Sarcopenia Market Summary

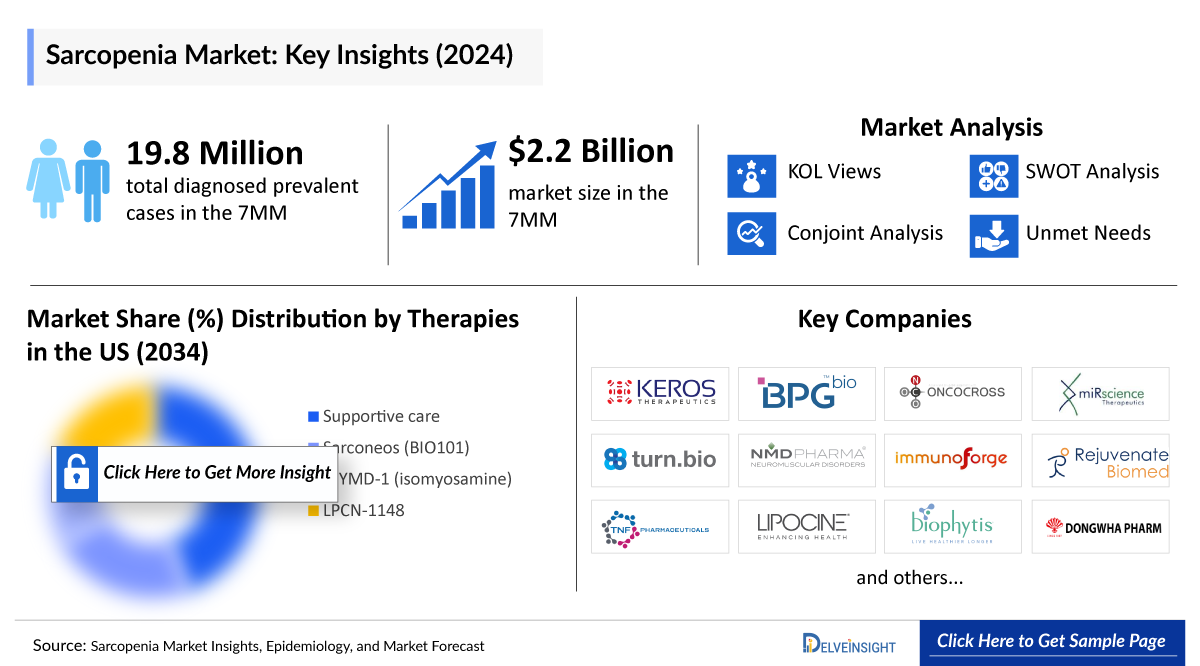

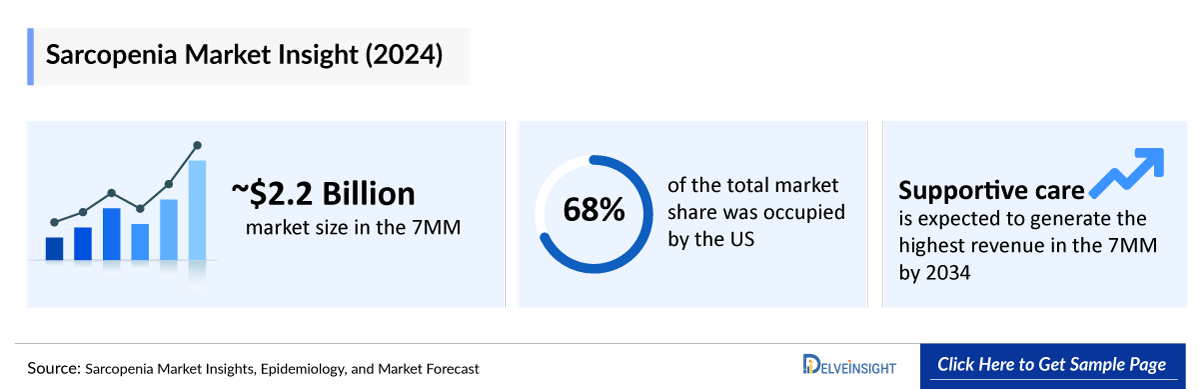

- The Sarcopenia Market Size in the 7MM is expected to grow from USD 2,276 million in 2025 to USD 5,626 million in 2034.

- The Sarcopenia Market is projected to grow at a CAGR of 10.6% by 2034 in leading countries like US, EU4, UK and Japan.

