Myocardial Infarction Market

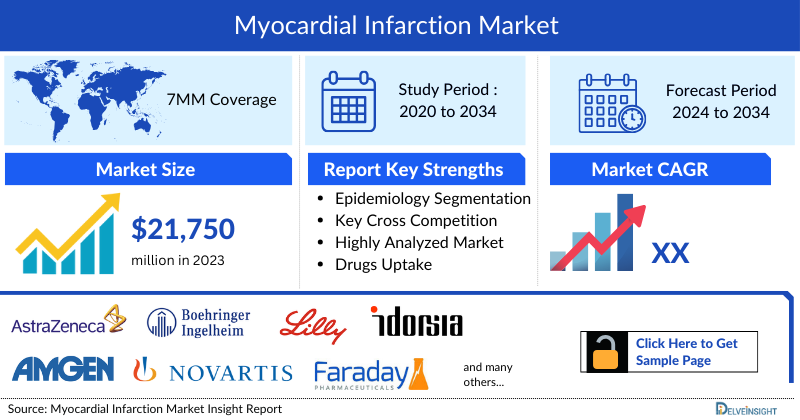

- The Myocardial Infarction Market Size in the 7MM was estimated to be nearly USD 21,750 million in 2023, which is expected to show positive growth by 2034.

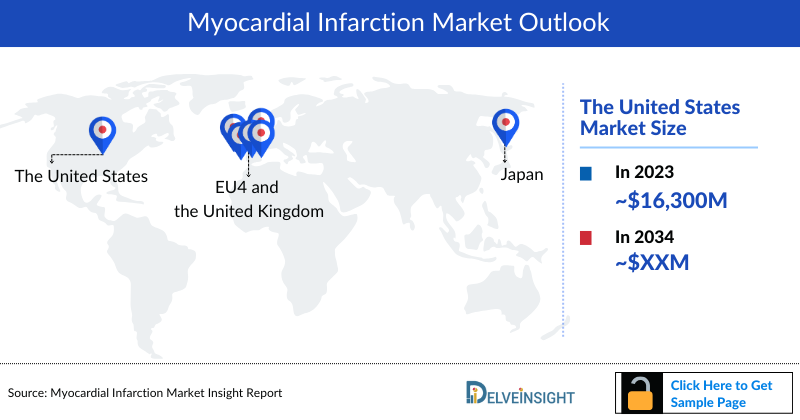

- According to the estimates, the United States will accounted for the largest Myocardial Infarction Market Size i.e., nearly USD 16,300 million in 2023, owing to higher cases and comparatively higher treatment costs.

- The pharmacologic Myocardial Infarction Treatment Market can be broken down into several groups of medications that improve survival, decrease recurrent ischemic events, and provide symptomatic relief. The primary Myocardial Infarction treatment is followed by multimodal regimen therapies.

- Current Myocardial Infarction Treatment Market has been segmented into therapeutic classes such as Antiplatelet agents, Anticoagulants, Vasodilators, Beta Blockers, Lipid-lowering drugs, Angiotensin-converting Enzyme Inhibitors (ACE), Angiotensin-II receptor Blockers (ARBs), and Calcium channel blockers

Curious about the latest market insights? Request your sample page today! @ Myocardial Infarction Treatment Market

DelveInsight's “Myocardial Infarction Market Insights, Epidemiology and Market Forecast– 2034” report delivers an in-depth understanding of the Myocardial infarction, historical and forecasted epidemiology as well as the Myocardial infarction therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan.

Myocardial infarction market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM Myocardial infarction market size from 2020 to 2034. The report also covers current Myocardial infarction treatment practice/algorithm and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Myocardial Infarction Market |

|

|

Myocardial Infarctions Market Size | |

|

Myocardial Infarction Companies |

AstraZeneca, Boehringer Ingelheim, Eli Lilly and Company, Amgen, Novartis, Idorsia Pharmaceuticals, Faraday Pharmaceuticals, CSL Behring, Immediate Therapeutics, Mitsubishi Chemical Group, Kancera, Bayer, Recardio, Mesoblast, and others |

|

Myocardial Infarction Epidemiology Segmentation |

|

Myocardial Infarction Treatment Market

Myocardial infarction refers to ischemic necrosis of myocardial tissue. The most common underlying cause is coronary artery disease. Type 1 MI occurs when an unstable plaque ruptures, leading to the occlusion of a coronary artery. Type 2 Myocardial infarction occurs when there is a mismatch between oxygen supply and demand (e.g., systemic hypotension, vasospasm). Myocardial infarction manifests clinically with acute coronary syndrome (ACS), a potentially lethal condition.

From a pathologic perspective, Myocardial infarction is defined as cardiomyocyte death caused by an ischemic insult. Application of this definition in the clinical context is challenging because the diagnosis of Myocardial infarction is dependent on the sensitivity and specificity of the clinical criteria, electrocardiographic findings, imaging studies, and biomarkers used to detect the death of cardiomyocytes. In recent years, the development of highly sensitive biomarkers (such as cardiac troponins) has significantly enhanced the clinician’s ability to see cardiomyocyte death. It should be emphasized that, although sudden elevations in circulating troponin levels reflect myocardial injury, they are not specific markers of ischemic cardiomyocyte death but in some cases may reflect increased cell wall permeability or release of proteolytic troponin degradation products. Besides, the slow average turnover of cardiomyocytes may be responsible for modest persistent elevations of troponin levels in specific normal individuals

For the sake of immediate treatment strategies such as reperfusion therapy, it is usual practice to designate Myocardial infarction in patients with chest discomfort or other ischemic symptoms who develop new ST-segment elevations in two contiguous leads or new bundle branch blocks with ischemic repolarization patterns as a STEMI. In contrast, patients without STEMI at presentation are usually designated non-ST-elevation MI (NSTEMI). The categories of patients with STEMI, NSTEMI, or unstable angina are customarily included in the concept of ACS.

Myocardial Infarction Diagnosis

The initial evaluation of a patient with a suspected AMI should include a focused clinical history, physical examination, electrocardiography, radionuclide imaging, MRI, cardiac markers, and a chest radiograph. An ECG is especially useful for distinguishing between an NSTEMI and a STEMI. It should be performed within 5–10 min of arrival into an emergency department. In addition, posterior leads (V7–V9) and leads V3R and V4R should be used in patients with suspected posterior and right ventricle (RV) infarctions, respectively. Serum biomarkers of myocardial necrosis include cardiac-specific troponins T and I, MB isoforms of creatine (CK-MB), creatine kinase (CK), and myoglobin.

Myocardial Infarction Treatment

The goals of initial Myocardial Infarction treatment are relief of pain, immediate identification of ST changes via 12-lead EKG, initiation of reperfusion (if the patient is a candidate), and assessment and treatment of hemodynamic abnormalities. Pain relief is best achieved with oxygen, nitroglycerin, and morphine sulfate. Patients with ST-segment elevation or a new LBBB with symptoms for 12 h or less are candidates for reperfusion therapy. Further treatment of an Myocardial infarction may be separated into two pathways depending on whether or not the patient has a STEMI or an NSTEMI.

Myocardial Infarction Epidemiology

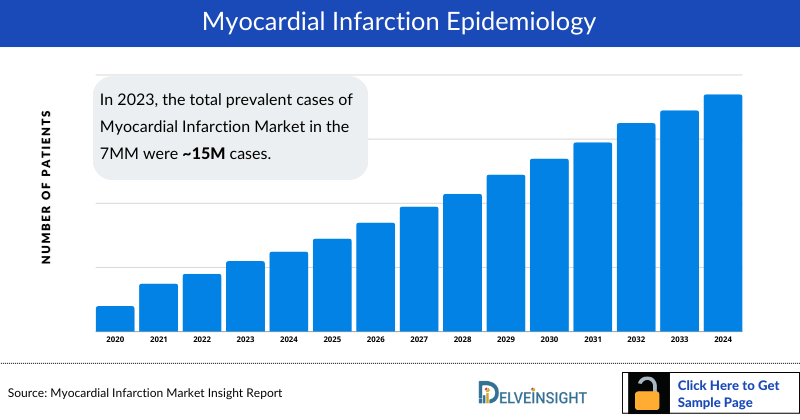

The disease epidemiology of Myocardial Infarction covered in the report provides historical as well as forecasted epidemiology segmented by Myocardial Infarction diagnosed prevalent cases, Myocardial Infarction gender-specific prevalence cases, and Myocardial Infarction type-specific cases, in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- The total Myocardial Infarction diagnosed prevalent cases in the 7MM comprised of approximately 15.5 million cases in 2023 and are projected to increase during the forecasted period.

- The total Myocardial Infarction diagnosed prevalent cases in the United States were around 8 million cases in 2023.

- The United States contributed to the largest Myocardial Infarction prevalent populationI, acquiring ~55% of the 7MM in 2023. Whereas, EU4 and the UK, and Japan accounted for around 35% and 10% of total population share, respectively, in 2023.

- Among the EU4 and the UK, Germany accounted for the largest number of diagnosed Myocardial infarction cases followed by France, whereas Spain accounted for the lowest cases in 2023.

- According to DelveInsight estimates, there were around 3.2 million cases of STEMI and 5 million cases of NSTEMI in the United States in 2023. The prevalence is projected to increase during the forecasted period.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Myocardial Infarction Prevalence

Myocardial Infarction Recent Developments

- In September 2025, Caristo Diagnostics celebrated Abcentra's successful dosing of the first patient in the FORTIFY clinical trial and announced its role as the global imaging core lab. Caristo is responsible for coronary inflammation and plaque measurement and monitoring, as well as aiding patient selection using its proprietary CaRi-Heart® and FAI-Score™ technologies, advancing cardiovascular disease diagnosis and treatment.

- In March 2025, Powerful Medical, a leader in AI-driven cardiovascular diagnostics, announced that its PMcardio STEMI AI ECG model has received Breakthrough Device Designation from the US FDA. This recognition highlights PMcardio's innovation in detecting ST-elevation myocardial infarction (STEMI) and STEMI equivalents, conditions that require urgent intervention.

Myocardial Infarction Drug Chapters

Drug chapter segment of the Myocardial Infarction therapeutics market report encloses the detailed analysis of Myocardial Infarction marketed drugs and late stage (Phase-III and Phase-II) Myocardial Infarction pipeline drugs. It also helps to understand the Myocardial Infarction clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest Myocardial Infarction news and press releases.

Myocardial Infarction Marketed Drugs

- INSPRA (eplerenone): Pfizer

INSPRA (eplerenone) is a steroid nucleus-based mineralocorticoid receptor (MR) antagonist with a higher degree of selectivity than spironolactone. Eplerenone is thought to be a more selective blocker at the mineralocorticoid receptor since there is evidence that some of the effects result from a blockade of cortisol stimulation of the MR-receptor. It is indicated for improving survival of stable patients with LV systolic dysfunction (LVEF ≤40%) and CHF after acute myocardial infarction.

- PLAVIX (clopidogrel bisulfate): Sanofi-Aventis/Bristol-Myers Squibb

Sanofi-Aventis’s PLAVIX is a P2Y12 platelet inhibitor that reduces the risk of death and cardiovascular complications in patients with symptomatic atherosclerotic disease in the setting of percutaneous coronary intervention (PCI) and in patients with unstable angina or non-STEMI. It is indicated for the acute coronary syndrome (ACS), recent Myocardial infarction, recent stroke, or established peripheral arterial disease.

Get More Insights @ PLAVIX Market

BRILINTA (ticagrelor): AstraZeneca

BRILINTA (ticagrelor) is an oral, reversible, direct-acting P2Y12 receptor antagonist that works by inhibiting platelet activation. BRILINTA, together with aspirin, has been shown to significantly reduce the risk of MACE, defined as myocardial infarction (MI, heart attack), stroke, or CV death, in patients with ACS or a history of Myocardial infarction. BRILINTA, co-administered with aspirin, is indicated to prevent atherothrombotic events in adult patients with ACS or for patients with a history of Myocardial infarction and a high risk of developing an atherothrombotic event. It is marketed as BRILIQUE in the EU.

- PRALUENT (alirocumab): Regeneron/Sanofi

PRALUENT is a PCSK9 (Proprotein Convertase Subtilisin Kexin Type 9) inhibitor antibody developed by Sanofi. In the US, PRALUENT is approved to reduce the risk of heart attack, stroke, and unstable angina. PRALUENT is also approved as an adjunct to diet, alone or in combination with other lipid lowering therapies (e.g., statins, ezetimibe), for the treatment of adults with primary hyperlipidemia (including heterozygous familial hypercholesterolemia) to reduce LDL-C.

Note: Detailed current therapies assessment will be provided in the full report of MI...

|

Table 1: Comparison of Marketed Products | |||||

|

Drug Name |

Company Name |

Indication |

MOA |

Therapeutic Class |

RoA |

|

INSPRA (eplerenone) |

Pfizer |

MI |

Aldosterone receptor antagonists |

Antihypertensives |

Oral |

|

PLAVIX (clopidogrel bisulfate) |

Sanofi-Aventis/BMS |

re-infarction, stroke or death in patients with acute ST-segment elevation myocardial infarction (STEMI) |

Purinergic P2 receptor antagonists |

Antiplatelets |

Oral |

|

history of ischemic stroke, MI, and peripheral vascular disease | |||||

|

BRILINTA (ticagrelor) + aspirin |

AstraZeneca |

heart attack or stroke in high-risk patients with coronary artery disease |

P2Y12 receptor antagonist |

Antithrombotics |

Oral |

|

BRILINTA (ticagrelor) |

heart attack (MI) and cardiovascular (CV) death in adult patients with acute coronary syndrome (ACS) | ||||

|

history of heart attack (MI) beyond the first year | |||||

|

BRILIQUE1 (ticagrelor) |

patients who have suffered a heart attack at least 1 year prior and are at high risk of developing a further atherothrombotic event | ||||

|

BRILINTA (ticagrelor) |

ACS (unstable angina, nonST-segment elevation myocardial infarction, and ST-segment elevation myocardial infarction) | ||||

|

ZONTIVITY (vorapaxar) + aspirin and/or clopidogrel |

Merck |

history of MI or with peripheral arterial disease (PAD) |

Protease-activated receptor-1 antagonists |

Antithrombotics |

Oral |

Myocardial Infarction Emerging Drugs

- FARXIGA/FORXIGA (dapagliflozin): AstraZeneca

Dapagliflozin is a first-in-class, oral, once-daily SGLT2 inhibitor. Research has shown FARXIGA’s efficacy in preventing and delaying cardiorenal disease while protecting the organs – important findings given the underlying links between the heart, kidneys, and pancreas. FARXIGA is currently being tested in the DAPA-MI Phase III trial, a first-of-its-kind, registry-based randomized controlled trial in patients without type 2 diabetes following an acute Myocardial infarctionor heart attack. The DAPA-MI trial is conducted in collaboration with Uppsala Clinical Research Center (UCR) and Myocardial Ischaemia National Audit Project (MINAP) in the UK. In July 2022, AstraZeneca was granted FTD in the US for the development of FARXIGA to reduce the risk of hospitalization for heart failure (hHF) or cardiovascular (CV) death in adults following an AMI or heart attack.

Know More Insights of the Report @ FARXIGA Market Size

- JARDIANCE (empagliflozin): Boehringer Ingelheim and Eli Lilly and Company

Empagliflozin is an inhibitor of sodium-glucose co-transporter-2 (SGLT2), the transporters primarily responsible for glucose re-absorption in the kidney. It is marketed under the brand name JARDIANCE and is the first type 2 diabetes medicine to include cardiovascular death risk reduction data on the label in several countries. Empagliflozin lowers blood glucose levels by preventing glucose re-absorption in the kidneys and increasing the amount of glucose excreted in the urine. It has a relatively long duration of action requiring only once-daily dosing. As its mechanism of action is contingent on the renal excretion of glucose, empagliflozin may be held in cases of acute kidney injury and/or discontinued in patients who develop chronic renal disease In September 2020, the FDA granted FTD for the development of JARDIANCE to prevent hospitalization for heart failure and reduce the risk of mortality in patients with and without diabetes who have had an acute MI.

Learn More Insights of the Report @ Empagliflozin Market Size

- Olpasiran: Amgen

Olpasiran (formerly AMG 890) is a small interfering RNA designed to lower the body’s production of apolipoprotein(a), a key component of Lp(a) that has been associated with an increased risk of cardiovascular events. In November 2022, the company presented end-of-treatment data from its Phase II OCEAN (a)-DOSE study of olpasiran in adults with elevated lipoprotein(a) [Lp(a)] levels (>150 nmol/L) and a history of atherosclerotic cardiovascular disease (ASCVD) during the Late-Breaking Science Session of the American Heart Association (AHA).

|

Table 2: Comparison of Emerging Drugs | ||||||

|

Product |

Company |

Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

FARXIGA/FORXIGA (dapagliflozin) |

AstraZeneca |

III |

AMI |

Oral |

Sodium-glucose Cotransporter-2 (SGLT2) inhibitor |

Small molecule |

|

JARDIANCE (empagliflozin) |

Boehringer Ingelheim and Eli Lilly and Company |

III |

AMI |

Oral |

SGLT2 inhibitor |

Small molecule |

|

Pelacarsen (TQJ230) |

Novartis |

III |

Major Cardiovascular Events in Patients With Established Cardiovascular Disease |

SC |

ASO targeting Lp(a) |

Antisense oligonucleotide |

|

Olpasiran |

Amgen |

III |

Atherosclerotic cardiovascular disease and elevated lipoprotein(a) |

SC |

Lowers the body's production of apolipoprotein(a) |

siRNA |

|

Selatogrel |

Idorsia Pharmaceuticals |

III |

AMI |

SC |

P2Y12 receptor antagonist |

Small molecule |

|

FDY-5301 |

Faraday Pharmaceuticals |

III |

ST-elevation MI |

IV bolus injection |

Destroys hydrogen peroxide |

Small molecule |

|

CSL112 |

CSL Behring |

III |

Acute Coronary Syndrome |

IV infusion |

Increases cholesterol efflux capacity |

Apolipoprotein A-I |

|

IMT-358 |

Immediate Therapeutics |

III |

Acute coronary syndrome (Acute MI) |

IV infusion |

Provide metabolic protection, potentially to minimize cardiac damage and instability during ACS |

Glucose–insulin–potassium |

|

CL2020 |

Mitsubishi Chemical Group |

II/III |

ST-elevation AMI |

IV infusion |

Tissue repair |

Muse cell-based therapy |

Myocardial Infarction Drugs Market Insights

The current market has been segmented accordingly into different commonly used therapeutic classes based on the prevailing treatment pattern across the 7MM, which present itself with minor variations in the overall prescription pattern. Antiplatelet agents, Anticoagulants, Vasodilators, Beta Blockers, Lipid-lowering drugs, Angiotensin-converting Enzyme Inhibitors (ACE), Angiotensin-II receptor Blockers (ARBs), and Calcium channel blockers are the major classes.

Myocardial Infarction Market Outlook

The pharmacologic Myocardial Infarction treatment can be broken down into several groups of medications that improve survival, decrease recurrent ischemic events, and provide symptomatic relief. The primary Myocardial Infarction treatment is followed by multimodal regimen therapies. The treatment starts with rapid diagnostic tests and serial biomarker analysis to classify the disease. For this, the Thrombolysis in Myocardial Infarction (TIMI) and Global Registry of Acute Coronary Events (GRACE) models are helpful to assess the risk and initiate the treatment plan. The treatment plan includes the initiation of antithrombotic therapy, Sublingual nitroglycerin to control the ischemic and blood pressure conditions. High-intensity statin therapy, angiotensin-converting–enzyme (ACE) inhibitors/ARBs, and Beta-Blockers.

The current market has been segmented accordingly into different commonly used therapeutic classes based on the prevailing treatment pattern across the 7MM, which present itself with minor variations in the overall prescription pattern. Antiplatelet agents, Anticoagulants, Vasodilators, Beta Blockers, Lipid-lowering drugs, Angiotensin-converting Enzyme Inhibitors (ACE), Angiotensin-II receptor Blockers (ARBs), and Calcium channel blockers are the major classes that have been covered in the forecast model.

The dynamics of the MI market are currently changing as a consequence of the recent launch of Proprotein Convertase Subtilisin Kexin Type 9 (Lipid-lowering therapies). The expected launch of new upcoming therapies and greater integration of early patient screening, medication in secondary care and other clinical settings, research on best methods for implementation, and an upsurge in awareness will eventually facilitate the development of effective treatment options. Key players such as Novartis (pelacarsen), Recardio (dutogliptin), Idorsia Pharmaceuticals (selatogrel), Boehringer Ingelheim and Eli Lilly and Company (JARDIANCE), Amgen (olpasiran), Mitsubishi Chemical Group (CL2020), and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of Myocardial infarction.

- The total Myocardial Infarction Market Size in the 7MM was USD 21,750 million in 2023 and is projected to increase during the forecast period (2024-2034)

- In the US, the Myocardial Infarction Market Size comprised of nearly USD 16,300 million in 2023.

- Among all the current therapies, the highest revenue is generated by Lipid-lowering drugs in the US in 2023.

- Among EU4 and the UK, Germany accounted for the maximum Myocardial Infarction Market Size in 2023 while Spain occupied the bottom of the ladder in 2023

Myocardial Infarction Drugs Uptake

This section focuses on the rate of uptake of the potential Myocardial Infarction drugs expected to get launched in the market during the study period 2020-2034. The analysis covers Myocardial infarction market uptake by drugs; patient uptake by therapies; and sales of each drug. For example- JARDIANCE (empagliflozin) is an inhibitor of sodium-glucose co-transporter-2 (SGLT2), the transporters primarily responsible for glucose re-absorption in the kidney. It is marketed under the brand name JARDIANCE and is the first type 2 diabetes medicine to include cardiovascular death risk reduction data on the label in several countries. Empagliflozin lowers blood glucose levels by preventing glucose re-absorption in the kidneys and increasing the amount of glucose excreted in the urine. It has a relatively long duration of action requiring only once-daily dosing. As its mechanism of action is contingent on the renal excretion of glucose, empagliflozin may be held in cases of acute kidney injury and/or discontinued in patients who develop chronic renal disease.

Myocardial Infarction Pipeline Development Activities

The Myocardial Infarction therapeutics market report provides insights into Myocardial Infarction clinical trials within Phase III, Phase II, and Phase I stage. It also analyzes key Myocardial Infarction Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Myocardial Infarction therapeutics market report covers the detailed information of collaborations, acquisition and merger, licensing and patent details for Myocardial infarction emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Myocardial Infarction Treatment Drugs

KOL- Views

To keep up with current market trends, we take KOLs and SME's opinion working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders from UT Southwestern Medical Center in Dallas, Cancer Research UK Barts Centre in London, MD Anderson Cancer Center. Their opinion helps to understand and validate current and emerging therapies treatment patterns or Myocardial infarction market trend. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the market and the unmet needs.

|

KOL Views | |

|

United States |

“Standardized but limited point-of-care echocardiograms are helpful in early triage and identification of patients presenting with cardiovascular symptomatology such as abnormal electrocardiograms that at times mimicked acute myocardial infarctions or in patients with elevated cardiac biomarkers.” |

|

United Kingdom |

“Previous studies have identified some characteristics of these lipid deposits which put them at high risk of rupturing. These studies involved examining the obstructed coronary arteries of patients who died from infarction, or using special imaging techniques to view these vessels from the inside. But the exact mechanism of plaque rupture, and especially the forces at work behind it, are still not known.” |

Myocardial Infarction Therapeutics Market Report Scope

- The Myocardial Infarction therapeutics market report covers the descriptive overview, explaining its causes, signs and symptoms, pathogenesis and currently available therapies

- Comprehensive insight has been provided into the Myocardial infarction epidemiology and treatment

- Additionally, an all-inclusive account of both the current and Myocardial Infarction emerging therapies are provided, along with the assessment of new therapies, which will have an impact on the current Myocardial Infarction treatment market landscape

- A detailed review of Myocardial Infarction treatment market; historical and forecasted is included in the report, covering the 7MM drug outreach

- The Myocardial Infarction therapeutics market report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM Myocardial Infarction drugs market

Myocardial Infarction Therapeutics Market Report Highlights

- In the coming years, Myocardial Infarction Drugs Market is set to change due emerging therapies in the pipeline, and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence MI R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- As per DelveInsight’s analysis, the major types of MI include STEMI and NSTEMI

- The Myocardial Infarction Therapeutics Market Report also encompasses other major segments, i.e., diagnosed prevalent cases of MI, gender-specific prevalence cases of MI, and type-specific cases of Myocardial infarction

- Expected launch of potential therapies such as FARXIGA/FORXIGA (AstraZeneca), JARDIANCE (Boehringer Ingelheim and Eli Lilly and Company), Olpasiran (Amgen), and Pelacarsen (Novartis), might change the landscape in the treatment of Myocardial infarction

- The US FDA-approved drugs, which are currently available, include INSPRA, PLAVIX, BRILINTA, and others

Myocardial Infarction Therapeutics Market Report Insights

- Patient-based Myocardial Infarction Market Forecasting

- Myocardial Infarction Therapeutic Approaches

- Myocardial Infarction Pipeline Analysis

- Myocardial Infarction Market Size

- Myocardial Infarction Market Trends

- Myocardial Infarction Therapeutics Market Opportunities

- Impact of upcoming Myocardial infarction Therapies

Myocardial Infarction Drugs Market Report Key Strengths

- 11 Years Myocardial Infarction Market Forecast

- 7MM Coverage

- Myocardial infarction Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Myocardial Infarction Drugs Market

- Myocardial Infarction Drugs Uptake

Myocardial Infarction Drugs Market Report Assessment

- Current Myocardial Infarction Treatment Market Practices

- Myocardial Infarction Unmet Needs

- Myocardial Infarction Pipeline Product Profiles

- Myocardial Infarction Drugs Market Attractiveness

- SWOT

- Conjoint Analysis

- Myocardial infarction Market Drivers

- Myocardial infarction Market Barriers

Key Questions Myocardial infarction Market Report:

Myocardial Infarction Treatment Market Insights:

- What was the Myocardial Infarction Drugs Market Share (%) distribution in 2020 and how it would look like in 2034?

- What would be the Myocardial Infarction treatment market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Myocardial Infarction market size during the study period (2020–2034)?

- At what CAGR, the Myocardial Infarction market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the Myocardial Infarction market outlook across the 7MM during the study period (2020–2034)?

- What would be the Myocardial Infarction market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Myocardial Infarction Epidemiology Insights:

- What is the disease risk, burden and Myocardial Infarction unmet need?

- What is the historical Myocardial Infarction patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What would be the forecasted patient pool of MI at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to MI?

- Out of the above-mentioned countries, which country would have the highest incident population of MI during the study period (2020–2034)?

- At what CAGR the population is expected to grow across the 7MM during the study period (2020–2034)?

Current Myocardial Infarction Treatment Market Scenario, Marketed Drugs and Emerging Therapies:

- What are the current options for the Myocardial Infarction treatment? What are the current treatment guidelines for the Myocardial Infarction treatment in the US and Europe?

- What are the Myocardial Infarction marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety and efficacy, etc.?

- How many Myocardial Infarction Companies are developing therapies for the treatment?

- How many emerging therapies are in the mid-stage and late stage of development for the Myocardial Infarction treatment?

- What are the key collaborations (Industry–Industry, Industry–Academia), Mergers and acquisitions, licensing activities related to the MI therapies?

- What are the recent novel therapies, targets, mechanisms of action and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for MI and their status?

- What are the key designations that have been granted for the Myocardial Infarction Emerging Therapies?

- What are the 7MM historical and forecasted Myocardial Infarction Market?

Reasons to Buy Myocardial infarction Market Forecast Report:

- The Myocardial Infarction treatment market report will help in developing business strategies by understanding trends shaping and driving the Myocardial Infarction.

- To understand the future market competition in the Myocardial Infarction treatment market and Insightful review of the SWOT analysis of Myocardial Infarction.

- Organize sales and marketing efforts by identifying the best opportunities for MI in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Myocardial Infarction drugs market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for Myocardial Infarction drugs market.

- To understand the future market competition in the Myocardial Infarction drugs market.

Stay Updated with us for Recent Articles:-

-market.png&w=256&q=75)