Thalassemia Market Summary

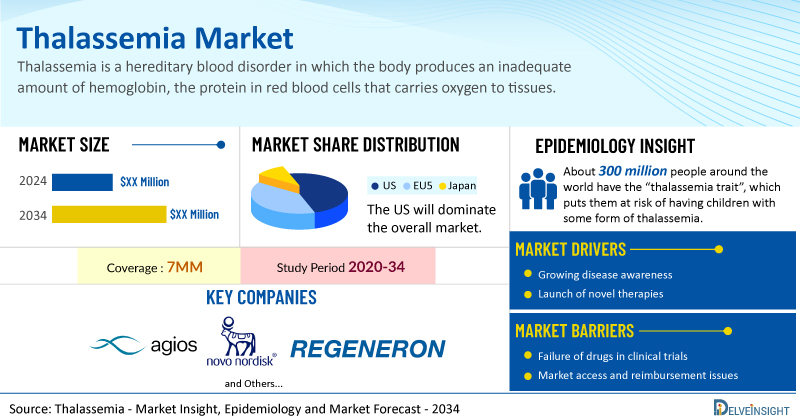

- The Thalassemia Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- Thalassemia is the most common form of inherited anemia worldwide. The World Health Organization reports suggest that about 60,000 infants are born with major thalassemia every year.

- Alpha treatment- and beta-thalassemia depend on disease severity and include regular blood transfusions, iron chelation therapy to manage iron overload, and curative options like stem cell transplantation or gene therapy; milder cases may not require treatment, while newer targeted therapies are showing promising potential.

- Currently, there are no approved therapies for alpha thalassemia; however, there are certain therapies approved for beta thalassemia, i.e., CASGEVY (Vertex Pharmaceuticals), ZYNTEGLO (Bluebird Bio), REBLOZYL (Bristol-Myers Squibb), and others.

- The pipeline for thalassemia is not very robust. However, some key players like Agios Pharmaceuticals (PYRUKYND), Novo Nordisk (etavopivat), and Regeneron Pharmaceuticals (REGN7999) are conducting trials for the treatment of patients with thalassemia.

- In January 2025, Agios Pharmaceuticals announced that the US Food and Drug Administration (FDA) accepted for review the supplemental New Drug Application (sNDA) for mitapivat for the treatment of adults with non-transfusion-dependent and transfusion-dependent alpha- or beta-thalassemia. The review classification for this application is Standard, and the Prescription Drug User Fee Act (PDUFA) goal date is September 7, 2025.

- Awareness around thalassemia is steadily increasing, driven by advancements in diagnostics, improved management strategies, and the emergence of curative approaches such as stem cell and gene therapy. With ongoing innovation in targeted treatments, enhanced patient monitoring, and expanding newborn screening programs, the global outlook for thalassemia care is improving. As a result, the thalassemia treatment market is expected to witness significant growth in the coming years, supported by rising demand for effective therapies and broader healthcare access.

DelveInsight's “Thalassemia Market Insight, Epidemiology and Market Forecast – 2034” report delivers an in-depth analysis of thalassemia epidemiology, market, and clinical development in thalassemia. In addition to this, the report provides historical and forecasted epidemiology and market data as well as a detailed analysis of the thalassemia therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The thalassemia market report provides real-world prescription pattern analysis, emerging drugs assessment, market share, and uptake/adoption pattern of individual therapies, as well as historical and forecasted thalassemia market size from 2020 to 2034 in 7MM. The report also covers current thalassemia treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Scope of The Thalassemia Market Report | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Thalassemia Epidemiology |

Segmented by:

|

|

Key Thalassemia Companies |

|

|

Thalassemia Key Therapies |

|

|

Thalassemia Market |

Segmented by:

|

|

Analysis |

|

Key Factors Driving the Growth of the Thalassemia Market

Growing diagnosed thalassemia patient pool drive the market

Improved surveillance, wider newborn/prenatal screening, and better reporting have increased the number of diagnosed thalassemia cases worldwide, enlarging the treated population and demand for therapies and diagnostics.

Emergence of novel thalassemia drug class will propel the market

Pyruvate kinase activators like Agios Pharmaceuticals’ PYRUKYND are emerging as promising oral therapies for both transfusion-dependent and non-transfusion-dependent alpha- and beta-thalassemia. Regulatory approvals are underway in key markets, including the US and EU. On the other hand, Novo’s pyruvate kinase activator Etavopivat is also in a thalassemia clinical trial.

