Ascites Market Summary

Ascites Market & Epidemiological Analysis

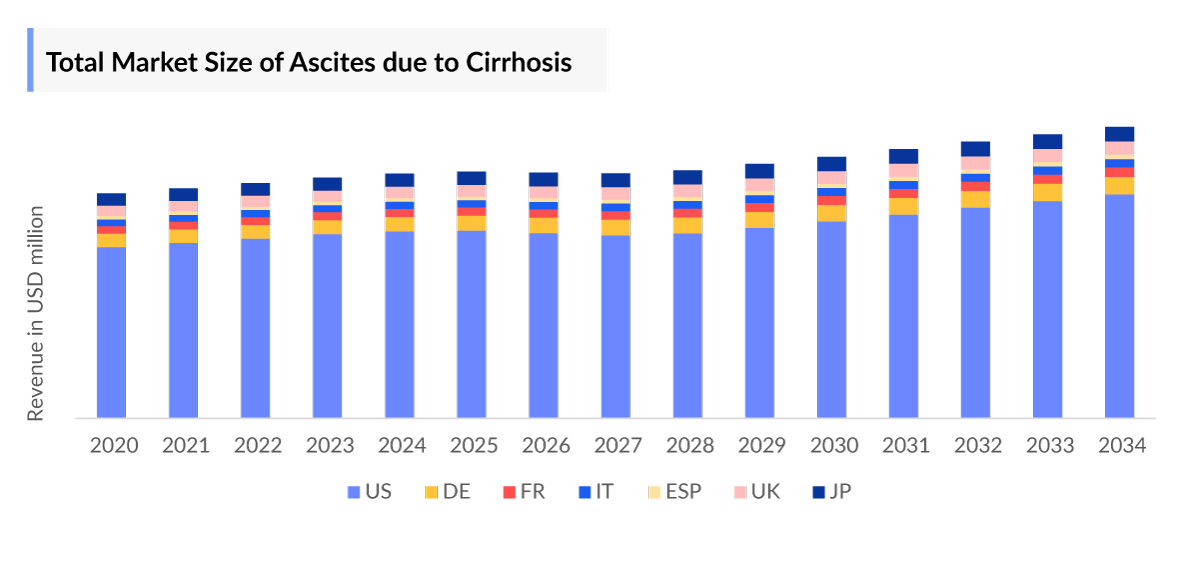

- The largest Ascites Market Size in the 7MM was occupied by the US.

- Among EU4 and the UK, Germany captured the maximum revenue share, followed by the UK and France in 2023.

- Sodium restriction and diuretics are the mainstays of treatment for patients with ascites due to portal hypertension, but patients with low Serum Ascites Albumin Gradient (SAAG) (less than 1.1 g/dL) ascites do not respond well to these measures.