Sarcopenia Market and Epidemiology Analysis

- Sarcopenia is an age-related condition affecting approximately 25% of older people and is significantly associated with frailty. The criteria for sarcopenia include low muscle mass, low physical function, and low muscle strength.

- The Sarcopenia Prevalence ranges from 18% in diabetic patients to 66% in patients with unresectable esophageal cancer. Additionally, sarcopenia is highly prevalent in patients with liver cirrhosis and is associated with adverse clinical outcomes, affecting approximately 40% of individuals with the condition.

- Based on the definitions of sarcopenia provided in the European Working Group on Sarcopenia in Older People (EWGSOP) and the International Working Group on Sarcopenia (IWGS) criteria, 1–29% of community-dwelling people aged = 65 years and 14–33% of people living in care facilities meet the criteria for sarcopenia.

- There are currently no approved drugs to treat sarcopenia. Physical exercise is currently the only recommended option for muscle aging and sarcopenia, showing benefits in improving life expectancy and delaying the onset of age-associated disorders.

- The Sarcopenia Pipeline is advancing with the development of innovative therapies with different mechanisms of action, including TNF-a inhibitors (MYMD-1), androgen receptor agonists (LPCN 1148), proto-oncogene protein c-MAS-1 agonists (Sarconeos), Glucagon-like peptide-1 (GLP-1) receptor agonists (Froniglutide), and agents targeting the aerobic glycolytic pathway (BPM 31510), among others.

- The leading Sarcopenia Companies developing therapies for treating sarcopenia include TNF Pharmaceuticals (MYMD-1/Isomyosamine), Biophytis (Sarconeos), and Lipocine (LPCN 1148). Additionally, Sarcopenia Companies working on early-phase sarcopenia treatment drugs include ImmunoForge (Froniglutide), Rejuvenate Biomed (RJx-01), Keros Therapeutics (KER-065), BPGbio (BPM 31510), and others with their candidates in different stages of clinical development.

- The aging global population offers a growing market for both pharmaceutical and non-pharmaceutical sarcopenia treatments. As awareness rises and new therapies emerge, the market is set for expansion, with innovative treatments and combination therapies advancing in clinical development to address unmet needs.

Sarcopenia Market size and forecast

- 2025 Market Size: USD 2,276 million in 2025

- 2034 Projected Market Size: USD 5,626 million in 2034

- Growth Rate (2025-2034): 10.6% CAGR

- Largest Market: United States

Key Factors Driving the Sarcopenia Market

-

Sarcopenia prevalence driving recognition

Sarcopenia, the progressive loss of muscle strength and function, impacted nearly 15 million people in the 7MM in 2024. With the global population over 65 expected to rise sharply by 2034, the patient pool is anticipated to more than double, making sarcopenia a major geriatric concern.

-

Sarcopenia treatment paradigm

Management remains non-pharmacological, relying on exercise regimens, protein supplementation, and lifestyle interventions. No pharmacologic therapies are currently approved.

-

Sarcopenia pipeline spotlight

Drug development is focused on muscle anabolic pathways. Notable programs include bimagrumab (Novartis/Versanis), REGN2477 (Regeneron, myostatin inhibitor), and SARMs from Viking Therapeutics. Combination approaches with nutritional support are also being studied.

-

Sarcopenia market dynamics and opportunity

Approval of the first effective drug will unlock a massive, previously untapped market. Pharma interest is rising, with opportunities tied to the aging demographic and preventive health trends.

DelveInsight’s ‘Sarcopenia Treatment Market Insight, Epidemiology, and Market Forecast 2034’ report delivers an in-depth understanding of the sarcopenia, historical and forecasted epidemiology as well as the sarcopenia market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Sarcopenia Treatment Market Report provides current treatment practices, emerging drugs, sarcopenia market share of individual therapies, and current and forecasted sarcopenia market size from 2025 to 2034 segmented by seven major markets. The report also covers the current sarcopenia treatment practice/algorithm, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Sarcopenia Disease Understanding

Sarcopenia is a progressive and generalized skeletal muscle disorder involving the accelerated loss of muscle mass and function that is associated with increased adverse outcomes, including falls, functional decline, frailty, and mortality. It occurs commonly as an age-related process in older people, influenced not only by contemporaneous risk factors but also by genetic and lifestyle factors operating across the life course. It can also occur in mid-life in association with various conditions. The first was the introduction of muscle function into the concept in six consensus definitions since 2010. This new focus on muscle function, usually defined by muscle strength, muscle power, or physical performance, occurred because the function was consistently a more powerful predictor of clinically relevant outcomes than muscle mass alone.

The second milestone was the recognition of sarcopenia as an independent condition with an International Classification of Diseases-10 code in 2016. Yet, most clinicians remain unaware of the condition and the diagnostic tools needed to identify it. The pathophysiology of sarcopenia is multifactorial, with decreased caloric intake, muscle fiber denervation, intracellular oxidative stress, hormonal decline, and enhanced myostatin signaling all thought to contribute.

Adequate protein intake, proper nutrition, vitamin D supplements, and, in some cases, hormone replacement therapy may be employed under the guidance of healthcare professionals to address hormonal imbalances and support overall musculoskeletal health. Other than nutritional supplements steroid hormones such as dehydroepiandrosterone, testosterone, and anabolic steroids have demonstrated some positive effects, but their use is limited due to associated adverse effects.

Sarcopenia Diagnosis

The evaluation of sarcopenia requires objective measurements of muscle strength and muscle mass. Several methods of evaluating sarcopenia currently used include walking speed, calf circumference, Bio-impedance Analysis (BIA), handgrip strength, dual-energy X-ray absorptiometry, and imaging methods (computerized tomography and magnetic resonance imaging). None of these measures is very sensitive or specific for evaluating sarcopenia.

Sarcopenia Screening

The screening tools include the ‘Red Flag’ approach, which uses clinician-observed or patient-reported parameters to assess the degree of risk of sarcopenia; this includes general weakness, visible muscle loss, reduced walking speed, a mini-nutrition assessment, bodyweight as recorded by the physician and weight loss, weakness, reduced muscle strength, fatigue, impaired mobility, falls, low energy and difficulty in performing activities of daily living as reported by the patient. The SARC-F questionnaire was developed as a possible rapid screening test for sarcopenia. This questionnaire could enable healthcare providers to quickly and easily assess the risk of sarcopenia during a regular health consultation.

To be able to diagnose or comment on the extent of sarcopenia, robust methods for assessment are required which include:

- Muscle mass assessments: Dual X-ray absorptiometry, anthropometry, bio-electrical impedance, MRI and CT scanning, and, more rarely, measurement of urinary metabolites, isotope dilution, and in vivo neutron activation.

- Muscle strength assessment: Hydraulic dynamometer and others.

- Physical performance assessment: Gait speed and others.

Sarcopenia Treatment

The Basic therapeutic options for managing sarcopenia include resistance exercise, increasing protein intake, and 25-OH-vitamin D supplementation if required. However, discoveries regarding the pathogenesis of sarcopenia have led to the development of novel therapeutic agents. Physical activity is crucial for maintaining muscle mass and strength, especially in older adults at risk of sarcopenia. Aerobic exercise, such as swimming, running, and walking, enhances cardiovascular fitness and endurance. Progressive Resistance Training (PRT) is a widely utilized approach for older individuals, with regular sessions improving physical function, gait speed, balance, and muscle strength, especially in high-intensity training groups. Along with these non-drug therapies are widely used such as protein and other nutrients, supplements such as testosterone, GH, vitamin D, and others. Some drug therapies are used in severe cases which include; ACE inhibitors, myostatin inhibitors, and others.

Sarcopenia Epidemiology

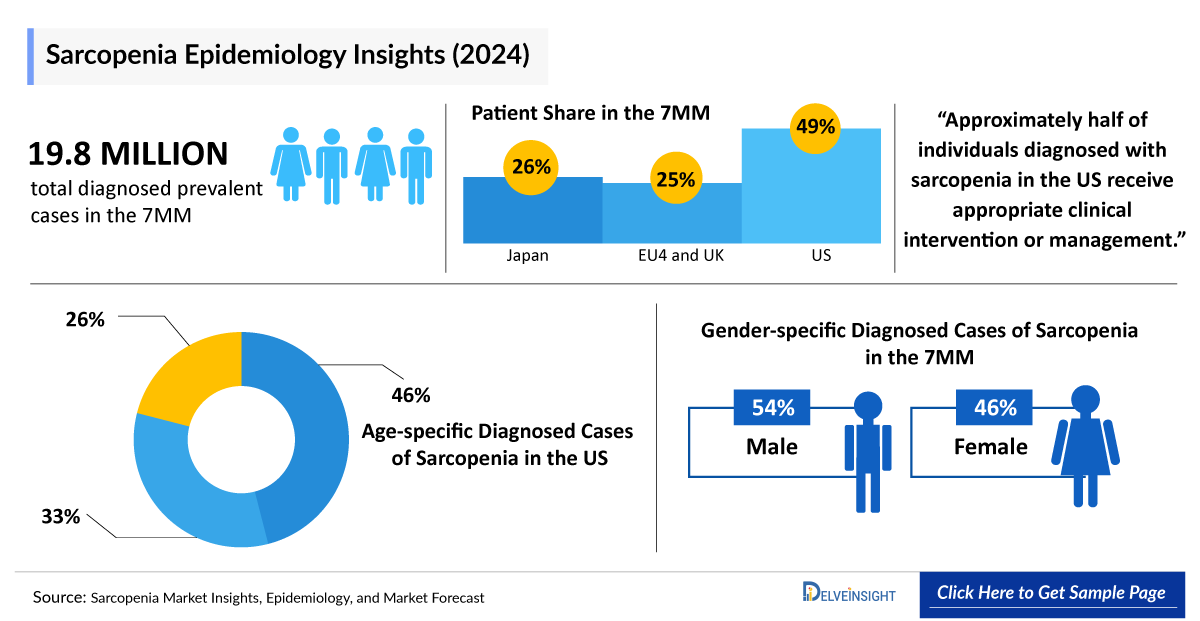

The sarcopenia epidemiology division provides insights into the historical and current sarcopenia patient pool and forecasted trends for seven major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the DelveInsight report also provides the diagnosed patient pool and their trends along with assumptions undertaken. The disease epidemiology covered in the report provides historical as well as forecasted sarcopenia epidemiology segmented by total diagnosed prevalent cases of sarcopenia, gender-specific diagnosed prevalent cases of sarcopenia, age-specific diagnosed prevalent cases of sarcopenia, and severity-specific diagnosed prevalent cases of sarcopenia in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom and Japan from 2020 to 2034.

Key Findings from Sarcopenia Epidemiological Analysis and Forecast

- The Sarcopenia Diagnosed Prevalent Cases in the 7MM were nearly ~19,836,200 in 2024 and are projected to increase during the study period (2020–2034).

- Among the EU4 and the UK, the UK accounted for the highest number of sarcopenia diagnosed prevalent cases, followed by Germany, whereas Spain accounted for the lowest number of cases in 2024.

- Based on severity, sarcopenia cases are classified as mild to moderate and severe. The mild to moderate accounted for the highest number of patients in 2024 in the US.

- In the US, based on age, sarcopenia cases are stratified in the age group 65–69 years, 70–79 years, and =80 years. 65–69 years of age group accounted for the highest number of patients i.e. nearly ~4,520,200 in 2024 in the US.

- In Japan, the cases of sarcopenia account for approximately ~5,225,100 in 2024.

- In the US, male accounts more number of cases related to sarcopenia then female in 2024.

Sarcopenia Epidemiology Segmentation in the 7MM

- Total diagnosed prevalent cases of sarcopenia

- Gender-specific diagnosed prevalent cases of sarcopenia

- Age-specific diagnosed prevalent cases of sarcopenia

- Severity-specific diagnosed prevalent cases of sarcopenia

Sarcopenia Drugs Analysis

The drug chapter segment of the Sarcopenia treatment market report encloses a detailed analysis of sarcopenia (Phase-III and Phase-II), and Sarcopenia Pipeline Drugs analysis. It also helps to understand the sarcopenia clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Sarcopenia Emerging Drugs

-

MYMD-1/Isomyosamine: TNF Pharmaceuticals

MYMD-1 is a novel, orally dosed TNF-a inhibitor drug for treating multiple conditions related to immune-metabolic dysregulation, including delayed aging, increased longevity, and autoimmune diseases. A successful and statistically significant small Phase II study was completed in 2023, evaluating the safety and efficacy of MYMD-1 as a treatment for sarcopenia, the progressive loss of muscle mass and strength associated with aging. The drug is distinguished from currently marketed TNF-a blockers in multiple ways. It is a first-in-class oral treatment shown to reduce TNF-a and inflammation without infusion or injection. The company is now planning to initiate a Phase III trial. If approved, MYMD-1 has the potential to be the first drug approved by FDA for the sarcopenia.

-

- In January 2025, TNF Pharmaceuticals announced that it had achieved a key safety data milestone supporting expanded and longer-term clinical studies of isomyosamine in multiple indications.

- In December 2024, TNF Pharmaceuticals presented positive top-line results from a Phase IIa study of its lead drug candidate MYMD-1 at a prestigious international congress of global experts in sarcopenia and related disorders.

-

LPCN 1148: Lipocine

LPCN 1148, an oral prodrug of bioidentical testosterone, is studied in a Proof-of-Concept (POC) Phase II study in patients with decompensated cirrhosis. Treatment with LPCN 1148 in the POC study improved sarcopenia and associated clinical outcomes. LPCN 1148 is targeted to be a first-in-class product candidate with a novel mechanism of action for the management of cirrhosis. Lipocine is currently in the planning stages of a Phase III clinical study; therefore, clinical trial programs are the primary way to access the lipocine investigational medicine, LPCN 1148.

-

-

- In December 2024, the US FDA granted Fast Track Designation (FTD) to LPCN 1148 as a treatment for sarcopenia in patients with decompensated cirrhosis.

- In May 2024, Lipocine presented an oral presentation of the data from the Phase II study of LPCN 1148 at the European Association for the Study of Liver (EASL) Congress.

-

Sarcopenia Drugs Insights

TNF-a inhibitors can help treat sarcopenia by targeting key factors that contribute to muscle loss. First, they reduce inflammation, as TNF-a is a protein that plays a central role in promoting inflammation, which accelerates muscle degradation. By inhibiting TNF-a, these drugs can lower inflammation levels and slow down the process of muscle wasting. Additionally, TNF-a inhibitors help prevent muscle atrophy by blocking the actions of TNF-a, which is directly linked to muscle loss. These inhibitors can also prevent pyroptosis, a form of cell death driven by inflammation, which further damages muscle cells. In this way, TNF-a inhibitors have the potential to slow the progression of sarcopenia, particularly in cases where inflammation is a primary driver of muscle degeneration.

Androgen receptor agonists help treat sarcopenia by targeting the androgen receptors in muscles, which are responsible for muscle growth and strength. These drugs act like natural hormones such as testosterone, boosting muscle protein production and helping to build and maintain muscle mass. By activating these receptors, androgen receptor agonists can help increase muscle strength, prevent further muscle loss, and improve muscle function in people with sarcopenia, especially in older adults with lower testosterone levels. This makes them a promising treatment option for slowing down or reversing muscle loss caused by sarcopenia.

Sarcopenia Market Outlook

Currently, sarcopenia is mainly managed through nutritional interventions, physical therapy, and lifestyle modification, with no drug yet approved for this disease. The primary goal of sarcopenia treatment is to preserve or restore muscle mass and function, thereby improving the individual’s quality of life and reducing the risk of associated complications, such as falls and fractures. The multifaceted nature of sarcopenia requires a comprehensive approach that includes nutritional interventions, exercise programs, and, in some cases, pharmacological therapies.

Adequate protein intake, proper nutrition, vitamin D supplements, and, in some cases, hormone replacement therapy may be employed under the guidance of healthcare professionals to address hormonal imbalances and support overall musculoskeletal health. Other than nutritional supplements, steroid hormones such as dehydroepiandrosterone, testosterone, and anabolic steroids have demonstrated some positive effects, but their use is limited due to associated adverse effects.

- The clinical development landscape lacks late-stage assets. Consequently, in light of this scarcity, our forecast considers the potential impact of TNF Pharmaceuticals’s MYMD-1, Lipocine’s LPCN 1148, and Biophytis’s BIO101.

- As per DelveInsight’s estimates, the drugs that can mark a significant change in the forecast period include MYMD-1, LPCN 1148, BIO101, and others.

- The total market size of sarcopenia in the 7MM was approximately USD ~2,200 million in 2024 and is projected to increase during the forecast period (2025–2034).

- Among EU4 and the UK, the UK accounted for the maximum market size in 2024, while Spain occupied the bottom of the ladder.

- Among the therapies, supportive care is expected to generate the highest revenue in the 7MM by 2034.

Sarcopenia Market Recent Developments and Breakthroughs:

- In July 2025, Animuscure Inc. announced a clinical trial aims to find out whether AMC6156 can improve physical function and is safe in older adults with sarcopenia. Participants will take AMC6156 or a placebo daily for 12 weeks, and their movement, strength, and safety will be regularly monitored through tests and checkups.

Sarcopenia Drugs Uptake

This section focuses on the rate of uptake of the potential Sarcopenia drugs expected to be launched in the market during the study period. The analysis covers sarcopenia market uptake by drugs; patient uptake by therapies; and sales of each drug. This section focuses on the uptake rate of potential drugs expected to be launched in the Sarcopenia Heatlhcare Market during 2020–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Sarcopenia Pipeline Development Activities

The Sarcopenia Pipeline Segment Report provides insights into different therapeutic candidates in the Phase II and Phase I stages. It also analyzes key Sarcopenia Companies involved in developing targeted therapeutics.

Latest KOL Views

To keep up with current Sarcopenia Healthcare Market Trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts contacted for insights on sarcopenia evolving treatment landscape, patient reliance on conventional therapies, patient’s therapy switching acceptability, and drug uptake, along with challenges related to accessibility, include Medical/scientific writers, Professors; MD, Head of the Departments, Universities, and others.

Delveinsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Hospital Universitario Ramón y Cajal, St Thomas’ Hospital, University of Pisa, University of Maryland School of Medicine, etc. were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or sarcopenia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Sarcopenia Healthcare Market and the unmet needs.

What KOLs are saying on Spinal Cord Injury Patient Trends?

- In Spain, “Sarcopenia, a condition that significantly affects older adults as they age, has not been widely integrated into the knowledge and practices of many active physicians. Survey findings indicate that enhancing physicians' awareness of sarcopenia and reaching a consensus on diagnostic criteria could lead to more frequent screening and treatment of the condition.”

- In UK, “Advancing the field of sarcopenia research requires not only deepening knowledge but also broadening it, and this is beginning to take place with growing global recognition of sarcopenia. However, there are still regions of the world where research on this condition remains sparse.”

Sarcopenia Qualitative Analysis

We perform Qualitative and Sarcopenia Drugs Market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Sarcopenia Treatment Market Landscape. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Further details in the report...

Sarcopenia Market Report Scope

- The Sarcopenia therapeutics market report covers the descriptive overview, explaining its causes, signs and symptoms, pathophysiology, and currently available therapies.

- Comprehensive insight has been provided into the sarcopenia epidemiology and treatment in the 7MM.

- Additionally, an all-inclusive account of both the current and emerging therapies for sarcopenia is provided, along with the assessment of new therapies, which will have an impact on the current Sarcopenia Treatment Market Landscape.

- A detailed review of the Sarcopenia Therapeutics Market; historical and forecasted is included in the report, covering drug outreach in the 7MM.

- The Sarcopenia Therapeutics Market Report provides an edge while developing business strategies, by understanding trends shaping and driving the Global Sarcopenia Drugs Market.

Sarcopenia Market Report Insights

- Patient-based Sarcopenia Market Forecasting

- Therapeutic Approaches

- Sarcopenia Pipeline Drugs Analysis

- Sarcopenia Market Size and Trends

- Sarcopenia Drugs Market Opportunities

- Impact of Upcoming Sarcopenia Therapies

Sarcopenia Market Report Key Strengths

- 10 Years Sarcopenia Treatment Market Forecast

- 7MM Coverage

- Sarcopenia Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Sarcopenia Treatment Supplements Market

- Sarcopenia Drugs Uptake

Sarcopenia Market Report Assessment

- Current Sarcopenia Treatment Supplements Market Practices

- Sarcopenia Unmet Needs

- Sarcopenia Pipeline Product Profiles

- Sarcopenia Healthcare Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Sacropenia Market Report:

- What was the Sarcopenia Healthcare Market Size, the Sarcopenia Treatment Market Size by therapies, and Sarcopenia Healthcare Market Share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which class is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the disease risks, burdens, and unmet needs of sarcopenia? What will be the growth opportunities across the 7MM concerning the patient population of sarcopenia?

- What is the historical and forecasted sarcopenia patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What are the current options for the treatment of sarcopenia? What are the current guidelines for treating sarcopenia in the US and Europe?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of sarcopenia?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What key designations have been granted for the emerging therapies for sarcopenia?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, current therapies?

Reasons to Buy the Sarcopenia Market Report

- The Sarcopenia Supplement Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the sarcopenia healthcare market.

- Insights on patient burden/disease Sarcopenia Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Sarcopenia Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential emerging therapies.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles