Wound Closure Devices Market Summary

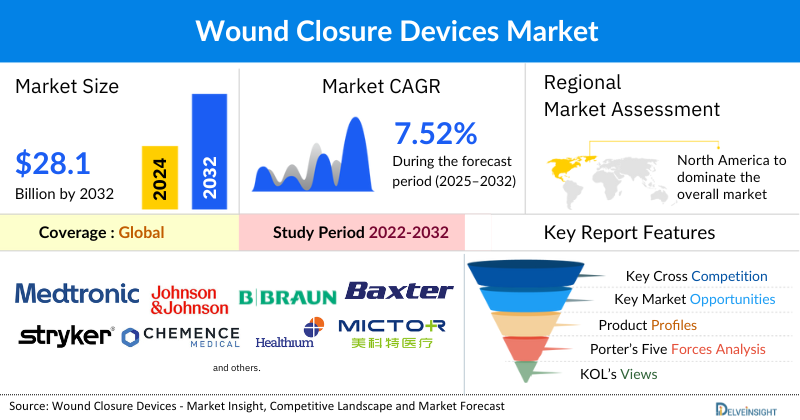

- The global wound closure devices market is expected to increase from USD 15,831.38 million in 2024 to USD 28,128.89 million by 2032, reflecting strong and sustained growth.

- The global wound closure devices market is growing at a CAGR of 7.52% during the forecast period from 2025 to 2032.

Wound Closure Devices Market Trends & Insights

- The market of wound closure devices is being primarily driven by the rising prevalence of chronic and acute wounds, the growing number of surgical procedures worldwide, and the increasing product launches and regulatory approvals by key market players are driving market growth.

- The leading companies operating in the wound closure devices market include Medtronic, 3M, Johnson & Johnson Services, Inc., B. Braun Melsungen AG, Baxter, Smith & Nephew, Stryker, Chemence Medical, Inc., Healthium Medtech, Meril Life Sciences Pvt. Ltd., Futura Surgicare Pvt Ltd., Advanced Medical Solutions Group plc, Microcure (Suzhou) Medical Technology Co., Ltd., CooperSurgical Inc., Adhezion Biomedical, Cresilon, Cardinal Health, Dukal LLC, ORION SUTURES INDIA PVT LTD, Lotus Surgicals, and others.

- North America is expected to dominate the overall wound closure devices market. The region's market growth is primarily driven by the rising prevalence of chronic wounds, traumatic injuries, and a growing number of surgical procedures. Increasing adoption of advanced wound closure solutions, such as absorbable sutures, staplers, and adhesive-based products, is fueled by the demand for faster healing and reduced hospital stays. Strong R&D investments, frequent product approvals, and the presence of leading medical device companies further strengthen the region’s market position.

- In the product type segment of the wound closure devices market, the sutures category is estimated to account for the largest market share in 2024.

Wound Closure Devices Market Size and Forecasts

- 2024 Market Size: USD 15,831.38 million

- 2032 Projected Market Size: USD 28,128.89 million

- Growth Rate (2025-2032): 7.52% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Concentrated

Factors Contributing to the Growth of the Wound Closure Devices Market

Market Driver - Rising prevalence of chronic and acute wounds leading to a surge in wound closure devices market

The growing global burden of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, along with acute wounds caused by trauma, accidents, and burns, is significantly driving the demand for wound closure devices. With the global increase in diabetes and obesity, the number of patients prone to non-healing wounds is rising, creating a continuous need for advanced closure methods that promote faster healing and reduce complications.

Market Driver - Increasing number of surgical procedures globally

The rising incidence of elective and emergency surgeries, including cardiovascular, orthopedic, cosmetic, and bariatric procedures, has fueled the adoption of wound closure devices. With surgical volumes increasing due to advancements in healthcare access, medical tourism, and the growing geriatric population requiring complex procedures, the demand for efficient closure products such as sutures, staplers, and adhesives continues to escalate.

Market Driver - Technological advancements in wound closure products

The market is benefiting from continuous innovation, including the development of bioabsorbable sutures, antimicrobial-coated closure devices, tissue sealants, and next-generation stapling systems. These technologies are designed to minimize infection risks, reduce scarring, enhance cosmetic outcomes, and shorten recovery times. The integration of minimally invasive surgical techniques further supports the need for advanced wound closure solutions tailored to modern surgical practices.

Wound Closure Devices Market Report Segmentation

This wound closure devices market report offers a comprehensive overview of the global wound closure devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation of Wound Closure Devices by Product Type (Sealants & Adhesives, Staplers, Sutures [Absorbable and Non-Absorbable], Hemostats, and Others), End-User (Hospitals, Specialty Clinics, and Others), and geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing wound closure devices market.

Wound closure devices are medical instruments and materials used to close and secure wounds, either from surgery, trauma, or chronic conditions, to promote healing, prevent infection, and minimize scarring. These devices bring the edges of a wound together and maintain them in proper alignment until natural healing occurs.

The wound closure devices market is growing due to several key factors. The rising global incidence of chronic and acute wounds, spurred by an aging population and increasing rates of conditions like diabetes, is a primary driver. Additionally, a global rise in surgical procedures across various specialties is fueling demand for advanced closure solutions. The market is further boosted by continuous innovation, with leading companies introducing new product launches and approvals for technologies like advanced sutures, sealants, and wound adhesives that promote faster healing and better patient outcomes.

What are the latest Wound Closure Devices Market Dynamics and Trends?

The wound closure devices market is witnessing strong growth, fueled by the rising prevalence of chronic wounds, increasing surgical procedures, and continuous advancements in product innovation. In Australia, DelveInsight estimates that over 500,000 people are affected by diabetes-related foot disease (DFD), leading to an average of 14 amputations and 3 deaths each day, and imposing a direct healthcare cost burden of more than AUD 1.6 billion annually. On a global scale, DelveInsight reports that in African countries, diabetic foot ulcer (DFU) prevalence ranges from 11% to 25%, with lower-limb amputation rates between 3.5% and 34%, highlighting the urgent demand for advanced wound closure and management solutions

At the same time, market growth is reinforced by the rising number of surgical procedures. According to DelveInsight, Germany performed over 250,000 hip replacements in 2024, a figure projected to surpass 260,000 by 2028. Similarly, Finland’s orthopedic surgeries are expected to rise from approximately 16,100 in 2024 to 17,000 by 2026. This steady increase in surgical volumes directly translates into higher demand for sutures, staples, adhesives, and other wound closure products.

Emerging market dynamics further accelerate adoption. Key trends include the shift toward minimally invasive and atraumatic solutions such as skin adhesives and barbed sutures, the rise of bioabsorbable and antimicrobial-coated closure materials, and the emergence of digital health integration, where smart sutures and remote wound monitoring tools support improved recovery and infection prevention. In addition, value-based healthcare systems are emphasizing devices that demonstrate both clinical efficacy and cost efficiency.

Manufacturers are also amplifying their portfolios through regulatory approvals and product launches. For example, in June 2023, the Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST) secured CDSCO approval for Cholederm, an advanced and cost-effective wound healing product for burns and diabetic wounds. Such innovations, alongside investment in smart bandages and robotic-assisted closure systems, reflect the market’s strategic focus on affordability, accessibility, and next-generation care.

The wound closure devices market, while growing, faces several notable restraints. The high cost of advanced products, such as bioengineered solutions and antimicrobial-coated sutures, can limit adoption, especially in developing economies and budget-conscious healthcare systems. Furthermore, the stringent and time-consuming regulatory approval process for new technologies can significantly delay their market entry. A lack of specialized training for healthcare professionals in using these complex devices can also hinder their widespread use. Finally, the market faces intense competition from alternative wound care products, including advanced dressings and negative pressure wound therapy systems, which may be preferred for certain wound types, thereby impacting the market share of traditional closure devices.

Wound Closure Devices Market Segment Analysis

Wound Closure Devices by Product Type (Sealants & Adhesives, Staplers, Sutures [Absorbable and Non-Absorbable], Hemostats, and Others), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

Wound Closure Devices Market Segmentation By Product Type

By Product Type: Sutures Dominate the Market

In the product type segment of the wound closure devices market, the sutures are estimated to account for the largest market share of 25% in 2024. Sutures are a foundational and powerful driver of the wound closure devices market, with their dominance rooted in a combination of versatility, surgeon preference, and relentless innovation. They are utilized in an incredibly broad spectrum of procedures, from routine outpatient visits to complex, life-saving surgeries, underscoring their essential role in modern medicine. Their adaptability to different tissue types and surgical environments, including general surgery, orthopedics, and delicate gynecological and cardiovascular procedures, ensures sustained high demand.

The latest market dynamics reveal that sutures are not just a traditional tool but a platform for cutting-edge technology. The shift toward bioabsorbable sutures is a key trend, with recent product innovations offering predictable degradation and enhanced patient comfort by eliminating the need for removal. Furthermore, the imperative to reduce surgical site infections (SSIs) is a major growth catalyst, propelling the development and adoption of antimicrobial-coated sutures. For instance, researchers in China recently developed a novel suture that generates an electric charge to stimulate healing, while Corza Medical launched new ophthalmic microsurgical sutures with needles made from highly tempered stainless steel to enhance precision in delicate eye procedures.

Beyond material science, sutures are becoming more integrated into advanced surgical workflows. Innovations such as barbed, knotless sutures save critical time in the operating room by eliminating the need to tie knots, making them highly desirable for minimally invasive and robotic-assisted surgeries. Moreover, the FDA's clearance of new systems like the Suture-TOOL System by Suturion demonstrates a move towards automating and standardizing surgical closures to improve patient safety and reduce complications. This continuous evolution in materials, coatings, and delivery systems solidifies the suture market's position at the forefront of wound closure technology.

Wound Closure Devices Market Segmentation By End-User

By End-User: Hospitals Dominate the Market

Hospitals are the leading end-users of wound closure devices, driven by their high volume of surgical procedures and the management of complex patient cases. As the primary location for a vast range of surgeries, from emergency trauma care to major elective operations, hospitals have a continuous and substantial need for a wide spectrum of devices, including sutures, staples, and adhesives. Furthermore, they are uniquely equipped to treat complex and chronic wounds, which often require advanced and costly technologies like bioengineered skin substitutes. This, combined with their financial capacity to invest in and adopt the latest innovations, such as antimicrobial-coated sutures and robotic-assisted surgical tools, firmly establishes hospitals as the dominant segment in the wound closure devices market.

Wound Closure Devices Market Regional Analysis

North America Wound Closure Devices Market Trends

North America is expected to capture the largest portion of the wound closure devices market in 2024, holding approximately 38.5% of global share, driven by the rising prevalence of chronic and acute wounds, increasing surgical procedures, and the strong presence of leading market players engaged in mergers, acquisitions, product launches, and technological advancements. In the United States, traumatic injuries continue to be a major health concern, with the American Society for Biochemistry and Molecular Biology reporting that a brain injury occurs every nine seconds, resulting in more than 3.5 million incidents annually, including around 2.8 million traumatic brain injuries (TBI) and 280,000 hospitalizations.

Surgical activity is also expanding across the region; according to the World Bank, Canada recorded approximately 6,928 surgical procedures per 100,000 population in 2021. Furthermore, diabetes remains a critical driver of wound-related complications. Data from the CDC (2024) shows that 38.4 million Americans, or 11.6% of the U.S. population, live with diabetes, with diabetes accounting for nearly 80% of all lower-limb amputations (LLAs). This rising diabetic population significantly increases the demand for wound closure devices, particularly those designed to manage complex wounds and surgical interventions.

In addition to epidemiological drivers, ongoing product innovations are strengthening market growth. For example, in October 2023, DuPont introduced its new DuPont™ Liveo™ MG 7-9960 Soft Skin Adhesive, designed for advanced wound care dressings and long-term medical device adherence, balancing strong adhesion with gentle removal. Such developments highlight the region’s focus on next-generation wound closure and wound care solutions.

Taken together, the growing burden of chronic conditions, rising surgical volumes, high prevalence of trauma and diabetes-related complications, and continuous innovation from market leaders are expected to firmly position North America as the dominant region in the global wound closure devices market during the forecast period.

Europe Wound Closure Devices Market Trends

The European wound closure devices market is experiencing steady growth, driven by a combination of a rapidly aging population and a rising incidence of chronic diseases, which collectively fuel the demand for surgical and wound care solutions. The region benefits from a well-established healthcare infrastructure and favorable reimbursement policies that facilitate the adoption of advanced technologies. Key trends include a shift towards minimally invasive surgical techniques, which is boosting the demand for tissue adhesives and sealants, and a strong emphasis on infection prevention, leading to increased use of antimicrobial-coated sutures. While a growing number of surgical procedures across the continent directly translates to higher product demand, the market also faces challenges, including the complexities of the new EU Medical Device Regulation (MDR) and the high cost of advanced, innovative devices.

Asia-Pacific Wound Closure Devices Market Trends

The Asia-Pacific wound closure devices market is the fastest-growing region globally, driven by a powerful combination of demographic, economic, and technological factors. The rising prevalence of chronic conditions like diabetes and the rapid growth of the aging population in countries such as China and India are directly fueling demand for both surgical and advanced wound care. Recent estimates from DelveInsight highlight this trend, projecting the Asia-Pacific medical device market to expand at a CAGR of 6.98% between 2025 and 2032, ultimately surpassing a valuation of USD 250 billion. This growth is supported by increasing healthcare expenditure, improving medical infrastructure, and rising consumer awareness. The market is also benefiting from a surge in product innovation, including the development of advanced antimicrobial-coated and bioabsorbable sutures, as well as the increasing adoption of wound sealants and tissue adhesives. These advancements are driven by a growing focus on infection prevention and a shift towards minimally invasive surgical techniques, positioning the region as a major hub for both consumption and development of cutting-edge wound closure solutions.

Who are the major players in the Wound Closure Devices Market?

The following are the leading companies in the Wound Closure Devices market. These companies collectively hold the largest market share and dictate industry trends.

Wound Closure Devices Companies and Manufacturers

- Medtronic

- 3M

- Johnson & Johnson Service, Inc.

- B. Braun Melsungen AG

- Baxter

- Smith & Nephew

- Stryker

- Chemence Medical, Inc.

- Healthium Medtech

- Meril Life Sciences Pvt. Ltd.

- Futura Surgicare Pvt Ltd.

- Advanced Medical Solutions Group plc

- Microcure (Suzhou) Medical Technology Co., Ltd.

- CooperSurgical Inc

- Adhezion Biomedical

- Cresilon

- Cardinal Health

- Dukal LLC

- ORION SUTURES INDIA PVT LTD

- Lotus Surgicals

- Others

How is the competitive landscape shaping the Wound Closure Devices Market?

The wound closure devices market is moderately concentrated, dominated by a few global leaders such as Medtronic, Johnson & Johnson, 3M, and B. Braun, who leverage extensive product portfolios, strong distribution networks, and continuous innovation to maintain market leadership. These major players focus on mergers, acquisitions, strategic partnerships, and new product launches to strengthen their regional presence and technological capabilities. Simultaneously, numerous regional and niche players contribute to innovation in specialized segments, such as bioabsorbable sutures, antimicrobial-coated devices, and smart adhesives. The competitive dynamics are further shaped by regulatory approvals, rising adoption of minimally invasive procedures, and the increasing demand for cost-effective and advanced wound closure solutions, creating a landscape where both scale and innovation drive success.

Recent Developmental Activities in the Wound Closure Devices Market

- In May 2025, Johnson & Johnson Services, Inc. launched the ECHELON LINEAR Cutter in the U.S., featuring 3D-Stapling Technology to enhance staple line security and improve patient outcomes.

- In May 2025, Merit Medical acquired Biolife Delaware, a company that manufactures hemostatic devices under the names StatSeal and WoundSeal. This acquisition allows Merit to expand its product offerings for post-procedure care.

- In January 2025, Cresilon received FDA approval for Traumagel, a plant-based hydrogel designed to control severe bleeding within seconds.

- In January 2025, the Suture-TOOL System by Suturion received FDA clearance and is designed to standardize and automate abdominal wall closures, aiming to improve patient safety and reduce complications.

Scope of the Wound Closure Devices Market | |

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Wound Closure Devices Market CAGR |

7.52% |

|

Key Companies in the Wound Closure Devices Market |

Medtronic, 3M, Johnson & Johnson Services, Inc., B. Braun Melsungen AG, Baxter, Smith & Nephew, Stryker, Chemence Medical, Inc., Healthium Medtech, Meril Life Sciences Pvt. Ltd., Futura Surgicare Pvt Ltd., Advanced Medical Solutions Group plc, Microcure (Suzhou) Medical Technology Co., Ltd., CooperSurgical Inc., Adhezion Biomedical, Cresilon, Cardinal Health, Dukal LLC, ORION SUTURES INDIA PVT LTD, Lotus Surgicals, and others |

|

Wound Closure Devices Market Segments |

by Product Type, by End-user, and by Geography |

|

Wound Closure Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Wound Closure Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Wound Closure Devices Market Segmentation

Wound Closure Devices Market Segmentation By Product Type

- Sealants and Adhesives

- Staplers

- Sutures

- Absorbable

- Non- absorbable

- Hemostats

- Others

Wound Closure Devices Market Segmentation By End-User

- Hospitals

- Specialty Clinics

- Others

Wound Closure Devices Geography Exposure

- North America Wound Closure Devices Market

- United States Wound Closure Devices Market

- Canada Wound Closure Devices Market

- Mexico Wound Closure Devices Market

- Europe Wound Closure Devices Market

- United Kingdom Wound Closure Devices Market

- Germany Wound Closure Devices Market

- France Wound Closure Devices Market

- Italy Wound Closure Devices Market

- Spain Wound Closure Devices Market

- Rest of Europe

- Asia-Pacific Wound Closure Devices Market

- China Wound Closure Devices Market

- Japan Wound Closure Devices Market

- India Wound Closure Devices Market

- Australia Wound Closure Devices Market

- South Korea Wound Closure Devices Market

- Rest of Asia-Pacific

- Rest of the World

- South America Wound Closure Devices Market

- Middle East Wound Closure Devices Market

- Africa Wound Closure Devices Market

Wound Closure Devices Market Recent Industry Trends and Milestones (2022-2025) | |

|

Category |

Key Developments |

|

Wound Closure Devices Product Launches |

Traumagel by Cresilon, ECHELON LINEAR Cutter by Johnson & Johnson Services, Inc., Suture-TOOL System by Suturion |

|

Partnerships in the Wound Closure Devices Market |

Topcon Healthcare & OphtAI, Visionix Aligns with Espansione Group & Insight Medical Technologies |

|

Acquisitions in the Wound Closure Devices Market |

Merit Medical Systems acquired Biolife Delaware, |

|

Company Strategy |

Smith & Nephew: Turnaround Strategy, Convatec: Expansion and Regulatory Challenges |

|

Setbacks in the Wound Closure Devices Market |

Product Recalls and Safety Issues, Regulatory Scrutiny and Delays, Cost and Reimbursement Challenges: |

|

Emerging Technology |

Smart Bandages with Real-Time Monitoring, Electrotherapy-Integrated Dressings |

Impact Analysis

What is the impact of AI on the Wound Closure Devices Market?

AI-Powered Innovations and Applications:

- AI is a core component of next-generation surgical robotics, which directly impacts the wound closure segment. AI-guided robots can perform complex procedures, including suturing and anastomosis, with greater precision and consistency than human surgeons. For example, systems can analyze real-time video feeds and haptic feedback to guide a robotic arm to place sutures at the optimal depth and tension, reducing the risk of tissue damage and improving healing outcomes. This is particularly relevant in minimally invasive surgeries, where AI-powered robotics can overcome the limitations of human dexterity and visualization, ultimately driving demand for specialized robotic-compatible sutures and staples.

- AI and machine learning are revolutionizing wound assessment by providing objective, data-driven insights.

- The integration of AI with sensor technology is creating a new generation of "smart" wound closure devices.

- AI is significantly accelerating the research and development cycle for new wound closure materials. Machine learning models can simulate the performance of new materials, such as bioabsorbable polymers or tissue adhesives, in virtual environments.

U.S. Tariff Impact Analysis on the Wound Closure Devices Market

U.S. tariff policies, particularly on imports from countries like China, have had a notable impact on the wound closure devices market by increasing production costs and creating supply chain disruptions. Many manufacturers rely on imported materials and components, such as metals and specialized polymers, and tariffs on these inputs have directly raised their cost structures. In response, companies are adjusting strategies, including diversifying supply chains, maintaining production in Asia, or exploring alternative sourcing to mitigate tariff-related expenses. These changes affect healthcare providers as well, potentially leading to higher procurement costs and occasional delays in product availability, which could impact patient care. Overall, tariffs have added complexity to the market, prompting both manufacturers and providers to adopt flexible approaches to manage costs and ensure consistent access to wound closure products..

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends | ||||

|

Company Name |

Total Funding |

Main Products |

Stage of Development |

Core Technology |

|

MedVital |

₹8.4 Crore (approx. $1 million) |

NoWound™ - a Negative Pressure Wound Therapy (NPWT) device; developing liquid chitosan-based dressings. |

Pre-seed funding. The company aims to expand its product portfolio and distribution networks in India. |

NPWT technology: future focus on next-generation biomaterials and regenerative medicine. |

|

Nami Surgical |

Opened a $10 Million Series A round |

Mini ultrasonic scalpel for robotic surgery. |

Series A round. The company is advancing its core technology and team. |

Miniaturized ultrasonic technology for precise tissue cutting and sealing in robotic surgery. |

|

Fibroheal Woundcare |

₹6.3 Crore (approx. $0.75 million) |

Bandages derived from silk protein for healing acute and chronic wounds. |

Pre-Series A round. The company is in the process of scaling operations and expanding its market presence in India. |

Silk fibroin-based biomaterials for wound healing. |

Key takeaways from the wound closure devices market report study

- Market size analysis for the current wound closure devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the wound closure devices market.

- Various opportunities available for the other competitors in the wound closure devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current wound closure devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the wound closure devices market growth in the future?

What is the growth rate of the wound closure devices market?

The wound closure devices market is estimated to grow at a CAGR of 7.52% during the forecast period from 2025 to 2032.

What is the market for wound closure devices?

The wound closure devices market was valued at USD 15,831.38 million in 2024, and is expected to reach USD 28,128.89 million by 2032.

Which region has the highest share in the wound closure devices market?

North America is projected to hold the largest share of the wound closure devices market in 2024. This growth is driven by the rising prevalence of chronic and acute wounds, increasing surgical procedures, supportive government initiatives, and the active presence of key market players pursuing mergers, acquisitions, product launches, and other strategic activities. These factors are expected to collectively accelerate the market growth throughout the forecast period.

What are the drivers for the wound closure devices market?

The demand for wound closure devices is primarily driven by the rising incidence of chronic and acute wounds. Additionally, the increasing number of surgical procedures, along with growing product launches and regulatory approvals by key market players, are expected to significantly propel the overall market growth during the forecast period from 2025 to 2032.

Who are the key players operating in the wound closure devices market?

Some of the key market players operating in the wound closure devices market include Medtronic, 3M, Johnson & Johnson Services, Inc., B. Braun Melsungen AG, Baxter, Smith & Nephew, Stryker, Chemence Medical, Inc., Healthium Medtech, Meril Life Sciences Pvt. Ltd., Futura Surgicare Pvt Ltd., Advanced Medical Solutions Group plc, Microcure (Suzhou) Medical Technology Co., Ltd., CooperSurgical Inc., Adhezion Biomedical, Cresilon, Cardinal Health, Dukal LLC, ORION SUTURES INDIA PVT LTD, Lotus Surgicals, and others.