Contract Development Manufacturing Organization (CDMO) Market

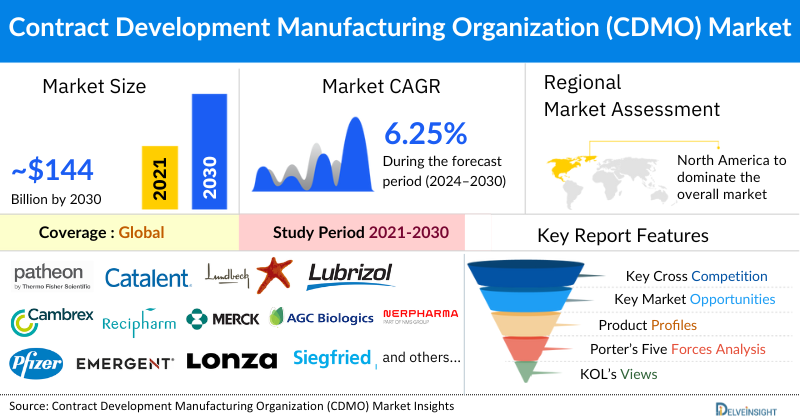

- The global CDMO market size is projected to increase from USD 233.71 billion in 2024 to USD 407.09 billion by 2032, reflecting strong and sustained growth.

- The global CDMO market is expected to grow at a CAGR of 7.25% during the forecast period from 2024 to 2030.

- The factors contributing to the growth of the myopia medical device market are escalating global prevalence of myopia, growing demand for non-invasive and long-term vision correction solutions, and continuous innovation in optical and therapeutic technologies, coupled with expanding access in emerging healthcare markets.

- The leading companies working in CDMO market are Thermo Fisher Scientific Inc., Catalent Inc., The Lubrizol Corporation, Recipharm (EQT), Cambrex Corporation, Merck & Co., Inc., AGC Biologics, Nerpharma S.r.l, Pfizer Inc, EMERGENT, Onyx Scientific Limited, Lonza, Siegfried Holding AG, CordenPharma International, FUJIFILM Diosynth Biotechnologies, Samsung Biologics, Delpharm, Center for Breakthrough Medicines, WuXi Biologics, Laboratoire Elaiapharm, and others.

- Among all the regions, North America is expected to lead the CDMO market by 2032, driven by rising chronic diseases and growing outsourcing trends among pharma and biotech firms to cut costs, boost efficiency, and speed time-to-market.

- The CDMO Market is segmented by drug type (small molecules, biologics), service type (API, finished drug products), forms (solids, liquids), and manufacturing (clinical and commercial).

Request for unlocking the report of the CDMO Market

Key factors contributing to the rise in growth of the Contract Development and Manufacturing Organization (CDMO) Market:

- Rising Prevalence of CDMO Services: Increasing demand for outsourced drug development and manufacturing due to rising prevalence of chronic and rare diseases.

- Growing Adoption of CDMO Partnerships: Pharmaceutical and biotech companies are increasingly relying on CDMOs to reduce costs, enhance efficiency, and speed up time-to-market.

- CDMO Technological Advancements & Product Launches: Integration of advanced biomanufacturing technologies, continuous processing, and innovative service offerings are boosting market expansion.

- Government Awareness Initiatives for CDMO: Regulatory support, funding programs, and favorable outsourcing policies are encouraging CDMO adoption.

- Expanding Access in Emerging Markets: Rising R\&D investments, improving healthcare infrastructure, and growing pharmaceutical activities in developing regions are opening new growth opportunities for CDMOs.

CDMO Market by Drug Type (Small Molecules and Biologics), Service Type (API and Finished Drug Products), Forms (Solids and Liquids), Manufacturing, (Clinical Manufacturing and Commercial Manufacturing), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the increasing instances of chronic disorder, rising demand of biologics and small molecules, and increase in strategic activities among the key market players across the globe

The global CDMO market was valued at USD 233.71 billion in 2024, growing at a CAGR of 7.25% during the forecast period from 2025 to 2032 to reach USD 407.09 billion by 2032. The Contract Development and Manufacturing Organization (CDMO) market is experiencing significant growth driven by the increasing prevalence of chronic disorders such as cancer, cardiovascular diseases, and diabetes, which has led to a surge in demand for innovative therapies. Alongside this, the rising need for biologics and small molecules particularly due to their effectiveness in treating complex conditions is expanding the scope of outsourced drug development and manufacturing. Furthermore, strategic activities such as mergers, acquisitions, partnerships, and capacity expansions among key market players are enhancing service capabilities and global reach. Collectively, these factors are expected to propel the growth of the CDMO market by increasing reliance on external expertise for efficient and scalable drug development solutions during the forecast period from 2025 to 2032.

CDMO Market Dynamics:

According to data provided by the World Health Organization (2024), the International Agency for Research on Cancer (IARC) stated that, in 2022, approximately, 20 million new instances of cancer were registered globally. As per the same source, lung cancer accounted for 2.5 million new cases globally, of all the registered new cancer cases, making it the most common cancer. Next in order of incidence was breast cancer with 2.3 million cases, colon cancer with 1.9 million cases, and stomach cancer with 0.97 million cases globally.

As pharmaceutical and biotech companies race to develop innovative oncology drugs including targeted therapies, immunotherapies, and personalized medicine they increasingly turn to CDMOs for specialized expertise in drug development, scale-up, and manufacturing. Cancer drugs often involve complex molecules, such as biologics and antibody-drug conjugates (ADCs), which require sophisticated manufacturing infrastructure and regulatory compliance areas where CDMOs excel thereby boosting their market.

Additionally, the rising demand for biologics and small molecule drugs is significantly boosting the CDMOs market, as pharmaceutical and biotechnology companies increasingly outsource these complex and resource-intensive processes to specialized partners. Biologics therapies derived from living organisms such as monoclonal antibodies, vaccines, and recombinant proteins are among the fastest-growing segments in the pharmaceutical industry. Their development and manufacturing require sophisticated infrastructure, stringent quality controls, and advanced technologies like cell culture, fermentation, and purification. These requirements are often too costly or technically challenging for small to mid-sized biotech firms and even large pharmaceutical companies to manage in-house. CDMOs with specialized biologics capabilities, such as Lonza, Samsung Biologics, and Catalent, have capitalized on this need by offering full-service solutions from cell line development to commercial-scale manufacturing. For instance, in October 2024, Samsung Biologics signed a USD 1.24 billion contract manufacturing deal with an Asia-based pharmaceutical company, marking its largest single-client contract. The production was planned at its Songdo, South Korea facility, with the agreement running through December 2037. This deal pushed the company’s total contract value for 2024 beyond USD 3.3 billion.

Thus, all the factors mentioned above are expected to boost the global CDMO market throughout the forecast period from 2025 to 2032.

Despite these promising growth factors, the CDMO market faces challenges. Regulatory hurdles for CDMOS in gaining product approval are significant constraints that could potentially hinder market growth during the forecast period.

CDMO Market Segment Analysis:

CDMO Market by Drug Type (Small Molecules and Biologics), Service Type (API and Finished Drug Products), Forms (Solids and Liquids), Manufacturing, (Clinical Manufacturing and Commercial Manufacturing), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the drug type segment of the CDMO market, the biologics category held the largest revenue share in 2024. The growing demand for biologics is significantly boosting the overall market of Contract Development and Manufacturing Organizations (CDMOs). Biologics, which include monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins, are more complex to develop and manufacture than traditional small-molecule drugs. This complexity requires specialized expertise, advanced facilities, and high-end technology resources that many pharmaceutical companies, especially small and mid-sized firms, may lack in-house. As a result, these companies increasingly rely on CDMOs to support everything from early-stage development to large-scale commercial production. The global surge in biologics development driven by the rise of chronic diseases, cancer, autoimmune disorders, and rare diseases has created a strong pipeline of biological products, prompting biopharma companies to partner with or outsource to CDMOs.

Additionally, CDMOs are responding by investing in state-of-the-art biologics production facilities, expanding their capacity, and acquiring smaller firms with niche expertise. This has not only enhanced their service portfolios but also positioned them as critical enablers in the biopharmaceutical value chain, thereby driving the overall growth of the CDMO market. For instance, in July 2024, Agilent Technologies acquired Biovectra for $925 million to enhance its CDMO capabilities in biologics, highly potent APIs, and gene editing technologies. This acquisition expands Agilent's service portfolio and strengthens its presence in the biologics and gene therapy markets.

Thus, all these factors combined are fueling the biologics category, thereby acting as a strong catalyst in the growth of the global CDMO market, thereby driving the overall expansion of the CDMO market.

CDMO Market Segmentation

CDMO Market By Drug Type

- Small Molecules

- Biologics

CDMO Market By Service Type

- API

- Finished Drug Products

CDMO Market By Forms

- Solids

- Liquids

CDMO Market By Manufacturing

- Clinical Manufacturing

- Commercial Manufacturing

North America CDMO Market

- United States CDMO Market

- Canada CDMO Market

- Mexico CDMO Market

Europe CDMO Market

- France CDMO Market

- Germany CDMO Market

- United Kingdom CDMO Market

- Italy CDMO Market

- Spain CDMO Market

- Russia CDMO Market

Rest of Europe

- Asia-Pacific CDMO Market

- China CDMO Market

- Japan CDMO Market

- India CDMO Market

- Australia CDMO Market

- South Korea CDMO Market

Rest of Asia Pacific

- Rest of the World (RoW)

- Middle East CDMO Market

- Africa CDMO Market

- South America CDMO Market

|

Report Metrics |

Details |

|

Study Period |

2020 to 2030 |

|

Forecast Period |

2024-2030 |

|

CAGR |

6.25% (Request Sample To Know More) |

|

CDMO Market |

~USD 143 billion by 2030 |

|

Key Contract Development Manufacturing Organization Companies |

Patheon (Thermo Fisher Scientific), Catalent,Inc, Laboratoire Elaiapharm, The Lubrizol Corporation, Cambrex Corporation, Recipharm (EQT), Merck & Co., Inc, AGC Biologics, Nerpharma S.r.l, Pfizer CenterOne (Pfizer Inc), EMERGENT, Onyx Scientific Limited, Lonza, Siegfried Holding AG, CordenPharma International, FUJIFILM Diosynth Biotechnologies, Samsung Biologics, Delpharm, Center for Breakthrough Medicines, and WuXi Biologics and others. |

CDMO Market Regional Insights

North America is expected to dominate the overall CDMO Market:

North America is projected to account for the largest share of the CDMO market in 2024. This dominance can be attributed to several key factors, including the increasing instances of chronic disorders such as cancers and tuberculosis, additionally, the advantages associated with CDMOs in streamlining the process are further increasing trends among pharmaceutical and biotechnology companies to outsource drug development and manufacturing to reduce costs, improve efficiency, and accelerate time-to-market are further driving market expansion through the forecast period from 2025 to 2032.

National Cancer Institute (2024), estimated that 2 million new cases of cancer will be diagnosed in the US by the end of 2024. Furthermore, it is estimated that prostate, lung, and colorectal cancers are expected to represent approximately 48% of all cancer diagnoses in men. For women, the most prevalent cancers are breast, lung, and colorectal, which are expected to account for about 51% of all new cancer diagnoses.

According to Global Cancer Observatory’s data (2024), in 2022, the US represented 89.1% of all cancer cases and Canada represented 10.9% of all cancer cases in the region. The rising incidence of cancer and other infectious diseases such as tuberculosis in the region is significantly contributing to the growth of the CDMO market. As the burden of complex and chronic illnesses increases, pharmaceutical and biotechnology companies are under pressure to accelerate the development of innovative therapies, including targeted treatments and advanced diagnostics. This has led to a greater reliance on CDMOs that offer specialized capabilities in drug development, biologics manufacturing, and molecular diagnostics. In oncology, the demand for novel, personalized therapies has surged, requiring flexible and scalable manufacturing solutions that CDMOs are well-positioned to provide. Similarly, the need for rapid and accurate diagnostic tools, especially in managing diseases like tuberculosis, has highlighted the importance of advanced molecular technologies, many of which are developed and produced through CDMO partnerships.

Furthermore, the increase in strategic activities among the key market players is further escalating the market across the region. For instance, in December 2024, Lonza announced its decision to exit the capsules and health ingredients business to concentrate on its core CDMO operations. The company plans to restructure into three business platforms: Integrated Biologics, Advanced Synthesis, and Specialized Modalities, starting from Q2 2025. This strategic shift aimed to enhance Lonza's leadership in high-value therapeutic areas and advance manufacturing technologies.

CDMO Market Key Players:

Some of the key CDMO companies operating in the market include -

- Thermo Fisher Scientific Inc.

- Catalent Inc.

- The Lubrizol Corporation

- Recipharm (EQT)

- Cambrex Corporation

- Merck & Co. Inc.

- AGC Biologics

- Nerpharma S.r.l

- Pfizer Inc

- EMERGENT

- Onyx Scientific Limited

- Lonza

- Siegfried Holding AG

- CordenPharma International

- FUJIFILM Diosynth Biotechnologies

- Samsung Biologics

- Delpharm

- Center for Breakthrough Medicines

- WuXi Biologics

- Laboratoire Elaiapharm, and others

Recent Developmental Activities in the CDMO Market:

- In May 2025, Lupin Manufacturing Solutions (LMS) announced the relegation of its core assets and long-term vision to capitalize on emerging opportunities in the CDMO space. By investing in innovative treatment platforms and harnessing the strength of India’s robust API ecosystem, LMS aimed to enhance its capabilities and drive sustainable growth in the global contract development and manufacturing market.

- In May 2025, VGXI, Inc., a CDMO specializing in plasmid DNA for gene therapies and vaccines, successfully completed a US FDA inspection at its GMP facility, leading to approval of a client’s Biologics License Application (BLA). This milestone highlights VGXI’s commitment to quality and regulatory excellence.

- In May 2025, Tivic Health® Systems, Inc. announced a definitive agreement with Scorpius BioManufacturing to complete GMP manufacturing validation of Entolimod™, its lead TLR5 candidate for Acute Radiation Syndrome (ARS), in preparation for a BLA filing with the FDA.

- In March 2025, Ayrmid Pharma Ltd. and RoslinCT announced plans to form a strategic partnership for the production of Omisirge, a cell therapy used to treat hematologic malignancies and commercialized in the U.S. by Ayrmid’s subsidiary, Gamida Cell Inc.

- In February 2022, a China-based CDMO Asymchem Inc. plans to buy Snapdragon Chemistry, a US-based company focused on continuous manufacturing and early-stage chemical process development services for a total value of USD 57.94 million. This transaction was aimed at the expansion of the business of the Chinese CDMO in the US.

- In February 2022, MilliporeSigma, the U.S. and Canada Life Science business sector of Merck KGaA closed the transaction marking the acquisition of Exelead for approximately USD 780 million in cash. This was expected to add to the capabilities of the LifeSciences business in becoming one of the prominent CDMOs in the mRNA value chain.

Key CDMO Highlights Summary (2022–2025)

| Category | Key Developments |

|---|---|

| Product Launches | Introduction of advanced biologics, cell, and gene therapy solutions by leading CDMOs to meet rising demand. |

| Regulatory Approvals | Multiple global approvals for manufacturing sites, strengthening compliance with FDA, EMA, and other agencies. |

| Partnerships | Strategic collaborations with pharma/biotech companies for end-to-end drug development and manufacturing services. |

| Acquisitions | Mergers and acquisitions aimed at expanding geographic presence and diversifying service portfolios. |

| Company Strategy | Focus on expanding biologics and gene therapy capabilities, digital transformation, and flexible manufacturing platforms. |

| Setbacks | Supply chain disruptions, regulatory delays, and rising operational costs impacting timelines. |

| Emerging Technology | Adoption of AI, machine learning, and digital twins for process optimization and predictive manufacturing. |

Impact Analysis:

AI Advancement in CDMO (Contract Development and Manufacturing Organizations)

Artificial Intelligence is reshaping the operations of CDMOs by enabling faster drug development, improved manufacturing efficiency, and enhanced quality control. As the pharmaceutical and biotech sectors demand accelerated timelines and cost-effective solutions, AI integration helps CDMOs deliver innovative, precise, and scalable services across the drug lifecycle.

Key Highlights:

- Accelerated Drug Discovery: AI models analyze massive datasets to identify potential drug candidates, reducing R\&D timelines.

Process Optimization: AI-driven predictive analytics streamline manufacturing processes, ensuring higher yields and efficiency. - Quality Assurance & Control: Automated AI systems detect defects and deviations in real-time, enhancing compliance with GMP standards.

- Supply Chain Management: AI helps forecast demand, manage raw material sourcing, and optimize logistics for uninterrupted supply.

- Personalized Medicine Support: Facilitates tailored drug formulations and small-batch production to meet niche therapy needs.

- Regulatory Compliance: AI-enabled documentation and monitoring systems assist in maintaining global regulatory requirements.

- Cost Reduction: Through automation and predictive maintenance, AI lowers operational costs while improving reliability.

Tariff Inclusion in CDMO (Contract Development and Manufacturing Organizations)

Tariff inclusion in the CDMO market analysis focuses on the impact of international trade duties, customs regulations, and cross-border taxation on the manufacturing and distribution of pharmaceutical and biotech products. Since CDMOs often operate on a global scale—sourcing raw materials from one region, manufacturing in another, and distributing worldwide—tariffs significantly influence production costs, supply chain efficiency, and regional competitiveness. Understanding tariff dynamics helps pharmaceutical companies and CDMOs optimize strategies for global operations, reduce risks, and maintain profitability in highly regulated markets.

How This Analysis Helps Clients:

- Cost Management: Evaluates tariff-related expenses, enabling accurate budgeting and pricing strategies for drug manufacturing and distribution.

- Supply Chain Optimization: Identifies tariff-driven bottlenecks and helps companies select cost-efficient sourcing and logistics routes.

- Regulatory Navigation: Offers insights into varying international trade policies and compliance requirements, reducing risks of penalties or delays.

- Strategic Planning: Supports decision-making on site selection, outsourcing strategies, and regional expansions to minimize tariff impact and maximize profitability.

Startup Funding & Investment Trends in CDMO

| Company Name | Total Funding | Main Products/Focus | Stages of Development | Core Technology |

|---|---|---|---|---|

| Samsung Biologics | USD 500 Million+ | Biologics development & large-scale manufacturing | Commercial Expansion | Bioprocessing & AI-driven automation |

| WuXi Biologics | USD 300 Million+ | End-to-end biologics CDMO services | Global Commercial Scale | Single-use bioreactors & digital platforms |

| Lonza Biologics | USD 200 Million+ | Cell & gene therapy manufacturing | Advanced Clinical & Commercial | Cell & gene therapy platforms |

| Catalent Pharma | USD 150 Million+ | Drug delivery technologies & manufacturing | Late-Stage Development | AI-driven formulation & delivery systems |

| Sartorius Stedim Biotech | USD 100 Million+ | Process solutions for CDMOs | Growth/Scale-up | Digitalized biomanufacturing & analytics |

Key Takeaways from the CDMO Market Report Study

- Market size analysis for current CDMO market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the CDMO market

- Various opportunities available for the other competitors in the CDMO market space

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current CDMO market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for CDMO market growth in the coming future?

Target Audience Who Can be benefited from this CDMO Market Report Study

- CDMO product providers

- Research organizations and consulting companies

- CDMO-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in CDMO

- Various end-users who want to know more about the CDMO market and the latest technological developments in the CDMO market

Frequently Asked Questions for the CDMO Market:

1. What is CDMO?

- A contract development and manufacturing organization (CDMO) is a company that provides outsourced services to pharmaceutical and biotechnology firms, covering drug development and manufacturing processes. These services include formulation, analytical testing, clinical trial material production, and commercial-scale manufacturing. CDMOs enable pharma companies to reduce costs, accelerate time-to-market, and access specialized expertise without investing in in-house infrastructure. Many CDMOs offer end-to-end solutions, supporting the entire drug lifecycle from early development to final production.

2. What is the market for CDMO Market?

- The global CDMO market was valued at USD 233.71 billion in 2024, growing at a CAGR of 7.25% during the forecast period from 2025 to 2032 to reach USD 407.09 billion by 2032.

3. What are the drivers for the global CDMO Market?

- The Contract Development and Manufacturing Organization (CDMO) market is experiencing significant growth driven by the increasing prevalence of chronic disorders such as cancer, cardiovascular diseases, and diabetes, which has led to a surge in demand for innovative therapies. Alongside this, the rising need for biologics and small molecules particularly due to their effectiveness in treating complex conditions is expanding the scope of outsourced drug development and manufacturing. Furthermore, strategic activities such as mergers, acquisitions, partnerships, and capacity expansions among key market players are enhancing service capabilities and global reach. Collectively, these factors are expected to propel the growth of the CDMO market by increasing reliance on external expertise for efficient and scalable drug development solutions during the forecast period from 2025 to 2032.

4. Who are the key players operating in the global CDMO Market?

- Some of the key market players operating in the CDMO market include Thermo Fisher Scientific Inc., Catalent Inc., The Lubrizol Corporation, Recipharm (EQT), Cambrex Corporation, Merck & Co., Inc., AGC Biologics, Nerpharma S.r.l, Pfizer Inc, EMERGENT, Onyx Scientific Limited, Lonza, Siegfried Holding AG, CordenPharma International, FUJIFILM Diosynth Biotechnologies, Samsung Biologics, Delpharm, Center for Breakthrough Medicines, WuXi Biologics, Laboratoire Elaiapharm, and others.

5. Which region has the highest share in the global CDMO Market?

- North America is projected to account for the largest share of the CDMO market in 2024. This dominance can be attributed to several key factors, including the Increasing instances of chronic disorders including cancers and tuberculosis, advantages associated with CDMOs in streamlining the process, the increasing trend among pharmaceutical and biotechnology companies to outsource drug development and manufacturing to reduce costs, improve efficiency, and accelerate time-to-market are further driving market expansion through the forecast period from 2025 to 2032.