CD223 Antigen Inhibitors Market Forecast

- The CD223 Antigen Inhibitor market size is also exploring applications of LAG-3 inhibitors in autoimmune diseases, expanding their therapeutic scope. However, challenges persist in identifying predictive biomarkers and optimizing combination strategies to maximize patient benefit.

- CD223 antigen inhibitors refer to drugs or biological agents that inhibit the function of CD223, also known as Lymphocyte Activation Gene-3 (LAG-3), thereby lifting the immune suppression and enhancing T cell activity, especially in tumor microenvironments.

- CD223 (LAG-3) is an immune checkpoint receptor on activated immune cells that binds to MHC class II to suppress T cell activity. Like PD-1 and CTLA-4, it contributes to T cell exhaustion in cancer, making it a key target for therapies aimed at boosting anti-tumor immunity.

- OPDUALAG (a fixed-dose combo of nivolumab and relatlimab) was FDA-approved in March 2022 as a first-line treatment for unresectable or metastatic melanoma. It combines dual checkpoint inhibition—nivolumab targets PD-1, while relatlimab blocks LAG-3 (CD223)—to reinvigorate exhausted T cells more effectively than PD-1 blockade alone. This synergy enhances anti-tumor immunity and represents a key advancement in immunotherapy beyond traditional single-agent approaches.

- This application was approved under the US FDA’s Real-Time Oncology Review (RTOR) pilot program, which aims to ensure that safe and effective treatments are available to patients as early as possible.

- The leading CD223 Antigen Inhibitor Companies are actively advancing investigational therapies targeting CD223 (LAG-3) across various indications. For example, Regeneron is developing fianlimab, a fully human anti-LAG-3 monoclonal antibody, in Phase II/III trials for several settings—including first-line advanced NSCLC, perioperative NSCLC, first-line metastatic melanoma, adjuvant melanoma, and perioperative melanoma.

- The unmet need for CD223 (LAG-3) inhibitors lies in overcoming tumor resistance and limited efficacy in certain cancers. While combination therapies show promise, the optimal strategies and biomarkers for patient selection remain unclear. Additionally, LAG-3 inhibitors in autoimmune diseases are still in early development, requiring further research to establish safety and efficacy.

Request for Unlocking the Sample Page of the "CD223 Antigen Inhibitor Market"

DelveInsight’s CD223 Antigen Inhibitor Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CD223 antigen inhibitors, historical and projected epidemiological data, competitive landscape as well as the CD223 antigen inhibitors therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The CD223 Antigen Inhibitors Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CD223 antigen inhibitors market size from 2020 to 2034. The report also covers current CD223 Antigen Inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

|

|

CD223 Antigen Inhibitor Epidemiology |

Segmented by:

|

|

CD223 Antigen Inhibitor Companies |

|

|

CD223 Antigen Inhibitor Drugs |

|

|

CD223 Antigen Inhibitor Clinical Relevance |

|

|

CD223 Antigen Inhibitor Market |

Segmented by:

|

|

Analysis |

|

CD223 Antigen Inhibitor Disease Understanding

CD223 (LAG-3) is a key immune checkpoint receptor that plays a role in regulating T cell activation and exhaustion. Inhibiting LAG-3 with monoclonal antibodies, like OPDUALAG, has emerged as a promising strategy to enhance anti-tumor immunity, particularly in melanoma. LAG-3 inhibitors act synergistically with other checkpoint inhibitors, like PD-1, to reinvigorate exhausted T cells and improve immune responses. Clinically, OPDUALAG is the only FDA-approved LAG-3 inhibitor, offering a new treatment option for metastatic melanoma. The clinical relevance extends beyond melanoma, with ongoing trials targeting a range of cancers, including NSCLC and melanoma, as well as autoimmune diseases. However, challenges remain in optimizing combination therapies and identifying predictive biomarkers to maximize the therapeutic benefit and overcome resistance in solid tumors.

CD223 Antigen Inhibitor Epidemiology

The CD223 antigen inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total CD223 Antigen Inhibitor Cases in selected indications, total eligible patient pool in selected indications for CD223 antigen inhibitors, and total treated cases in selected indications for CD223 antigen inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

