca-T is currently being evaluated in a pivotal Phase III clinical trial that has completed enrollment at leading transplant centers across the US. It is designed to deliver improved outcomes for patients while overcoming the limitations of standard allogeneic HSCT. The company is expecting topline results of the Orca-T pivotal Phase III clinical trial vs. a conventional allogeneic stem cell transplant in the first half of 2025.

RAPA-501: Rapa Therapeutics

RAPA-501 is a cell treatment that is thought to protect motor neurons from inflammation. RAPA-501 aims to increase the levels of Tregs in people with MND. The Phase I study successfully showed RAPA-501 to be safe in a small cohort of nine people. The open-label study offered most participants two doses over 42 days. The study also showed an increase in T-reg cell protective markers.

Currently, Rapa Therapeutics is conducting a Phase II/III clinical trial of RAPA-501 in patients with ALS, where the treatment has demonstrated safety (with no product-related adverse events), biological activity (exhibiting diverse anti-inflammatory effects), and early indications of potentially slowing the decline in pulmonary function. Rapa’s clinical trial efforts using RAPA-501 have been partially supported by an award from the ALS Association.

|

Company |

Highest Phase |

Indication |

RoA |

MoA |

|

Orca Bio |

III |

Advanced hematologic malignancies undergoing allogeneic hematopoietic cell transplantation (Acute Myeloid Leukemia [AML], Acute Lymphocytic Leukemia [ALL], and high-risk Myelodysplastic Syndrome (MDS]) |

IV infusion |

T lymphocyte replacements |

|

Rapa Therapeutics |

II/III |

ALS |

IV infusion |

T-lymphocyte replacement |

|

Tract Therapeutics and Taiwan Bio Therapeutics |

II |

Kidney transplantation rejection |

IV infusion |

Restores immune balance so the body accepts foreign organs after transplantation |

|

ILTOO Pharma |

II |

Type 1 diabetes, COVID 19, recurrent miscarriage rheumatoid arthritis, ankylosing spondylitis, SLE, psoriasis, Behcet's disease, Wegener's granulomatosis,Takayasu's disease, Crohn's disease, ulcerative colitis, autoimmune hepatitis, sclerosing cholangitis, Gougerot-sjagren, idiopathic thrombocytopenic purpura (ITP), systemic sclerosis, bipolar depression, advanced-stage solid tumors |

SC |

IL-2 replacements |

|

Nektar |

II |

Atopic dermatitis, Alopecia areata, SLE, Psoriasis |

SC |

IL-2 T regulatory cell stimulator |

|

PolTREG |

II |

Pre-symptomatic diabetes type 1 (stage 1) and relapsing-remitting multiple sclerosis |

Intrathecal; IV |

Regulatory T-lymphocyte replacements |

|

REGiMMUNE |

II |

Prevention of acute graft-vs-host disease (GVHD) following allogeneic hematopoietic stem cell transplantation |

IV |

Immunomodulators; α-galactosylceramide analog |

|

Quell Therapeutics |

I/II |

Rejection: Transplant, Liver; Liver Failure and Liver Diseases |

IV infusion |

HLA-A2 targeted |

|

Georgiamune |

I/II |

Melanoma stage IV and solid tumor |

Oral |

Treg Inhibitor |

|

Sangamo Therapeutics |

I/II |

Kidney transplant rejection |

IV infusion |

T-lymphocyte replacements |

|

Egle Therapeutics |

I/II |

Selected advanced/metastatic solid tumors |

IV |

Treg-selective anti-CTLA4-IL-2m |

|

RAPT Therapeutics |

I/II |

NSCLC, head and neck squamous cell carcinoma (HNSCC), nasopharyngeal carcinoma, metastatic triple negative breast cancer (TNBC), urothelial carcinoma, gastric cancer, esophageal carcinoma, cervical cancer, classical hodgkin lymphoma (CHL) |

Oral |

CCR4 antagonist |

|

Tr1X |

I/II |

Moderate to severe treatment-refractory Crohn's disease and hematological malignancies undergoing HLA-mismatched related or unrelated hematopoietic stem cell transplantation |

