Spinal Non Fusion Devices Market

Spinal Non-Fusion Devices by Product Type (Artificial Disc [Lumbar and Cervical], Dynamic Stabilization Devices, Facet Replacement Products, and Others), Application (Spinal Stenosis, Degenerative Disc Diseases, Spondylolisthesis, and Others), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the increased prevalence of spinal disorders, increasing preference for minimally invasive procedures, and increase in product launches and approvals by key market players across the globe.

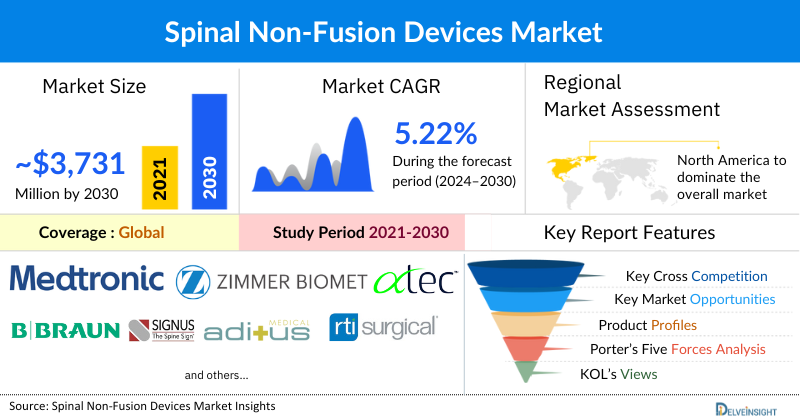

The spinal non-fusion devices market was valued at USD 2,757.17 million in 2023 and is likely to register a CAGR of 5.22% during the forecast period from 2024 to 2030 to reach USD 3,731.02 million by 2030. The growing prevalence of spinal disorders, particularly among the aging population, is driving demand for non-fusion devices as alternatives to traditional spinal fusion surgeries. These devices, are less invasive, catering to the needs of patients with various spinal disorders who seek to avoid the long-term complications associated with fusion procedures. Market growth is further accelerated by continuous innovation and the launch of advanced spinal non-fusion devices, alongside regulatory approvals. This expansion of treatment options and increased competition enhances patient outcomes and propels market growth from 2024 to 2030.

Spinal Non Fusion Devices Market Dynamics:

According to the latest data provided by the World Health Organization (2024), globally, over 15 million people are living with spinal cord injury (SCI), which is a significant cause of long-term disability. Additionally, in 2021, SCI accounted for more than 4.5 million years of life lived with disability (YLDs). SCI often results in severe, long-term disability, leading to a considerable need for advanced medical interventions to improve patient's quality of life and functional outcomes. Non-fusion devices offer a promising alternative to traditional spinal fusion surgeries, providing solutions that can help manage and potentially alleviate the complications associated with SCI.

Additionally, as per the recent data provided by the Global Burden of Disease (2023), by 2050, 840 million population are projected to suffer from lower back pain.

Furthermore, according to the stats and data provided by the Australian Institute of Health and Welfare (2024), in 2022, it was estimated that around 4.0 million people, or 16% of the population, in Australia, were living with back problems. During the 2021–2022 period, there were 177,000 hospitalizations with a principal diagnosis of back problems, equating to 690 hospitalizations per 100,000 population. Spinal Non-Fusion Devices are designed to maintain or restore spinal function and flexibility while alleviating pain, which aligns with the increasing patient preference for treatments that minimize surgical risks and recovery times. Furthermore, non-fusion devices often require less invasive surgical techniques, leading to quicker recovery and reduced hospital stays, which is attractive both to patients and healthcare providers.

Moreover, it has been observed that annulus fibrosus injury from herniation and degeneration can result in complications such as accelerated degeneration and prolonged chronic pain. As spinal disorders can majorly impact the quality of life of patients, these indications require surgical interventions as one of the key treatment methods.

Furthermore, product approval across the globe is further boosting the overall market of Spinal Non-Fusion Devices. For instance, in October 2023, Johnson & Johnson MedTech announced that DePuy Synthes, the orthopedics company of Johnson & Johnson, had received 510(k) clearances from the U.S. Food and Drug Administration (FDA) for the TriALTIS™ Spine System and TriALTIS™ Navigation Enabled Instruments. It is designed to address spinal disorders while preserving motion and function, offering an alternative to traditional spinal fusion procedures.

However, the availability of alternative products and slow adoption due to limited clinical evidence may be certain impeding factors to the Spinal Non-Fusion Devices market growth during the forecast period.

Spinal Non Fusion Devices Market Segment Analysis:

Spinal Non-Fusion Devices by Product Type (Artificial Disc [Lumbar and Cervical], Dynamic Stabilization Devices, Facet Replacement Products, and Others), Application (Spinal Stenosis, Degenerative Disc Diseases, Spondylolisthesis, and Others), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the overall spinal non-fusion devices market, the artificial discs category is expected to hold the largest share of 58.99% in the year 2023. This can be attributed to the wide applications and advantages associated with the lumbar and cervical artificial discs of the spinal non-fusion devices market during the given forecast period.

The goal of artificial disc replacement is to alleviate pain by reducing aggravating micromotion, stabilizing the spinal segment, and minimizing inflammation. Further, one advantage of the artificial lumbar disc is that it may also prevent premature breakdown of adjacent levels of the lumbar spine.

The lumbar artificial disc replacement comes in a variety of sizes, angles, and designs. The constrained-designed lumber artificial disc provides a fixed center of rotation that doesn’t change. The unconstrained design allows the center of the implant to move forward and back slightly during lumbar motion.

Artificial cervical discs eliminate the potential complications and issues associated with the need for a bone graft and spinal instrumentation for spinal fusion and also allow for a quicker return to neck movement after surgery.

Further, the increasing strategic activities by the key market players are expected to propel the market in the forthcoming years. For instance, in August 2021, Orthofix Medical Inc. announced the first patient implant in the M6-C Artificial Cervical Disc Two-Level investigation device exemption (IDE) Study. The M6-C artificial cervical disc was FDA-approved for single-level implantation from C3 to C7 in 2019. It is indicated as an alternative to cervical fusion

Hence, all the above-mentioned factors are expected to generate considerable revenue for the segment pushing the overall growth of the global spinal non-fusion devices market during the forecast period.

North America Is Expected To Dominate The Overall Spinal Non Fusion Devices Market:

Among all the regions, North America is expected to hold the largest share of 59.57% in the spinal non-fusion devices market in 2023. Owing to significant growth factors such as the rising prevalence of the geriatric population, increasing incidences of spinal disorders, rising government initiatives, and increased government product regulations are expected to aid in the growth of the North American spinal non-fusion devices market.

As per the data provided by the American Cancer Society (2024), in 2023, it was estimated that about 25,400 malignant tumors of the brain or spinal cord were diagnosed in the United States, including both adults and children. This number comprised 14,420 cases in males and 10,980 cases in females. The figures would have been significantly higher if benign (non-cancer) tumors had also been included. These tumors often require surgical intervention to relieve pressure on the spinal cord and nerves, which can complicate traditional spinal fusion approaches. Non-fusion devices, designed to preserve spinal motion and minimize adjacent segment degeneration, offer an attractive alternative. As spinal cord tumors are diagnosed, there is a heightened need for innovative solutions that can effectively manage the tumor while maintaining spinal stability and function.

Additionally, as per the data provided by the United States Bone and Joint Initiative (2023), musculoskeletal diseases affect more than one out of every two persons in the United States aged 18 and over and nearly three out of four aged 65 and over. Trauma, back pain, and arthritis are the three most common musculoskeletal conditions reported, and for which healthcare visits to physicians’ offices, emergency departments, and hospitals occur each year. Furthermore, the abovementioned source stated that in any given year, 12% to 14% of the adult population will visit their physician for back pain.

Furthermore, as per the recent data provided by Johns Hopkins University, Scoliosis is a prevalent spinal condition frequently observed in adolescents. In the United States, approximately 3 million new cases are diagnosed annually, with the majority being idiopathic scoliosis, which typically manifests in children aged 10 to 12 years.

The increasing number of product development activities in the region is further going to accelerate the growth of the spinal non-fusion devices market. For instance, in April 2021, NuVasive Inc. received 510k approval from the US FDA for their two-level cervical total disc replacement- Simplify Disc.

Therefore, the above-mentioned factors are expected to bolster the growth of the spinal non-fusion devices market in North America during the forecast period.

Spinal Non Fusion Devices Market Key Players:

Some of the key market players operating in the spinal non-fusion devices market include Stryker, NuVasive Inc., Medtronic, Zimmer Biomet, ATEC Spine, Inc., B. Braun Melsungen, SIGNUS Medizintechnik GmbH, Aditus Medical, RTI Surgical, Orthofix Medical Inc., Premia Spine, Globus Medical, SpineSave AG, Centinel Spine®, LLC, AxioMed LLC., Spinal Stabilization Technologies Ltd., SpineVision, Norm Medical Devices Co. Ltd., Neuro France Implants, Ackermann Medical GmbH & Co. KG, and others.

Recent Developmental Activities in Spinal Non Fusion Devices Market:

- In June 2023, Premia Spine received the Food and Drug Administration (FDA) approval for its Total Posterior Spine (TOPS) facet joint replacement system. The TOPS System previously earned the FDA’s Breakthrough Designation status and has now completed its Premarket Approval (PMA) application. The TOPS™ System replaces anatomical structures, such as the lamina or the facet joint that are removed from the vertebrae during the spinal decompression treatment to alleviate pain.

- In May 2021, Spinal Stabilization Technologies Ltd received the Breakthrough Designation for the PerQ disc Nucleus Replacement System for degenerative disc disease. The device also received the CE mark approval. PerQdisc is the only commercially available lumbar nucleus replacement system in the world.

|

Report Metrics |

Details |

|

Study Period |

2020 to 2030 |

|

Base Year |

2021 |

|

Forecast Period |

2024 to 2030 |

|

CAGR |

5.54% |

|

Market Size |

USD 1.60 billion by 2030 |

|

Key Companies | Stryker, NuVasive Inc, Medtronic, Zimmer Biomet, ATEC Spine, Inc, B. Braun Melsungen, SIGNUS Medizintechnik GmbH, Aditus Medical, RTI Surgical, Orthofix Medical Inc, Premia Spine, Globus Medical, SpineSave AG, Centinel Spine®, LLC, AxioMed LLC., Spinal Stabilization Technologies Ltd, SpineVision, Norm Medical Devices Co. Ltd., Neuro France Implants, Ackermann Medical GmbH & Co. KG and others |

Key Takeaways from the Spinal Non Fusion Devices Market Report Study

- Market size analysis for current spinal non-fusion devices size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the spinal non-fusion devices market.

- Various opportunities available for the other competitors in the spinal non-fusion devices market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current spinal non-fusion devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for spinal non-fusion devices market growth in the coming future?

Target Audience who can be benefited from this Spinal Non Fusion Devices Market Report Study

- Spinal non-fusion devices product providers

- Research organizations and consulting companies

- Spinal non-fusion devices -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in spinal non-fusion devices

- Various end-users who want to know more about the spinal non-fusion devices market and the latest technological developments in the spinal non-fusion devices market.

Read Our Recent Blogs- Latest DelveInsight Blogs