Better diagnostics & screening technologies will surge the market growth

Wider use of molecular diagnostics, NGS panels, carrier screening, and newborn screening programs improves early detection and stratification (who needs aggressive therapy versus conservative management). Earlier diagnosis both increases short-term utilization (confirmatory testing, genetic counseling) and long-term demand for therapies and monitoring.

Thalassemia Disease Understanding

Thalassemia Overview

Thalassemia is a genetic blood disorder in which the body produces insufficient hemoglobin, the protein in red blood cells responsible for carrying oxygen throughout the body. This results in fewer and less effective red blood cells, leading to anemia, a condition marked by fatigue, weakness, and other symptoms due to reduced oxygen delivery to tissues. Thalassemia is inherited from one or both parents and varies in severity, from mild forms with little to no symptoms to severe forms requiring regular blood transfusions. It is more common in people of Mediterranean, Middle Eastern, South Asian, and African ancestry. The condition can affect either the alpha or beta part of hemoglobin, giving rise to alpha thalassemia or beta thalassemia, respectively.

Thalassemia Diagnosis

Thalassemia is typically diagnosed through a combination of medical history, family history, and specialized blood and genetic tests. If symptoms are mild or absent, it may be detected incidentally during a routine blood test. In more severe cases, signs often appear before the age of two. To confirm a diagnosis, healthcare providers may conduct a complete blood count (CBC) to assess hemoglobin levels and red blood cell characteristics, special hemoglobin tests to identify abnormal hemoglobin types, and genetic testing to determine the specific form of thalassemia.

Further details related to country-based variations in diagnosis are provided in the report

Thalassemia Treatment

Treatment for thalassemia depends on its type and severity. Carriers or individuals with mild forms like alpha or beta thalassemia trait may not need treatment. More serious types, such as hemoglobin H disease, beta thalassemia intermedia, or major, often require regular or occasional blood transfusions to manage anemia. Frequent transfusions can cause iron overload, which is managed through iron chelation therapy using medications like deferasirox, deferiprone, or deferoxamine. In severe cases, a blood or bone marrow transplant may offer a cure, though donor matches are limited. Additional treatments may include medications like luspatercept or hydroxyurea to reduce transfusion needs, and splenectomy in certain cases to improve symptoms.

Thalassemia Epidemiology

The thalassemia epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total diagnosed prevalent cases of thalassemia, type-specific diagnosed prevalent cases of thalassemia, total diagnosed prevalent cases of thalassemia based on transfusion requirement, and total treated cases of thalassemia in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Thalassemia Epidemiological Analyses and Forecast

- About 300 million people around the world have the “thalassemia trait”, which puts them at risk of having children with some form of thalassemia. More than 1 million people have non-transfusion-dependent thalassemia, while more than 100,000 people have transfusion-dependent thalassemia. In the US, there are at least 1,200 people with transfusion-dependent thalassemia.

- In 2021, there were 1,310,407 cases of thalassemia globally.

- Worldwide, at least 300,000 children are born each year affected with a severe form of hemoglobinopathy. Furthermore, at least 20% of the global population carries at least a single gene deletion for alpha thalassemia.

- Globally, the Age-standardized Prevalence Rates (ASPR), Age-standardized Incidence Rates (ASIR), Age-standardized Mortality Rates (ASMR), and age-standardized DALYs rates for thalassemia in 2021 were 18.28 per 100,000 persons, 1.93 per 100,000 persons, 0.15 per 100,000 persons, and 11.65 per 100,000 persons, respectively.

- The number of β-thalassemia prevalent cases in the US was previously estimated at 2,600, and state-specific prevalence data are limited.

- Globally, approximately 60,000 newborns are born with β-thalassemia major per year, with the majority living in developing countries and constituting about 1.5 % of the total population (80–90 million people).

- In Italy, in 2021 were recorded more than 400,000 people were recorded with rare disease. Because of its location and history, Italy has an unfortunate statistic regarding the presence and prevalence of two rare genetic diseases, namely beta-thalassemia, of which there are about 90 million carriers worldwide, 400,000 of whom are actually affected.

- Over half of alpha-thalassemia cases in Japan are of Southeast Asian origin, while the rest involve unique, largely undetermined Japanese mutations, indicating a dual origin. Beta-thalassemia occurs in about 1 in 600–1,000 people, and alpha(+)-thalassemia (-α/) in about 1 in 400, making alpha-thal trait (-α/-α) extremely rare.

Thalassemia Drug Analysis

The drug chapter segment of the thalassemia report encloses a detailed analysis of thalassemia marketed drugs and late-stage (Phase III and Phase II) Thalassemia pipeline drugs. It also deep dives into thalassemia’s pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Thalassemia Marketed Drugs

CASGEVY (exagamglogene autotemcel): Vertex Pharmaceuticals

Casgevy is the first FDA-approved therapy utilizing CRISPR/Cas9, a type of genome editing technology. CASGEVY is a non-viral, ex vivo CRISPR/Cas9 gene-edited cell therapy for eligible patients with sickle-cell disease or transfusion-dependent beta thalassemia, in which a patient’s own hematopoietic stem and progenitor cells are edited at the erythroid-specific enhancer region of the BCL11A gene through a precise double-strand break. This edit results in the production of high levels of fetal hemoglobin (HbF; hemoglobin F) in red blood cells. HbF is the form of the oxygen-carrying hemoglobin that is naturally present during fetal development, which then switches to the adult form of hemoglobin after birth. CASGEVY has been shown to reduce or eliminate vaso-occlusive crises for patients with sickle-cell disease and transfusion requirements for patients with transfusion-dependent beta thalassemia.

Patients’ hematopoietic (blood) stem cells are modified by genome editing using CRISPR/Cas9 technology. In January 2024, Vertex Pharmaceuticals announced the US FDA had approved CASGEVY for the treatment of transfusion-dependent beta thalassemia in patients 12 years and older.

REBLOZYL (luspatercept): Bristol-Myers Squibb

REBLOZYL, a first-in-class therapeutic option, promotes late-stage red blood cell maturation in animal models. REBLOZYL is being developed and commercialized through a global collaboration with Merck as of November 2021. With this approval, REBLOZYL is indicated in the US for the treatment of anemia in adult patients with beta thalassemia who require regular Red Blood Cell (RBC) transfusions.

In November 2019, the US FDA approved REBLOZYL for the treatment of anemia in adult patients with beta thalassemia who require regular red blood cell transfusions.

|

Product |

Company |

RoA |

MoA |

First Approval |

|

CASGEVY (exagamglogene autotemcel) |

Vertex Pharmaceuticals |

IV bolus via a central venous catheter |

Gene therapy |

2024 |

|

ZYNTEGLO betibeglogene autotemcel) |

Bluebird Bio |

IV infusion |

Gene therapy |

2022 |

|

REBLOZYL (luspatercept) |

Bristol-Myers Squibb |

SC |

TGF-beta superfamily protein inhibitors |

2019 |

Thalassemia Emerging Drugs

PYRUKYND (mitapivat): Agios Pharmaceuticals

PYRUKYND is a pyruvate kinase activator indicated for the treatment of hemolytic anemia in adults with pyruvate kinase deficiency in the US, and for the treatment of PK deficiency in adult patients in the European Union. Recently, the US FDA accepted for review the sNDA for mitapivat for the treatment of adults with non-transfusion-dependent and transfusion-dependent alpha- or beta-thalassemia.

In June 2025, Agios Pharmaceuticals presented new data on the company’s PK activators, mitapivat and tebapivat, will be featured in oral and poster presentations during the 30th European Hematology Association (EHA) Congress 2025.

Etavopivat (FT-4202): Novo Nordisk

Etavopivat is a small-molecule activator of the enzyme Pyruvate Kinase R (PKR). In its active state, PKR pushes red blood cells to produce energy, and 2,3-DPG levels drop. By reducing the levels of 2,3-DPG and increasing the production of energy, etavopivat should allow stronger binding of oxygen to the faulty hemoglobin protein. This would prevent red blood cells from taking on a sickle-like shape, thereby prolonging red blood cell survival, easing anemia, and reducing VOC frequency. Currently, it is being evaluated in Phase III for thalassemia in clinical trials, while as per the company’s pipeline the product is in Phase II for thalassemia.

|

Table 2: Comparison of key emerging drugs | ||||

|

Drug name |

Company |

MoA |

Phase |

Indication |

|

PYRUKYND (mitapivat) |

Agios Pharmaceuticals |

Pyruvate kinase activator |

III |

Transfusion-dependent alpha- or beta-thalassemia |

|

Etavopivat* (FT-4202) |

Novo Nordisk |

Pyruvate kinase-R activator |

II |

Thalassemia |

|

REGN7999 |

Regeneron Pharmaceuticals |

Targets TMPRSS6 |

II |

Iron overload in beta-thalassemia |

*As per Novo Nordisk’s pipeline (accessed 17th July 2025) etavopivat is in Phase II for the treatment of thalassemia. While a Phase III trial is initiated in clinicaltrials.gov (NCT06609226).

Note: Detailed emerging therapies assessment will be provided in the final report....

Thalassemia Drug Class Analysis

Gene therapy for β-thalassemia, including approved treatments like CASGEVY and ZYNTEGLO, uses genome editing tools (e.g., CRISPR-Cas9) or modified stem cells to restore β-globin function. Despite challenges like delivery efficiency and off-target effects, integration with zebrafish models and single-cell sequencing is enhancing precision and safety.

Pyruvate kinase activators like PYRUKYND are emerging as promising oral therapies for both transfusion-dependent and non-transfusion-dependent alpha- and beta-thalassemia. Regulatory approvals are underway in key markets, including the US and EU.

Thalassemia Market Outlook

The thalassemia market is anchored by regular blood transfusions and iron chelation therapies to manage anemia and prevent iron overload. Curative options like stem cell transplants are limited by donor availability. There are no marketed drugs for alpha thalassemia; however, there are marketed drugs for beta thalassemia, including CASGEVY, ZYNTEGLO, and REBLOZYL. Emerging therapies such as PYRUKYND aim to reduce transfusion dependence, are expected to reshape the long-term treatment outlook.

Key Thalassemia Companies, such as Agios Pharmaceuticals, Novo Nordisk, and others, are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products for the treatment of thalassemia.

Thalassemia Market Recent Developments and Breakthroughs

- In June 2025, Agios Pharmaceuticals presented new data on the company’s PK activators, mitapivat and tebapivat, will be featured in oral and poster presentations during the 30th EHA Congress 2025.

Thalassemia Drug Uptake

This section focuses on the uptake rate of potential Thalassemia drugs expected to be launched in the market during 2025–2034, which depends on the competitive landscape, safety, and efficacy data, along with the order of entry. It is important to understand that the key Thalassemia companies evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies' drug uptake in the report…

Thalassemia Thalassemia Clinical Trial Analysis

The Thalassemia pipeline report provides insights into Thalassemia clinical trials within the Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Thalassemia Pipeline Development Activities

The Thalassemia clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for thalassemia therapies.

Latest KOL Views on Thalassemia

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Professors, and Others.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as UT Health San Antonio MD Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or thalassemia market trends.

What KOLs are saying on Thalassemia Patient Trends? |

|

“Alpha thalassemia has long remained underdiagnosed in the US, especially the silent carriers and HbH disease subtypes. Most treatments are still palliative, relying on transfusions and iron chelation. However, investigational agents like mitapivat and gene-editing platforms such as CRISPR-Cas9 hold promise for disease modification. The real opportunity lies in shifting from supportive care to targeted molecular correction, provided these drugs meet safety and access benchmarks.” Hematologist, NIH Collaborator, USA |

Thalassemia Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Thalassemia Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Thalassemia Market Report

- The Thalassemia market report covers a segment of key events, an executive summary, a descriptive overview of thalassemia, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of the diagnosis rate, and disease progression along treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Even though management of patients happens by off-label therapies, novel drug development is an ongoing opportunity for patients in this disease group. Market, historical, and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach are included in the report, covering the 7MM drug outreach.

- The Thalassemia market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM thalassemia market.

Thalassemia Market Report Insights

- Thalassemia Patient Population

- Thalassemia Therapeutic Approaches

- Thalassemia Pipeline Analysis

- Thalassemia Market Size and Trends

- Existing and future Market Opportunity

Thalassemia Market Report Key Strengths

- Ten-Year Forecast

- 7MM Coverage

- Thalassemia Epidemiology Segmentation

- Key Cross Competition

- Conjoint analysis

- Thalassemia Drugs Uptake

- Key Thalassemia Market Forecast Assumptions

Thalassemia Market Report Assessment

- Current Thalassemia Treatment Practices

- Thalassemia Unmet Needs

- Thalassemia Pipeline Product Profiles

- Thalassemia Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Thalassemia Market Drivers

- Thalassemia Market Barriers

FAQs in Thalassemia Market Report

- What is the historical and forecasted thalassemia patient pool/patient burden in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Which combination of treatment approaches will have a significant impact on the thalassemia drug treatment market size?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the treatment of thalassemia?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

- How many key players are developing therapies for thalassemia?

- Which drug will be the major contributor thalassemia market by 2034?

Reasons to buy Thalassemia Market Forecast Report:

- The Thalassemia Market report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the thalassemia market.

- Insights on patient burden/disease Incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Thalassemia Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Thalassemia companies in the Thalassemia Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Thalassemia Market so that the upcoming Thalassemia companies can strengthen their development and launch strategy.

-market.png&w=256&q=75)