Infusion via central line |

Regulatory T-lymphocyte replacements |

|

Nanjing Immunophage Biotech |

I/IIa |

Advanced solid tumors |

Oral |

CCR8 antagonist |

|

Cellenkos and Incyte |

Ib |

Myelofibrosis |

IV infusion |

Exploit the CXCR4/CXCL12 axis |

|

Abata Therapeutics |

I |

Progressive multiple sclerosis |

IV infusion |

Express TCR that specifically recognizes immunogenic myelin fragments |

|

Novabio Therapeutics |

I |

Neurodegenerative diseases |

Intrathecal injection |

Regulatory T-lymphocyte replacement |

|

Cellenkos |

I |

Bone marrow failure syndrome |

IV infusion |

Replaces defective Tregs and protects the body from T-cell attack |

Regulatory T Cells Market Outlook

Over the last decade, T-cell therapy has taken a huge revolution. The idea of targeting Tregs resistance and Tregs dysfunction in a combined approach is still relatively new and in its infancy. Discovered as a specialized subset of CD4+ T cells expressing the FOXP3 transcription factor, Tregs are essential for suppressing excessive immune activation and preventing autoimmune reactions. Over the years, advancements in immunology have underscored the potential of Tregs in treating autoimmune disorders, chronic inflammatory diseases, and transplant rejection, as well as their modulation in cancer therapy.

The therapeutic potential of Tregs is expanding rapidly with next-generation approaches addressing earlier challenges. Polyclonal Tregs showed promise but faced issues like stability and scalability. Advances such as antigen-specific and CAR-Tregs now enable precise targeting of disease pathways with reduced side effects, reshaping the treatment landscape.

The market for Treg therapies remains wide open, as no treatments have been approved yet, signaling a substantial unmet need. The dynamics of Treg therapy market is anticipated to change as companies across the globe are thoroughly working toward the development of new Treg therapies options to treat a wide array of indications such as Systemic lupus erythematosus (SLE), lupus nephritis, Atopic dermatitis, Rheumatoid arthritis, Psoriasis, Progressive Multiple Sclerosis, Inflammatory Bowel Disease, Ulcerative Colitis, Crohn's Disease, Bone Marrow Failure Syndrome (BMF), Kidney Transplant, Myelofibrosis, Liver Transplant, Aplastic Anemia, Amyotropic Lateral Sclerosis (ALS), Hematopoietic stem-cell transplantation (HSCT), HNSCC, Triple negative breast cancer (TNBC), Type 1 diabetes, and others.

The therapeutic landscape is enriched by the growing number of clinical trials evaluating Treg therapies across other multiple indications. For instance, CK0801 (Cellenkos), a cord blood-derived Treg product, is being evaluated in Phase I for aplastic anemia. In type 1 diabetes, SBT-11-5301 is being evaluated early-stage trial, underscoring the broad potential of Treg therapies across a spectrum of diseases. Emerging candidates in the pipeline such as EGL-001 (Egle Therapeutics), DT2216 (Dialectic Therapeutics), IPG7236 (Nanjing Immunophage Biotech), Tivumecirnon (RAPT Therapeutics), GIM-531 (Georgiamune), CK0804 (Cellenkos), and others demonstrate the growing interest in leveraging Tregs for cancer therapy. Several candidates, such as TRK-001 (Phase II), Orca-T (Phase III), TX200 (Phase I/II), TRX103 (Phase I), RGI-2001 (Phase IIb), and others are under clinical evaluation to prevent graft-versus-host disease (GvHD). Several other companies are also evaluating their assets, actively contributing to this growing area of research.

- Among the 7MM, the US held the largest market share at approximately 76 % in the 7MM in 2034.

- Within the EU4 and the UK, Germany is estimated to have the largest market size, while Spain at the bottom, by 2034.

- Among all the indications T1DM will be the major market share contributor in 2034 in the 7MM.

- By 2034, among all the therapies, the highest revenue is expected to be generated by PTG-007/PTG007-DM1, while the lowest revenue is expected to be generated by CK0801 in the US.

Further details will be provided in the report….

Regulatory T Cells Recent Developments

- In October 2024, Nektar announced to publishing of the results from Phase Ib studies of rezpegaldesleukin in atopic dermatitis and psoriasis in nature communications.

- In October 2024, Egle Therapeutics presented preclinical efficacy data for EGL-001, a CTLA-4/CD25 antagonist fusion protein at the Society for Immunotherapy of Cancer Meeting.

- In October 2024, REGiMMUNE and Kiji Therapeutics announced an intention to merge companies, which will create a pan-global Treg specialist to use multiple modalities to target Tregs for several indications.

- In September 2024, Sonoma Biotherapeutics announced that it had received a USD 45 million milestone payment from Regeneron Pharmaceuticals under the terms of its active collaboration to discover, develop, and commercialize engineered Tregs therapies for autoimmune diseases.

- In August 2024, the FDA cleared the IND application for TRX103 to treat patients with refractory Crohn’s disease.

- In August 2024, Abata Therapeutics announced the US FDA granted Fast Tract Designation (FTD) for ABA-101 for the treatment of patients with progressive multiple sclerosis.

- In March 2024, Sonoma Biotherapeutics and Regeneron Pharmaceuticals announced a collaboration for the discovery, development, and commercialization of novel Tregs therapies for autoimmune diseases.

To be continued in the report….

Regulatory T Cells Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034. The landscape of Tregs has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience.

Further detailed analysis of emerging therapies drug uptake in the report…

Regulatory T Cells Pipeline Development Activities

The report provides insights into different Tregs clinical trials within Phase III, Phase II/III, Phase II, and Phase I/II. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Tregs emerging therapies.

Latest KOL Views on the Regulatory T Cells

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, PhD, Research Project Manager, Director, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Tregs market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Delveinsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the University of Michigan Kellogg Eye Center, Cedars-Sinai Medical Center, Laboratory of Endocrinology and Receptor Biology at NIDDK, University of Amsterdam, Cedars-Sinai Medical Center, Temple University School of Podiatric Medicine, Basedowian Ophthalmopathy Center, etc., were contacted. Their opinion helps understand and validate Tregs epidemiology and market trends.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Further detailed analysis will be provided in the report…

Scope of the Regulatory T Cells Market Report

- The report covers a descriptive overview of Tregs, their mechanism of action, approvals timeline and background.

- Comprehensive insight has been provided into Tregs epidemiology.

- Additionally, an all-inclusive account of both the current and emerging Tregs is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the Tregs market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM Tregs market.

Tregs Market Report Insights

- Tregs Patient Population

- Tregs Therapeutic Approaches

- Tregs Pipeline Analysis

- Tregs Market Size and Trends

- Tregs Market Opportunities

- Impact of Upcoming Tregs Therapies

- Tregs Drugs Market

Tregs Market Report Key Strengths

- 9-Years Forecast

- 7MM Coverage

- Tregs Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Tregs Drugs Uptake

Tregs Market Report Assessment

- Current Tregs Treatment Practices

- Tregs Unmet Needs

- Tregs Pipeline Product Profiles

- Tregs Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Tregs Market Drivers

- Tregs Market Barriers

Key Questions Answered in the Regulatory T Cells Market Report

- What was the Tregs market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Tregs total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- Which country will have the largest Tregs market size during the study period (2020–2034)?

- What are the burdens and unmet needs of Tregs?

- What is the Tregs targeted patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of Tregs?

- Which indication accounted for the highest number of indication-wise eligible cases in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- How many emerging therapies are in the mid-stage and late stage of development?

- Which inidication will be the major market share contributor in 2034 in the 7MM?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to Tregs therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed?

- What are the clinical studies going on for Tregs and their status?

- What are the key designations that have been granted for the emerging therapies for Tregs?

Reasons to buy Regulatory T Cells Market Forecast Report

- The report will help in developing business strategies by understanding trends shaping and driving Tregs.

- To understand the future market competition in the Tregs market and Insightful review of the SWOT analysis of Tregs.

- Organize sales and marketing efforts by identifying the best opportunities for Tregs in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.