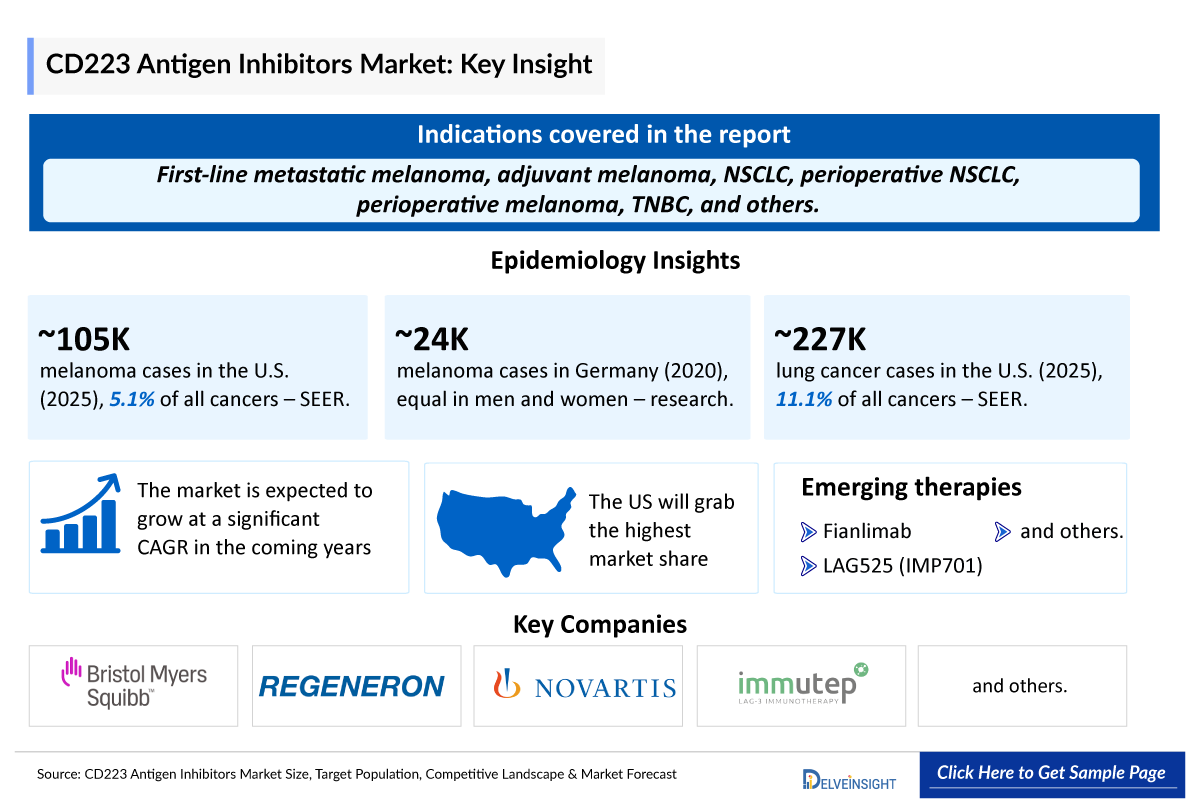

Melanoma

- As per the SEER database, in 2025, the United States is projected to report approximately 104,960 new cases of melanoma of the skin. Melanoma of the skin represents 5.1% of all new cancer cases in the US.

- As per the secondary research, in 2020, about 23,650 people in Germany were diagnosed with a malignant melanoma of the skin, affecting approximately the same number of women as men.

- As per the data from Cancer Research UK, there were around 17,500 new melanoma skin cancer cases in the UK every year (2017-2019).

Lung Cancer

The 2 main types of lung cancer are small cell lung cancer (SCLC) and non-SCLC (NSCLC); NSCLC accounts for approximately 85% of all cases of lung cancer.

- As per the SEER database, in 2025, the United States is projected to report approximately 226,650 new cases of lung and bronchus cancer. Lung and bronchus cancer represents 11.1% of all new cancer cases in the US.

- As per the data from Cancer Research UK, there were around 49,200 new lung cancer cases in the UK every year (2017-2019).

- According to the secondary research, as of 2022, Japan’s overall lung cancer incidence was 30.5 cases per 100,000 people.

CD223 Antigen Inhibitor Drugs Analysis

The drug chapter segment of the CD223 Antigen Inhibitor Therapeutics Market Reports encloses a detailed analysis of CD223 antigen inhibitors’ marketed drugs and early, mid, and late-stage (Phase I, Phase II and Phase III) CD223 Antigen Inhibitor Pipeline Drugs. It also helps understand the CD223 Antigen inhibitors' Clinical Trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed CD223 Antigen Inhibitor Drugs

-

OPDUALAG (nivolumab and relatlimab-rmbw) - Bristol Myers Squibb

OPDUALAG (nivolumab and relatlimab-rmbw) is a first-in-class, fixed-dose, dual immunotherapy combination of the programmed death-1 (PD-1) inhibitor nivolumab and the lymphocyte activation gene 3 (LAG-3) blocking antibody relatlimab.

In May 2022, Bristol Myers Squibb announced that the US FDA approved it for the treatment of adult and pediatric patients 12 years of age or older with unresectable or metastatic melanoma. The approval is based on the Phase II/III RELATIVITY-047 trial, which compared OPDUALAG to nivolumab alone.

The trial met its primary endpoint of progression-free survival (PFS), with OPDUALAG more than doubling median PFS vs. nivolumab alone: 10.1 months vs. 4.6 months. The safety profile of OPDUALAG was consistent with nivolumab monotherapy, with no new safety signals. However, grade 3/4 drug-related adverse events were higher with OPDUALAG (18.9% vs. 9.7%), as were discontinuation rates due to adverse events (14.6% vs. 6.7%).

- In September 2022, the EU approved OPDUALAG for first-line treatment of advanced melanoma in patients ≥12 years with PD-L1 < 1%.

- In February 2025, Bristol Myers Squibb announced that the Phase III RELATIVITY-098 trial evaluating OPDUALAG (nivolumab and relatlimab-rmbw) for the adjuvant treatment of patients with completely resected stage III-IV melanoma did not meet its primary endpoint of recurrence-free survival (RFS). The safety profile of OPDUALAG observed in this analysis was consistent with the known profiles of nivolumab and relatlimab.

|

Product |

Company |

Indication |

|

OPDUALAG (nivolumab and relatlimab-rmbw) |

Bristol Myers Squibb |

|

Note: Detailed current therapies assessment will be provided in the full report of CD223 Antigen Inhibitor...

Emerging CD223 Antigen Inhibitor Drugs

-

Fianlimab: Regeneron

Fianlimab is a fully human monoclonal antibody targeting the immune checkpoint receptor LAG-3 on T cells and was invented using Regeneron’s proprietary VelocImmune technology. In melanoma, LAG-3 expression on cancer cells is associated with therapeutic resistance to PD-1 inhibitors. Fianlimab is being investigated in combination with Regeneron's PD-1 inhibitor LIBTAYO to determine whether concurrent blockade of LAG-3 and PD-1 can help overcome this resistance and release the brakes on T cell activation. As per the company’s pipeline, it is currently being evaluated in Phase III trials for first-line metastatic melanoma; adjuvant melanoma and in Phase II trials for NSCLC; perioperative NSCLC and perioperative melanoma.

-

- In May 2023, Regeneron Pharmaceuticals announced positive data from three independent cohorts evaluating an investigational combination of LAG-3 inhibitor fianlimab and PD-1 inhibitor LIBTAYO (cemiplimab) in adults with advanced melanoma.

-

LAG525 (IMP701) – Novartis/Immutep

IMP701 is a therapeutic antibody originally developed by Immutep to target LAG-3, an immune checkpoint receptor. This antagonist antibody enhances anti-tumor immunity through a dual mechanism: it activates effector T cells by blocking inhibitory signals and simultaneously inhibits regulatory T cells (Tregs) that suppress immune responses. By lifting these two immune "brakes," IMP701 helps restore the immune system’s ability to recognize and attack cancer cells—unlike some other checkpoint inhibitors that only target effector T cells.

Novartis holds exclusive rights to develop and commercialize IMP701 and is advancing its humanized form, LAG525, in Phase I/II CD223 Antigen Inhibitor Clinical Trials, in combination with its PD-1 inhibitor spartalizumab, across various cancer indications. Novartis leads the development of the LAG-3 program, while Immutep remains eligible for milestone payments and royalties tied to clinical and commercial success.

List of CD223 Antigen Inhibitor Emerging Drugs | |||||

|

Drug Name |

Company |

Indication |

ROA |

Phase |

NCT ID |

|

Fianlimab |

Regeneron |

First-line metastatic melanoma; Adjuvant melanoma; NSCLC ; perioperative NSCLC and perioperative melanoma |

IV |

II/III |

NCT06190951 among others |

|

LAG525 (IMP701) |

Novartis/Immutep |

Triple Negative Breast Cancer; Melanoma among others |

IV |

- |

NCT02460224 |

|

XX |

XX |

XX |

XX |

XX |

XX |

CD223 Antigen Inhibitor Market Outlook

The CD223 (LAG-3) inhibitors market is rapidly evolving, driven by the need for advanced immunotherapies to address resistance to existing checkpoint inhibitors. The approval of OPDUALAG (nivolumab + relatlimab) marked a significant milestone, introducing the first dual checkpoint blockade targeting PD-1 and LAG-3 for unresectable or metastatic melanoma. Beyond OPDUALAG, a robust pipeline of LAG-3-targeted therapies is under development, with multiple candidates in various clinical stages. Notable among these are fianlimab by Regeneron. The synergistic potential of combining LAG-3 inhibitors with PD-1/PD-L1 blockers is a focal point of ongoing research, aiming to enhance efficacy in patients unresponsive to monotherapies.