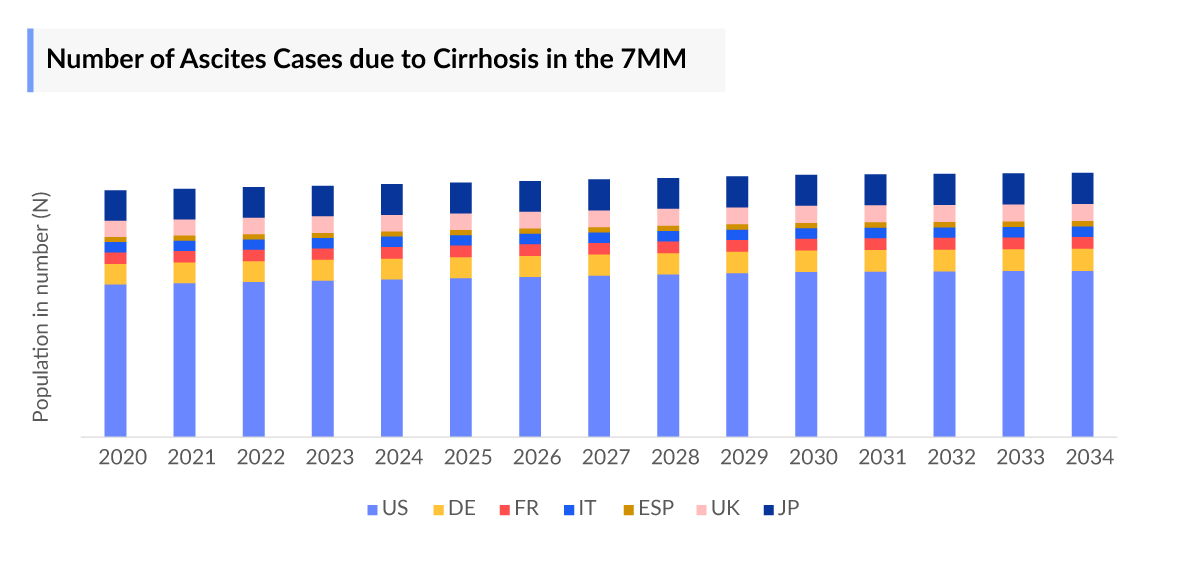

- The US accounted for the highest number of ascites cases due to cirrhosis, with more than 152,000 cases in 2023.

- Breast cancer, followed by colorectal cancer accounted for the highest number of ascites cases by malignancies in the US in 2023.

- In January 2024, Sequana Medical announced that the Premarket Approval (PMA) application for its alfapump had been accepted for substantive review by the United States Food and Drug Administration (US FDA). The company is anticipating the FDA approval in the second half of 2024.

- In December 2023, the US FDA granted Orphan Drug Designation (ODD) to OCE-205 for the treatment of ascites due to all etiologies except cancer.

Request for Unlocking the Sample Page of the "Ascites Treatment Market"

Key Factors Driving the Ascites Market Growth

-

Rising Prevalence of Liver Cirrhosis

As liver cirrhosis remains the leading cause of ascites, the increasing global burden of chronic liver diseases continues to accelerate market growth.

-

Growing Burden of Alcohol-Related Liver Disorders

Increased alcohol consumption worldwide is contributing significantly to liver damage, creating a higher incidence of ascites.

-

Increase in Hepatitis B & C Cases

Rising hepatitis infections are directly linked to advanced liver disease, expanding the target patient population.

-

Advancements in Diagnostic Techniques

Improved imaging modalities, biomarkers, and paracentesis techniques are enhancing early detection and disease monitoring, positively impacting treatment demand.

-

Emerging Therapeutics in the Pipeline

Novel drugs targeting portal hypertension, inflammation, and fluid accumulation are demonstrating potential, boosting market expectations.

-

Improved Healthcare Access and Awareness

Better awareness of liver disease complications and increased access to healthcare in developing regions are enabling timely diagnosis and treatment.

-

Increasing Adoption of Paracentesis and Albumin Therapy

These procedures remain standard for managing moderate to severe ascites, supporting consistent market demand.

-

Rising Geriatric Population

Older adults are at higher risk of developing chronic liver diseases and associated complications, contributing to market expansion.

-

Focus on Minimally Invasive Treatment Approaches

Growing acceptance of procedures like TIPS (Transjugular Intrahepatic Portosystemic Shunt) is improving patient outcomes and expanding treatment utilization.

DelveInsight’s "Ascites Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of the ascites historical and forecasted epidemiology as well as the ascites market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Ascites Drugs Market Report provides current treatment practices, emerging drugs, Ascites Market Share of individual therapies, and current and forecasted ascites market size from 2020 to 2034, segmented by seven major markets. The report also covers current ascites treatment market practices/algorithms and ascites unmet needs to curate the best of the opportunities and assess the underlying potential of the market.

Scope of the Ascites Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Ascites Epidemiology |

Segmented by:

|

|

Ascites Companies |

|

|

Ascites Drugs |

|

|

Ascites Drugs Market |

Segmented by:

|

|

Ascites Drugs Market Analysis |

|

Ascites Treatment Market: Overview

Ascites is defined as an abnormal amount of intraperitoneal fluid. Ascites is a condition in which fluid collects in spaces within the abdomen. If severe, ascites may be painful. The problem may keep the patient from moving around comfortably. Ascites can set the stage for an infection in the abdomen. Fluid may also move into the chest and surround the lungs. This condition can make eating, drinking, and moving around difficult. It can also make it hard to breathe. Ascites can lead to abdominal infections, which may cause kidney failure and can also cause umbilical or inguinal hernias. Ascites are common in patients with cirrhosis and usually develop when their liver is beginning to fail. The elevation of the pressure in the veins that run through the liver (portal hypertension) and a decrease in liver function due to the scarring on the liver result in fluid build-up.

