Cardiac Biomarkers Testing Devices Market

Cardiac Biomarker Testing Market by Product Type (Instruments and Reagents & Kits), Biomarker Type (Troponin, Creatine Kinase-Mb, B-Type Natriuretic Peptide, Myoglobin, and Others), Application (Acute Coronary Syndrome, Congestive Heart Failure, Myocardial Infarction, and Others), End-User (Hospitals, Pathology Labs, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a substantial CAGR forecast till 2030 owing to the increasing cases of cardiovascular disorders, and the rising research and development activities across the globe.

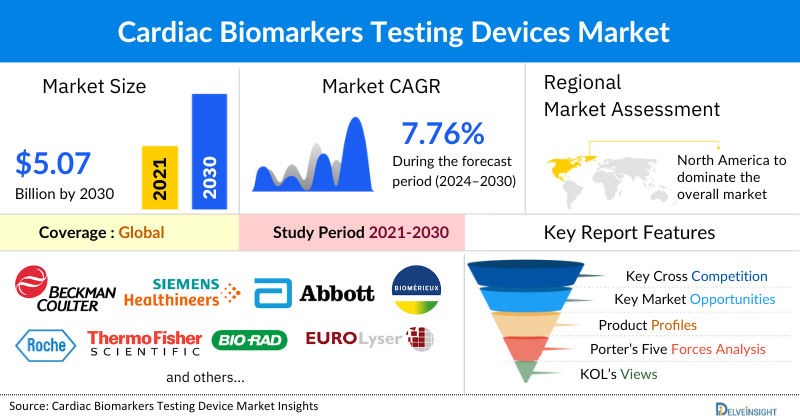

The global cardiac biomarkers testing market was valued at USD 3.25 billion in 2023, growing at a CAGR of 7.76% during the forecast period from 2024 to 2030 to reach 5.07 billion by 2030. The cardiac biomarker testing market is experiencing significant growth, owing to the increasing cases of cardiovascular diseases such as myocardial infarction, acute coronary syndrome, and congestive heart failure, the growing need for early disease diagnosis, the rising aging population, advancements in research in identifying novel clinically-relevant cardiac biomarkers, presence of key Cardiac Biomarker Testing Manufacturers, among others which is expected to drive the cardiac biomarker testing market during the forecast period from 2024 to 2030.

Cardiac Biomarkers Testing Market Dynamics

As per the recent data provided by the World Heart Report (2023), in 2021, it was stated that more than half a billion people were living with cardiovascular diseases (CVDs) globally. Some CVDs include myocardial infarction, congestive heart failure, acute coronary syndrome, and other conditions.

Further, according to recent data provided by the merican Heart Association (2023), it is estimated that by 2030 over 12 million people will have atrial fibrillation globally.

Moreover, the European Society of Cardiology (2024) stated that each year, more than 6 million new cases of cardiovascular disease (CVD) are reported in the European Union (EU), with over 11 million new cases across Europe as a whole. Nearly 49 million people in the EU are currently living with this disease. The economic impact on EU economies is substantial, amounting to Euro 210 billion annually.

Therefore, owing to the rising incidence of CVD, the demand for early and accurate diagnostic tools is increasing, the substantial economic burden of the demand in cardiac biomarker testing market plays a crucial role in early diagnosis, risk assessment, and monitoring of CVD thereby boosting the market for cardiac biomarker testing market.

Also, it has been observed that the current diagnostic and triage systems based on clinical history and electrocardiograms are insufficient for the timely diagnosis of cardiovascular diseases. They may result in some patients being misdiagnosed and being administered inappropriate treatment, care, and investigations. In some patients, the diagnosis is delayed resulting in the late administration (or no administration) of essential early treatment. Therefore, the need for an early diagnosis of cardiovascular diseases is fuelling the demand for cardiac biomarker testing.

Hence, the interplay of all the above mentioned factors are expected to drive the Cardiac Biomarker Testing market during the given forecast period from 2024 to 2030.

However, the lack of sensitivity and specificity to cardiac muscle necrosis, limited understanding of the biochemistry of biomarkers, challenges in sample collection, and obtaining results may restrain the growth of the cardiac biomarker testing market.

Cardiac Biomarker Testing Recent Developments

- On September 27, 2024, the FDA approved flurpiridaz F-18 (Flyrcado; GE HealthCare), a new radioactive tracer for positron emission tomography (PET) myocardial perfusion imaging. This is the first new cardiac PET radiotracer in decades and is expected to enhance testing growth. It will be used to evaluate myocardial ischemia or infarction in adults, joining existing tracers like rubidium-82 and N-13 ammonia, approved in 1989 and 2000, respectively.

Cardiac Biomarker Testing Market Segment Analysis

Cardiac Biomarker Testing Market by Product Type (Instruments and Reagents & Kits), Biomarker Type (Troponin, Creatine Kinase-MB, Natriuretic Peptide, Myoglobin, and Others), Application (Acute Coronary Syndrome, Congestive Heart Failure, Myocardial Infarction, and Others), End-User (Hospitals, Pathology Labs, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the biomarker type segment of the cardiac biomarker testing devices market, the troponin category of cardiac biomarkers is predicted to account for the largest market revenue share in 2023. This is primarily because troponins are highly specific to cardiac muscle injury, making them the most reliable indicators of myocardial infarction (heart attack). When heart muscle damage occurs, troponins are released into the bloodstream, and their levels can be measured to confirm or rule out a heart attack. Their exceptional specificity ensures that other conditions are less likely to cause elevated troponin levels, reducing the risk of false positives and leading to more accurate diagnoses.

This early detection capability is crucial in acute care settings, where timely diagnosis and intervention can significantly improve patient outcomes. High-sensitivity troponin assays can identify patients at risk of adverse cardiac events even when traditional biomarkers may not yet show abnormal levels. This enhances clinical decision-making and facilitates the initiation of appropriate therapeutic measures sooner. Moreover, the extensive clinical validation and widespread adoption of troponin testing in medical practice further validate its dominance in the market. Troponin assays are routinely used in emergency departments, intensive care units, and other healthcare settings worldwide, supported by numerous clinical guidelines and protocols that endorse their use for diagnosing acute coronary syndromes.

Troponin enters the bloodstream soon after a heart attack and remains in the bloodstream for a longer period as compared to other biomarkers. Two forms of troponin may be measured- troponin T and troponin I. Troponin I is considered to be highly specific to the heart and stays higher longer than creatinine kinase-MB. The latest guidelines by the American Heart Association (AHA) mention this biomarker to be the best biomarker for finding a heart attack.

The robust evidence backing the efficacy of troponin testing in improving patient management and outcomes reinforces its status as the preferred choice among cardiac biomarkers. Therefore, this category is expected to witness considerable growth eventually contributing to the overall growth of the cardiac biomarker testing market during the forecast period.

North America is expected to dominate the Overall Cardiac Biomarkers Testing Market

Among all the regions, North America is expected to amass the largest share of the cardiac biomarker testing market. This can be ascribed to the rising prevalence of cardiovascular diseases in the region, the increasing focus on research and development activities, and the increasing collaborations between key Cardiac Biomarker Testing companies in the region during the forecast period from 2024 to 2030.

According to the recently updated data by the Centres for Disease Control and Prevention (CDC) (2024), it was stated that 805,000 people in the US have a myocardial infarction (heart attack) every year on average.

According to data provided by the Centers for Disease Control and Prevention (CDC) (2024), it was stated that 805,000 people in the US on an average have a heart attack every year, with 1 out of 5 being silent heart attacks. The latest data provided by the National Institute of Health (2023), stated that 20.5 million people in the US were living with CAD.

Furthermore, as per the data provided by the Canadian Institute for Health Information (2022), about 2.4 million Canadians were suffering from heart disease.

Heart disease is an umbrella term that encompasses numerous indications such as acute coronary syndrome, atherosclerosis, and congestive heart failure among others. As per the information by the Centers for Disease Control and Prevention (2024), some of the key risk factors associated with heart diseases are high blood cholesterol, high blood pressure, and smoking. The source further mentioned that about half of Americans (47%) have at least one of these three risk factors. Therefore, the presence of a large patient population suffering from heart disease is one of the major factors contributing to the North American cardiac biomarker testing market growth.

Moreover, the presence of key Cardiac Biomarker Testing companies and extensive R&D activities by regulatory authorities also provide favorable conditions for the growth of the cardiac biomarker testing market in North America. For instance, in September 2022, the US FDA stated that it is at the forefront of pioneering research to foster the development of innovative biomarkers. Their focus includes identifying highly sensitive indicators of drug-induced cardiac and liver injury, pivotal for ensuring patient safety and enhancing drug development processes. Additionally, the FDA is actively pursuing advancements in creating advanced in vitro and in vivo tests to assess treatment-induced genetic damage comprehensively. These initiatives underscore the FDA's commitment to advancing regulatory science, thereby fostering more precise and effective evaluation methods that are crucial for safeguarding public health and accelerating the discovery of new therapies.

Thus, all the factors mentioned above promote a conducive environment for the cardiac biomarker testing devices market during the forecast period from 2024 to 2030.

Cardiac Biomarkers Testing Manufacturers

Some of the key Cardiac Biomarkers Testing Devices Companies operating in the cardiac biomarker testing market include Beckman Coulter, Inc, Siemens Healthcare GmbH, Abbott, bioMérieux SA, F. Hoffmann-La Roche Ltd, Thermo Fischer Scientific Inc, Bio-Rad Laboratories Inc, Eurolyser Diagnostica GmbH, Diagnostic Automation / Cortez Diagnostics, Inc, Randox Laboratories Ltd, Tosoh Corporation, DIALAB GmbH, CardioGenics Holdings Inc, Lepu Medical Technology (Beijing) Co. Ltd, Biosynex, and others.

Recent Developmental Activities in Cardiac Biomarkers Testing Market

- In April 2024, Remote Cardiac Enablement, an innovative artificial intelligence-based medical technology company, announced the successful completion of the first-in-human trial for its transdermal continuous cardiac biomarker monitoring device.

- In October 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched a high-sensitivity troponin I (hs-cTnI) and NT-proBNP cardiac biomarker, enhancing the accuracy and reliability of cardiovascular disease diagnosis.

- In April 2021, Roche announced the series of five new intended uses for two key cardiac biomarkers using the Elecsys technology; High-sensitive cardiac troponin T (cTnT-hs) and N-terminal pro-brain natriuretic peptide test (NT-proBNP).

|

Report Metrics |

Details |

|

Study Period |

2020 to 2030 |

|

Base Year |

2021 |

|

Forecast Period |

2024 to 2030 |

|

CAGR |

7.77% |

|

Cardiac Biomarkers Testing Market Size |

USD 5.48 billion by 2030 |

|

Key Cardiac Biomarkers Testing Companies | Beckman Coulter, Inc, Siemens Healthcare GmbH, Abbott, bioMérieux SA, F. Hoffmann-La Roche Ltd, Thermo Fischer Scientific Inc, Bio-Rad Laboratories Inc, , Eurolyser Diagnostica GmbH, Diagnostic Automation / Cortez Diagnostics, Inc, Randox Laboratories Ltd, Tosoh Corporation, DIALAB GmbH, CardioGenics Holdings Inc, Lepu Medical Technology (Beijing) Co. Ltd., Biosynex and others. |

Key Takeaways from the Cardiac Biomarkers Testing Market Report Study

- Market size analysis for current cardiac biomarker testing market size (2023), and market forecast for 6 years (2024 to 2030)

- Top Cardiac Biomarker Testing product/services developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key Cardiac Biomarker Testing companies dominating the cardiac biomarker testing market

- Various opportunities available for the other competitors in the cardiac biomarker testing market space

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current cardiac biomarker testing market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for cardiac biomarker testing market growth in the coming future?

Target Audience who can be benefited from this Cardiac Biomarker Testing Market Report Study

- Cardiac biomarker testing providers

- Research organizations and consulting companies

- Cardiac biomarker testing related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in cardiac biomarker testing

- Various end-users who want to know more about the cardiac biomarker testing market and the latest developments in the cardiac biomarker testing market

Frequently Asked Questions for Cardiac Biomarker Testing Market:

1. What is cardiac biomarker testing?

Cardiac biomarker testing is a specialized diagnostic tool designed to detect and measure specific proteins, enzymes, and other substances released into the blood when the heart is damaged or stressed. These devices are crucial in the early diagnosis, management, and monitoring of cardiovascular diseases.

2. What is the market for cardiac biomarker testing?

The cardiac biomarker testing market was valued at USD 3.25 billion in 2023, growing at a CAGR of 7.76% during the forecast period from 2024 to 2030 to reach 5.07 billion by 2030.

3. What are the drivers for the cardiac biomarker testing market?

The cardiac biomarker testing market is experiencing significant growth, owing to the increasing cases of cardiovascular diseases such as myocardial infarction, acute coronary syndrome, congestive heart failure, and others. Additionally, the growing need for early disease diagnosis, the rising aging population, the advancement in research in identifying novel clinically-relevant cardiac biomarkers, and the presence of key market players highlight the dynamic nature of the cardiac biomarker market, which is projected to grow substantially from 2024 to 2030.

4. Who are the key players operating in the cardiac biomarker testing market?

Some of the key Cardiac Biomarker Testing companies operating in the cardiac biomarker testing market include Beckman Coulter, Inc, Siemens Healthcare GmbH, Abbott, bioMérieux SA, F. Hoffmann-La Roche Ltd, Thermo Fischer Scientific Inc, Bio-Rad Laboratories Inc, Eurolyser Diagnostica GmbH, Diagnostic Automation / Cortez Diagnostics, Inc, Randox Laboratories Ltd, Tosoh Corporation, DIALAB GmbH, CardioGenics Holdings Inc, Lepu Medical Technology (Beijing) Co. Ltd, Biosynex, and others.

5. Which region has the highest share in the cardiac biomarker testing market?

Among all the regions, North America is estimated to hold a significant revenue share in the cardiac biomarker testing market. This can be ascribed to the rising prevalence of cardiovascular diseases in the region, the increasing focus on research and development activities, and the increasing collaborations between key market players in the region during the forecast period from 2024 to 2030.