The CD223 Antigen Inhibitor market is also exploring applications of LAG-3 inhibitors in autoimmune diseases, expanding their therapeutic scope. However, challenges persist in identifying predictive biomarkers and optimizing combination strategies to maximize patient benefit. Overall, the CD223 (LAG-3) inhibitors market represents a dynamic and promising frontier in oncology and immunotherapy, with significant potential to improve outcomes for patients with various cancers.

CD223 Antigen Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging CD223 antigen inhibitors expected to be launched in the CD223 Antigen Inhibitor market during 2020–2034.

CD223 Antigen Inhibitor Pipeline Development Activities

The CD223 Antigen Inhibitor pipeline Report provides insights into different CD223 Antigen Inhibitor clinical trials within phase III phase II, and phase I. It also analyzes key CD223 Antigen Inhibitor Companies involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense opportunity for CD223 antigen inhibitors’ market growth over the forecasted period.

KOL Views on CD223 Antigen Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CD223 antigen inhibitors’ evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility. DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or CD223 antigen inhibitors’ market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the CD223 Antigen Inhibitor unmet needs. “LAG-3 is emerging as a critical checkpoint in the immune exhaustion landscape. The approval of relatlimab has validated this target clinically, but we’re just beginning to understand its broader potential. What excites me most is the synergy we’re seeing when LAG-3 inhibitors are combined with PD-1 blockade—this could redefine how we approach tumors that are otherwise resistant to standard immunotherapy.”

CD223 Antigen Inhibitor Report Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

CD223 Antigen Inhibitor Therapeutics Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Patient access, reimbursement, and co-pay support

BMS Access Support offers benefit investigation, prior authorization assistance, and appeal process support, as well as an easy-to-initiate co-pay assistance process and information on financial support. The Oncology Co-Pay Assistance Program assists with out-of-pocket co-payment or co-insurance requirements for eligible, commercially insured patients who have been prescribed certain Bristol Myers Squibb oncology products, including OPDUALAG (nivolumab and relatlimab-rmbw).

Scope of the CD223 Antigen Inhibitor Therapeutics Market Report

- The CD223 Antigen Inhibitor Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining their mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, forecasts, and the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies that will impact the current landscape.

- A detailed review of the CD223 antigen inhibitor treatment market, historical and forecasted CD223 Antigen Inhibitor market size, CD223 Antigen Inhibitor drugs market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CD223 Antigen Inhibitor Therapeutics Market Report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CD223 antigen inhibitor market.

CD223 Antigen Inhibitor Market Report Insights

- CD223 Antigen Inhibitor Targeted Patient Pool

- CD223 Antigen Inhibitor Therapeutic Approaches

- CD223 Antigen Inhibitor Pipeline Analysis

- CD223 Antigen Inhibitor Market Size

- CD223 Antigen Inhibitor Market Trends

- Existing and future CD223 Antigen Inhibitor Drugs Market Opportunity

CD223 Antigen Inhibitor Market Report Key Strengths

- 10 Years CD223 Antigen Inhibitor Market Forecast

- The 7MM Coverage

- Key Cross Competition

- CD223 Antigen Inhibitor Drugs Uptake

- Key CD223 Antigen Inhibitor Market Forecast Assumptions

CD223 Antigen Inhibitor Market Report Assessment

- Current CD223 Antigen Inhibitor Treatment Practices

- CD223 Antigen Inhibitor Unmet Needs

- CD223 Antigen Inhibitor Pipeline Drugs Profiles

- CD223 Antigen Inhibitor Market Attractiveness

- Qualitative Analysis (SWOT)

- CD223 Antigen Inhibitor Market Drivers

- CD223 Antigen Inhibitor Market Barriers

Key Questions Answered In The CD223 Antigen Inhibitor Market Report:

- What was the CD223 antigen inhibitor treatment market size, the market size by therapies, CD223 Antigen Inhibitor drugs market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which CD223 Antigen Inhibitor is going to be the largest contributor in 2034?

- Which is the most lucrative market for CD223 antigen inhibitor?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for CD223 antigen inhibitor evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with CD223 antigen inhibitor? What will be the growth opportunities across the 7MM for the patient population of CD223 antigen inhibitor?

- What are the key factors hampering the growth of the CD223 antigen inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CD223 antigen inhibitor?

- What is the cost burden of approved CD223 Antigen Inhibitor therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved CD223 Antigen Inhibitor therapies?

Reasons to buy CD223 Antigen Inhibitor Market Forecast Report

- The CD223 Antigen Inhibitor Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing dynamics driving the CD223 antigen inhibitor Drugs Market.

- Understand the existing CD223 Antigen Inhibitor Drugs Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming CD223 Antigen Inhibitor companies in the CD223 Antigen Inhibitor Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CD223 Antigen Inhibitor Drugs Market so that the upcoming CD223 Antigen Inhibitor companies can strengthen their development and launch strategy.

Stay updated with us for Recent Articles @ Latest DelveInsight Blogs