Ascites Diagnosis

The initial evaluation of a patient with ascites includes medical history, physical examination, and laboratory assessment, including electrolytes and liver and renal biochemistry. Further diagnosis includes blood tests to assess liver and kidney function, imaging studies such as ultrasound or CT scans to visualize the abdominal organs and the extent of fluid accumulation, and paracentesis, a procedure involving the removal of fluid from the abdomen for analysis. The fluid analysis helps determine the cause of ascites, whether it be liver cirrhosis, heart failure, malignancy, or other underlying conditions. Additionally, further diagnostic procedures, such as endoscopy or biopsy, may be necessary to pinpoint the exact cause.

Further details related to diagnosis will be provided in the report…

Ascites Treatment

The principles behind the treatment of ascites due to cirrhosis include diuretics, paracentesis, insertion of a transjugular intrahepatic portosystemic shunt (TIPS), as well as managing complications to ascites such as spontaneous bacterial peritonitis (SBP). Mild and moderate ascites due to liver cirrhosis can be treated with dietary sodium restriction, treatment of the underlying disorder, fluid restriction, use of diuretics, and use of therapeutic paracentesis. The treatment of refractory ascites in liver cirrhosis includes optimization of medical management, serial large volume paracenteses, TIPS, peritoneovenous shunt, and liver transplantation. Sodium restriction and diuretics are the mainstays of treatment for patients with ascites due to portal hypertension, but patients with low Serum Ascites Albumin Gradient (SAAG) (less than 1.1 g/dL) ascites do not respond well to these measures, except those with nephrotic syndrome.

Ascites Epidemiology

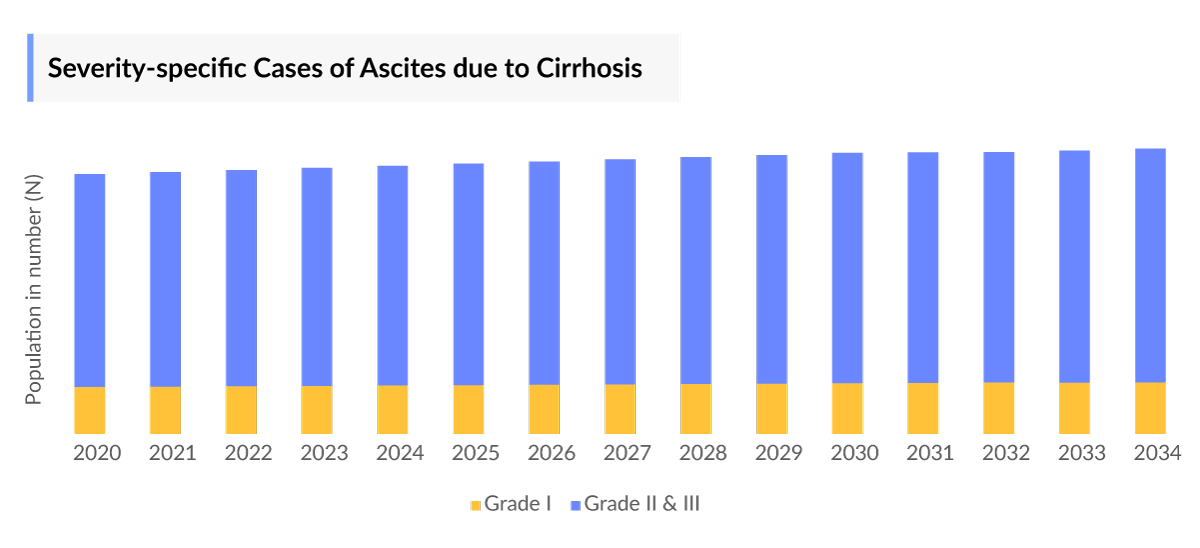

The ascites epidemiology chapter in the Ascites drugs market report provides historical as well as forecasted epidemiology segmented by the Number of Ascites Cases due to Cirrhosis, Number of Ascites Cases by Malignancies, Severity-specific Cases of Ascites due to Cirrhosis, and Refractory Ascites Patients with Cirrhosis in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM, the US accounted for the highest number of ascites cases due to cirrhosis, with more than 152,000 cases in 2023. These numbers are anticipated to increase during the forecast period (2024-2034).

- Among the number of ascites cases caused by malignancies, breast cancer accounted for the highest number, with nearly 13,000 cases, followed by colorectal cancer in the US in 2023.

- Among the severity-specific cases, Grade II and III accounted for nearly 125,000 cases in the US in 2023.

- Among the EU4 and the UK, Germany accounted for the highest number of cases, followed by the UK, while Spain occupied the bottom of the ladder.

Ascites Drug Analysis

The drug chapter segment of the Ascites market size report encloses a detailed analysis of the emerging drugs. The current key players for emerging drugs and their respective drug candidates include Ocelot Bio (OCE-205), PharmaIN (PHIN-214), Genfit (VS-01), and others. The drug chapter also helps understand the ascites clinical trials details, expressive pharmacological action, agreements and collaborations, and the Latest Ascites News and press releases.

Ascites Emerging Drugs

-

PHIN-214: PharmaIN

PharmaIN has advanced PHIN-214, a novel compound being developed for treating refractory ascites due to advanced liver cirrhosis, into a US Phase Ib clinical trial in cirrhotic patients. The therapeutic approach of PHIN-214 therapy is to shut down the RAAS signaling pathway, thereby halting the retention of excess salt and water by the kidneys and ending ascites fluid production.

-

OCE-205: Ocelot Bio

Ocelot Bio is developing OCE-205, an investigational therapy to transform the treatment of end-stage liver disease. The company is also developing OCE-205 for the treatment of ascites, a complication of ESLD-induced portal hypertension that leads to the accumulation of fluid in the peritoneal cavity. Currently, the company is conducting a Phase II multi-center, randomized, placebo-controlled, double-blind, adaptive dose-ranging study to assess the safety and efficacy of intravenous OCE-205 in adults diagnosed with cirrhosis with ascites who have developed hepatorenal syndrome-acute kidney injury, and a Phase I clinical trial of ascites.

Get More Insights into the Report @ OCE-205 Market

|

Comparison of Emerging Therapies | ||||

|

Emerging Drug |

Company |

Phase |

MoA |

RoA |

|

VS-01 |

Genfit |

II |

ASK1 inhibition |

Intraperitoneally |

|

PHIN-214 |

PharmaIN |

Ib |

Inhibiting RAAS pathway |

SC |

|

OCE-205 |

Ocelot Bio |

I |

V1a receptor antagonist |

SC |

Detailed emerging therapies assessment will be provided in the final report.

Ascites Drug Class Insight

The goals of pharmacotherapy for ascites are to reduce morbidity and to prevent complications in patients. Diuretic agents are the gold standard of medical therapy in ascites. It should be initiated in patients whose ascites do not respond to sodium restriction. V2 receptor antagonists may be considered in the management of patients with cirrhosis, ascites, and dilutional hyponatremia. The potential benefits of vasopressin-related drugs include the predictability of their effect, rapid onset of action, and limited urinary electrolyte excretion.

Ascites Market Outlook

Sodium restriction and diuretics are the mainstays of treatment for patients with ascites due to portal hypertension, but patients with low Serum Ascites Albumin Gradient (SAAG) (less than 1.1 g/dL) ascites do not respond well to these measures, except those with nephrotic syndrome. Tolvaptan, a novel aquaporin modulator, was made available in Japan in 2013 for the treatment of patients with refractory ascites due to cirrhosis. However, it is not approved in Japan for the treatment of ascites.

Most often, Ascites Patients will require water pills (diuretics) to treat ascites. Commonly used water pills are spironolactone (Aldactone) and/or furosemide (Lasix) and their dosages are appropriately adjusted. These water pills can cause problems with blood electrolytes (sodium and potassium levels) and as such close monitoring by blood tests may be required. The current ascites market has a high unmet need for approved and efficacious therapies. The Ascites treatment options for patients are limited, and with very few therapies in the pipeline, it is further a point of concern. However, due to the rising patient population and the expected launch of emerging therapies shortly, the ascites therapeutics market is further expected to increase in the forecast period (2024–2034).

Detailed market assessment will be provided in the final report.

Key Findings from the Ascites Market

- Among the 7MM, the US accounted for the largest Ascites Market Size due to cirrhosis in 2023.

- The total Ascites Market Size in the US due to cirrhosis was estimated to be more than USD 800 million in 2023, which is expected to grow during the forecast period (2024–2034).

- The Ascites Market Size of diuretics for ascites due to cirrhosis was estimated to be nearly USD 140 million in the US in 2023.

- Among EU4 and the UK, Germany accounted for the largest Ascites Market Size, followed by the UK in 2023.

Ascites Drugs Uptake

This section focuses on the uptake rate of Potential Ascites Drugs expected to be launched in the market during 2024–2034. The Ascites treatment market landscape has experienced a transformation with the uptake of drugs. These innovative therapies with novel mechanisms of action are redefining standards of care.

Ascites Pipeline Development Activities

The Ascites pipeline segment provides insights into therapeutic candidates in different phases of development. It also analyzes key Ascites Companies involved in developing targeted therapeutics. Companies like Ocelot Bio, PharmaIN, Genfit, and others are actively engaging their product in research and development efforts for ascites. The Ascites Pipeline possesses a few potential drugs and there is a positive outlook for the Ascites Therapeutics Market, with expectations of growth during the forecast period (2024–2034). The Ascites pipeline segment covers information on collaborations, acquisitions and mergers, licensing, and patent details for ascites emerging therapy.

Latest KOL- Views on Ascites

To keep up with current Ascites Treatment Market Trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving ascites treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Gastroenterology specialists, Hepatology specialists, and others.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as the University of Nebraska Medical Center, Centers for Disease Control and Prevention, Department of Gastroenterology, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or ascites market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Over 90% of people that undergo TIPS to prevent bleeding will have relief in their symptoms and experience little to no bleeding thereafter. When TIPS is performed for ascites, 60-80% of people have relief in their ascites. Some of these patients no longer require paracentesis, a procedure where a needle is placed into the abdominal cavity to drain away excessive fluid. Other patients still need paracentesis, but much less often than before the TIPS procedure.” |

|

“Diuretics were also a major cause of adverse drug events in the cirrhosis Ascites population. The incidence of diuretic-related adverse drug complications was markedly lower than the 24% estimate reported by specialized physicians, which is not surprising taking into account the universally accepted rate of under-reporting of adverse drug reaction.” |

Ascites Qualitative Analysis Report

We perform Qualitative and Ascites Treatment Market Intelligence analysis using various approaches, such as SWOT. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Ascites Treatment Market Landscape.

Ascites Therapeutics Market Report Scope

- The Ascites therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the Ascites epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the Ascites emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Ascites treatment market landscape.

- A detailed review of the ascites Drugs Market, historical and forecasted Ascites market size, Ascites market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Ascites therapeutics market report provides an edge while developing business strategies by understanding trends through SWOT analysis and KOL views, patient journey, and treatment preferences that help shape and drive the ascites drugs market.

Ascites Therapeutics Market Report Insights

- Patient-based Ascites Market Forecasting

- Therapeutic Approaches

- Ascites Pipeline Analysis

- Ascites Market Size

- Ascites Market Trends

- Existing and Future Ascites Drugs Market Opportunity

Ascites Therapeutics Market Report Key Strengths

- 11 Years Ascites Market Forecast

- The 7MM Coverage

- Ascites Epidemiology Segmentation

- Key Cross Competition

- Ascites Drugs Uptake

- Key Ascites Market Forecast Assumptions

Ascites Treatment Market Report Assessment

- Current Ascites Treatment Market Practices

- Ascites Unmet Needs

- Ascites Pipeline Product Profiles

- Ascites Drugs Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the Ascites Market

- What was the Ascites market size, the Ascites market size by therapies, Ascites market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future paradigm for ascites treatment?

- What are the disease risks, burdens, and Ascites unmet needs? What will be the growth opportunities across the 7MM concerning the patient population with ascites?

- What are the current options for the Ascites treatment? What are the current guidelines for treating ascites in the 7MM?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient share in ascites?

Reasons to Buy the Ascites Market Report

- The Ascites Treatment Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Ascites Drugs Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the Ascites epidemiology of the disease during the forecast years.

- Understand the existing Ascites Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the Ascites Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies to provide visibility around leading classes.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the Ascites unmet needs of the existing Ascites treatment market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles