Systemic Sclerosis Market Summary

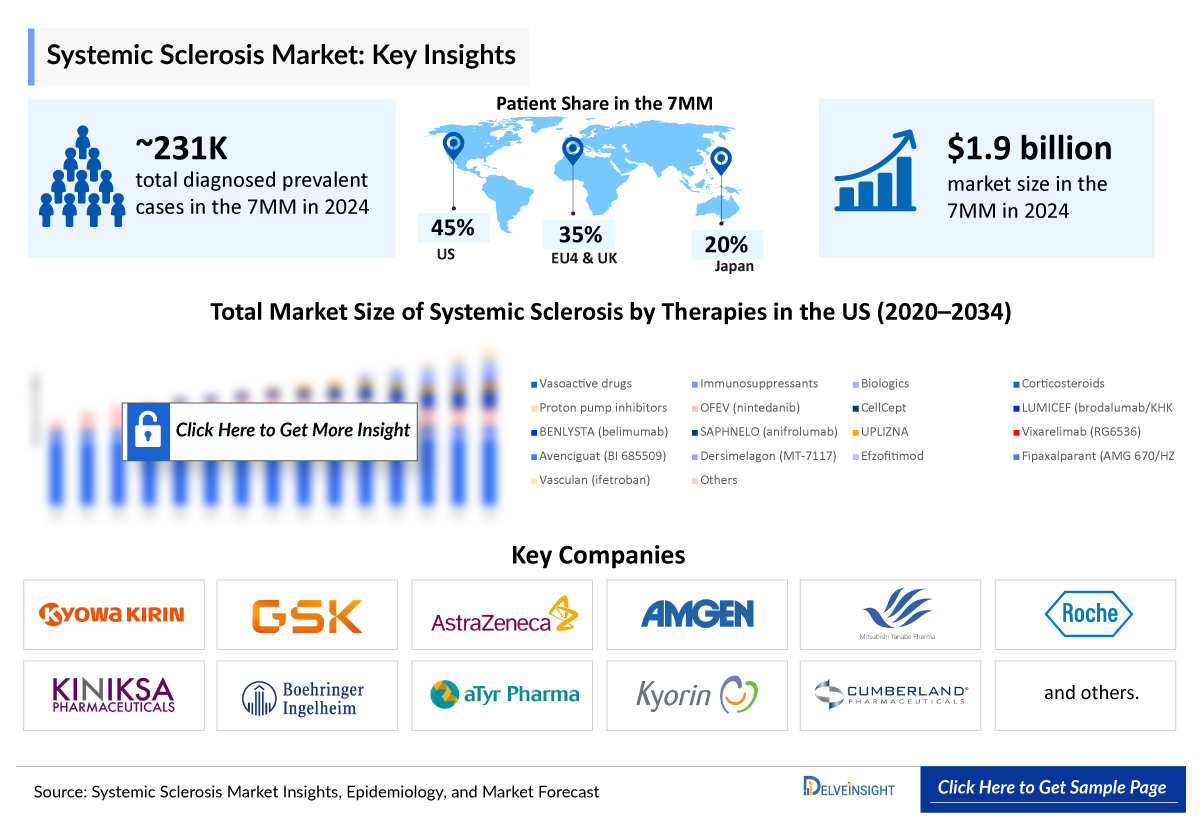

- The Systemic Sclerosis Market Size was valued at ~USD 1,937 million in 2025 and is anticipated to grow with a significant CAGR of 3.6% to reach ~USD 2,660 million by 2034 during the study period (2020-2034).

- In 2024, the United States represented the largest share of the systemic sclerosis market within the 7MM, accounting for nearly 75% of the total market size.

- Among EU4 and the UK, Italy accounted for the largest Systemic Sclerosis Market Size, whereas Spain accounted for the smallest market size in 2023.

- The leading Systemic Sclerosis companies developing therapies in the market include - Genentech, Kyowa Kirin, GSK, AstraZeneca, Amgen (Horizon Therapeutics), Mitsubishi Tanabe Pharma, Roche (Genentech), Kiniksa Pharmaceuticals, Boehringer Ingelheim, aTyr Pharma, Kyorin Pharmaceutical, Cumberland Pharmaceuticals, and others.

Systemic Sclerosis Market and Epidemiology Analysis

- In the current market, the majority of the share was accounted for by vasoactive drugs in the US, which was around USD 1,180 million in 2024.

- According to DelveInsight’s 2024 analysis, the 7MM accounted for nearly 231,200 diagnosed prevalent systemic sclerosis cases, with numbers expected to rise over the forecast period.

- RITUXAN and ACTEMRA, whose primary patents have expired, face biosimilar competition in several indications, impacting their overall sales significantly.

- Approved therapies for systemic sclerosis include OFEV (nintedanib) from Boehringer Ingelheim, ACTEMRA (tocilizumab) by Roche, RITUXAN (rituximab) from Zenyaku Kogyo/Chugai Pharmaceutical, and CELLCEPT (mycophenolate), all of which are used to manage different aspects of the disease.

- Although the prognosis for systemic sclerosis patients has significantly improved over time, the disease is still among the most serious. The specific disease subgroup, the autoantibody profile, and—above all—the exact organ involvement determine the prognosis.

- In June 2025, aTyr Pharma announced interim Phase II EFZOCONNECT trial results for efzofitimod, demonstrating favorable safety and tolerability, along with stable or improved mRSS across all patients, meaningful clinical benefits in diffuse SSc-ILD, and promising biomarker responses.

- Systemic Sclerosis Patients with diffuse cutaneous systemic sclerosis or those with lung, heart, or kidney involvement need to be closely monitored to avoid irreversible organ damage or potentially fatal complications. In contrast, patients with limited cutaneous systemic sclerosis and no significant organ involvement have a prognosis comparable to that of healthy individuals.

- In Systemic Sclerosis Patients, the lungs may be substantially affected. Breathing becomes challenging while breathing with interstitial lung disease because normal lung tissue is fibrotic. With an exceptionally high morbidity and death rate, interstitial lung disease is present in about half of systemic sclerosis patients.

- Although OFEV and ACTEMRA are approved therapies for SSc-ILD, both of these medications have demonstrated no significant difference in change in modified Rodnan skin score (mRSS) compared to placebo. Rituximab is the only drug that showed statistically significant improvements in mRSS in the actual drug group compared with the placebo group

- CAR-T cell therapies such as KYV 101 (Kyverna Therapeutics) and CABA-201 (Cabaletta Bio) are currently in Phase I/II clinical development. These therapies may present a significant advantage over current standard-of-care therapies by aiming to directly deplete B cells and potentially resetting disease-contributing B cells. CABA-201 received Orphan Drug Designation by the US FDA in March 2024.

- In September 2023, Roche withdrew its application for the use of ROACTEMRA in the treatment of interstitial lung disease associated with systemic sclerosis in Europe.

- The introduction of novel treatments for systemic sclerosis, along with a promising pipeline of upcoming products, is likely to spur industry growth. The pipeline of systemic sclerosis holds a few late-stage and some mid-stage drugs such as LUMICEF (Kyowa Kirin), BENLYSTA (GSK), SAPHNELO (AstraZeneca), UPLIZNA (Amgen [Horizon Therapeutics]/Mitsubishi Tanabe Pharma), Vixarelimab (Roche [Genentech]/Kiniksa Pharmaceuticals), Efzofitimod (aTyr Pharma/Kyorin Pharmaceutical), and others.

Request for unlocking the CAGR of the "Systemic Sclerosis Drugs Market Trends"

Key Factors Driving Systemic Sclerosis Market

- Rising Prevalence and Diagnosis of Systemic Sclerosis: The increasing number of diagnosed cases, particularly in the 40–69 age group, is driving demand for effective therapies. Enhanced awareness among healthcare professionals and improved diagnostic techniques are contributing to earlier detection.

- Growing Awareness and Education Initiatives: Patient awareness campaigns and educational programs for physicians are helping identify and manage systemic sclerosis more effectively, boosting market growth.

- Launch of Novel and Targeted Therapies: Recent approvals and emerging therapies such as nintedanib (OFEV), tocilizumab (ACTEMRA), and rituximab (RITUXAN) are expanding treatment options. Innovative drug development targeting fibrosis and immune modulation is expected to revolutionize SSc management.

- Supportive Regulatory Frameworks: Orphan drug designations and fast-track approvals by regulatory bodies like the FDA and EMA are accelerating the availability of therapies for this rare autoimmune condition, promoting market expansion.

- Rising Investment in R&D and Clinical Trials: Increased research activities, clinical trials for novel molecules, and combination therapies are driving pipeline growth, offering hope for better outcomes and attracting investor interest in the systemic sclerosis market.

DelveInsight’s "Systemic Sclerosis Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of systemic sclerosis, historical and forecasted epidemiology as well as the systemic sclerosis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Systemic Sclerosis Treatment Market Report provides current treatment practices, emerging drugs, systemic sclerosis share of individual therapies, and current and forecasted systemic sclerosis market size from 2020 to 2034, segmented by seven major markets. The market report also covers current systemic sclerosis treatment market practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Systemic Sclerosis drugs market.

Scope of the Systemic Sclerosis Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Systemic Sclerosis Market |

|

|

Systemic Sclerosis Market Size | |

|

Systemic Sclerosis Companies |

Genentech, Kyowa Kirin, GSK, AstraZeneca, Amgen (Horizon Therapeutics), Mitsubishi Tanabe Pharma, Roche (Genentech), Kiniksa Pharmaceuticals, Boehringer Ingelheim, aTyr Pharma, Kyorin Pharmaceutical, Cumberland Pharmaceuticals, and others |

|

Systemic Sclerosis Epidemiology Segmentation |

|

Systemic Sclerosis Disease Understanding

Systemic Sclerosis Overview

Systemic Sclerosis (SSc), also known as scleroderma, is a rare autoimmune connective tissue disorder characterized by hardening and tightening of the skin and connective tissues. It occurs when the immune system attacks the body’s own tissues, leading to fibrosis (excessive tissue buildup), vascular abnormalities, and organ dysfunction. The disease can affect the skin, lungs, heart, kidneys, and digestive tract, causing symptoms such as skin thickening, Raynaud’s phenomenon, difficulty swallowing, shortness of breath, and fatigue.

Systemic Sclerosis Diagnosis

Diagnosing systemic sclerosis becomes a little easier if some of the primary physical symptoms or signs are present, such as Raynaud’s phenomenon or skin that appears to become puffy, swollen, or thick suddenly. There is no single test for systemic sclerosis. It is a clinical diagnosis that requires a thorough exam and history by the doctor. The doctor will do a physical exam and may order a biopsy to look at a small sample of the affected skin under a microscope and may also order urine, blood, and other tests to see if any internal organs have been affected. Physical examination is one of the most important tests. A rheumatologist will be able to assess the skin for skin tightening or swelling, which is typically seen in patients with systemic sclerosis. The doctor may also order an antibody nuclear (ANA) test, which will let them know if any autoantibodies (blood proteins) are in the blood.

Further details related to diagnosis will be provided in the report…

Systemic Sclerosis Treatment

Treatment options for patients with systemic sclerosis are limited to managing organ disease manifestations. Patients usually require long-term regular follow-up with numerous medical specialists. As systemic sclerosis is an autoimmune disease, medications that suppress the immune system (immunosuppressants) are used, especially in severe cases with diffuse skin involvement, interstitial lung disease, inflammation of the heart muscle (myocarditis), and severe muscle or joint inflammation. Immunosuppressants in systemic sclerosis include methotrexate, mycophenolate mofetil (MMF), and azathioprine. Glucocorticoids such as prednisone are also occasionally used in some patients, but their use is generally avoided if possible due to the risk of side effects. While vasoactive therapies comprised endothelin receptor antagonists (ERAs) bosentan, ambrisentan, and macitentan, the 5-phosphodiesterase inhibitor (PDE5) sildenafil, the synthetic analog of prostacyclin iloprost, and calcium channel blockers (CCB) are also used.

Boehringer Ingelheim’s OFEV (nintedanib) has been approved by the US FDA, EMA, and the Japanese MHLW to slow the rate of decline in pulmonary function in patients with systemic sclerosis-associated interstitial lung disease. The US FDA has also approved Roche’s (Genentech) ACTEMRA (tocilizumab) for a similar indication. Zenyaku and Chugai obtained approval from the Japanese MHLW for an antiCD20 monoclonal antibody, RITUXAN (rituximab), for systemic sclerosis.

Systemic Sclerosis Epidemiology

The systemic sclerosis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total diagnosed prevalent cases of systemic sclerosis, systemic sclerosis cases by disease subset, age-specific cases of systemic sclerosis, systemic sclerosis cases with organ involvement, systemic sclerosis severity by organ damage cases, and systemic sclerosis by severity by skin thickness cases in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings in the Systemic Sclerosis Epidemiology Forecast

- Based on DelveInsight's assessment in 2024, the 7MM had approximately 231,200 diagnosed prevalent cases of systemic sclerosis. These cases are projected to increase during the forecast period.

- Among EU4 and the UK, Italy had the highest number of diagnosed prevalent cases of systemic sclerosis, while Spain had the lowest number of diagnosed prevalent cases.

- It is observed that systemic sclerosis occurs majorly in the age group of 40–69 years.

- Systemic sclerosis severity is distributed by organ damage and skin thickness. Mild organ damage and mild skin thickness are present in a majority of patients with systemic sclerosis.

- Analysis of age-specific data in the US indicates that systemic sclerosis was least prevalent among individuals aged 39 years or younger, with the highest number of diagnosed cases observed in those aged between 40 and 69 years.

Systemic Sclerosis Epidemiology Segmentation

- Total Diagnosed Prevalent Cases of Systemic Sclerosis in the 7MM

- Systemic Sclerosis by Disease Subset in the 7MM

- Age-specific Cases of Systemic Sclerosis in the 7MM

- Systemic Sclerosis Severity by Skin Thickness in the 7MM

- Systemic Sclerosis Severity by Organ Damage in the 7MM

- Systemic Sclerosis With Organ Involvement in the 7MM

Recent Developments in the Systemic Sclerosis Treatment Landscape

- In June 2025, aTyr Pharma announced interim Phase II EFZOCONNECT trial results for efzofitimod, demonstrating favorable safety and tolerability, along with stable or improved mRSS across all patients, meaningful clinical benefits in diffuse SSc-ILD, and promising biomarker responses.

- In April 2025, Calibr-Skaggs Institute for Innovative Medicines (Scripps Research) received FDA clearance for their IND application to study switchable CAR-T therapy (CLBR001 + SWI019) in autoimmune diseases. The upcoming Phase 1 trial will assess safety and efficacy in patients with myositis, systemic sclerosis, lupus, and rheumatoid arthritis, with plans to potentially expand to other conditions.

- In February 2025, the FDA cleared Allogene Therapeutics’ investigational new drug (IND) application for ALLO-329, an allogenic CAR-T cell therapy. Researchers are set to begin the Phase 1 RESOLUTION trial in mid-2025 for autoimmune diseases, including systemic lupus erythematosus (SLE), lupus nephritis (LN), idiopathic inflammatory myopathies, and systemic sclerosis.

- In Sept 2024, Aisa Pharma, Inc. announced that the FDA has granted Orphan Drug Designation to AISA-021 (cilnidipine), a fourth-generation calcium channel antagonist. AISA-021 is being developed for the treatment of systemic sclerosis (SSc), a rare autoimmune disease affecting approximately 175,000 Americans, known for its high mortality rate.

Systemic Sclerosis Drugs Market Analysis

The drug chapter segment of the systemic sclerosis drugs market report encloses a detailed analysis of the late-stage (Phase III and Phase II) and early-stage (Phase I/II) Systemic Sclerosis pipeline drugs. The current key Systemic Sclerosis Companies for emerging drugs and their respective drug candidates include Kyowa Kirin [LUMICEF (brodalumab/KHK-4827)], GSK [BENLYSTA (belimumab)], AstraZeneca [SAPHNELO (anifrolumab)], Amgen (Horizon Therapeutics)/Mitsubishi Tanabe Pharma [UPLIZNA [inebilizumab/MT-0551)], aTyr Pharma/Kyorin Pharmaceutical (efzofitimod), Roche (Genentech)/Kiniksa Pharmaceuticals [vixarelimab (RG6536)], and others. The drug chapter also helps understand the systemic sclerosis clinical trials details, expressive pharmacological action, agreements and collaborations, approval, and patent details, and the latest news and press releases.

Systemic Sclerosis Marketed Drugs

-

OFEV (nintedanib): Boehringer Ingelheim

Nintedanib is in a class of medications called kinase inhibitors and works by blocking the action of enzymes involved in causing fibrosis. It is used to slow the rate of decline in lung function in people with systemic sclerosis-associated interstitial lung disease, a disease in which there is scarring of the lungs that is often fatal. In September 2019, the US FDA approved OFEV capsules to slow the rate of decline in pulmonary function in adults with systemic sclerosis-associated interstitial lung disease. The company holds Orphan drug exclusivity of OFEV until 2026.

-

ACTEMRA (tocilizumab): Roche

ACTEMRA is an anti-IL-6 receptor biologic and is available in both intravenous (IV) and subcutaneous (SC) formulations. ACTEMRA SC is approved in the US to slow the rate of pulmonary function decline in adult patients with systemic sclerosis-associated interstitial lung disease. The drug is part of a co-development agreement with Chugai Pharmaceutical. In March 2021, the US FDA approved ACTEMRA SC injection for slowing the rate of decline in pulmonary function in adult patients with systemic sclerosis-associated interstitial lung disease. In September 2023, Roche withdrew its application to use ROACTEMRA in Europe for the same.

Systemic Sclerosis Emerging Drugs

-

LUMICEF (brodalumab/KHK-4827): Kyowa Kirin

LUMICEF is a recombinant, human IgG monoclonal antibody to the interleukin (IL)-17A receptor, the engagement of which results in the release of pro-inflammatory mediators. The binding of the monoclonal antibody blocks the interaction of IL-17A with its receptor and thus decreases inflammatory pathways that are involved in immune-mediated cell injury. In December 2019, LUMICEF was designated as an Orphan Drug by the Ministry of Health, Labour and Welfare (MHLW) for systemic sclerosis and is subject to Priority Review. The application of LUMICEF is under review in Japan for systemic sclerosis. In December 2021, Kyowa Kirin announced that the company filed an application to the MHLW for a partial change of approved indication of LUMICEF for systemic sclerosis in Japan.

-

BENLYSTA (belimumab): GSK

BENLYSTA is a recombinant, fully human monoclonal antibody that is approved by the US FDA for the treatment of systemic lupus erythematosus. It binds to soluble human BLyS and inhibits its biological activity, leading to apoptosis of B lymphocytes and decreased autoantibody production. In February 2023, GSK announced that the US FDA granted an Orphan Drug Designation to BENLYSTA for the potential treatment of systemic sclerosis. As per GSK’s first quarter 2024 clinical trial appendix, for the BLISSc-ILD Phase III trial, the data is anticipated in 2026+.

-

SAPHNELO (anifrolumab): AstraZeneca

SAPHNELO is a first-in-class, fully human monoclonal antibody. It disrupts the Type I interferon auto-amplification loop that can trigger the loss of immune tolerance and autoimmunity. In addition, it partially inhibits the upregulation of costimulatory molecules and the production of pro-inflammatory cytokines by plasmacytoid dendritic cells (pDCs). SAPHNELO was granted Orphan Drug Designation by the US FDA for the treatment of systemic sclerosis in 2013.

As per AstraZeneca’s first quarter report of 2024, the first patient commenced dosing in the fourth quarter of 2023, the first estimated filing acceptance and the data is anticipated >2025 in the Phase III DAISY clinical trial.

Systemic Sclerosis Drugs Market Insights

Immunosuppressants, biologics, corticosteroids, and proton pump inhibitors (PPIs) are currently used for the management of systemic sclerosis. Immunosuppressants in systemic sclerosis include methotrexate, mycophenolate mofetil (MMF), and azathioprine. Glucocorticoids such as prednisone are also occasionally used in some patients, but their use is generally avoided if possible due to the risk of side effects. While vasoactive therapies comprise endothelin receptor antagonists (ERAs) bosentan, ambrisentan, and macitentan, the 5-phosphodiesterase inhibitor (PDE5) sildenafil, the synthetic analog of prostacyclin iloprost, and calcium channel blockers (CCB) are also used. Apart from immunosuppressive therapies, the tyrosine kinase inhibitor nintedanib, an anti-fibrotic agent is an FDA-approved treatment.

Enhanced understanding of the mechanisms and mediators involved in systemic sclerosis has spurred drugs trials targeting IL-17A, type I IFN receptor, anti-CD19, OSMRß, sGC activator, MC1R agonist, NRP2, lysophosphatidic acid receptor 1 (LPAR1), TxA2, and PGH2, among others.

Systemic Sclerosis Market Outlook

Systemic Sclerosis treatment options for patients with systemic sclerosis are limited to managing organ disease manifestations. Typically, immunosuppressants are used. A breakthrough came in September 2019 when the US FDA approved Boehringer Ingelheim’s OFEV as the first and only medicine to slow the rate of decline in pulmonary function in patients with systemic sclerosis-associated interstitial lung disease. Boehringer Ingelheim’s 2023 annual report reported that OFEV showed an increasingly recorded strong growth in systemic sclerosis with interstitial lung disease. In March 2021, the US FDA approved Roche’s (Genentech) ACTEMRA, also for slowing the rate of decline in pulmonary function in adult patients with systemic sclerosis-associated interstitial lung disease. ACTEMRA was the first biologic therapy approved by the FDA to treat the disease.

Then, in September 2021, Zenyaku obtained approval from the Japanese MHLW for an anti-CD20 monoclonal antibody, RITUXAN. The biosimilar versions of RITUXAN have already been launched in Japan for various indications. The emergence of nintedanib, tocilizumab, and rituximab has significantly expanded treatment options for skin sclerosis and systemic sclerosis-associated interstitial lung disease, heralding a new era in the management of systemic sclerosis. The emerging pipeline of systemic sclerosis therapies includes promising candidates such as SAPHNELO (anifrolumab), dersimelagon (MT-7117), fipaxalparant (AMG 670/HZN 825), avenciguat (BI 685509), BENLYSTA (belimumab), and others.

- The systemic sclerosis market was valued at approximately b and is expected to expand at a notable CAGR of 3.6%, reaching around USD 2,660 million by 2034 over the study period (2020–2034).

- The US accounts for the largest market size of systemic sclerosis among the 7MM in 2024, i.e., nearly 75%.

- According to DelveInsight’s estimates, between EU4 and the UK, Italy accounted for the largest market of systemic sclerosis in 2024, while Spain accounted for the least with around in the respective year.

- In the current market, the majority of the share was accounted for by vasoactive drugs in the US, which was around USD 1,180 million in 2024.

- RITUXAN and ACTEMRA, whose primary patents have expired, face biosimilar competition in several indications, impacting their overall sales significantly.

Systemic Sclerosis Competitive Landscape

The Systemic Sclerosis (SSc) competitive landscape is evolving rapidly as biopharma companies intensify R&D efforts to address this complex autoimmune connective tissue disease with high unmet medical need. Historically, treatment focused on symptomatic management with immunosuppressants and vasodilators, but the landscape is now shifting toward targeted therapies aimed at modulating fibrosis, immune dysregulation, and vascular damage.

Systemic Sclerosis Therapeutic Categories

- Antifibrotic Agents: A major focus given SSc’s hallmark of excessive tissue fibrosis.

- Immunomodulators: Target immune pathways driving chronic inflammation in SSc.

- Vasodilators & Endothelin Receptor Antagonists: Address vascular dysfunction and digital ulcerations.

- Cell and Gene Therapies: Early-stage exploration in regenerative approaches.

Systemic Sclerosis Pipeline Dynamics

- The pipeline comprises preclinical, Phase I-III candidates, with several in late-stage development showing promise in reducing skin fibrosis or improving lung function in systemic sclerosis-associated interstitial lung disease (SSc-ILD).

- Combination therapy approaches pairing immunomodulators with antifibrotics are under evaluation to maximize clinical benefit.

Key Systemic Sclerosis Companies

The Key Systemic Sclerosis companies actively involved in the Systemic Sclerosis treatment landscape include -

- Genentech

- Kyowa Kirin

- GSK

- AstraZeneca

- Amgen (Horizon Therapeutics)

- Mitsubishi Tanabe Pharma

- Roche (Genentech)

- Kiniksa Pharmaceuticals

- Boehringer Ingelheim

- aTyr Pharma

- Kyorin Pharmaceutical

- Cumberland Pharmaceuticals

Systemic Sclerosis Drugs Uptake

This section focuses on the rate of uptake of the potential Systemic Sclerosis drugs expected to be launched in the market during the study period. The analysis covers systemic sclerosis drugs market uptake by drugs; patient uptake by therapies; and sales of each drug. The probability of success in the case of emerging drugs in the case of systemic sclerosis is low considering the lack of data on proof of concept studies.

Rituximab has not been licensed for systemic sclerosis in the US or Europe. Only Japanese patients were involved in the DESIRES research, and rituximab is the only medication that has shown statistically significant improvements in mRSS when compared to the placebo group. Rituximab may be more attractive than other medications as it can improve SSc-ILD, as seen by the fact that both the nintedanib and tocilizumab studies demonstrated a drop in FVC from baseline in the real drug group. While MMF and MTX, which are widely used worldwide, are not approved in Japan for the treatment of systemic sclerosis or SSc-ILD, CYC and AZA are, nevertheless, approved for the treatment of systemic sclerosis. Relative to US and EU-disclosed statistics, a smaller number of patients in Japan are prescribed immunomodulatory medicines.

Systemic Sclerosis Clinical Trial Activities

The Systemic Sclerosis pipeline report provides insights into different Systemic Sclerosis clinical trials within Phase III, Phase II, and Phase I/II stage. It also analyzes key Systemic Sclerosis Companies involved in developing targeted therapeutics.

Systemic Sclerosis Pipeline Development Activities

The Systemic Sclerosis clinical trials analysis report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for systemic sclerosis emerging therapies.

Latest KOL- Views on Systemic Sclerosis Market Report

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, Professor and Vice Chair of the Department of Rheumatology and Director, PhD, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or systemic sclerosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Systemic Sclerosis unmet needs.

Delveinsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Department of Rheumatology - Descartes University, Johns Hopkins University School of Medicine, University of California, Northwestern University, etc., were contacted. Their opinion helps understand and validate systemic sclerosis epidemiology and market trends.

Systemic Sclerosis Therapeutics Market Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Systemic Sclerosis treatment market landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Systemic Sclerosis Therapeutics Market Access and Reimbursement

Patients taking OFEV cannot afford to go without it, but many also cannot afford to pay the full retail price, which can be as high as USD 15,000 per month without insurance. Even those with prescription coverage can find their out-of-pocket costs for OFEV beyond their reach. The resulting financial stress takes a toll on patients and family members already coping with the stress of a serious illness that can be treated but not cured. There are patient assistance programs that can greatly reduce the cost of expensive but essential medications. Unfortunately, many who need such help do not know these programs exist.

If patients have commercial insurance, they will have the opportunity to enroll in the OFEV Copay Program. The Specialty Pharmacy will enroll them in the program and provide a status on their eligibility. The OFEV Bridge Program can help close the gap and temporarily provide OFEV free of charge to eligible patients. ACTEMRA which is prescribed for systemic sclerosis-associated interstitial lung disease patients, has assistance programs to make the drug easily available to the patients. ACTEMRA Access Solutions works closely with practice managers, patient advocates, and other healthcare professionals to help patients get their ACTEMRA.

Scope of the Systemic Sclerosis Treatment Market Report

- The Systemic Sclerosis treatment market report covers a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into systemic sclerosis epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and Systemic Sclerosis emerging therapies is provided, along with the assessment of new therapies, which will have an impact on the current Systemic Sclerosis treatment market landscape.

- A detailed review of the systemic sclerosis treatment market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The Systemic Sclerosis treatment market report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM systemic sclerosis drugs market.

Systemic Sclerosis Market Report Insights

- Patient-based Systemic Sclerosis Market Forecasting

- Systemic Sclerosis Therapeutic Approaches

- Systemic Sclerosis Pipeline Analysis

- Systemic Sclerosis Market Size and Trends

- Systemic Sclerosis Drugs Market Opportunities

- Impact of Upcoming Systemic Sclerosis Therapies

Systemic Sclerosis Market Report Key Strengths

- 11 Years Systemic Sclerosis Market Forecast

- 7MM Coverage

- Systemic Sclerosis Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Systemic Sclerosis Drugs Market

- Systemic Sclerosis Drugs Uptake

Systemic Sclerosis Market Report Assessment

- Current Systemic Sclerosis Treatment Market Practices

- Systemic Sclerosis Unmet Needs

- Systemic Sclerosis Pipeline Drugs Profiles

- Systemic Sclerosis Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Systemic Sclerosis Market Drivers

- Systemic Sclerosis Market Barriers

FAQs Related to the Systemic Sclerosis Market:

- What was the systemic sclerosis drugs market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the systemic sclerosis treatment market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings about the market across the 7MM and which country will have the largest systemic sclerosis market size during the study period (2020–2034)?

- At what CAGR, the systemic sclerosis market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the systemic sclerosis market growth till 2034 and what will be the resultant market size in the year 2034?

- What are the disease risks, burdens, and unmet needs of systemic sclerosis?

- What is the historical systemic sclerosis patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What would be the forecasted patient pool of systemic sclerosis at the 7MM level?

- What will be the growth opportunities across the 7MM concerning the patient population of systemic sclerosis?

- Amon the 7MM which country would have the most prevalent cases of systemic sclerosis during the study period (2020–2034)?

- At what CAGR the population is expected to grow across the 7MM during the study period (2020–2034)?

- How many companies are developing therapies for the treatment of systemic sclerosis?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of systemic sclerosis?

- What are the key collaborations (industry–industry, industry-academia), Mergers and acquisitions, and licensing activities related to systemic sclerosis therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for systemic sclerosis and their status?

- What are the key designations that have been granted for the emerging therapies for systemic sclerosis?

- What are the 7MM historical and forecasted market of systemic sclerosis?

Reasons to Buy Systemic Sclerosis Market Forecast Report

- The Systemic Sclerosis therapeutics market report will help in developing business strategies by understanding trends shaping and driving the systemic sclerosis drugs market.

- To understand the future Systemic Sclerosis drugs market competition in the systemic sclerosis market and insightful review of the SWOT analysis of systemic sclerosis.

- Organize sales and marketing efforts by identifying the best opportunities for systemic sclerosis in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Systemic Sclerosis drugs market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the systemic sclerosis drugs market.

- To understand the future market competition in the systemic sclerosis drugs market.

Stay Updated with us for Recent Articles:-

-pipeline.png&w=256&q=75)